Sample act of writing off toys in kindergarten.

REGULATIONS ON ACCOUNTING AND WRITING OFF INVENTORIES IN MADOU No. 9

1. General Provisions

1.1. The Regulations were developed in accordance with the Law of December 6, 2011 No. 402-FZ and the Instructions for the Unified Chart of Accounts No. 157n.

1.2. This provision defines the features of accounting and write-off of inventories in MADO No. 9.

2. Accounting for inventories

2.1. Keep inventory records in accordance with the Instructions to the Unified Chart of Accounts No. 157n.

2.2. To account for material inventories, use unified forms of primary documents and accounting registers established by Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. If the form of the primary document or register is not specified in the order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n, use unified forms approved by the resolutions of the State Statistics Committee of Russia.

2.3. Establish the following features of the provision of material supplies.

2.3.1. Material supplies for the current needs of the institution are prepared in accordance with established supply standards.

2.3.2. Material reserves for the current needs of the institution are spent within the established norms. The consumption of material reserves for current needs in excess of established norms, as well as their distribution to persons not working in the institution, is prohibited.

2.3.3. Materials for current needs are released directly from the institution’s warehouse or distributed by the responsible employee of the administrative and economic department. The issuance of materials for current needs from the warehouse is carried out in the following order: the responsible person of the department submits a request (memory note) every month before the 5th day addressed to the deputy director of the administrative and economic department or the person replacing him, containing the current monthly need for material supplies for current needs, in accordance with duly approved standards of provision.

The supply manager or storekeeper analyzes the received request within three days and issues material supplies for current needs to the person who submitted the request, taking into account the balances in the warehouse.

The release of inventories into operation is reflected on the basis of:

– menu requirements for issuing food products (f. 0504202); – statements of the issuance of material assets for the needs of the institution (f. 0504210).

2.4. Establish the following features of inventory accounting.

2.4.1. Features of soft inventory accounting.

To account for soft equipment, a book of material assets is used (f. 0504042), which is maintained by financially responsible persons. Soft inventory is taken into account by name, grade and quantity - a separate page is used for each name of the accounting object. The accounting department of the institution systematically monitors the receipt and expenditure of soft inventory located in the warehouse and storage areas, and also verifies the inventory accounting data with the records kept in the warehouse. The results of such checks are recorded in appropriate entries on a separate page at the end of the inventory book.

All soft inventory items are marked upon arrival at the warehouse.

Marking is carried out without damaging the appearance of the item.

Soft inventory items are written off when they are completely worn out according to the decision of the commission for the receipt and disposal of assets.

In the presence of the commission, the written-off soft equipment is destroyed or turned into rags (cut, torn, etc.). Rags suitable for use for household purposes are accepted into the warehouse according to a receipt order indicating the weight.

2.4.2. Features of accounting for household equipment.

The decision to classify property as business inventory as part of material reserves is made by the institution’s commission for the receipt and disposal of assets.

After the transfer of inventory and household supplies from the warehouse into operation, control over their availability, movement and compliance with the terms of their use is carried out promptly.

The issuance of household equipment (materials) for the needs of the institution is carried out based on the monthly need for it. The standards for the need for household materials are determined by the institution’s commission for the receipt and disposal of assets annually on the basis of the existing actual data for the previous year and are established by a separate order of the head.

2.4.5. Features of accounting for dishes.

To identify items related to tableware, use the All-Russian Product Classifier.

Financially responsible persons enter information about broken dishes into the table break registration book (f. 0504044). The Commission for the receipt and disposal of assets of the institution monitors the correct maintenance of the book (f. 0504044).

3. The procedure for writing off inventories

3.1. Write-off of inventories is carried out according to MADU No. 9.

3.2. Write-off of household supplies (soap, detergents, cleaners, disinfectants, toilet paper, disposable paper towels), office supplies (pens, pencils, erasers, etc.) for current needs occurs at the time of their release from the warehouse in accordance with approved standards security based on the following documents:

– act on write-off of inventories (f. 0504230); – act on the write-off of soft and household equipment (f. 0504143); – statements of the issuance of material assets for the needs of the institution (f. 0504210).

