An advance to accountable persons is money given to employees of an organization for targeted expenses. Who is the accountable person, how to reflect the issuance of funds and their return in accounting - we will tell you in the article.

An accountable person is a company employee who has received money for specific purposes. Goals can be divided into 3 groups:

- business and operating expenses;

- travel expenses;

- reimbursement to the employee for travel expenses incurred.

However, not every employee of the organization can receive money on account. A prerequisite is that the employee must report on all previously issued amounts. Transfer of advance amounts from one person to another is prohibited. Do not give out funds to persons who are not employees of the company.

How to properly return accountable money to the organization’s account?

These days, almost every employee has a salary card.

It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking. How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts” in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

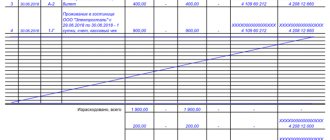

BOO

Accountable amounts are reflected in the balance sheet on account 71. The debit balance shows the debt of an employee of the organization. By turnover, amounts issued and reimbursed overexpenditure are displayed. The loan includes the use of funds and the return of the balance to the cash desk. All amounts are recorded in the order journal. Entries are made in it on the basis of PKO, RKO, and advance reports. The latter are handed over to the cashier only after the accountant has checked the arithmetic calculations and the intended use of the funds. Let's look at the basic wiring.

- DT71 KT50(51) – money was issued for reporting from the cash register (current account).

- KT71 DT20 (26, 44, 71) – write-off of funds for main production expenses (general business expenses, additional sales costs).

- KT71 DT07 (10, 15, 41) – accountable amounts were used to purchase material assets.

- KT71 DT50 – refund to the cash register.

- KT71 DT94 – amounts not returned on time are taken into account.

- DT70 KT94 – non-refunded amounts are withheld from the accountable person.

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

If reimbursement of the commission is provided for by local regulations, then the employer can take it into account in income tax expenses, like other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, Letters No. 03-03 -06/1/18005, No. 16-15/105572).

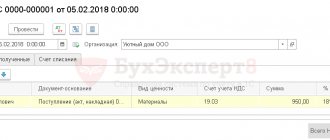

Working in 1C 8.3

The issuance of money from the cash register is formalized by an expense order with the same type of operation. Full name is written in the tabular part of the document. employee, amount, purpose of using funds. Additionally, it is indicated which document details will be printed. Usually this is the employee's passport. After posting the document, posting DT71 KT50 for the amount of the transaction is generated.

If they are transferred to a current account, a bank statement is generated. Type of operation: “Transfer of funds to an individual.” The same fields are filled in, but the account details are additionally indicated. This document forms the wiring DT71 KT51.

All transactions involving the use of funds must also be entered into the program. The basis for writing off money may be a plane ticket purchased by the organization itself. In this case, the document “Issue of monetary documents” is generated in the “Bank and cash desk” section. It indicates the full name. accountable person, and on the second tab the document itself, for example, like this: “ticket for the plane “Moscow - Belgorod - Moscow”.” This operation creates a transaction from DT71 to KT50 for the amount of the ticket price.

All settlements with accountable persons are documented in document AO-1. Its printed form includes:

- transferred amounts;

- directions of their use;

- details of supporting documents.

In the program, all these amounts are written off using the “Advance report” document in the “Bank and cash desk” section. It consists of 5 tabs. The first is called “Advances”. The documents on the basis of which funds were issued to the employee (PKO, bank statement) are listed here. The “Products” tab contains a list of areas for using funds. If necessary, the “Returnable container” is filled in. If, using the funds received, the employee paid for goods or services provided to the organization, then these amounts are reflected on the “Payment” tab. After posting the document for these transactions, posting DT60 KT71 will be generated. All other expenses, including daily allowance, travel expenses and general business needs, are reflected in the “Other” tab. The fields filled in here do not generate transactions, but are used in the printed form of the document.

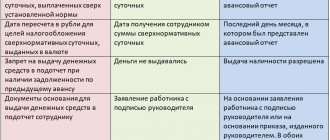

Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than 3 business days from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U). The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

The essence

After three days from the date of return from a business trip, the employee must report on the funds received and spent. To do this, an advance report of the accountable person is drawn up, and documents confirming the expenditure of funds are attached to it: travel tickets, hotel bills, etc. The form of the form is approved by the manager. Unused amounts are handed over to the cashier using a receipt order. If the employee does not have enough issued funds, then the overexpenditure is also compensated from the cash register, but according to an expense order. If the employee does not provide a report on the use of funds at all, then this amount is withheld from his salary.

