Home • Blog • Online cash registers and 54-FZ • Online cash register receipt. Details in a new way

The online cash register receipt and its details are constantly changing in accordance with amendments to the law. So, in connection with the change in Federal Law No. 54-FZ, which regulates the rules for the use of cash register equipment, the requirements for checks and strict reporting forms (SSR) have changed. Read further in our article to learn what a check looks like according to the new rules, what mandatory details must be displayed, what a QR code is and how to generate a check.

What should be in an online cash register receipt

With the entry into force of the law, online checkout receipts began to contain much more data about the product. The list of required details in the new sample cash receipt has increased significantly compared to the old version.

Now the cash register software should be able to print the following information on the receipt:

- Title of the document

- Serial number per shift

- Date, time and place of settlement

- Name of organization or individual entrepreneur

- TIN of an organization or individual entrepreneur

- Tax system

- Settlement indicator (sale or return)

- List of sold goods indicating quantity, cost, price and applied discounts

- Calculation amount indicating rates and VAT amounts at these rates

- Payment form (cash or non-cash payment)

- Position and surname of the person performing the settlement

- Shift number

- CCP registration number

- Serial number of the fiscal drive

- Fiscal data attribute

- Fiscal document number

- OFD website address

- Title OFD

- QR code

- Marked product code for an electronic receipt, symbol [M] in a paper version.

- Buyer's subscriber number or email address (if the check is sent to the buyer electronically)

- Subscriber number or email address of the store (if the check is transferred to the buyer electronically)

The absence of at least one item from the proposed list in the check makes it invalid and is not considered by the tax authorities.

For individual entrepreneurs on UTII, PSN and simplified taxation system it is allowed not to transfer the list of goods and their quantity until 02/01/2021. The exception is the sale of excisable goods.

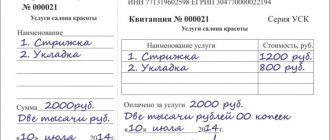

Since 2021, exact requirements for entrepreneurs to write down the names of goods in a receipt have not been published, but the buyer must understand the meanings in the receipt for which the payment was made. So, when filling out a check at an online cash register for hairdressing services, it is not enough to write “haircut”, the service must be specified in full - a woman’s haircut is short, but when selling, for example, cabbage pies, it is not necessary to state the contents of the product, it is enough to indicate “assorted pie”.

Note!

Compliance with the new requirements for online cash receipts involves additional costs. Entrepreneurs under special regimes for whom there was a deferment from indicating the item on the check must fulfill the following conditions from February 1, 2021:

- 1. Buy a tablet, computer or laptop to connect an online cash register.

- 2. Purchase the appropriate software and install it on the control device.

- 3. If you have a cash register, please note that some models cannot connect to a tablet, computer or laptop, which requires either updating the device or purchasing a new one.

| Read also: “Cash receipt from February 2021” |

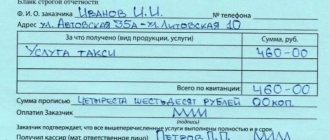

Why do you need a cashier's check?

Such paper is a full-fledged document confirming the very fact of a transaction between the seller and the buyer. In other words, this is a kind of contract, greatly reduced and abbreviated, but proving the signing of an agreement that the store sold a quality product and the consumer purchased it for personal use. But the information contained in this small piece of paper is useful not only as proof of the transaction.

It allows you to carry out full accounting of the movement of incoming funds for the subsequent preparation of financial statements and provision of information to the tax service. Accordingly, it becomes possible for official government bodies to monitor the activities of the seller for compliance with rules, requirements and laws. A new sample cash register receipt can act as evidence in court proceedings and in the settlement of various disputes. Naturally, the correctness of its design is strictly monitored.

What should the QR code of an online cash register receipt contain?

According to 54-FZ, online cash registers must support printing a QR code on a receipt - a two-dimensional barcode measuring at least 20 × 20 mm, which contains information about the purchase in encrypted form. The presence of a QR code on the receipt allows the buyer to check the authenticity of the fiscal document and the purchase made. You can scan the barcode using your mobile device's camera.

Based on this, the QR code should display the following information:

- Calculation date and time

- Serial number of the fiscal document

- Calculation sign

- Settlement amount

- Serial number FN

- Fiscal sign of the document

However, it is important to note that the QR code should not contain any links to resources on the Internet.

Results

New cash register receipts issued from 07/01/2017 have many mandatory details, containing both information about the cash register and official document itself, as well as about goods and services. If some details are not on the check, it is considered invalid and therefore does not confirm the fact of payment. You can check receipts using the mobile application or on the OFD website.

