Maintaining subaccount 58-1

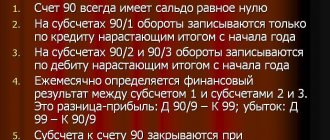

Subaccount 58-1 is intended to systematize data on investments in shares of joint-stock companies (joint stock companies), capital of other companies, etc. The next subaccount is used to analyze investments in private and public debt assets (for example, bonds).

Investments made by the company must be displayed in the Debit of the 58th account and in the number of accounts in which the corresponding values are taken into account. For example, a company acquires assets of other enterprises for money. This fact is reflected in two entries: according to the D-t of account 58 and according to the K-t of one of the accounts 51 or 52 “Currency accounts”, “Currency accounts”.

Long-term financial investments

Cash in transitAccount 58. Short-term financial investmentsAccount 59. Provisions for impairment of short-term financial investments

A share (German Aktie, from Latin actio - action, claim) is an issue-grade security that secures the rights of its owner (shareholder) to receive part of the profit of the joint-stock company in the form of dividends, to participate in the management of the joint-stock company and to part of the property remaining after its liquidation. A share is usually understood as a security that is issued by a joint-stock company during its creation (establishment), during the transformation of an enterprise or organization into a joint-stock company, during the merger (absorption) of two or more joint-stock companies, as well as to raise funds when increasing the existing authorized capital. An investor in shares is attracted by the following: 1. Voting rights in exchange for capital invested in shares.

How to maintain a subaccount 58-2

How to keep accounting for assets for which the current market value is not determined?

In this case, the difference between the initial and nominal price of assets is evenly recorded on the financial results of the company.

If we are talking about a non-profit organization, the amount should be attributed to a decrease or increase in expenses. If you need to write off the difference between two asset prices, the accountant makes 3 entries simultaneously.

The entries are as follows:

- “Settlements with various debtors and creditors” - Dt 76 (the amount of income on assets is indicated here);

- “Financial investments - Kt 58 (only part of the difference between the purchase and nominal value is indicated here);

- “Other income and expenses” - Kt 91 (the difference between the amounts attributed to 76 and 58).

If you need to additionally charge the difference between the real and nominal prices of assets, you also need to make three entries.

The accountant makes notes:

- D-76 (you must indicate the amount of income received from securities);

- Dt 58 (this account takes into account only the share of the difference between two prices);

- Kt 91 (the entire amount that was allocated to the 2 accounts above is recorded here).

The fact of repurchase of securities is taken into account according to the D-tu of the 91st account and according to the K-tu of the account considered in this article. An exception to the rule is companies that record such transactions using the “Sales” account (No. 90).

Participation in other companies

It is reflected on the account. 58 in various forms. At the same time, the instructions focus on the fact that this article covers values not only transferred for the purpose of making the relevant investments, but also those that are subject to transfer. In the latter case, in particular, we mean securities, the ownership rights to which have already transferred to the acquirer. As a rule, participation in other companies is expressed in the purchase of shares. But the market value of securities constantly fluctuates. During the accounting process, difficulties that arise can become decisive. The previous instructions noted that bonds, shares and other securities are recorded under the heading of financial investments at their purchase price. The new recommendations say nothing about this. This is due to the fact that the procedure in accordance with which assets are assessed is regulated by other regulations. One of them, in particular, is the Regulation on Accounting and Reporting. Clause 44 states that financial investments are fixed in the amount of the investor’s actual expenses. These costs are in some cases higher than the purchase price by the amount of certain expenses. The latter, in particular, may be payment for consulting and information services related to the acquisition of securities, remuneration for the intermediary with the help of whom the transaction was concluded, and so on.

Procedure for maintaining the sub-account “Granted loans”

Subaccount 58-3 takes into account loans that the company issues to legal entities and individuals.

The latter do not include employees of the organization itself. Loans that are secured by bills of exchange must be accounted for separately. Granted loans are displayed in two records at once: according to the D-th of the 58th account and according to the K-th of the account corresponding to the resource provided. For example, if money is provided, you need to make an entry to the credit of the “Current Accounts” account (No. 51). The repayment of the debt corresponds to the reverse entry - according to D-t 51 and the credit of the 58th account.

