I know that VAT is a value added tax. What does it mean?

This means that, as a result, companies pay tax only on the markup, and not on the entire cost. But this does not always work out: only if the supplier and buyer both work with VAT. Why in this case it is unprofitable to work with the simplified tax system or a patent we will explain below.

Most often, VAT is paid at a rate of 20%, but there are also preferential rates for products important to life.

Zhenya sold the lamps for 18,000 rubles, including VAT of 3,000 rubles. But before that, he bought a llama: for 12,000 rubles, including VAT of 2,000 rubles, which he can deduct. As a result, he will pay VAT only 1,000 ₽ (3,000 - 2,000).

Accounting for VAT on purchases

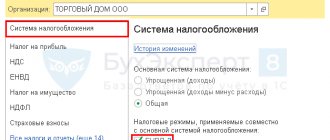

At the level of Russian legislation, tax services are expected to regulate the activities of entrepreneurs. In this case, one of the types of payments that must be paid to the budget is value added tax. VAT

is a tax that is assumed in accordance with

the general OSNO taxation system

.

The main purpose of this tax is that a company that is engaged in the activities of selling goods, performing work and adding additional value to their cost is required to send a special portion to the budget up to the added amount. At the same time, the object of taxation is the procedure for the sale and import of goods and materials into the territory of Russia, and the rate will be 20%. This amount consists of the international transportation of products in the field of space activities, it is 0%, sales of food products, newspapers, magazines in accordance with Article 164 of the Tax Code of Russia, it is 10%. Read about how VAT is accounted for at auctions and tenders in this article.

The client asks me to work with VAT. Why is this important to him?

It's all about input VAT, which can be deducted.

Output VAT is the VAT that a company charges when selling its services and goods. This is what she must pay.

Input VAT is the VAT invoiced by the suppliers of this company. It can reduce its output VAT by the input VAT. This is called VAT deduction.

As a result: the more a company buys on OSNO including VAT, the less VAT it needs to pay. Entrepreneurs using the simplified tax regime do not charge VAT at all, which means that they will not be able to receive a deduction. That's the whole secret.

Anya has a store with healthy food products. A pack of protein bars costs 1,440 rubles, including VAT 240 rubles. Anya bought bars for 1,152 ₽, including VAT 192 ₽, which she can deduct. As a result, she will pay only 48 ₽ VAT (240 - 192).

If Anya had purchased the bars from a supplier without VAT, she would have paid the entire 240 ₽ tax.

Invoices help you track how much input VAT you have and how much output VAT you have. At the end of the period, entrepreneurs, roughly speaking, add up VAT from outgoing invoices and subtract VAT from incoming ones.

VAT in purchases under 44 Federal Laws

In total, there are 2 stages in which this tax can be used:

- The first will be the formation of the NMCC;

- The second stage will be the price of concluding the contract.

Based on the order of the Ministry of Economic Development number 567 dated October 2, 2013, which discloses the method for identifying the NMCC and does not contain recommendations for entering VAT into the NMCC

, but still makes it clear that the price will need to be adjusted in accordance with the requirements of the planned procurement procedure.

If the item of the order is on the list of taxable objects, then the customer will need to make a contribution to the NMCC. According to this, the contractor can participate in the procurement procedure regardless of the form of ownership and taxation system. Based on this, the question arises at what price should a contract be concluded if the winner of the procurement procedure is a person who will work under special tax regimes or an individual. Our “Center” provides assistance in participating in electronic trading and auctions, we help in concluding profitable contracts, for more information about this service, see this link.

In accordance with 44 Federal Laws, when concluding a contract, it is noted that its price will be fixed and determined for the entire period of execution of the contract, which can be concluded in accordance with the conditions implied by the notification of documentation and the application.

At the same time, standard contracts that are published in the Unified Information System indicate that the price must be included in the costs related to the payment of taxes, fees and other payments.

