The simplified tax system or simplified system is a tax regime under which more than half of small businesses work. By choosing this system, the taxpayer receives simple reporting, a low tax rate and the opportunity to reduce tax due to paid insurance premiums.

The simplified tax system Income option is especially popular among entrepreneurs without employees, because with small revenue the tax can be reduced completely, i.e. to zero. How to do this is shown in the examples below, but first read about the main features of the simplified tax system 2018.

The most important thing about the simplified tax system 2021

In the simplified system there are two objects of taxation:

- income, standard rate 6%

- income reduced by expenses, standard rate 15%

You can choose a taxable object only once a year, so you need to understand in advance what business expenses you may have. If you started working on the simplified tax system Income, where expenses are not taken into account, and then your costs increased sharply, then you will be able to switch to the simplified tax system Income minus expenses only from the new year.

The standard tax rates indicated above can be reduced by regional laws to 1% for the simplified tax system for Income and up to 5% for the simplified tax system for Income minus expenses. For example, in one of the regions there is a standard rate of 6% for the simplified tax system Income and only 5% for the simplified tax system Income minus expenses, but only for construction. As you can see, the second option is more profitable, even if the share of costs is small.

By establishing such preferential rates for certain types of activities, the authorities seek to develop some direction in their region, most often this is production or construction. Therefore, before choosing a simplified taxation object, study the regional law; it is possible that a preferential rate applies to your type of activity. You can find out these features at the Federal Tax Service or the economic department of the local administration.

The main limitation on the ability to apply the simplified system is related to the amount of income received during the year. Initially, this amount was 60 million rubles, but in the period from 2021 to 2021 another limit is in force - 150 million rubles.

Another important limitation is set for the number of employees - no more than 100 people. In principle, most individual entrepreneurs meet these conditions and therefore have the right to work under a simplified regime.

Law on new online cash registers for individual entrepreneurs in 2021 - realities and prospects

At the federal level, several laws have been adopted regulating the activities of individual entrepreneurs and LLCs.

In accordance with Federal Law No. 54 and Federal Law No. 290, the transition period for all entrepreneurs ends on July 1, 2021.

Until this moment, businessmen must have time to:

- Purchase a new, improved, modern cash register that will comply with all legal requirements. Please note that the equipment must have access to the Internet in order to transmit information about all payments made to the fiscal data operator (FDO) and to the tax service (FTS). In addition, the online cash register must operate smoothly and harmoniously.

- Register the purchased equipment with the OFD and the Federal Tax Service and conclude an agreement with the operator.

- Agree with the technical service center about the installation of equipment and further maintenance of the CCP.

- Start using an online cash register at work.

Remember that by mid-2021 all entrepreneurs will have to install and begin using new equipment.

Individual entrepreneurs working under PSN and UTII have until July 1

But by mid-2021, all other individual entrepreneurs had to install the equipment. A fine will be imposed for them in 2021, since the online cash register system was not installed on time.

Important: if you think that you will be able to use the old cash register in 2021, then this is not so.

All old-style cash registers were deregistered by the tax service in the summer of 2021, even without a personal application or appeal.

How to pay tax on a simplified system

The tax that simplifiers pay is called single. Personal income tax and income tax are not paid under the simplified tax system. VAT, in addition to that which is paid when importing goods into the territory of the Russian Federation, is also not charged. The basic tax is calculated based on the results of the calendar year and entrepreneurs must pay it no later than April 30 of the following year. For example, the simplified tax system tax for 2021 must be paid no later than 04/30/2019.

However, during the year there are reporting periods, at the end of which part of the tax must be paid in advance, i.e. in advance. These payments are called advance payments. Deadlines for their payment:

- for the first quarter - April 25

- for the half year - July 25

- for nine months - October 25

This is the official name of the reporting periods, associated with the calculation methodology, but in practice it is easier to assume that advance payments are made for each quarter. Moreover, they must be entered only if the entrepreneur received income in the reporting quarter. If there was no income, then you don’t need to pay anything.

All advance payments that were paid during the year are taken into account when calculating tax for the year. In addition, every entrepreneur, regardless of the chosen tax regime, is required to pay insurance premiums for himself. These payments also reduce the tax amount.

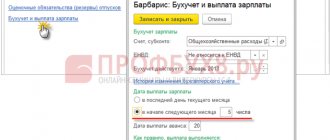

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Individual entrepreneur insurance premiums 2021

Contributions for oneself are the amounts that an individual entrepreneur pays for his pension and health insurance. Until 2021, contributions were paid to special extra-budgetary funds: PRF and Compulsory Medical Insurance, but then the function of collecting them was transferred to the Federal Tax Service.

Thus, individual entrepreneurs do not pay insurance premiums to the Pension Fund for themselves in 2021. In practice, other concepts are now used:

- contributions to compulsory pension insurance (OPI)

- contributions for compulsory health insurance (CHI)

The amount of individual entrepreneurs’ contributions for themselves is established by the state, and the following amounts are planned for 2018: 26,545 rubles for compulsory health insurance and 5,840 rubles for compulsory medical insurance. The deadline for their payment is December 31 of the current year, but it is more convenient to pay them in installments in order to immediately reduce advance payments.

