GRAPHIC INTERFACE OF THE PROGRAM “ENTER DPU 3.0”

Let's consider filling out form PU-3 in the case when an employee is accrued and paid temporary disability benefits. The amounts of benefits for temporary disability are reflected in the column “Amount (in rubles) of benefits for temporary disability” section. 1 “Information on the amount of payments (income) taken into account when assigning a pension, and insurance contributions.”

They say that if you dream about something very much, this dream will definitely come true. Of course, for those whose fulfillment of desires is not delayed...

To provide access, in the window that opens, check the box next to “Private networks, for example, home or work network” and click the “Allow access” button. Performing these steps is necessary for further updating the program using the Internet.

Is the deadline for submitting Form PU-3 postponed if the last day of the submission deadline falls on a non-working day resulting from the postponement by the Government of the Republic of Belarus of certain working days?

The period for performing work on the GPA is from 06/01/2018 to 10/25/2018. Remuneration was accrued in August and October 2021. Insurance premiums have been paid in full.

Legal entities and individual entrepreneurs who entered into civil contracts (contracts) with individuals during 2021 must submit individual information in the PU-3 form for 9 months of 2021 during October 2021. Previously, employers did not have the obligation to submit such reports for citizens working under civil contracts.

This cannot be undone.","stories_remove_from_narrative_warning":"Are you sure you want to delete this story?

For more than 20 years, it has specialized in the supply, installation, implementation and maintenance of automated systems based on the 1C:Enterprise platform.

Differences between a Civil Contract and an Employment Contract

A civil contract has a number of fundamental differences from an employment contract. The main differences are as follows:

- Under contracts for the provision of services or performance of work, the performer (contractor) undertakes to fulfill a specific task of the customer, which is already known at the time of conclusion of the contract.

According to the employment contract, the employee occupies a specific position in accordance with the staffing table, works in a certain profession, specialty and carries out all the employer’s instructions as they are received.

In civil law relations, the priority is a specific result, and in labor relations, the employer is primarily interested in the process of the employee’s labor activity.

In labor relations, the employee occupies a subordinate position in relation to the employer. In civil law relations, the principle of equality of both parties under a civil law contract is observed.

Performers and contractors independently determine the procedure for fulfilling the obligations assigned to them by the contract and do this at their own expense. The employee must follow the internal labor regulations established by the employer, including the employee must comply with the working hours. In addition, the employer is obliged to provide the employee with everything necessary to perform his job duties, pay compensation for the employee’s use of his property in his work, and reimburse other personnel expenses incurred in the interests of the employer.

The employee always performs his work function personally. By participating in civil legal relations, the performer (contractor) has the right to involve third parties in the execution of a civil contract.

Performers and contractors do not receive wages, but remuneration stipulated by the contract, which is paid not every half month, like wages, but in the manner established by the contract on the basis of a certificate of work performed (services rendered).

According to the employment contract, the employee bears full financial responsibility only in the cases provided for in Art. 243 of the Labor Code of the Russian Federation (for example, shortage of valuables, damage, etc.). Performers and contractors are obliged to fully compensate for the losses caused by them.

An employment contract can be fixed-term only in strictly defined cases. A civil contract providing for the performance of work or the provision of services is concluded for a certain period or until the result occurs.

If a civil law contract has been concluded with an individual, then the guarantees provided for by labor legislation in relation to employees working under an employment contract do not apply to him.

For example, such guarantees are:

guarantees for payment of wages (at least twice a month);

guarantees for temporary disability (saving a job, paying for sick leave);

reimbursement of expenses when using personal property;

guarantees when using vacations (saving a job, paying vacation pay);

guarantees for persons combining work with study (saving a job, vacation);

guarantees upon termination of an employment contract (severance pay, preferential right to remain at the enterprise);

- guarantees when sent on a business trip (saving a job, paying expenses).

Still have questions about accounting and taxes? Ask them on the “Salaries and Personnel” forum.