What happens is that the contract is concluded at the price offered by the winning bidder in the procurement procedure, regardless of whether the supplier will be a VAT payer.

The procedure for the customer to withhold the cost of tax upon payment will be considered unlawful. In addition, this amount will act as an additional profit for the participant; this will indicate the most advantageous position of the participants in special modes, if we take them in comparison with OSNO. For more information on how the transition from simplified tax system to OSNO occurs, see this article.

I provided the service without VAT, but the client still highlighted it in the payment order. Will you have to pay?

You won't have to either. The main thing is not to issue an invoice with VAT allocated. If, nevertheless, questions arise from the tax authorities towards the individual entrepreneur, then this is the correct answer: no VAT invoice was issued, so there was no obligation to pay this tax.

And the best thing is to immediately ask the client to correct the error. He will need to send a letter to his bank about the error in the wording of the payment purpose.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. She will help you issue invoices, generate a VAT return and reporting according to the simplified tax system.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

If the counterparty is a foreigner...

When working with foreigners, you should always remember Art. 161 Tax Code of the Russian Federation. This article contains a list of situations in which an organization or entrepreneur is recognized as VAT tax agents required to withhold VAT from income paid to foreign persons.

T. KRUTYAKOVA, tax consultant

TAX AGENT - WHO IS HE?

Tax agents are persons who, in accordance with the Tax Code of the Russian Federation, are entrusted with the duties of calculating, withholding from the taxpayer and transferring taxes to the budget system of the Russian Federation (Article 24 of the Tax Code of the Russian Federation). Tax agents are obliged to: - correctly and timely calculate, withhold from funds paid to taxpayers, and transfer taxes to the budget system of the Russian Federation to the appropriate accounts of the Federal Treasury; - within one month, notify in writing the tax authority at the place of your registration about the impossibility of withholding tax from the taxpayer and about the amount of the taxpayer’s debt; — keep records of income paid to taxpayers, taxes withheld and transferred to the budget system of the Russian Federation, including personally for each taxpayer; - submit to the tax authority at the place of your registration the documents necessary to monitor the correctness of calculation, withholding and transfer of taxes; — for four years, ensure the safety of documents necessary for the calculation, withholding and transfer of taxes.

WHO IS RECOGNIZED AS A VAT TAX AGENT?

In accordance with Art. 161 of the Tax Code of the Russian Federation, a tax agent for VAT is recognized as a person who: 1) on the territory of the Russian Federation purchases goods (work, services) from a foreign person who is not registered with the tax authorities; 2) leases state property from a body of state power and administration (local government body); 3) sells confiscated property, ownerless valuables, treasures on the territory of the Russian Federation; 4) acting as an intermediary involved in settlements, sells on the territory of the Russian Federation goods of foreign persons who are not registered with the tax authorities as taxpayers; 5) being a shipowner, performs the operations specified in clause 6 of Art. 161 Tax Code of the Russian Federation. The last two grounds for the emergence of duties of a tax agent for VAT appeared in Chapter 21 of the Tax Code of the Russian Federation only from January 1, 2006.

Note! The occurrence of a person's duties as a tax agent for VAT is not conditioned by his status as a payer of this tax. Therefore, tax agents for VAT also include persons who are not VAT payers or who are exempt from the duties of a taxpayer.

When performing the duties of a tax agent on the grounds listed above in paragraphs 1, 2 and 5, the tax agent must withhold tax from income paid to the taxpayer and transfer it to the budget. Moreover, if the tax agent is a VAT payer, then he receives the right to deduct the amount of VAT withheld from the income of taxpayers and paid by him to the budget (provided that the goods (work, services) purchased by him are used in activities subject to VAT). Persons recognized as tax agents on the grounds listed above in paragraphs 3 and 4 must add VAT to the cost of goods sold and pay it to the budget in the generally established manner (either at the time of receiving an advance from the buyer, or at the time of shipment of goods, depending on what happened earlier) (clause 15 of article 167 of the Tax Code of the Russian Federation). In this case, the amounts of VAT paid by the tax agent to the budget are not accepted for deduction from him. When selling goods to final buyers, the tax agent issues them invoices, which indicate the amount of VAT accrued on the cost of the goods sold. Based on these invoices, deductions are made by buyers of goods. Payment of the tax amount is carried out by the tax agent at his location (clause 3 of Article 174 of the Tax Code of the Russian Federation).