In addition to these fixed amounts, which all entrepreneurs are required to pay regardless of the amount of income received in the business, there is one more additional contribution. It is 1% of annual income over 300,000 rubles.

Let's assume that an entrepreneur earned 830,000 rubles in 2021. Then the additional contribution will be (830,000 – 300,000 = 530,000) * 1%)) 5,300 rubles. In total, together with the fixed amount of insurance payments, he needs to transfer 37,685 rubles to the budget.

Next, as promised, we will show with examples how entrepreneurs pay the simplified tax system for different objects of taxation. And for those who still have questions or for those who want to get advice from a professional, we can offer a free consultation on taxation from 1C specialists.

The list of cases in which payment of contributions is considered not submitted has been expanded

Law No. 335-FZ supplemented paragraph 7 of Article 431 of the Tax Code of the Russian Federation with cases when the inspectorate has the right to consider the payment of insurance premiums not submitted (clause 78 of Article 2 of Law No. 335-FZ). We are talking about errors in the indicators listed below and (or) discrepancies between these indicators for each individual and for the organization as a whole:

- total amount of payments in favor of individuals;

- the amount of payments in favor of individuals within the base for contributions to compulsory pension insurance;

- the basis for calculating contributions to compulsory health insurance at an additional tariff;

- the amount of contributions to compulsory health insurance calculated at the additional tariff.

The listed changes are effective from 01/01/2018 (Part 3 of Article 9 of Law No. 335-FZ). Accordingly, taxpayers must take them into account starting with reporting for 2021.

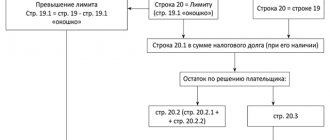

Previously, calculations for insurance contributions were considered unsubmitted if information on the total amount of pension contributions from payments within the base did not coincide with the amount of these contributions accrued for each individual (clause 7 of Article 431 of the Tax Code of the Russian Federation). In other words, in Appendix 1 of Section 1, Line 061 in columns 3, 4, 5 must coincide with the amounts in line 240 of Section 3 for each month of the reporting (calculation) period (see letter of the Federal Tax Service of Russia dated January 19, 2017 No. BS-4-11 / [email protected] ).

If the tax office considers the calculation not submitted, it will notify the payer about this. In this case, the policyholder needs to submit an adjusted calculation within five days (if the notice was sent on paper - within ten days) from the date the notice was sent. Then the date of its submission will be the date of submission of the initial calculation. These provisions of the Tax Code of the Russian Federation remained unchanged (paragraph 3, clause 7, article 431 of the Tax Code of the Russian Federation).

From the editor. In 1C: Lecture Hall on 03/01/2018 there was a lecture “The procedure for calculating and paying contributions in 2021, preparation for submitting reports for the first quarter of 2021” with the participation of L.A. Kotova (Ministry of Finance of Russia) and 1C experts. The video recording can be viewed on the 1C:ITS website on the 1C:Lectures page.

Calculation of tax payments on the simplified tax system Income

For example, let's take a typical entrepreneur who provides household services himself, for example, sewing and repairing clothes at home. His expenses are small, because the fabric and accessories are paid for by the customer, and there is no need to spend money on rent either.

Income is unstable throughout the year; there is a circle of regular customers who order things from time to time. However, for 2021, income from sewing and repairing clothes amounted to 540,000 rubles. Let's see how many taxes and contributions need to be paid on this turnover if an individual entrepreneur works on the simplified tax system Income.

We will not use an academic formula for the calculation, because it is difficult for beginners in accounting. But the option we propose is easier to understand in practice, and all payments will be exactly the same as according to the accounting rules.

So, during the year the income received:

- in the 1st quarter – 83,000 rubles

- in the 2nd quarter – 119,000 rubles

- in the 3rd quarter – 52,000 rubles

- in the 4th quarter – 286,000 rubles

The advance payment for the 1st quarter amounted to (83,000 * 6%) 4,980 rubles, but in March the individual entrepreneur paid part of the insurance premiums for himself in the same amount. The advance payment is completely reduced by the contributions paid, so there is no need to transfer anything to the budget.

The advance for the second quarter is equal to (119,000 * 6%) 7,140 rubles, while in May 7,000 rubles were paid for oneself. We find that the advance payment will be only 140 rubles.

In the third quarter, the calculated advance payment (52,000 * 6%) was 3,120 rubles, with 3,020 rubles paid as contributions in September. You need to transfer 100 rubles to the budget as an advance.

In the last quarter, the entrepreneur paid additional mandatory contributions, taking into account those already paid:

- total fixed amount of contributions 32,385 rubles

- paid quarterly (4,980 + 7,000 + 3,020) = 15,000 rubles

- paid an additional 17,385 rubles

The total amount of the single tax for the year is equal to (540,000 * 6%) 32,400 rubles, while 240 rubles of the advance payment and 32,385 rubles of fixed contributions are deducted from this amount. We find that the amount of tax payable is: 32,400 – 240 – 32,385 = -225 rubles, i.e. an overpayment has occurred. This amount can be offset against future payments or returned from the budget. But for this you need to write an application to the Federal Tax Service, so such a small overpayment can be neglected.

