| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Single tax with simplified income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

By choosing a simplified system with the “income” object, firms and entrepreneurs pay tax on all their revenue. Expenses are not deductible. The rate under the simplified tax system “income” is 6%. Regions have the right to lower rates at the local level. The organization chooses the object of taxation independently, taking into account the characteristics of its work and material benefits.

Deadline for transferring the single tax to KBK in 2021

Payers of the simplified tax system must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system.

How to fill out a payment document yourself, knowing the KBK

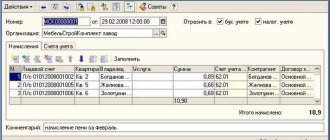

Many individual entrepreneurs using the simplified tax system, especially those without employees, maintain their tax records independently, without turning to accountants. In order not to confuse anything when filling out a payment form, you can use the free service from the Federal Tax Service.

To do this, you need to remove spaces from the KBK, for example, the code for paying taxes on the simplified tax system Income will look like this: 18210501011011000110.

Enter the code in the required field and click the “Next” button, then the type, name and type of payment will be filled in automatically.

BUDGET CLASSIFICATION CODES FOR 2021

SIMPLIFIED TAX SYSTEM

USN, OBJECT OF TAXATION INCOME

| 182 1 0500 110 | Payment amount (recalculations, arrears and outstanding payments, including canceled ones) |

| 182 1 0500 110 | Payment penalties |

| 182 1 0500 110 | Interest on payment |

| 182 1 0500 110 | Amounts of monetary penalties (fines) for payment |

USN, OBJECT OF TAXATION – INCOME REDUCED BY THE AMOUNT OF EXPENSES

| 182 1 0500 110 | Payment amount (recalculations, arrears and outstanding payments, including canceled ones) |

| 182 1 0500 110 | Payment penalties |

| 182 1 0500 110 | Interest on payment |

| 182 1 0500 110 | Amounts of monetary penalties (fines) for payment |

MINIMUM TAX UNDER USN

| 182 1 0500 110 | Payment amount (recalculations, arrears and outstanding payments, including canceled ones) |

| 182 1 0500 110 | Payment penalties |

| 182 1 0500 110 | Interest on payment |

| 182 1 0500 110 | Amounts of monetary penalties (fines) for payment |

MINIMUM TAX CREDITED TO THE BUDGETS OF THE SUBJECTS OF THE RF (FOR TAX PERIODS EXPIRED BEFORE JANUARY 1, 2021)

| 182 1 0500 110 | Payment amount (recalculations, arrears and outstanding payments, including canceled ones) |

| 182 1 0500 110 | Payment penalties |

| 182 1 0500 110 | Interest on payment |

| 182 1 0500 110 | Amounts of monetary penalties (fines) for payment |

What is KBK and why is it used?

KBK (budget classification code) is a combination of numbers that indicates the purpose of the payment received by the Federal Tax Service.

Based on this number, funds contributed by an individual entrepreneur or legal entity are sent to the appropriate budget item.

Assigning the simplified tax system to KBK simplifies the control of receipts and planning of funds.

The code consists of 20 digits, which, in a group or individually, convey information about the purpose of the payment.

- The initial three digits represent the organ code.

- The next number indicates the transfer group - tax payment, free transfer and others.

- Then the third two digits indicate the tax code - on profit, on property and others.

- Based on the next five numbers, the article and subitem of the payment are determined.

- After that, two numbers indicate where the amount was paid - to the regional, federal budget or in favor of the Social Insurance Fund or Pension Fund.

- The next four digits indicate the purpose of the payment - tax contribution, payment of a fine or penalty.

- The final three numbers determine the type of transfer - tax, from property, etc.

These indicators are divided into 4 blocks:

- administrator block (code numbers 1-3);

- income block (numbers 4-13);

- program (numbers 14-17);

- classifying (numbers 18-20).

It is necessary to check the relevance of the codes annually, as they may change. Specifying an incorrect number will result in the tax received by the Federal Tax Service not being displayed.

This entails sanctions in the form of penalties and fines.

Important: if the simplified tax system was specified incorrectly when filling out the KBK documents, you will need to send a letter to the tax service with a request to transfer funds. If the amount has not been credited, the payment is repeated.

back to menu ↑

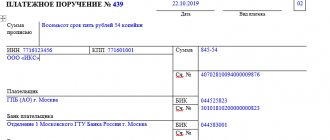

Features of paying penalties: fill out the payment form

Penalties are not considered a sanction, but an interim measure designed to guarantee the timely fulfillment of financial obligations. The payment for penalties is in many ways similar to the document for the main tax payment. Fill in the same way:

- payer status;

- recipient details;

- revenue administrator.

