Individual entrepreneur and self-employment - what is the difference?

At one time, Russian Prime Minister D. Medvedev advised citizens to go into business. Well, unless, of course, you don’t have enough money to live on. In 1919, news broke about the introduction of a new special regime for the self-employed (SZG - self-employed citizens). And if at the beginning the special regime was introduced on a trial basis in Moscow, the Kaluga and Moscow regions, as well as in Tatarstan, then in the twentieth year this list expanded to 23 subjects of the Russian Federation. Today we will look at the key differences between the concepts of individual entrepreneurs and self-employment.

Individual entrepreneur wants to pay less taxes

Artem makes and sells pottery, and also gives pottery lessons.

He works as an individual entrepreneur under the simplified tax system “income minus expenses”. Artem earns about 100,000 rubles per month, investing 30,000 rubles in materials and equipment. The state receives 15% tax on the difference between income and expenses - 10,500 rubles. Artem also has to pay about 4,500 ₽ in contributions per month, but they are completely covered by taxes. It turns out 59,500 ₽ net earnings.

Artem wants to save on taxes and try to combine individual entrepreneurs and self-employment.

Brief information about professional income tax

The main things that are known about the new tax regime now:

- The new regime applies only to those who do everything themselves, without an employer. It cannot be applied to those who work under an employment contract and have no other income other than salary.

- Starting from 2021, the new tax will begin to work only in four regions: Moscow and the region, Kaluga region, Tatarstan.

- Self-employed people cannot have employees and engage in certain types of activities.

- You don't have to pay insurance premiums. But in this case, the citizen can only count on a social pension.

- Tax rates for self-employed: 4% when working with individuals, 6% when collaborating with legal entities and individual entrepreneurs.

- The maximum professional income per year is 2.4 million rubles.

- Both individual entrepreneurs and individuals can work in this mode.

- Individual entrepreneurs can abandon other systems and switch to a new regime at any time. And they can go back.

- There are no tax returns in this mode, no cash registers are needed, taxes are calculated automatically in a special application.

You cannot: Become self-employed and remain an individual entrepreneur in a different tax regime

Now Artem is an individual entrepreneur using the simplified tax system “income minus expenses.” This tax regime suits him because Artem receives 50,000 rubles per month from pottery and spends 30,000 rubles on materials. It turns out only 3000 ₽ tax on net profit.

The income from pottery lessons has increased, and it is now unprofitable to pay such a tax. For the last three months, Artem has been earning 50,000 rubles per month from training. There are no expenses here, but he is still forced to pay 15% in the “income minus expenses” mode - 7,500 rubles. And in a no-expenses mode, for example, self-employment, he could reduce the tax rate to 4% and pay only 2,000 rubles.

Artem doesn’t want to lose profits and pay taxes on all income without taking into account the costs of clay. It would be more convenient for him to combine two tax regimes: apply the NAP for pottery lessons and the simplified tax system for the sale of dishes. But you can’t do that—you’ll have to choose one thing.

Self-employment is a special tax regime, NPI (professional income tax). Essentially the same as simplified, general system, patent, UTII. Only with its own conditions, and one of them is the incompatibility of the NAP with other tax regimes. This means that if an individual entrepreneur switches to NAP, he cannot maintain his old tax regime.

Individual entrepreneur and self-employment: how to combine to avoid tax claims

Let's look at these rules in more detail. So, if you want to combine individual entrepreneurs with self-employment, then you will have to comply with a number of conditions.

Refuse other special modes

An individual has the right to be an individual entrepreneur and self-employed at the same time, but he cannot combine the professional income tax (PIT) with other special tax regimes - simplified tax system, UTII and unified agricultural tax. That is, you cannot use two tax regimes at the same time.

You need to have time to refuse special regimes within a month from the day the individual entrepreneur registered as self-employed (Part 4 of Article 15 of the Federal Law of November 27, 2018 No. 422-FZ). Otherwise, the registration will not be counted. To do this, it is important to send to the tax office, with which the entrepreneur is registered, a notice of refusal of the simplified tax system, UTII or Unified Agricultural Tax in the standard form, which is given in the Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 N ММВ-7-3 / [email protected] This can be done in person, by mail, through the personal account of an individual entrepreneur.