But if the individual entrepreneur did not pay contributions quarterly, then first he would have paid all the calculated advance payments (4,980 + 7,140 + 3,120) in the amount of 15,240 rubles. Then, in December, contributions would be paid in a one-time amount of 32,385 rubles. In this case, the calculated balance of tax payable would be (32,400 – 15,240) 17,160 rubles. This calculated amount is reduced by the contributions paid (17,160 – 32,385

To prevent this from happening, we recommend immediately reducing the calculated advance payments using insurance premiums paid in installments throughout the year.

As for the additional insurance premium in the amount of (540,000 - 300,000) * 1%) 2,400 rubles, the individual entrepreneur has the right to pay it next year - until April 1. In this case, the additional contribution will reduce the advance payment paid for the 1st quarter of 2021.

Fears and hopes of entrepreneurs: about new laws and the business climate

According to research by IPT Group, almost 80% of companies operating in Russia have recently experienced increased pressure due to taxation. Most entrepreneurs consider problems associated with tax risks (unscrupulous counterparties and interdependence of the parties to the transaction, transfer pricing, application of reduced tax rates) as serious obstacles to the development of their business. Recent laws, such as the transition to online cash registers, adopted with the formal purpose of making it easier to do business, are assessed ambiguously by entrepreneurs.

Olga Kosets, owner of the Sofiano clothing production

Entrepreneurs are extremely pessimistic. There is a lot of negativity all around and stories about how someone has closed their business, and someone else has been “closed” in a pre-trial detention center or put under house arrest. It is clear that many, after apologizing, were forced to be released due to the lack of evidence of a crime. The point here is not in the remaining sediment and unethical attacks on justice, but in the fact that, first of all, business suffered - the work of a lifetime, the source of income for both the entrepreneur himself and his employees, and also state interests in the form of lost taxes from for forced downtime - closure is also in the passive voice.

The President's August proposal to ban the seizure of servers and computer hard drives during investigative measures at enterprises can be called the only serious plus of many legislative innovations.

Important!

At the end of February 2021, it became known that the Ministry of Justice had developed clear amendments and additions to the Code of Criminal Procedure. These amendments regulate the activities of law enforcement agencies in cases where a company or individual entrepreneur is suspected of committing economic crimes (fraud, embezzlement, money laundering, etc.). We are talking about the addition of Art. 164 of the Criminal Procedure Code (“General Rules for Investigative Actions”) with a rule prohibiting the use of measures that lead to the suspension of the activities of legal entities and entrepreneurs, “including the unjustified seizure of electronic storage media.”

Art. 177 of the Code of Criminal Procedure (“Procedure for conducting an inspection”) is supposed to be supplemented with a special part, according to which “the seizure, seizure of electronic media during an inspection of a premises or home” for economic crimes “is allowed only if there is data” that the content of information “on electronic media may be relevant to the criminal case." However, investigative authorities will retain the right to copy information in the presence of its owner and witnesses.

It's harder than ever for businessmen today. The unprecedented decline in consumer demand, perhaps the most devastating in the entire history of Russian business, requires a new, more thoughtful and calculated approach, adequate legislative solutions and constructive amendments.

However, the quantity of signed innovations still does not translate into quality. For example, the Law on Online Cash Registers, adopted to simplify and structure retail trade, as a result made this link, to put it mildly, a switchman. Owners of retail facilities, in addition to unplanned expenses for the purchase, installation and maintenance of cash register systems, are forced to enter a lot of information into the receipt, that is, to be responsible for all manufacturers and logisticians.

The consolation in the form of assurances about minimizing fiscal checks is absolutely not impressive due to the endless financial expenses and the permanent struggle with Internet providers. The long-awaited bankruptcy law, which simplifies the casuistry of procedures, is little consolation for company owners who are experiencing panic about the future.

Now people are in no hurry to open their own businesses and, perhaps for the first time, sincerely sympathize with the occasional “chips” in the great struggle against the forest of corruption. However, few people speak out loud about the monopolization of businesses affiliated with government agencies, their regular victories in tenders and receipt of the most profitable government orders. And all this against the backdrop of disrupted full cycles in all spheres of the economy, except, perhaps, the agricultural complex.

My sewing company “Sofiano” is more than 20 years old.

Today's problems cannot be compared with the difficulties of the turbid post-perestroika times. After all, if you look at it, all of our domestic products can very conditionally be considered Russian.

We work on imported equipment, use Turkish fabrics and Chinese fittings, even labels with our trademark, which we proudly sew onto the finished product and order from foreign contractors. And so it is in everything.

