Interest-free loans are fairly common ways to lend a certain amount of money. They can be carried out between individuals or different companies. In this case, a corresponding agreement is created, which is a guarantee of the return of funds. Borrowing money using this method is quite easy. However, the material benefit of an interest-free loan must be determined, which is calculated quite simply.

The fact is that even for an interest-free loan a rate can be set; it usually takes into account the level of inflation. But most often the interest rate is approximately 2/3 lower than the refinancing rate. In this case, the borrower receives a benefit represented by unpaid interest on the use of borrowed funds. This income is subject to taxation, so it is important to correctly calculate the material benefit, determine the amount of tax, and also pay it to the tax authorities.

Getting an interest-free loan

Before calculating what material benefits will come from this type of financing, you need to understand the concept itself. As a rule, lenders issue money at a certain percentage, that is, by taking a certain amount of money for a certain period, the borrower returns it, adding accrued interest for use. Alternatively, the parties can agree on a gratuitous loan, that is, the amount is returned to the lender, no additional payments are required from the borrower.

In this case, the agreement concluded by the parties must stipulate the benefits of both parties - no interest for the borrower and a refund in full for the lender. As for such an issue as material benefit, this is additional income received by the lender (legal entity) after providing finance to the borrower, or interest manipulation for an individual.

When does material gain arise?

The very concept of an interest-free loan can imply different interpretations. The agreement to provide third-party financing may not specify interest, but the lender can legally receive the money due for the fact that the borrower used its finances:

- the interest rate is not specified in the contract;

- the agreement and laws of the Russian Federation imply the collection of interest equal to the refinancing rate adopted by the Central Bank;

- at the end of the agreement, the loan amount is returned in full along with accrued interest.

In this case, the lender, especially when it comes to a legal entity, receives income, which is considered as a material income received from an interest-free loan. According to the country's tax laws, the lender is required to report the income received. It would be useful to use a calculator if the material benefit from an interest-free loan is not a constant source of income for the lender.

There are several important points regarding the concept of “material benefit”. For an interest-free loan, it is calculated taking into account the following conditions:

- material benefit is a deduction paid exclusively by residents of the Russian Federation;

- considered only in the case of loans of a monetary nature;

- issues arising during registration and calculation are regulated by the Tax Code.

As for the material benefits received by individual borrowers, the legislation also takes into account various cases. When it comes to purchasing real estate, tax legislation comes into force:

- the person saved on interest on the loan (credit) received, if the creditor is a legal entity;

- financial transactions of a fixed-term nature with the purchase of securities;

- purchase of goods and services from a creditor interdependent on the taxpayer.

The material benefit received by an individual from an interest-free loan must be taken into account in relations with the tax authority.

How does the loan interest calculator calculate?

The online calculator is adjusted to standard terms of service, as well as discounts, and calculates the total amount based on these data. The service operates automatically. To find out the interest on the loan agreement, you need to enter the following data:

- loan amount (in rubles);

- loan term (number of calendar days);

- percentage per day.

The resulting amount of financial costs for the full period can be seen in the final table form. The tool helps, without leaving home, to find out in a matter of seconds: the amount of daily payments, interest repayments, and the balance of the debt. As a result, you can save on this type of lending and not overpay.

The formula by which material benefits are calculated

With an interest-free loan, which in terms of significance can be classified as preferential, the benefit is calculated using a calculator that suggests using the formula existing in 2021. In general, preferential loans include those whose rate does not exceed the refinancing rate adopted by the Central Bank of the Russian Federation.

To determine the material benefit of an interest-free loan, we apply a simple calculation formula:

- two-thirds of the current refinancing rate is taken;

- is compared with the rate specified in the loan agreement;

- if the rate in the agreement is less than the obtained value calculated from the refinancing rate, the borrower receives a benefit.

The material benefit from an interest-free loan is calculated at the end of the agreement. All this time the refinancing rate is monitored. If we are talking about lending in national currency, then the agreed interest for the use of funds should not exceed 6.16% per annum. When an agreement is concluded using foreign currency, the specified rate should not exceed 9% per annum.

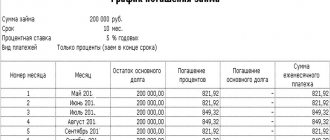

If the loan rate is much lower than two-thirds of the Central Bank refinancing rate, then such a loan interest rate is considered preferential. To better understand the situation, let’s look at the manipulations using a specific example:

- the enterprise enters into an interest-free loan agreement with a person in the amount of two hundred thousand rubles;

- the agreement is valid for one calendar year;

- both parties agreed that the borrower would pay quarterly a quarter of the requested amount to the lender.

In this case, there is a material benefit from an interest-free loan. It is calculated as follows. A quarterly payment of fifty thousand rubles is multiplied with the refinancing rate (6.16% per annum) and a component representing the ratio of a conditional quarter (90 days) to a calendar year (366 days).

