What is it and when does it occur

Material benefit under a loan agreement is the amount generated when signing an agreement on an interest-free or preferential loan, calculated as the borrower saving money on interest payments. Of this, 35% is paid as personal income tax, which has been approved since the beginning of the 90s.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The reason for introducing such a norm into legislation was the policy of some companies to evade paying taxes: processing salaries in the form of interest-free loans, signing loan agreements for relatives, etc.

Saving money when applying for a loan in national currency can occur when:

- interest-free loan;

- a loan with interest less than 2/3 of the bank refinancing rate in a given territory.

When borrowing in foreign currency, profit arises during an interest-free agreement and an agreement with a rate of less than 9% per annum.

Material benefits can only arise from monetary loans. In the case of a property loan, it is not determined.

To ensure that the provision of a service such as an interest-free or preferential loan does not cost the borrower more than a loan with regular interest, you need to know how the material benefit and the tax on it are calculated.

Calculation

Material benefits arise from the date of payment of interest on the loan (with a preferential loan). When concluding an interest-free agreement, the date of formation of the material benefit is not established by the Tax Code.

Therefore, you can choose one of the options:

- the moment of full or partial repayment of the loan;

- daily throughout the tax period;

- end date of the contract;

- last day of the tax period.

For each loan option, the amount of material benefit is calculated separately.

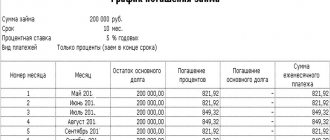

Calculation of material benefits for an interest-free loan

The material benefit under an interest-free loan agreement is calculated at the bank refinancing rate at the time of loan repayment. When repaying the debt in parts, this amount is calculated separately at each time the payment is made.

Formally, material benefit (MB) can be expressed as follows:

MV = PS x NW / 365 d. x SK,

Where:

PS – marginal refinancing rate (2/3); SZ – loan amount; SC – loan term, days.

It is also worth taking into account that when a loan is repaid on the last day of the contract, the material benefit arises only in the month of repayment and is accrued on the entire loan amount.

For a loan with a preferential interest rate

Determining the material benefit for a loan with a preferential interest rate (below two-thirds of the refinancing rate) is carried out almost in the same way as for an interest-free loan, only the difference of 2/3 of the bank’s rate with the contract rate (SD) is taken as interest:

MV = (PS-SD) x SZ / 365 d. x SK

On an interest-bearing loan at an enterprise

The company has the right to issue loans to its employees at interest rates that are lower than bank interest rates.

If the organization’s interest rate is less than two-thirds of the refinancing rate, then the resulting difference is a material benefit for the borrower, which must be subject to personal income tax - 35% of the benefit amount. Most often it is deducted from your salary.

Deadlines for payment of personal income tax by a tax agent

Next, we will note when a tax agent should pay personal income tax in 2021 in the most common situations.

- Advance and salary for the second half of the month - the day following the day of payment of salary for the second half of the month.

- Bonus – the day following the day of its payment.

- Vacation pay is the last day of the month in which they are paid.

- Sick leave is the last day of the month in which they are paid.

- Payments upon dismissal, including compensation for unused vacation and salary - the day following the last day of work.

- LLC dividends – the day following the day of their payment.

- Payments under GPC agreements (contract, provision of services) - the day following the day of payment of any income under the agreement, including advance payment.

- Material assistance and other cash income - the day following the day of payment.

- The material benefit from saving on interest is the day following the next cash payment after calculating the personal income tax from the financial benefit.

If personal income tax payment deadlines are violated in 2021, penalties will be charged for each day of delay. To avoid such costs, it is important to be aware of payment dates and adhere to them. See the table for the deadlines for paying personal income tax on different types of income of individuals: wages, vacation pay, sick leave benefits and other payments.

Material benefit is a benefit in monetary or in-kind form that can be assessed and defined as income in accordance with the tax legislation of the Russian Federation.

