The sale of oil and products at AZM differs little from other types of trade. Organizations have the opportunity to conduct wholesale, retail or wholesale-retail trade. Peculiarities arise in connection with the classification of a number of petroleum products as excisable goods. The main document defining the features of accounting for oil and petroleum products are the Rules for the technical operation of gas stations, approved by Order of the Ministry of Energy of the Russian Federation dated August 1, 2001 No. 229. In the article we will talk about accounting at gas stations and give examples of postings.

Non-automated methods for accounting for petroleum products at gas stations

Quantitative accounting of petroleum products at gas stations is regulated by current regulatory documentation. The main regulatory document is the Instruction on the procedure for receipt, storage, accounting and dispensing of petroleum products at gas stations (hereinafter referred to as the Instruction).

It assumes that accounting and settlement operations are carried out in accordance with all current GOSTs, guidelines, rules and other standards.

According to paragraph 1.1 of this Instruction, the quantity of petroleum products at gas stations is recorded in liters.

This amount may vary depending on temperature fluctuations in the atmospheric air, and is associated with the physicochemical properties of petroleum products. In addition, products of the same brand, but manufactured by different manufacturers, differing in their grade and some associated technical and economic features, are often poured into the same container.

To organize an optimal system for recording the quantity of petroleum products at gas stations, it is necessary to determine:

- the procedure for accounting and its organization, including both the system itself and document flow, as well as the frequency of inventory;

- financially responsible persons from among gas station employees;

- persons whose responsibility will be to monitor the order and reliability of accounting;

- composition of the inventory commission.

Organizing competent quantitative accounting at gas stations involves determining the following indicators:

- quantity of petroleum products in tanks (for each tank - separately and by brand of petroleum products in total);

- presence of petroleum products in pipelines for technological purposes;

- quantity of products dispensed through fuel and oil dispensers.

For efficiency, such records at gas stations are kept in liters, but for control purposes it would not hurt to keep records in weight units (tons and kilograms). This is due to the fact that weight indicators (unlike volume and density) are constant in their quantitative value and do not depend on changes in external conditions or parameters.

According to the above-mentioned Instructions, the weight of petroleum product (hereinafter referred to as OP) is calculated as follows:

| № | Helpful information |

| 1 | when using the volume-mass measurement method - by multiplying the density of the product and its volume, measured at the same temperature and pressure, or reduced to the same values |

| 2 | when using the mass measurement method (both for containerized petroleum products and tank trucks) - by weighing on scales |

| 3 | if the volumetric method is used, only the volume of the product is measured |

| 4 | if the hydrostatic method is used, then the mass of the petroleum product is calculated by multiplying the difference between the initial and final pressure values of the product column (before and after the commodity operation) by the average cross-sectional area of that part of the tank from which the product was shipped. Then this product is divided by the acceleration of gravity, which is established by the formula described in paragraph 2.42 of the above-mentioned Instructions |

The most universal, and therefore the most popular of these, is the volumetric-mass method.

Organizing analytical accounting of petroleum products at gas stations implies dividing them according to the following criteria:

- brand;

- own petroleum products and products that are in safe custody (bailor’s products).

Write-off of fuel and lubricants in 1C 8.3

Accounting for the write-off of fuel and lubricants in 1C is carried out according to waybills. This information is verified with reports provided by the reporting employee himself and summarizing the data from waybills and gas station receipts.

The write-off of gasoline and other fuels and lubricants is documented in the same way using the “Demand-invoice” document, which is located in the “Warehouse” section.

Fig. 12 Fragment of the “Warehouse” menu item

In the document, using the “Selection” or “Add” button, the name of the fuel, volume and account to which we will write it off are indicated. The latter, in turn, depends on the type of activity of the company: for example, if the company is a trading company, then the write-off account is 44.01, production (for main production) is 20, and general business needs is account 26. Checking the “Cost accounts” box on the “Materials” tab, will make it possible to indicate accounts on the same line with the item. Otherwise, they will be filled out on a separate tab.

Fig. 13 Filling out the “Requirements-invoice” for writing off fuel and lubricants

When making an invoice claim, the cost of gasoline written off as expenses is taken into account at the average cost.

Fig. 14 Report on the movement of the document “Demand-invoice”

The same document can also be generated on the basis of an expense report. To do this, open the report itself or the entire “Advance reports” journal, click the “Create based on” button and select the document you are looking for.

Fig. 15 Creating a “Requirement-invoice” from an “Advance report”

Organization of accounting when accepting petroleum products

Petroleum products can be supplied to gas stations in the following ways:

- railway tanks;

- automobile tanks;

- through pipelines;

- in a container.

The most common way to deliver products to a gas station tank is by tanker truck.

