As it was before

Insurance premiums for individual entrepreneurs consist of a fixed part and 1% of income over 300 thousand rubles.

Previously, 1% was calculated from income and did not take into account expenses, even if the individual entrepreneur was on the simplified tax system “Income minus expenses.” For example, Ilya has 6 million income and 4 million expenses. Contributions must be counted from 6 million.

(6,000,000 - 300,000) x 1% = 57,000 rubles.

If Ilya had calculated contributions from the difference between income and expenses, he would have saved 40 thousand: (2,000,000 - 300,000) x 1% = 17,000 rubles.

Registration

So, according to officials, to calculate contributions from the income of a “simplified” entrepreneur exceeding 300,000 rubles, it is necessary to take into account only the income specified in Article 346.15 of the Tax Code. You cannot reduce them for expenses.

The Supreme Court of the Russian Federation initially adhered to the same position (ruling of the Supreme Court of the Russian Federation dated July 28, 2021 No. 306-KG16-9938).

However, in the ruling dated April 18, 2021 No. 304-KG-16937, the Supreme Court changed its opinion to the exact opposite. The Supreme Judges stated that an individual entrepreneur using the simplified tax system with the object “income minus expenses” can take into account his expenses when paying insurance premiums for himself (determination dated April 18, 2021 No. 304-KG-16937).

The judges took into account the resolution of the Constitutional Court of the Russian Federation dated November 30, 2016 No. 27-P. True, it concerned entrepreneurs under the general taxation regime. The constitutional judges indicated then that an individual entrepreneur, when calculating personal income tax, can reduce the income he receives for expenses.

Expenses must be documented and directly related to the extraction of income (professional tax deduction). The composition of expenses is determined in a manner similar to that established for calculating income tax (clause 1 of Article 221 of the Tax Code of the Russian Federation). And profit, as a general rule, is income reduced by expenses.

As pointed out by the Supreme Court, the principle of determining the tax base for a “simplified” tax is similar to the principle of calculating the base for personal income tax. Therefore, for the purpose of paying insurance premiums, the decision of the Constitutional Court can be extended to individual entrepreneurs using the simplified tax system. This means that an individual entrepreneur using the simplified tax system can take into account expenses when paying insurance premiums for himself.

A little earlier than the Supreme Court, the Arbitration Court of the Volga-Vyatka District came to a similar conclusion in resolution No. F01-6260/2016 dated February 6, 2017. The federal arbitrators also decided to apply the conclusion of their “constitutional” colleagues to the determination of the income of the “simplifier.” According to arbitration judges, nothing prevents an individual entrepreneur using the simplified tax system from determining the amount of income for calculating contributions as the difference between income and expenses. Because profit, in its essence, is this difference.

In rulings dated February 19, 2021 No. 306-KG18-25467 and dated November 22, 2021 No. 303-KG17-8359, the Supreme Court once again stated that when calculating individual entrepreneur contributions to the “income-expenditure” simplified tax system, income received is reduced by the amount expenses incurred. True, the determination was made in relation to a situation that occurred before January 1, 2021. That is, when insurance premiums were paid to extra-budgetary funds. Therefore, individual entrepreneurs using the simplified tax system can apply for a recalculation of contributions paid before January 1, 2021 based on the entire amount of income.

As it turned out, this was not a period in the dispute, but only a comma. The Supreme Court, in a decision dated June 8, 2021 in case No. AKPI18-273, again stated that expenses cannot be taken into account. More precisely, the judges pointed out that there is no direct rule in the Tax Code that allows “simplified people” to reduce income for expenses in order to determine the base for insurance premiums. Most likely, the court deliberately avoided considering the case on its merits in order to have room for maneuver in the future, when specific disputes regarding additional charges arise. Moreover, earlier both the Constitutional Court and the Supreme Arbitration Court quite clearly stated that it is not legal to take into account only income.

Let us add that reducing income for expenses starting in 2021 is risky. The fact is that the aforementioned rulings of the Supreme Court, which related to contributions transferred to extra-budgetary funds in accordance with the Law of July 24, 2009 No. 212-FZ, do not apply to contributions paid after January 1, 2021 under the Tax Code (letter from the Ministry of Finance of Russia dated June 9, 2021 No. 03-15-05/36277).

What changed

In April of this year, the Supreme Court allowed 1% of contributions to be calculated from the difference between income and expenses. He referred to last year's decision of the Constitutional Court, which used a similar approach to individual entrepreneurs on the general tax system.

The Pension Fund of Russia and the Ministry of Labor supported the decision of the Supreme Court.

The tax office has not yet expressed its opinion, but you can already count your contributions under the new scheme. Even if disputes arise, the courts take the side of entrepreneurs because they listen to the Supreme Court.