I consider the question often asked by journalists about what laws are needed today for the development of SMEs to be rhetorical. And not because there is no specifics, but because for several years in a row on all capital and regional business platforms, federal television channels and megaforums, we, entrepreneurs, constantly talk about the need to adopt a law on franchising, which would largely stop the activity of fraudsters, we raise the issue of the relevance of introducing amendments to the trade law, which almost openly, systematically and consistently lobbies the interests of big business to the detriment of non-stationary trade objects, we are listening to assurances of interest in the development of the SME cluster and are anxiously awaiting new legislative initiatives.

Elena Vasilyeva, General Director of Foros-Audit

I have been working in private business for a long time. First as an employee, now as an individual entrepreneur. For several years now, business life has become more and more complicated. There is more control on the part of the Federal Tax Service and other authorities: the number of reporting forms has increased, correspondence with authorities has increased significantly, explanations and documents are required, they have begun to exercise more control, and they are looking at current accounts.

Over the past year, the situation has worsened, and for many, critically. The Federal Tax Service received more freedom to influence taxpayers.

The list of fines for violation of deadlines, failure to submit required documents, and failure to confirm requirements has expanded. They fine you for everything, your accounts are blocked, your work is not smooth.

There are a lot of changes, and the supervisory authorities themselves do not keep up with the changes: often reports are not accepted because the Federal Tax Service has not yet updated the database. Tightening control is not so bad; in light of the constant changes in the Federal Tax Service and the Pension Fund of the Russian Federation, they themselves do not know what to do in a given situation and prefer not to do anything, so as not to get it from those who control them.

I wouldn’t say that I’m inspired by any of the laws, because the stranglehold is dragging on, but I don’t feel any fear of future changes either; I will solve problems as they arise.

Stanislav Grushevsky, Marketing Director of the monitoring and analysis center "Smimonitor"

In our monitoring and analytics industry, several bills have been adopted that regulate the activities of the media and have a direct impact on our work as a specialized monitoring service.

First of all, we followed the Federal Law of June 23, 2016 No. 208-FZ “On Amendments to the Federal Law “On Information, Information Technologies and Information Protection,” better known as the law on aggregators, which came into force on 1 January 2021. In fact, it began to act later, since only in winter Roskomnadzor published the register of news aggregators. As a result of the bill, aggregators refused to cooperate with many publications, this is especially noticeable with Yandex.News.

Important!

On June 23, 2021, the President signed Federal Law No. 208-FZ of June 23, 2016, which supplemented Federal Law No. 149-FZ of July 27, 2006 “On Information, Information Technologies and Information Protection” with provisions establishing the legal status of the owner of a news aggregator.

In accordance with Part 1 of Art. 10.4 of Federal Law No. 149-FZ, the owner of a news aggregator is the owner of a program for electronic computers, the owner of a website and (or) website page on the Internet, which are used for processing and disseminating news information in the state language of the Russian Federation, the state languages of the republics in composition of the Russian Federation or other languages of the peoples of the Russian Federation, in which advertising may be distributed aimed at attracting the attention of consumers located in the territory of the Russian Federation, and access to which during the day is more than 1 million Internet users.

The owner of a news aggregator is obliged to:

- comply with the requirements of Russian legislation when processing and disseminating news information;

- store for six months the news information distributed by him, information about the source of its receipt, as well as information about the timing of its distribution;

- provide Roskomnadzor with access to information.

Within the established powers, Roskomnadzor maintains a register of news aggregators.

Also, due to stricter requirements (Federal Law “On the Mass Media”), many have ceased to register as media outlets, although in essence they perform precisely such functions. This is clearly visible in the IT sector - for example, the very popular vc.ru or rb.ru are not official media. Many publications on cryptocurrencies that have now appeared in the wake of the popularity of the topic are also not mass media.

On the one hand, these laws “played” to our advantage - it became more difficult for users to track the information agenda, mentions of the right people and companies in the press, so they began to more often turn to specialized paid services and companies like ours.

On the other hand, we now, in a sense, have the function of Roskomnadzor: when searching for sources, we have to focus less and less on the formal side of the matter (whether the publication is registered or not), and more and more manually add sites that are in fact media and have significant influence, but formally are outside the scope of existing legislation.

Alexander Kolesnikov, director

I would not say that pressure from the tax authorities has increased, but on the part of banks, control over the circulation of funds has increased. Any payment or receipt that is suspicious from the bank’s point of view may simply be “frozen” for a long time. And it doesn’t matter that you urgently need to pay for the goods, it doesn’t matter that you’re just running out of deadlines and paying late fees. At this time, the bank is being “sorted out”. At the same time, you show all the documents for the goods, show the documents to whom you are shipping this product, and you are also asked to make an advance payment to the tax office (the bank forces you to make an advance payment to the tax office on the amount received, but no one understands what this has to do with taxes) , and no one names the time frame for unfreezing the amounts. This usually takes about a month, and a month of downtime for an entrepreneur is simply death for the business.

The main problem is the dishonesty of counterparties. If a conflict arises with the tax authorities, the counterparty's accounts, shipped goods and funds transferred by the counterparty for goods and services to another organization are blocked.

The tax office left us no choice; now we must definitely check who we are working with, since a chain of “random” counterparties can also affect us. We use programs to check the integrity of contractors, find out who else they work with, and call suppliers/buyers to clarify the quality of the services provided.