To confirm that the notification has been sent to the tax office, you can make a copy or photograph the application with a note of acceptance.

If an individual entrepreneur applies a special regime for some type of activity that is not subject to professional income tax, he must pay personal income tax on income from this activity. In this case, self-employment for all income, including income from personal property, terminates automatically.

Please note that if an individual entrepreneur uses a patent taxation system, he will be able to register as a tax payer only after the patent expires or after he notifies the tax authority of the termination of such activities.

Monitor your income

They should not exceed the limit of 2.4 million rubles. in year. This is exactly the limit specified in Federal Law No. 422-FZ of November 27, 2018 for tax on professional income. If you go beyond this limit, the tax office will certainly notify you of the termination of your self-employed status.

Therefore, “it is important to monitor the level of your income and, if it exceeds it, promptly switch to other taxation regimes in order to avoid paying personal income tax of 13% and VAT of 20%,” notes lawyer and general director of SaaS Project Izabella Atlaskirova. “If a self-employed person is late in switching to the new tax regime, he will have to pay taxes under the general tax regime until the end of the year.”

To avoid this situation, you can again choose a special regime by submitting a notification to the tax office at your place of residence using a standard form within 20 days after termination of registration as a self-employed person (Part 6, Article 15 of Federal Law No. 422-FZ of November 27, 2018).

Online accounting for new business

Details

Do not count on a decrease in income for expenses

In the “Questions to an Expert” section of Kontur.Magazine, the following questions periodically appear: how can a self-employed person deduct expenses necessary for the manufacture of products?

But if a self-employed person is engaged in the manufacture of products, then the costs of creating them do not reduce the income received from the sale of these products. According to paragraph 1 of Art. 8 of Federal Law No. 422-FZ of November 27, 2018, when citizens apply the NDP, expenses associated with conducting activities are not taken into account. Income is considered the entire amount of proceeds from sales, regardless of the amount of business development expenses and net profit. Self-employed people pay tax on this income - in the amount of 4% or 6% of revenue, depending on whether they work with individuals or legal entities.

Thus, the NAP differs from the special regime of the simplified tax system with the object “income minus expenses”.

The simplified tax system with the object “income” may be more profitable than self-employment

“Individual entrepreneurs on the simplified tax system and self-employed people cooperating with legal entities pay the same tax - 6% of income, but at the same time, for individual entrepreneurs, the tax is reduced by the amount of insurance premiums, and self-employed people pay insurance premiums in full,” notes the lawyer and general director “SAAS project” Isabella Atlaskirova.

“Accordingly, an individual entrepreneur on the simplified tax system, cooperating with legal entities and other individual entrepreneurs, finds himself in a more advantageous position than a self-employed person.” In addition to the opportunity to reduce tax under the simplified tax system, you can also save your pension using insurance contributions. In addition, the simplified tax system, unlike the NAP, allows you to earn more than 2.4 million rubles. per year and still maintain the same tax rate.

Keep separate records of income and expenses

If an individual entrepreneur, in addition to entrepreneurial activities, carries out other activities as an employee, he will have to keep separate records of income and expenses.

When receiving income from ordinary individuals, a self-employed person applies a tax rate of 4% on income. In case of receiving income from individual entrepreneurs or legal entities, but deducts 6% of the income.

It is important to pay attention to the fact that when carrying out business activities as an individual entrepreneur, it is better if all cash receipts go through the individual entrepreneur’s current account. Although the Letter of the Federal Tax Service of the Russian Federation dated June 20, 2018 No. ED-3-2/ [email protected] states that an individual entrepreneur has the right to use a personal bank card issued to him as an individual to receive funds from customers, unless the bank account agreement directly prohibits the use personal account in commercial activities. Accordingly, these incomes are taken into account for tax accounting purposes if they are produced for the purposes of entrepreneurial activity.

For self-employed individuals providing personal services, an individual’s personal account opened with a bank is used. At the same time, self-employed people can accept payments via payment systems or electronic wallets. To do this, an agreement is concluded with the payment system. Self-employed people do not need an online cash register.

Expect some privileges

In particular, when switching to self-employment, you can maintain your current account and individual entrepreneur status. But he won't be able to hire employees or resell goods that someone else made. But if he wants to do this, then he will have to switch back to the simplified tax system or another tax regime.