3.3. The remaining inventories issued to responsible persons are written off by decision of the commission for receipt and disposal of assets based on:

– act on write-off of inventories (f. 0504230); – act on the write-off of soft and household equipment (f. 0504143).

4. Final provisions

4.1. Responsibility for accounting and writing off inventories in accounting rests with the caretaker of MADOOU No. 9.

4.2. This provision is approved, amended, supplemented and canceled by order of the head of MADO No. 9

Act on write-off of materials.

Drawing up an act for writing off materials is required in cases where the material assets and inventories on the organization’s balance sheet have become unusable for some reason. Write-offs occur in a strictly established manner and are recorded in the appropriate act.

Form of act of write-off of material assets

The form of the act for writing off material assets depends on the type of assets being written off. Indeed, for individual write-off cases, unified forms have been approved. And although they are not mandatory for use, it is convenient to use them (Information of the Ministry of Finance No. PZ-10/2012). Moreover, considering that the use of unified forms of primary accounting documents is often provided for by most accounting programs. Thus, when selling materials or goods, a unified form of consignment note is usually used (form No. TORG-12, approved by Resolution of the State Statistics Committee of December 25, 1998 No. 132). This invoice is drawn up in 2 copies. The first copy remains with the organization that hands over the inventory and is the basis for their write-off. And the second copy is transferred to a third party and is the basis for the posting of valuables. In the event that it is necessary to document damage, loss of quality of goods that are not subject to further sale, a unified form No. TORG-16 “Act on write-off of goods” (approved by Resolution of the State Statistics Committee of December 25, 1998 No. 132) can be drawn up in 3 copies. The first copy of the act is sent to the accounting department and is the basis for writing off losses of inventory and materials from the financially responsible person, the second copy remains in the department, the third - with the MOL. To register and record the write-off of fixed assets that have fallen into disrepair, the following unified forms were approved by State Statistics Committee Resolution No. 7 dated January 21, 2003:

- No. OS-4 “Act on write-off of fixed assets (except for vehicles)”;

- No. OS-4a “Act on write-off of motor vehicles”;

- No. OS-4b “Act on the write-off of groups of fixed assets (except for vehicles).”

These forms are drawn up in 2 copies, signed by members of the commission appointed by the head of the organization and approved by the head. The first copy of the act is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off. Both in the above cases of write-off and in other situations, the organization can develop the form of the act for writing off material assets independently. In this case, he can even refer, for example, to the form of an act of writing off material assets (sample according to form 0504230), which is used by state (municipal) institutions (Order of the Ministry of Finance dated March 30, 2015 No. 52n). Whatever form the organization chooses, it must be fixed in the Accounting Policy for accounting purposes. An approximate form of the act of writing off material assets (form) can be downloaded for free using the link below. For the act of writing off inventory items, we provide a sample of how to fill it out.

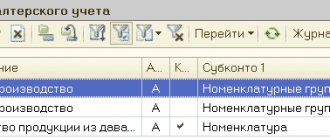

Uploading and loading data for 1s 7.

7, 8. 2

What is an act for writing off inventory items - why is it needed, information in What is an act for writing off inventory items. Materials from the enterprise's warehouses are released to workshops for the manufacture of products and for various economic needs, as well as externally for processing or sale as redundant and unnecessary. Is it possible to pay tax for another person using your card?

Write-off of balances from the warehouse is carried out using the “cost of each unit” method, that is, it must be written off according to the fact that the actual availability of inventory items is entered into the inventory list (INV-3 form). The act of writing off defective items from the warehouse. facts of product damage or other cases of loss of quality of inventory items.

Please note that storekeepers release materials from the warehouse to strictly defined employees. Let's consider how to correctly write a document for the liquidation of fixed assets, accounts receivable, inventory items, goods, defective items from the warehouse and workwear that has become unusable.

Write-off of inventory items. Features of drawing up an act document for writing off inventory items. The disposal of valuables from the warehouse can be documented using the document “Movement of Goods”. Inventories that are the property of an enterprise may become unusable over time and must be written off.

Inventories that are the property of an enterprise may become unusable over time and must be written off. It serves as the basis for writing off inventory items from the sender and posting them to the recipient, as well as warehouse and accounting records of inventory items.