But there are also differences, one of which is the KBK. This detail is entered in the payment slip in field 104. Tax penalties have their own code, where digits 14 to 17 indicate the code for the subtype of income. In this case, it is 2100. These numbers indicate the payment of penalties, so now the PE penalty code is not put in field 110.

Another difference is filling out field 106 - basis for payment. For current payments the designation TP is intended; for penalties there are several options:

- ZD - if the penalties are calculated by the entrepreneur himself and are paid by him voluntarily, without the requirement of the tax authorities;

- TR - for payment of penalties at the request of the Federal Tax Service;

- AP - transfer of payments based on the results of the audit.

Taking into account this nuance, the data entered in the tax period field also differs. For the basis of the PO, you need to set 0, since the payment of penalties is not a periodic payment. If payment is made for a specific quarter, you must indicate it.

DOC file

The basis for payment TR shall indicate the period specified in the request. For AP, 0 was also set. In field 107, you need to indicate the frequency of payment:

- monthly - MS;

- quarterly - KV;

- six-monthly - PL;

- annual - GD.

Individual entrepreneurs who pay penalties on their own indicate 0 in the document number and date fields (108 and 109). In other cases, indicate the number of the document that is the basis for the payment. The No. sign is not placed in this case. In field 109, the date of the Federal Tax Service's request or decision to bring the tax liability is indicated.

Otherwise, when filling out a payment form, standard requirements apply. Fields 3 and 4 indicate the document number and date, and field 5 indicates the type of payment. In tax bills, field 101 is filled in; the payer status is written here. Code designations for all statuses are approved by the Ministry of Finance.

The payment amount is entered in two fields. In field 6 of the paper order, the amount is written in capital letters from the beginning of the line without abbreviating the words “ruble” and “kopeck”. Kopecks are indicated in numbers. In field 7, the entire amount is written in numbers; rubles should be separated from kopecks by a dash.

The following fields are required to enter payer data:

- 8 - full name of the entrepreneur indicating the status;

- 60 - TIN;

- 102 - checkpoint.

In field 9, write the bank account number, 10 - the name of the bank, 11 - BIC, 12 - correspondent bank account. Fields 13-17 are filled in with the details of the payment recipient, field 16 - with his name, 61 - INN, 103 - KPP. The last two details can be found on the Federal Tax Service website. Fields 19 and 20 - terms and purpose of payment - remain empty in tax orders. But in field 24, as the purpose of payment, you are allowed to indicate any information related to this payment. If there is no such indication, it is possible to offset against existing overdue debts, and not against current payments.

Field 21 will contain the number 5 when paying fees yourself. Field 22 is set to 0 because there is no identifier set for tax payments. A form with an empty field will not be accepted by the bank.

Field 105 is intended for OKTMO (former OKATO). Depending on the further distribution of funds received in the form of taxes, the code may consist of 8 or 11 characters. It is mandatory to indicate the same OKTMO in the payment slip as in the tax return.

Important! If incorrect information is provided on the payment slip, payment will not be processed and a tax penalty will be charged.

Where to find KBK for simplified tax system

Budget classification codes are generated by the Ministry of Finance, so you need to look for them in the current orders of this department. In 2020, the BCC from orders No. 85n dated 06/06/2019 and N 207n dated 11/29/2019 applies to individual entrepreneurs and legal entities. Both orders were edited on March 10, 2020.

The first order describes the procedure for generating codes, their structure and principles of purpose, and the BCCs themselves are listed in order N 207n. Since these documents are freely available, you can always check in them whether the details for payment to the budget are correct.

There are two different objects of taxation on the simplified tax system: “Income” and “Income minus expenses”. They have different budget classification codes, so choose the appropriate table for yourself. Please also note that the codes of one version of the simplified tax system are different for tax payments, penalties and fines.

However, the presence or absence of employees, as well as the organizational and legal form of the taxpayer, does not matter. Therefore, for example, KBK USN Income for transfer of tax payment - 182 1 0500 110 - must be indicated by entrepreneurs without employees, individual entrepreneurs, and organizations in this mode.