In the consignment note form number 1-T, suppliers (or depositors) indicate the following parameters of the goods:

- the exact name of the brand of petroleum product;

- the value of its temperature, volume and density measured during shipment;

- weight of petroleum product.

The volume-mass method of determining weight involves measuring density and volume indicators at the time of acceptance of the goods, subject to the same (or reduced to the same) values of pressure and temperature.

Read also:

Description of substances in the fractional composition of petroleum products

The volume of the resulting petroleum product is determined using special calibration tables, either by measuring the level of petroleum product in containers (reservoirs, railway tanks, tanks of oil tankers), or by the capacity of any of the listed containers. Alternatively, the volume can be measured using a liquid meter.

Density in vehicles and tanks is determined by sampling (in accordance with State Standard No. 2517-85) with subsequent laboratory measurements. The density of the sample can be determined both on site and in laboratory conditions (depending on the equipment available at the gas station).

Data on the actual amount of petroleum product received is entered during the process and upon completion of the discharge of the received goods into the tanks of the gas station in a special receipts journal, as well as in the shift report and in the invoice.

If the actual quantity of goods received (in tons) coincides with the supplier specified in the attached invoice, the gas station employee puts his signature on it, leaves one copy at the gas station, and gives the other three copies to the driver who delivered the goods.

If these values differ, it is necessary to draw up a deficiency report. It is drawn up in three copies, the first of which is attached to the shift report, the second is given to the driver who brought the disputed cargo, and the third is stored at the gas station itself. An appropriate note about such a shortage must be made on all copies of the consignment note accompanying the cargo.

The possibility of accepting a petroleum product when a quantitative shortage is identified, which may be the result of a delay in delivery of goods by tank truck to the gas station, underfilling at the supplier’s enterprise or any other reasons, is determined either by the management of the gas station or its owner, guided by the organization’s established quantitative accounting procedure.

Accounting press and publications

“Accounting and taxes in trade and public catering”, 2005, N 4

Gas station - ACCOUNTING AND TAXATION

Gas stations (gas stations) are essentially retail trade organizations that provide fuel and lubricants to the end consumer - the population and legal entities.

The following technological processes are carried out at gas stations: reception, storage, delivery (dispensing) and accounting of the quantity of petroleum products. Additionally, the gas station sells lubricants, special liquids, spare parts for cars and other vehicles, and also provides services to vehicle owners and passengers.

Reception, storage, delivery and accounting of petroleum products at gas stations are carried out in accordance with the Guiding document RD 153-39.2-080-01 “Rules for the technical operation of gas stations”, approved by Order of the Ministry of Energy of Russia dated August 1, 2001 N 229 and put into effect on 1 November 2001 (hereinafter referred to as the Rules for the Technical Operation of Gas Stations).

Let's consider the procedure for accounting and taxation of receipts and sales of fuels and lubricants at gas stations.

Accounting

Receipt of fuels and lubricants

Delivery of petroleum products to gas stations is usually carried out by road. Acceptance of all petroleum products arriving at gas stations in tank trucks, as well as petroleum products packaged in small containers, is carried out according to the consignment note.

Clause 13.7 of the Rules for the Technical Operation of Gas Stations establishes that if there is no discrepancy between the actually accepted quantity (in tons) of petroleum product and the quantity (in tons) indicated in the consignment note, the operator signs the consignment note, one copy of which remains at the gas station, and three copies returned to the driver who delivered the petroleum products. If a discrepancy between the received petroleum products and the delivery note is revealed, a shortage report is drawn up in three copies, of which the first is attached to the shift report, the second is given to the driver who delivered the petroleum products, and the third remains at the gas station. About the shortage of petroleum products, a corresponding note is made on all copies of the consignment note.

The amount of petroleum products received into gas station tanks is recorded in the logbook of incoming petroleum products and in the shift report.

Petroleum products packaged in small containers are transported in packaging that prevents spills of petroleum products, damage to containers and labels.

According to clause 13.15 of the Rules for the Technical Operation of Gas Stations, when accepting petroleum products packaged in small containers, the gas station employee checks the number of places received, the compliance of stencils with the data specified in the consignment note, the availability of passports and quality certificates.

Fuel and lubricants received at gas stations are goods and, accordingly, they are accounted for in account 41 “Goods”.

When organizing accounting for fuels and lubricants, you should be guided by PBU 5/01 and the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n.

In accordance with clause 13 of PBU 5/01, retail trade organizations can account for goods either at the cost of their acquisition or at the selling price. The method of accounting for fuels and lubricants adopted by the gas station must be recorded in its accounting policy.

