The list of off-balance sheet accounting accounts is included in a separate section of the unified accounting plan in the amount of 11 pieces.

Each is used to record and control individual amounts of transactions that are not reflected in the balance sheet accounts.

Intended for:

- collecting information about the availability and movement of valuables temporarily accepted by the organization from other persons - fixed assets for rent, for installation, MC for secondary storage, in processing, goods on consignment;

- control of individual operations - accounting of strict reporting forms, wear and tear of fixed assets, written off bad debts of debtors;

- reflections of contingent rights and obligations - guarantees from other persons and provided to other persons.

Type of operation “Receipts (acts, invoices)”

Type of operation “Recognition of leasing payments in NU”

When performing the regulatory operation “Recognition of leasing payments in the tax accounting system” (as part of the month-end closing), the difference between the leasing payments reflected in the document “Receipts (acts, invoices)” and the accrued depreciation in tax accounting is determined. If the monthly lease payment exceeds the amount of accrued depreciation, the difference is reflected in tax accounting expenses. If the accrued depreciation exceeds the amount of the lease payment, then the depreciation amount is reversed by this difference.

Account 03 Profitable investments in material assets

The following subaccounts can be opened for account 03:

- subaccount “Purchase of objects of profitable investments in material assets”;

- subaccount “Objects of profitable investments in material assets not transferred to the lessee”;

- subaccount “Objects of profitable investments in material assets transferred to the lessee.”

Just like fixed assets, property intended for rent (leasing, rental) is accounted for at its original cost, which is defined as the sum of all costs associated with the acquisition of this property.

Costs for the purchase of property are collected in the debit of account 08 “Investments in non-current assets”, and after putting this property into operation they are written off from the credit of account 08 to debit 03:

Debit 08 Credit 60 (76.51...) - costs associated with the acquisition of property intended for temporary use (excluding VAT) are taken into account.

Debit 19 Credit 68 - VAT on costs based on supplier invoices is taken into account.

Debit 03 - Credit 08 - property intended for transfer for temporary use has been put into operation.

Debit 68 subaccount “Calculations for VAT” Credit 19 - a tax deduction for VAT was made.

The transfer of property for temporary use (possession) to other organizations, as well as the return of such property, is reflected in accounting as follows:

Debit 03 subaccount “Objects of profitable investments in material assets transferred to the lessee” Credit 03 subaccount “Objects of profitable investments in material assets not transferred to the lessee” - the property was transferred for temporary use (ownership) to other organizations.

Debit 03 subaccount “Objects of profitable investments in material assets not transferred to the lessee” Credit 03 subaccount “Objects of profitable investments in material assets transferred to the lessee” - the property was returned to the organization.

The usual practice when transferring property for temporary use is that ownership remains with the transferring party. This means that the organization needs to charge depreciation on the following fixed assets:

Debit 20 Credit 02 - depreciation has been accrued on fixed assets.

For convenience, it is better to open an additional subaccount “Depreciation of property intended for temporary use” on account 02 “Depreciation of fixed assets”.

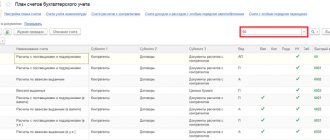

Chart of Accounts

Account 01.03 “Leased property”

Account 01.03 “Leased property” is intended to summarize information on the availability and movement of the organization’s fixed assets that are leased until their disposal.

Account 02.03 “Depreciation of leased property”

Account 02.03 “Depreciation of leased property” is intended to summarize information on depreciation of leased property.

Account 76.07 “Rent payments”

Account 76.07 “Settlements for rent” reflects settlements under lease agreements in the currency of the Russian Federation.

Account 76.07.1 “Rental obligations”

Account 76.07.1 “Rental obligations” is intended to summarize information on long-term financial obligations under lease agreements in the currency of the Russian Federation.

Account 76.07.2 “Debt on leasing payments”

Account 76.07.2 “Debt on leasing payments” is intended to summarize information on current payments under leasing agreements in the currency of the Russian Federation.

Account 76.27 “Rent payments (in foreign currency)”

Account 76.27 “Settlements for lease (in foreign currency)” reflects settlements under lease agreements in foreign currencies.

Account 76.27.1 “Rental obligations (in foreign currency)”

Account 76.27.1 “Lease obligations (in foreign currency)” is intended to summarize information on long-term financial obligations under lease agreements in foreign currencies.

Account 76.27.2 “Debt on leasing payments (in foreign currency)”

Account 76.27.2 “Debt on leasing payments (in foreign currency)” is intended to summarize information on current payments under leasing agreements in foreign currencies.