Quick check and selection of contractors. The most important information about any company in one window

Try it

At the moment, there are practically no problems with opening an organization to do business. Everything opens in two or three days. A bank is selected for cashless reception and payments. However, there are barriers - first of all, people’s low financial literacy, lack of understanding of what business is and what it consists of. Without knowledge of the basic functions of running a business, it is very easy for people to put themselves into debt to the government, suppliers, and clients.

We do not have the culture and education to start doing business, this is what I see as the main problem.

The IT services market is specific. Leaders of large organizations do not always understand why they need to develop an IT infrastructure in their organization. A lot of time is spent training people on why processes need to be automated in organizations. Only with a change in the current management team, and these are managers 45-60 years old, will the IT market, and subsequently the quality and profitability of the organizations involved in it, rise. The profitability of our business is now 5-6%.

All legislative changes related to doing business have a positive impact on the development of our business, but the technical part of the implementation of the party that controls the innovation process itself is always lame. As happened with online cash registers: the law came into force, but did not ensure a high-quality and painless transition. Problems with FN, problems with cash register software, problems with the cash registers themselves (malfunctions) had a negative impact on clients and our business.

Use all the features of Kontur.OFD for free for up to three months and comply with the requirements of 54-FZ!

To learn more

The understanding of entrepreneurship in Russia has changed. In fact, no one is introducing any restrictions as such, but they simply won’t let you earn a lot. You cannot take on a good project without sharing it with someone; you constantly need to prove something to clients, increase their level of education in the IT field, which is also expensive. For every ruble earned, you must give a full report to the tax office; for every ruble withdrawn from the bank, you must prove to the bank that these funds are for the intended use. Therefore, instead of developing business in Russia, entrepreneurs are forced to come up with different schemes for making money, and not work for the sake of work.

Artem Yudkin, Advisor to the Chairman of the Board at SEC Modernization

We monitor the sentiments of various groups in the business community, reflecting reactions to government regulation of the economy.

One of the expectations at the beginning of the year was an attempt to systematize and regulate non-tax payments. Most entrepreneurs associated with the real sector of the economy noted that non-tax payments (for example, recycling fees, fees for heavy vehicles) constitute no less of a burden on them. However, at present, the bill has not been submitted to the State Duma, and the roadmap for systematizing non-tax payments adopted only in August makes it possible to postpone the actual start of the law for at least six months.

No less important for entrepreneurs remains the control and supervisory burden, which is not significantly reduced in terms of unscheduled inspections, although the new risk-based approach to control and supervisory activities aims to reduce both planned and unscheduled control activities.

Assessment of financial condition and warning about inspections by the Federal Tax Service, Pension Fund, Social Insurance Fund, Rospotrebnadzor, etc.

To learn more

Perhaps most often, entrepreneurs note a general wariness due to the instability and unpredictability of economic decisions. The most problematic issue is the lack of a single comprehensive position on supporting small and medium-sized businesses, and decisions establishing new mandatory requirements only give reason to think about a potential increase in administrative pressure on business.

An earlier experiment with EGAIS in the alcohol business shows that the introduction of such a system can also extend to the circulation of other goods, primarily food. Such expectations make some entrepreneurs think about the issue of future implementation of mandatory accounting systems in their areas of work.

Important!

From July 1, 2021, each stage of the life cycle and movement of products of animal origin will be recorded in the Federal State Information System (FSIS) "Mercury".

According to the Federal Law of July 13, 2015 No. 243 “On Amendments to the Law of the Russian Federation “On Veterinary Medicine””, all companies involved in the circulation of goods of animal origin are required to switch to electronic veterinary certification through the FSIS “Mercury”. These are manufacturers and distributors of goods supervised by State Veterinary Control - meat processing plants, poultry factories, dairies, seafood producers, as well as logistics centers, retail chains and retail stores. How to work in FSIS "Mercury" and how to prepare for changes?

In general, the mood of entrepreneurs can be characterized as transitioning from distrust to expectation, largely associated with the approaching new political cycle, within which it can be assumed that significant reforms will be introduced in the field of state regulation of the economy.

Sergey Nazarov, director of Sinta-Promo

We are a small business, there are no gray schemes with VAT or anything like that, so we haven’t noticed any particular increase in pressure specifically because of taxation.

90% of contractors pay us for services, and not vice versa. Therefore, the risks on our part are small. We limit ourselves to simply checking the client according to the Unified State Register of Legal Entities, and also make sure that contracts and acts are signed on time.

We had one case when we received government support for one project. We no longer participate in such programs, primarily due to difficulties with reporting. As a rule, a state grant is targeted, and the cost estimate is strictly defined and cannot be adjusted, and planning the ideal estimate for a project, especially a startup, in advance is only possible in an ideal world.

In general, IT is a unique area of business in terms of government support. When officials ask us, IT specialists, “how can the state help you?”, it seems to me that they expect an answer like “it would be great if the state acted as a customer more often.” In fact, government orders are a tasty morsel for many sectors of the economy. But in the case of IT, the answer is usually different: “If you want to help, don’t interfere.” And it’s true: the powerful Russian IT companies, Kaspersky Lab, 1C) achieved success during a period when IT was not overly regulated by the state.

