Authorized capital - postings in 1C 8.3: example and step-by-step instructions

Let's look at how to form authorized capital and transactions in 1C 8.3, using an example.

On April 10, a decision was made to create the Limited Liability Company "GRANTMEBEL". Shares in the authorized capital are distributed as follows:

- 10% - LLC "AZBUKA COMFORT";

- 90% - Lyubov Andreevna Trofimova.

On April 22, the registration of the Company was confirmed by an extract from the Unified State Register of Legal Entities.

On April 27, the receipt of contributions to the management company is reflected in the bank statement.

Authorized capital in 1C 8.3 - step-by-step instructions

So that's why you are needed, authorized capital!

Immediately after registering a new legal entity, this company has NOTHING in its property! That is, nothing at all. Zero.

However, the law establishes for LLCs and other legal entities. persons minimum size of property. If this amount is not available, the company will not be able to start operating at all.

The minimum property of a legal entity is its authorized capital (AC)

The size of the charter capital may be greater than what is established by law - this is determined by the founders of the company. For legal entities of different organizational and legal forms, different amounts of the minimum authorized capital are established.

The minimum authorized capital for a Limited Liability Company (LLC) is 10,000 rubles. This amount must be contributed in the form of cash or other assets at the discretion of the company founders. It is through the authorized capital that the new company acquires some property and, therefore, the opportunity to conduct business activities.

The minimum size of the charter capital for closed joint-stock companies and open joint-stock companies is much higher than for LLCs, therefore all new companies are limited liability companies. After all, at the initial stage of doing business, as a rule, there is nowhere to get a lot of money from!

Formation of authorized capital - postings in 1C 8.3

Postings in 1C 8.3 on the formation of the authorized capital after registration of the company are reflected for each participant as of the date of registration of the company.

Enter the first document that begins accounting for the new organization Formation of authorized capital in the Operations .

The list of founders is stored in two directories - Individuals and Counterparties. Click the Add to indicate who the founder is - an individual or a legal entity.

If an individual is listed only in the Counterparties , for example, as an Individual Entrepreneur , enter him in the Individual Entrepreneurs and, when selecting a founder, select him from this directory.

Print the list of LLC participants using the button List of founders . When paying for the authorized capital in cash, you do not need to edit anything before printing. If payment for a share in the authorized capital is made by property contribution, click on the Edit and manually correct the information in the Form of payment .

Authorized capital - postings in 1C 8.3

Familiarize yourself with the regulatory part of the formation of authorized capital - Topic 4.1. Registration of the LLC course Accounting and tax accounting in 1C: Accounting 8 ed. 3 from A to Z

There is no need to enter balances for the new company. How to start working?

Indeed, if we do not enter balances, then the bookkeeping accounts will be empty! Therefore, we cannot perform any transactions. For example, we have money in the form of cash and we want to purchase goods from a supplier. But in 1C, account 50 is empty, which means we will not be able to reflect the fact of payment in the program - the cash balance will simply go into the minus.

You can familiarize yourself with the features of errors when performing cash transactions in individual courses on the “Enterprise Accounting 8.3” configuration

Therefore, we need to reflect in the program the actual availability of funds in account 50 (cash) before conducting cash transactions. The same goes for other accounting accounts! Thus, if a new company actually has something (inventory, cash, etc.), then before starting work they need to be entered into the 1C database.

- So this is the entry of initial balances, you say! But no! If in doubt, just read this article.

Payment of authorized capital - postings in 1C 8.3

Contribution to the authorized capital - postings in 1C 8.3

Contributions to the authorized capital can be made either in money or other property. The minimum authorized capital (RUB 10,000) is paid only in cash. Depending on the type of contribution, the required 1C document is selected. The diagram shows the main standard payment documents for management companies.

In our example, the contribution to the management company was made by non-cash payment to the account. Enter the document Receipt to the current account in the Bank Statements (section Bank and Cash ).

When selecting founders, select an LLC participant from the directory Individuals or Counterparties - depending on who he is: an individual or a legal entity.

If you fill out the Cash Flow Report in the Income Item , select the item with the Type of Flow - Receipts of cash deposits from owners (participants) .

