From this article you will learn:

- What does working capital mean?

- How the policy for the formation of working capital is built

- What are the sources of working capital formation?

- How to control the sources of working capital formation and analyze the results

Working capital is the difference between assets and liabilities in circulation. Any enterprise requires a sufficient amount of this kind of funds, otherwise its implementation is not possible.

What is own working capital

Working capital

A company is considered financially sound when it has a balanced capital structure, is attractive to investors and can repay its debts on time.

Own working capital (WCC) is an indicator that is used when analyzing the balance sheet. This value reflects exactly what proportion of the company’s own funds is used in turnover, that is, goes to cover its current assets.

Attention! According to the standard rule, the following ratio must be maintained between the sections of the balance sheet: non-current assets (abbreviated as VNA) are formed from own funds, as well as long-term liabilities; working capital (OA) - through short-term loans and internal sources of financing.

Calculation example

For ease of calculation, let’s take the balance sheet data. It is best to use the first formula with two variables. An example calculation can be downloaded in Excel.

| Month and year | Line 1200 | Line 1500 | SOS |

| January 2017 | 1 500 | 1 200 | |

| February 2017 | 1 700 | 1 520 | |

| March 2017 | 1 350 | 1 580 | |

| April 2017 | 1 560 | 1 250 | |

| May 2017 | 1 750 | 1 260 | |

| June 2017 | 1 840 | 1 345 | |

| July 2017 | 1 950 | 1 580 | |

| August 2017 | 1 850 | 1 650 | |

| September 2017 | 1 840 | 1 440 | |

| October 2017 | 1 760 | 1 380 | |

| November 2017 | 1 830 | 1 280 | |

| December 2017 | 1 750 | 1 270 | |

| Total for the year | 20 680 | 16 755 | |

| Average per month | 1 723,3 | 1 396,3 | 327,1 |

Thus, the enterprise has experienced a surplus of its own working capital in all months of 2021, except one. The deficit was noted only in March and amounted to minus 230 thousand rubles. In general, for the remaining months the amount of own working capital was relatively stable. On average for the year, the amount of SOS was equal to 327.1 thousand rubles.

Rice. 1. SOS in dynamics on the chart

First method of determination: formula

To determine the SOC, it is enough to subtract the amount of long-term funds and property not involved in turnover from the total amount of the company’s internal sources of financing. The total calculation looks like this:

SOK = SK – (VNA – DO), where

- SK is the amount of equity capital, taken in line 1300 of the balance sheet

- VNA is non-current assets (line 1100)

- TO are long-term liabilities (line 1400)

Calculation rules

Important! Long-term loans and credits are taken into account only to the extent that they are used to finance VNA. This also includes debt under leasing agreements. That is, only the value of such VNAs that are financed from internal sources is taken.

The company's internal resources (IC) are recorded as a total amount in Section 3 of the balance sheet. In addition to the authorized capital, they include reserve and additional capital, and retained earnings. VNA includes fixed assets, long-term financial assets. investments, intangible assets and other components of Section 1. Subsidiaries are included in Section 4 of the balance sheet.

Definition

Own working capital (SOC) is the cost of the excess of current assets over short-term liabilities. In another way, this source of financing is called working capital. These are funds that are deposited on the company’s balance sheet and are used to finance current activities.

SOS show how much money a company has, the amount of capital it can freely manage, including to cover short-term liabilities.

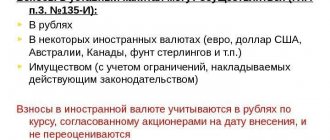

Sources of SOS formation:

Second method of determination: formula

Another calculation option involves data on current assets and short-term liabilities (financial). It takes the following form:

SOK = OA – KFO, where

- ОА – amount of current assets (line code 1200)

- KFO – short-term financial liabilities (take line code 1500)

Important! In a situation where the company's equity is financed not only by its short-term but also long-term borrowings, their size must also be subtracted. The formula will be like this:

SOK = OA – KFO – DO

OA constitute Section 2 of the balance sheet and include the following items: inventories, accounts receivable, financial investments (short-term) and the most liquid component - cash. CFOs form Section 5 of the balance sheet.

Topic 8. Current assets of the enterprise

Topic questions:

1. Composition of the current assets of the enterprise.

2. Determining the need for current assets of the enterprise.

3. Indicators of efficiency in the use of current assets.

The purpose and objectives of studying the topic:

disclosure of the economic content and fundamentals of functioning of the enterprise’s current assets; consideration of planning and efficiency of use of working capital of enterprises.

After studying the topic, the following knowledge should be acquired:

economic content of the enterprise's current assets; the procedure for planning the working capital of an enterprise; indicators of the use of working capital of the enterprise.

When studying the topic, you need to focus on the following concepts:

current assets, work in progress, norm, standard, turnover.

Theoretical material of topic 8

Amplitude of values and their interpretation

The RNS value obtained as a result of the calculation can be positive, negative or equal to zero. Let's figure out what this means:

Difference of indicators

- If the result is zero, it means that the company’s current assets are formed entirely through loans, but the company can pay off all its short-term debts without resorting to the sale of less liquid assets.