Material benefits are generated when receiving loans (credits) from individual entrepreneurs and organizations at a low interest rate, when purchasing goods (works, services) under civil contracts from individuals, individual entrepreneurs and organizations that are interdependent in relation to the purchasing organization, as well as when purchasing securities at prices below market prices.

Thus, a material benefit arises in situations where an individual acquires ownership of something on more favorable terms than the established conditions for all other buyers or consumers.

Material benefits are subject to personal income tax.

Material benefit from a loan in foreign currency

When the interest rate on a foreign currency loan is below 9% per annum, the resulting difference is a material benefit. According to the law, income in foreign currency must be converted into rubles at the rate at which this income was received. That is, on the day the loan or part thereof is repaid.

To calculate the material benefit of a foreign currency loan, you must have data on:

- loan amount;

- interest rate;

- days (actual) of use of borrowed money;

- tax period;

- exchange rate of the Bank of Russia on the date of receipt of income.

Calculation of material benefits under a loan agreement can be calculated using the formula:

MV = SZ x CV x (9%-PZ) / 365 d. x SK,

Where:

MB – material benefit; SZ – loan amount; KV – exchange rate on the date of receipt of the benefit; PZ – loan interest; SC – loan term, days.

With an interest-free loan, the formula will be almost the same:

MV = SZ x CV x 9% / 365 d. x SK

That is, personal income tax should be paid at 9% per annum of the loan amount on the date of partial or full repayment.

The classification of government loans can be seen in the table in the article: classification of government loans. How to apply for a loan on a card instantly, around the clock and without refusal, read here.

Buying a home

In Art. 212 of the Tax Code of the Russian Federation defines the concept of material benefit and cases of its accrual, the exception of which is interest savings on a loan issued for the construction or purchase of housing, acquisition of land, etc.

In other words, the financial benefit from a home loan is not subject to taxation.

But the borrower must have an approved document that will indicate his right to deduct property. This form is approved by law and is mandatory.

Without this document, a loan is considered simply a cash loan and income tax will be charged on it.

From the date the lender provides the property right, no material benefit will arise, therefore the tax will not need to be paid according to the rules of an interest-free or preferential loan.

But organizations are recommended to withhold tax until receiving a notification from the borrower, since the start of the benefits is the day when he submits documents to the tax office, and it takes 30 days to issue a notification.

Therefore, in order not to submit an application for a tax refund from the budget, you should not rush to deduct it.

Loan to an employee, individual

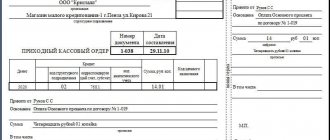

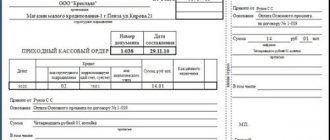

An organization that issues a loan to its employee without interest or on preferential terms becomes his tax agent. It calculates the material benefit to the borrower, withholds personal income tax on it and transfers this money to the budget.

The employee receives a material benefit with each loan payment and can be either once a month or one-time when the entire amount of the debt is repaid.

If during one tax period (1 year) there were no loan payments, then no material benefit arose.

The lending company most often withholds personal income tax from the employee’s salary, but this amount should not exceed 50% of the payment amount.

As a tax agent, the lending organization keeps records of the funds issued in the employee’s tax register, and also provides it to the tax authorities within the period established by law.

The only difference when issuing a loan to an employee and an individual who is not an employee of the company is that personal income tax can be withheld and paid to the budget only from the employee. This is also shown differently in accounting.

The issuance of a loan to an employee is carried out in account 73: debit 73-1 credit 50 (51), and return - vice versa. Interest on the loan is indicated in the credit account 91-1. A loan to an individual is a financial investment, since it brings economic profit to the enterprise, therefore it should be recorded in subaccount 58-3.

Interest on the loan is posted through debit 76 credit 91-1. Interest-free loans are not investments, so they are shown in account 76.

Benefits when purchasing securities

Material benefits received from the acquisition of securities arise if they:

- received free of charge;

- purchased at prices below market prices.

