Laptop/computer – the main tool or not? This is one of the questions that arises when registering this object. After all, a PC can in fact consist of separate devices - a system unit, monitor, mouse, keyboard, webcam, printer, etc. - that can work together. Are they independent objects or is the assembled computer the main tool? Let's find out in this article.

Also see:

- How to estimate the value of fixed assets in accounting

- Accounting certificate of fixed assets: sample

Acceptance for accounting of fixed assets up to 100,000 rubles.

Let's consider the first example, where we will take into account an asset costing less than 100,000 rubles. enterprise on the general taxation system (OSNO).

Let’s say the organization Trading House “Complex” purchased an HP LaserJet Pro 500 color MFP M570dw laser color MFP for 67,956 rubles. We are faced with the task of taking this OS into account in the 1C 8.3 database.

First, let’s create the document Acceptance for accounting of fixed assets: in the menu OS and intangible assets, open the section Acceptance for accounting of fixed assets:

Click the Create button:

Fill in the date of acceptance for accounting of the fixed assets; we select a financially responsible party (MOL) and the location of the property.

In the Non-current assets section, we record the method of receipt of fixed assets, select the multifunctional device from the product group, and indicate the storage warehouse:

Go to the Fixed Assets tab and click the Add button:

Select the desired OS object. If the required OS is not in the nomenclature list, then we create a new one. Fill in the name and asset accounting group by selecting the OKOF code. The depreciation group in 1C 8.3 will be filled in automatically:

Let's go to the Accounting tab: enter an account where the fixed assets and accounting procedure will be taken into account. The fixed asset has a cost of more than 40,000 rubles, so it is necessary to calculate depreciation in accounting. Check the Accrue depreciation box and indicate the accrual account. Let for this enterprise the depreciation costs of fixed assets be charged to account 20.01 - main production in a straight-line manner for 5 years:

For tax accounting, property worth 100,000 rubles. and less purchased after 01/01/2016 are taken into account as part of fixed assets and are not considered depreciable. The costs of purchasing such property are taken into account immediately as part of material costs.

On the Tax Accounting tab, in the line Procedure for including costs in expenses, select Inclusion in expenses when accepted for accounting:

We post the document and analyze its movement using the Dt/Kt button. In our case, the enterprise does not apply PBU 18/02 “Accounting for calculations of corporate income tax.” Therefore, the wiring will look like this:

- In accounting, acceptance of fixed assets for accounting – Dt 01.01/Kt 08.04;

- In tax accounting, it is also included in expenses - Dt 20.01/Kt 01.01:

If an organization applies PBU 18/02, then permanent differences in the value of an object accepted for accounting will be reflected in tax accounting entries with a minus. Thus, entries Dt 20.01/Kt 01.01 reflect the cost of fixed assets not recognized as depreciable, removed from tax accounting:

How to set depreciation parameters for accounting and tax accounting in 1C 8.2 (8.3) under OSNO, when depreciation for tax accounting is calculated according to the provisions of Chapter 25 of the Tax Code of the Russian Federation, see our video lesson:

How to capitalize fixed assets worth more than 100,000 rubles.

Let's look at the second example.

Let’s say that the organization Trading House “Complex” under OSNO accepts for accounting a Toyota Camry passenger car for 600,000 rubles, VAT 18%.

We fill out the document Acceptance for accounting of fixed assets in the same way as the first example considered:

On the Tax Accounting tab, in the line Order of inclusion in expenses, select Accrual of depreciation. We check the Accrue depreciation checkbox and indicate the useful life of the OS - 84 months:

We post the document and analyze its movement using the Dt/Kt button. In accounting and tax accounting, the entries will have the following form: accounting for fixed assets - Dt 01.01/Kt 08.04 for the amount net of VAT - 508,474.58 rubles:

Results

Thus, in the current conditions in the Russian Federation, an extensive regulatory framework has been formed for accounting for fixed assets at an enterprise, which consists of both federal laws and PBUs, as well as methodological recommendations that explain the rules and regulations of mandatory documents.

However, some issues in these documents are not sufficiently resolved. Eliminating the shortcomings of the regulatory framework, as well as bringing it as close as possible to IFRS standards is a primary task in the current conditions in the Russian Federation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Acceptance of fixed assets for accounting under the simplified tax system

For the simplified taxation system (STS), special accounting of fixed assets (FA) is used and the document Acceptance for accounting of fixed assets is filled out differently.

When applying the simplified tax system, depreciation of fixed assets for tax purposes is not charged, and expenses for twelve months are accepted in a special manner. For expenses to be accepted, the debt to the supplier must be repaid.

Expenses can begin to be written off from the last day of the quarter (March 31, June 30, September 30, December 31) in which the OS was put into operation. At the end of the year, the purchased OS must be completely written off.

For example, if an OS object is put into operation in 1C:

- In the first quarter, expenses are recognized at a quarterly rate;

- If in the second, then one third for three quarters;

- If in the third quarter, then half the amount for two quarters;

- If in the fourth quarter, then the entire amount is recognized at a time.

If the fixed asset has not been paid in full, then the paid share will be taken into account in proportional shares during the remaining reporting periods of the year after the payment date.

Let's consider the third case.

Let’s say that the organization Garant-Service LLC uses the simplified tax system (income minus expenses) to take into account a Lenovo laptop worth 95,000 rubles.