As a result of the calculation, the amount of seven hundred fifty-seven rubles is obtained, which is recorded as the material benefit received by the borrower (individual) from an interest-free loan. Income tax is calculated from the amount received, which is paid no later than July of the following year.

Formula and examples

A material benefit is stated when the interest rate established for the use of loan amounts is less than the current refinancing rate.

To calculate the tax base for material benefits, you need to track information from the Central Bank.

| date | Key rate (CB) | Arithmetic operation | Final bid |

| 14.09.2012 | 8,25% | 8.25*two thirds | 5,5% |

| 01.01.2016 | 11% | 11*two thirds | 7,33% |

| 14.06.2016 | 10,5% | 10.5*two thirds | 7% |

Accordingly, the obligation to pay does not always arise. It is valid when the interest stated in the agreement is less than or equal to the last column with examples. Of course, when reproducing arithmetic operations, you need to take into account the date of payment of the loan portion. The key rate is taken to be current, according to the Central Bank.

To calculate the exact income from material benefits, to find the exact values, you must use the formula:

Tax base = key rate * 2/3 * debt amount * capitalized interest.

Material benefits arising from various transactions

When two people agree among themselves to provide an interest-free loan, simply put, they borrow money without requiring interest - even in this case, a material benefit arises. Thus, a number of factors need to be taken into account:

- when the debt is repaid in parts, the material benefit is also calculated in parts, on the day of repayment;

- the material benefit is calculated based on the refinancing rate and the term of the agreement;

- if we are talking about a loan for the purchase of real estate, the state provides a tax deduction and material benefits are not considered.

If an interest-free loan agreement is concluded between legal entities, there is not a material benefit, but an economic one. The amounts included in the agreement are not taken into account for tax purposes as income received. Transferring funds in this manner is quite beneficial for companies and enterprises.

What it is

The material benefit from an interest-free loan or a loan with a low interest rate is defined as a special type of income. They talk about it in cases where a citizen of the Russian Federation (an organization registered on the territory of the Russian Federation) receives “free” services from partners, acquaintances, relatives, and work colleagues.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Moscow)

+7 (Saint Petersburg)

8 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Under normal circumstances, these events would have been organized at a high cost and at a higher interest rate.

Article 212 of the Tax Code of the Russian Federation lists three ways for a taxpayer to obtain material goods at a low cost.

This includes:

- savings on low interest rates when concluding a loan agreement that is beneficial for the borrower;

- purchasing goods and services at low prices from related parties;

- purchase of securities.

Income of individuals

The borrower has a material benefit from saving on interest payments when he enters into an interest-free loan agreement. Accordingly, he falls under the watchful eye of the tax authorities, who are required to report on income. If, in the standard sense, the income of an individual is burdened with a rate of thirteen percent, then when a material benefit arises, other calculations are used:

- material benefits from an interest-free loan are subject to a rate of thirty-five percent of the amount received for residents of the Russian Federation;

- citizens who are not residents of the Russian Federation are calculated using a lower rate - thirty percent.

When the agreement involves a lump sum payment to repay the borrowed funds, then the calculation of the material benefit occurs at the end of the agreement. If the calculation is carried out in several stages, then the material benefit from the interest-free loan is calculated based on the payment schedule.

A borrower (an individual) who has entered into an agreement for an interest-free loan with the company in which he works does not have to worry about the tax side of the transaction - in this case, the employer ensures the timely calculation and payment of taxes to the budget. In other cases, the borrower is obliged to calculate the material benefit received from the interest-free loan and pay the corresponding financial burden.

When we are talking about a long term interest-free loan, up to several years, the benefit is calculated annually and income taxes are paid no later than April thirtieth of the year following the reporting year. It is worth remembering that pension and insurance contributions have nothing to do with material benefits.

Calculation rules

To calculate the material benefit of an interest-free loan, a standard formula is used. It arises from the day when interest is paid under the contract in accordance with preferential terms. If an agreement is concluded under which there is no interest, then the benefit is usually formed on the day the debt is repaid. However, in NK there is no such rigid concept. Therefore, one of the following days is selected:

- the moment of repayment of the loan, both in full and in part;

- every day during the term of the contract;

- last day of validity of the document;

- the last day of a certain period.

Moreover, for each option it is important to carry out the calculation correctly, since each method has its own characteristics. The most commonly used formula is that the calculation is based on the full repayment of the loan. To do this, it is important to know what the refinancing rate is on a specific day when the benefit is calculated. If partial payments are made, then a separate indicator is calculated for each deposit of funds.

How to calculate the benefit is a very logical question. To do this, it is considered optimal to use the following simple formula:

Мв = refinancing rate, which is the maximum * loan amount /365*.

Important! If the loan is repaid on the last day of lending, then the benefit is generated only in the month when the repayment is made, and therefore is accrued on the full amount of borrowed funds.

How is benefit determined under preferential conditions?

Determining the benefit is important not only for a completely interest-free loan, but also for a loan provided on preferential terms. In this case, it is important that the rate set for such a loan does not exceed 2/3 of the refinancing rate. The entire calculation is carried out in almost the same way as described above, but a slightly modified formula is used:

Мв = (refinancing rate, which is the maximum - loan rate) * loan amount / 365 * period of use of credit money in days.

