The list of basic details that should include a cash receipt printed on new cash registers with online data transfer function is named in Art. 4.7 of Law No. 54-FZ of May 22, 2003. Issuing a check without reflecting the necessary information may result in the entrepreneur or company being held liable under Art. 14.5 Code of Administrative Offenses of the Russian Federation.

Organizations and individual entrepreneurs using online cash registers in their activities are required to issue checks to customers that meet the requirements established by law. The check can be generated either in paper or electronic form. By default, the document is printed on paper, but if the buyer asks for it to be sent to him by phone or email, the check is drawn up in electronic form. Let's look at what an online cash register receipt looks like and what information must be included in it.

Where do the details come from?

Information comes into the check from several sources.

This is both technology and software that connects several devices into one system. For example, a fiscal drive, checkout scales, barcode scanner. Figure 1 shows the ways in which information is received and its sources. Figure 1. Sources of information for a cash receipt .

Some of the details are supplied by the cash register software (highlighted in blue in Figure 1), namely:

- type of receipt (receipt or expense);

- check number;

- quantity of goods;

- the cost of several units of one product;

- tax amount;

- total purchase amount;

- form of payment (cash or non-cash form, amount received from the buyer, amount of change);

- VAT amount;

- buyer and sender email;

- date and time of purchase;

- advertising text.

Some data in the check comes directly from the commodity accounting system (highlighted in yellow in the figure):

- Name of product;

- unit cost;

- VAT rate;

- Cashier's name.

Another part of the details is sent to the check by the online cashier itself (highlighted in green in the figure):

- serial number of the cash register;

- taxation system;

- shift number;

- details of the selling company;

- website address for checking the fiscal characteristics of the document (FPD);

- KKT registration number (machine registration number, RNM);

- serial number of the fiscal drive;

- serial number of the fiscal document;

- fiscal sign of the document;

- QR code.

How should the value added tax rate be reflected if an organization uses a simplified taxation system and is not a VAT payer? Should I indicate 0% for each item or in the cost of settlements as a whole? Organizations and individual entrepreneurs that use the simplified taxation system are not payers of value added tax. They do not indicate VAT when printing cash receipts: neither separately for each item (clause 1 of Article 4.7 of Law No. 54-FZ) nor for the receipt as a whole (note No. 6 to Table 19 of the Appendix to the order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ -7-20/229).

Cash receipts - what does the online cash register break through and how to check the information from the receipt?

We buy something every day. Entrepreneurs sell dozens, hundreds, or even thousands of products every day. Every transaction between buyer and seller must be documented by law. The document that serves as confirmation of the transaction is a cash receipt.

The rules for generating checks, requirements for cash registers - devices that generate checks - as well as the procedure for their use by entrepreneurs are clearly described in federal legislation. The implementation of these rules and requirements on the territory of the Russian Federation is monitored by the Federal Tax Service.

A receipt is a document that records data about the product sold, the seller and the technical devices that recorded the fact of the sale.

What a check looks like - a sample of an online cash register receipt, details and description

The information that must be contained in an online cash register receipt is described in Article 4.7 of Federal Law No. 54-FZ. Also, the entrepreneur (owner of the cash register) can, at his discretion, add additional information to the check.

Let's look at an example of a real check and go through its details. The order in which they are displayed (that is, which field follows which) is not specified by law and depends on the model of the online cash register and its settings by the owner.

Branding

In the header of the check, the seller, as a rule, indicates information about himself in a beautiful form. You can place your company logo, name, slogan, etc. here. This part of the check can be filled out in free form by specifying the necessary data in the cash register settings. Naturally, the inclusion of a logo in a fiscal receipt is not a requirement of the Federal Tax Service, but simply an option that was provided by cash register manufacturers and which entrepreneurs can use for marketing purposes.

Product information.

The name of the goods (work, services) must be entered on the receipt. The name of the product can be entered manually by the cashier when issuing a check or selected from the product nomenclature database, which was added to the cash register in advance. When installing the necessary equipment and software, product names can be automatically generated by the cash register when the barcode is read from the product.

Number of goods

Number of goods (works, services). Required details.

Unit price

The price per unit is indicated taking into account discounts and markups. Also required details.

Price

Cost including discounts and surcharges. It is calculated as the unit price of the product multiplied by the quantity. Required details.

VAT rate

Value added tax rate. In this example, the character "A" is specified as a footnote to the line below, which indicates 18%. Required details.

Discount

The amount of the accrued discount - for each item and in total. An optional field, but it is usually included in the cash register functionality and is actively used by entrepreneurs.

Settlement amount

The total cost to be paid for all items, taking into account all taxes, fees, discounts, promotions, bonuses. Must be included in the check.

VAT amount

Total VAT amount. It must be indicated separately for each VAT rate, if there were different rates for different product items.

Calculation form

The payment form indicates the amount of payment in cash and (or) electronic means of payment. Required details

Organization, TIN

Name of the organization that owns the cash register (or full name of the individual entrepreneur) and TIN. Required details.

Place of settlement

Place of payment for goods. The address with postal code, or the name and number of the vehicle (for example, for a taxi), or an Internet address (for online stores) is indicated. Required details.

Tax system

The applicable taxation system must also be indicated: OSN, simplified tax system, UTII, etc.

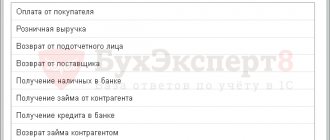

Calculation form

Obligatory field. Possible values:

- Receipt – receipt of funds from the buyer;

- Receipt return – return of funds received from the buyer;

- Expense – issuance of funds to the buyer;

- Refund of expenses - receipt of funds from the buyer (client) issued to him.

