Using the unified form OS-4, an act on the write-off of a fixed asset item is filled out. You can not use the official form of the OS-4 act, but independently develop forms of primary accounting documents, including for registering the liquidation of a fixed asset. A document that confirms the liquidation of a fixed asset can be, for example, an act of write-off (liquidation) of a fixed asset item. You can develop the document yourself; to fill it out, take the unified OS-4 form as a sample. The form was approved by Resolution of the State Statistics Committee dated January 21, 2003 No. 7.

The decision to liquidate fixed assets must be formalized by order of the manager. Data on the disposal of fixed assets must also be included in the documents that are drawn up by the company to record the presence and movement of fixed assets (for example, you can use an inventory card for recording a fixed asset item in Form No. OS-6). It is worth paying attention that the registration of liquidation of vehicles must be carried out differently, in a special order.

Unified form OS-4 (form)

The unified form OS-4 is an act of write-off of fixed assets (OS). The form (you can download it on our website) and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

Let us remind you that at present the use of unified forms is optional. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets.

More details about this can be found in the material “Primary document: requirements for the form and the consequences of its violation” .

ConsultantPlus experts explained how to correctly account for real estate:

If you do not have access to the K+ system, get a trial online access for free.

Who takes 4-OS and when?

Legal entities and individual entrepreneurs report according to 4-OS.

One condition is that their activities must be related to nature conservation. Other companies and entrepreneurs do not submit this report. 4-OS - annual form. The deadline is January 25. If it is a weekend, the deadline is postponed to the first working day. For 2021 it was necessary to report before January 25, 2021. For 2021 - before January 27, 2021, since January 25 is a Saturday.

For missing deadlines, officials may impose a fine under Article 13.19 of the Code of Administrative Offenses of the Russian Federation. For officials, the fine for the first violation is 10-20 thousand rubles, for a repeated violation - 30-50 thousand rubles. For legal entities, the fine is more significant - 20-70 and 100-150 thousand rubles.

Features of drawing up the OS-4 form

The act of writing off a fixed asset is drawn up by the employee responsible for accounting for fixed assets in the organization, based on the manager’s order to write off (liquidate) the fixed asset and the commission’s report on the impossibility of its further operation.

Form OS-4 is drawn up in 2 copies:

- the first is transferred to the accounting department (on its basis, accounting reflects the disposal of the fixed asset and its write-off from account 01);

- the second remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of dismantling the object.

The act is signed by members of the commission appointed by the head of the organization and approved by the head or his authorized person. The write-off results are reflected in the asset inventory card.

Sample order for inventory

Comparing the availability of assets with accounting information is an inventory. A commission is created consisting of the chief accountant, persons responsible for property, and specialists of the institution. The working group carries out an inventory when changing the financially responsible person, identifying facts of theft, damage, or reorganization of the enterprise. During the inventory, the actual cost of fixed assets is compared with the balance sheet data.

The procedure is preceded by the issuance of an order on the inventory of fixed assets. To draw up an order, use a form in the INV.22 form, approved by Decree of the State Statistics Committee of Russia No. 88 of 08.18.98.

The text of the document contains a list of members of the inventory commission, the timing and reasons for the conduct. The manager certifies the order with a personal signature. Additionally, an application is prepared with information about the assets subject to inventory: name, inventory number, cost, date of commissioning of fixed assets.

A sample order for conducting an inventory can be downloaded here.

Nuances of filling out the act of writing off the operating system

The act consists of 3 sections.

Section 1 reflects information about the condition of the object as of the date of write-off, including:

- initial (replacement) cost;

- the amount of depreciation accrued from the beginning of operation of the facility;

- residual value of the operating system.

If the object has been revalued, column 7 indicates the replacement cost based on the results of the last revaluation. For non-revalued objects, their original cost is indicated on the date of acceptance for accounting.

About the revaluation of fixed assets and its role for different types of accounting, read the article “Why is the revaluation of fixed assets (fixed assets) necessary?”

Section 2 provides a brief individual description of the OS (devices, accessories, content of precious metals), and also provides the commission’s conclusion on the condition of the object and the possibility (impossibility) of its further operation.

Section 3 contains information about the costs associated with the write-off of fixed assets and the remaining usable inventory items after write-off.

You can view a sample of filling out the unified form OS-4 on our website.

