Who should switch to online cash register from the new year, and who will the changes affect later? Find out all the latest news about the procedure for using cash register equipment.

What are online cash registers

Online cash register. The new procedure for using cash registers obliges the use of only online cash registers for cash payments. There is no need to explain to anyone what online is – these are activities or operations carried out in real time via the Internet.

Old-style devices that work with EKLZ (electronic control tape protected) can only accumulate sales data in their fiscal devices. Between the seller working on a new type of cash register and the tax office there will be an intermediary - a fiscal data operator (FDO). This is a specialized commercial organization that has qualified personnel and the necessary technical conditions for receiving and transmitting data in electronic form.

When conducting an online sale, the cash register sends a request to the fiscal data operator, who accepts it, creates a fiscal sign for the cash register receipt and confirms acceptance of the data. Without confirmation from the OFD, a receipt will not be generated and the purchase will not take place. Then the operator transmits systematized information about the payments made to the tax office, where they are stored. It is expected that the sales process will last only one and a half to two seconds longer than it does now.

How an online cash register works

Approximately according to this principle, when selling alcohol, cash registers connected to the Unified State Automated Information System already operate.

A special device similarly transmits a request via the Internet to confirm the legal origin of each bottle and receives permission to sell or refuse if the alcohol is adulterated.

Cash desk service procedure

The new act on cash registers abolished the obligation to periodically check and service new devices in specialized workshops.

After purchasing an online cash register, the owner himself makes the decision to call a specialist for the purpose of carrying out preventive maintenance or carrying out repairs. It is expected that such functions will continue to be performed by maintenance centers.

Also, the new law abolished the obligation for centers to register with the Federal Tax Service when performing repair or maintenance work on cash registers. It is planned that thanks to this, new specialists and companies will come to the industry.

Due to the abolition of mandatory maintenance, CCP owners now have the opportunity to choose:

- Sign a long-term contract with the service center;

- Involve center specialists only if a cash register malfunction occurs;

- Hire craftsmen who do not work in cash register service centers, but have all the necessary knowledge to repair a cash register;

- If the company has a lot of new devices, then you can add a separate specialist to your staff who will repair and maintain cash registers.

You might be interested in:

Fiscal data operator: 2021 list, how to choose

What caused the transition to new cash registers?

The initiative to switch to new cash registers from 2021 belongs to the Federal Tax Service. Tax authorities consider the main advantages of innovations to be:

- Transparent accounting of sellers' income;

- Increase in tax revenues;

- Reducing the number of inspections;

- Obtaining additional opportunities for consumers to protect their rights.

The introduction of online cash registers began as an experiment conducted by the Federal Tax Service in Moscow, Tatarstan, Moscow and Kaluga regions for six months, starting in August 2014. Although just over 3 thousand cash register units were tested as part of the experiment, the organizers concluded that the idea was viable and proposed to implement it at the legislative level.

The bill twice received a negative opinion from the Ministry of Economic Development, and business has repeatedly opposed the introduction of innovation funds. As a temporary concession, the tax authorities decided to introduce new cash registers in 2021, and not in 2021, as originally planned. As a result, the law was adopted in the third reading on June 14, 2021 under No. 290-FZ and it is now in force throughout the Russian Federation.

How to register an online cash register with the tax office

IMPLEMENTATION TIMELINE

| from 02/01/2017 Registration of cash registers only with data transfer to the Federal Tax Service; Mandatory data transfer through the OFD; Installation of a new EKLZ is prohibited, only the fiscal drive can be used until 07/01/2017 Mandatory data transfer for all cash registers; The use of cash registers according to the old procedure has been DISCONTINUED >>> From the moment the Law comes into force, voluntary registration and use of new and modernized cash registers begins from 07/01/2017 Mandatory transfer of data for individual entrepreneurs with PSN, organizations providing services to the public, as well as those who are not currently applies the cash register from 07/01/2018 In case of non-use of the cash register, the cash register does not meet the requirements / documents were not provided to the Federal Tax Service / Violation of the cash register deadlines Failure to issue a paper/electronic check to the buyer) |

Who should switch to the new CCP

And now more about who should install a new CCP in 2017. The answer to this question depends on what tax regime the seller operates in, what goods and under what conditions he trades.

Payers of the simplified tax system, OSNO, unified agricultural tax

From July 1, 2021, to switch to the new cash register system . These taxpayers still use cash registers, so this requirement will not be news to them. Registration of old-style cash registers ceases from February 1 and until July 1, 2021, all sellers already working with a cash register must upgrade their equipment or purchase new ones.