Account 76.37 “Rent payments (in cu)”

Account 76.37 “Settlements for rent (in cu)” reflects settlements under lease agreements that are actually carried out in rubles, but are accounted for in conventional units.

Account 76.37.1 “Rental obligations (in cu)”

Account 76.37.1 “Rental obligations (in cu)” is intended to summarize information on long-term financial obligations under lease agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

Account 76.37.2 “Debt on leasing payments (in cu)”

Account 76.37.2 “Debt on leasing payments (in cu)” is intended to summarize information on current payments under leasing agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

Account 76.07.9 “VAT on rental obligations”

Subaccount 76.07.9 “VAT on lease obligations” takes into account the amount of value added tax payable by the organization related to the acquisition of fixed assets under lease agreements in the currency of the Russian Federation.

Account 76.37.9 “VAT on rental obligations (in cu)”

Account 76.37.9 “VAT on lease obligations (in cu)” takes into account the amounts of value added tax due to payment by the organization related to the acquisition of fixed assets under lease agreements, payments for which are actually carried out in rubles, but are taken into account in conventional units. Account balances and turnover are formed simultaneously in conventional units and in rubles. Any currency from the “Currencies” directory can be used as a conventional unit.

What are off-balance sheet accounts?

Off-balance sheet accounts are intended to account for funds located at the enterprise, but not belonging to it, as well as guarantees received and issued, and bad debts of debtors.

They have a three-digit code - 001, 002, ... 011. Their list is included in the standard counting plan.

Off-balance sheet accounts are not subject to the double entry rule. That is, the transaction amount is reflected only once - either as a debit or as a credit.

EXAMPLE:

The fixed asset is leased, its cost is 100,000.

Leased fixed assets are reflected in off-balance sheet account 001.

The lease of fixed assets is not reflected in the balance sheet accounts, only an entry is made to account 001 - the transaction amount of 100,000 is entered into debit 001 ( Dt 001 ).

When transferring the leased asset back to the owner, the organization removes the object from off-balance sheet accounting, and an entry is made for loan 001 in the amount of 100,000 ( Kt 001 ).

According to their structure, off-balance sheet accounts can be classified as active - when property is received, conditional rights and obligations arise, the amount is reflected in debit, when temporary rights and obligations are disposed of and terminated - in credit.

The standard accounting plan has 8 sections devoted to balance sheet accounts. Off-balance sheet accounts are located at the end of the Plan outside the main sections. This once again emphasizes that these accounts do not belong to the main ones, are not included in the balance sheet, but are only auxiliary for accounting for third-party property, temporary rights and obligations.

When preparing annual financial statements, their indicators are not taken into account.

The standard unified Plan provides for 11 off-balance sheet accounts.

Brief table

001 - Leased fixed assets

Off-balance sheet account 001 shows information about fixed assets taken for temporary use, reflected at the valuation amount specified in the lease agreement.

- Debit 001 - reflects the receipt of fixed assets taken for use for a limited period, according to the valuation amount specified in the lease agreement,

- Credit 001 – shows the disposal of leased fixed assets when they are returned to the lessor.

002 — inventory items accepted for safekeeping

Account 002 is used by purchasing companies to account for inventory items taken for temporary storage.

- Debit 002 - reflects the receipt of inventory items for safekeeping,

- Credit 002 – return of goods and materials taken for safekeeping to the owner.

003 — Materials accepted for processing

Off-balance sheet account 003 is necessary for accounting for the so-called customer-supplied raw materials - data is shown on the customer’s raw materials and materials accepted for processing; the company does not pay for such raw materials, but returns them to the owner as part of the finished product.

- Debit 003 - reflects the receipt of customer-supplied raw materials at the price specified in the contract (processing costs are included in the cost of work and services of the organization,

- Credit 003 – write-off of customer-supplied raw materials as part of finished products.

004 — Goods accepted for commission

Off-balance sheet account 004 - used by commission agent organizations that reflect goods accepted under a commission agreement from the principal.

- Debit 004 - reflects the receipt of goods for commission at the price specified in the acceptance certificates,

- Credit 004 – shipment of goods to customers.

005 – Equipment accepted for installation

Off-balance sheet account 005 is used by contractor organizations performing work.

- Debit 005 - equipment accepted for installation is reflected at the price specified in the customer’s accompanying documents,

- Credit 005 – disposal of installed equipment and transfer to the customer.