What documents in addition to OS-4 need to be drawn up when writing off an OS, find out in the Typical Situation from ConsultantPlus. Get trial access to the K+ system and access sample documents for free.

How to correctly draw up an act of write-off of fixed assets

Since sooner or later an enterprise has to make a write-off, every accountant must be able to correctly formalize this procedure. This allows the company to always display the real situation with the property on the company’s balance sheet.

Various objects are subject to write-off:

- faulty transport;

- dilapidated buildings;

- outdated equipment;

- other property.

The main reason for write-off is the unsuitability of the property. The main condition is that it cannot be repaired or restored. This is determined by a specially created commission. However, if we are talking about technically complex property, it is unlikely that it will be possible to do without an expert opinion. For example, the air conditioner broke down. Company employees visually see only non-working equipment. An opinion on its malfunction can only be given by a specialist provided by the relevant company.

Even if the faulty equipment can be repaired, the service company must provide a full estimate to fix the problem. This will allow you to determine the economic benefit of the repair. If repair is not practical, the equipment is subject to write-off. Thus, it is the expert’s opinion that allows you to determine whether faulty OS can be written off.

Who fills it out?

Before decommissioning an object, it is inspected, upon which an inspection report is drawn up.

When the OS is confirmed to be unsuitable for use, the write-off process is launched and a corresponding report is issued.

It is also compiled by the commission that conducted the property survey.

The commission for writing off assets must include at least 3 people.

This may include heads of various departments and third-party experts.

The document is issued only after a thorough inspection of the written-off fixed asset. All commission members must affix their visas to the document.

If one of them does not want to sign, a special note is made about this.

write-off act:

- motor transport - OS-4a;

- groups of objects - OS-4.

Filling procedure

The act can be filled out in any form or in the form approved by the company. But, most companies use the unified OS-4 form.

Such an act can be filled out for one or several objects at once.

Basic rules for filling out the OS-4 form:

The top of the form includes the following information:

- Company name;

- form code;

- grounds for drawing up the paper;

- the write-off date is indicated;

- FULL NAME. mat. responsible person;

- Director's visa and signature date.

The main part of the form should consist of 3 tables. Before each of them you need to write down the reason for writing off the object.

Let’s say: the fixed asset is outdated, incorrect operation of the equipment, damage as a result of an accident, etc. The contents of the tables should be as follows:

| Information about the state of the object being written off |

|

| OS characteristics |

|

| Cost information |

|

Under the second table are the conclusions of the commission members about the results of the inspection of the OS. The accompanying documents are also listed here and the composition of the commission is prescribed.

Under the final table, the results of the write-off are written down in detail, and the visa of the chief accountant is also affixed.

The act can be filled out by hand or printed on a computer (other printing equipment).

Important! The signatures of the commission members and the director must be “living” (original).

When the OS-4 form is filled out manually, a black or blue ballpoint pen is used. Using a pencil to fill out a document is unacceptable. Errors and corrections in such documentation are not permitted.

It is not necessary to put a company seal. No stamps are needed here either. But only if such a condition is not specified in the company’s local documentation.

The unified form OS-4 is compiled in two pieces. One of them is transferred to the accounting department. Based on it, the department employee reflects the write-off and transfers it to the warehouse for disposal.

If necessary, you can make copies of the document.

Examples of reasons for disposal of an asset

The reasons for writing off a fixed asset can be varied.

The main reasons for disposal are:

- the main tool is outdated,

- the object was subject to improper operation,

- The OS is damaged as a result of accidents, natural disasters or fire,

- the operating time of the facility has been completed and under other similar circumstances.

What to write in the line “write-off results”

The line about the results of the write-off indicates the monetary value of the loss as a result of the deregistration of the fixed asset. Let’s say “the loss is two thousand rubles.”

Download free form and sample in word

Download the standard form of the act of the unified form OS-4 – word, excel.

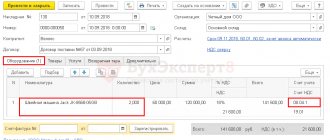

filling out the statement of write-off of fixed assets OS-4 – excel.

We write off the costs of purchasing fixed assets

If you apply the simplified tax system “Income”, you will not be able to write off expenses for fixed assets. Only people have the right to significantly reduce the tax base due to the costs of fixed assets.