This applies to both securities traded on the organized market and securities not traded on the organized market (Clause 4 of Article 212 of the Tax Code of the Russian Federation).

The conditions for the emergence of material benefits are described in paragraph 4 of Article 212 of the Tax Code of the Russian Federation.

When a shareholder (founder) receives additional shares (shares, units) as a result of the revaluation of fixed assets, no material benefit arises. Such income is exempt from personal income tax (clause 19, article 217 of the Tax Code of the Russian Federation).

The amount of material benefit is equal to the excess of the market value of securities over the costs of their acquisition (paragraph 1, paragraph 4, article 212 of the Tax Code of the Russian Federation).

The market value of securities is determined taking into account the maximum limit of its fluctuations.

If securities are traded on an organized market:

- market value is determined in accordance with the Procedure approved by Order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-65/pz-n;

- the maximum limits for fluctuations in market value are determined on the basis of clause 5 of the Procedure, approved by order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-65/pz-n.

The market value of securities not traded on an organized market is determined based on the settlement price, taking into account the maximum limit of its fluctuations:

- the settlement price is determined in accordance with the Procedure approved by order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-66/pz-n;

- the maximum limits of fluctuation (upward and downward) are 20 percent of the calculated price (clause 7 of the Procedure approved by Order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-65/pz-n).

The market value of securities (both traded and non-traded on the organized market) is determined as of the date of the transaction (paragraph 6, clause 4, article 212 of the Tax Code of the Russian Federation).

This procedure for calculating the market value of securities to determine material benefit follows from the set of norms of paragraph 4 of Article 212, paragraph 6 of Article 280 of the Tax Code of the Russian Federation, paragraphs 2 and 4 of the Procedure approved by order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-65/pz -n, paragraph 1 of the Procedure approved by order of the Federal Financial Markets Service of Russia dated November 9, 2010 No. 10-66/pz-n.

Between legal entities

If an interest-free loan agreement is concluded between legal entities, then the borrowing organization does not pay tax, since it does not have a material benefit.

This comes out of ch. 25 of the Tax Code of the Russian Federation, which indicates all types of income subject to taxation, among which there is no material benefit when concluding an interest-free or preferential loan agreement. Therefore, the borrower does not need to pay interest.

When a legal entity is a UTII, its taxation is determined by local authorities, which can tax certain areas of activity. But even in this case, the material benefit from the loan cannot be subject to taxation.

The lending organization, according to the law, is not subject to VAT when issuing a loan, as specified in Art. 149 of the Tax Code of the Russian Federation. All funds given or received from the loan account are not taken into account as expenses or income of the lender, and therefore are not subject to tax.

The interest that the borrower pays for using the loan is considered non-operating income of the organization. Each loan must be accounted for separately, and the interest on it is included in the list of monthly income.

If the debt is repaid ahead of schedule or upon expiration of the contract, income is taken into account on the date of repayment.

When the loan is returned to the company's cash desk, interest income is accrued immediately.

Date of receipt of income from interest savings

The material benefit from saving on interest for using borrowed (credit) funds arises on the last day of each month during the loan period (subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation). At this point, the tax agent must calculate the amount of personal income tax. And withhold the tax and transfer it to the budget - upon the first payment of any funds (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

Apply this rule to the material benefit from saving on interest for the free use of borrowed (credit) funds.

Personal income tax

The calculation of personal income tax for material benefits from saving money on interest on a loan is determined by Art. 212 of the Tax Code of the Russian Federation.

This income is taxed at the rate:

- 35% when the borrower is a tax resident of the Russian Federation;

- 30% when the borrower is not a tax resident of the Russian Federation.

A tax resident is considered to be an individual who stays in Russia for at least 183 consecutive days per year.

When a loan is issued by an organization to its employee, the amount of personal income tax from the material benefit received is automatically withheld from each salary and transferred to the budget.