According to Art. 2 of the Federal Law of November 27, 2018 No. 422-FZ, individual entrepreneurs applying NAP:

- are not recognized as VAT taxpayers, with the exception of VAT payable when importing goods into the territory of the Russian Federation and other territories under its jurisdiction (including tax amounts payable upon completion of the customs procedure of the free customs zone on the territory of the SEZ in the Kaliningrad region);

- are not exempt from performing the duties of a tax agent;

- are not recognized as payers of insurance premiums for the period of application of the NAP of individual entrepreneurs specified in subparagraph. 2 p. 1 art. 419 of the Tax Code of the Russian Federation).

When is it more profitable to completely close an individual entrepreneur?

If an entrepreneur, having become self-employed, accepts payments only from individuals, he does not need a current account for entrepreneurs, as well as the individual entrepreneur status itself. In this case, he can submit a tax application to close the individual entrepreneur.

A hired employee works under an employment contract, he is also an individual entrepreneur. Can he also be self-employed?

“There are no obstacles to registering as self-employed for persons working under employment contracts and at the same time being individual entrepreneurs,” assures Isabella Atlaskirova (SaaS project). – It is important that activities as a self-employed person do not overlap with activities as an individual entrepreneur and are not carried out in the interests of the organization in which he works under an employment contract.

For example, you can simultaneously work as a manager in an organization, be the owner of a store as an individual entrepreneur, and provide accounting services as a self-employed person.

Individual entrepreneurs that do not use the labor of hired workers, are not engaged in activities prohibited for self-employed workers, and apply special tax regimes (STS, UTII or Unified Agricultural Tax), have the right to switch to paying NAP.”

You can: Become an individual entrepreneur under the new NAP tax regime

For a long time, Artem spent 30,000 rubles a month on consumables, but then he started using cheaper clay and reduced his expenses to 15,000 rubles. Then he decided to become self-employed, because expenses had decreased, there were more pottery lessons and paying 13% was now definitely unprofitable.

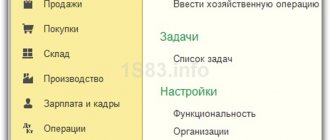

To become an individual entrepreneur on NPD, Artem:

- Registered in the “My Tax” application.

- I sent a written notification to the tax office where I was registered that I was abandoning the previous regime. Artem did this at the tax office in person, but it was possible to send a registered letter by mail or leave an application at the State Services.

- He submitted a declaration under the simplified tax system for 2021 - all this time he worked as an individual entrepreneur.

The notification must be sent within 30 days after registering as self-employed. If you don’t make it in time, the tax office will cancel your registration as a self-employed person and recalculate taxes at the simplified taxation system rate. So it's better to do everything at once.

Artem retained the status of an individual entrepreneur and some privileges, for example, an entrepreneur’s current account. Some of his LLC customers are still more willing to work with individual entrepreneurs because they know little about the self-employed.

What are the advantages of self-employment?

The main advantage of self-employment for individual entrepreneurs is that you only need to pay for the months in which you had income. If there were no receipts to the current account, there will be no taxes either.

When payments are received from individuals, the tax will be 4% of income; if payments are received from companies and other individual entrepreneurs, then the tax will be 6%.

Here are some more advantages of self-employment:

There are no mandatory payments. Pension contributions are optional. If you want to insure yourself for sick leave or pension, you can voluntarily pay to the Pension Fund and the Social Insurance Fund.

No tax returns or reporting. Record sales through the “My Tax” service and send receipts to customers - the tax is calculated and charged automatically.

The IP status is maintained. There will be no need to renegotiate contracts, because only the tax regime changes. It is enough to warn the counterparty that you will now send checks for payments. Otherwise, the counterparty will not be able to pay its expenses.

Tax deduction - 10 thousand rubles. It's like a bonus or gift from the Federal Tax Service. It appears immediately after registration and reduces the tax rate to 3% for individuals and 4% for companies and individual entrepreneurs. It works like this: accrued taxes are deducted from the bonus until it ends. And only when 10 thousand rubles. will be spent, the standard rates of 4% and 6% will return, and taxes will have to be paid from your own funds.