In addition, the expense must be confirmed, economically justified and correspond to the list in Art. 346.16 of the Tax Code of the Russian Federation, the following mandatory conditions must be met:

- purchase costs must be paid in full;

- the fixed asset must be used in business activities;

- registered ownership, for example, if we are talking about buying a car or an office.

The need for such a serious purchase for a business must be able to be justified in the event of questions from tax authorities, otherwise the expense may be considered unlawful and, as a result, additional taxes, penalties and fines will be charged.

The fixed asset is written off at its original cost. It’s not difficult to determine, we simply add up all the actual acquisition costs:

- cost of fixed assets under the contract;

- VAT;

- consulting fees associated with the acquisition;

- customs duties and fees;

- state duty in connection with the acquisition;

- if purchased through an intermediary, then remuneration under the intermediary agreement.

Expenses for the purchase of fixed assets are written off in equal installments during one tax period (calendar year) and are taken into account on the last day of the quarter: March 31, June 30, September 30 and December 31. We begin to write off expenses in the quarter in which the last date falls: payment, commissioning or registration of ownership. It turns out that at the end of the year the fixed asset is fully included in expenses.

Let's look at an example:

On March 25, 2021, we bought a car worth 900 thousand rubles and registered it with the traffic police on April 5, 2021.

Before registering with the traffic police, the car cannot be used, so we will reflect the first write-off in KUDiR on June 30, 2021 and take into account when calculating the advance payment for the simplified tax system for the six months of 300 thousand rubles (⅓ of 900,000). Then we make write-offs on September 30, 2021 in the amount of 300 thousand rubles and on December 31, 2021 in the amount of 300 thousand rubles.

If we bought a car in October 2021, and registered it with the traffic police in November 2021, then all 900 thousand rubles would be written off as expenses on December 31, 2021.

If a fixed asset was purchased before the registration of an individual entrepreneur and is used in business, can it be written off as an expense?

Despite the fact that the Tax Code does not contain an unambiguous prohibition, regulatory authorities have repeatedly given clarifications on this matter in their letters. An entrepreneur does not have the right to include in expenses a fixed asset purchased before registering an individual entrepreneur. But when selling it, it is necessary to reflect the proceeds from the sale in the income of the simplified tax system and pay tax.

Submit reports in three clicks

Elba will prepare a tax return according to the simplified tax system and calculate taxes. The service is used by 100,000 individual entrepreneurs and LLCs. Try it too!

Gift or exchange

When making a gratuitous transfer of fixed assets, a distinction is made between the donating organization and the recipient organization (person). If the cost of the object exceeds 5 minimum wages (Civil Code Art. 574) and the donor is a legal entity, then an agreement must be concluded, sealed by both parties, which stipulates all the terms of the transaction.

Documentation and accounting entries are complicated by the fact that usually the property has a residual value, estimated depreciation, and it is not put out of use until the contract is signed, during the donation procedure and until it is accepted by the other party.

ON APPROVAL OF ACCOUNTING REGULATIONS “ACCOUNTING FOR FIXED ASSETS” PBU 6/01

(as amended by Orders of the Ministry of Finance of the Russian Federation dated May 18, 2002 N 45n, dated December 12, 2005 N 147n, dated September 18, 2006 N 116n, dated November 27, 2006 N 156n, dated October 25, 2010 N 132n, dated December 24, 2010 N 186 n, from 05/16/2016 N 64n)

In pursuance of the Program for reforming accounting in accordance with international financial reporting standards, approved by Decree of the Government of the Russian Federation of March 6, 1998 N 283 (Collected Legislation of the Russian Federation, 1998, N 11, Art. 1290), I order:

1. Approve the attached Accounting Regulations “Accounting for fixed assets” PBU 6/01.

2. Recognize as invalid Order of the Ministry of Finance of the Russian Federation dated September 3, 1997 N 65n “On approval of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/97” (Order registered with the Ministry of Justice of the Russian Federation dated January 13, 1998 N 1451) and paragraph 1 of Amendments to regulatory legal acts on accounting, approved by Order of the Ministry of Finance of the Russian Federation dated March 24, 2000 N 31n (Order registered with the Ministry of Justice of the Russian Federation on April 26, 2000, registration number 2209).