Thus, it is very simple to calculate this indicator, both when using an interest-free loan and when using preferential lending.

Calculation features for loans issued in foreign currency

There are often situations when funds are lent without interest or at a small rate not in rubles, but in some currency. In the case when the rate is set for such a loan and does not exceed 9%, then the borrower certainly receives a benefit from which the tax is calculated. The borrower must pay it to the state. The legislation clearly states that income received in foreign currency must be converted into rubles at the exchange rate of the day on which the profit was received. In this situation, the debtor receives income on the day when he fully or partially repays the loan.

The calculation is carried out using a simple formula:

Мв = loan amount * exchange rate of the specific currency in which the loan was issued, and on the date when the loan was repaid * (9% - percentage of the loan) / 365 * period during which the borrower will use the loan funds.

If an interest-free agreement was drawn up at all, then the indicator will be calculated using a slightly modified formula:

Мв = loan amount * exchange rate of the specific currency in which the loan was issued, and on the date when the loan was repaid * 9% / 365 * period during which the borrower will use the loan funds.

Thus, after receiving the desired benefit, you can determine the amount of tax; it is equal to 35% of this indicator.

Benefits from buying a home

The legislation states that material benefits can only be calculated if funds are lent. If they are used to purchase or construct residential real estate, as well as to acquire a plot of land, then such loans are not subject to taxation.

However, the creditor must submit a special document to the inspectorate, according to which he has the right to expect to receive a deduction. The paper is formed in a special form approved at the legislative level, and is also submitted to the tax authorities without fail. Without this document, it will not be possible to prove that the loan was not monetary, so the tax office charges tax on the calculated material benefit.

Calculation rules in a situation where the lender is a company

Not only a private person, but also a legal entity can act as a creditor. Most often, different companies issue interest-free loans to their employees, and for this purpose interest may not be charged at all or a rate may be set that is significantly lower than bank interest. For this purpose, a corresponding agreement is also drawn up. The whole process occurs according to the following scheme:

- If a company has issued a loan to a private individual at a low rate, then the material benefit from the interest-free loan must be calculated. After calculating it, it is important to calculate the tax, and it is equal to 35% of the benefit. Most often, such a tax is calculated by the organization itself - the lender, after which the required amount of funds is deducted from the salary of the borrower employee.

When the borrower receives funds from the employer, the company automatically becomes his tax agent. In this case, it is obliged to independently calculate the material benefits of its employees, who take money from the employer on preferential terms. The amount of personal income tax is determined from the calculated amount, and the calculated funds are transferred to the budget.

- The benefit constantly arises when repaying a loan on which either preferential interest is charged or no rate is established at all. Payments can be monthly or one-time. Often, during one tax period, which is a calendar year, the borrower does not make any payments on the loan. Therefore, material benefits are not calculated this year, since they are absent.

- Most often, a company that provides loans to its employees independently calculates interest and also withholds personal income tax, for which a certain amount of money is taken from the employee’s official salary. In this case, the tax amount cannot exceed half of a citizen’s income.

- Since the employer acts as the tax agent of the borrower, he maintains records of all loans issued to each employee - for which a special tax register is used. This information is provided to the inspectorate within a certain time frame.

Features of issuing interest-free loans between companies

Borrowed funds are often provided to legal entities from other companies, and preferential conditions are used for this. For this purpose, an appropriate interest-free loan agreement is concluded between organizations. In this case, the company acting as a borrower may not pay tax, since it does not generate any material benefit.

This point is clearly stated in Chapter 25 of the Tax Code, since in this case all income on which tax is levied is listed. These do not include the material benefit that arises from receiving an interest-free loan or a loan with preferential terms, under which the rate is very low.

If a company that uses the UTII system in its work is a legal entity, then the tax is calculated depending on certain constant indicators, and the coefficients are set by regional authorities. However, even in such a situation, you cannot use material benefits to calculate tax.

A company acting as a lender is also not required by law to pay VAT when issuing borrowed funds to another organization. This is due to the fact that money issued and returned is not reflected as expenses or income.

If minimum interest is established under the agreement, then the funds received under it are classified as non-operating income.

Material benefit and its features

When concluding an interest-free loan agreement, it is worth remembering some nuances that require the borrower’s attention:

- material benefits from an interest-free loan are not calculated if the parties to the agreement are individuals;

- you don’t have to worry about tax deductions if an individual entrepreneur enters into an interest-free loan agreement with an ordinary citizen to provide funds, but they are not used in business activities;

- in other cases, it is necessary to monitor the value of the Central Bank refinancing rate, in relation to which the calculation is made.

As can be seen from the above, it is very profitable to enter into interest-free loan agreements between companies. In this case, material benefit as such does not appear. Calculating material benefits, if necessary, is quite easy. When using an interest-free loan in 2021, take the simplest formula or a ready-made calculator that uses it.