If, according to the accounting policy of the gas station, purchased fuels and lubricants are valued at the cost of their acquisition, when they are capitalized, the following entries are made:

debit of account 41 credit of account 60 “Settlements with suppliers and contractors” - for the amount of the cost of received fuels and lubricants and related products;

debit of account 19 “Value added tax on purchased values” credit of account 60 - for the amount of value added tax allocated in the supplier’s invoice;

debit of account 60 credit of account 51 “Current accounts” - for the amount of payment of the invoice of the supplier of petroleum products;

debit of account 68 “Calculations for taxes and fees” credit of account 19 - for the amount of value added tax presented for credit.

If fuels and lubricants are valued at sales prices, along with the above entries, an entry is drawn up reflecting the amount of the trade margin:

debit of account 41 credit of account 42 “Trade margin” - for the amount of the difference between the sales and purchase prices of fuels and lubricants.

Example 1. In accordance with the accounting policy adopted at gas stations, goods are accounted for at sales prices. Petroleum products worth RUB 330,400 were received from the supplier. (including VAT - 50,400 rubles). The supplier's invoice has been paid. The selling price is set at RUB 495,600. (including VAT - 75,600 rubles).

The following entries will be made in the accounting records of the gas station:

debit of account 41 credit of account 60 - for the amount of the cost of petroleum products - 280,000 rubles;

debit of account 19 credit of account 60 - for the amount of value added tax - 50,400 rubles;

debit of account 41 credit of account 42 - for the amount of trade margin - 165,200 rubles. (RUB 495,600 - RUB 330,400);

debit of account 60 credit of account 51 - for the amount of funds transferred to the supplier to pay the invoice - 330,400 rubles;

debit of account 68 credit of account 19 - for the amount of value added tax claimed for deduction - 50,400 rubles.

Sale of fuels and lubricants

According to clause 14.1 of the Rules for the Technical Operation of Gas Stations, petroleum products are dispensed at gas stations only through fuel or oil dispensers into vehicle tanks or consumer containers, as well as through the sale of packaged petroleum products. Samples of packaged petroleum products are displayed in display cases or on special stands to familiarize consumers with the range and retail prices.

Sales of petroleum products are carried out either in cash, or using credit cards, or by bank transfer with the preliminary sale of coupons.

When selling fuels and lubricants in cash or using payment cards, the organization is obliged to use cash register equipment. This is required by Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” Based on the provisions of this Law, the scope of its regulation is cash payments, regardless of who makes purchases (orders services) and for what purposes. That is, cash registers can be used not only for cash payments with the population, but also in cases where cash payments are made with an individual entrepreneur or organization (buyer, client).

Based on Art. 169 of the Tax Code of the Russian Federation, when selling petroleum products to legal entities, the gas station is obliged, along with a cash receipt, to issue an invoice to the buyer. If an organization purchases petroleum products through an accountable person who, when purchasing, does not declare himself to be a representative of a legal entity, i.e. does not present a power of attorney, the gas station is not obliged to issue an invoice. This follows from paragraph 7 of Art. 168 of the Tax Code of the Russian Federation, according to which, when selling goods for cash by organizations and individual entrepreneurs of retail trade, as well as other organizations, individual entrepreneurs performing work and providing paid services directly to the population, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller issued the buyer a cash receipt or other document in the established form.

According to the decision of the State Interdepartmental Expert Commission on Cash Registers (Protocol No. 14 of November 10, 1994), cash registers intended for making cash payments for petroleum products and providing services in the field of supplying petroleum products print cash receipts with the following details: factory car number, programmable name of the enterprise (gas station), at least 20 characters, serial number of the operation, date of sale (purchase), time of sale (purchase), amount of sale (purchase) (except for indirect non-cash payment), brand of petroleum product, identifier (number ) operator, quantity of petroleum product, number of the dispensing tap (fuel dispensing tap), type of payment, card number for non-cash payment, amount paid by the buyer and change amount for cash payment, taxpayer identification number of the enterprise (gas station) from the fiscal memory of the cash register , a field for marking the number and amount of the correction check, at least 15 characters.

As noted in the Letter of the Department of the Ministry of Taxes and Taxes of Russia for Moscow dated April 30, 2004 N 29-12/29514, indirect non-cash payment is considered a form of payment for petroleum products at gas stations with payment cards, coupons and other documents that are equivalent to a pre-paid certain amount of petroleum products . Thus, gas stations, when making non-cash payments for the supply of petroleum products (using coupons, payment cards), in the generally established manner, must punch cash receipts (without indicating the sales amount, but indicating the brand and number of liters of petroleum product) on cash register equipment and issue them to customers.

A cash receipt issued when using cash register equipment is a document confirming the fulfillment of obligations under a purchase and sale (service) agreement between the buyer (client) and the relevant legal entity or individual entrepreneur, and is drawn up at the time of the transaction, as required by the Law about accounting.

Let's look at the accounting entries for each option for selling petroleum products.