Posting authorized capital - payment in money in 1C 8.3

The second statement is prepared in the same way.

Familiarize yourself with the regulatory regulation in accounting for payment of authorized capital - Topic 6.1: Receipt of payment for shares in the authorized capital of the course Accounting and Tax Accounting in 1C: Accounting 8th ed. 3 from A to Z

We have formed the authorized capital in 1C 8.3 - now we can move on to registering other business transactions.

Differences between entering authorized capital for a new company

When creating a new 1C database, there are only two options: either the company is new, or the work has already been carried out and the creation of a new database is due to purely technical reasons (for example, switching to accounting in another program).

In the first case, the company has just been created and activities have not yet been carried out. This, at a minimum, means that no “opening balances” need to be entered. However, many novice users still try to enter something through the Assistant for entering initial balances... The result is predictable.

I remind you:

For a new company, you do not need to enter any opening balances, since there have been no business transactions yet!

Increasing and decreasing authorized capital in 1C: Accounting

Published 04.12.2018 23:35 Author: Administrator Authorized capital is the initial source of formation of the company’s property. In the course of activity, the authorized capital can be either reduced or increased. Each LLC participant has their own share, i.e. part of the authorized capital owned specifically by him. A company participant who has paid for a share in the authorized capital has the right to independently dispose of this share. In this article we will analyze the main options for leaving the founders and their reflection in the 1C: Enterprise Accounting 8 edition 3.0 program.

The main options for transferring ownership of a share:

— payment of monetary compensation in the amount of the actual value of the share (the share is transferred to the company);

— payment of a share property ;

— repurchase of a share (or part thereof) by the company at market value (an expert assessment is required);

— buyout of shares by company participants (they have a pre-emptive right);

— sale of a share to a third party;

— donation of a share to the company (or a third party).

In addition, the opposite situation is possible:

-increase in the authorized capital at the expense of a new participant in the company.

To leave the society, a participant must write a statement, have it certified by a notary and hand it over to the head of the organization or an employee of the organization whose duties include accepting incoming documents. The date of the application will be the date when the fact of the withdrawal of a company participant from the founders is reflected in the accounting records.

The preemptive right to repurchase a share has the members of the company, unless otherwise provided by the Charter. As a general rule, participants acquire a share in proportion to the size of their shares, but there may be any other principles of division.

Anatomy of a question

Payment of compensation for the actual value of the share to the participant

Participant Oleg Fedorovich Ivanov (31.25% share in the authorized capital) submitted an application to leave the company on June 4, 2021. The company pays compensation to the participant in the amount of the actual value of the share.

We determine the actual share of the participant Ivanov O.F.

The actual value of a participant's share is part of the value of the company's net assets, proportional to the size of the participant's share.

What are the organization's net assets (NA)?

Interpretation of concept No. 1

NA is the difference between the value of assets minus the liabilities of the organization accepted for calculation.

Interpretation of concept No. 2

NA is the value of the organization’s current and non-current assets, secured by its own funds.

Formula for calculating net assets:

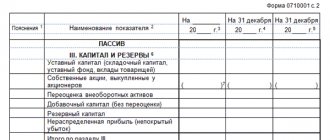

Net assets = “Total section III of the balance sheet” plus “Deferred income” minus “Debt of the founders for contributions to the authorized capital”

For the calculation, the balance sheet data for the last reporting period preceding the date of submission of the application is accepted.

Important: the fact that interim financial statements are not subject to presentation and publication is not a reason for their ignorance.

Let us recall the procedure in 1C: Enterprise Accounting, edition 3.0 when forming the authorized capital of an organization.

Before release 3.0.46: “Operations” - “Operations entered manually.”

After the release of 3.0.46: “Operations” - “Formation of authorized capital”.

It is possible to create a list of participants with distribution by shares in the authorized capital:

The debt of the founders can be repaid through the cash register, current account and by contributing property (expert assessment).