Maintaining subaccount 58-4

Subaccount 58-4 is intended for analyzing contributions to the partnership. For example, a cash investment is reflected by an entry in the debit of the 58th account and in the K-t of the 51st account or other account corresponding to the type of material assets or assets provided. If the partnership agreement is terminated, the tangible assets are returned to the firm. The accountant makes reverse entries to the original entries.

To reflect generalized information about investments and deposits made by organizations in securities, account 58 is used. In the article we will talk about the basic rules for using this account, and also consider in detail examples of recording transactions on account 58.

The legislative framework

The legality of all financial transactions carried out by a business entity is regulated by government regulations, orders, recommendations and guidelines on accounting. The balance sheet line “Financial investments” is legally provided for:

- Regulations on accounting audit PBU 19/02, in connection with Order of the Ministry of Finance of the Russian Federation No. 126 dated December 10, 2002 (amended in 2010).

- Federal project on accounting (402-FZ).

- Civil Code of the Russian Federation (both parts).

- Tax Code.

For accurate and legal financial investment, the organization must take into account all the necessary standards provided for in the bills. Regulatory regulation in this system consists of several levels.

The highest is the Decree of the President of the Russian Federation, and the lowest are the instructions and regulations of the enterprise itself in accordance with the industry focus and the amount of profit received.

Account 58: account transactions using examples

In order to clearly understand all aspects of accounting for account 58, we use examples.

Account 58. Operations involving the provision of loans

According to the agreement concluded on August 1, 2015, Spectr JSC provides Etude LLC with a loan on the following terms:

- loan amount – 1,415,300 rubles;

- Refund deadline – November 30, 2015;

- interest on borrowed funds is 28% per annum.

Based on the agreement, the accountant of Spektr JSC recorded the following transactions:

Account 58. Accounting for bonds with coupon income

Hidden text

- nominal value - 1241 rubles;

- purchase price – 1315 rubles.

The issuer of the bond is Megapolis JSC.

For this bond you must receive two coupon payments, each of which is 15% of the bond's par value (1,240 rubles * 15% = 186 rubles).

The accountant of Stolitsa JSC carried out the following accounting operations:

| Debit | Credit | Description | Sum | Document |

| 58.2 | 51 | RUR 1,315 | Payment order, agreement | |

| 76 | 58.2 | The write-off of part of the bond value upon receipt of coupon income is reflected ((RUB 1,315 – RUB 1,241) / 2) | 37 rub. | Agreement |

| 76 | 91.1 | The amount of the difference between the coupon income (accrued) and the cost of the bond (written off) is taken into account (186 rubles - 37 rubles) | 149 rub. | |

| 51 | 76 | 186 rub. | Bank statement | |

| 76 | 91.1 | RUB 1,241 | Agreement | |

| 91.2 | 58.2 | RUB 1,241 | Agreement | |

| 51 | 76 | RUB 1,241 | Bank statement |

If the agreement provided for the purchase of a bond at a price of 1063 rubles, then the entries in the accounting of JSC Stolitsa would be as follows:

| Debit | Credit | Description | Sum | Document |

| 58.2 | 51 | Funds were transferred as payment for the purchased bond. The receipt of the purchased bond is taken into account | RUB 1,063 | Payment order, agreement |

| 58.2 | 76 | Reflects additional accrual of part of the bond value upon receipt of coupon income ((RUB 1,241 – RUB 1,063) / 2) | 89 rub. | Agreement |

| 76 | 91.1 | The amount of income on the bond is taken into account - coupon income (accrued) and the cost of the bond (additionally accrued) (186 rubles + 89 rubles) | 275 rub. | Agreement, accounting certificate-calculation |

| 51 | 76 | Funds are credited as coupon income received | 186 rub. | Bank statement |

| 76 | 91.1 | The amount of debt of Megapolis JSC for the redeemed bond is taken into account | RUB 1,241 | Agreement |

| 91.2 | 58.2 | The face value of the bond is written off as expenses | RUB 1,241 | Agreement |

| 51 | 76 | Funds were credited from JSC Megapolis to pay off the debt | RUB 1,241 | Bank statement |

Account 58. Placing a foreign currency deposit

On September 12, 2015, an agreement was concluded between Kvartal JSC and Stolichny Bank for the placement of a deposit:

- deposit amount – USD 54,300;

- placement period – 2 months;

- interest rate – 9.5% per annum.

