The procedure for registering a change of director of an LLC in 2021 depends on the composition of the company’s founders. If there is only one participant, he independently makes the decision to change the leader. If the company has several owners, it is necessary to hold a general meeting and voting, following which a protocol is drawn up. Further actions are the same for limited liability companies with any number of participants: you also need to prepare form P13014, register changes in the tax office, reissue internal documentation, and inform the bank and partners.

Making a decision at a meeting

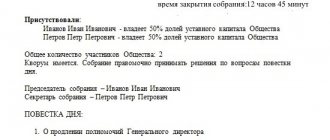

At the meeting of LLC participants, two issues need to be raised: dismissal of the old manager and approval of the new one. According to the law (Part 8, Article 37 of the Federal Law “On LLC”), a majority vote is sufficient to dismiss a director. But members of the organization can change the rules in the Charter, increasing the requirements. An important point when changing a director are clearly defined deadlines when one person relinquishes his powers and the other assumes them. That is, in no case should it be allowed for an LLC to have two managers in one time period. Also, there should not be “anarchy” - so that the old director is relieved of his post, and his place remains vacant for some time according to the documents.

When removing an old manager, it must be taken into account that the powers of attorney issued by him while in office do not lose legal force. Also at the meeting you should take a responsible approach to drawing up the minutes. This document may be needed in the future by the Tax Service. You will also need a number of documents to submit to the supervisory authority.

Make changes to the organization's charter - if necessary

The new edition of the charter and the list of amendments to it are documents of equal legal force. They differ only in shape.

Information about the director does not have to be contained in the company's charter. Therefore, you will need to prepare one of these documents only if such information is specifically in your charter. Otherwise, do not change the constituent document if there are no other changes in the LLC.

If columns about the identity of the manager are present in the charter of the LLC, a sheet of amendments to the charter may be sufficient to change them. If, in addition to changing the director, which is mentioned in the charter, you make other changes, it is easier to draw up a new version of the charter.

In the change sheet

indicate which clause of the charter you are changing and provide its new wording. The list of changes will become an appendix to the current charter; after registering the changes, they will need to be stored and submitted together.

New edition

will completely replace the previous charter. All provisions of the charter will need to be set out in full, including those that you do not change. After registering changes, the old version will no longer be valid. Do not staple the new version of the charter before submitting it to the inspectorate: the tax document will be scanned page by page.

How to prepare documents

The main point when changing the manager is the preparation of an application in form P14001. It must be filled out, signed and notarized. When filling out the application, the following information is required:

- Passport details of the old and new directors.

- Complete information about the LLC.

- OKVED activity codes.

In addition to the application, the notary may need the following documents from you:

- LLC Charter.

- TIN and OGRN certificates.

- Minutes of the meeting with the decision to replace the director.

- Extract from the Unified State Register of Legal Entities with current data about the organization. Some notaries independently request information from the register, some accept documents only in paper form, and others only in electronic form. Therefore, this issue needs to be clarified in advance. A paper extract from the Unified State Register of Legal Entities will need to be prepared before submitting documents to a notary.

If a representative of the management applies to the Federal Tax Service, he will also need to issue a notarized power of attorney.

Step-by-step instruction

Algorithm of actions:

- Making a decision to replace the manager based on the organization’s charter. Preparation of documentary evidence: protocol or decision.

- Filling out the application P14001 and having it certified by a notary.

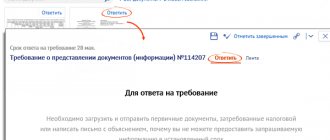

- Submission of forms to the tax office in person by the director, by mail or through a representative on the basis of a power of attorney, which clearly states the powers. Forms can also be submitted electronically, this is now possible, but to use them you need software and a qualified signature.

- Receive ready-made forms. Now the tax office issues all tax forms only in electronic form, sending them by mail (thus, indicating the email address in the application becomes mandatory). A paper sample is available upon request.

For more information about the procedure for changing a director, read the article “How to change a director in an LLC: step-by-step instructions.”

