What is account 70 used for in accounting?

Account 70 “settlements with personnel for wages” is used according to the Chart of Accounts to reflect on it all wage settlements for both employees carrying out activities under employment contracts, and under contracts for the provision of services with individuals.

This account accumulates information on salary calculation in all its components:

- salary payment;

- bonuses;

- additional payments;

- vacations;

- compensation;

- payment of benefits and financial assistance, etc.

With the help of this information, the administration can make the necessary decisions on labor costs. This account summarizes the salaries of employees in all departments of the company. On the other hand, depending on the corresponding account, it is possible to establish labor costs for each structural unit.

This reflects information about the existence of existing debts, both of the employee for overpaid wages, and of the enterprise itself for wages that were not paid on time.

Attention! Account 70 also reflects settlements with the founders, who are also employees of the company, for dividends accrued to them.

Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

You will find the current form and the procedure for filling it out in the article “Unified form No. T-54a (personal account (SVT)).”

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

Account characteristics

To record payroll calculations, account 70 is used. When asked which account 70 is active or passive, you can clearly answer that it is an active-passive account.

Depending on the situation, it can have two balances at once. The debit balance reflects the debt of persons working at the enterprise for the wages paid to them by the enterprise. The loan balance, on the contrary, reflects the employer’s debt to the employees working in the company.

When determining the final account balance, it matters which side the balance is on. If by debit, then the debit turnover reflects the increase in debt, and the credit turnover reflects its repayment.

The opening balance is added to the debit turnover, after which the resulting result must be compared with the credit balance. If the final value of the difference with the loan turnover turns out to be positive, then the final balance is a debit.

When the initial balance of account 70 is on credit, then the increase in debt is reflected on the credit side, and its repayment on the debit side. If the difference between the amount of the opening balance and the turnover on the credit account with the debit turnover is positive, then the ending balance is in credit. Otherwise, at the end of the period, a debit balance of account 70 is obtained.

Attention! The turnover sheet for account 70 can reflect two balances at once. This is due to the fact that subaccounts within it can be either debit or credit, and the synthetic account has a folded double balance.

In the balance sheet, account 70 balances are reflected as follows:

- In the asset as part of current assets on line 1230 as accounts receivable.

- In liabilities as part of short-term liabilities on line 1520 as accounts payable.

You might be interested in:

Chart of accounts for [year] with explanations and entries

What subaccounts are used?

Analytical accounting for account 70 is built for each employee separately. As a rule, information on people is combined into higher subaccounts, which are created for each department in the company.

The Chart of Accounts does not establish subaccounts recommended for opening, therefore it is customary to independently create subaccounts of a higher order with the following grouping:

- Settlements with staff members.

- Calculations under contract agreements.

- Settlements with part-time workers.

- Settlements with disabled personnel.

Attention! The enterprise must approve the Working Chart of Accounts when putting the Accounting Policy into effect.

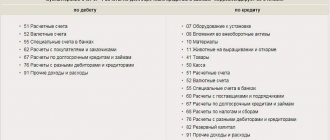

Corresponds with accounts

Account 70 can correspond with the following accounts:

From the debit of account 70 to the credit of accounts:

- Account 50 - when paying wages in cash from the cash register;

- Account 51 – when paying wages by transfer from a current account;

- Account 52 – when paying wages by transfer from a foreign currency account;

- Account 55 – when paying wages by transfer from a special account;

- Account 68 - regarding tax withholding from wages;

- Account 69 - when withholding funds not covered by the social insurance fund (for example, when paying for a voucher);

- Account 71 - when withholding unpaid accountable amounts;

- Account 73 - when withholding funds in favor of the company (for example, when covering damage or defects);

- Account 76 - when depositing unpaid wages, or deductions under writs of execution;

- Account 79 - for settlements between the parent company and the branch;

- Account 94 - for a one-time recovery of the deficiency from the guilty person.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - regarding the calculation of wages to employees involved in the creation or preparation for operation of a non-current asset;

- Account 20 - when calculating wages to the main employees of the workshop;

- Account 23 – when calculating wages for employees of the auxiliary workshop;

- Account 25 – when calculating salaries for managerial or technical personnel;

- Account 26 - when calculating salaries for administrative staff;

- Account 28 - when calculating wages for employees who are constantly engaged in correcting defects;

- Account 29 – when calculating wages to employees of service farms;

- Account 44 - when calculating wages for employees engaged in trade;

