One of the usual, proven options for purchasing fuel and lubricants is purchasing through an accountable person: for cash or by bank card. In both cases, a retail purchase and sale agreement is used. This means that there are difficulties with accepting VAT as a deduction and taking it into account in expenses.

From the article you will learn:

- how to reflect the issue of cash on the report;

- how to register an employee’s advance report and capitalize fuel and lubricants;

- What to do with VAT when purchasing fuel and lubricants for cash.

How to prepare an advance report

The document must contain the following information:

- name of the enterprise;

- date of reporting;

- the amount of money allocated;

- the main purpose of issuing money;

- documentation confirming the fact of expenses.

Reporting also contains information about the movement of finances, their accounting, analytical accounts and other information that can reflect the amounts of allocated, spent and returned money.

The advance report is completed by authorized employees of the accounting department. This information is certified by the head of the organization.

The tear-off note reflects the amount of money spent and to be returned. After approval, it is issued to the accountable person. The reverse side contains a breakdown of expenses. It indicates the company's account, which changes due to the debiting of money for certain expenses.

Step-by-step instruction

March 15 Stepanov S.S. received funds from the organization’s cash desk for the purchase of fuel and lubricants in the amount of 4,200 rubles.

March 20 Stepanov S.S. presented an advance report, according to which he refueled a Ford Mondeo with AI-92 gasoline in the amount of 100 liters. for the amount of 4,200 rubles. (including VAT 20%). A cash receipt with allocated VAT confirming expenses for fuel and lubricants is attached to the advance report.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Issuing funds to an accountable person from the cash register | |||||||

| March 15th | 71.01 | 50.01 | 4 200 | 4 200 | Issuance to an accountable person | Cash withdrawal - Issue to accountable person | |

| Employee advance report for the purchase of fuel and lubricants | |||||||

| 20th of March | 10.03.1 | 71.01 | 3 600 | 3 600 | 3 600 | Acceptance of materials for accounting | Advance report - Products tab |

| 19.03 | 71.01 | 600 | 600 | Acceptance for VAT accounting | |||

| 91.02 | 19.03 | 600 | VAT write-off | ||||

| HE.01.9 | — | 600 | Reflection of expenses not taken into account in tax accounting | ||||

Reimbursement of expenses based on advance report

Tax legislation regulates the timing of drawing up a document to reimburse money spent. The financially responsible employee must report to the accounting department within three working days.

ATTENTION! In situations where the accountable person has not spent the allocated amount in full, the advance report also includes information about the remaining finances. This amount is the refund.

There are other possible situations in which the employee first spent his own funds, and only then presented documents for reimbursement. Despite the fact that the procedure is different, it is still issued through the representation expenses of the advance report.

Application for the release of money on account

The advance payment is assigned by drawing up and submitting an appropriate application. There is no standardized form for filling it out.

The standard form of such an application contains the following information:

- information about the person to whom the application is sent;

- information about the applicant;

- the essence of the application is a request for the issuance of money in a certain amount;

- the reason for the need for money;

- date of preparation and signature of the applicant;

- the accountant’s signature confirming the fact that there is no debt on previously issued amounts;

- signature of the manager on acceptance of the application.

The organization develops the application form independently, but at least one of the indicated points cannot be excluded.

Reflection of an advance report on fuel and lubricants in the 1C Accounting 8 program

Often, at enterprises that have their own vehicles, drivers are not given fuel, but money to buy it. In accounting, this procedure is reflected in the advance report transaction.

In the program 1C: Accounting 8 edition 3.0. First, the issuance of accountable funds is formalized. If the driver receives money for gasoline at the cash register, then a “Cash Withdrawal” document is created in the cash register journal. The program will offer several types of transactions; the cashier must select “Issue to an accountable person.” The document specifies the basis for issuance, the amount and details of the recipient. We carry out this cash withdrawal using Account Debit 71.01 and Account Credit 50.01. In the first tab of the advance report, which will be created in the “Bank and Cash Office” tab, you must fill in the name of the document with which we issued the advance to our accountable driver, the purpose of the advance and the number of attachments to the report.

In the second tab “Goods” of the advance report, we will already reflect the receipt of diesel fuel or gasoline. The name of the supplier, price, type and brand of fuel and how much was purchased are also required. An invoice may be attached to the report. Then in the report itself you will need to indicate the date of its issue and number. Fuel must be received on account 10.03., which is indicated in the nomenclature. Don't forget to check this. Then, according to the document, we will generate the posting Debit 10.03, Credit 71.01. In the event that it is necessary to indicate VAT, we will also carry out the debit of the account on 19.03.

In the event that our driver has not spent all the money given to him on fuel, he returns the rest to the cashier. The cashier registers “Cash receipt”, the type of transaction selects “Return from an accountable person”. It happens the other way around. There wasn't enough money, so the driver invested his own. Then the cashier pays the difference using the document “Cash Withdrawal”, with the type of operation “Issue to an accountable person”. The basis for both documents will be our expense report.

When the time comes to write off the fuel purchased for cash for production, the accountant must create a document “Request-invoice”, which is created, accordingly, on the “Production” tab. The invoice must include what exactly was purchased and how much. You must also assign a write-off account. If fuel was purchased for the main production, then the posting will go to account 20, if the enterprise is a trading enterprise, then 44.01, if gasoline was used for the enterprise’s own needs, then account 26.

What documents support expenses?