The conventional US dollar exchange rate was:

- as of September 12, 2015 – 61.47 rubles/dollar. USA;

- as of September 30, 2015 – 61.72 rubles/dollar. USA;

- as of 10/31/2015 – 61.66 rubles/dollar. USA;

- as of November 12, 2015 – 61.22 rubles/dollar. USA.

The accountant of Kvartal JSC recorded the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 58 | 52 | Funds were credited to replenish the deposit in foreign currency (USD 54,300 * 61.47) | RUR 3,337,821 | Bank statement |

| 58 | 91.1 | The exchange rate difference (positive) resulting from the revaluation of the deposit as of September 30, 2015 was taken into account ((USD 54,300 * (61.72 – 61.47) | 13.575 rub. | |

| 76 | 91.1 | Income reflected - interest accrued for 09/2015 ($54,300 * 9.5% / 365 days * 19 days * 61.72) | RUR 16,574 | Banking agreement |

| 91.2 | 58 | The exchange rate difference (negative) resulting from the revaluation of the deposit as of 10/31/2015 was taken into account ((USD 54,300 * (61.72 – 61.66) | RUR 3,258 | Accounting statement, bank agreement |

| 91.2 | 76 | The exchange rate difference (negative) resulting from the revaluation of interest for 09/2015 was taken into account ((USD 54,300 * 9.5% / 365 days * 19 days * (61.72 – 61.66) | 16 rub. | Accounting statement, bank agreement |

| 76 | 91.1 | Income reflected - interest accrued for 10/2015 ($54,300 * 9.5% / 365 days * 31 days * 61.66) | RUR 27,014 | Banking agreement |

| 91.2 | 58 | The exchange rate difference (negative) resulting from the revaluation of the deposit as of November 12, 2015 was taken into account ((USD 54,300 * (61.66 – 61.22) | RUR 23,892 | Accounting statement, bank agreement |

| 91.2 | 76 | The exchange rate difference (negative) resulting from the revaluation of interest for 10/2015 was taken into account ((USD 54,300 * 9.5% / 365 days * 31 days * (61.66 – 61.22) | 193 rub. | Accounting statement, bank agreement |

| 76 | 91.1 | Income reflected - interest accrued for 11/2015 ($54,300 * 9.5% / 365 days * 12 days * 61.22) | RUB 10,383 | Banking agreement |

| 52 | 58 | The deposit return amount is reflected - credited to the foreign currency account (USD 54,300 * 61.22) | RUR 3,332,246 | Bank statement |

| 52 | 76 | Funds were credited to the foreign currency account to pay off interest on the deposit (USD 54,300 * 9.5% / 365 days * 62 days * 61.22) | RUB 53,643 | Bank statement |

Account 58. Accounting for transactions with bills of exchange

As of November 1, 2015, the debt of Revansh JSC to the thermal energy supply company Teplovik amounted to 12,954 rubles, VAT 1,976 rubles. In November 2015, Revansh JSC acquired a bill of exchange from Teplovik at a price of RUB 9,340. (nominal value - 12,954 rubles). The promissory note was purchased to pay off the debt of Revansh JSC to the Teplovik company, which was done on November 30, 2015.