Total for line 1300 of the balance sheet as of May 31, 2021. amount 8292.0 thousand rubles (authorized capital as of May 31, 2021 is indicated for reference)

Balance on the debit of account 75 “Settlements with founders” (there are no debts on contributions to the authorized capital)

Balance on the credit of account 98 “Deferred income” (zero balance)

Net assets of the company as of the date of withdrawal of the participant Ivanova O.F. amounted to:

8292.0 thousand rub. (line 1300 of balance) + 0 thousand rubles. (balance on account D 98) – 0 thousand rubles. (balance on K-account 75) = 8292.0 thousand rubles.

The actual value of the share of the participant Ivanov O.F. is:

8292.0 / 100 * 31.25 = 2591.25 thousand rubles.

We reflect the transfer of the share of participant O.F. Ivanov. to society:

— an increase in the company’s additional capital in the amount of the actual value of the share of the “exiting” participant;

— transfer of the nominal share of the “exiting” participant to the company.

Nominal value of the authorized capital as of June 30, 2021. hasn't changed.

The withdrawal of a participant from the company is not the sale of a share (property right), therefore the participant is not obliged to pay the tax on his own. This is the responsibility of the organization.

Important: if the share was acquired after January 1, 2011. and the period of ownership of the shares was more than 5 years, then the participant does not have taxable income.

On the day the actual share is paid to the participant (no later than 3 months from the date such an obligation arises), personal income tax must be withheld from the entire amount of the actual value of the share. Amounts paid to a participant upon leaving the company are not wages or remuneration for work performed (services provided), and therefore are not subject to insurance premiums and accident insurance contributions.

Settlements with participant Ivanov O.F. closed.

If the participant’s share is not paid within 3 months, then the organization will receive non-operating income.

Payment of shares using company property

When a participant pays a share with property, the organization at OSNO becomes obligated to pay VAT on the difference between the market value of the property transferred to the participant and his initial contribution. The market valuation of the property must be confirmed by an expert opinion.

Moreover, it is necessary to restore the VAT on this property, if it was previously accepted for deduction because property is involved in a transaction that is not recognized as a sale. The specifics of VAT recovery are defined in clause 3 of Article 170 of the Tax Code of the Russian Federation.

Actions with shares after a participant leaves the company

During the year, the share of the retired participant must be distributed among all participants, or offered for acquisition to third parties (if this does not contradict the charter).

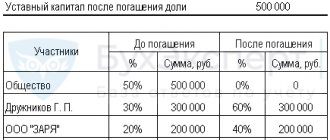

Important: if after a year the share received by the company is not sold or distributed, then it must be repaid. In this case, the nominal value of the capital is reduced by the value of the redeemed share. This leads to an increase in the percentage of participants.

Distribution of shares between participants:

The share is distributed among the participants at par value. The postings in this case are intuitive (D-t 80 sub-account “Participant” K-t 80 sub-account “Society”). The actual value of the share is written off against net profit (D-t 84 K-t 81).

The size of the authorized capital remains the same, the percentage of participation in the authorized capital and the nominal size of the share of participants increases. The participants receive neither money nor property - therefore, they have no economic benefit.

For the amount of the actual value of the share, the participant who left the company becomes obligated to pay personal income tax, and the LLC becomes obligated to pay tax agent.

The tax is withheld from the next payment and transferred to the budget no later than the next day. The payment can be salary, rent, dividends, bonuses, financial assistance.

If it was not possible to withhold personal income tax until the end of the tax period, no special payments are required to be made to the “exiting” participant. In this case, before March 1 of the next year, a 2-NDFL certificate is submitted to the tax office (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Sign 2: “type of certificate” - “about the impossibility of withholding personal income tax”

Sale of shares to participants or a third party

The company may sell the actual share ( or part thereof ) to one or more participants or third parties. The sale price is set by a decision of the general meeting of participants. In this case, the company has taxable income (Ct. 91.1 “Other income”).

The article contains the main options for structural changes in the authorized capital of an LLC. If there are special nuances in your practice, please write in the comments. Let's think together.

And, as usual, a little motivation:

“Sometimes the difference between achieving a goal and failing is just how quickly you give up hope of success. Hope is not an emotion; it’s a trilogy of purpose, direction and resilience.”

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments