- home

- Investments

Anastasia Osipova

Updated: February 3, 2021

0

Article navigation

- Long-term investments in accounting

- Regulations on accounting for long-term investments

- Accounting for long-term investments: postings

- Typical wiring

- Organization and procedure for accounting for long-term investments

Long-term investments are the company's costs for the creation and acquisition of non-current durable assets that are not intended for sale. As sources of their financing, the enterprise’s own funds (net profit, amortization of intangible assets) and attracted funds (bank loans, borrowed funds from other organizations, targeted financing from the state budget, etc.) can be used.

In accounting, financial investments are considered as an independent object along with fixed assets and intangible assets. This approach is associated with the concept of separating costs between the company’s current activities and investments. The main purpose of accounting is to fully reflect information about long-term investments. If we consider the accounting of financial investments briefly, we can say that this is an influx of new capital in the reporting year.

What is investment in fixed capital

Investments in fixed capital are understood (section II of Rosstat order No. 746 dated November 25, 2016):

- costs of creation, reconstruction (modernization) of facilities, purchase of machinery, equipment, inventory, classified from an accounting point of view as non-current assets;

- investments in intellectual property;

- investments in biological resources.

Investments in fixed capital can be made both at the expense of one’s own funds and at the expense of borrowed (or received as assistance) funds, within the framework of exchange agreements and equity participation agreements.

Investments in fixed capital do not include the cost of acquiring assets whose price is less than 40,000 rubles, except for cases when these assets are reflected in accounting as fixed assets.

The following are not recognized as investments in the fixed capital of an organization:

- purchase of fixed assets that were previously on the balance sheet of third-party organizations;

- costs of purchasing apartments in multi-apartment residential buildings;

- purchase of land plots, environmental management facilities;

- concluding lease agreements, purchasing licenses, purchasing goodwill, marketing connections (related to non-produced assets in accordance with the system of national accounts).

A synonym for the concept of “investment in fixed capital” is “capital investments” (Article 1 of the Law “On Investment Activities” dated February 25, 1999 No. 39-FZ).

It should be noted that investments in fixed assets (as opposed to, in fact, fixed capital) are outside the jurisdiction of the main sources of law governing the accounting of fixed assets - Order of the Ministry of Finance dated October 13, 2003 No. 91n, as well as PBU 6/01. What rules of law should be considered as guiding principles when accounting for capital investments?

For what purposes are funds invested?

Investments are usually made on:

- capital construction of fixed assets, expansion of the area of an already constructed facility, changes in building structures or its technical re-equipment;

- acquisition of buildings, equipment, inventory, etc.;

- creation or purchase of intangible assets;

- acquisition of land and environmental management facilities;

- carrying out research work;

- acquisition of securities (securities).

Objects of long-term investment are purchased, built or modernized fixed assets and intangible assets, as well as some types of livestock (in agriculture). Capital investments are the most important element of their reproduction, and since the process of forming or creating an object is often extended over time, it is necessary to correctly take into account costs.

Accounting for long-term investments is regulated by special Regulation No. 160, approved by the Ministry of Finance of the Russian Federation on December 30, 1993. It presents a list of possible areas of capital investment and defines the organization of accounting for long-term investments. Separate sections of this PBU are devoted to the specifics of accounting for the costs of construction and acquisition of fixed assets, as well as the formation of their inventory value.

Investments for the long term also include investments by companies in the authorized capital of third-party organizations, in joint participation in their activities, the purchase of securities, the issuance of interest-bearing loans and other similar expenses. Accounting for such long-term financial investments is regulated by PBU 19/02 “Accounting for Financial Investments”.

Accounting for investments in fixed assets: basic regulatory standards

The legislator's main attention is paid to accounting for the results of investments - directly the fixed capital listed on the organization's balance sheet. As soon as fixed capital is formed and reflected in accounting at its original cost, it already falls under the jurisdiction of the specified rules of law - order No. 91n and PBU 6/01.

Until the moment an object of fixed assets is registered, an accountant can legally be guided by only one source of law - Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, which introduces charts of accounts used by private enterprises.

How to account for investments in fixed capital according to Order No. 94n (on accounting accounts)

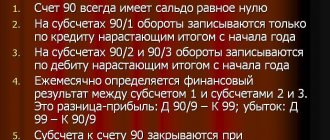

The order in question introduces account 08 “Investments in non-current assets”, which can be legally used to reflect investments on the balance sheet of an enterprise as accounting objects. But as soon as the result of these investments is the manufacture or acquisition of a fixed asset, its accounting is kept in another account - 01 “Fixed Assets”, and this accounting is regulated, as we noted above, by the norms of Order No. 91n and PBU 6/01.