The accountant of Revansh JSC made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 20 | 60 | The cost of thermal energy consumed by Revansh JSC as of 11/01/2015 is taken into account (RUB 12,954 – RUB 1,976) | RUR 10,978 | Acts, receipts |

| 19 | 60 | The amount of VAT is reflected on the cost of consumed thermal energy | RUR 1,976 | Invoice |

| 68 VAT | 19 | VAT is accepted for deduction | RUR 1,976 | Invoice |

| 58 | 51 | The transaction of purchasing a bill of exchange from the company “Teplovik” is reflected. | RUR 9,340 | Agreement |

| 76 | 91.1 | The bill “Teplovik” was presented for payment | RUB 12,954 | Bill of exchange |

| 91.2 | 58 | The accounting (book) value of the bill is written off as expenses | RUR 9,340 | Bill of exchange |

| 60 | 76 | The operation of debt offset between “Revenge” and “Teplovik” is reflected | RUB 12,954 | Bill of exchange |

| 91.9 | 99 | The amount of profit received at the end of November 2015 is taken into account (RUB 12,954 – RUB 9,340) | RUR 3,614 | Turnover balance sheet |

Financial investments"

58.1 - “Units and shares”;

58.2 - “Debt securities”;

58.3 - “Loans provided”;

58.4 - “Deposits under a simple partnership agreement”, etc.

UNIT - a share of the capital of a company, which gives the right to participate in general meetings of shareholders, to receive dividends and part of the company’s property upon its liquidation. P. is expressed in a specific document - a certificate, to which coupons for receiving dividends are attached.

SHARES are securities issued by a joint-stock company, the owners of which are granted all property and personal rights associated with the ownership of a share: a) the right to receive dividends, depending on the size of the corporation’s profit; b) the right to participate in the management of the corporation by voting at meetings; c) the right to receive part of the property after the liquidation of the corporation. Rights are exercised in an amount proportional to the size of the shares.

D 58 K 51 –

the emergence of a financial investment object is reflected (when transferring or paying for this object from a current account);

D 58 K 76 –

the occurrence of debt to counterparties is reflected (if payment for financial investment objects will be made after obtaining ownership rights to them, for example, in the case of securities).

D 91 K 58

– reflects the negative difference between the purchase and par value (or between the par and purchase value) of the acquired debt securities.

In account 58, investments are accounted for at actual cost (in the amount of costs incurred for their acquisition).

Financial investments are the second most liquid after cash in hand and in current accounts.

Account 59 “Reserves for the impairment of financial investments” is intended to summarize information on the availability and movement of reserves for the impairment of the organization’s financial investments.

The reserve is formed at the expense of financial results (as part of operating expenses), which is reflected in the accounting entry as a debit to account 91 “Other income and expenses” and a credit to account 59 “Provisions for impairment of financial investments.” A similar entry is made when increasing reserves in the event of a further decrease in the estimated value of financial investments.

The reserve is reduced (used) in the following cases: if the estimated value of the relevant assets in the reporting period has increased, if their value is no longer subject to a sustained significant decrease, as well as upon disposal of these assets. In this case, an entry is made in the debit of account 59 “Provisions for impairment of financial investments” in correspondence with the credit of account 91 “Other income and expenses”.

In the financial statements, financial investments for which an impairment reserve has been created are reflected at their book value less the amount of the reserve.

In the net balance sheet, when reflected in the asset, the difference between 58 and 59 accounts is reflected. Those. There is no account in the liabilities side of balance 59!

Reserve for depreciation of financial investments” (passive, contractual to account 58).

If we have a large number of shares of one company, and its shares have sharply decreased in price, we cannot reflect these changes in account 58, because this will lead to misstatement of the financial statements.

The reserve for impairment of financial investments is created by the following entry:

D 91.2 K 59

D 59 K 91.2 –

reserve amount restored

As soon as financial investments are disposed of, the corresponding reserve amounts are written off to other income of the enterprise (91.1).

Regulatory regulation of the accounting of bills of exchange is carried out by the “Regulations on promissory notes and bills of exchange” dated August 7, 1937.

When purchasing bills of exchange, they are accounted for at actual cost on account 58, disposal is reflected through account 91.

D 60 K 91

– we pay the supplier with a bill of exchange.