Entrepreneurs on UTII and PSN

Payers of UTII and PSN, who are not yet required to issue cash receipts, will need an online cash register from July 1, 2018 , so they have another year and a half left. During the same period, the issuance of strict reporting forms (SRB) of a printed sample when providing services to the public is stopped. From now on, BSO must be issued using a new automated system, which is also considered cash register equipment.

In total, the latest news about the timing of the introduction of new cash registers from 2021 can be summarized in the following table.

| Taxpayer category | Deadline for switching to a new CCP |

| Working for the simplified tax system, OSNO, unified agricultural tax | July 1, 2021 |

| Working on UTII and PSN | July 1, 2021 |

| Providing services to the population in any mode | July 1, 2021 |

The list of those who will not need cash registers for retail sales from 2021 has been significantly reduced. Thus, those selling at markets are removed from it if the goods are included in the list prepared by the Government of the Russian Federation (carpets, clothing, shoes, furniture, rubber and plastic products, etc.). So far, only a draft Resolution has been developed, but there is a high probability that it will be adopted.

The list of situations in which online cash registers are not used since 2021 is given in the latest version of Article 2 of Law No. 54-FZ dated May 22, 2003 (for a complete list, please refer to the source):

- Sales of printed materials in kiosks, if they account for at least half of the turnover;

- Sale of securities, tickets and coupons for travel on public transport, provided that they are sold directly in the vehicle;

- Catering services in educational institutions during school hours;

- Trade at fairs, retail markets, exhibitions at some retail locations (except for shops, auto shops, containers, pavilions, kiosks, tents);

- Sales of ice cream and soft drinks by the glass;

- Trade from tanker trucks with milk, kvass, vegetable oil, live fish, kerosene;

- Sale of vegetables, fruits, melons in season;

- Retail trade, except for goods requiring special storage and sale conditions;

- Sales of folk art products by the manufacturer themselves;

- Shoe repair and painting;

- Manufacturing and repair of metal haberdashery and keys;

- Rural pharmacies.

In addition, cash registers will not be required from 2021 for merchants conducting cash payments in remote or hard-to-reach areas where there are problems with Internet connection. The list of such settlements is approved by regional authorities, and cities, regional centers, and urban-type settlements cannot be included in it.

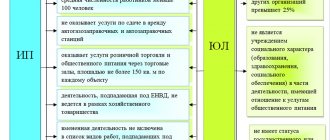

WHO DOES THE CHANGES AFFECT?

KKT USERS | SELLERS OF EXCISE GOODS | SERVICES TO THE PUBLIC | ONLINE STORES |

| Organizations that pay customers using cash register systems | Alcohol, cars, cigarettes, gold, gasoline, fuels and lubricants | Organizations operating under UTII or the patent system | Distance trading through an online store |

How much do new cash registers cost?

The latest news reports that innovative devices capable of transmitting sales information in real time cost from 25 to 45 thousand rubles. If you already have an existing cash register, then some of their models can be upgraded, then it will cost 5-10 thousand rubles. Special software also costs money - from 5 thousand rubles.

In addition, constant stable Internet connection and services of a fiscal data operator will require expenses. It is easy to calculate that starting from 2021, the minimum costs for operating new equipment will be more than 20 thousand rubles per device per year, and even then, if you do not buy it, but upgrade the existing one.

| Expenses | Price |

| Modernization of cash register machines | from 5 to 10 thousand rubles. |

| Purchase of new equipment | from 25 to 45 thousand rubles. |

| Software | from 5 thousand rub. |

| Internet connection for a year | from 5 thousand rub. |

| OFD services for the first year | from 3 thousand rub. |

CCP and OFD registers

The Federal Tax Service website has a special section dedicated specifically to online cash registers. We recommend that you familiarize yourself with its contents, you can find a lot of useful information there. For example, check the presence of a cash register in the register of cash registers that meets the new rules and is approved for use, and also look at the list of accredited OFDs in order to choose the operator that is suitable for you.

Here is a list of these services with links:

- CCP register;

- Register of fiscal drives;

- OFD register.

With their help, you can check the accuracy of the information provided to you by sellers of cash register equipment and companies offering OFD services, so as not to run into unscrupulous counterparties.

Administrative sanctions

From 2021, higher fines are imposed on violators of the law “On CCP” under Article 14.5 of the Code of Administrative Offenses of the Russian Federation. Individual entrepreneurs are fined less than organizations, but these are significant losses for small businesses:

- Failure to use a cash register when it is required – from ¼ to ½ of the purchase amount, but not less than 10 thousand rubles;

- Repeated violation, if the cash register was not used for a purchase amount of more than 1 million rubles, – suspension of the activities of the individual entrepreneur for a period of up to 90 days;

- The use of old-style devices, as well as violation of the procedure for their registration/re-registration, threatens with a fine of 1.5 to 3 thousand rubles, but can be replaced with a warning for the first time;

- For failure to issue a paper check or refusal to send an electronic check to the buyer - a warning or a fine of 2 thousand rubles.

Let's summarize - who should switch to new cash registers from 2021 and how to do it :

- Starting from 2021, online cash registers should only be used by individual entrepreneurs using the simplified tax system, OSNO, and unified agricultural taxes.

- Order No. 616 of the Ministry of Telecom and Mass Communications of Russia dated December 5, 2021 allows the use of old cash register models in settlements with a population of up to 10,000 people instead of online cash registers. Some models of existing devices can be upgraded by replacing the fiscal drive and installing software. You can find out about this from the manufacturer or fiscal data operator. If upgrading your model is allowed, then by July 1 of next year you must re-register your cash register with your tax office.

- You can purchase online cash registers only from the list on the Federal Tax Service website.

- Before registering new equipment or re-registering old equipment, you must enter into an agreement with the fiscal data operator. Select OFD only from the official list.

- Payers of UTII and PSN, as well as those who provide services to the population in any mode with the issuance of BSO, will switch to issuing cash receipts only from July 1, 2021.

- From March 31, 2021, all beer sellers in any mode, including in public catering, are required to use a cash register. The requirement is established by Law No. 261-FZ of July 3, 2021.

- An innovation for online stores - from July 1, 2021, they will have to use cash registers for remote payments when paying by card on the website and through services such as Yandex Cashier.

How to register a cash register for an individual entrepreneur

What should the cash register of an individual entrepreneur be in 2021? The old-style cash register provided for the fiscalization of information through EKLZ by collecting data from the seller. New online models are equipped with an improved device - a fiscal information storage device and have Internet access. At the same time, to transfer data to the Federal Tax Service, there is a special organization between the tax inspectorate and the seller - OFD (fiscal data operator), with the help of which all information about cash payments with clients is promptly received by the control authorities.

We figured out whether an individual entrepreneur should have a cash register. How to register the device with the tax office if an online cash register is a necessity?

Buying an online cash register

Before you buy new equipment, make sure that you cannot upgrade the old one. For clarification, you can contact the cash register supplier directly with a question about the possibility of improving the cash register. When modernization is permissible, the device must be deregistered with the Federal Tax Service and transferred to the manufacturer to perform a set of works. The cost of such a service will certainly be cheaper for the individual entrepreneur than purchasing a new electronic cash register. The approximate average price of modernization work ranges from 5 to 10,000 rubles. At the same time, the cost of purchasing a new cash register will be 15,000-30,000 rubles.

Note! You need to purchase new online cash registers only from the list approved by the Federal Tax Service, posted on the tax service website. If the selling company is not on the official list, you should not enter into an agreement with such a company due to violation of legal requirements.

Selecting OFD

After the individual entrepreneur has purchased an online cash register, you should select the OFD through which information about sales will be transmitted to the Federal Tax Service. Like cash register suppliers, you should choose an operator exclusively from the official list. The main guideline when choosing is the cost of service, as well as the availability of additional services, for example, online registration of changes, including deregistration of cash registers. The average service price for the first year is 3,000 rubles, in subsequent years - about 12,000 rubles. annually. Additionally, you will need an Internet connection, the cost of which will be about another 6,000 rubles. in year.

Registration of cash register with the tax office

Does an individual entrepreneur need to register a cash register with the Federal Tax Service? Of course, such registration of cash register is necessary. This can be done through your OFD or independently. In the first case, you will need to pay for an additional service - about 2000-3000 rubles. In the second, you can act independently through the official website of the Federal Tax Service; the necessary condition is the presence of an enhanced digital signature (electronic digital signature). If the signature is not completed, you will not be able to register an online cash register via the Internet yourself.

What does the process of registering an online cash register with the Federal Tax Service include:

- An application of the established form is submitted - through the website of the Federal Tax Service or your OFD, with which an agreement for the provision of services has been previously concluded. Additionally, a registration certificate, copies of conclusions and other documents at the request of the tax inspectorate are attached confirming the KKM’s compliance with regulatory requirements.

- Within one working day, the Federal Tax Service informs the applicant of the registration number of the cash register: the data is entered into the Federal Tax Service (fiscal drive) along with the name of the individual entrepreneur.

- Registration of the cash register is carried out by an inspector of the Federal Tax Service within 5 days from the date of filing the application - after which the data on the cash register is entered into the cash register registration card, which is redirected to the entrepreneur and serves as official confirmation of the registration of the cash register for tax purposes.