The procedure for issuing funds for reporting

Giving an employee money for travel, business and other expenses related to the company’s activities is a common practice. The procedure for issuing funds for reporting is regulated by the Directive of the Central Bank of the Russian Federation dated March 11, 2014. No. 3210-U.

To minimize cash turnover, payments with employees are also transferred to non-cash form. The possibility of using bank cards of employees, including salary cards, for settlements of accountable amounts was confirmed by the Ministry of Finance back in 2013 in Letter No. 02-03-10/37209.

Quite often the question arises: if it is possible to transfer money against an account to an employee’s bank card, is it possible to return the accountable amounts to the company’s current account?

The employee must return the amounts received for travel or business expenses that were not spent by him within the following periods:

- on the day of expiration of the period for which the funds were issued;

- on the first day of returning to work after the end of a business trip, vacation, illness, etc., if the end of the period for which the money was issued on account falls within these periods.

Russian legislation does not contain any explanations on how an employee can return money received on account: by returning the accountable amounts to the cash desk or by wire transfer. Order of the Ministry of Finance No. 94n allows the correspondence of account 71 “Settlements with accountable persons” for the return of funds with accounts 50 “Cash” and 51 “Settlement accounts”. Thus, a return to the current account is possible, and if the organization has minimal or no cash handling, it is the only possible option.

Examination

The application first goes to the accountant. He checks whether old settlements with accountable persons have been closed. If an employee has not provided a report on previously used amounts, then new cash cannot be issued to him. Entertainment expenses, travel allowances, daily allowances – a document must be presented for all money spent. The results of report processing show who owes what and how much. If there is a difference between the funds issued and the funds used, it means that the employer or employee owes a debt.

Establishing deadlines for which cash can be issued on account

Figure 1. ORDER FOR APPROVAL OF DEADLINES FOR ISSUING CASH ON ACCORDANCE

| Limited Liability Company "Yarilo" ORDER No. 4 On approval of the terms for which they can be issued cash on account Yaroslavl 01/11/2011 For the purpose of carrying out business expenses by employees of the enterprise I ORDER: Approve for 2011 the following terms for which cash can be issued on account: Purpose of issuing money | Deadlines in calendar days |

| Purchase of household equipment | 21 days from the date of issue |

| Purchasing office supplies | 7 days from the date of issue |

| Payment for minor repairs of office equipment | 28 days from the date of issue |

| Payment of postal and telegraph expenses | 7 days from the date of issue |

General Director A.A. Veselov Veselov

In addition to the order on employees who have the right to receive money on account, it makes sense for the head of the enterprise to issue an order approving the deadlines for which cash can be issued on account. After all, it is possible that one of the accountable persons will delay reporting on the amounts spent and making the final payment for them. And if the employee has not reported on the previously received advance, then, according to the above-mentioned paragraph 11 of the Procedure, he cannot receive the next amount of cash on account. This order helps organize work with cash and discipline the workforce.

Please note that the time period for which an employee can be given cash on account is determined by the head of the enterprise at his own discretion. There are no restrictions in the legislation.

Establishing the period for which employees are given accountable money is the right, and not the responsibility, of the head of the enterprise. However, if the specified period of time is not determined, then the employee must report on the day the accountable amounts are received. This follows from the letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704.

Example 1

The head of JSC "Perun" did not establish the period for which the company's employees are given cash for business expenses.

On May 12, 2011, office manager of Perun CJSC V.P. Lastochkina received money to buy stationery. On the same day, she is obliged to complete the task, submit an advance report and return the unspent balance of accountable money to the cashier.

For organizations that do not review during the year the deadlines for which cash can be issued on account for business expenses, it is advisable to specify these deadlines in their accounting policies.

Providing funds

It is allowed to issue accountable amounts by transferring them to the employee’s salary card. But to do this, it is necessary to indicate in the management accounting order the possibility of this method of transferring funds. In the application itself, the worker must write that the money is transferred to his salary card and provide details. In the payment order, the purpose of the payment should be indicated as the movement of accountable amounts. Documents for the expense report submitted by an employee of the organization must include slips of all checks.

Retention of unspent imprest amounts

So, let’s say that an employee, from the funds received as an account, paid for the business expenses of the enterprise, while he still had a certain amount of money left unspent. Or, during the period for which he was given cash on account, he did not carry out or pay business expenses at all.

In the first case, the employee must submit a report to the organization’s accounting department on the amounts spent and make a final payment for them: return the remaining money to the company’s cash desk. In the second case, the employee must return to the company’s cash desk all the money he received on account. In this case, they do not prepare a report on the amounts spent.