We fill out Acceptance for accounting of fixed assets in the same way as the first example considered:

After filling out the sections Fixed Assets and Accounting, we move on to Tax Accounting (STS). We indicate the cost of the fixed asset, the date of its acquisition and useful life. The procedure for including costs in expenses is Include in expenses. In the Payment subsection we enter the amount and date of payment accepted for accounting of the fixed assets:

We post the document and analyze its movement using the Dt/Kt button. In accounting, the entries will be generated: acceptance of fixed assets accounting – Dt 01.01/Kt 08.04:

It is worth remembering that only those individual entrepreneurs or organizations whose residual value of depreciable fixed assets does not exceed one hundred million rubles can apply the simplified tax system.

For more information on how to avoid mistakes when determining the costs of purchasing an operating system for tax accounting when applying the simplified tax system, the object “income minus expenses” in 1C 8.2 (8.3) can be seen in our video:

Prospects for improving regulatory accounting of fixed assets

The gaps listed above in the regulatory regulation of fixed assets accounting at an enterprise determine current directions for improving the documentary accounting base in the Russian Federation.

In particular, some restructuring of the rules for accounting for fixed assets is expected in the context of focusing on the following IFRS standards:

- IFRS 16 OS;

For more information on accounting for fixed assets according to IFRS, see the article “IFRS No. 16 Fixed Assets - Features of Application”

- IFRS 36 Impairment of Assets;

- IFRS 23 Borrowing Costs.

At the same time, among the areas of improvement, the following can be highlighted:

- Bringing permitted depreciation methods into compliance with IFRS. Namely: from Russian practice it is proposed to exclude the method based on the sum of the numbers of years of useful life, which is not established by IFRS.

- Deviation from a clear cost restriction allowing the asset to be accounted for as fixed assets.

- Introducing the practice of accounting for impairment of fixed assets.

Entering fixed asset balances in 1C using the example of a car

Let's consider one more case. Often, the commissioning of an OS object occurs before the enterprise begins to use any software products for accounting.

Let’s say Garant-Service LLC 01/01/2015. purchased and put into operation a ŠKODA Rapid car worth RUB 622,000. To start working with the 1C Enterprise Accounting 8.3 database as of December 31, 2015. the enterprise needs to enter the initial balances of the operating system.

We use the Balance Entry Assistant:

We set the date for entering balances: December 31, 2015. and click the button Enter account balances by selecting account 01 Fixed assets:

Click the Add button. We create an OS object - a ŠKODA Rapid car. Fill in the name and asset accounting group – Vehicle. We select the OKOF code, and the depreciation group in 1C 8.3 is filled in automatically.

On the Initial balances tab, indicate the initial cost of the car - 622,000 rubles. and Accumulated depreciation - the amount of accrued depreciation from the moment the vehicle was put into operation - RUB 124,400.

For this enterprise, fixed assets depreciation expenses are charged to account 26 General business expenses:

On the Accounting tab, fill out the MOL, the useful life of the OS is 60 months and check the box - Calculate depreciation:

Next tab Tax accounting. We fill in: the initial cost of the car, the date of its purchase is 01/01/2015. and useful life - 60 months:

On the Events tab, fill in the date of registration of the ŠKODA Rapid car with commissioning, as well as the name and number of the document confirming the operation:

Click on the Save and Close button. Now the balance appears in the assistant for entering initial balances:

- Dt on account 01.01– 622,000 rubles;

- Kt on account 02.01 – 124,400 rubles:

Let's calculate the amount of depreciation for January 2021. for the ŠKODA Rapid car, through the Closing of the month. To do this, in 1C 8.3, in the Operations menu, open the Month Closing section:

In the Period field, indicate the month of depreciation calculation – January. We forward the documents one month in advance and perform the operation Depreciation and wear and tear of fixed assets:

We generate a Help calculation of depreciation: by clicking on the line Depreciation and depreciation of fixed assets - Depreciation. According to the certificate, it is clear that the ŠKODA Rapid car was put into operation on 01/01/2015. and its useful life is another 49 months, the residual value of the fixed asset is 497,600.00 rubles, the amount of depreciation is 10,366.67 rubles:

Do not forget that information about the presence, movement and wear of operating systems is the main source of data for assessing and analyzing the production potential of an enterprise.

What inaccuracies may an accountant make when entering OS balances in 1C 8.2 (8.3), see the following video:

OS limit in accounting

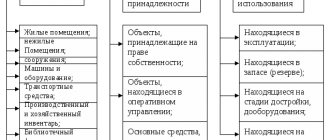

In accounting, assets are classified as fixed assets if they simultaneously meet such requirements, and the object (clause 4 of PBU 6/01 “Accounting for fixed assets”):

- intended for use in production, for the management needs of an organization, or for provision for a fee for temporary possession and use or for temporary use;

- intended for use over a long period of time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

- the organization does not intend to resell it;

- capable of bringing economic benefits (income) to the organization in the future.

In this case, paragraph 5 of PBU 6/01 establishes a limitation. If the listed conditions are met, but the property has a value of no more than 40,000 rubles (or the value within these limits established in the accounting policy), then such property belongs to the inventory.

What does it mean?

If the limit is set at no more than 40,000 rubles, then the property can be written off at a time when put into operation. And property that exceeds such a limit in value is classified as fixed assets based on accounting policies.

But if the accounting policy does not establish a cost limit, then all property that meets the criteria of fixed assets should be classified as depreciable property and depreciated “by default.”