If we purchased a bill with a face value of 1000 rubles, and with a discount it was transferred to us for actually 900 rubles, then we will reflect the acquisition price in accounting - 900 rubles.

Upon disposal of this bill, we will make the following entries:

D 60, 76 K 91.1 1000

D91.2 K 58 900

A credit balance of 100 rubles is formed, and income tax is paid on it.

If we provide a loan, we make the following entries:

D 58 K 51

If our main activity is the purchase and sale of financial investments, then income and expenses are charged to account 90, otherwise - to account 91.

When transferring shares, bills, i.e. When they are disposed of and sold, the following entry is made:

D 90.1, 91.2 K 58

Wiring cannot be done: D 60 K 58

D 76 K 91.1

– interest accrued on loans is reflected;

If the loan is provided to an employee, then interest will be accrued to account 73.

D 73 K 91.1

If we have been accrued dividends on the objects of any financial investments, then we will reflect their receipt by posting:

D 51 K 91.1

58.4 — “Deposits under a simple partnership agreement”

(joint activity of enterprises, which is carried out on the books of one of the enterprises);

When depositing assets, account 58 is used.

Under the simple partnership agreement, funds were deposited from the current account:

D 58 K 51

The following materials were included under the simple partnership agreement:

D 58 K 10

And if we bring them in at a higher price, then the transfer of materials will have to be reflected this way.

Account 58 “Financial investments” is intended for detailed accounting of the enterprise’s investments. What is a financial investment? In what order is accounting kept? 58? Let's look at typical examples and wiring.

Account characteristics

Financial investments, account 58 is an active accounting account. That is, when the volume of the indicator increases, the operation is formalized as a debit turnover, and the disposal is recorded as a credit turnover. For example, if an organization purchased debt bonds, then the accountant must record the cost of the purchase as a debit to account 58, and when repaying an interest-bearing loan or selling bonds, as a credit.

Order of the Ministry of Finance No. 94n provides for the opening of additional sub-accounts to account 58:

- 58-1 - for accumulating information on purchased units and shares.

- 58-2 - to reflect information on debt securities, both public and private.

- 58-3 - to generate information about interest-bearing loans provided.

- 58-4 - to collect data on deposits under simple partnership agreements.

As we noted earlier, all of a company’s financial investments can be divided into two types: long-term, with a turnover period of more than 12 months, and short-term, with a duration of less than one year.

If the company's activities involve both short-term and long-term financial investments, which account should be used in this situation? In this case, the company’s accounting policy, and then in the accounting itself, should provide for analytical detail on accounting account 58. That is, the company must independently divide financial investments according to their turnover periods and reflect this information in accounting.

What is it for? When preparing annual and interim accounting reports, data on short-term and long-term financial investments are reflected in different lines of the balance sheet. Thus, deposits with a maturity of up to 12 months should be included in line 1240, and investments with a validity period of more than a year should be included in line 1170.

Count 58 – active or passive?

The placement of the organization's investments is carried out by debiting account 58 in correspondence with cash or other accounts - 50, , 51, , 76, 75, 98, . The credit of account 58 reflects the repayment of loans, the excess of the purchase price of securities over the nominal value, the repurchase and sale of securities, the return of assets on deposits of a simple partnership and other operations. Correspondence is carried out with accounts - 52, 51, 76, 90, 80, 91, 99. The balance of active account 58 shows the balance of financial investments as of a given date.

Important! 58 account in the balance sheet is displayed together with the account. 73 and 55 (in terms of loans to staff and deposits) on lines 1170, 1240, depending on the validity period minus the account balance. 59, where reserves for impairment of investments are formed.

Reflection methods

Based on PBU 19/02, financial investments in the balance sheet are reflected in long-term and short-term storage.

Information on the storage of loans is located in section 5. The report fully reflects the movement of the cash fund to receive interest and dividends from the investment procedure, as well as the allocation of cash to pay interest on purchased securities. Details of the accrual of dividends and interest are displayed in the income statement.

Methods for reflecting investments in accounting are determined by the assessment and analysis of cash investments upon disposal by type and method of analysis of economic activity.