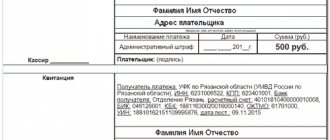

Please note that the document confirming the employee’s return of unspent amounts and the acceptance of these amounts by the company’s accountant is a cash receipt order. Its unified form No. KO-1 was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

An advance report is provided for settlements with accountable persons. Its unified form No. AO-1 was approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55. To this document, the reporting employee must attach documents confirming the expenses incurred: travel certificate, business trip report, cash receipts, receipts and other documents for payment of business expenses. expenses.

Let us repeat that three working days are allotted for submitting a report on the amounts spent and making a final settlement on them. They should be counted either after the expiration of the period established by the head of the enterprise for which cash can be issued on account, or from the day the employee returns from a business trip.

The accountable person must return the unspent accountable amounts to the enterprise's cash desk simultaneously with the submission of an advance report to the accounting department.

If the employee does not return the unspent accountable amounts, they are withheld from his salary. Paragraph 2 of Part 2 of Article 137 of the Labor Code allows this to be done.

Holding order

According to Part 3 of Article 137 of the Labor Code, in order to repay an unspent and not timely returned advance previously issued to an employee for reporting, the employer has the right to decide to deduct from the salary of the specified employee no later than one month from the date of expiration of the period established for the return of the advance. Condition - the employee must not dispute the grounds and amounts of the withholding.

The employer makes and formalizes the decision, usually in the form of an order or instruction. Normative legal acts have not established a unified form for such an order. To deduct amounts from wages, his written consent must be obtained. Such conclusions are given in the letter of Rostrud dated August 9, 2007 No. 3044-6-0.

Please note that deductions from wages can be made in a limited amount. Unspent accountable amounts should be withheld for each payment of wages to an employee who has not returned them on time, in the amount of no more than 20 percent of the unpaid amount. The basis is Article 138 of the Labor Code.

Example 2

Manager of Yarilo LLC N.K. Razin received 4,000 rubles as a report on May 16, 2011. to pay for printer repairs in a specialized organization. Repairing the printer cost only 2,500 rubles.

At Yarilo LLC, cash on account for payment for minor repairs of office equipment based on the order of the manager is issued for a period of 28 calendar days from the date of issue. According to clause 11 of the Procedure, the amounts spent must be reported within three working days. Thus, submit the advance report to the accounting department and unspent accountable amounts to the cash desk of Yarilo LLC. Razin must until June 15, 2011 inclusive.

On June 15, 2011, Razin brought a repaired printer from a specialized organization to Yarilo LLC. On the same day, he submitted an advance report to the organization’s accounting department, to which he attached a cash receipt and an acceptance certificate for the work performed. In this case, the balance of the unspent accountable amount is 1,500 rubles. (4000 – 2500) — Razin did not return.

On June 27, 2011, Razin gave written consent to withhold 1,500 rubles. from his salary. On the same day, the head of Yarilo LLC issued an order to make the appropriate deductions.

Salary N.K. Razin for June 2011 amounted to 24,000 rubles. This means that the accountant of Yarilo LLC has the right to withhold 4,176 rubles from his salary for the specified month. . Since the unreturned balance of the unspent accountable amount (1,500 rubles) is less than this amount, the accountant withheld it in full from Razin’s salary for June 2011.

Figure 2. WRITTEN CONSENT OF THE EMPLOYEE TO RETENTION

to CEO

LLC "Yarilo"

A.A. Veselov

From the manager

N.K. Razin

Due to my failure to return unspent accountable amounts in the amount of 1,500 rubles within the prescribed period. I don’t mind their deduction from my salary.

June 27, 2011 Razin N.K. Razin

Limited Liability Company "Yarilo"

ORDER No. 61

About deduction from wages

unspent accountable amounts

Yaroslavl 06/27/2011

1. To repay the unspent and not returned timely advance payment issued for printer repairs, deduct from the salary of manager N.K. Razin a sum of money in the amount of 1500 rubles.

2. Accountant Z.P. Stepanova to deduct from the salary of the specified employee starting in June 2011.

General Director A.A. Veselov Veselov

Contractor accountant Stepanova Z.P. Stepanova

The order has been reviewed by: Razin N.K. Razin

Figure 3. HOLD ORDER

The following entries were made in the accounting records of Yarilo LLC:

DEBIT 94 CREDIT 71

— 1500 rub. — the accountable amount not returned on time is reflected;

DEBIT 20 CREDIT 70

— 24,000 rub. – salary accrued for June 2011 N.K. Razin;

DEBIT 70 CREDIT 68 SUB-ACCOUNT “PIT SETTLEMENTS”

— 3120 rub. (RUB 24,000 × 13%) – personal income tax withheld from N.K.’s salary. Razin;

DEBIT 70 CREDIT 94

— 1500 rub. — the accountable amount not returned on time is withheld;

DEBIT 70 CREDIT 50

— 19,380 rub. (24,000 – 3120 – 1500) – N.K.’s salary was paid. Razin.