The most significant obstacles to business development in Russia are bureaucracy and high taxes in the social sphere (personal income tax, social contributions). To stimulate the development of small businesses in Russia, it is necessary to simplify reporting as much as possible, reduce the level of control and reduce the tax burden.

Now, strictly speaking, nothing has changed systemically, but entrepreneurs stopped taking a wait-and-see attitude (they realized that it was pointless to wait for something passively) and began to gradually increase their business activity. Therefore, in general, the current condition is satisfactory.

I can’t remember any positive innovations, but the tightening of sanctions for violating Federal Law No. 152-FZ on personal data and the transition to online cash registers has brought a lot of stress for many of our clients. The worst thing is that the mechanisms for implementing laws are often unclear, and in the case of online cash registers and the Federal Law on personal data, this is especially noticeable - businesses have more questions than answers, and this adds a level of stress.

Fiscal data operator service

- Online transfer of checks to the Federal Tax Service

- Registration of cash registers via the Internet

- Analytics on fiscal data

Find out more

In the IT sector, the business climate is generally normal. This is due to the fact that we are “at the cutting edge of progress” and new niches and tools are constantly opening up for us and our colleagues in the market, which are not yet so heavily regulated by the state.

Over the past year, the mood has changed towards moderate optimism, but this is due more to emotions than logic, because you can’t expect bad things forever.

But pessimism prevails among clients, especially in the real sector - in businesses related to production and supply.

We don’t even try to work abroad, because we know several cases from our colleagues in the market - there are more costs and stress than profits. We have very prohibitive regulation in the field of foreign trade.

Dmitry Lukyanov, founder of the production center DLSHOW

Of the organizational forms at the moment, I have chosen individual entrepreneurs, although I have previously created legal entities. In general, life is quite comfortable now: all the fiscal requirements of the authorities are clear, the funds and amounts of payments are known, the Internet works great - websites of funds, tax authorities, government services, etc., all information is received promptly. I even use online accounting, which makes life much easier and reduces the cost of maintaining an account.

Of course, when you contact the authorities in person, you get the feeling that “the screws are being tightened.” But I am even a supporter of such processes, since taxes are an important source of the state. However, in our case this is not always done humanely.

I'll share a case. After paying taxes for one of the last years, a couple of years later I receive a request to pay a penalty for late filing of the return. The fine, by the way, is several times higher than the average income in Moscow.

At the Pension Fund of Russia, I am greeted by an employee who is already of advanced age, but young-looking and fashionable - red horn-rimmed glasses, bracelets and earrings of a famous brand. A few pleasant greeting phrases. To my question “Why?” She replies with self-esteem: “But look how quickly we taught you!”

The lady looked into the computer and inserted something from somewhere. The issue was resolved quite quickly - there was no error. “They scared me!” I remarked. There was a line behind me of about 30 IP officers who had received similar “letters of happiness.”

Vladislav Varshavsky, managing partner

We are under tax pressure, as are the clients we advise. This can be explained by significant changes to tax legislation. The latest changes are mainly related to the tightening of the attitude of fiscal authorities towards taxpayers and the strengthening of tax administration. The pressure from tax authorities, as well as negative judicial practice in tax disputes, is felt more strongly.

The most significant issues will be different for every business. For small and medium-sized businesses, which should be the basis of the economy, the greatest problem is the application of different tax regimes, for example, the general regime and the simplified one. For large businesses, the problem is issues related to the interdependence of individuals, as well as transfer pricing.

In any case, the issue of dishonesty of counterparties is an acute issue for any business. This is due to the lack of clear criteria, they are vague, as well as the inability to quickly monitor changes in the counterparty’s position. You can start working with a counterparty who does not meet the criteria for being unscrupulous, but in the process of long-term work he may become so.

Checking the counterparty today is no longer the right of the entrepreneur, but his responsibility. First of all, because failure to fulfill obligations by an unscrupulous counterparty entails not only non-receipt of income, non-delivery of goods, non-provision of services, but also causes claims by the tax service against the entrepreneur.

To check, we use open sources of information: the website of the Federal Tax Service of the Russian Federation, data on court cases in which the counterparty is involved, the FSSP website, the Unified Federal Register of Bankruptcy Information.

It is impossible to single out any one problem; there is a complex of problems. The lack of predicted economic growth is one of the most important problems. The legislator very often changes the rules of the game, especially in the field of tax legal relations. It is also worth noting the deteriorating dynamics of the consideration of disputes with government bodies in the courts.

The task of the state is to develop conditions for the successful development of entrepreneurship in the legal field, to create prerequisites for the launch and successful operation of a business, development and stimulation, first of all, of small and medium-sized businesses.