Account 08 “Investments in non-current assets” can reflect costs incurred from any sources of financing:

- own;

- borrowed;

- allocated from the budget.

Account 08 reflects the costs of creating, modernizing, as well as maintaining the enterprise’s capacities, purchasing equipment, machinery and other production and non-production fixed assets.

This is evidenced by the provisions of clause 1.2.1 of the Recommendations for accounting in agricultural cooperatives, approved by the Ministry of Agriculture of Russia on January 25, 2001. Based on the principle of legal analogy, due to the absence of other industry norms, this formulation can also be applied to enterprises in other areas not related to agriculture.

An enterprise, when accounting for investments in fixed assets, can open various sub-accounts to account 08 if necessary. For example, if capital investments are made in the independent production of an asset, then subaccount 08.03 “Construction of fixed assets” can be used. If an asset is purchased, subaccount 08.04 “Purchase of fixed assets” is used.

Account 08 of the Chart of Accounts is rightfully classified as active. That is, its debit reflects directly investments in working capital, and its credit reflects the write-off of the enterprise’s costs in the process of capitalizing certain assets. The entries in this account reflect the monetary value of business transactions on an accrual basis from the beginning of the reporting year.

In what cases are investments in non-current assets subject to property tax, ConsultantPlus experts explained. Get trial access to the K+ system and go to the Tax Guide for free.

Let us now study the nuances of accounting for investments in fixed assets using the specified account and its subaccounts in more detail.

Investments in OS can be made in the form of:

- investments in independent production of funds;

- investments in the production of funds using contractors;

- purchases of ready-made funds.

VAT on acquired long-term investments

In order to deduct VAT on purchased non-current assets, the following conditions must be met:

- the object will be used for transactions subject to VAT, otherwise the amount of VAT will be included in the cost of the object (when used in both taxable and non-VAT taxable transactions, it is necessary to divide the amount of tax into that accepted for deduction and included in the cost of the object);

- Availability of supplier invoice;

- the object is written off from account 08 to the accounts of fixed assets and intangible assets.

According to paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, deductions of tax amounts presented by sellers to the taxpayer upon acquisition or paid upon import into the territory of Russia of fixed assets, equipment for installation, and intangible assets are made in full after registration.

The Tax Code does not explain in which account non-current assets should be accounted for at the time of deduction - on account 08 or on accounts 01,03,04, that is, when the objects are completely ready for use. There are two opposing expert opinions and court decisions. The official position of the Ministry of Finance is that VAT can be deducted only after writing off objects from account 08 and reflecting them on accounts 01,03,04. The choice is up to the accountant.

For information on how to take VAT into account for deduction during construction, read the article about capital construction.

Accounting for capital investments on account 08: OS production

Accounting for funds produced by an enterprise independently in an economic way is carried out during the following business transactions:

1. Payment of wages to employees involved in the production of fixed assets. This payment is made by posting:

Dt 08.03 Kt 70 - the accrual of the actual salary is reflected;

Dt 08.03 Kt 69.01 (02, 03, 04) - the accrual of contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, and the Federal Compulsory Medical Insurance Fund is reflected on wages.

2. Acceptance of equipment into the production workshop for the purpose of installing it on the fixed asset facility being created. This operation is reflected in the register using the following entries:

Dt 08.03 Ct 07.

3. Acceptance of materials into the production workshop for the purpose of their use in the creation of fixed assets. The following correspondence applies here:

Dt 08.03 Kt 10.

4. Implementation of other expenses not classified within the above operations, but directly related to the creation of an item of fixed assets, which characterize the corresponding operations. For example, these may be costs associated with paying for the services of transport companies. They are reflected in the registers by posting:

Dt 03/08 Kt 60.

Thus, the main accounting objects within the framework of investing in fixed assets will be:

- expenses for labor, equipment, materials;

- expenses for third party services.

In turn, if an enterprise, investing in the production of fixed assets, attracts contractors, then the cost of work performed by these contractors (excluding VAT) is reflected in the debit of account 08 and the credit of account 60. VAT is reflected in the debit of account 19.01.

Another way to invest in OS is to purchase ready-made assets.