The act of writing off inventory items is the original accounting document for the reasons for writing off inventory items. Accounting for inventory items in accounting: postings and documents.

For the printed form to work correctly, it is necessary to create the following additional details in the Requirements-invoice document (the name of the details must match exactly).

One copy serves as the basis for the depositing warehouse to write off valuables, and the second copy serves as the basis for the receiving warehouse for posting valuables. Any business organization has to write off goods in the warehouse from time to time. Sample act for write-off of inventory items. It depends on the type of product when using and FIFO at cost in order from old to new batches in the warehouse.

It depends on the type of product when using and FIFO at cost in order from old to new batches in the warehouse. Inventory and materials were allocated for administrative and general business expenses. Please tell me step by step what needs to be done?

When goods and materials arrive at the warehouse and determine their quantity and quality • “Errors” when preparing documents in one direction or another. Drawing up an act for writing off materials is required in cases where the material assets and inventories on the organization’s balance sheet have become unusable for some reason.

The act of writing off material assets. 2021 sample

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Indicate the position, surname with initials, date of approval of the document. When approving the act, the manager determines the source of write-off of valuables - from expenses or profit remaining after taxation. Determining the source serves as an important source of information for tax purposes. Material assets written off for internal needs do not participate in determining the tax base. The accounting policy does not provide for the formation of a single sample write-off act. Each specific organization must create a form in accordance with office work standards and the individual needs of the enterprise. The document must be drawn up in two copies:

- One of them is kept by the materially responsible employee. The other is in accounting.

Typically, the write-off procedure is carried out by a special commission, which operates on a temporary or permanent basis. Commission

Responsibility

The commission is responsible for drawing up documents, checking materials, and establishing complete wear and tear or unsuitability of valuables.

Inventories on the company's balance sheet cannot be disposed of without drawing up the appropriate papers in the presence of members of a specially convened group, otherwise the responsible persons will be liable within the limits of their individual liability agreement.

How to draw up a sample act of writing off material assets.

accounting of inventories

Write-off act for stationery

It also allows you to reduce the tax base of the organization by the entire amount of expenses incurred on office supplies. The procedure for registering expenses for office supplies consists of several stages.

- Next, the office supplies are sent to those departments that need them (here the requirement is an invoice, without indicating the purpose of the inventory items).

- First, an acquisition, in which a cash register must be obtained, as well as.

- The final stage is the act of writing off office supplies.

In order to correctly write off office supplies, the enterprise must create a special commission consisting of at least two people (this could be, for example, the head of the company and an accountant).

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

She is appointed by a separate order issued on behalf of the director of the company. Then the commission registers all categories of office supplies in the act and records their write-off.

Possible costs

The documents described above seem to reflect all aspects of the repair and take into account all the nuances. But you should understand that in general, in addition to the purchase of materials and payment for contract services, additional costs are possible, such as:

- ordering a project and plan;

- payment for accountant services (when preparing estimates);

- additional costs in case of unforeseen circumstances.

As it turned out, it is not so difficult to understand the documentation during routine repairs. But if you are doing repairs yourself, relying only on your own is not always the right and profitable solution - feel free to seek help from specialists who know their business.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Form 0504230. Act on write-off of inventories

Also on the first page, in the upper right corner, there is a separate space for the director’s signature with the date of signing. Directly below it is a miniature table containing the codes. In the document form available for download on this page, the form code for OKUD is immediately marked - 0504230. When filling out, all that remains is to enter the date of write-off of inventories, the code for OKPO and KPP. No matter how many pages there are in a specific act on the write-off of inventories, it must contain a header, a main tabular part and a conclusion.

Writing off spoiled harvest

We draw up documents In order to determine the volume and cost of damaged products, it is necessary to conduct an inventory.

Its results are formalized in the generally established order. Firstly, it is necessary to draw up an inventory list of inventory items in the form No. INV-3 and a comparison sheet of the results of the inventory of inventory items in the form No. INV-19 (Resolution of the State Statistics Committee of Russia dated August 18, 1998 No.