Note! If a tax agent is also a VAT payer, then he does not have the right to offset the VAT amounts paid by him as a taxpayer and the VAT amounts paid by him as a tax agent. For example, an organization that pays VAT has overpaid VAT. At the same time, it becomes obligated to pay VAT to the budget on income paid to the foreign counterparty. An organization in such a situation does not have the right to offset the existing overpayment against the payment of VAT, which is subject to transfer to the budget as part of the performance of the duties of a tax agent. This VAT amount must be transferred in full to the budget (see letter of the Department of the Ministry of Taxes of Russia for Moscow dated 08/27/2003 N 20-08/46737).

PERFORMANCE OF THE OBLIGATIONS OF A TAX AGENT WHEN PURCHASING GOODS (WORKS, SERVICES) FROM FOREIGN PERSONS

If an organization (entrepreneur) purchases goods (work, services) from a foreign entity, then it may have obligations as a tax agent for VAT, i.e. it may be obligated to withhold VAT from amounts paid to a foreign person and transfer it to the budget. The obligations of a tax agent for VAT arise for an organization (entrepreneur) if the following conditions are simultaneously met: - foreign taxpayer - the seller is not registered with the tax authority in the territory of the Russian Federation; — the place of sale <*> of goods (works, services) purchased from a foreign taxpayer is recognized as the territory of the Russian Federation.

EXAMPLE 1. A Polish trading company, not registered for tax purposes in the Russian Federation, sold trade equipment in the territory of the Russian Federation to a Russian company that had switched to a simplified taxation system. is not a VAT payer. However, in accordance with the requirements of part two of the Tax Code of the Russian Federation, it is assigned the responsibility for calculating, withholding and transferring to the budget of the Russian Federation VAT on the amount of income to be transferred to a foreign counterparty.

EXAMPLE 2. An agreement was concluded between the Russian organization “Beta” and a Ukrainian company (contractor) not registered for tax purposes in the Russian Federation for the provision of training services for specialists of the Russian organization. Training is conducted on the territory of Ukraine. In this case, the place of sale of training services is not the territory of the Russian Federation (subclause 3, clause 1.1, article 148 of the Tax Code of the Russian Federation), therefore their cost is not subject to Russian VAT. Accordingly, the Russian organization Beta does not have duties as a tax agent for VAT. The organization will pay the Ukrainian company the cost of training services without VAT withholding.

EXAMPLE 3. An agreement was concluded between the Russian organization Gamma (customer) and a Turkish construction company (contractor), which is not registered for tax purposes in the Russian Federation, to carry out repair work. The subject of the agreement is to carry out major repairs of a building located on the territory of the Russian Federation. The place of implementation of repair work in this case is the territory of the Russian Federation (subclause 1, clause 1, article 148 of the Tax Code of the Russian Federation), therefore their cost is subject to VAT in the generally established manner. In accordance with the requirements of the Tax Code of the Russian Federation, the Russian organization "Gamma" is obliged to withhold the amount of VAT from the proceeds to be transferred to the Turkish company and transfer it to the budget.

DETERMINATION OF THE AMOUNT OF VAT SUBJECT TO WITHHOLDING

How to correctly determine the amount of VAT that needs to be withheld from the income of a foreign counterparty? The tax base in this case is the amount of income from the sale of goods (work, services) including VAT (clause 1 of Article 161 of the Tax Code of the Russian Federation). The amount of VAT subject to withholding for each transaction is determined as the percentage of the tax base corresponding to the tax rate (clause 1 of Article 166 of the Tax Code of the Russian Federation). Thus, the amount of VAT that needs to be withheld is calculated based on the full amount of income to be transferred to the foreign partner, using estimated tax rates of 18/118 or 10/110 (clause 4 of Article 164 of the Tax Code of the Russian Federation). Note! Chapter 21 of the Tax Code of the Russian Federation provides for a special procedure for paying VAT for persons who are recognized as tax agents in connection with the purchase of goods (work, services) from foreign persons. In this case, the tax must be transferred to the budget simultaneously with the amount transferred to the foreign partner. The tax agent must submit two payment slips to the bank at once: one for the transfer of money to a foreign person, the second for the transfer of the amount of VAT withheld from the foreign person’s income to the budget. A bank servicing a tax agent does not have the right to accept an order from him to transfer funds in favor of a foreign counterparty, if the tax agent has not also submitted to the bank an order to pay tax from an account opened with this bank if there are sufficient funds to pay the entire amount of tax (p 4, Article 174 of the Tax Code of the Russian Federation). There is no need to withhold VAT and pay it to the budget until the money is transferred to the foreign partner. Russian organizations (individual entrepreneurs) carry out settlements with foreign counterparties, as a rule, in foreign currency. And the tax to the budget system of the Russian Federation must be paid in rubles. When determining the tax base, the taxpayer's revenue (expenses) in foreign currency is determined at the time the tax base is determined in accordance with Art. 167 of the Tax Code of the Russian Federation or on the date of actual expenditure (clause 3 of Article 153 of the Tax Code of the Russian Federation). Thus, the tax agent must convert the tax base of a foreign taxpayer selling goods (work, services) for foreign currency into rubles at the Bank of Russia exchange rate on the date of transfer of funds to the foreign taxpayer. That is, the amount of VAT to be withheld and paid to the budget is determined in rubles at the Bank of Russia exchange rate on the date of transfer of funds to the foreign partner.

Calculations without the use of funds

In practice, settlements between counterparties can be carried out without the use of funds, for example, by transferring securities or other property to the seller as payment for the cost of purchased goods (works, services). How to deal with VAT in such a situation? Settlements with the budget through the transfer of property in kind are not provided for by tax legislation (clause 3 of Article 45 of the Tax Code of the Russian Federation). In addition, the duties of the tax agent include withholding tax specifically from funds paid to the taxpayer (Article 24 of the Tax Code of the Russian Federation). Therefore, it would be logical to conclude that when making settlements under a transaction without using cash, the tax agent does not have the obligation to withhold and transfer VAT to the budget. In such a situation, the tax agent must inform the tax authority within a month about the amount of income paid and the impossibility of withholding tax. In principle, this is precisely the approach set out in paragraph 10 of the resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 11, 1999 N 41/9 “On some issues related to the implementation of part one of the Tax Code of the Russian Federation.” However, the Russian Ministry of Finance believes that the use of other property in calculations does not relieve the tax agent from the obligation to withhold the amount of VAT from the income paid and pay it to the budget. How to do it? Officials of the Ministry of Finance propose to simply reduce accordingly (by the amount of VAT) the counterparty’s income received in non-monetary form, and pay the amount of VAT to the budget in cash (letter of the Ministry of Finance of Russia dated June 26, 2006 N 03-04-08/130). If goods are purchased on the territory of the Russian Federation from a foreign person under an exchange agreement, then, according to the Russian Ministry of Finance, the Russian buyer as a tax agent must pay VAT to the budget at his own expense (letter of the Russian Ministry of Finance dated October 24, 2006 N 03-04-15/190 ).

Deduction of the amount of withheld VAT

Amounts of VAT withheld from the income of a foreign taxpayer and actually paid to the budget by the tax agent - the buyer, can be presented to them for deduction (clause 3 of Article 171 of the Tax Code of the Russian Federation). The right to deduction arises if: - the tax agent is a VAT payer; — goods (work, services) are purchased by a tax agent to carry out transactions recognized as subject to VAT; - the amount of VAT was withheld and paid by the tax agent from the income of the taxpayer - a foreign person; — goods (work, services) are accepted for accounting. Accrued tax amounts subject to deduction are reflected in the accounting records of the tax agent in the debit of account 19 “VAT on acquired assets” and, after actual payment to the budget, are written off from the credit of account 19 to the debit of account 68 (sub-account “Settlements with the budget for VAT”), provided that goods (work, services) paid to a foreign person have been accepted for accounting. If the tax agent pays in advance, then the amount of VAT withheld and paid to the budget is deductible only after the paid goods are actually received (work is completed, services are provided). Amounts of VAT accepted for deduction from a tax agent are reflected by him on line 310 “The amount of tax paid by the taxpayer as a tax agent, subject to deduction” of Section 3 of the VAT Return.

EXAMPLE 4. An agreement was concluded between the Russian organization Alpha (customer) and a foreign company (contractor) for the provision of consulting services necessary for the production activities of the Russian organization. The place of sale of consulting services is the territory of the Russian Federation (subclause 4, clause 1, article 148 of the Tax Code of the Russian Federation), therefore, their cost is subject to VAT. The cost of services in accordance with the contract is $10,000. The acceptance certificate for the work performed was signed by the parties in May 2007, payment to the foreign company was made in June. The dollar to ruble exchange rate on the date of signing the acceptance certificate for the work performed was 25 rubles. per dollar, on the date of transfer of funds to a foreign company - 24.8 rubles. for a dollar. The amount of tax to be withheld is $1,525.42 (10,000 x 18/118). The Russian organization "Alpha" is a VAT payer, and the purchased services are used to carry out activities subject to VAT. The following entries must be made in the accounting records of the Alpha organization. May: Debit 20 - Credit 60 - 211,864.5 rubles. — on the date of signing the act, the cost of consulting services (excluding VAT) was recognized as part of the costs (8474.58 x 25). June: Debit 19 - Credit 68/"VAT paid as a tax agent" - RUB 37,830. — reflects the amount of VAT withheld from the cost of consulting services and subject to payment to the budget (1525.42 x 24.8); Debit 60 - Credit 52 - RUB 210,169.58. — the cost of consulting services was paid to the foreign company minus VAT (8474.58 x 24.8); Debit 68/"VAT paid as a tax agent" - Credit 51 - RUB 37,830. — VAT withheld from the income of a foreign company is transferred to the budget; Debit 60 - Credit 91 - 1694.92 rubles. — the exchange rate difference is reflected in the cost of services excluding VAT; Debit 68/ “VAT” - Credit 19 - 37,830 rub. — VAT actually paid is accepted for deduction. Let's assume that the Alpha organization pays VAT to the budget on a monthly basis. Then, when filling out the VAT Declaration for June 2007, the organization includes Section 2, which indicates the amount of VAT withheld from the income of the foreign company and transferred to the budget. For the procedure for filling out Section 2 for this example, see example 7. In addition, in Section 3 of the VAT Return for June 2007, in line 310, the organization will indicate the deduction amount in the amount of 37,830 rubles. Amounts of tax withheld from the income of a foreign taxpayer and paid to the budget are not accepted for deduction, but are taken into account in the cost of the relevant goods (work, services) in the following cases: - purchased goods (work, services) are used by the tax agent in carrying out transactions that are not subject to taxation of VAT on the grounds provided for in paragraphs 1 - 3 of Art. 149 Tax Code of the Russian Federation; — purchased goods (work, services) are used by the tax agent when carrying out operations, the place of sale of which is not the territory of the Russian Federation; - the tax agent is not a VAT payer or is exempt from fulfilling the duties of a taxpayer in accordance with Art. 145 Tax Code of the Russian Federation; - goods (work, services) purchased by a tax agent are intended to carry out operations that are not recognized as the sale of goods (work, services) in accordance with clause 2 of Art. 146 of the Tax Code of the Russian Federation.

If the tax is paid from your own funds

Quite often, Russian organizations encounter difficulties when negotiating with foreign partners regarding the contract price: imposing the obligation to pay VAT on a foreign (Russian) partner can lead to the fact that the amount actually received by him will be less than the contract price by the amount of VAT withheld. Many foreign companies do not agree to enter into a contract on such terms, and Russian organizations (entrepreneurs), in order not to complicate their relationships with foreign counterparties, often prefer to pay the tax at their own expense and transfer the entire amount stipulated by the contract to the foreigner. Note! For many years, tax authorities have insisted that a tax agent does not have the right to deduct the amount of VAT paid by him from his own funds, since a prerequisite for obtaining a deduction is the withholding of the amount of VAT from the income of a foreign person. At the same time, in 2006, several clarifications from the Russian Ministry of Finance appeared, which stated that the amount of VAT paid at one’s own expense can be taken into account by the tax agent as part of expenses that reduce the tax base for income tax (see letters from the Russian Ministry of Finance dated March 24, 2006 N 03-04-03/07, dated 07/18/2006 N 03-03-04/2/175). However, in 2007 the situation changed. The Russian Ministry of Finance issued two letters at once (dated 02/07/2007 N 03-07-08/13 and dated 04/12/2007 N 03-07-08/75), which expressed the opinion that the tax agent has the right to deduct the amount of VAT paid by him as a tax agent, including in a situation where the tax was paid by the tax agent at his own expense. At the same time, in a letter dated 04/12/2007 N 03-07-08/75, representatives of the financial department explain that the 2006 clarifications dealt exclusively with situations when the tax agent used the work (services) purchased by him from a foreign person in activities not subject to VAT. If the acquired works (services) are used by the tax agent in activities subject to VAT, then he has the right to a deduction regardless of whose funds the VAT was paid to the budget (at the expense of the tax agent’s own funds or from funds to be transferred to a foreign counterparty ). The main thing is that the tax is paid to the budget.

PERFORMANCE OF THE OBLIGATIONS OF A TAX AGENT WHEN SALE OF GOODS OWNED BY FOREIGN PERSONS

Since January 1, 2006, tax agents are recognized as intermediaries who sell goods on the territory of the Russian Federation that belong to foreign persons who are not registered as taxpayers and who take part in payments for these goods (clause 5 of Article 161 of the Tax Code of the Russian Federation). In contrast to the general procedure for fulfilling the duties of a tax agent, when tax amounts are withheld from the taxpayer’s funds, in this case the tax agent must “increase” VAT on top of the cost of goods sold. The intermediary pays VAT on the cost of goods sold by him in the generally established manner (at the time of either receiving an advance from the buyer or shipping the goods, depending on what happened first) (Clause 15 of Article 167 of the Tax Code of the Russian Federation). VAT, calculated on the cost of goods sold, is paid to the budget in full (without applying any deductions). VAT amounts paid by an intermediary—a tax agent—to the budget are not accepted for deduction. When selling goods to final buyers, the tax agent (intermediary) issues them invoices, which indicate the amount of VAT accrued on the cost of the goods sold. Based on these invoices, deductions are made by buyers of goods.