Briefly about the main thing

Every organization strives to increase its net profit. However, ignorance of tax benefits often leads to a high fiscal burden.

Organizations operating under the simplified tax system of 6% are entitled to a tax reduction of 50%. This occurs by subtracting insurance premiums paid for employees from company income.

Organizations operating under the simplified tax system of 15% can reduce tax either by reducing income or by increasing expenses. There are many legal ways to reduce your tax base. This is part of the company's tax optimization and should be carried out by a specialist with in-depth knowledge of tax legislation.

Sources:

Chapter 26.2. SIMPLIFIED TAX SYSTEM, Tax Code.

How to recalculate contributions for 2021

Throughout 2021, Elba counted contributions according to the old scheme - only from income. Until recently, we were not entirely sure that the Supreme Court's decision would be supported by regulatory authorities, and we did not want you to take risks. But at the end of November, the Supreme Court once again repeated its opinion, and we changed the calculation in the service.

If your income in 2021 exceeded 300 thousand rubles, you paid 1% contributions on income and did not take into account expenses. With the new calculation, you will pay less. Elba automatically recalculated the contributions and determined the amount of your overpayment.

What does the grace period include?

The Tax Code stipulates that in some cases it is still possible not to pay STV. An individual entrepreneur is exempt from paying them if he does not conduct business activities, because:

- called up for military service;

- cares for a baby up to one and a half years old, a disabled child or a disabled person with the first group of disability;

- looks after an elderly person who has already turned 80;

- lives with a spouse who is on military service under a contract, if there is no opportunity for employment. The benefit period is valid for 5 years;

- lives outside the country with a spouse who has received a referral to the consulate or diplomatic mission of the Russian Federation (maximum period - 5 years).

Important! When, if there is a benefit, an individual entrepreneur has income from business, then he is obliged to pay the STV as usual.

What to do with contributions from previous years

You can return the overpayment of contributions for 2014, 2015 and 2016, but you need to calculate it yourself.

Contact your local Pension Fund office for a recalculation of contributions and a refund of the overpayment. The Pension Fund should not object because it supported the new calculation procedure in a letter.

You may be asked for tax reports for previous years. The reports must have a tax stamp indicating their receipt. If you reported electronically through Elba, download the report and go to the tax office to mark it.

Individual entrepreneur – payer of insurance premiums

Individual entrepreneurs have a dual status. At the same time he speaks:

- an individual;

- subject of business activity.

The individual entrepreneur is his own employer. Therefore, all responsibility regarding ensuring a future pension and medical insurance lies solely with him.

The tax burden of individual entrepreneurs includes not only taxes, but also insurance premiums, which must be paid. An individual entrepreneur can influence the amount of taxes if he treats his income and expense items wisely. As for STV, their amount is fixed for individual entrepreneurs.

Questions related to the procedure for calculating STV and their payment are constantly heard. Individual entrepreneurs who suspend their activities for some time or work at a loss insist that payment of contributions for this period should not be mandatory.

Government agencies have the opposite opinion. It is based on the fact that if an individual entrepreneur is listed in the register, but does not carry out activities, it means that he has good (for him) reasons. In order not to pay fees during downtime, you need to deregister.

Important! The obligation to pay STV for an individual entrepreneur appears simultaneously with the status of an entrepreneur. It has nothing to do with whether the activity is actually carried out or whether the individual entrepreneur receives income (

Responsibility of an entrepreneur for non-payment of STV

For untimely transfer of STV, their absence or errors in calculations, the following are fraught with financial liability:

| Violation | Fine, % of the amount of STV that must be paid | Note |

| Missing the established reporting deadline, that is, late filing of the calculation | 5,0 | Minimum amount 1000.00 rub. Maximum – 30% of the size of the STV |

| Downplaying the basis for determining ETS | 20,0 | Minimum – RUB 40,000.00. |

| Complete non-payment of STV or payment in an underestimated amount | 40,0 | |

| Late provision of personalized reporting data, submission of incomplete information or unreliable data | 500 rub. | For each insured employee |

In addition to fines for failure to pay STV on time, penalties have been developed. They are determined as a percentage of the amount of non-payment and are:

- for late payments up to 30 days. – 1/300 of the refinancing rate of the Central Bank of the Russian Federation;

- starting from 31 days – 1/150 of the rate indicated above.

Features of reporting under STS

Individual entrepreneurs with employees provide a single calculation of STV quarterly to the Federal Tax Service. The deadline for submission is the 30th day of the month that follows the reporting period.

If the number of employees is more than 25, the report should be submitted only in electronic form.