Employers, when concluding civil contracts (hereinafter referred to as “GPA”) with individuals, are required to pay insurance premiums to the Social Security Fund (paragraph 2 of part one of article 7 of the Law of the Republic of Belarus dated January 31, 1995 No. 3563-XII, paragraph 3 subclause 1.1 clause 1 of the Decree President of the Republic of Belarus dated July 6, 2005 No. 314 “On some measures to protect the rights of citizens performing work under civil law and labor contracts”).

Starting from 2021, form PU-3 (form type - original) is submitted once a quarter during the month following the reporting quarter and contains information related to the reporting period, as well as if there is a need to adjust previously submitted information (part one, paragraph. 16 Rules for individual (personalized) registration of insured persons in the state social insurance system, approved by Resolution of the Council of Ministers of the Republic of Belarus dated July 8, 1997 No. 837, hereinafter referred to as Rules No. 837).

If it is necessary to correct previously provided information, form PU-3 is filled out (form type - original), which completely replaces the data provided previously. Correctly filled in details are repeated in the same form as they were filled in earlier, incorrect ones are replaced with correct ones.

When drawing up form PU-3 for persons performing work according to the GPA, you must be guided by the following rules:

Get access to a demo version of ilex for 7 days

The end date of periods with the code “NEOPLDOG” may fall not only in the reporting quarter, but also in subsequent quarters. However, it must remain within the reporting year.

All chat members will see this change.","mail_unpin_title":"Unpin message","mail_unread_message":"Unread message","mail_vkcomgroup_leave_confirm":"If you unfollow, you will no longer receive new messages from this channel. On January 1, 2009, the Law of the Republic of Belarus “On Professional Pension Insurance” came into force. This led to changes in the order of filling out section. 2 “Additional information about experience” of form PU-3. The column “Features of filling out” of Appendix 2 to the Instructions explains for which reporting periods additional information about the length of service is filled out.

Form PU-3 is filled out and submitted by the individual entrepreneur to the Fund body at the place of registration as a contribution payer using electronic and automated (computer) technologies in electronic form.

Enter the site

RSS Print

Category : Reporting Replies : 5484

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. … 505 506 507 508 509 510 511 512 514 515 516 517 518 519 520 521 … Next. → Last (549) »

| LO-LA [email protected] Belarus Gomel Wrote 1250 messages Write a private message Reputation: 140 | #5121[982180] May 6, 2021, 7:21 am |

Tatyana wrote:

Please tell me if form PU 3 is filled out correctly, according to the contract dated 02/01/2020, its period is 02/01/20-02/29/20, remuneration is accrued along with the salary on 02/29/20, contributions are transferred on 03/20/20, payment under it is also 03/20/20 section 1 in February the amount of remuneration section 2 Information about the length of service 01.02.20-29.02.20 contributions time and 01.02.20-29.02.20 Agreement And under the second agreement dated 01.03.20, its period is 01.03.20-31.03.20, remuneration accrued on 31.03 .20, contributions were transferred on 04/17/20, but it was not paid, there is no money Section 1 in March the amount of remuneration section 2 Information about experience 03/01/20-03/31/20 contributions time and 03/01/20-03/31/20 Dogneopl

No. If you recorded the accrual of remuneration in your accounting, then in PU-3 you reflect it in the month of accrual.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Tatiana [email hidden] Minsk Wrote 64 messages Write a private message Reputation: | #5122[982183] May 6, 2021, 9:20 |

LO-LA wrote:

Tatyana wrote:

Please tell me if form PU 3 is filled out correctly, according to the contract dated 02/01/2020, its period is 02/01/20-02/29/20, remuneration is accrued along with the salary on 02/29/20, contributions are transferred on 03/20/20, payment under it is also 03/20/20 section 1 in February the amount of remuneration section 2 Information about the length of service 01.02.20-29.02.20 contributions time and 01.02.20-29.02.20 Agreement And under the second agreement dated 01.03.20, its period is 01.03.20-31.03.20, remuneration accrued on 31.03 .20, contributions were transferred on 04/17/20, but it was not paid, there is no money Section 1 in March the amount of remuneration section 2 Information about experience 03/01/20-03/31/20 contributions time and 03/01/20-03/31/20 Dogneopl

No. If you recorded the accrual of remuneration in your accounting, then in PU-3 you reflect it in the month of accrual. Then for March section 2 01.03.20-31.03.20 contributions time and 01.03.20-31.03.20 agreement And when and how to reflect that there were no payments on it.