- If the figure is greater than zero, part of the own funds is involved in the formation of the OA. This value of the indicator is desirable and corresponds to the state of equilibrium of balance sheet items.

- If the number is negative (i.e. less than zero), it means that the firm lacks internal sources and even its BNA is partially formed by short-term liabilities. This does not correspond to a state of equilibrium of balance. This situation in most sectors of the economy indicates that the company is financially unstable.

As can be seen from the above formulas, the change in the value of the indicator under consideration depends on each line of the balance sheet. So, for example, an increase in retained earnings will also cause an increase in the amount of SOC. Conversely, the acquisition of fixed assets and investment in long-term financial instruments reduce the analyzed indicator.

However, the resulting high numbers may indicate that the company has chosen an ineffective financial strategy: it avoids short-term financing, does not fully utilize accounts payable, and irrationally manages the profits received.

Definition and formulas for calculating own working capital

Calculation of SOS is one of the first steps in analyzing the financial condition of an enterprise.

The amount of own working capital can be calculated in several ways.

As the difference between the sum of sources of own funds (SC) and the value of non-current assets (VA):

Look at the Excel table "Analysis of financial condition" 70 ratios, dynamics for 8 periods Bankruptcy risk assessment

As the difference between the amount of own and long-term borrowed funds (DP, long-term liabilities) and the amount of non-current assets:

SOS = SK + DP - VA

As the difference between the value of current assets (OA) and the amount of short-term debt (KP, short-term liabilities):

SOS = OA - CP

Where is it used?

Knowing the SOC indicator, we can calculate the share of the SK in the formation of the company’s OA:

DSC = SOK / OA

A value of this coefficient of at least 0.1 is considered acceptable. Comparison of this indicator over several periods (over time) will show an increase or decrease in the company’s dependence on external borrowings.

The capital agility ratio illustrates how much the firm's capital is involved in turnover and is calculated as follows:

KMK = SOK / SK

Another important indicator is the availability of inventory sources of financing. If the amount of inventories at the reporting date is less than the value of the SOC, the enterprise is characterized by absolute short-term financial stability. When calculating the supply ratio, the SOC value is divided by the amount of reserves. The normal value of this coefficient is 0.5.

conclusions

Having your own working capital is a prerequisite for a stable financial and economic position of an enterprise. This source is used to finance the material and technical base, replenish supplies, purchase patents and other resources. In the absence of this source, borrowed assets are used: short-term and long-term loans, borrowings, loans. For successful business operations, it is important that the SOS value is positive, that is, a surplus is formed, however, companies with a high turnover rate can afford to successfully operate with a negative SOS value (fast food, some types of services).

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

A good example

Let's look at an example of calculation using specific numbers. To do this, we provide conditional data for reporting that does not exist as of December 31, 2016 (thousand rubles):

- 97 415 – VNA

- 103 480 – OA

- 61,500 – UK

- 65 103 – BEFORE

- 74 292 – KFO

Calculation examples

We check that the amount of assets and liabilities in the company’s balance sheet is equal:

97 415 + 103 480 = 61 500 +65 103 + 74 292 = 200 895

Let's calculate the value of SOC as of the reporting date in two versions.

Option 1. Let's assume that long-term loans and credits are aimed at financing the company's BNA, which corresponds to the norm. In this case:

- first method 61,500 – (97,415 – 65,103)

- second method 103,480 – 74,292 = 29,188

It can be seen that according to both formulas the result was the same: 29,188 thousand rubles. If this does not happen, there was an error in the calculations.

The result is a positive number. This means that according to this indicator the company will be considered financially stable. Current assets in the amount of 29,188 thousand rubles. financed from the company's internal sources. VNA in the amount of 65,103 thousand rubles. are formed with the help of attracted external long-term sources, the rest (32,312 thousand rubles) - from their own money.

Option 2. Due to long-term obligations, the enterprise forms an OA, which initially does not correspond to the norm. The calculations are as follows:

- the first way 61,500 – 97,415

- the second way 103,480 – 74,292 – 65,103

As you can see, the indicator is negative and amounts to -35,915 thousand rubles. The company is in a difficult financial situation. The company's own funds are not enough to form an OA; the company is not able to pay off its current debts using only funds in circulation.

The two calculation options considered show that the same balance sheet data can be interpreted differently and lead to opposite results. It is important to correctly evaluate and classify long-term loans and borrowings. Without knowing the purposes and directions of their use, it is impossible to correctly determine the SOC. In reality, the entire volume of long-term borrowings of an enterprise does not have one purpose of use. Therefore, it is necessary to carefully analyze all available loans.

In general, to maintain a normal level of the indicator under consideration, and therefore ensure the financial stability of the company, the following should be done:

- strive to obtain and increase profits

- optimize non-current assets of the enterprise

- monitor the size and quality of accounts receivable

- do not allow the use of long-term liabilities to form current assets

- maintain an optimal balance structure

These measures will help the normal functioning of the enterprise. Using the indicator, you can assess whether a company is able to pay off its short-term debts with liquid funds.

