KUD is a document obligatory for entrepreneurs who have chosen the patent taxation system.

The main thing to remember is that for each individual patent and for each tax period, its own income book is kept.

If the patent has expired, but the book has not yet, you can postpone it until further renewal and start a new one.

The second point is that you can keep a book either in paper form or electronically by filling it out on a computer. But remember that the electronic version of the KUD must be printed at the end.

The third point is that when the book ends, the entrepreneur is required to take several simple actions:

- Flash a book

- Number the pages

- Specify the number of pages. This is done on the last sheet

- Keep the book safe. It is necessary to ensure safety for at least another four years. When audited by the tax authorities, you will be forced to pay a fine if you fail to provide one of the books for any period during those four years. And the fine, by the way, is 30 thousand rubles (Article 120 of the Tax Code of the Russian Federation).

There is no need to indicate expenses in this book!

Rules for maintaining CUD on a patent

The patent system is the youngest tax regime in Russia. Therefore, many entrepreneurs have questions regarding its use in practice. Traditionally, tax and accounting rules cause difficulties.

Entrepreneurs with a patent are exempt from accounting. They also do not submit a declaration on the value of the patent to the Federal Tax Service, which distinguishes PSN from other tax regimes. Their only responsibility is to maintain a book of income accounting for individual entrepreneurs on a patent. It is this document that serves as a form of tax accounting.

Many individual entrepreneurs are concerned about the question of why keep a book of income accounting if their real revenue is not taken into account anywhere, and the value of a patent is determined on the basis of potential profitability. Maintaining a register is necessary to confirm the businessman’s right to work on the PSN and his compliance with the profitability limit. The fact is that in order to apply a patent, a businessman’s annual revenue should not exceed 60 million rubles.

The actual proceeds received are not used for other purposes. Pension contributions are also paid based on the potential income for each type of activity on the PSN.

The book is kept for the period for which the patent was purchased, and for each patent separately if the entrepreneur combines several types of activities.

The book for PSN does not keep records of expenses, so the merchant does not need to collect primary documents confirming expense transactions. At the same time, it is advisable to keep all receipts and invoices, as they will allow you to defend your rights when purchasing low-quality goods. They may also be needed if the profitability limit for PSN is exceeded, then the individual entrepreneur will be transferred to OSNO and he will need to document expense transactions to reduce the tax base.

If an individual entrepreneur combines PSN and STS in its activities, then total expenses (for example, for office rent or employee salaries) are distributed according to the share of income from each tax regime in total revenue.

Individual entrepreneurs have the right to maintain a register in electronic or paper form. When maintaining it electronically after the patent expires, it is printed, stitched and sealed (or signed by the individual entrepreneur when working without a seal). Data on the number of sheets in the book must be indicated on the last page.

There is no need to have the document certified by the Tax Office. But a businessman must be ready to present it at any time upon request of Federal Tax Service employees. For the absence of a book, an entrepreneur faces a fine of 10,000 rubles. And if he commits a violation again, the fine will increase to 30,000 rubles.

Return to contents

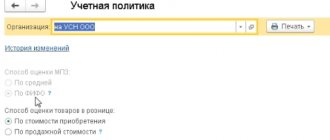

Rules for reflecting income and expenses in KUDiR under the simplified tax system

In KUDiR you need to record only those incomes and expenses that are taken into account when calculating the simplified tax system. Moreover, expenses need to be included in the book only if you are using the simplified tax system “Income minus expenses.” And on the simplified tax system “Income” it is enough to reflect in the book the income and insurance premiums paid for individual entrepreneurs and employees.

You need to take into account income from the sale of goods, work or services, as well as some non-operating income. Make an appointment with KUDiR on the day you receive payment from the client. In a special article you will find details about accounting for income in the simplified tax system.

Expenses are more difficult. Firstly, only expenses from Section 346.16 of the Tax Code can be taken into account. Secondly, this must be done on the last date:

- date of full payment to the counterparty;

- date of receipt of paid goods, works or services from the counterparty;

- the date of transfer of the goods to the final buyer (if you are buying the goods for subsequent resale).

A separate article describes the nuances of accounting for expenses in the simplified tax system.

Each entry in KUDiR is confirmed by primary documents. These can be payment orders, strict reporting forms, sales or cash receipts, acts, invoices and others.

Book of accounting of income and expenses for the simplified tax system

News KUDiR in Elbe

With Elba, keeping a book of income and expenses will not be difficult! We will automatically fill in the required fields and help you save the KUDiR in Word or PDF format!

The procedure for filling out the IP book on a patent

How to fill out the income book of an individual entrepreneur on a patent? To do this, you need to download the form approved by order of the Ministry of Finance and consistently deposit all the businessman’s receipts in cash (according to PKO, BSO, sales or cash receipts) and to the current account. Only income from activities within the framework of the PSN is entered into the journal; transactions from other tax regimes are not taken into account (there is a special form for them).

You can find a sample of filling out the CUD at the territorial office of the Federal Tax Service.

On the title page you must indicate:

- Full name, address and TIN of the entrepreneur;

- the validity period of the patent and the region of its acquisition;

- the businessman’s current account number indicating the bank (if the individual entrepreneur has a current account).

The main section indicates all income, indicating the date of receipt, the number of the primary document, the content of the transaction (for example, revenue from the provision of services). Finally, the total amount of income received for the tax period is indicated.