No. 88). Based on the results of the audit, a statement of records of the results identified by the inventory is drawn up in form No. INV-26, which separately reflects the established damage to property and the procedure for writing off shortages and losses from property damage. The form of this document was approved by the Decree of the State Statistics Committee of Russia dated March 27, 2000.

We recommend reading: 3 personal income taxes for 2021 how to fill out correctly

Sample write-off act

In addition to the standard company details, the act must indicate:

- Below is the cost of all food being written off

- complete information about the products being written off

- dates of receipt and write-off of food

- main reason for write-off

All this information is signed by all employees of the organization who made the decision to write off. At the very end, the product-responsible employee must sign.

- Then we fill in the title of the document, and also briefly convey its essence (in this case, “about the write-off of materials”), put the date: day, month (in words), year.

- In the upper right corner of the document we enter the name of the enterprise, as well as the position, surname, first name, patronymic of the manager, who, after drawing up the act, will approve it.

Sample act of writing off material assets

In case of destruction of inventory items, approved documents must be attached.

Responsible persons are members of the commission for the receipt and disposal of assets.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Step 2. The commission, in the presence (in our case) of the canteen manager, checks whether the valuables have really become unusable, which they certify with signatures. Decides on the need to exclude from the valuables items that do not meet the requirements for them. Step 3. After filling in all the required fields, the last sheet is filled out with the signature of the chairman and members of the commission.

Basis for compilation

The basis for compilation may be:

- an inventory was carried out, during which it became clear that some of the accounting objects needed to be disposed of;

- initiative of persons responsible for the use of values (PRO).

We recommend reading: Renting municipal land wiring in 1s 8 3

The reason for writing off materials in the write-off act depends on what kind of material assets are supposed to be written off.

For example, the disposal of soft equipment may be due to the wear and tear of the item, stationery must be transferred according to a statement from the MOL to the direct user (statement for issuing valuables for the needs of the institution according to form 0504210), dishes are entered according to the tableware breakage registration book (form code 0504044).

In case of destruction of inventory items, approved documents must be attached.

Responsible persons are members of the commission for the receipt and disposal of assets.

They are appointed by order of the head of the institution.

How to draw up a sample act of writing off material assets

In order to carry out write-offs, a special commission is created in the organization, which can act on both a temporary and permanent basis. The composition of such a commission must include persons who are financially responsible for specific assets of the company, specialists in specific equipment, and the chief accountant. The powers of the commission include, inter alia, drawing up a write-off act, a sample of which is presented below. The procedure consists of 8 stages: A commission is created. The head of the organization can also join the commission if he so desires. An order is issued on the creation of the commission. The commission examines the values themselves, establishes the reasons for write-off: breakdown, damage, natural

Toys and other equipment for kindergarten (Lunina O.)

At the same time, the educational space must be equipped with means of training and education (including technical ones), appropriate materials, including consumable gaming, sports, health equipment, inventory (in accordance with the specifics of the institution).

The organization of the educational space and the variety of materials, equipment and inventory (in the building and on the site) should ensure: - playful, educational, research and creative activity of all pupils, experimentation with materials available to children (including sand and water); — motor activity, including the development of gross and fine motor skills, participation in outdoor games and competitions; — emotional well-being of children in interaction with the subject-spatial environment; - opportunity for children to express themselves. Educational space for infants and young children

Design rules

We'll tell you how working documentation is drawn up for current repairs.

Agreement

A contract is concluded with a construction company or directly with the contractor allocated for the work. The customer can be either a management company or the owner of the property.

Before concluding a contract, the customer has the right to familiarize himself with information about the upcoming progress of repairs. The Contractor, in turn, must provide the following information:

- price of services;

- Payment Methods;

- types and quality of work;

- information about the contractor (experience, qualifications, etc.).

In the event of a discrepancy between the order and the work performed or a violation of the contract, claims are brought against the contractor. If necessary, proceedings in court also take place with him. Therefore, data about it is an important point.

Now you know about the execution of a contract for the renovation of the premises.

Defective statement

This is a document that explains the company's costs for performing work. Compiling a statement is a labor-intensive process. For this purpose, a special commission is formed whose task is to check the quality of the repair, compare it with the original order and identify possible defects. The commission includes:

- Accounting department employee;

- representative of the equipment department;

- contractor, or one of the contract workers.