006 – Strict reporting forms

Account 006 – the movement of the BSO is taken into account.

- Debit 006 reflects the receipt of BSO according to the conditional valuation,

- Credit 006 – BSO expense (issue).

007 – Debt of insolvent debtors written off at a loss

Account 007 – accounts receivable that is not returned by debtors and written off at a loss (debts that are not realistic for collection, as well as for which the statute of limitations has expired), such bad debt is taken into account on the balance sheet for 5 years to monitor the possibility of its collection, if the financial situation of the debtor will change.

- Debit 007 - reflects written-off receivables not returned by debtors,

- Credit 007 - reflects either the repayment of the debt by the debtor, or a record of the removal of the debt from accounting due to the liquidation of the debtor’s organization, or upon expiration of the 5-year period for recording such information.

008 – Security for obligations and payments received

Off-balance sheet account 008 - takes into account the amount of guarantees received from other organizations to ensure the fulfillment of any obligations (payment for goods received, repayment of a loan), as well as to ensure payment for goods sold to customers. Account 008 are usually used by pawn shops to account for property received as collateral.

- Debit 008 - reflects the amount of the guarantee received from another organization,

- Loan 008 – writing off the guarantee amount after fulfilling the obligation for which the guarantee was received (for example, paying for the goods received, repaying the loan).

009 – Security for obligations and payments issued

Account 009 – the amounts of guarantees issued for the fulfillment of any obligations are taken into account - pledges, sureties, deposits.

- Debit 009 - takes into account the amount of guarantees issued to another person to ensure the fulfillment of obligations by a third-party organization (payment for goods received by it, repayment of a loan, etc.),

- Loan 009 – write-off of these guarantees as obligations are fulfilled.

010 – Depreciation of fixed assets

Off-balance sheet account 010 - shows the amounts of depreciation for housing facilities, external improvements, forestry and road management, etc.

- Debit 010 - depreciation is reflected,

- Credit 010 – write-off of depreciation upon disposal of objects.

011 – Fixed assets leased

Account 011 – data on fixed assets transferred for temporary use is reflected in cases where these objects must be taken into account on the tenant’s balance sheet.

- Debit 011 - fixed assets transferred for use to other persons for a limited period are reflected at the price shown in the lease agreement,

- Credit 011 - the return of these fixed assets is reflected.

We also recommend reading:

⇒ What are balance sheet accounts?

⇒ Chart of accounts table with explanation for beginners.

Directory "Organizations"

Explanations for the directory details

When creating a new directory element, the basic details of the organization can be filled in by TIN or name by specifying it in the “Automatic completion of details by TIN” field. The details will be filled in in accordance with the information contained in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. It is recommended to fill in the details that are not filled in automatically manually. To correctly fill in the details, you can use the button prompt with a question mark. The hint contains a brief description of the props, as well as a detailed illustrated one via the “More details” hyperlink.

Name of individual entrepreneur

The full and abbreviated name of an individual entrepreneur, as well as the option for its reflection in the program, can be found via a hyperlink in the “Name” field of the “Organizations” directory element.

Main bank account

The full and abbreviated name of an individual entrepreneur, as well as the option for its reflection in the program, can be found via a hyperlink in the “Name” field of the “Organizations” directory element.

Cash accounting

Budget classification codes

The list of BCCs is brought into compliance with Order of the Ministry of Finance of the Russian Federation dated March 12, 2015 No. 36n “On amendments to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.”

Document journal "Bank statements"

In the “Bank Statements” journal, using the “Download” button, you can select a file with data from the bank and load it into the program. In this case, documents are created and posted automatically. Uploaded documents and their results are displayed in the journal.

Document "Payment order"

The document “Payment order” is reflected in the list of payment orders, the transaction log, as well as in the lists of documents for the counterparty and the agreement. You can go to the list of documents for a counterparty or for an agreement from the form of the corresponding directory using the “Documents” hyperlink.

When transferring wages to an employee, in the “Recipient” field of the payment order, you may need to indicate the bank, and not the full name. employee (for example, when transferring funds to the employee’s personal account of a salary project). In this case, you should use the “Recipient” toggle switch. If the “Recipient” toggle switch is set to the “Employee” position, then the employee’s bank account is selected in the “Recipient Account” field.

If the “Recipient” toggle switch is set to the “Bank” position, then an additional field “Recipient Bank” appears. In this case, in the “Recipient Account” field, select the bank account intended for further transfer of funds to employee accounts. Information about the employee’s personal account or his card number is entered in the “Payment purpose” field. The information entered in the “Payment Purpose” is saved and subsequently automatically filled in when processing payment orders for this employee.

Methodological changes

In accordance with the letter of the Federal Tax Service of Russia dated 04/22/2015 No. GD-4-3/ [email protected] , the list of selection of transaction codes issued when filling out section 7 of the value added tax declaration as amended by the order of the Federal Tax Service of Russia dated 10/29/2014 No. MMV -7-3/ [email protected] , added code: 1010823 - transactions for the sale of property and (or) property rights of debtors recognized as insolvent (bankrupt) in accordance with the legislation of the Russian Federation.

The forms of accounting statements of small enterprises are brought into accordance with the order of the Ministry of Finance of Russia dated 04/06/2015 No. 57n, including a new form of report on the intended use of funds has been added.

Basic Operations

Receipt of investments in material assets

For accounting purposes, receipts are recognized when costs associated with the formation of the value of profitable investments have been incurred and documented.

Acceptance of an object for accounting is documented by the following transactions:

Dt 08 Kt 60 - purchase costs;

Dt 08 Kt 10 (70, 69) – costs for materials (salaries, insurance premiums) related to the formation of material assets are taken into account;

Dt 19 Kt 60 – VAT allocated;

Dt 03 Kt 08 – the accounting value of the investment has been generated.

Account 03 is not directly involved in the formation of accounting value. It is used only when all costs are collected in the account. 08.

If a company is engaged in the construction of complex technical objects and structures, an invoice is used when registering the receipt of fixed assets. 07 “Equipment for installation”. On the account 07, all costs for installation and connection to communications are accumulated, then written off from the CT account. 07 at Dr. 08, and further from count. 08 in Dt ch.03.

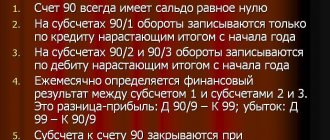

Selling investments

When profitable investments are sold. The accountant forms the residual value by reducing the original price of the object (account 03) by the amount of depreciation (account 02):

Dt 62 Kt 91 – the sale of property is reflected;

Dt 91 Kt 68 – VAT allocated;

Dt 02 Kt 03 – depreciation written off;

Dt 91 Kt 03 – residual value written off.

A mandatory criterion for proper accounting is the ability to identify the economic result from each sale of a property: if the residual value is higher than the sale price, the operation is considered unprofitable, if less, it is considered profitable. Thus, the sale of an asset affects the formation of the economic results of the work.

Liquidation of OS

Liquidation (full or partial) is formalized according to a scheme similar to transactions for the sale of fixed assets - the residual value is formed and written off as expenses:

Dt 02 Kt 03 – depreciation written off;

Dt 91 Kt 03 – the residual value of the object is written off as other expenses.

Typically, liquidation is carried out when the property has expired its useful life, is completely depreciated, is morally and physically obsolete and is not capable of generating economic benefit. In such a situation, the account balance. 03 is equal to the account balance. 02, and the write-off will not affect the formation of profit or loss.

Victor Stepanov, 2016-10-30

Changes in electronic submission of regulated reporting forms

The electronic presentation of statistics forms is brought into compliance with XML templates: - Form No. 1-MO “Information on municipal infrastructure facilities” (approved by Rosstat order No. 685 dated December 2, 2014) XML template dated March 31, 2015; — form No. ZP-zdrav “Information on the number and remuneration of healthcare workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — forms No. ZP-culture “Information on the number and remuneration of cultural workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015;

— forms No. 3P-science “Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — forms No. ZP-education “Information on the number and remuneration of employees in the education sector by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015. — Form No. 3P-social “Information on the number and remuneration of social service workers by personnel categories” (approved by Rosstat order No. 671 dated November 19, 2014) XML template dated March 31, 2015; — Form No. P-2 “Information on investments in non-financial assets” (approved by Rosstat order No. 548 dated 09/04/2014) XML template dated 04/06/2015.

— Form No. 11-NA “Information on the availability, movement and composition of contracts, leases, licenses, marketing assets and goodwill (business reputation of the organization)” (approved by Rosstat order No. 543 dated August 29, 2014) XML template dated April 21, 2015; — Form 1-MO “Information on municipal infrastructure facilities” (approved by Rosstat order No. 685 dated December 2, 2014) XML template dated April 23, 2015; — Form 11 (transaction) “Information on transactions with fixed assets on the secondary market and their rental” (approved by Rosstat order No. 543 on August 29, 2014) XML template dated April 29, 2015.