Here's how the bonus works:

For example, Evgeniy is a lawyer. In May, he became self-employed and was awarded a tax bonus of 10 thousand rubles in the My Tax application. In June, Evgeniy consulted three companies and received 30 thousand rubles, so the tax amount will be: 30,000 × 4% = 1,200 rubles.

But Evgeniy does not need to pay tax from his own money, because 1,200 rubles will be written off from the bonus. Taxes will be deducted from the bonus until it expires. Let us remind you that the bonus is 10 thousand rubles.

If Evgeny had already spent the tax bonus in full, he would have paid: 30,000 × 6% = 1,800 rubles from his wallet.

This is how the tax office encourages the use of self-employment.

You can: Close your individual entrepreneur and switch to self-employment only

Over time, Artem had no more LLC clients. All individual clients pay in cash or by card, and a bank account for entrepreneurs is now useless. It also costs an extra 500 rubles a month for maintenance.

Artem also stopped using the status of individual entrepreneur, so he decided to abandon this form of entrepreneurial activity and remain only self-employed.

To do this, Artem came to the tax office and submitted an application to close the individual entrepreneur. In fact, nothing has changed for him: he continued to issue checks and pay taxes through the “My Tax” application, but as an individual with self-employed status.

Answers to popular questions

Are those who provide one-time assistance considered self-employed?

Do not apply. The fact of regular provision of services is fundamental: for example, you repair people’s cars and get paid for it. However, if you once helped a neighbor with car repairs, this will not be considered the provision of services.

Can an individual entrepreneur re-register as self-employed?

Maybe if he considers that this mode is more profitable for him. But the main goal of the law on self-employed people is to allow people who are not yet registered to leave the “gray zone”.

Is it possible to work under an employment contract and be self-employed?

It is possible to combine an employment contract and self-employment. If you have a main job, but also work part-time or rent out an apartment, you can register and use this special mode. At work, they will pay your contributions and withhold personal income tax, and on additional income you will pay 4%.

Will self-employed people be able to obtain income certificates to purchase government guarantees and benefits?

They can, like any citizen.

Where should a self-employed person register if he operates in several regions?

He can choose the region most convenient for him to register. You do not need to register in all regions. Unlike an individual entrepreneur, who is required to register at his place of residence.

Where will the tax money go?

They will go to the regional budget at the location of the activity. Regions will be able to distribute them and send part of the income to municipalities.

“And this is very important for the regions. Because today the regions make payments to the Compulsory Health Insurance Fund for the non-working population. As soon as a person leaves the “gray” zone, 1.5% of the tax he paid will be credited to the Compulsory Medical Insurance Fund, and the region will no longer pay for it to the Compulsory Medical Insurance Fund,” notes Andrei Makarov.

Why are new types of entrepreneurs being introduced?

It is clear that they want to increase the tax collection of individuals who are engaged in small services and do not want to register as individual entrepreneurs.

According to the Ministry of Labor, there are approximately 22.5 million such people.

Do you need tax reporting and cash register?

According to RBC, this will not happen.

Will they be fined if not all income is processed?

If the tax office discovers this, it will issue a fine - 20% of the amount of the first income “bypass the cash register”. And if this happens again within six months, the fine will be equal to the amount of income.

Can this tax be refunded using deductions?

No, this tax is not subject to the rules described in the articles about tax deductions, and is not refundable.

Should a self-employed person register with the Federal Tax Service?

There are different opinions, but analysts advise against such action. So far, only one thing is clear: the government collects information about citizens who have a stable income but do not pay taxes to the budget. Now the question of how to force them to give away part of their income is just being resolved. But we know for sure that the tax holiday will end.

Moreover, the list of areas for which tax benefits are provided is limited. The rest will simply not be able to submit a notification. But there will be extra attention from the state to your income.

Features of registration

The algorithm for carrying out the registration procedure was approved directly by the Federal Tax Service; the main provisions are contained in the corresponding act dated May 11, 2021, published on the official portal of the department. To join the database, you must fill out a notification and submit it to the authorized body working with individuals. You should contact the department at your place of residence.