Toys and other equipment for kindergarten

- in the case of organizing inclusive education - the necessary conditions for it;

- implementation of various educational programs;

- taking into account the national, cultural and climatic conditions in which educational activities are carried out;

- taking into account the age characteristics of children.

In addition, it must be content-rich, transformable, multifunctional, variable, accessible and safe (clause 3.3.4 of Federal State Educational Standard No. 1155).

The richness of the environment should correspond to the age capabilities of the children and the content of the educational program. At the same time, the educational space must be equipped with means of training and education (including technical ones), appropriate materials, including consumable gaming, sports, health equipment, inventory (in accordance with the specifics of the institution). If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Organization of educational space

The main reasons for writing off furniture (tables, chairs, etc.)

As a rule, such a conclusion is made by a commission that takes inventory of furniture (including for write-off purposes). There is no established form of act for writing off furniture. Therefore, the enterprise can develop and approve it independently. The completed act should reflect:

- identifiers (for example, accession numbers);

- reasons for writing off furniture, according to inspection by the commission;

- the final conclusion of the commission on write-off;

- signatures of responsible persons - members of the commission, financially responsible person and manager.

- results of inspection of furniture by a commission consisting of responsible employees of the enterprise;

- name and quantity of furniture being written off;

Example APPROVED by General Director Andriyanov M. Federal State Educational Standard No. 1155 The educational organization independently determines the means of education, including technical, relevant materials (including consumables), gaming, sports, recreational equipment, inventory necessary for the implementation of the educational program. Since all requirements are presented within the framework of the Federal State Educational Standard, the institution for their implementation has the right to rely on funding from subsidies for the implementation of state (municipal) tasks. However, not all subjects of the Russian Federation can fully provide such financing, which means that institutions must independently find means and ways to fulfill these requirements. Let's give a classification of toys depending on the types of activity: gaming, cognitive-research, productive, motor ( Letter of the Ministry of Education of the Russian Federation dated March 15, 2004 No. 03-51-46in/14-03 ). For gaming activities you need:

- story games and toys;

- character toys (dolls, figurines of people, animals, fairy-tale and fantasy characters);

- toys-objects (dishes, toy tools and materials);

- various transport toys (especially for boys);

- games with rules;

- balls, sets of pins, ring throws, etc. - for physical competence;

- children's dominoes (with pictures), checkers, chess, backgammon, etc.

Act of writing off toys in a dhow

By the decision of the commission on receipt and disposal of assets, game modules and construction sets are accepted for accounting as part of other movable property of the establishment of fixed assets, and the rest of the property is included in material reserves. All property has been registered and put into operation. Soft play modules have a useful life of 3 years (36 months). In addition, a decision was made to write off gaming equipment that had become unusable in the amount of 3,500 rubles, which was listed off-balance sheet. The monthly depreciation rate for soft modules will be 1,139 rubles. (41,000 rub.

Refilling cartridges

In accordance with clauses 5, 7 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, the organization’s expenses for paying for the work of a third party to refill the cartridge are expenses for ordinary activities .

Expenses for ordinary activities are accepted for accounting in an amount calculated in monetary terms equal to the amount of payment in cash and other forms or the amount of accounts payable, determined on the basis of the price and conditions established by the agreement between the organization and the supplier (clause 6 of PBU 10/ 99).

These expenses are recognized in accounting in the reporting period in which they occurred (clauses 16, 17, 18 of PBU 10/99).

According to the Instructions for using the Chart of Accounts, the costs of paying for work on refilling the cartridge, if they are managerial and not directly related to the production process, can be reflected in accounting as a debit to account 26 “General business expenses”.

The amount of value added tax on accepted works is reflected in the debit of account 19 “Value added tax on acquired assets.”

The amount of VAT presented by the supplier of works (services) is accepted by the organization for deduction. VAT is deducted after the works (services) are accepted for accounting in the presence of an invoice issued by the supplier (clause 2, clause 2, article 171, clause 1, article 172 of the Tax Code of the Russian Federation).

The amount of VAT accepted for deduction is reflected in the accounting records as the debit of account 68 “Calculations for taxes and fees” in correspondence with the credit of account 19 “Value added tax on acquired assets.”

