What is OKVED and who needs it

OKVED is a directory of codes, each of which corresponds to a specific type of activity. This directory was developed by the Ministry of Economic Development and is part of the standardization system of the Russian Federation (Rosstandart order “On the adoption and implementation of the All-Russian Classifier of Types of Economic Activities OK 029-2014” dated January 31, 2014 No. 14-st).

Each enterprise or individual entrepreneur is obliged to correctly code its activities when registering for tax purposes. These codes help tax authorities systematize your activities. And the FSS, based on the main OKVED, assigns a contribution rate for injuries.

About this, see: “Do not confuse the FSS with unnecessary OKVED!”.

Also, using the OKVED code, you can determine whether your activity is licensed or not.

Read about this in the articles:

- “The procedure for licensing educational activities”;

- “Who needs a license to practice medicine.”

The OKVED code can consist of 2, 3, 4, 5 and 6 characters (ХХ.ХХ.ХХ):

1, 2 - class;

3 - subclass;

4 - group;

5 - subgroup;

6 - view.

When registering, you must specify a code of at least 4 characters. You also have the right to indicate several codes in case you work in different areas. The code for the main activity is written first.

In the process of work, you have the right to change or supplement your OKVED codes.

When and how you can change OKVED codes, read:

- “How to change or add the main activity of an LLC?”;

- “Changing the OKVED ID of a legal entity - step-by-step instructions.”

See also: “Activities under OKVED not specified during registration: consequences.”

Changes and additions to OKVED

Algorithm of actions when changing OKVED

This procedure is done free of charge, without duties or fees. But it will require a huge amount of paperwork. Namely, you will have to refill a number of documents in form P14001:

- 1 page. In the 2nd paragraph, indicate the number 1 (since information about the legal entity changes), and also make the necessary changes to paragraphs 1.1, 1.2, 1.3, 2.

- Page 1 sheet N. A new code is entered in paragraph 1.1.

- Page 2 sheet N. The old code is indicated in paragraph 2.1, it must be the same as indicated in the Unified State Register of Legal Entities. There is no need to fill out anything else on sheets N.

- Pages 1 to 4 in sheets R. Filled out in accordance with the new forms of registration of legal entities indicating the new codes.

The code numbers in the application are written from left to right, each number in a separate cell. The completed application will be on 7 sheets. Then, with the documents and details of the company, you need to contact a notary office, then the Federal Tax Service.

A similar application will be filled out to add code, change it and delete it. The last two actions can be performed independently or through special organizations that provide such services.

What OKVED is required for online stores?

The operating conditions for an online store are the same as for a physical store. Keep this in mind. Therefore, it is necessary to obtain a special code. It is listed as a separate organization, has employees, and pays taxes.

The code for retail trade is indicated if the store has opened recently and is sold online.

If delivery is carried out to the buyer, then it is necessary to obtain a code corresponding to the parcel trade.

When subsequently opening a physical store corresponding to an online store, it is necessary to enter a new OKVED corresponding to sales. And if such an activity is your main one, then the code for the main activity profile will need to be replaced.

We select OKVED agent services

For agency services, the OKVED code is selected depending on the specific type of intermediary services provided by the enterprise or individual entrepreneur.

The further procedure will be as follows. We determine what activities in our company will be the main one. And we begin to carefully read the directory, in it we first look for a complete match with the name of our services.

Let's take a closer look at several sections of the reference book.

In section G “Wholesale and retail trade; repair of motor vehicles and motorcycles” paragraphs 45, 46, 47 refer to the services of agents in the field of wholesale and retail trade, as well as services related to motor vehicles.

For example, code 46.11 “Activities of agents in the wholesale trade of agricultural raw materials, live animals, textile raw materials and semi-finished products” is suitable for agents whose activities are related to agriculture.

You will learn which OKVED code you need to use when renting non-residential premises or vehicles from the articles:

- “Used OKVED when leasing vehicles”;

- "OKVED codes - rental of non-residential premises."

If nothing suitable is found, then you can subsume the declared activity under the “other services” section.

Agency services also include codes from sections S “Provision of other types” and N “Administrative activities and related additional services”.