Example 5. Alfa LLC, as a commission agent, sells goods on the territory of the Russian Federation that belong to a foreign company that is not registered with the tax authorities of the Russian Federation as a taxpayer. In accordance with the terms of the commission agreement concluded between Alpha LLC and the foreign company, the price of goods sold is $20 per unit (excluding VAT). In January 2007, Alpha LLC entered into an agreement with the buyer for the supply of goods in the amount of 1000 pieces. The sales value of the goods is $20,000. At the same time, in addition to the cost of goods, Alpha LLC charges the buyer VAT at a rate of 18% in the amount of USD 3,600. Under the terms of the supply agreement, payment is made by the buyer in rubles at the Central Bank exchange rate on the date of shipment. In January 2007, the goods were shipped to the buyer. The exchange rate on the date of shipment was 26 rubles. for a dollar. Payment was also made by the buyer in January (after shipment) in the amount of RUB 613,600. (including VAT - 93,600 rubles). In this case, Alpha LLC issues an invoice to the buyer for the cost of goods sold (RUB 613,600), which includes a VAT amount of RUB 93,600. This VAT amount must be transferred in full to Alpha LLC to the budget. It is reflected in Section 2 of the VAT Declaration, which Alpha LLC submits to the tax office at its place of registration. For the procedure for filling out Section 2 for this situation, see example 8. If the buyer transfers funds in advance, then the intermediary pays VAT on the amount of the advance payment received. Then, when the goods are shipped to the buyer, VAT is charged to the budget on the cost of the goods shipped. In this case, the amount of VAT calculated from the amount of the advance received is accepted for deduction.

EXAMPLE 6. Let us assume that in the conditions of example 5, the buyer transferred an advance in the amount of 118,000 rubles in January, and then, after the goods were shipped, made the final payment by transferring the amount of 495,600 rubles to the account of Alpha LLC. In this case, at the time of receipt of the advance, Alpha LLC accrues the amount of VAT in the amount of 18,000 rubles for payment to the budget. At the time of shipment of goods, the amount of VAT payable to the budget on the cost of goods shipped is determined - 93,600 rubles. At the same time, VAT calculated upon receipt of the advance is deductible - 18,000 rubles. All these amounts are reflected by Alpha LLC in Section 2 of the VAT Declaration (see example and do not fall into Section 3. If the tax agent (organization or entrepreneur) is not a VAT payer, then the tax payment to the budget is made by him no later than the 20th date of the month following the quarter in which the corresponding obligation to the budget arose. A similar procedure is established for tax agents who are VAT payers, but exempt from taxpayer obligations in accordance with Article 145 of the Tax Code of the Russian Federation, as well as for those taxpayers for whom the tax authorities The VAT period is a quarter.If a tax agent is also a VAT payer and the tax period for him is a month, he pays the tax as a tax agent no later than the 20th day of the month following the month in which the corresponding obligation to the budget arose. If a tax agent-intermediary is a VAT payer, then he, as a taxpayer, is obliged to pay VAT on the amount of remuneration that he receives under an agreement with a foreign buyer. These amounts are reflected in Section 3 of the VAT Return in accordance with the generally established procedure.

In this case, at the time of receipt of the advance, Alpha LLC accrues the amount of VAT in the amount of 18,000 rubles for payment to the budget. At the time of shipment of goods, the amount of VAT payable to the budget on the cost of goods shipped is determined - 93,600 rubles. At the same time, VAT calculated upon receipt of the advance is deductible - 18,000 rubles. All these amounts are reflected by Alpha LLC in Section 2 of the VAT Declaration (see example and do not fall into Section 3. If the tax agent (organization or entrepreneur) is not a VAT payer, then the tax payment to the budget is made by him no later than the 20th date of the month following the quarter in which the corresponding obligation to the budget arose. A similar procedure is established for tax agents who are VAT payers, but exempt from taxpayer obligations in accordance with Article 145 of the Tax Code of the Russian Federation, as well as for those taxpayers for whom the tax authorities The VAT period is a quarter.If a tax agent is also a VAT payer and the tax period for him is a month, he pays the tax as a tax agent no later than the 20th day of the month following the month in which the corresponding obligation to the budget arose. If a tax agent-intermediary is a VAT payer, then he, as a taxpayer, is obliged to pay VAT on the amount of remuneration that he receives under an agreement with a foreign buyer. These amounts are reflected in Section 3 of the VAT Return in accordance with the generally established procedure.