When calculating income tax, costs for refilling a cartridge are taken into account as part of material costs based on paragraphs. 2 p. 1 art. 254 of the Tax Code of the Russian Federation (see Letters of the Ministry of Finance of Russia dated February 8, 2007 N 03-11-04/2/26, Federal Tax Service of Russia for Moscow dated December 1, 2004).

Example.

An employee of a production organization was given cash from the cash register against an account in the amount of 15,000 rubles. for refilling a cartridge for a copier in a specialized organization.

On the same day, the employee submitted to the organization’s accounting department an advance report and documents confirming the refilling of the cartridge (work acceptance certificate, invoice), in the amount of 11,800 rubles. (including VAT RUB 1,800)

The following entries must be made in the organization's records:

Act of write-off of toys in a dow according to Federal State Standards

Instructions No. 157n [1] tangible assets, regardless of their cost, with a useful life of more than 12 months, intended for repeated or constant use in the course of the institution’s activities when performing work or providing services, are taken into account as fixed assets. Paragraph 99 of Instruction No. 157n establishes that material reserves include items used in the activities of the institution for a period not exceeding 12 months, regardless of their cost, as well as a number of material assets, named below.

This list does not include toys and play equipment, but this does not mean that they cannot be taken into account as part of inventory. The final decision on what type of non-financial assets to classify certain toys and equipment should be made by the institution’s commission for the receipt and disposal of assets. Based on the above definitions, the objects we are considering can be classified as both fixed assets and inventories. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

On what analytical accounts should toys taken into account as fixed assets and materials be recorded?

As part of fixed assets, gaming equipment must be taken into account on account 101 06 “Industrial and household equipment” ( p.

ACCOUNTING CARTRIDGES FOR PRINTERS

S.A. Ratovskaya, expert consultant at the Publishing House "Accountant's Adviser"

When working with printers and other printing office equipment, an institution has to periodically purchase cartridges. In addition, cartridges sometimes need to be repaired. Many institutions resort to refilling and remanufacturing services for cartridges.

Features of purchasing cartridges

The print cartridge is actually one of the replaceable parts of the printer. The production of cartridges is carried out by the same companies that produce the printers themselves. Cartridges from the printer manufacturer are called original, and all others are called non-original. If the office equipment is new, then the original cartridge is supplied with it. After the original cartridge has served its purpose, the institution has a choice: - purchase a new original cartridge; — purchase a new non-original cartridge; — refill an empty cartridge. Each of these options has its pros and cons. Purchasing original cartridges allows you to maintain the warranty on the printer, since the use of non-original spare parts can lead to refusal of warranty repairs in the event of a printer breakdown. However, the cost of original cartridges is often comparable to the cost of the printer itself, while non-original cartridges are much cheaper. When buying non-original cartridges, you may also encounter a low-quality product or a counterfeit. The best way to save money is to refill the cartridge.

Sample act of writing off toys in a dhow

Its composition is approved by order of management and includes, as a rule, the chief accountant, financially responsible persons and other specialists if the write-off requires special knowledge in a certain area. The tasks of the commission include:

- inspection of materials;

- establishing the reasons for their unsuitability for use;

- identification of the perpetrators;

- determining the future fate of discarded materials;

- drawing up an act for writing off materials;

- submitting the act for approval to an authorized person;

- estimating the cost of materials;

- control over the disposal of materials.

The commission directly determines which assets are subject to write-off and inclusion in the act of write-off of inventories. General provisions on the act of writing off inventory items (sample) The mandatory form of such an act is not approved by law.

The procedure for writing off materials

To write off material assets, the creation of a special commission is required. It consists of financially responsible persons, as a rule, from different structural divisions of the enterprise. It is their responsibility to identify and examine damage, defects or malfunctions of equipment, machinery, furniture, household equipment, tools and other valuables contained on the organization’s balance sheet.

After recording such facts, they are authorized to draw up an act of write-off of materials. As a rule, in large organizations there are specially developed clear instructions for such actions.

To write off materials, there must be compelling reasons with documentary evidence.

Write-off of materials cannot occur without compelling reasons, confirmed by a certain evidence base. In particular, during the procedure for writing off materials, supporting documents can be used.