OKVED - agency services for finding clients

Let us dwell in more detail on the provision of services for finding clients in areas not related to trade. In our time of fierce competition, this service has become very in demand.

Unfortunately, after reviewing the entire collection of OKVED, it is not possible to select a code with exactly this name. But there's nothing wrong with that. There are general purpose codes for such situations.

For this activity, it would be correct to use code 82.99, specified in section N “Administrative activities and related additional services.”

The code has the following decoding:

- clause 82 - administrative and economic activities, support activities to ensure the functioning of the organization, activities to provide other support services for business;

- subclause 99 - activities related to the provision of other support services for business, not included in other groups.

Results

Having considered what OKVED is, we can say that choosing the correct code will not be very difficult; the main thing is to carefully read the reference book itself. In this case, for agent services for finding clients, there is no exact match in the directory, and we can use the code 82.99. If you doubt the correctness of the selected code, you can always call the tax office and consult with them.

You can find the current reference book in the section “All-Russian classifiers assigned to the Ministry of Economic Development of Russia” on the website of the Ministry of Economic Development of Russia.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Intermediary and agency services: how to choose OKVED codes

An intermediary/agent is an entrepreneur whose activity is to identify the client's needs and find solutions that meet the criteria established by the client from among those available.

For example:

- realtors search, at the buyer’s request, for a property from among those offered by sellers;

- travel agencies find a tour for the client from those provided by tour operators;

- persons providing financial services sell insurance policies or enter into loan agreements with clients on behalf of another person - the actual lender, etc.

Important! Intermediary and agency services are a collective concept; intermediaries and agents can operate in many areas. They are not identified as a separate group of types of entrepreneurial activities in the All-Russian Classifier of Types of Economic Activities (OKVED). Therefore, a person intending to provide intermediary/agent services must first determine the type of economic activity within which such services will be provided.

Note! From July 11, 2016, when filling out an application for registration of a business entity with the tax authority (or changes in information about such an entity), codes for types of economic activity are taken from the All-Russian Classifier OKVED2 OK 029-2014 (NACE, rev. 2), approved. by order of Rosstandart dated January 31, 2014 No. 14-st (see letter of the Federal Tax Service of Russia dated June 24, 2016 No. GD-4-14 / [email protected] ).

How many OKVED codes can you choose?

Important! Information about the types of economic activities of the subject refers to information that is mandatory entered into the Unified State Register of Legal Entities (subparagraph “p”, paragraph 1, article 5 of the law “On State Registration of Legal Entities.” dated 08.08.2001 No. 129-FZ). Thus, the business entity indicates in the application for registration at least one OKVED code (denoting the main type of activity of the entity).

In addition, a business entity can indicate OKVED additional types of activities, and their number is not limited by law.

Typically, OKVED of intermediary services is indicated in the section “Additional types of activities,” but this rule is also not approved at the legislative level. Theoretically, the OKVED code for intermediary services can also designate the main (and only) type of activity, if in fact the subject is not engaged in anything else.

Conclusion! You can select a number of types of intermediary services, indicating one of them as the main activity (or all as additional). The law does not limit entrepreneurs in establishing the priority of a particular type of activity.

The issue of choosing OKVED is discussed in detail in our other articles. For example, “How many OKVED codes can you indicate when registering an individual entrepreneur?” or “The procedure for changing OKVED codes for LLCs in 2018-2019.” We recommend reading them.

So, we have found out what to follow when choosing OKVED for the provision of intermediary services. A separate universal OKVED code for the activities of intermediaries/agents has not yet been introduced. However, many groupings of activities according to the current classifier OKVED2 OK 029-2014 (NACE, rev. 2) contain OKVED to designate intermediary services in a particular field of economic activity.

OKVED-2020 codes for intermediary/agency services

So, there are no universal OKVED codes for intermediary services. You can select codes that best describe the nature of the business entity’s activities from the available groupings.