Individual entrepreneurs who have not submitted tax returns are no longer threatened with accrual of the maximum amount of fixed contributions. This norm does not exist in the Tax Code. But there is another one - when a businessman has not paid the STV, but has provided reporting, tax specialists will independently determine the debt. This is very easy to do, having in hand the data entered by the individual entrepreneur into the tax return.

The date for submitting calculations under the STS by the heads of peasant farms is January 30 (previously the last day of February).

Individual entrepreneurs - self-employed persons are not required to provide reporting on their STI.

Important! When, as a result of checking the calculation by tax specialists, the amount of employee pension contributions in total diverges from the final amount of the STV, the document is considered not submitted. The individual entrepreneur has 5 days to correct the error.

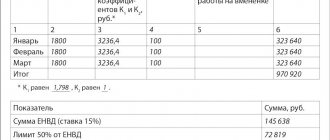

Insurance premiums when combining simplified taxation system and UTII

When an entrepreneur combines two tax regimes, he should decide where exactly the hired force is employed. If it is not on the “simplified” tax code, but is in the state in the “imputed” tax code, it is possible to reduce the amount of income under the simplified tax system on the STV of the merchant directly. The UTII tax is reduced by the amount of stipulated income transferred for hired workers. But a maximum of 50% of the calculated amount paid to the treasury.

If there are no employees in “imputed” activities, the STV for the entrepreneur is applied to a reduction in the amount of imputed income. Income under the simplified tax system is reduced by the amount of STI of hired employees. The accountant will include them in costs.

Accounting for a combination of several special modes is carried out separately, which allows you not to confuse anything with STV (

Individual entrepreneur contributions for hired employees

When an individual entrepreneur attracts hired labor to his activities and officially employs employees, he will also have to pay STV for them. Otherwise, the time worked will not be included in the insurance period, which will affect pensions in the future, and in the present – the ability to receive free medical care.

For individual entrepreneurs, insurance premium rates are:

| STV payment directions | Rates, % |

| Pension Fund | 22,0 |

| FSS | 2,9 |

| FFOMS | 5,1 |

| FSS for injuries | 0,2-8,5 |

The specific STV tariff for accidents depends on the type of activity that the individual entrepreneur is engaged in.

Depending on the same factor, reduced tariffs may apply.

Procedure for paying insurance premiums and where to transfer them

Control over the payment of STV has passed to the tax authorities. Insurance premiums are now subject to the Tax Code. Since the recipient of the STV has changed, a different BCC should be recorded on receipts and payments. Each of them begins with three numbers "182" and ends with "160". Now:

1. Individual entrepreneurs should not transfer contributions to the Pension Fund. Instead, payments are made to the Federal Tax Service where the individual entrepreneur is registered.

2. Nothing has changed in the calculation of contributions and payment deadlines. They are simply sent to a different address.

3. If an individual entrepreneur works without hired force, then he does not need to fill out new reports.

4. All tax regimes (except patent) continue to provide for a reduction in the tax base or calculated tax by the amount of the ETS.

5. Payments for all types of STS (except for injuries) must be filled out by individual entrepreneurs according to the rules that apply for tax payments.

STV in case of injury to individual entrepreneurs is transferred to the Social Insurance Fund. KBK remained the same.

Some sites offer their services for calculating STV. They have developed an online calculator that allows you to make a quick and correct calculation of STV. You can find it on the websites of Sberbank, Tinkoff Bank, and New Reforms.

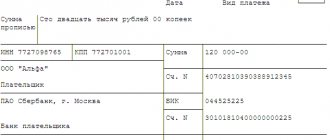

STV is paid by payment from the individual entrepreneur's bank account or in cash using a receipt.

You can generate receipts on the Federal Tax Service website for free. To do this, you just need to methodically fill out the cells, choosing what you need from the list provided. Even if there is no data on the BCC, this information will appear automatically after the correct selection of the tax group (STG) and the name of the payment.

On the right side of the site there are tips that allow you to accurately enter the necessary information.

At the very end, you should select the type of payment and receive a ready-made receipt for payment of STV. All you need to do is print it out and submit it to the bank for payment.

Important! To pay STV to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, two separate receipts should be prepared.

Results

The use of the simplified tax system does not exempt either legal entities or individual entrepreneurs from paying insurance premiums.

Contributions for both must be paid from payments in favor of employees. At the same time, the individual entrepreneur has the obligation to pay contributions for himself, regardless of whether he has employees. The procedure for determining the amount of contributions accrued for employees and individual entrepreneurs is different. For contributions to employees, three types of tariffs can be applied: basic, additional, reduced. The ability to use the latter has been limited since 2019. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.