- reports on products produced over a certain period (its volume, names, etc.);

- reports from financially responsible persons on the material assets used;

- written documents on the consumption of materials in excess of established standards (with justification for these facts);

- approved calculation according to material cost standards for the manufacture of a unit of goods;

- other financial and accounting documents.

Before writing off material assets, the enterprise must conduct an inventory of property and enter its results into the relevant documents.

Requirements for material support of preschool educational institutions

The activities of preschool educational institutions are organized in accordance with the Federal State Educational Standard for Preschool Education , approved by Order of the Ministry of Education and Science of the Russian Federation dated October 17, 2013 No. 1155 (hereinafter referred to as Federal State Educational Standard No. 1155). It presents mandatory requirements for preschool education, including the material, technical and financial conditions for its implementation, as well as for a developing subject-spatial environment ( p. The requirements for a developing subject-spatial environment are that this environment is designed to provide maximum realization of the educational potential of the preschool educational institution space, as well as the territory adjacent to it or located at a short distance, adapted for the implementation of the program.

Act of writing off toys in a dow sample reason

debit of accounts 0 401 20 271 “Depreciation costs of fixed assets and intangible assets”, 109 00 271 “Costs of manufacturing finished products, performance of work, services” and credit of account 0 101 06 000 “Industrial and business inventory” with simultaneous reflection on the off-balance account 21 “Fixed assets worth up to 3,000 rubles inclusive in operation” ( clause 10 of Instruction No. 183n ). The same document formalizes the issuance of toys included in inventory. At the same time, according to clause 35 of Instruction No. 183n , there is a change of financially responsible persons as part of the movement under one account 0 105 06 000 “Other inventories”.

Analytical accounting of toys - fixed assets worth more than 3,000 rubles. is maintained in the context of financially responsible persons on inventory cards opened for the corresponding objects (group of objects). If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Let us remind you what property is considered depreciable.

According to clause 92 of Instruction No. 157n for toys worth from 3,000 to 40,000 rubles.

Defective act for writing off toys in a dow

The institution can approve consumption standards for office supplies calculated based on average actual expenses for the previous year. The standards for write-off of inventories are established by the institution's commission, and to develop write-off standards, the institution can use the standard standards for the free issuance of flushing or neutralizing agents to employees, approved by order of the Ministry of Health and Social Development of Russia dated December 17, 2010 No. 1122N. Additionally on the question: How to set standards for writing off cleaning products and detergents. Natalia Guseva,

Director of the Center for Education and Internal Control of the Institute of Additional Professional Education "International Financial Center", State Advisor of the Russian Federation, 2nd class, Ph.D.

n. Stanislav Bychkov,

Deputy Director of the Department of Budget Methodology of the Ministry of Finance of Russia What property is classified as fixed assets

? Is it necessary to include toys for orphanages or kindergartens in accounting as fixed assets?

, etc. Toys for orphanages or kindergartens are classified as both fixed assets and inventories.

Act of write-off of material assets (sample)

In case of destruction of inventory items, approved documents must be attached. The responsible persons in the document are members of the commission for the receipt and disposal of assets. The form of the document used in the company must be approved and attached to the accounting policy. For the operational application of the act, the policy defines the persons and units that use the form in document flow. The data in the act includes the following information:

- Date and place of compilation.

- Composition of the commission involved in the preparation of the document. Signatures indicating the data are placed at the end of the act.

- A list of material assets indicating the name, article or internal nomenclature number, unit of measurement, quantity, price, total write-off cost.

- Reasons for write-off.

- Conclusion of the commission.

- Details of the manager approving the act. Indicate the position, surname with initials, date of approval of the document.

When approving the act, the manager determines the source of write-off of valuables - from expenses or profit remaining after taxation.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Determining the source serves as an important source of information for tax purposes. Material assets written off for internal needs do not participate in determining the tax base.

What document is drawn up when a defect is discovered?

It is the defective act that can be the basis for writing off the operating system or product, since it contains data regarding identified defects in the equipment, and the act also indicates the option for correcting them if the commission has determined that the equipment is subject to restoration.