There are no administrative barriers to starting a business as such. Barriers appear in the process of doing business. The most common are violations of the requirements of the Code of the Russian Federation on Administrative Offences. Migration issues, labor relations, waste, special assessment of working conditions, notification of military registration and enlistment offices, protection of personal data - these are only a small part of the responsibilities of an ordinary entrepreneur, for failure to fulfill which he may be subject to a significant fine, including the suspension of the enterprise.

The financial position of a business cannot be called completely stable; this is influenced by many factors. The effect of the introduction of any bills does not appear immediately.

It seems to me that one of the most significant changes that will affect the activities of merchants is the transfer of the powers of the Social Insurance Fund to administer insurance premiums to the Federal Tax Service of the Russian Federation.

I can’t say that the business climate in our area can be called positive. It is obvious that a stable trend in the development of the service sector has not yet emerged: on the one hand, businesses and private clients will always have legal problems that require a professional consultant to solve, on the other hand, clients are in no hurry to part with money, trying to resolve the existing problem at the initial stage. stage independently, on your own. Existing difficulties are not a factor contributing to a decrease in interest in entrepreneurship. When becoming an entrepreneur, you need to be aware of the possible risks and difficulties.

Subscribe to our Telegram channel to learn about all the most important changes affecting business!

Calculation of tax payments using the simplified tax system Income minus expenses

For those simplifiers who have chosen this object of taxation, the procedure for reducing tax is different. Insurance premiums paid for oneself do not reduce the calculated tax, but are simply taken into account along with other expenses of the individual entrepreneur.

For example, let’s take an entrepreneur who opened a small retail outlet. His expenses are already significant: purchasing goods, renting premises, transportation costs, etc. The tax rate is standard - 15%.

In the table we will record the income and expenses of individual entrepreneurs by quarter. Contributions paid for yourself quarterly will be indicated separately.

| Period | Income | Expenses, no fees | Paid fees |

| 1 sq. | 320 000 | 243 000 | 6 500 |

| 2 sq. | 382 000 | 196 000 | 10 000 |

| 3 sq. | 158 000 | 84 000 | 3 000 |

| 4 sq. | 570 000 | 310 000 | 12 885 |

| Total | 1 430 000 | 833 000 | 32 385 |

We calculate advance payments payable:

- for the first quarter – (320,000 – 243,000 – 6,500) * 15% = 10,575 rubles

- for the second quarter – (382,000 – 196,000 – 10,000) * 15% = 26,400 rubles

- for the third quarter – (158,000 – 84,000 – 3,000) * 15% = 10,650 rubles

The calculated taxes for individual entrepreneurs in 2021 from our example will be (1,430,000 – 833,000 – 32,385) * 15% = 84,692 rubles, but of this amount 47,625 rubles have already been paid in advance. You need to pay an additional 37,067 rubles.

But the calculation of the additional insurance premium, which will be paid next year, is based on all income without taking into account expenses, i.e. (1,430,000 – 300,000) * 1% = 11,300 rubles. The injustice of this approach has already been noted by the Supreme Court, but the necessary changes to the Tax Code of the Russian Federation have not yet been made.

Inconsistencies under OKVED have been eliminated to make it possible to apply reduced contributions under the simplified tax system

Organizations and individual entrepreneurs using the simplified tax system have the right to pay contributions at reduced rates if their main activity in accordance with OKVED is listed in subparagraph 5 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation.

Until recently, the list of types of activities in the Tax Code of the Russian Federation corresponded to the list from OKVED1. However, this classifier has become invalid since 01/01/2017. Instead, OKVED2 is used, in which the types of activities are named and grouped differently.

For this reason, many payers in 2021, while continuing to conduct the same “preferential” type of activity, lost the right to reduced tariffs, since in the new OKVED2 such activity was included in other groups (subgroups, sections) to which they were not applied.

Since November 27, 2017, subclause 5 of clause 1 of Article 427 of the Tax Code of the Russian Federation has been in effect in a new edition (clause 76 of Article 2 of Law No. 335-FZ). Now the types of activities in it are named in the same way as in the new OKVED2. At the same time, the amendments apply to legal relations that arose from January 1, 2017 (Part 9 of Article 9 of Law No. 335-FZ).

Consequently, if payers on the simplified tax system who meet the requirements for applying the benefit, due to the mentioned inconsistencies, paid contributions at general rates in the current year 2021, they have the right to recalculate contributions, submit updated calculations for expired reporting periods and an application for offset or refund of the overpayment.

Insurance premiums for individual entrepreneurs for themselves

Insurance premiums are not tax payments, but these are the amounts that individual entrepreneurs are required to pay to the budget under any taxation regime. To plan his business, an entrepreneur needs to know how much he will have to transfer to pay contributions, regardless of whether he receives income.

The amount of contributions for individual entrepreneurs in 2021 will be calculated not from the minimum wage, as in previous years, but from a fixed amount established by the Government:

- for compulsory pension insurance - 26,545 rubles

- for compulsory medical insurance - 5,840 rubles

In total, the fixed amount of contributions for individual entrepreneurs in 2021 will be 32,385 rubles, provided that his annual income does not exceed 300,000 rubles.