Let’s say that the head of an organization missed the deadline allotted for making a decision on withholding from an employee’s salary an advance that was not spent and not returned in a timely manner. Or the employee disputes the grounds and amounts of the withholding. In this case, the organization will have to go to court.

If the employee repays the debt on the previously received accountable amount on his own, then the unspent and not returned on time accountable amount in accounting should also be written off to the shortage account by posting to the debit of account 94 and the credit of account 71. Then, when the amount of debt is returned, for example, to the cash desk of the enterprise it is necessary to make an accounting entry on the credit of account 94 in correspondence with the debit of account 73 subaccount “Settlements with personnel for shortages”.

Reflection of the operation on the corporate card

You can use one payment instrument to display the amounts spent on entertainment expenses related to business activities. The organization issues a corporate card. Then, upon the employee’s request, he issues it to a specific person and transfers accountable amounts there.

The order of movement of payment instruments must be approved by order of the manager. Sample:

LLC (name)

Director (last name, initials, signature) 03/14/16

I APPROVED: The procedure for using corporate cards

1. PIN code information is confidential information. Holders of the payment instrument do not have the right to disclose it to third parties.

2. A business trip report or other document confirming the use of funds must be provided to the director within three days from the date of making payments on the card (including withdrawal of funds) or from the date of return to the workplace. The document must be accompanied by checks confirming the movement of money.

3. If the documents are missing or the director has not confirmed the report, then the amounts written off from the card are collected from the employee’s salary.

4. The list of cardholders is presented in Appendix No. 1.

5. The issuance and return of payment instruments is kept in the accounting journal (Appendix No. 2).

6. If the card is stolen, its holder is obliged to immediately notify the bank.

The moment of handing over a payment instrument to an employee does not constitute the issuance of money. Entries in the accounting system are made at the time of withdrawal of funds. From the statement of the credit institution you can find out the exact date of the transaction when the accountable amount was used. Account 55 is used to display transactions on a corporate card. A sub-account of the same name is opened for it. On the date the funds are written off, the following entry is generated in the accounting system: DT71 KT55.

The amount is credited to the resigned employee

If an employee who did not return the accountable amounts was fired, then after the expiration of the statute of limitations, the organization may recognize his debt as uncollectible and write off as expenses in the amount in which it was reflected in the organization’s accounting records (clause 14.3 of PBU 10/99 ).

Debt with an expired statute of limitations must be written off:

- or through the reserve for doubtful debts (if the organization created such a reserve). In this case, a posting is made to the debit of account 63 and the credit of account 71;

- or on the financial results of the organization’s activities with an accounting entry on the debit of account 91 and the credit of accounts 71.

Then such debt is subject to reflection on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss” within five years from the date of write-off (clause 77 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Please note that the limitation period for accountable amounts that the employee has not returned begins to count at the end of the period for which the money was issued. This follows from paragraph 2 of Article 200 of the Civil Code. The limitation period is three years (Article 196 of the Civil Code of the Russian Federation). If there are grounds for interrupting the limitation period, the said period begins to count anew (Article 203 of the Civil Code of the Russian Federation).

Example 3

Yarilo LLC issued 3,000 rubles for reporting on May 18, 2011 to office manager Shorkina. for the purchase of household equipment. Let us recall that, according to the order of the head, in the specified organization, cash on account for the named purposes is issued for a period equal to 21 calendar days, starting from the day of issue.

May 25 M.A. Shorkina quit, did not report on the accountable amounts, and did not return the funds to the company’s cash desk.

Yarilo LLC began to count the limitation period for accountable amounts that the employee did not return at the end of the period for which the money was issued - from June 8, 2011.

On June 8, 2014, Yarilo LLC will finish counting the limitation period if there are no reasons for its interruption.

Tax accounting

Issuing money on account does not lead to expenses for the organization, both general and special taxation systems (USNO and UTII). This follows from paragraph 14 of Article 270, paragraph 3 of Article 273, paragraph 2 of Article 346.17, paragraph 1 of Article 346.29 of the Tax Code.

Returned unspent accountable amounts do not increase taxable income, both when calculating income tax and the single tax under the simplified tax system or UTII. After all, accountable amounts do not become the employee’s property, but are his receivables until he reports on them and returns the unused amounts. The basis is Articles 41 and 346.29 of the Tax Code.