But this amount should not be more than 50% of the payment itself (salary). In the 2-NDFL certificate, this tax from material benefit is carried out through code 2610. The certificate is submitted to the Federal Tax Service within the time limits established by law.

When providing a loan to a non-employee of the organization, a 2-NDFL certificate is drawn up without deduction of funds and transferred to the Federal Tax Service and the borrower.

In this case, you need to notify the tax authority in advance that personal income tax is not collected from the borrower, and the borrower that he needs to pay tax.

Personal income tax can be calculated using the formula: personal income tax = financial benefit x tax percentage. If the debt is forgiven, then this amount is fully included in the individual’s income and is taxed at 13%.

Also, material benefits in some cases are not taxed, as indicated in Art. 212 of the Tax Code of the Russian Federation. This always applies when issuing a loan to a legal entity.

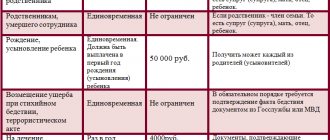

Material benefits from a loan to an individual are not subject to personal income tax in the following cases:

- for housing construction;

- for the purchase of a residential property or part of it (house, apartment, room, etc.);

- for the full or partial acquisition of land for the construction of a residential property;

- for the purchase of a plot with a residential building;

- for refinancing loans that were issued for the construction or purchase of a residential property, land for building a house, land with a house, shares in construction, etc. In this case, the bank providing the initial loan must be located on the territory of the Russian Federation.

In order to confirm the purpose of his loan, the borrower must provide the lender with a document certifying his right to a tax deduction in connection with the purchase of housing or a plot for its construction.

Until this moment, the organization withholds tax on its material profits. As soon as the borrower contacts the tax service to obtain an identification document, he must inform the lender about this, since personal income tax ceases to be calculated from the moment of application. The document itself is issued only 30 days after application.

The financial benefit of a loan is the amount of money that the borrower saves on interest payments. With an interest-free loan, it is equal to two-thirds of the refinancing rate of the Bank of Russia, and with a preferential loan, it is equal to the difference between these 2/3 and the interest on the loan (if it is lower).

A loan in foreign currency implies a material benefit if the interest on it is less than 9% per annum, and when calculating the benefit, the amount received is converted into rubles at the current exchange rate at that time.

If a loan is issued to a legal entity, there is no material benefit from it. In other cases, personal income tax is withheld from the amount of economic benefit in the amount of 35%.

If a loan was issued by an organization to its employee, then personal income tax is deducted from the salary, and when a loan is issued to another individual, he must pay the tax himself.

What is the possible maximum amount for an interest-free loan between legal entities is described in the article: interest-free loan between legal entities. To draw up a subordinated loan agreement without errors, see the sample.

Find out about the agreement to terminate the loan agreement on the page.

Benefits when purchasing goods, works, services

When determining the material benefit from the acquisition of goods (work, services), it matters whether the parties to the transaction are interdependent persons. If so, then when using reduced prices, the buyer may be required to pay personal income tax on material benefits (subclause 2, clause 1, article 212 of the Tax Code of the Russian Federation).

The parties to the transaction are recognized as interdependent persons in the following cases:

- one person is subordinate to another by position (for example, a buyer to a seller or vice versa) (subclause 10, clause 2, article 105.1 of the Tax Code of the Russian Federation);

- the buyer and seller are married, are relatives, have a relationship between an adoptive parent and an adopted child, a trustee and a ward (subclause 11, clause 2, article 105.1 of the Tax Code of the Russian Federation).

Thus, the buyer and seller can be recognized as interdependent persons.

Income in the form of material benefits from the acquisition of goods (work, services) arises on the day of acquisition (subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation). You define material benefit as follows:

| Material benefit from the purchase of goods (works, services) | = | Market price of goods (works, services) | – | The price of goods (works, services) at which they were sold to the employee |

Determine the market price of goods (works, services) taking into account the provisions of paragraph 3 of Article 105.3 of the Tax Code of the Russian Federation.

For more information about the procedure for determining the market price, see How to determine the market price of goods (works, services).