Sales of petroleum products for cash

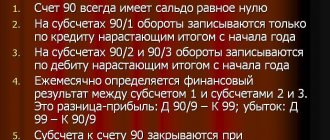

Debit account 50 “Cash” credit account 90 “Sales”, subaccount 1 “Revenue” - for the amount of the sales cost of fuels and lubricants;

debit of account 90, subaccount 3 “Value added tax” credit of account 68 - for the amount of value added tax;

debit account 90, subaccount 2 “Cost of sales” credit account 41 - for the amount of the accounting (purchase or sale) cost of fuels and lubricants;

debit account 90, subaccount 2 “Cost of sales” credit account 42 - reversal for the amount of the trade margin (when accounting for fuels and lubricants at sales prices);

debit of account 90, subaccount 9 “Profit/loss from sales” (99 “Profits and losses”) credit of account 99 (90, subaccount 9 “Profit/loss from sales”) - for the amount of profit (loss) from the sale of fuels and lubricants .

Sales of petroleum products using credit cards

Since when selling petroleum products using credit cards, funds are not received at the gas station’s cash desk, but to its current account, the date of actual crediting of funds to the current account does not always coincide with the date of settlements between the buyer and the gas station. Therefore, before funds are credited to the gas station’s settlement account, the amount of revenue from the sale of petroleum products should be reflected in account 57 “Transfers in transit”:

debit of account 57 credit of account 90, subaccount 1 “Revenue” - for the amount of the sales value of goods sold using credit cards;

debit of account 90, subaccount 3 “Value added tax” credit of account 68 - for the amount of value added tax;

debit account 90, subaccount 2 “Cost of sales” credit account 41 - for the amount of the accounting cost of goods sold;

debit account 90, subaccount 2 “Cost of sales” credit account 42 - reversal for the amount of the trade margin (when accounting for petroleum products at sales prices);

debit of account 51 credit of account 57 - for the amount of money received for goods sold.

Sales of petroleum products using coupons

In this case, the client organization transfers funds via bank transfer to the gas station, which, in turn, transfers to the client a delivery note for petroleum products, an invoice and coupons. Refueling of the client's car is carried out upon presentation of coupons. The funds received from the buyer are considered as an advance against future sales of petroleum products. Coupons purchased by gas stations are strict reporting forms and are recorded in account 006 “Strict reporting forms”. Settlements with a buyer purchasing petroleum products using coupons are reflected in gas station accounting as follows:

debit of account 006 - gasoline coupons were capitalized;

debit of account 51 credit of account 62 “Settlements with buyers and customers”, subaccount “Advances received” - an advance was received under an agreement with the buyer;

debit of account 62, subaccount “Advances received” credit of account 68 - value added tax is charged on the prepayment amount;

account credit 006 - coupons were issued to the buyer;

debit of account 62 credit of account 90, subaccount 1 “Revenue” - for the amount of revenue from the sale of petroleum products using coupons;

debit of account 90, subaccount 3 “Value added tax” credit of account 68 - for the amount of value added tax accrued on sales volume;

debit account 90, subaccount 2 “Cost of sales” credit account 41 - for the amount of the accounting cost of petroleum products;

debit account 90, subaccount 2 “Cost of sales” credit account 42 - for the amount of the trade margin (when accounting for petroleum products at sales prices);

debit of account 62, subaccount “Advances received” credit of account 62 - for the amount of the offset prepayment;

debit of account 68 credit of account 62, subaccount “Advances issued” - for the amount of value added tax subject to deduction.

Excise taxes

The main products sold by gas stations - gasoline, diesel fuel, motor oils - are excisable goods in accordance with paragraph 1 of Art. 181 Tax Code of the Russian Federation. According to paragraphs. 3 p. 1 art. 182 of the Tax Code of the Russian Federation, the object of excise taxation is the acquisition of petroleum products into the ownership of an organization or individual entrepreneur who has a certificate of registration of a person carrying out transactions with petroleum products.

Clause 8 of Art. 200 of the Tax Code of the Russian Federation establishes that the supply of petroleum products through fuel dispensers is recognized as retail sales of petroleum products. In this regard and on the basis of paragraph 1 of Art. 179.1 of the Tax Code of the Russian Federation, gas stations can obtain a certificate for the retail sale of petroleum products.

According to paragraph 4 of Art. 179.1 of the Tax Code of the Russian Federation, a certificate for retail sales is issued to organizations and individual entrepreneurs if there is ownership of the organization and individual entrepreneur (organization in which the applicant organization owns more than 50 percent of the authorized (share) capital (fund) of a limited liability company or voting shares of a joint-stock company ) capacities for storage and distribution of petroleum products from stationary fuel dispensers (with the exception of motor oils for diesel and (or) carburetor (injection) engines) and (or) capacities (premises) for storage and sale of motor oils. The procedure for issuing certificates of registration of a person carrying out transactions with petroleum products was approved by Order of the Ministry of Taxes and Taxes of Russia dated February 6, 2003 No. BG-3-03/52.

