Freight transport is carried out in various directions and with great regularity. Moreover, the transportation of goods is accompanied by the mandatory execution of a whole package of documents. One of the main documents is the consignment note. They are issued using a special 1T form. This form is necessary in cases where inventory is transported between two organizations. Moreover, this is relevant both when transporting by the sender using its own fleet, and when using the services of intermediaries represented by transport companies. At the same time, the consignment note (Bill of Lading) has its own rules, features and standards for filling out. They should be strictly adhered to. If errors or inaccuracies are made, the document may be invalidated. This will entail certain difficulties during cargo transportation.

The procedure for issuing a consignment note.

Characteristics of the consignment note

A bill of lading (CH) is a document that is created for accounting when purchasing all types of goods. It helps to properly organize the work of both parties and facilitates the reporting procedure to the tax authorities.

The invoice is filled out in two copies: one for each party to the transaction. For the seller, the TN is the basis for writing off the goods; for the buyer, it is an official document of ownership. This invoice is one of the primary documents that are subject to accounting and tax accounting.

Features of filling out, basic details and samples of technical specifications are established by the Album of unified forms of primary accounting documentation. It was created in 1998 to summarize sample documents that will be accepted anywhere in the country.

Ideally, TN is drawn up on a standard size paper sheet. It is possible to fill out a document electronically using electronic signatures of one or both parties to the transaction.

The delivery note can be filled out in paper or electronic form

Mandatory TN details

Filling out the form of this invoice is regulated by the Album of unified forms of primary accounting documentation, articles of the Tax Code and the article “On Accounting”.

It is imperative to check the availability of such information in the technical specifications:

- the invoice form must be drawn up exactly at the moment of receipt of the goods: the date must be real;

- in the column “Shipping organization” indicate the full or generally accepted abbreviated name, bank details.

The TN sample is called TORG-12. This form is not mandatory for formalizing economic relations. Organizations have the right to develop their own TN forms. But they must comply with tax requirements and be as clear as possible for all participants in the transaction.

To avoid misunderstandings and additional questions, it is better to use the unified TN form - TORG-12. It is available to everyone and most accountants are guided by it.

The consignment note has the following mandatory details:

- header – the name of the participants in trade relations (supplier, recipient and payer);

- the basis on which information about the contract or order for the supply of goods is placed;

- TN number and the date of its preparation, which is the date of the purchase and sale;

- supplier code according to OKUD and OKPO;

- The basis of the technical specification is a table that shows the name of the product, its description, cost, quantity, and so on.

At the bottom of the TORG-12 form, information is placed about the persons who conducted the transaction, their personal signatures, as well as seals of organizations.

The date and signatures of the parties are placed at the bottom of the invoice

Basic requirements for filling out the TN

There are a number of rules that must be followed when filling out a delivery note. They are designed to simplify the procedure for receiving and transferring material assets.

- telephone numbers, address and other necessary information;

- the “Base” field provides information about the document that created the basis for the transaction and shipment of goods;

- laws allow minor changes to be made to the invoice that do not affect required fields.

The delivery note must be kept in the organization for 5 years. A sample of filling out the TN at the link:

https://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n=23886;fld=134;dst=100161,0;rnd=0.2148351106913211#1

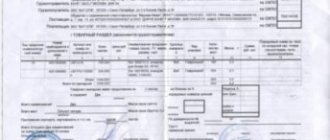

Sample of filling out the TN

Information about the waybill (Bill of Lading)

If the goods are transported by a third party (a freight transportation company) or the shipper independently delivers the goods, then a consignment note is drawn up. The document exists specifically to accompany goods during transportation.

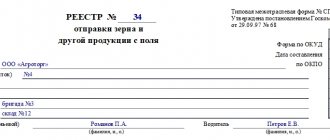

If the recipient of the goods is engaged in its transportation, then the consignment note is not drawn up. The document is mandatory when transporting goods and has a general unified form No. 1-T, as well as specialized forms depending on the type of goods (international transport, transportation of alcohol, oil, grain, and so on).

TTN regulates the tripartite relationship between seller, buyer and carrier. The document must remain with the shipper or carrier, and it can be transferred to the recipient of material assets (depending on transportation rules). In total, the seller makes 4 copies of the invoice, 2 of which remain for reporting to the carrier company.

TTN has a commodity and transport section. They are intended for different parties to the transaction: information about the cargo, its condition, quantity, as well as the exact time and date of the start and end of transportation.