How to submit documents

Papers for changing the director of an LLC need to be sent only to the branch of the Tax Inspectorate where the company was registered. In large cities, there are inter-district divisions for this purpose. In St. Petersburg you need to contact the address: st. Krasnogo Tekstilshchik, 10-12, lit. A. It is necessary to submit an application on form P14001 within 3 working days from the date of the decision to replace the manager. Those who fail to meet this deadline will be fined 5,000 rubles.

Please note that, according to the law, to change the director, only application P14001 is sufficient. However, the Federal Tax Service may be asked to provide a decision on replacing the old manager and an order to assume the position of a new one. The procedure for making adjustments to the Unified State Register of Legal Entities is free and there is no fee.

Results

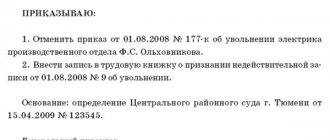

An order to change the head of a company in accordance with the legislation of the Russian Federation can be presented in two varieties - as an order to dismiss the current director, and also as an order to hire a new head of the company. Both orders are issued on the basis of the minutes of the general meeting of owners or the decision of the founder.

You can learn more about the legal regulation of the procedure for changing leadership in an organization in the articles:

- “Who announces a change of director: the new and old director?”;

- “Act of acceptance and transfer of documents upon change of director”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

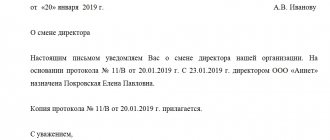

How to notify the bank about a change of director

The following documents must be sent to the bank where the current account of the limited liability company is registered:

- Minutes of the meeting of founders with the decision to replace the director.

- Record sheet from the Unified State Register of Legal Entities.

- Order on the appointment of a new manager.

- Card with sample signature of the new director.

If the current account is registered in the Internet banking system, you will also need to create a new electronic key.

The service includes:

| Preparation of documents for changing the general director of the company | 1000 |

| Submission and receipt of documents to MIFNS No. 15 | 1500 |

| Notary Services | 3920 |

Total: 6 420

rub.

Dismissal of the LLC director

If the decision of the founders (the sole founder) was formalized in a legal manner, then you can then proceed with the preparation of personnel documents on the dismissal of the director and make a final settlement with him. In this case, dismissal will occur under clause 2, part 1, art. 278 of the Labor Code of the Russian Federation (in connection with the adoption by an authorized body of a legal entity, or the owner of the organization’s property, or a person authorized by the owner of a decision to terminate the employment contract). It is possible to dismiss on this basis, even if the director’s employment contract has not expired and the director has no disciplinary offenses.

The General Director will need to pay compensation in the absence of guilty actions (inaction) on his part (Article 279 of the Labor Code of the Russian Federation, paragraph 1, paragraph 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 2, 2015 No. 21, Determination of the Constitutional Court of the Russian Federation dated September 28, 2017 No. 2059-O). Compensation is paid in the amount determined by the employment contract, but not less than three times the average monthly salary (Article 279 of the Labor Code of the Russian Federation). The Ministry of Finance has repeatedly indicated that compensation paid to the head of an organization in the event of termination of an employment contract on the basis of clause 2 of Art. 278 of the Labor Code of the Russian Federation, not subject to personal income tax (letter of the Ministry of Finance of the Russian Federation dated June 20, 2011 No. 03-04-06/6-144.

Don’t forget that the Labor Code of the Russian Federation prohibits dismissing employees while they are on sick leave, on vacation, or pregnant. In the personal file of the employee (the director being dismissed), it is necessary to make an entry about the termination of the employment contract. The following must also be written in the work book: “The employment contract was terminated due to the decision by the owner of the organization’s property to terminate the employment contract, paragraph 2 of part one of Article 278 of the Labor Code of the Russian Federation.” The document - the basis for this in the book - can indicate the dismissal order or the minutes of the general meeting of the founders.

In addition to paragraph 2 of Part 1 of Art. 278 of the Labor Code of the Russian Federation, the law also provides for other grounds for dismissal, where it can be initiated by the founders.