Here are examples of grouping codes that are most often used in practice to designate a business entity’s activities as an intermediary or agent in a particular area of business (according to NACE, rev. 2):

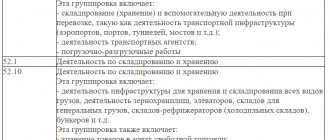

| OKVED code | Kind of activity |

| Activities involving direct sales or sales by sales agents with delivery | |

| Other auxiliary activities in the field of financial services, except insurance and pensions | |

| Activities of insurance agents and brokers | |

| Real estate trade | |

| Activity of real estate agencies on a fee or contract basis | |

| Other professional, scientific and technical activities not included in other groups | |

| Activities providing other business support services, not elsewhere classified | |

| 96.09 | Provision of other personal services not included in other categories |

Note! The proposed list of OKVED-2020 codes for intermediary services is not exhaustive. A business entity, at its own discretion, may choose other types of economic activity. The main thing is that they correspond to the activities that the subject actually conducts (see article “Discrepancy between OKVED and actual activities: the position of the Federal Tax Service”).

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Code classifier and selection of OKVED

Classifier of OKVED codes 2020

We live in a time when it is very prestigious to work for yourself, and not “for your uncle.” There are all the necessary conditions for this, you just need to have an enterprising brain and desire. But beginning businessmen often face difficulties when choosing activities due to lack of knowledge. If a subject wants to organize his own business, he needs to register an individual entrepreneur (individual entrepreneur) and select the necessary types of activities according to the OKVED 2021 code classifier.

The OKVED code classifier is a classifier of an all-Russian format that defines types of economic activity. Its codes are used if an organization wants to change the type of activity. In accordance with the order of the Russian standard, the official entry into force occurred on July 11, 2016. According to OKVED rules, regardless of the form of ownership and source of investment, the classifier is the same for everyone, so this must be taken into account when registering.

Intermediary services: OKVED

46.2 - 46.9; - retail trade carried out by commission agents outside stores, see 47.99 46.12.1 Activities of agents for the wholesale trade of solid, liquid and gaseous fuels and related products 46.12.2 Activities of agents for the wholesale trade of ores and metals in primary forms 46.12.21 Activities of agents for wholesale trade of ores 46.12.22 Activities of agents for the wholesale trade of metals in primary forms 46.12.3 Activities of agents for the wholesale trade of industrial and technical chemicals, fertilizers and agrochemicals 46.12.31 Activities of agents for the wholesale trade of industrial and technical chemicals 46.12.32 Activities of agents for wholesale trade of fertilizers and agrochemicals 46.13 Activities of agents for wholesale trade of timber and building materials 46.13.1 Activities of agents for wholesale trade of timber

OKVED for agency agreement in joint purchases

660 lawyers are now online Consult a lawyer online Ask a lawyer 660 lawyers are ready to answer now Answer in 15 minutes Good evening.

Occupation: organizer of joint purchases. Which OKVED to choose, you need an agency agreement with the buyer.

Those. On behalf of buyers, I enter into contracts with suppliers (on behalf of my individual entrepreneur) and, at the expense of buyers, I also purchase goods for them at wholesale prices. Next, the order is issued to the buyer.

For this I receive a 15% reward. The simplified tax system of 6% will be selected. September 25, 2021, 18:48, question No. 2115876 Marina, Samara Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (1) 572 answers 258 reviews Chat Free assessment of your situation Lawyer, Yoshkar-Ola Free assessment of your situation Marina, hello!

You need to include 2 OKVED-2 codes: Main - 47.99 -

“Other retail trade outside shops, stalls, markets”

, which includes retail sales by commission agents (outside stores). Additional – 47.91 –

“retail trade by mail or via the Internet information and communication network”

. And I have a question: why do you need the simplified tax system of 6%?

Isn’t it easier for you to register as a UTII payer?

Then, if you are an individual entrepreneur, then you will only pay insurance premiums in a fixed amount for yourself.

In my opinion, UTII is more suitable for you... I can draw up a sample agency agreement for you. Contact us! September 25, 2021, 19:12 1 0 All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price. Similar questions 25 December 2021, 15:16, question No. 1484773 24 January 2021, 20:34, question No. 1113247 01 December 2014, 21:19, question No. 636742 09 February 2021, 19:16, question No. 1533146 13 Jul la 2015, 07:34, question No. 903236 See also Pravoved.ru In the mobile application and Telegram, lawyers answer faster and an answer is guaranteed even to a free question!

We are trying! Treat the designer to a cup of coffee, he will be pleased