The list of income that does not need to be taken into account when filling out the register includes interest on bank deposits or previously issued loans, fines and penalties received from buyers, property received as a gift or other income that is not directly related to business activities.

If the income was received in foreign currency, then in the book of income and expenses of the individual entrepreneur on the patent the amount in rubles is displayed at the exchange rate of the Central Bank of the Russian Federation on the day of the transaction. Income in the form of property or bills of exchange is reflected in the amount specified in the agreement or on the bill of exchange.

The return of a previously received advance reduces income only in the period in which the money was returned to the entrepreneur. Let's give an example. Entrepreneur Ivanov received an advance payment on November 20, 2016. In January 2021, he was forced to return it to his buyer. In this case, income can be reduced only in January 2017.

The only tax accounting register for individual entrepreneurs using the patent taxation system (PTS) is the income book

. It is needed in order not to exceed the income limit for PSN - 60 million rubles from the beginning of the year. The income book of an individual entrepreneur on a patent consists of a title page and section I Income.

The book is opened in one single copy; there is no need to register it with the tax office. For every patent a new book is opened. If the patent expires during a calendar year and a new patent is acquired, then you need to start a new book.

The income ledger can be kept in paper form or electronically. If in paper form, then it must be sewn and numbered, on the last page indicate the number of sheets and certified with a seal (if any) and signature. Before you start using it, you need to fill out the title page: full name of the entrepreneur, TIN, address, current account number, the period for which the patent was issued and the subject of the Russian Federation where it was received.

If an individual entrepreneur made a mistake in the income book, it must be corrected and certified with a signature and seal (if any) and the date of correction must be entered.

If the book is kept in electronic form, then at the end of the period for which the patent was issued it must be printed, bound and numbered. On the last page, enter the number of pages and certify with a seal (if available) and signature of the individual entrepreneur.

Income book

How to fill out

The form of the income book for individual entrepreneurs using PSN and the procedure for filling it out were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

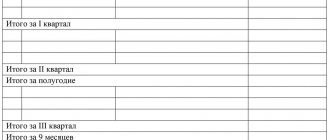

Everything is clear on the title page; no questions can arise there. As for the “Income” section, entries are made in it in chronological order:

- serial number;

- date and number of the primary document;

- content of the operation - the income from sales received from the type of activity specified in the patent is indicated. Other income (from another patent) is not taken into account;

- amount of income.

Sales income

— this is revenue from the sale of goods (works or services) of one’s own production or previously acquired, revenue from the sale of property rights. Sales proceeds are determined based on all receipts associated with payments for goods sold (work, services) or property rights expressed in cash and (or) in kind (Article 249 of the Tax Code).

Income is reflected in the book on a cash basis, that is, on the day when income is received (in cash, to bank accounts) or transferred in kind. If income is returned, it is deducted from the tax period in which the return occurred.

Income in foreign currency is converted into rubles at the official exchange rate of the Central Bank of the Russian Federation on the date of receipt of income.

Income in kind is recorded at market value.

If an individual entrepreneur, in addition to a patent, applies other tax regimes, he is obliged to keep separate records of property, liabilities and business transactions related to different taxation systems.

How to apply for KUDiR

Every year begins with the registration of a new KUDiR. Entries in the book can be made manually or filled out on a computer and printed at the end of each quarter. At the end of the year, the book must be bound and numbered, the number of pages must be indicated on the last sheet, signed and sealed if available. There is no need to certify the book with the tax office. Keep the completed book for 4 years and provide it to the tax authorities upon receipt of a request.

Instructions: how to fill out the KUDiR section by section

Photo instructions: how to stitch KUDIR

Results

KUD for individual entrepreneurs on PSN is a mandatory tax register. If, at the request of the tax authorities, the income book is not provided, this will entail a fine. CUD is necessary to control the income limit for the purpose of applying PSN. It includes all income received within the framework of patent activity for the tax period.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to punish for violating the rules of conducting KUDiR

The management of KUDiR must be approached responsibly. For the absence of a book or false information about income and expenses, you can be fined.

If requested by the tax authorities, the KUDiR must be provided within 10 days. If you do not do this, you may be fined 200 rubles for each book not provided.

If tax officials, during an audit, find at least two cases of incorrect reflection of income and expenses in the KUDiR, they face a fine of 10,000 to 30,000 rubles. And if this led to an understatement of tax, the fine will be 20% of the unpaid amount, but not less than 40,000 rubles.

Who can use PSN

Only an individual entrepreneur can obtain a patent for a type of activity; legal entities are deprived of this right. To obtain a patent, you must comply with the following restrictions:

- you are engaged in activities for which the use of a patent is permitted (see the list in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation);

- in your region it is allowed to use PSN - find out this first;

- you have no more than 15 employees during the tax period (including under GPC agreements);

- annual income for all types of activities on a patent - no more than 60 million rubles;

- you have no debt on previously issued patents.

Rules for reflecting income in KUDiR on a patent

Only income from “patent” activities needs to be recorded in the patent income book. They are taken into account according to the same rules as income on the simplified tax system - on the day the payment is received from the client. There is no need to include expenses in the patent ledger.

Income book for a patent

Submit reports in three clicks

Elba will help you work without an accountant.

She will generate reports, calculate taxes and prepare KUDiR. Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months