Read the latest materials about online cash registers in the section of the same name on our website.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Fines

Checks without the required names in the nomenclature will become invalid from February 1, 2021, and entrepreneurs who violate the requirements required by law will receive fines, the amounts of which are regulated by Part 4 of Art. 14.5 Code of Administrative Offenses of the Russian Federation. If there is no data on the check, the following fines are provided:

- For officials - from 1,500 to 3,000 rubles;

- For legal entities - from 5,000 to 10,000 rubles.

To avoid fines in the future, you need to prepare now.

Mandatory details of cash receipt and BSO in 2021

Federal Law 54-FZ regulates the use of cash register equipment. Details of the cash receipt and strict reporting form are filled out in accordance with this document.

In this article, we will figure out which details of the cash receipt and BSO are required to be filled out in 2021.

Required cash receipt details in 2021

Cash receipt

is a primary accounting document printed using an online cash register (new format cash register). The check can be not only in printed form, but also in electronic form, but it must contain information about the calculation made and comply with the requirements.

From January 1, 2021, it became mandatory to indicate the taxation system used during calculation on the cash receipt. And from February 1, 2021, for individual entrepreneurs who use the special modes of the PSN, simplified tax system and unified agricultural tax, it has become mandatory to indicate the name of the product.

Mandatory details are specified in Art. 4.7 54-FZ:

- Title of the document;

- serial number for the shift;

- date, time and address of settlement;

- name of the user organization or last name, first name, patronymic of the individual entrepreneur-user;

- user's taxpayer identification number;

- the taxation system used in the calculation;

- sign of calculation;

- name of goods, works, services;

- the calculation amount with a separate indication of the rates and amounts of value added tax at these rates;

- calculation form;

- position and surname of the person who made the settlement with the client;

- registration number of cash register equipment;

- serial number of the fiscal drive model;

- fiscal sign of the document;

- the address of the website of the authorized body, where you can check the fact of recording this calculation and the authenticity of the fiscal indicator;

- subscriber number or email address of the client in case of transfer of a cash receipt to him in electronic form;

- email address of the sender of the cash receipt if the document is transferred to the client in electronic form;

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message;

- QR code.

Additional details may be entered into the cash receipt, taking into account the field of activity in which the payments are made. Also, the authorized body can determine which details may not be indicated in the document.

Mandatory BSO details in 2021

Form of strict accountability

is an alternative to a cash receipt that does not violate the requirements of the legislation of the Russian Federation. According to the explanation given in Art. 1.1 54-FZ, BSO is equal to a cash receipt and, like a check, it can be printed or created in electronic format. The form must contain information about the calculation, which confirms its implementation.

The details of the strict reporting form do not differ from those that must be present on the cash receipt. This is stated in paragraph 1 of Art. 4.7 54-FZ. And also BSO can be supplemented with other details if required by the type of activity.

Control over the use of BSO

Only those who are exempt from using the online cash register can use strict reporting forms printed in the printing house. In other cases, like cash receipts, BSOs must be printed using a new type of cash register.

Control over the use of strict reporting forms is exercised by the authorized body, in this case the Federal Tax Service. Immediately after the formation of the BSO, the data is received by the tax service, and the taxpayer stores it on the fiscal drive.

Fines for failure to issue BSO

Violations of the law regarding the issuance of strict reporting forms are considered administrative and entail a warning or fines. The following penalties are provided (in accordance with Article 14.5 of the Code of Administrative Offenses of the Russian Federation):

- for failure to issue a BSO, a fine of 2 thousand rubles is imposed on officials, and a fine in the amount of 10 thousand rubles on legal entities;

- for failure to use an online cash register, officials are subject to a fine in the amount of 25% to 50% of the settlement amount, but not less than 10 thousand rubles, and for legal entities - from 75% to 100% of the settlement amount, but not less than 30 thousand rubles.

Repeated violation (if the amount of proceeds without a receipt or BSO exceeds 1 million rubles) entails suspension of activities for up to 90 days or disqualification for two years.

In addition, punishment will follow for failure to comply with the procedure and terms for storing fiscal documents. You also need to remember that the strict reporting form is a primary document, which means that for its absence fines may be imposed under Art. 120 Tax Code of the Russian Federation.

The online service “Astral.OFD” is suitable for transmitting fiscal data in accordance with the requirements of the law “On the use of cash register equipment”. In addition to the main function, the program also has other capabilities, such as analytics of fiscal data, sending receipts via SMS and Email, monitoring the operation of retail outlets.

What does a receipt for labeled goods look like?