If it is impossible to indicate in the CTN the entire quantity of material assets transported (due to their quantity or extensive characteristics), then an additional waybill is attached. In such cases, it is written on the waybill that it is invalid without the technical specification for the cargo. The TTN must indicate the number and date of issue of TORG-12 or other documents for the cargo.

The consignment note is used if a third party is involved in the transportation.

no commodity and transport

Completion Guide

When filling out the required bill of lading, it is extremely important to follow certain rules and standards. In this case, the sender or recipient, depending on who is involved in signing the contract with the cargo carrier, can turn to specialists for help. But if you understand all the nuances, there is nothing complicated about filling it out yourself. First, you need to follow a few general rules, and then separately study the nuances of the design of the first and second parts of the TTN.

- First of all, the number is written down on the invoice. It is not taken out of thin air, but according to the internal circulation of documentation in the company that issues the invoice. The date when the document is completed is also indicated.

- Next comes the point about the shipper. Do not confuse this with a shipping company. Information about the company that will send the goods is indicated here. Moreover, it is important to enter data about the full name of the organization, its actual address and contact information.

- By analogy, fill in the line that is intended for the consignee. As in the previous paragraph, here you need to write down the full name, address and contact information.

- The next line is the payer. Here you enter information about the company that undertakes to pay for the services of the transport organization.

- Opposite the shipper, consignee and payer there are special cells designed to indicate OKPO codes. This is a special classifier operating in the Russian Federation, classifying organizations and enterprises.

When the basic information is filled out, you should proceed with the registration of the commodity and transport part of the TTN.

Product part

The first section is almost entirely intended to be filled out by the shipper. It is required to enter information about the goods being transported into a special table. You should be careful with the first 4 columns of the table when filling out the consignment note sequentially. Here are some points that we propose to consider. The first column records the item numbers of the goods transported. But this is only relevant for those cases when the company uses the appropriate accounting system.

The second and third columns are for article numbers and price lists. Again, if they exist. The fourth line is already mandatory and serves to display the quantitative characteristics of the product. Therefore, an exact figure is entered here, which is equal to the number of goods transported. Each corresponding name has its own separate number. They are followed by other columns, which should not be skipped either. Here you can enter data that displays:

- the cost of one unit of transported goods;

- product name;

- units of measurement used;

- types of packaging used.

The number of places occupied by goods, weight (necessarily in tons), as well as the total price of each individual type of goods as part of the transported cargo are also indicated here. If there are additional volumetric and warehouse markups, transportation costs, these data must be included in the table. Next, information about the total cost of the entire cargo is filled in, summing up all items. The last column is for the item number according to the shipper's warehouse file used.

If there are any attachments that are attached to the waybill, they must be marked in the cell for indicating additional sheets. This is done in words. The total number of varieties of goods and places is also indicated. To do this, the data entered in the first table is duplicated. Next, according to Form 1T, you need to write down in words and corresponding numbers information about the weight of the cargo being transported. And then all applications are indicated (the number of sheets is recorded). Just below, also in words, the total price of the goods released from the shipper’s warehouse is entered.

At the bottom of the product section of the document there are signatures and transcripts of representatives of the sender of the goods. These are the persons who have the authority to carry out such operations, the chief accountant and the storekeeper who performed the specific shipment. On the right there are lines for information about the driver, including information about the presence of a power of attorney issued by the cargo carrier. At further stages of transportation, it is also necessary to obtain signatures from authorized representatives of the recipient of the goods. Basically, the signature is placed by the storekeeper who receives the goods. If the autograph at the bottom of the document confirms that the goods arrived at the recipient's warehouse in the appropriate condition and were accepted.

Transport part

This part of the document is intended for entering information regarding transportation. First, provide information about:

- terms of delivery of goods;

- a company that deals with cargo transportation (full correct name and current contact information);

- the vehicle used (make, model and state registration number);

- numbers of the invoice and waybill (the rightmost column is provided for this information).

There is a line for the payer. Here you enter information about the company that acts as a customer for the cargo transportation being carried out. You need to write down your full name, phone number, address and payment details. The driver comes next. Here you need his last name and initials, as well as his driver's license number. Please note that in some cases it is better to enter the full name, and not just the last name with initials. The sections of the license card and its registration number are optional. They are allowed through because licensing is not currently carried out. Just remember to fill out the line indicating the type of transportation. It simply states that the transport is of a commercial nature.