I want to draw the moderator's attention to this message because:Notification is being sent...

| LO-LA [email protected] Belarus Gomel Wrote 1250 messages Write a private message Reputation: 140 | #5123[982189] May 6, 2021, 10:42 |

Tatyana wrote:

LO-LA wrote:

Tatyana wrote:

Please tell me if form PU 3 is filled out correctly, according to the contract dated 02/01/2020, its period is 02/01/20-02/29/20, remuneration is accrued along with the salary on 02/29/20, contributions are transferred on 03/20/20, payment under it is also 03/20/20 section 1 in February the amount of remuneration section 2 Information about the length of service 01.02.20-29.02.20 contributions time and 01.02.20-29.02.20 Agreement And under the second agreement dated 01.03.20, its period is 01.03.20-31.03.20, remuneration accrued on 31.03 .20, contributions were transferred on 04/17/20, but it was not paid, there is no money Section 1 in March the amount of remuneration section 2 Information about experience 03/01/20-03/31/20 contributions time and 03/01/20-03/31/20 Dogneopl

No. If you recorded the accrual of remuneration in your accounting, then in PU-3 you reflect it in the month of accrual. Then for March section 2 01.03.20-31.03.20 contributions time and 01.03.20-31.03.20 agreement And when and how to reflect that there were no payments on it. This is reflected in the accounting (debt) to the contractor. If I understand you correctly, then you accrued

remuneration under the contracts, therefore you reflect it in PU-3 in the month of accrual. But if it had not been accrued, then in form PU-3 only section 2 “Additional information about the length of service” would be filled out, indicating the period of work under this contract (subclause 1.2, clause 1 of Resolution No. 1). The period of work under the GPA without accrual of remuneration is indicated by the code “NEOPLDOG” (clause 65 of Appendix 2 to the Instructions on filling out the DPU).

Notification is being sent...

| bobel.natali [email hidden] Wrote 77 messages Write a private message Reputation: | #5124[982541] May 15, 2021, 9:54 am |

What actions? Reports for the first quarter were submitted to the Federal Social Security Fund ((( How to correct the situation?? I read that I am paying contributions from this under-accrued bonus, then I submit PU-3 for the employee, but what about the 4-fund report? Please help!!! I want Please draw the moderator's attention to this message because:

What actions? Reports for the first quarter were submitted to the Federal Social Security Fund ((( How to correct the situation?? I read that I am paying contributions from this under-accrued bonus, then I submit PU-3 for the employee, but what about the 4-fund report? Please help!!! I want Please draw the moderator's attention to this message because: Notification is being sent...

| Olenka [email protected] Always near Wrote 11452 messages Write a private message Reputation: 1119 | #5125[982546] May 15, 2021, 10:33 |

Notification is being sent...

NO MATTER WHAT COME TO YOUR HEAD, THERE WILL ALWAYS BE LIKE-MINDED PEOPLE.....| bobel.natali [email hidden] Wrote 77 messages Write a private message Reputation: | #5126[982549] May 15, 2021, 11:08 |

Olenka wrote:

Accrue now, accounting certificate that additional bonus has been accrued. Reflect in 4-Fund in April, in PU-3 in March

Thank you))

I want to draw the moderator's attention to this message because:Notification is being sent...

| Bonita_LT [email hidden] Minsk Wrote 6282 messages Write a private message Reputation: 1103 | #5127[982835] May 22, 2021, 5:29 pm |

Quote:

10. Form PU-3 is filled out and submitted: by the employer on the basis of accounting documents and other documents on the accrual, payment of mandatory insurance contributions, the period (periods) of employees’ employment in jobs subject to inclusion in the special length of service.

In case of payment of compulsory insurance premiums not in full, the amount of paid compulsory insurance premiums is indicated by the employer for all insured persons in forms PU-3 in proportion to the accrued compulsory insurance premiums for the reporting period;

...