It should be borne in mind that the Tax Code of the Russian Federation does not oblige taxpayers to obtain a certificate for the sale of petroleum products. If the organization purchasing petroleum products does not have a certificate, the object of taxation does not arise.

The amount of excise tax is calculated by gas stations that have a certificate of registration of a person carrying out transactions with petroleum products, based on the tax base, which, according to clause 3 of Art. 187 of the Tax Code of the Russian Federation is defined as the volume of petroleum products received (capitalized) in physical terms, and the tax rate, which is established by clause 1 of Art. 193 of the Tax Code of the Russian Federation in rubles per 1 ton of petroleum product of a certain group. The Tax Code of the Russian Federation establishes the following excise tax rates:

2657 rub. — for 1 ton of motor gasoline with an octane number up to “80” inclusive;

3629 rub. - for 1 ton of motor gasoline with other octane numbers;

1080 rub. — for 1 ton of diesel fuel;

2951 rub. — for 1 ton of oil for diesel and (or) carburetor (injection) engines.

There is a zero excise tax rate for straight-run gasoline.

The procedure for assigning excise tax amounts upon receipt of petroleum products is established in clause 4 of Art. 199 of the Tax Code of the Russian Federation. In accordance with paragraphs. 3 of the specified paragraph of Art. 199 of the Tax Code of the Russian Federation, the amount of excise tax calculated on operations for obtaining petroleum products, in the case of transfer of excisable petroleum products to a person holding a certificate, is not included in the cost of the transferred excisable products and is subject to deduction from the budget on the basis of clause 8 of Art. 200 Tax Code of the Russian Federation. The amount of excise tax calculated by the taxpayer in the case of transfer of excisable petroleum products to a person who does not have a certificate is included in the cost of the transferred excisable petroleum products (clause 3, clause 4, article 199 of the Tax Code of the Russian Federation).

As noted earlier, gas stations sell petroleum products to the end consumer, i.e. organizations and individuals who use petroleum products not for resale, but for their own needs and, accordingly, do not have a certificate for the sale of petroleum products. Therefore, a gas station that has a certificate includes the excise tax charged when purchasing petroleum products in their cost. This operation is reflected in accounting at the time of receipt of petroleum products by posting:

debit of account 41 credit of account 68 - for the amount of accrued excise tax.

When transferring excise tax to the budget, the following entry will be made:

debit of account 68 credit of account 51 - for the amount of the transferred excise tax.

Example 2. A gas station that has a certificate for the retail sale of petroleum products purchased 30 tons of gasoline, the excise tax rate for which is 3,629 rubles. per ton.

The gasoline supplier was paid 188,800 rubles. (including value added tax - 28,800 rubles).

The following entries will be recorded in the gas station accounting:

debit account 41 credit account 60 - for the amount of the cost of gasoline - 160,000 rubles;

debit of account 19 credit of account 60 - for the amount of value added tax - 28,800 rubles;

debit of account 41 credit of account 68 - for the amount of accrued excise tax - 108,870 rubles. (30 tons x 3629 rub.);

debit of account 60 credit of account 51 - for the amount of funds transferred to the gasoline supplier - 188,800 rubles;

debit of account 68 credit of account 51 - for the amount of excise tax transferred to the budget - 108,870 rubles.

The actual cost of gasoline was 268,870 rubles. (RUB 160,000 + RUB 108,870).

In accordance with paragraph 8 of Art. 200 of the Tax Code of the Russian Federation, excise tax amounts assessed by a taxpayer who has a certificate for the retail sale of petroleum products, in relation to excise tax amounts accrued upon receipt of petroleum products sent for retail sale (i.e. through fuel dispensers), are not subject to deductions.

Thus, upon receipt of a certificate of registration of a person engaged in the retail sale of petroleum products, the gas station will have to calculate the excise tax upon receipt of petroleum products and pay it to the budget no later than the 10th day of the month following the expired tax period (Clause 2 of Article 204 of the Tax Code of the Russian Federation ). According to Art. 192 of the Tax Code of the Russian Federation, the tax period for excise taxes is a calendar month.

As noted earlier, if the organization purchasing petroleum products does not have a certificate, the object of taxation does not arise. However, in this case, the gas station for its suppliers who have certificates will be a buyer who does not have a certificate. Since according to paragraphs. 3 p. 4 art. 199 of the Tax Code of the Russian Federation, when a supplier who has a certificate transfers excisable petroleum products to a buyer who does not have a certificate, the amount of excise tax accrued by the supplier is included in the cost of the petroleum products transferred to the buyer, then when concluding contracts with suppliers who have certificates, a gas station operating without a certificate will purchase petroleum products at a price that includes excise tax.