After this, a section begins with information about loading and unloading operations. Here you enter the actual address where the goods are delivered, as well as additional information. This includes possible redirection, the route of a cargo vehicle, the use of a trailer, etc. Below is the table. It is filled out in accordance with the product section. To determine the mass, manual, commercial or automatic scales can be used, which must be indicated in the document. If the goods are sent without weighing, then the standard weight is indicated or according to the labeling.

Under the table on the right side there are cells for entering documents that accompany the transported goods. Data on quality certificates, acts, passports, etc. is recorded here. On the left side, participants in the process of loading, delivery and shipment put their signatures. The next part contains a section on loading and unloading operations. There is also a special table where information about loading and unloading is entered:

- sender of the cargo;

- consignee;

- method of loading or unloading (can be manual, liquid, dump or mechanized);

- date of shipment;

- Arrival date;

- signatures of responsible persons.

There is still the penultimate table, which is filled out directly by the driver himself. Here you should indicate additional information about mileage, cost of transportation, fines, downtime, etc. Filling out the TTN is completed by calculating the cost and taxation. The transport company accountant is responsible for filling out these sections. It cannot be said that the procedure for filling out a consignment note is very complicated. Here you need to understand who should fill out certain pages and when, where signatures must be placed, and in what sequence copies of the document are transferred from one participant to another.

The TTN is necessary for all parties, therefore the transport company, the shipper and the consignee play a certain role in filling out and correct execution. Always try to carefully check the information you enter. Any inaccuracies and inconsistencies can result in hefty fines. Therefore, having experience in filling out such documents can only be beneficial.

Filling out the TTN

According to regulatory documents, registration of a consignment note is not required in the following cases:

- for cargo for which warehouse records are not kept;

- if the transport is used for filming, communication line service, power transmission, etc.;

- when transporting correspondence or mail;

- during the collection of secondary raw materials;

- when carrying out scientific or geological work.

The CTN must have the signatures and seals of the shipper and the carrier, the presence of which is verified by the recipient of the goods. The latter checks the quality of transportation of his goods, records the time of arrival of the cargo, and then puts his signature and seal on all copies for reporting.

The goods section of the invoice is filled out by the seller and the buyer, and the transport section is filled out by the carrier company. In the first section, all details of the parties must be indicated with addresses, telephone numbers and OKUD and OKPO codes. Sample TTN at the link: https://forms-blanks.ru/15-tovarno-transportnaya-nakladnaya-forma-1-t.html

Sample of filling out the TTN

Definition

TTN is a document according to which goods are moved from one storage point to another. Based on the consignment note, a certain amount of goods is debited from the shipper’s balance sheet and credited to the consignee’s balance sheet. The consignment note is drawn up in the case when transportation is carried out using any vehicle, and it can be carried out both between the seller and the buyer, and when moving from one warehouse to another within the same organization.

TN is a document that is drawn up during the direct sale of goods to the buyer, when ownership of them is transferred to him. It does not matter how the buyer will pick up the goods - using a vehicle or manually - in any case, the technical document is an accompanying document reflecting the main characteristics of the goods and the terms of the transaction.

How to distinguish a consignment note from a transport bill of lading

There is a difference between TTN and TN. These documents cannot be identified. A consignment note never replaces a transport note and vice versa.

Both types of invoices exist to accompany the goods during their movement, but the consignment note is issued in all cases of purchase and sale, and the consignment note is issued only in cases where a third party appears during the transportation of the goods - a transport company. The consignment note does not contain information about the fact of sale of material assets. Whereas the delivery note is an official document about the transaction, as a result of which the owner of the goods has changed. This invoice specifies the terms of the transaction, the price of the goods, VAT and the total cost of the cargo. This is not in TTN.

During the purchase and sale of any type of material assets, legal entities and individuals document the economic relations that have arisen between them. The state legislative framework offers unified forms of invoices to simplify accounting and tax accounting.

Conclusions TheDifference.ru

- A TTN is necessary in the case when goods are moved from one place to another using a vehicle; a TTN is issued during the sale and purchase of goods and a change of owner.

- TTN includes only the physical characteristics of the goods and the vehicle, and TTN, in addition to the characteristics of the product, also reflects its price in monetary units and the actual cost of the entire quantity.

Recently, accountants often have a question about what documents an organization can use to confirm the purchase of goods if the goods were delivered by road. This question arose after a new form of waybill appeared.