Top

Write your question in the form below

Determining the need for current assets of the enterprise

Rationing

represents the establishment of the optimal amount of working capital necessary for the organization and implementation of normal economic activities of the enterprise. Through rationing, the financial services of an enterprise determine the need for its own working capital in a minimum but sufficient volume to ensure the implementation of planned tasks and maintain the uninterrupted reproduction process.

There are several methods for calculating working capital standards: the direct counting method, analytical and coefficient methods.

Direct counting method

is labor-intensive, but most accurate; is based on the determination of scientifically based stock standards for individual elements of working capital and working capital standards, i.e. the value expression of the reserve, which is calculated for each element (particular standards) and in general for standardized working capital (aggregate standard).

The analytical

(experimental-statistical) method

involves an aggregated calculation of working capital in the amount of average actual balances. This method involves taking into account various factors influencing the organization and formation of working capital, and is used in cases where significant changes in the operating conditions of the enterprise are not expected and when funds invested in material assets occupy a large share. When calculating the planned need for working capital, the planned growth in revenue from product sales and the acceleration of working capital turnover are taken into account.

Coefficient method

is based on the determination of a new working capital standard based on the existing one, taking into account amendments for the planned change in production and sales volumes, and for accelerating the turnover of working capital. When applying this method, all inventories and costs of the enterprise are divided into those depending on changes in production volume (raw materials, supplies, costs of work in progress, finished products in the warehouse); and those that do not depend on the growth of production volume (spare parts, low-value and wearable items, deferred expenses).

For elements of current assets that depend on the volume of production, the demand is planned based on their size in the base year, the rate of production growth and the possible acceleration of turnover of working capital. For other elements of inventories and costs, the planned requirement is determined at the level of their average actual balances.

Let's take a closer look at the direct counting method.

. It is the main method for determining the planned need for working capital.

Working capital standards

- this is the volume of stock of the most important inventory items necessary for the enterprise to ensure normal, rhythmic operation. Norms are relative values that are established in days of stock or as a percentage of a certain base (commodity products, volume of fixed assets) and show the duration of the period provided by this type of stock of material resources.

Standards are established separately for the following elements of standardized working capital:

· production inventories;

· work in progress and semi-finished products of own production;

· stocks of finished products in the enterprise warehouse;

· future expenses.

Standardization process:

1. Calculation of production inventory standards: The standard in days for production inventories (raw materials, basic materials, purchased semi-finished products) is established for each type or group of materials and includes the time required for:

· unloading, receiving, storing and laboratory analysis (preparatory stock);

· the presence of raw materials and supplies in the warehouse in the form of stock for the current production process (current stock) and insurance or guarantee stock (safety stock);

· preparation for production associated with holding raw materials, drying, heating, settling and other similar operations (technological stock);

· location of materials in transit and document flow time (transport stock).

The main thing in industry is the current warehouse stock,

those. the time that inventories are in the enterprise's warehouse between two subsequent deliveries. Its value is directly related to the frequency and uniformity of supplies and the frequency of launching production of raw materials. The amount of this stock in industry is set at 50% of the average supply cycle.

Safety stock

– a reserve required in cases where failures occur in delivery conditions and terms, incomplete batches are received, or the quality of supplied materials is compromised. The amount of safety stock is set, as a rule, within 50% of the warehouse stock.

, the transport stock is of the same duration as

formed in the event of a discrepancy in the timing of document flow and payment for them and the time the materials are in transit.

The general stock norm for raw materials, basic materials, purchased semi-finished products is made up of the listed types of stocks.

Norms are also calculated for other types of inventories - auxiliary materials

(fuel, packaging, packaging materials, spare parts), for low-value and high-wear items.

After establishing inventory standards, a private cost standard should be determined for each element of standardized working capital. Standard

working capital shows the minimum required amount of cash to ensure the economic activities of the enterprise, i.e. monetary expression of the planned stock of inventory items.

2. The rate of working capital for work in progress is established based on the duration of the production cycle and the degree of readiness of products, which is expressed through the cost increase coefficient. This coefficient characterizes the degree of product readiness and is due to the fact that production costs are not incurred simultaneously, but throughout the entire production cycle, and subsequent costs are layered on top of the initial ones. The rise factor is always less than 1.

3. Inventory norms for finished products are calculated separately for finished products in the warehouse and shipped products for which settlement documents have not been submitted to the bank. Inventory standards are determined for each product group, taking into account the time of selection of individual types and brands of products, packaging and labeling, storage in the warehouse until shipment, assembling of products to the transport batch, loading, transportation and delivery from the warehouse to the departure station, time of preparation of settlement documents and handing them over to the bank.

The process of standardization ends with the establishment of a total working capital standard by adding up private standards: for inventories, work in progress, deferred expenses and finished products:

At enterprises, the need for cash in the cash register and working capital for inventories of goods is calculated. The methodology for their calculations is similar to normalization.