The advance report is prepared together with documents confirming the fact of expenses. They may be:

- sales receipt;

- cash receipt;

- cash receipt order (PKO), etc.

A standard check contains the following information:

- Name;

- date of purchase;

- name of the organization where the goods were purchased;

- information about the operation performed;

- quantity and price of each item in the receipt;

- position, initials and signature of the seller.

The sales receipt is not drawn up according to a unified form. However, it must indicate the basic details required to confirm expenses. It is used in entities working on UTII because they do not work with cash register equipment.

ADVICE! If there is no receipt, you can attach another strict reporting form to the report. For example, when an employee goes on a business trip - a boarding pass for an airplane, a train ticket, etc.

If there are no supporting documents

In the absence of supporting documentation, an advance report cannot be drawn up. If the accountable person cannot provide evidence of the legality of the expenses, the organization has the right to fully demand a refund of the money spent.

Tax legislation does not prohibit organizations from accepting reports without supporting documents. However, funds issued for reporting in such a situation cannot be included in expenses when working under the simplified taxation system.

Reflection of expenses in accounting

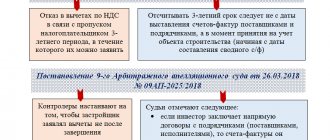

Risks in this situation are associated with different dates for recognition of costs established by the code for different types of expenses.

In accordance with paragraphs. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, if the expenses on the advance report are related to business trips, entertainment or similar expenses, then they must be taken into account during the period of approval of the advance report, and not in the period to which these expenses relate (the business trip period).

The controllers in their official explanations indicated that clause 5, clause 7 of Art. 272 of the Tax Code of the Russian Federation must be applied even if the period of the business trip and the date of approval of the advance report belong to different periods . So, in a situation where in the first half of the year an employee submitted an advance report with an agreement and an act on the provision of services for obtaining a visa, and the report was approved already in July, the Russian Ministry of Finance indicated that expenses should be recognized at the time the report is approved (Letter of the Russian Ministry of Finance dated July 18. 2013 No. 03-03-06/1/28117).

The judges took the same position. The FAS Moscow District indicated that travel and entertainment expenses should be taken into account in the period in which the advance report was approved. The inspectors argued that the expenses relate to the period in which the services were purchased, but the court did not support them (Resolutions dated February 27, 2012 in case No. A40-49520/11-20-208, dated November 18, 2009 No. KA-A40/10898- 09 in case No. A40-9041/09-108-33).

But the very fact of arbitration practice on this issue indicates that inspectors’ claims are not excluded. Moreover, if the expenses clearly relate to representation, travel or other similar expenses (directly mentioned in subparagraph 5 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation), the likelihood of defending the position in court is high.

However, it must be taken into account that the accountable person can pay not only travel expenses. Paragraph 2 of Article 272 of the Tax Code of the Russian Federation requires taking into account material costs on the date of transfer of materials to production. That is, as of the date of approval of the advance report, expenses for the acquisition of inventories cannot be recognized in tax accounting in any case. The costs of purchasing works and services of a production nature can also be considered material costs. In this case, they also need to be recognized on the date of signing the act of acceptance and transfer of work and services (clause 2 of article 272 of the Tax Code of the Russian Federation).

Therefore, the likelihood of claims from inspectors increases significantly if the accountable person pays for services of a production nature , which cannot be directly attributed to travel, entertainment or transport maintenance costs.

So, for example, there is a court decision which states that if the accountable person paid for training services, then, based on clause 2 of Art. 272 of the Tax Code of the Russian Federation, the date of recognition of costs will be the date of signing the acceptance certificate for the services themselves. In this case, the moment of approval of the advance report and the moment of recognition of expenses on it may not coincide. True, in that case, the inspectors, on the contrary, insisted that travel expenses associated with training should be recognized at the time of approval of the reports. But the court refused to the inspectors, pointing out that, by virtue of clause 4 of Art. 252 of the Code, if expenses relate simultaneously to several groups of expenses, the taxpayer has the right to independently determine which group he will attribute such expenses to (Resolution of the Federal Antimonopoly Service of the Ural District dated December 10, 2009 No. F09-9824/09-S3).

Therefore, in order to reduce risks and (or) prevent tax disputes, it is advisable to determine in advance in the accounting policy a list of expenses that should be taken into account as part of travel expenses, and a list of production services that should be taken into account as part of material costs. In this case, it is advisable to pay material costs directly (without issuing funds on account). If the accountable person still has to pay expenses classified as material by the accounting policy, then such expenses will need to be taken into account according to the rules of paragraph 2 of Article 272 of the Tax Code of the Russian Federation. That is, on the date of signing the service acceptance certificate, or on the date of transfer of materials to production.

In conclusion, we note another way to eliminate formal grounds for dispute. This method is widely known and widely practiced. It consists of signing a document indicating the date of the period in which the expenses were incurred . Please note that in fact, the accounting department always processes documents in the current month for the previous month. As a rule, December reports are dated December 30 or 31, despite the fact that the accountant processed them in January (or even February). At the same time, accounting and document flow have long been automated. Large companies or holdings often use ERP systems. However, the document automation systems they choose do not limit the actions of accountants in any way. We believe that in this case, you can choose software that would have the functionality for making changes to an electronic document and selecting a date.

Get expert advice

according to your situation and get expert advice.

Ask a Question

Ask a Question