In accordance with paragraphs. 3 p. 4 art. 199 of the Tax Code of the Russian Federation, the amount of excise tax payable by the taxpayer, calculated in accordance with the procedure established by Art. 202 of the Tax Code of the Russian Federation, applies to the taxpayer for expenses accepted for deduction when calculating corporate income tax.

According to Letter of the Ministry of Taxes and Taxes of Russia dated September 21, 2004 N 02-5-10/56 “On the procedure for accounting for excise taxes on petroleum products as expenses when calculating income tax,” the amount of excise tax, in accordance with paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, is subject to accounting for the reduction of the tax base for income tax as part of other expenses associated with production and sales.

The amount of tax calculated at the established rate from the object of taxation recognized for the transaction is taken into account as an expense when calculating income tax in the period for which calculations (declaration) for the corresponding tax are submitted, containing turnover on the transaction leading to the emergence of an object of taxation for this tax. .

In accordance with paragraph 5 of Art. 204 of the Tax Code of the Russian Federation, taxpayers who have a certificate for the retail sale of petroleum products are required to submit to the tax authorities at the place of their location, as well as at the location of each of their separate divisions, a tax return for the tax period regarding the operations they carry out that are recognized as the object of taxation, no later than The 10th day of the month following the expired tax period.

The tax return form and Instructions for filling it out were approved by Order of the Ministry of Taxes of Russia dated December 10, 2003 N BG-3-03/675 “On approval of excise tax return forms and Instructions for filling them out.”

Responsibility for violation of the rules of operation of facilities,

gas station structures and equipment

As noted earlier, the reception, storage, delivery and accounting of petroleum products at gas stations are carried out in strict accordance with the Guiding Document RD 153-39.2-080-01 “Rules for the technical operation of gas stations”.

If the rules for operating fuel storage, maintenance, sale and transportation facilities are violated, administrative liability arises under Art. 9.11 of the Code of Administrative Offenses in the form of imposing an administrative fine on citizens in the amount of five to ten times the minimum wage; for officials - from ten to twenty minimum wages; for legal entities - from one hundred to two hundred minimum wages.

Yu.N.Talalaeva

Signed for seal

15.03.2005

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Procedure for dispensing petroleum products at gas stations

The dispensing of petroleum products at gas stations can only be carried out through fuel dispensers (TRK) or oil dispensers (MRK), and only into the tank of the vehicle.

The total weight of all petroleum products dispensed during one shift at a gas station is calculated using the formula:

M=P x V,

where M is the total mass of petroleum products supplied per shift;

V is the volume of NPs issued per shift, according to the data of the counting mechanisms at the metering stations;

P – NP density measured at temperature at the time of shift transfer.

Switching to online gas station cash registers

For violation of the requirements of subparagraph 8 of paragraph 5 of Article 281 of the Code of Administrative Offenses of the Republic of Kazakhstan, liability is provided: - for individuals - a fine in the amount of one hundred and fifty, - for small businesses - in the amount of two hundred twenty-five, - for medium-sized businesses - in the amount of three hundred and fifty , - for large businesses - in the amount of eight hundred monthly calculation indices, with confiscation of petroleum products that are the direct subjects of the commission of an administrative offense, and (or) income received as a result of the commission of an offense.

The procedure for transferring shifts and compiling shift reports

At the moment of accepting/transferring a shift, both gas station operators (both the one transferring the shift and the one receiving it) together perform the following actions:

- take total readings from all meters of the metering station and all meters of dispensers and MRKs;

- jointly measure the volume of petroleum products sold during a shift (the volume indicator is determined using calibration tables after measuring the level of petroleum products residues);

- using the obtained volume and density values, as well as after measuring the temperature, the quantitative value of the mass of residues in each gas station tank is calculated;

- the balance of money and coupons, as well as other material assets, is transferred;

- carry out error monitoring at each fuel dispenser/MRK.

At the moment of shift handover, operators prepare a shift report. The report form is either number 25-NP, described in the Instructions, or an internal form that was developed in a specific organization on the basis of this document.

In addition to the basic indicators provided for in Form 25-NP, it is advisable to include in the shift report the results of temperature and density measurements taken during the shift.

This report also records the shortage or, conversely, surplus of petroleum products per shift, which are determined as the difference between the readings given by the dispenser meters (metering unit) and the data obtained by measuring the remaining petroleum products in the gas station tanks at the time of shift transfer.

The surplus/shortage of NP is indicated in weight units, taking into account the errors of the TRK/MRK measuring instruments, and is accepted by the enterprise accounting department for accounting for each individual shift. This accounting is maintained in the control and accumulative sheet during the entire interval between inventories. At the time of inventory, all such deviations are calculated in the total quantity for the entire inter-inventory period.