Would it be correct to program the following algorithm: 1. request the last month of the period for which everything was paid (for all months from January to the specified month, enter “paid” = accrued); 2. request the payment coefficient for the next month to indicate “paid in” part of the remaining paid amount from accrued contributions (if not paid, then K = 0, and accordingly, “paid in” = zeros, for the remaining months of the period - also zeros in paid); 3. request the date by which to indicate the paid contributions (for information about experience with a V/D CONTRIBUTION). But, I am confused by the phrase “ the amount of paid

compulsory insurance premiums

is indicated

by the employer for all insured persons in forms PU-3

in proportion to the accrued

compulsory insurance premiums

for the reporting period

.” Maybe each month the amount “paid” should be reduced in proportion to the accrued amount (amount paid/amount accrued)?

Notification is being sent...

| bony173 [email hidden] Wrote 929 messages Write a private message Reputation: 104 | #5128[982851] May 25, 2021, 9:32 am |

Bonita_LT wrote:

Good afternoon Maybe someone also has a question in connection with the latest changes in the Rules for individual personalized accounting (Post. CM of the Republic of Belarus dated April 30, 2020 No. 260) if there is arrears in paying contributions for the reporting period:

Quote:

10. Form PU-3 is filled out and submitted: by the employer on the basis of accounting documents and other documents on the accrual, payment of mandatory insurance contributions, the period (periods) of employees’ employment in jobs subject to inclusion in the special length of service.

In case of payment of compulsory insurance premiums not in full, the amount of paid compulsory insurance premiums is indicated by the employer for all insured persons in forms PU-3 in proportion to the accrued compulsory insurance premiums for the reporting period;

...

Would it be correct to program the following algorithm: 1. request the last month of the period for which everything was paid (for all months from January to the specified month, enter “paid” = accrued); 2. request the payment coefficient for the next month to indicate “paid in” part of the remaining paid amount from accrued contributions (if not paid, then K = 0, and accordingly, “paid in” = zeros, for the remaining months of the period - also zeros in paid); 3. request the date by which to indicate the paid contributions (for information about experience with a V/D CONTRIBUTION). But, I am confused by the phrase “ the amount of paid

compulsory insurance premiums

is indicated

by the employer for all insured persons in forms PU-3

in proportion to the accrued

compulsory insurance premiums

for the reporting period

.” Maybe each month the amount “paid” should be reduced in proportion to the accrued amount (amount paid/amount accrued)? This is how I understand this phrase. Since you do not pay for each individual person, but the entire amount at once, if the amount of payments paid is less than the accrued payments, then the amount paid must be distributed proportionally among people. For example, there are two people. One was credited 100, the other 300. The total amount is 400. Paid 200. Then the amount paid for 1 person is 200 * 100/400, for 2 200 * 300/400.

Notification is being sent...

| Bonita_LT [email hidden] Minsk Wrote 6282 messages Write a private message Reputation: 1103 | #5129[982884] May 25, 2021, 2:32 pm |

bony173 wrote:

Bonita_LT wrote:

Good afternoon Maybe someone also has a question in connection with the latest changes in the Rules for individual personalized accounting (Post. CM of the Republic of Belarus dated April 30, 2020 No. 260) if there is arrears in paying contributions for the reporting period:

Quote:

10. Form PU-3 is filled out and submitted: by the employer on the basis of accounting documents and other documents on the accrual, payment of mandatory insurance contributions, the period (periods) of employees’ employment in jobs subject to inclusion in the special length of service.

In case of payment of compulsory insurance premiums not in full, the amount of paid compulsory insurance premiums is indicated by the employer for all insured persons in forms PU-3 in proportion to the accrued compulsory insurance premiums for the reporting period;

...