According to Decree No. 521 dated April 16, 2020, a receipt for the sale of labeled products must contain additional details in the form of a product code. Its absence or incorrect display entails penalties, as in the case of incorrectly specified nomenclature. The display of the code for a receipt in paper and electronic versions will be different. On a paper cash register receipt, the product code is not printed; instead, the [M] symbol appears around the product name, while the electronic receipt contains a fully written code.

The Federal Tax Service monitors the presence of the product code on all receipts. In addition, the presence of marking details is necessary to track the exit of goods from circulation, since the transmitted transaction data is sent from the OFD to the Honest Sign system.

The product code is not indicated on the receipt if:

- A prepayment or advance payment has been made

- The prepayment or advance payment has been returned

- A loan is provided to pay for goods

- The product was returned without a receipt and the product code was lost or damaged

How to punch checks through online cash registers

Now that it has become clear what the mandatory nomenclature is in an online cash register receipt, you need to decide how to punch checks at an online cash register. A cash receipt must be entered for each buyer's payment when making a purchase. In addition, a fiscal document is generated in the following cases:

- With full or partial prepayment

- Upon receipt of an advance

- When selling goods on credit or in installments

- When returning money

- When generating a correction check

According to the law, the check must contain the additional detail “Indicator of the payment method”. Let's consider what data will be displayed for each case.

| Operation performed | Calculation method indicator | Details on the receipt |

| Full prepayment before receiving the goods | "Prepayment 100%" | If the volume and list of goods or services cannot be determined, the receipt displays only the funds actually received. |

| Partial prepayment before receiving the goods | "Prepayment" | |

| Receiving an advance | "Prepaid expense" | |

| Full payment for goods | "Full payment" | The receipt contains all the necessary information about the product. |

| Providing goods on credit for partial payment | "Partial settlement and credit" | The receipt displays the following data: indication of the payment method, name of the product, total cost of the product, amount of funds, amount of credit funds. |

| Providing goods on credit without payment | "Transfer on credit" | |

| Payment of credit for previously received goods | "Loan payment" |

The steps for returning funds to the buyer have not actually changed at all, however, there are certain nuances when generating a correction check. Creating a cash correction receipt is necessary in the following cases:

- The check was generated with an incorrect amount specified.

- The check was not generated when the buyer paid.

- Instead of a correction check, a refund check was issued.

At the same time, the adjusted check from the online cash register is processed strictly before the end of the shift and must contain a number of necessary details established by the tax service dated 2021 No. ММВ-7-20/ [email protected]

| Read also: “Correction receipt at the online cash register” |

Summarizing the above, let's look at how to punch checks at an online cash register. To do this you need to follow several basic steps:

- 1. Enter data about goods into cash register equipment.

- 2. Form the opening of the shift.

- 3. Receive payment from the buyer.

- 4. Confirm the operation.

- 5. Print the fiscal document or send it by email.

- 6. At the end of the working day, close the shift.

Need help setting up items?

Don’t waste time, we will provide a free consultation and help you enter items into the online cash register.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2021

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

Simplified tax system “income minus expenses” - how to keep records correctly

The simplified tax system “Income minus expenses” is a taxation system that is used primarily for small businesses.

A significant difference from the simplified tax system “Income” in this case is the accounting of the company’s costs; this approach is beneficial when there are large expenses. Accounting for the simplified tax system Income - Expenses Comprehensive accounting for the simplified tax system Income minus turnkey expenses for small and medium-sized businesses at a price of 7,000 ₽. … 868 Find out more

"Kontur.Market" and product labeling in "Chestny Znak"

In this article we will look at a well-known labeling product.

Let's study the main features of the software, pricing and other points. SKB Kontur is a well-known software developer in Russia. One of its products is the commodity accounting web service “Kontur.Market” for retail trade and catering. The software is recommended for small retail and networks with up to 100 retail outlets. "Kontur.Market" is used to work with... 894 Find out more

Product labeling: checks and fines

There are fines for failure to label goods.

Their sizes are determined by Art. 15.12 Code of Administrative Offenses of the Russian Federation. Today, tobacco, shoes, medicines and other goods are not sold without identification. From the first day of 2021, the process of labeling light industry, then dairy products began. By 2024, labeling will cover all categories of goods on the Russian market. Strengthened control over work with labeling by government... 462 Learn more

FFD 1.2 - deadlines for transition to a new format of fiscal data

Russia has introduced a new format for fiscal data - FFD 1.2, the transition period to which will last until August 6 of this year. By the end of the announced period, entrepreneurs using online cash registers when paying consumers are required to switch to fiscal drives with the function of supporting the new version 1.2. At the same time, entrepreneurs selling any products must change the format for transmitting fiscal documents using cash register equipment to...1013 Find out more