3. Put this Order into effect starting with the 2001 financial statements.

Minister

A.L. KUDRIN

APPROVED

by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 N 26n

Introductory information

Starting from January 2021, low-value fixed assets are reflected differently in accounting and tax accounting.

Maintain tax and accounting records of fixed assets according to the new rules

In tax accounting, a new version of paragraph 1 of Article 257 of the Tax Code of the Russian Federation is used, according to which fixed assets are recognized as means of labor with an initial cost of over 100 thousand rubles. Accordingly, cheaper objects are not classified as fixed assets, and their cost is written off as current expenses. Let us recall that this distinction applies to property that was put into operation on January 1, 2021 and later (see “Changes to the Tax Code of the Russian Federation: the cost of depreciable property and fixed assets has been increased, and a new revenue limit has been introduced for the payment of quarterly advances on income tax ").

Accounting rules allow the recording of fixed assets, the initial cost of which does not exceed the established limit, as part of inventories. The limit is 40 thousand rubles (clause 5 of PBU 6/01 “Accounting for fixed assets”). This means that objects up to 40 thousand rubles can be taken into account in one of two ways: either as fixed assets or as inventories. As for property worth 40 thousand rubles or more, there is no choice for it - in any case, it is reflected as a fixed asset.

For clarity, we have compared in the table the rules according to which, starting from 2016, fixed assets should be taken into account in tax and accounting.

How do the fixed asset accounting rules in force in NU and in accounting compare?

| Initial cost of the object | How to reflect in tax accounting | How to reflect in accounting |

| up to 40,000 rub. | write off as operating expenses upon commissioning | The organization has the right to choose one of two ways: – include in the inventory and write off as current expenses upon commissioning; – include in the OS and depreciate |

| from 40,000 rub. up to 100,000 rub. inclusive | write off as operating expenses upon commissioning | include in the OS and depreciate |

| over 100,000 rub. | include in the OS and depreciate | include in the OS and depreciate |

Sale

If an organization decides that a property item must be disposed of from its production or non-production activities, it may be sold to a third party or individual.

[goo_mid]

The value of this property is determined at the conclusion of the sales contract and agreed upon by both parties.

Accounting for funds from the sale is complicated by the fact that there is usually some difference between the residual value of the property and its actual sale price, since market conditions often force the price of the property to be reduced in order to find a buyer.

We will consider the basic accounting entries and documentation when selling objects (transfer act, order, entries) in a separate article.

Tax accounting

Starting from 2021, there is a new limit on the value of fixed assets in tax accounting. OS will be considered property worth more than 100,000 rubles. (Federal Law dated June 8, 2015 No. 150-FZ).

Objects that cost 100,000 rubles or less are considered materials.

Thus, with the adoption of the new law, companies will be able to take into account more costs at a time in the current period. These innovations improve the situation of organizations, because income tax payers depreciate fixed assets, and “simplified” companies gradually write them off during the reporting year.

There is only one difference between accounting and tax accounting when forming the initial cost of fixed assets. In accounting, it includes interest on a loan raised for the acquisition of fixed assets, recognized as an investment asset (clause 7 of PBU 15/2008). Otherwise, the initial cost is formed in the same way (clause 8 of PBU 6/01, clause 1 of Article 257 of the Tax Code of the Russian Federation).

Let me remind you that the initial cost of fixed assets is included in expenses through depreciation charges (clause 3, clause 2, article 253 of the Tax Code of the Russian Federation).

VAT can be deducted only on those fixed assets that will be used for transactions subject to this tax. Input VAT is accepted for deduction for any quarter in which three conditions are met (clauses 2, 6 of Article 171, clauses 1, 1.1, 5 of Article 172 of the Tax Code of the Russian Federation): the invoice is received from the supplier (contractor ); the purchased asset or goods (work, services) purchased for its creation are accepted for accounting; Three years have not elapsed since the purchased asset or goods (work, services) purchased for its creation were accepted for accounting.

VAT on fixed assets, which will be used only in tax-free transactions, is included in their cost in both accounting and tax accounting (clause 8 of PBU 6/01, clause 2 of Article 170, clause 1 of Article 257 of the Tax Code of the Russian Federation ). If fixed assets will also be involved in taxable transactions, then it is necessary to divide the tax into those accepted for deduction and included in the cost of the fixed assets.