Would it be correct to program the following algorithm: 1. request the last month of the period for which everything was paid (for all months from January to the specified month, enter “paid” = accrued); 2. request the payment coefficient for the next month to indicate “paid in” part of the remaining paid amount from accrued contributions (if not paid, then K = 0, and accordingly, “paid in” = zeros, for the remaining months of the period - also zeros in paid); 3. request the date by which to indicate the paid contributions (for information about experience with a V/D CONTRIBUTION). But, I am confused by the phrase “ the amount of paid

compulsory insurance premiums

is indicated

by the employer for all insured persons in forms PU-3

in proportion to the accrued

compulsory insurance premiums

for the reporting period

.” Maybe each month the amount “paid” should be reduced in proportion to the accrued amount (amount paid/amount accrued)? This is how I understand this phrase. Since you do not pay for each individual person, but the entire amount at once, if the amount of payments paid is less than the accrued payments, then the amount paid must be distributed proportionally among people. For example, there are two people. One was credited 100, the other 300. The total amount is 400. Paid 200. Then the amount paid for 1 person is 200 * 100/400, for 2 200 * 300/400. Thank you very much for participating in the discussion. That is, if the accountant indicates a coefficient of 0.5 (200/400), then when forming PU-3 for all persons for this month, in “paid” we indicate the amount of contributions multiplied by 0.5 (as a result, 100 is accrued for the first person paid 50, for the second - accrued 300 paid 150). In this case, the length of service should apparently indicate (let’s say for half a year) not on 06/30/2020, but on 06/15/2020, with a PAYMENT TIME.

Notification is being sent...

| bony173 [email hidden] Wrote 929 messages Write a private message Reputation: 104 | #5130[982890] May 25, 2021, 3:07 pm |

Bonita_LT wrote:

That is, if the accountant indicates a coefficient of 0.5 (200/400), then when forming PU-3 for all persons for this month, in “paid” we indicate the amount of contributions multiplied by 0.5 (as a result, 100 is accrued for the first person paid 50, for the second - accrued 300 paid 150). In this case, the length of service should apparently indicate (let’s say for half a year) not on 06/30/2020, but on 06/15/2020, with a PAYMENT TIME.

I haven’t encountered such a situation, I don’t know how the program is configured. But I would set the experience until the end of the month.

I want to draw the moderator's attention to this message because:Notification is being sent...

« First ← Prev. … 505 506 507 508 509 510 511 512 514 515 516 517 518 519 520 521 … Next. → Last (549) »

In order to reply to this topic, you must log in or register.

Computer system requirements for the “DPU Input” program

In the organization, 2 employment contracts are concluded with the employee: for performing the main job and for internal part-time work.

Also, in the absence of periods of inactivity, it is possible that the inspector will submit the data for you. But be sure to call and make an appointment. If no one submits data, there will be a fine.

This form is filled out for the reporting period in which accruals were made under this agreement. In cases where the period for performing work under the contract includes several reporting periods, in Sec. 2 “Additional information about experience” of form PU-3 indicates all periods of work performed under the contract.

The first form PU-3 for the current reporting period must have o. The deadline for submitting this form will determine the timeliness of the report.

This form is filled out for the reporting period in which accruals were made under this agreement. In cases where the period for performing work under the contract includes several reporting periods, in Sec. 2 “Additional information about experience” of form PU-3 indicates all periods of work performed under the contract.

It should be borne in mind that if during the period of work of the second employee from May 20 to December 31 there is a month with zero pay, then the program will not allow indicating one contract number. It will be necessary to assign a different contract number and date from the month following the month of the break, and exclude the month itself from the calculation. That is, you cannot set 0 this month.

GPA for work between individuals - what are its consequences?

The Civil Code of the Russian Federation does not prevent the conclusion of a civil contract between individuals. However, a number of questions arise here regarding who is responsible for paying taxes on the income received by the executor. Let us recall that each of the parties to such an agreement may be an individual entrepreneur, and due to this, the following options for the parties to the agreement are possible:

- both of them (the employer and the contractor) are individual entrepreneurs;

- the employer is an individual entrepreneur, and the performer is an ordinary individual;

- the employer is an ordinary individual, and the contractor is an individual entrepreneur;

- both of them are ordinary individuals.

Contract agreement with an individual

From 01/01/2019, the type of form PU-3 “corrective” is canceled. If there is a need to correct previously provided information, fill out the “original” form type. The "Original" form will replace the information in the previous "Original" form. If it is necessary to correct the information presented in form PU-3 “assignment of pension,” form PU-3 type of form “assignment of pension” is filled out.