Every month, the accounting department of the enterprise generates a balance sheet reflecting the movement of NP in units of mass, divided according to the following criteria:

- brands of petroleum products;

- ownership of them (own or provided for storage by bailors).

Calculation of excise duty for different types of rates

Excise duty is paid in cases where excisable products produced by one’s own enterprise, obtained by a court decision or during operations for processing straight-run gasoline, are sold through a gas station (see → excise taxes on gasoline in 2021)

When calculating the amount of tax, different types of rates are used - fixed, set based on the volume, ad valorem in the form of a percentage of the cost of products sold, and combined, combining both calculation options. The tax amount is calculated as the product of the base and the rate. Each type of excisable product is calculated separately.

An example of the use of excise taxes in the cost of fuel

A gas station enterprise, which has the right to carry out retail trade on the simplified tax system, received for sale petroleum products of its own production in the amount of 190,000 rubles, the excise tax on which is 25,000 rubles. The trade margin is set at 10%. The following entries are made in gas station accounting:

- The formation of the cost of products is reflected: Dt 41 Kt 20(25, 26) in the amount of 190,000 rubles;

- The trade margin was accrued: Dt 41 Kt 42 in the amount of 19,000 rubles;

- The cost of excise taxes is taken into account: Dt 41 Kt 68 in the amount of 25,000 rubles;

- The transfer of the excise tax amount to the budget after the sale is reflected: Dt 68 Kt 51 for the amount received in the period.

From the amount of cost written off when selling products, markup and excise tax are excluded. When determining the cost, the balance of production at the end of the month is taken into account.

Carrying out an inventory

Inventory at a gas station should be carried out monthly.

In its process, actual balances are removed in volumetric units on the first day of the month. After measuring the density of stored residues, based on data on their volumes, the actual amount of remaining products (for each brand) is calculated in weight units. After this, the received data is reconciled with the data of accounting documents. After this, either a shortage or a surplus of NP is determined.

Read also:

What are the oil reserves and how many years will they last?

The results of the inventory are recorded in the so-called comparison sheet, taking into account the errors of the measuring instruments.

Regulation of the identified shortage can occur in the following context:

- the loss of material assets that does not exceed the established standards and the shortage of petroleum products within the limits of measurement errors of fuel dispenser devices are distributed among the owners in proportion to the shares of petroleum products sold by the organization and given to depositors for the reporting period;

- the shortage of NP in excess of the standards listed above and the shortage that goes beyond the errors of the gas station's measuring instruments is covered by the financially responsible persons of the enterprise - the owner of the station.

Identified surpluses are distributed according to the same principle as shortages within acceptable standards (see above).

The distribution of loss within normal limits is carried out in weight units.

Gas stations and tax problems

ImportantFeatures of inventory:

- The inspection is carried out by a permanent commission, the duties and rights of which are fixed by order.

- All available petroleum products in tanks, barrels, and small containers are subject to inspection.

- As a control measure, the amount of money in the cash register and the coupons used during the shift are calculated.

- When calculating inventory items, the norms of natural loss determined by Decree of the USSR State Supply Committee dated March 26, 1986 No. 40 and ministry orders are taken into account.

Based on the results of the control procedure, an inventory list, a comparison sheet and an inspection report are drawn up. If a shortage or misgrading is identified, the persons responsible for accounting operations must provide explanatory notes.

Economic aspect of NP density

At the moment, some gas stations practice using such an indicator as the average density of petroleum products.

This makes it possible to significantly simplify accounting accounting procedures if the enterprise uses their manual versions.

The average density is calculated either for the past reporting period, or it is established by internal documents for the future reporting period (for example, for the entire season). Based on the results of the inventory carried out at the end of such a period, the accounting balances of petroleum products, calculated according to the average density indicator, are compared with the actual ones, which are calculated according to the density measured during the inventory process.

In this case, the average density is calculated as the arithmetic mean.

As mentioned above, at a gas station the volume and density with the subsequent calculation of the weight of petroleum products is produced:

- at the time of admission;

- when handing over a shift;

- during inventory.

In this case, the density value is obtained by calculation, and it depends on the specific moment of measurement. These values differ at different temperatures, and the final result is obtained using density conversion tables that bring the measured value to a temperature of +20 degrees Celsius.

In this regard, density, as a constantly changing value, cannot be correctly used for accounting purposes in its average value, since this leads to a distortion of the results of quantitative accounting of petroleum products in the period between inventories.

These distortions appear due to the fact that the inventory produces results that take into account not only actual surpluses/shortages, but also deviations of the calculated density values from the established averages.

Average density can be used in management accounting when it is necessary to obtain quick results for decision making.

It is worth saying that an artificial increase in the value of surpluses due to deviation of the calculated values from the established average is unprofitable from an economic point of view for excise tax payers, since the surpluses are included in the tax base when they are calculated.