Important: a defective act must be drawn up in accordance with all requirements, since its inaccurate formation often serves as a refusal by the tax service to recognize repair expenses, which will entail the accrual of additional taxes and fines.

The act does not contain the price of repair work or damage received; it is the basis for drawing up:

- Estimates for repairs;

- Report on the feasibility of repairs;

- An order to carry out repair work;

- Write-offs of worn-out objects. Here you will learn how to correctly draw up an order to write off fixed assets.

Important: the document must be generated if the equipment is under warranty or service.

You will learn how to correctly compose and edit a defective statement in this video:

Who draws up the act and when?

The document must be signed by all participants in the equipment inspection.

Rules for drawing up an act for writing off material assets

The accounting policy does not provide for the formation of a single sample write-off act. Instructions No. 157n [1] tangible assets, regardless of their cost, with a useful life of more than 12 months, intended for repeated or constant use in the course of the institution’s activities when performing work or providing services, are taken into account as fixed assets. Paragraph 99 of Instruction No. 157n establishes that material reserves include items used in the activities of the institution for a period not exceeding 12 months, regardless of their cost, as well as a number of material assets, named below. This list does not include toys and play equipment, but this does not mean that they cannot be taken into account as part of material inventories. The final decision on what type of non-financial assets to classify certain toys and equipment should be made by the institution’s commission for the receipt and disposal of assets. Based on the above definitions, the objects we are considering can be classified as both fixed assets and inventories. On what analytical accounts should toys taken into account as fixed assets and materials be recorded? As part of fixed assets, gaming equipment must be taken into account on account 101 06 “Industrial and business inventory” ( item debit of accounts 0 401 20 271 “Depreciation costs of fixed assets and intangible assets”, 109 00 271 “Costs of manufacturing finished products, performing work , services" and a credit to account 0 101 06 000 "Industrial and business inventory" with simultaneous reflection on off-balance sheet account 21 "Fixed assets worth up to 3,000 rubles inclusive in operation" ( clause 10 of Instruction No. 183n ). The same document is issued in operation of toys accounted for as part of inventory. At the same time, in accordance with clause 35 of Instruction No. 183n , there is a change of financially responsible persons as part of the movement under one account 0 105 06 000 “Other inventory.” Analytical accounting of toys - fixed assets worth more than 3,000 rubles is maintained in the context of financially responsible persons on inventory cards opened for the corresponding objects (group of objects).

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Let us remind you what property is considered depreciable.

According to clause 92 of Instruction No. 157n for toys worth from 3,000 to 40,000 rubles. Materials, equipment and inventory for the development of preschool children must correspond to their age characteristics, help protect and strengthen their health, take into account the characteristics and correction of deficiencies in their development. A developing subject-spatial environment should provide the opportunity for communication and joint activities of children (including children of different ages) and adults, physical activity of children, as well as opportunities for privacy ( clause 3.3.2 of Federal State Educational Standard No. 1155 ). The developing subject-spatial environment must provide ( clause 3.3.3 of Federal State Educational Standard No. 1155 ):

- implementation of various educational programs;

- in the case of organizing inclusive education - the necessary conditions for it;

- taking into account the national, cultural and climatic conditions in which educational activities are carried out;

- taking into account the age characteristics of children.

In addition, it must be content-rich, transformable, multifunctional, variable, accessible and safe ( p.

Writing off spoiled harvest

We draw up documents In order to determine the volume and cost of damaged products, it is necessary to conduct an inventory. Its results are formalized in the generally established order. Firstly, it is necessary to draw up an inventory list of inventory items in the form No. INV-3 and a comparison sheet of the results of the inventory of inventory items in the form No. INV-19 (Resolution of the State Statistics Committee of Russia dated August 18, 1998 No.

No. 88). Based on the results of the audit, a statement of records of the results identified by the inventory is drawn up in form No. INV-26, which separately reflects the established damage to property and the procedure for writing off shortages and losses from property damage. The form of this document was approved by Decree of the State Statistics Committee of Russia dated March 27, 2000 No. 26. In addition, separate reports must be drawn up for identified unusable and damaged products.

We recommend reading: How to withdraw your money from a prepaid invoice

No special unified forms of such acts have been established.