You didn’t have 2 employees, you had citizens working under a contract. Therefore, in the PU-3 report, select the insured person code 03. Indicate the number and date of the contract.

IMPORTANT: For the program to work correctly, use the name of the installation directory, indicated in Latin letters (using Cyrillic is not allowed).

In 2021, Decree No. 300 ceased to apply to the gratuitous transfer of property (except for funds) from a private organization to a public one.

In this case, it does not matter whether the remuneration was accrued in these nine months or not - in any case, under the contracts valid during this period, forms PU-3 must be submitted. We log in to the manager without authorization. To do this, check the box “Login without authorization” and click “OK”.

If you make it public, the attachments will also be available to everyone.","wall_publish_donut_freeing_attaches_confirmation_title":"This post has paid attachments.

You can register on the Foundation’s portal and sign the submitted PU-3 EDS form using a public key certificate issued in the State Public Key Management System (GosSUOK) and the Foundation’s attribute certificate.

The lines “Contract number” and “Date of conclusion of the contract” are filled in only for civil contracts.

Phys. a person intends to post on a website on the Internet in free access the information necessary for self-learning programming: books, programs, videos. In addition, through the website physical. the person plans to answer questions from other individuals. persons in programming (provide advisory services (tutoring)).

In times of crisis, legislation is rapidly changing; innovations have not bypassed the procedure for submitting personalized accounting forms.

In Sect. 1 “Information on accruals and insurance contributions” of form PU-3, fill in the types of payments taken into account when calculating the pension.

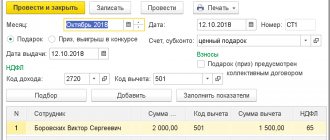

Reflection of GPC agreements in personal income tax accounting

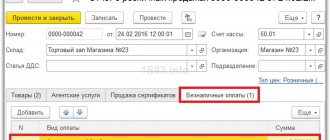

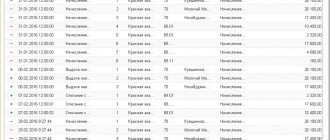

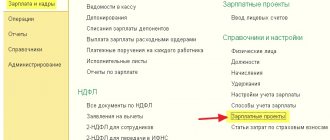

To reflect the remuneration under the GPC agreement, calculated and withheld tax in personal income tax accounting, the document “Personal Tax Accounting Operation” is provided in the menu item “Salaries and Personnel-All Personal Income Tax Documents-Create-Personal Tax Accounting Operation”

On the “Income” tab you must fill in:

Date of receipt of income - date of receipt of physical face of remuneration

Income code – code of income received

Type of income – type of income under GPC agreements

Amount of income – amount of income

Deduction code - is inserted automatically according to the income code, in this case the amount of actually incurred and documented expenses directly related to the performance of work (provision of services) under civil contracts.

On the tab “Calculated at 13% (30%) except dividends” you must indicate the amount of calculated personal income tax at a rate of 13%

On the “Deductions Provided” tab, the provided tax deductions are indicated (not used in our example)

Next, you need to fill out the “Withheld at all rates” tab, on which we indicate the date of receipt of income, tax rate, tax amount, transfer deadline, income code, type of income and amount of income paid.

Form and content of a civil contract with an individual - sample

How is the GPA completed? Since it contains quite a lot of conditions that require special reservations, it is always drawn up in writing. It should reflect:

- names and details of the contracting parties;

- subject of the task entrusted to the performer;

- conditions for its implementation (volumes, quality, timing, ownership of raw materials and necessary equipment);

- cost of work, terms of payment for them;

- rights and obligations of the parties (including the condition on the accrual or non-accrual of contributions for injuries);

- procedure for accepting completed work;

- liability of the parties for violations of the terms of the agreement.

To learn about which points in the GAP you should pay special attention to, read the article “Contract agreement and insurance premiums: nuances of taxation.”

A sample civil legal agreement with an individual, executed by a legal entity, can be viewed on our website:

We do not provide a sample of a civil law agreement between individuals, since there are no special rules for its execution. Only the tax consequences will be special for him.