So, if a new participant acquired 100 percent of the share from the previous owner, then he has the right to terminate the employment contract with the general director under clause 4 of part 1 of art. 81 Labor Code of the Russian Federation. It is possible to part with the director by agreement of the parties, because the initiator of such dismissal can be both the employee and the employer (Clause 1, Part 1, Article 77, Article 78 of the Labor Code of the Russian Federation).

Be prepared for the director to try to challenge his dismissal in court. Judges often grant such claims.

Thus, in 2015, the former head of the LLC filed a lawsuit against the LLC for reinstatement in the position of general director, payment for forced absence, collection of arrears of wages and compensation for moral damage. By the decision of the sole founder, she was dismissed from the position of general director of the company under clause 2 of Art. 278 of the Labor Code of the Russian Federation, that is, in connection with the adoption by an authorized body of a legal entity, or the owner of the organization’s property, or a person (body) authorized by the owner of a decision to terminate the employment contract.

In her statement of claim, the former manager indicated that she was pregnant at the time of her dismissal. The court sided with the former employee and reinstated her in her position: Part 1 of Art. 261 of the Labor Code of the Russian Federation prohibits the dismissal of pregnant women at the initiative of the employer. The appellate court agreed with this conclusion. The judges did not accept the employer's argument that he did not know about the director's pregnancy.

Rules for filling out an application on form No. P13014

The Federal Tax Service has strict requirements for filling out form No. P13014. Failure to comply with them will result in a refusal to apply for a government application. registration of changes. Follow these requirements:

- The completed form must not contain any corrections, errors, erasures or writing in pencil.

- Number all completed pages in order, starting with 001.

- When filling out on a computer, use Courier New font size 18. All letters must be capitalized.

- When filling out by hand, use only black, blue or purple pen. Letters must be capitalized.

- It is allowed to put only one letter, symbol or number in each cell.

- Print and fill out only the necessary pages. For a change of director - this is the title page, sheet I in two copies, sheet N.

- Copy abbreviations from documents exactly.

- When specifying a contact phone number, you do not need to write brackets, spaces, or dashes. And any Russian number, even a landline, must start with +7.

Who signs?

When drawing up a document, many people wonder who should certify the letter: the old or new general director of the organization. The answer here is clear: new. After all, the document on his appointment has already entered into force. And even if the tax authorities are still in the dark about the change of director, only the new boss now has the right to sign and certify the documentation with his visa.

In practice, a situation often occurs when two people are in power in a company at once.

In order to avoid such moments and possible related troubles, it is necessary to immediately indicate in the minutes of the meeting of owners on this issue specific dates for the dismissal of the previous employee and the appointment of a new one.

How to write a job application

There is no single form of application for employment, so it can be compiled in free form. The personnel officer may ask the applicant to write according to the model accepted in the organization. Deviation from this document is not a violation in the following cases:

- the text does not contain factual errors;

- the rules of the Russian language are observed;

- The employee took into account the general rules for processing such requests.

ATTENTION! The rules are also relevant for foreigners, minors and citizens working part-time.

In special cases, appropriate notes or attachments are left in the text of the appeal (for example, parental consent to the work of a teenager).

Sample application

Sample application for employment:

Application form

The HR employee gives the applicant a ready-made form to fill out. The document form may be filled out by hand. It is necessary to adhere to the general rules for drawing up such requests:

- the position of the addressee, his full name, the name of the organization, the full name of the applicant are indicated;

- the word “statement” is written with a small letter in the center of the line, after it you need to put a period;

- the text of the request begins with a red line with a capital letter, the content should be brief, but reflecting the important details of the contract (date of acceptance, position, salary);

- Finally, the employee indicates the date of preparation and puts a personal signature; regardless of the form of the form, the document must be signed personally.

The application form looks like this:

The HR specialist may ask the applicant to provide additional information in the text: address, age, marital status. This information is needed to select candidates, determine the employee’s workplace, and his schedule. The Labor Code does not oblige the applicant to provide such information, therefore the applicant has the right not to provide this information.

ADVICE! In case of refusal to hire for a reason not specified in the labor legislation, you can go to court. However, for legal proceedings it is necessary to request an official response to the application from the head of the enterprise. This document serves as evidence of a violation of the rights of the candidate for the vacancy.