Uncollectible accounts receivable in tax accounting are subject to write-off as non-operating expenses. If a reserve for doubtful debts is created for non-operating expenses, the amounts of bad debts not covered by the created reserve should be written off (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation). An organization using the general taxation system can do this.

Please note that the expiration of the statute of limitations is one of the criteria for recognizing a debt as bad and, therefore, taking it into account as expenses for corporate income tax purposes. To include amounts of receivables for which the statute of limitations has expired, documents confirming the expiration of the statute of limitations are required as expenses. This is stated in the letter of the Ministry of Finance of Russia dated September 15, 2010 No. 03-03-06/1/589.

An organization that applies the simplified tax system, regardless of the chosen object of taxation, does not have the right to reduce the base for a single tax by the amount of written off bad receivables (letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-11-04/2/274).

The amount of written off bad receivables does not matter for organizations paying UTII. This follows from paragraph 1 of Article 346.29 of the Tax Code.

Withholding personal income tax

When an employee is dismissed and has a debt in the form of a previously issued advance, the organization is recognized, on the basis of Article 226 of the Tax Code, as a tax agent for personal income tax and is obliged to calculate, withhold from the taxpayer and pay the amount of tax to the budget.

The organization must take all measures provided for by law to return the funds issued to the employee on account. If this turned out to be impossible due to, for example, the expiration of the statute of limitations or if the organization decided to forgive the employee’s debt, then the date the former employee of the organization received income in the form of unreturned amounts issued on account will be the date from which such collection became impossible, or the date of the relevant decision.

In accordance with paragraph 5 of Article 226 of the Tax Code, if it is impossible to withhold the calculated amount of personal income tax from the taxpayer, the tax agent is obliged, no later than one month from the date of the end of the tax period in which the relevant circumstances arose, to notify in writing the taxpayer and the tax authority at the place of his registration about the impossibility of withholding the tax and the amount of tax.

Similar explanations are given in the letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610.

Practical encyclopedia of an accountant

All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

When an employee is sent on a business trip, he must be given money for rent, travel and funds for daily expenses, the amount of which is established on the basis of regulatory documents. How to determine the amount of the advance and how to issue and return the remaining amount of money, as well as how to deal with recalculation?

Deadlines for submitting documents

A report on business trip expenses must be submitted to the accounting department within 3 days after return. Failure to comply with these deadlines will result in additional personal income tax being charged. The inspectorate may consider that the issued accountable amounts are the income of individuals. Therefore, the employee must prepare a report on each expenditure of funds. You can develop the form yourself or use a unified one. The deadlines for submitting reports must be approved by order of the manager. Sample:

LLC (name)

Order No. 15 on approval of deadlines for filing advance reports

Belgorod March 15, 2015

Employees who received money must submit a report on their use:

- for household needs - no later than two weeks from the date of receipt of funds;

- for travel expenses - within three days upon return to work.

Funds issued must be used strictly for their intended purpose.

No more than 100 thousand rubles are provided for business expenses and the purchase of goods. and only by order of the director.

Responsibility for fulfilling the order and the rules for drawing up documents rests with the chief accountant.

General Director ______________________ (full name)

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.

Issuing an advance for a business trip

The procedure for issuing funds from the cash desk of an enterprise is determined by the Regulations on the procedure for conducting cash transactions, which was approved by the Bank of Russia No. 373-P dated October 12, 2011 (hereinafter referred to as the Regulations).

The advance is issued from the following funds:

- Receipts to the organization's cash desk for the sale of goods (Services, works).

- Received from the current account.

An advance is not issued from money received from citizens for payment in favor of third parties (for example, under an agency agreement in payment for communication services).

Important! A person who has no debt on previously received advances can receive money for a business trip on account.

Travel allowances are issued on the following grounds:

- If there is an order drawn up in form T-9 (collective form T-9a).

- Statements from the employee regarding the amount of the advance and the period of issue with the director’s visa.

Money is issued according to a cash receipt order, which is issued in one copy. In the “consumables”, the employee must write down the amount of money received by hand (rubles are written in words, and kopecks in numbers, for example, five thousand rubles 38 kopecks), and then sign the receipt. The money must be counted in the presence of the cashier, otherwise claims for missing amounts will not be accepted.

Reasons

Since 2015, accountable amounts can be issued not only to employees of the organization, but also to persons with whom a civil contract has been concluded. The operation is carried out on the basis of an application. This rule applies to all persons without exception. Based on this document, a settlement settlement is issued. In the application you must indicate the amount, period of issue, date and put your signature.