PROCEDURE FOR COMPLETING INVOICES

We noted above that tax agents who are VAT payers have the right to deduct those amounts of VAT that they paid to the budget as tax agents. Questions arise. Based on what documents can a tax agent claim a deduction? Where can I get an invoice? Do I need to prescribe it for myself? Let us immediately note that not a single regulatory document obliges tax agents to independently issue any invoices and register them in the purchase book and in the sales book. There is no such requirement either in Chapter 21 of the Tax Code of the Russian Federation, or in the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax (approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914). Moreover, in paragraph 1 of Art. 172 of the Tax Code of the Russian Federation clearly states that the deduction of VAT amounts withheld by tax agents is carried out on the basis of documents confirming the payment of the withheld amounts to the budget. The legitimacy of this conclusion was also confirmed by the Constitutional Court of the Russian Federation (see Determination of the Constitutional Court of the Russian Federation of October 2, 2003 N 384-O). The court pointed out that the invoice is not the only document for providing the taxpayer with VAT deductions. A taxpayer who is a tax agent has the right to receive a VAT deduction on the basis of documents confirming the payment of VAT. At the same time, one cannot ignore the fact that it is the data from the purchase book and sales book that serve as the basis for filling out VAT tax returns, as well as for determining the amount of tax claimed by the taxpayer for deduction. In many organizations that maintain accounting using computer technology, the VAT return is filled out automatically based on the data from the purchase and sales books. In such cases, it is more convenient for the organization itself to prepare invoices and register them both in the sales book and in the purchase book. In addition, it must be taken into account that local tax authorities often insist on the need to issue invoices when performing the duties of a tax agent (see, for example, letter of the Department of the Ministry of Taxes of Russia for Moscow dated December 26, 2003 N 24-11/72147). As a result, today the tax agent independently decides whether to issue invoices or not. However, in order to avoid disputes with the tax authorities, in our opinion, it is better for taxpayers acting as tax agents to issue their own invoices and reflect the VAT amounts withheld and transferred to the budget both in the sales book and in the purchase book (if the taxpayer has the right to an appropriate tax deduction). We can propose the following procedure for using invoices (see letter from the Department of the Ministry of Taxes and Taxes of Russia for Moscow dated August 27, 2004 N 24-11/55681). When paying income to a foreign counterparty, the tax agent draws up an invoice in two copies for the full amount of proceeds to be transferred to the foreign entity, highlighting the amount of tax. In this case, a note “for a foreign person” is made on the invoice. The second copy of the compiled invoice is stored in the journal of issued invoices (as a basis for calculating VAT) and is registered in the sales book with the note “payment of tax by the tax agent” at the time of the actual transfer of funds to the foreign supplier. The first copy of the compiled invoice is stored in the journal of received invoices. It is the basis for applying tax deductions in the manner established by tax legislation (registered in the purchase book in the period when the tax agent receives the right to deduct VAT).

PROCEDURE FOR SUBMITTING TAX DECLARATIONS

Tax agents submit to the tax authority at their place of registration a VAT Declaration with completed Section 2 “The amount of tax payable to the budget, according to the tax agent.” If the tax agent is a VAT payer, then he submits to the tax authorities a single VAT Declaration, which reflects information about the amounts of VAT payable by him both as a taxpayer and as a tax agent. Then Section 2 is included in the single VAT Declaration. If the tax agent is not a VAT payer (for example, applies a simplified taxation system), then he submits to the tax authorities only the Title Page of the VAT Declaration with completed Section 2. The remaining sections of the Declaration in this case are not completed and are not included in the Declaration. Section 2 of the VAT return must be submitted only for those tax periods in which the organization (entrepreneur) had duties as a tax agent. Section 2 is filled out separately for each taxpayer - a foreign person for whom VAT is paid. A tax agent—an intermediary selling goods owned by foreign principals—fills out Section 2 separately for each foreign principal.