- Account 69 - when calculating payments made from social funds;

- Account 76 - when calculating payments from third parties in favor of a specific employee;

- Account 79 – for settlements between the parent company and the branch;

- Account 84 - when accruing income based on the results of activities to the founders, members of the company, etc.;

- Account 91 - when calculating wages to employees who are not engaged in their main activities;

- Account 96 - in case of accrual of payments made at the expense of a previously created reserve;

- Account 97 - when calculating payments that will actually be taken into account in the following periods;

- Account 99 - when calculating payment for work to eliminate the consequences of force majeure.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

What is reflected in debit and credit

The debit of account 70 shows:

- Amounts of paid salaries, bonuses, benefits, and other cash payments to the employee;

- Amounts of accrued taxes, fees, deductions under writs of execution, etc.

- Amounts of accrued but not paid wages on time.

The account credit reflects:

- The amount of salary that the employee earned for the specified period;

- Amounts of earnings that were accrued from reserves;

- Amounts of accrued benefits - sick leave, maternity leave, etc., paid from social insurance funds;

- Amounts of income from participation in the capital of the organization.

Postings for deductions from wages: Dt 70 Kt 76 (73, 68)

- The responsibility of the employer, who is an intermediary (tax agent) between the Federal Tax Service and the recipient of income (employee), is to calculate and withhold personal income tax. In this case, the entry is made: Dt 70 Kt 68.

For more information about the nuances of calculating personal income tax, see the article “Calculation of personal income tax (personal income tax): procedure and formula.”

- If a loan agreement has been entered into between the employee and the company, monthly interest and principal amounts may be deducted from his paycheck. The basis is a written statement from the employee. The accounting entry in this case will be as follows: Debit 70 Credit 73.

- Deductions for compensation for shortages of goods and materials or damage caused are reflected similarly: Dt 70 Kt 73.

- In addition, the employer is obliged to make deductions from the salary accrued to the employee according to executive documents. These may be court orders or bailiff orders, notarized agreements on the withholding of alimony, etc. Such transactions are reflected by the posting: Dt 70 Kt 76 .

Examples of accounting entries for an account

All transactions listed below in 1c are generated automatically by completing the necessary documents.

Payroll

| Debit | Credit | Description |

| 08 | 70 | Salaries accrued to employees involved in preparing non-current assets for operation |

| 20 | 70 | Salaries accrued to employees of the main workshop |

| 23 | 70 | Salaries accrued to employees of the auxiliary workshop |

| 25 | 70 | Salaries accrued to general production employees |

| 26 | 70 | Administrative staff salaries accrued |

| 29 | 70 | Salaries accrued to maintenance department employees |

| 44 | 70 | Salaries accrued to employees who sell products |

| 97 | 70 | Vacation accrued for the future period |

Salary payments

| Debit | Credit | Description |

| 70 | 50 | Payment was made in cash from the cash register |

| 70 | 51 | Payment was made by transfer from the current account |

| 70 | 55 | Payment was made by transfer from a special account |

Accounting for payroll in the accounting of the parent company for the branch

| Debit | Credit | Description |

| 20 | 79/2 | The salaries of the employees of the main workshop of the branch were calculated |

| 26 | 79/2 | The salaries of the administrative staff of the branch were calculated |

| 79/2 | 51 | Funds transferred to pay salaries |

Payroll calculation in the branch

| Debit | Credit | Description |

| 20 | 70 | The salaries of the employees of the main workshop were calculated |

| 26 | 70 | Administrative employees were accrued |

| 79/2 | 20 | The calculation of wages for workshop employees is attributed to settlements with the parent company |

| 79/2 | 26 | Payroll for administrative personnel is included in settlements with the parent company |

| 51 | 79/2 | Received funds from the parent company to pay salaries |

| 50 | 51 | Funds received at the cash desk |

| 70 | 50 | Salaries were issued in cash from the cash register |

Postings for salary payments Dt 70 Kt 50 (51)

According to the instructions of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U, the cashier must pay wages according to payrolls. In this case, an entry is made: Dt 70 Kt 50.

3 days are given for payment according to the statement. If for some reason the employee does not show up within the specified period, the cashier makes an entry in the “Signature” column indicating the following entry: Dt 70 Kt 76 . The employee can receive the deposited salary within 3 years.

Payments can also be made to employee salary cards. The wiring in this case will be as follows: Dt 70 Kt 51.