On the other hand, the Tax Code does not provide for any tax deductions in terms of excise duties when identifying a shortage of NP.

Therefore, the use of average density in quantitative accounting is also unprofitable from the point of view of excise payments.

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the cash withdrawal document

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Fig.10 Filling out the report

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report

Features of excise taxation

Payers of excise taxes on petroleum products are organizations that have a certificate of registration of an organization (or private entrepreneur) that carries out transactions with NP. In addition, persons who do not have such a certificate are also required to pay excise tax if their activity involves the production of petroleum products from customer-supplied raw materials.

It is worth saying that the processor pays excise tax only when the owner of the customer-supplied raw materials does not have the above certificate.

On the other hand, such certificates are the basis for applying tax deductions in terms of excise payments. Since obtaining a certificate to conduct transactions with PE is not an obligation, but a right of the organization, it is worth considering the feasibility of obtaining it depending on the circle of partners of the enterprise.

Even with such a certificate, the right to a deduction may not be obtained if the goods are sold to buyers without certificates. It is necessary to make a decision after analyzing the existing contractual relations at the enterprise.

Application of taxation systems in accounting

Enterprises trading through gas stations have the right to use the generally established or simplified taxation regime. UTII is not used in accounting due to the absence of the type of activity in the list established for the regime. The system does not apply to the trade of non-excise goods.

| Position | BASIC | simplified tax system |

| Production and sale of excisable goods | Applicable | Not applicable |

| Sales of excisable goods without production | Applicable | Applicable |

| Number limit | Absent | 100 people, determined by the entire headcount of the enterprise |

| The amount of fixed assets balance | No limits | 150 million rubles |

| Amount of income received | No limits | The limit value is established by Art. 346.12 Tax Code of the Russian Federation. The amount is subject to annual indexation |

| Installed | Default | By submitting a notification to the territorial office of the Federal Tax Service |

| Transition | Upon organization, from the beginning of the calendar year or upon loss of the right to a simplified regime | Upon organization or from the beginning of the calendar year |

Vacation in cash is carried out using cash register equipment, regardless of the mode used. The technique is used both in settlements with the population and when receiving payments from organizations. Read also: → Using online cash registers for gas stations in 2021

How to get a tax deduction?

To receive a deduction for excise taxes already paid, the taxpayer is required to provide the following documents to the tax authority:

- agreement with a certified buyer;

- all shipping documentation;

- invoices bearing the mark of the tax authority with which the buyer of the NP is registered.

This mark is placed by the tax authority after checking the compliance of the data specified by the buyer in his tax return and the data reflected in the invoices.

The tax can be credited to everyone except the last seller, which is most often gas stations, so many such stations do not have a certificate that oil refineries pay the excise tax.

Read also:

Why are corrosion inhibitors needed in oil production?

Features of accounting and tax accounting at gas stations: postings

He undertakes the obligation to receive, store, transmit taxpayer data and ensure its confidentiality. The fiscal data operator must have a license and be able to work with any cash registers Connection to the OFD Connection to the OFD is formalized by a license agreement. Information about the operator will be specified in the cash register settings. In the future, fiscal data will be transmitted automatically.

Info

No effort is required from the taxpayer. How to choose a fiscal data operator When choosing an OFD, you need to carefully read the service agreement. It is important to study what is included in the amount stated therein. Some operators include only the required minimum functions in the standard contract.

Features of the sale of petroleum products to buyers without certificates

The excise tax paid at the time of receipt of petroleum products, in the case of their sale to persons without certificates (including retail sales at gas stations), is included in the price of the NP. At the same time, the excise tax amount does not appear separately on the price tags or on the labels of the goods sold, as well as on receipts or other documents issued to the final buyer.

All this makes the sale of petroleum products to persons without certificates economically unprofitable, since the taxpayer is forced to increase his revenue by the amount of excise tax, and this increases the base for calculating value added tax.

Retail and wholesale in gas station trading activities

Gas stations operate with wholesale and retail customers. The conditions for document flow of activities differ.

| Condition | Wholesale trade | Retail holiday |

| Agreement | Mandatory document drawn up for a long period of time | The form of a retail trade agreement is a check |

| Consumers | Organizations or individual entrepreneurs | Individuals |

| Documentary proof of shipment | Vacations are made using fuel cards, and an invoice is issued at the end of the month | Data on the issue are indicated in the KKM receipt issued at the time of shipment |

| Invoice | One document is issued based on the results of the month for all shipments (when maintaining OSNO at gas stations) | Not issued |

Enterprises can purchase fuel without concluding permanent contracts. The purchase of petroleum products is carried out through the company’s accountable persons. Cash receipts are confirmation of leave and are used for taxation of activities as part of the costs of operating transport.

The difference between wholesale and retail is the purpose of the fuel used for resale or for the needs of enterprises and individuals.