It is important to note that confirmation of registration does not imply the issuance of any statements or accompanying documents. Therefore, in order to consolidate the new status, the applicant is recommended to ask the inspection staff to put a mark on the fact of acceptance on the copy of the notification form. What’s noteworthy is that the certificate itself is generated in a mobile application.

Accepting payments

Above, we discussed in detail how to become a self-employed citizen, now we propose to talk about how to make contributions to the state budget. Since NPD payers do not use cash registers, Federal Law No. 54 does not apply to them.

The algorithm looks something like this:

- You receive money from the buyer.

- Go to the application or log in to the official website of the Federal Tax Service.

- Indicate how much, for what and from whom you received it.

- You are making a translation.

- Hand the check to the client (you can do this, for example, by email).

Important! Receipts must be handed over to the person with whom the payments were made.

How to become a self-employed person: a new authorization method

If you want to register as a taxpayer making deductions from professional income, do not rush to send notification applications and go to the inspection department yourself. All issues are resolved remotely:

- using the “My Tax” mobile utility;

- through credentials on the official portal of the Federal Tax Service.

In addition, three registration methods are offered:

- by identification number and password from your personal account on the NS website;

- by phone and ID;

- by account on State Services.

Login and register in the ESIA - a new authorization option that is available to everyone.

How to register yourself as a self-employed person: notify the tax office

The registration procedure algorithm for those who do not have an individual entrepreneur is prescribed in the Tax Code of the Russian Federation in 2021, specifically in paragraph 7.3 of Article 83.

Please note that the concept of “self-employment” is not defined at the legislative level, although it is actively used. If we refer to the current code, then it defines representatives of this category as individuals conducting professional activities without the involvement of third-party employees.

The main thing is to send a correctly completed application in the prescribed format to the appropriate authority.

Below is a sample image showing what the document looks like.

Application

The legal force of this mobile service is secured by Federal Law No. 422 “On conducting an experiment...” dated November 27, 2021. However, it is suitable only for those who live in subjects from the established list and fall under the list of approved criteria.

Step-by-step guide on how to register using MN:

- install the software on the gadget (it is available both in the AppStore and on Google Play);

- enter a phone number;

- select your place of residence;

- upload a photo where your face is visible;

- add a passport scan;

- go through the process of confirming your personal data.

All notifications are generated automatically; no additional actions are provided.

Federal Tax Service office

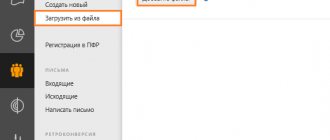

You can file your self-employment claim and tax notice using your taxpayer account. Although direct registration is not yet available, you can access the MN mobile application and create an account in it. Below are step-by-step instructions on what exactly needs to be done:

- Download and download the program to your smartphone.

- Please provide a current phone number.

- Select the appropriate region of the Russian Federation from the list that appears.

- Enter your ID number.

- Create a password that you will use to log in.

- Create a PIN for quick login.

In this case, photographs and documentation that can confirm your identity will not be required, which is very convenient because it allows you to avoid wasting time.

Bank

In accordance with Part 3 of Article 3 of Federal Law No. 422, individuals can use specialized platforms and institutions for information exchange. In other words, you can easily obtain the required status at any bank branch.

In this case, the algorithm of actions will look like this:

- You download the application and log in to it (for example, Sberbank Online).

- Open the “Payments” tab.

- Go to the “Government Services” category

- Indicate the lines “Your business.”

- Start the registration procedure and then follow the prompts from the system.

Only those citizens of the Russian Federation who permanently reside in one of the experimental regions will be able to use the described method.

What does registering as self-employed provide?

As of 2021, it does not provide any benefits other than tax exemption. But this exemption is temporary; by 2021, projects will be developed to tax this category of employees. This is the main reason why citizens do not want to register.

Penalty for non-registration

In 2021, registration is voluntary. This is an experiment by the government to withdraw citizens’ income from the shadow economy. The scale of registration is negligible; about 300 people were registered in 2021.

ATTENTION! There is not even an administrative penalty for refusal to register. The only consequence that awaits such people is the inability to receive a retirement pension. Currently in Russia there is a point system in which the labor pension depends on length of service.

The more years accumulated, the greater the amount paid from the Pension Fund. If the required length of service is not achieved, a person can only count on a minimum pension.