If your income is higher, then you will have to pay an additional contribution to pension insurance in the amount of 1% from the difference. For example, with an annual income of 1 million rubles, the additional contribution will be (1,000,000 – 300,000 = 700,000) * 1%) = 7,000 rubles.

Entrepreneurs who hire staff pay the same amount of contributions for themselves as individual entrepreneurs in 2021 without employees.

Personal contributions transferred by an entrepreneur to the budget in most cases reduce his tax payments, but this possibility depends on the chosen taxation system. Below we will look at the tax regimes for individual entrepreneurs in 2021 and the procedure for reducing taxes.

Unified agricultural tax for individual entrepreneurs

Conditions of use

In 2021, the Unified Agricultural Tax can be used by:

- Individual entrepreneurs producing agricultural products (that is, crop products, agriculture and forestry, livestock, and so on);

- Individual entrepreneurs engaged in fishing of aquatic biological resources;

- Individual entrepreneurs providing services to agricultural producers in the field of crop and livestock production.

Note! The share of income from the sale of the listed services must be at least 70%.

Tax exemption

Individual entrepreneurs on the Unified Agricultural Tax are exempt from paying the following taxes:

- Personal income tax (in relation to income from business activities);

- Property tax for individuals (on property used in business activities);

- Value added tax.

Advantages of Unified Agricultural Tax for individual entrepreneurs:

- Simplified accounting ;

- Possibility of combining with other tax regimes ;

- Minimum reporting .

Disadvantages of Unified Agricultural Tax for individual entrepreneurs:

- Responsibility for maintaining full accounting records .

Taxation systems for entrepreneurs in the Russian Federation

It is generally accepted that the tax burden of Russian small businesses is too high. In fact, this is not true. If you choose the right taxation system, the financial burden of an entrepreneur will be even less than that of an employee with his salary.

The following types of taxation for individual entrepreneurs are currently in effect in Russia:

- general OSNO system

- simplified simplified taxation system in the “Income” and “Income minus expenses” options

- single tax on imputed income UTII

- PSN patent system

- unified agricultural tax Unified Agricultural Tax

Each tax system differs in the procedure for calculating and paying taxes, while for the same type of activity under different regimes there will be different amounts payable. An example of calculating the tax burden for a store is in this article, and our users can get such a calculation for their business for free.

When choosing taxation for individual entrepreneurs and comparing tax payments under different regimes, it is necessary to take into account the possibility of reducing the calculated amounts by contributions paid for yourself.

| Types of taxation for individual entrepreneurs | Possibility to take into account paid contributions |

| BASIC | Included in expenses, reducing the tax base for tax calculation |

| PSN | Are not taken into account and do not reduce the value of the patent |

| UTII | Reduce the calculated quarterly tax |

| Unified agricultural tax | Included in expenses, reducing the tax base for tax calculation |

| USN Income | Reduce the calculated advance payment and taxes of individual entrepreneurs on the simplified tax system at the end of the year |

| USN Income minus expenses | Included in expenses, reducing the tax base for tax calculation |

An important feature of UTII and simplified tax system Income is that contributions paid by individual entrepreneurs in 2021 without employees for themselves can reduce the calculated payment to zero.

For example, the tax on UTII in 2021 for the quarter amounted to 7,800 rubles, while the entrepreneur paid part of the contributions for himself in the amount of 8,100 rubles in this quarter. The tax payment of 7,800 rubles is completely reduced by the contributions paid, so there is no need to transfer anything to the budget. Individual entrepreneur taxes on the simplified tax system are reduced in a different order, but can also be reduced to zero.

The right to choose a tax regime for individual entrepreneurs in 2021 remains declarative, i.e. The entrepreneur must contact the tax office with the appropriate application:

- on UTII

- to obtain a patent (PSN)

- to the simplified system (USN)

It's worth paying taxes on time

The main responsibility of an entrepreneur to the state is to pay all taxes and fees to the budget on time and in full, and to make deductions for insurance premiums to extra-budgetary funds. Public services are urged not to violate legal requirements. The main regulator of the Russian Federation, the Federal Tax Service, strictly controls private business and warns that violations of the Tax Code of the Russian Federation can lead to fines and administrative liability, and if particularly large economic crimes are committed, a criminal case can be opened.

Illegal actions, when a businessman tries to hide part of his income or shows increased expenses for running his business, trying to reduce the tax base, can lead to penalties from the Federal Tax Service of the Russian Federation:

- late submission of a declaration to the Federal Tax Service will entail an additional fee - 5% of the tax amount for each overdue month (no more than 30%, but not less than 1,000 rubles),

- late payment of tax - a fine of 20 to 40% of the tax amount.

At the same time, individual entrepreneurship is the least protected structure from the collection of fines. For debts to the state. budget, as well as for all financial obligations to counterparties, the individual entrepreneur is responsible with his property. Even if the property is not related to business activities, it can be taken into account when collecting a debt.

But with all the above risks, a private entrepreneur has many more benefits and advantages than an LLC:

- simplified reporting,

- lower fines for violations,

- freedom to manage your profits,

- simplified liquidation procedure (an application to terminate activities is sufficient).