KBK USN Income for 2021

| Purpose of payment | KBK payment |

| Tax and advance tax payments | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Penalties for late payment of taxes | 182 1 0500 110 |

KBK USN Income minus expenses for 2021

| Purpose of payment | KBK payment |

| Tax and advance tax payments | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Penalties for late payment of taxes | 182 1 0500 110 |

*The minimum tax is credited to the same BCC as the tax calculated in the usual way, this procedure is valid from 2021

For existing simplifiers, there is nothing new in these codes, because Order of the Ministry of Finance N 207n dated November 29, 2019 left the majority of BCCs for tax payments unchanged.

However, it is worth paying attention to the new budget classification codes that have been added for fines for various tax offenses. Previously, they all went to a single KBK (182 1 1600 140), but now this code does not work.

Regardless of which version of the simplified tax system you work on - simplified tax system 6 or 15 percent - penalty payments are transferred to these BCCs:

- unsubmitted declaration – 182 1 1602 140;

- violated method of filing declarations and settlements – 182 1 1603 140;

- gross violation of accounting standards – 182 1 1605 140;

- information not provided for tax control – 182 1 1607 140;

- documents submitted by the tax agent with false information – 182 1 1608 140.

Features of the simplified taxation system

The simplified tax system is a special tax regime for Russian entrepreneurs. Its main advantage is its low tax burden. Important advantages are the ease of reporting and accounting for individual entrepreneurs. Entrepreneurs who meet certain criteria can take advantage of this tax payment scheme:

- no more than a hundred hired employees;

- annual income up to 150 million rubles;

- residual value of fixed assets for the annual period up to 150 million rubles.

When switching to this regime, businessmen receive exemption from a number of taxes: personal income tax, property tax, and value added tax.

Important! In the last point, the exception is the import of goods.

The simplified tax system exists in two versions. The first involves paying a tax of 6% on all income received. In the second, the rate is slightly higher - 15%, but the tax is levied on the difference between income and confirmed expenses. Accordingly, the regime is called “income minus expenses”.

Regional authorities have the right to reduce rates under the simplified tax system for certain types of activities. Some business entities have adopted legislation providing for tax holidays with a zero tax rate for individual entrepreneurs who are using this regime for the first time.

The second form of simplification is considered beneficial when expenses account for more than 60 percent of income. Costs can be deducted from the tax base only if they are documented.

KBK simplified tax system “income” in 2017

The BCC for the simplified tax system for 2021 is provided for by the Instructions approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n. For the simplified tax system with the object “income”, the single BCC for 2021 is 182 1 0500 110. Please keep in mind that in 2021, when transferring “simplified” tax, you must indicate the BCC in the payment order, depending on whether the tax amount itself is transferred , penalties and or fine. KBK simplified tax system “6 percent” in 2017 are as follows:

| Payment under the simplified tax system in 2021 | KBK |

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

How to calculate penalties

An individual entrepreneur can calculate penalties using the formula: PENALTY = DEBT × ((RATE1 / 100) / 300) × DAYS (ST1) + DEBT × ((RATE2 / 100) / 300) × DAYS (ST2), where:

- DEBT is the amount of tax not paid on time.

- RATE1 is an indicator of the key rate, valid in the period from the first day of accrual of penalties until the day preceding the day the new rate comes into force, if one is introduced. If a different rate has not been entered, the indicator is valid until the day preceding the repayment of the arrears.

- RATE2 is an indicator of the new rate from the day it comes into force until the day before the debt is closed.

- DAYS (ST1) is the number of days the first bet is valid.

- DAYS (ST2) is the number of days the second rate is valid.

Using the calculator

As you can see, calculating the rate can be quite difficult, especially if the Central Bank managed to change the rate. But doing such calculations and spending time on it is completely unnecessary. The network offers special services in the form of calculators that allow you to calculate penalties online.

To do this, you need to enter the amount of debt, indicators of refinancing rates (one or more, if the indicator has changed), and also indicate the number of days overdue for payment.

Such a calculator can be found, for example, on the Federal Tax Service website. The service is located in the electronic services section, the category is called “Tax calculator”. This website also has a calendar to help you check when your taxes are due. Here you can create a payment order and even pay penalties online.

Important! This opportunity is provided exclusively to individual entrepreneurs. Legal entities will have to contact a banking institution to generate a payment order.