At the same time, the existing form of the consignment note has been preserved. The ambiguity of the current legislation regarding the documentation of the delivery of goods has baffled both buyers, sellers, and carriers. On July 25, 2011, the Rules for the carriage of goods by road (hereinafter referred to as the Rules for Transportation) came into force. This document was developed in accordance with Art. 3 of the Federal Law of November 8, 2007 N 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport” (hereinafter referred to as the Charter). Let us recall that the Motor Transport Charter regulates the relations that arise in the provision of services by motor transport. It defines the general conditions for the transportation of goods by trucks, as well as the general conditions for the provision of services to shippers, consignees, and carriers. In other words, the Charter and the Rules of Transportation regulate the relationship between shippers, consignees and carriers when concluding a contract of transportation.

The transportation document that confirms the conclusion of a contract for the carriage of goods is a waybill (Waybill). Without a technical specification, the carrier does not have the right to accept cargo for transportation (Article 8 of the Charter). Consequently, if an organization orders the transportation of cargo from a specialized company, the shipper is obliged to issue a waybill and hand it over to the driver of the car along with the cargo. The form and procedure for filling out the TN are established by the Transportation Rules. The TN is drawn up in triplicate. The first remains with the shipper, the second with the consignee, and the third with the carrier. The consignment note contains all information about the carrier, consignor, consignee, conditions of cargo transportation, as well as data confirming the fact of cargo transportation and the costs of such transportation.

Let's look at the main differences between the new waybill and the previously used waybill (Bill of Lading).

- Firstly, the waybill differs from the consignment note in structure. The waybill contains two sections: commodity and transport, which include tables. The waybill does not contain a commodity section and consists of 17 points containing data about the shipper, consignee, carrier, information about the cargo being transported, the vehicle used, the cost and conditions of transportation, as well as information confirming the acceptance and transfer of cargo.

- Secondly, the waybill is issued in three copies, one for the shipper, the consignee and the carrier, and the freight bill is issued in four copies: one for the shipper, two for the carrier and one for the consignee.

- Thirdly, these two documents have different purposes. A consignment note is necessary to record the movement of products, goods, materials and other inventory items, as well as to pay for the transportation of these inventory items. Also, the waybill is the main transportation document. The consignment note is a document that serves as the basis for the write-off and capitalization of transported inventory items, and the waybill is not the basis for the receipt of goods by the buyer and the write-off of goods by the supplier. The consignment note confirms the conclusion of the contract for the carriage of goods.

- Fourthly, the procedure for issuing a consignment note is prescribed in the second section of the new Transportation Rules, and the consignment note in the rules of the Ministry of Transport (section 6) and Resolution of the State Statistics Committee of Russia No. 78.

It should be noted that the key difference between a bill of lading and a consignment note is that it cannot serve as a basis for the receipt of goods by the buyer and the write-off of goods by the supplier either in accounting or tax accounting. After the TN form appeared, urgent questions arose among taxpayers about what document they needed in order to confirm the reality of the purchase of goods - TN or TTN, in which cases it is necessary to use a consignment note, and in which a goods transport one.

To answer these questions, the Russian Ministry of Transport first published Letter No. 03-01/08-1980is dated July 20, 2011, which explained the procedure for using these forms. Following him, the financial department decided to shed light on this problem, and letters from the Ministry of Finance appeared. Letters from the Ministry of Finance of Russia, including a letter dated 07/20/11, eight letters dated 08/17/2011 and one letter dated 11/08/11. In their explanations given in the Letter from the Ministry of Transport, experts responded that the use of a consignment note does not exclude the use of consignment notes forms 1-T and TORG-12. However, such a response to requests from organizations does not explain whether it is necessary to prepare all three documents when transporting goods or whether the TN can be replaced with a TTN. Therefore, let us turn to the explanations of the Russian Ministry of Finance on this issue, set out in the above Letters.

According to financiers, the use of a waybill does not exclude the use of invoice forms No. 1-T and TORG-12. When selling goods, a sales invoice (TORG-12) is always drawn up. Also in its Letters, the Ministry of Finance considered various cases when it is or is not necessary to use a transport and consignment note: - for self-pickup, - when involving a third-party transport organization; - upon delivery of goods and materials by the seller. In the first case, if the buyer independently removes the purchased goods from the seller’s warehouse, then there is no need to draw up a consignment note or technical specification. Expenses for transporting goods using your own transport can be recognized when calculating income tax on the basis of a waybill, since the route of the vehicle reflects the route of its movement. If the transportation of the sold goods is carried out by a third-party organization, then the shipper draws up both a waybill and a waybill (1-T).