Features of accounting for initial placement and redemption of shares

Let's look at the features of accounting for primary placement transactions in the table:

| № | Contents of operation | Account correspondence | |

| Debit | Credit | ||

| 1 | Investors' funds were received as payment for investment shares | 51 “Current account” | 86 “Targeted financing” (sub-account “Investment shares”) |

| Accounting for the sub-account “Investment units” is carried out with each issue of investment units and for each investor separately | |||

| 2 | Redemption of investment units by a company | 86 “Targeted financing” (sub-account “Investment shares”) | 51 “Current account”. |

Accounting for capital investments: purchasing OS

Business transactions that characterize this option for investing in fixed assets are reflected on almost the same principle as in the case of registration of transactions involving the services of contractors during the construction of fixed assets. That is, provided:

- reflecting expenses for the purchase of fixed assets in the debit of account 08 and the credit of account 60;

- when accounting for VAT on the debit of account 19.01.

In addition, if additional spare parts and tools are supplied to fixed assets, their cost can be reflected in the debit of account 10.05. If necessary, other subaccounts of account 10 can be used. For example, subaccount 10.03, if gasoline is supplied along with the fixed asset represented by a car. Or - subaccount 10.09, if the main asset, for example represented by a tractor, is also supplied with agricultural implements (mowers, winnowers).

Fixed assets are accepted for operation at the generated initial cost, and the corresponding business transaction is reflected by posting Dt 01 KT 08. After this, the enterprise accounts for the fixed asset accepted on the balance sheet according to the standards established by the above federal regulations.

You can learn more about the features of accounting using postings to account 08 in the article “08 accounting account (nuances)” .

Features of accounting for costs incurred by the management company

Cost accounting is reflected in the following entries:

| № | Contents of operation | Account correspondence | |

| Debit | Credit | ||

| 1 | Remunerations were accrued in the accounting records of the management company | 76 “Settlements with various debtors and creditors” | 90.1 "Sales" |

| 2 | The accounting records the receipt of remuneration | 51 “Current account” | 76 “Settlements with various debtors and creditors” |

| 3 | Expenses accumulated on account 26 “General business expenses” (advertising expenses, travel expenses associated with the management of mutual funds, etc.) are written off as a cost reduction to reduce revenue | 90.2 “Cost of sales” | 26 “General business expenses” |

| 4* | The financial result from the activities of the management company is written off to account 99 “Profits and losses” | 90.9 “Profit (loss) from sales” | 99 "Profits and losses." |

| Peculiarity | At the end of each month, the financial result must be calculated, which is determined by comparing the turnover in account 90.1 “Revenue” (credit turnover) and the total debit turnover. This is followed by point 4*. | ||

Results

Investing in fixed assets (making capital investments) refers to the process in which an enterprise invests capital in the creation, modernization or purchase of fixed assets. Before this object is accepted on the balance sheet, account 08 is used to account for investment in it. Afterwards, accounting for the fixed assets object is carried out using account 01 (in accordance with the norms of PBU 06/01 and corresponding sources of law).

You can get acquainted with other facts about the capital investments of the enterprise in the articles:

- “Capital investments in accounting are...”;

- “Formula for calculating specific capital investments (nuances)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of accounting for costs incurred by mutual investment funds"

The procedure for accounting for costs is given below:

| № | Contents of operation | Account correspondence | |

| Debit | Credit | ||

| 1 | The accounting records reflect a reserve for payment of management costs (sub-account “Investment shares”) | 96 “Reserves for future expenses” (sub-account “Reserve for payment of services of the management company and other persons”) | |

| 2 | The amount of the accrued reserve was written off to reimburse the cost of costs and remuneration for the management company (according to the Mutual Fund Rules) | 96 “Reserves for future expenses” (sub-account “Reserve for payment of services of the management company and other persons”) | 76 “Settlements with various debtors and creditors” |

| 3 | The amount of payments for expenses is reflected | 76 “Settlements with various debtors and creditors” | 51 “Current account” |

| 4 | The reversal of excessively accrued amounts for cost items (necessary for managing the property of mutual funds) is reflected. | 86 “Targeted financing” (sub-account “Investment shares”) | 96 “Reserves for future expenses” (sub-account “Reserve for payment of services of the management company and other persons”) |

If actual expenses for cost items exceed the amount of contributions to the reserve, then the difference in this excess will be reflected in the costs of the management company.