Calculation time

Calculation date and time. Obligatory field.

Cashier

position and surname of the person who made the settlement with the buyer (client), issued a cash receipt or strict reporting form and issued (transferred) it to the buyer (client). Obligatory field.

Shift number, serial number of the shift receipt

Also required details.

Website address for checking a receipt

According to the new law, each check can be checked via the Internet, since information about all cash transactions is now transmitted to the Federal Tax Service of Russia through the fiscal data operator. Required details.

Information about fiscal technology

The receipt must contain the following data: RN KKT - registration number of the cash register equipment, FN - serial number of the fiscal drive model, FN - fiscal attribute of the document (assigned to the cash receipt in the OFD), FD - serial number of the fiscal document. The names of abbreviations may differ depending on the CCP model.

QR code

On modern checks, a QR code must be placed to go to the verification page for this check on the website of the authorized body. It is understood that using smartphones you can check a receipt in a few seconds.

Advertising block.

Block with additional information. An entrepreneur can post any information materials that he deems necessary.

Information about electronic means of payment.

Sometimes data from the terminal used to accept payments from bank cards is displayed on a cash receipt along with fiscal information.

Title of the document.

Cash receipt or strict reporting form. Required details.

Optional details

Some details may be missing from the check; they are not mandatory.

For example, the details are “contacts of the buyer and the sender.” If a customer needs an electronic copy of a paper receipt, the cashier must provide it. To do this, when generating a check, the cashier enters the buyer's email address or mobile phone number. In this case, the cash register software will automatically insert into the check not only the buyer’s contacts, but also the e-mail of the store that sent the check (Figure 2). Figure 2. Buyer and seller contacts

If the client does not require an electronic duplicate, then the paper check will be printed without the lines “Buyer's Address” and “Sender's Address”.

The next optional detail is “KKT serial number ”. It should not be confused with the cash register registration number, which is assigned by the tax office at the time the cash register is registered. The manufacturer assigns a serial number to the cash register, and the cash register software automatically adds this number to the receipt. This information may be duplicated in different product positions on the receipt tape, although it is not required to be indicated there.

Figure 3. Serial number of the cash register

Figure 4. Registration number of cash register equipment

Usually, the receipt says “Welcome!” at the beginning and “Thank you for your purchase!” at the end. These inscriptions are called cliches (top) and advertising text (bottom) (Figure 5). Without these lines, the receipt is considered legal, but they are not difficult to create when setting up the cash register software - attention to the buyer never hurts.

Figure 5. Clichés and advertising text

Information required to be included in a check for paying agents

In addition to the above data, the payment agent must reflect in the document issued (sent) to the client the following information:

- The amount of remuneration that the agent receives from the client;

- Phone numbers of the client, agent, supplier and operator;

- Name of the transaction and its amount;

- Name, TIN, address of the operator making the transfer of funds to the client

Online cash register and bank cards: how to make card payments through the cash register.

Matrix code

Tax authorities have introduced the QR code as a tool for civil control.

The buyer can download the free mobile application “Checking a cash receipt with the Federal Tax Service of Russia,” scan the QR code and receive information from the tax authorities about the seller’s integrity. The QR code is not mentioned in the list of requirements for a cash register receipt, but it is mentioned in Article 4 of Law No. 54-FZ “Requirements for cash register equipment.” There, in particular, it is said that the cash register must “provide the ability to print on a cash receipt” a QR code measuring at least 20 x 20 mm. It turns out that the QR code is not a required requisite, but the cash register must be able to print it (Figure 6).

Figure 6. Matrix (QR) code for checking a receipt by the buyer using the Federal Tax Service mobile application

In encoded form, the QR code contains the following information:

- date and time of purchase;

- serial number of the fiscal document;

- calculation indicator (receipt or expense, return);

- settlement amount;

- serial number of the fiscal drive;

- fiscal sign of the document.

You can set up QR code printing in the same place as the general view of the receipt - in the driver, utility or cash register service, depending on the manufacturer of your online cash register.

Main innovation

Receipt generation will be carried out online, and each buyer can receive a cash receipt to their email or mobile device. This innovation, first of all, is a plus for the buyer, since if he loses a paper receipt, he can confirm payment for the purchase using its electronic version.

If the check was issued to the buyer in paper form, it is not necessary to send it electronically, since the client himself can request it from the Federal Tax Service through the mobile service. The client can also check the correctness of the check, and if it is incorrect, send a complaint to the Federal Tax Service - then they will come to the seller with a check or at least ask for clarification.

Sanctions for violations

There are no separate sanctions for issuing an “incorrect” check.

However, penalties will follow for failure to issue a paper (electronic) check. Or because the cash register does not comply with the requirements of the law, while the contents of the check is one of such requirements (Part 6 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation). For failure to issue a check, officials and individual entrepreneurs will pay a fine of 2,000 rubles, and legal entities may be fined 10,000 rubles. However, both violators can get off with a warning. It should be noted that the period for holding people accountable for violating the law has increased from two months to one year.

Generating the “correct” check is a rather complex process in which all sources of details must interact correctly with each other. Therefore, when choosing equipment for a cashier’s workplace, it makes sense to focus on comprehensive solutions that can provide a combination of an inventory system, an online cash register and software.

How to Use a Cashier's Receipt in Marketing

The use of online cash register technology has become a mandatory element of doing business in Russia. At the same time, many entrepreneurs encountered cash registers for the first time in 2021 and 2018. Therefore, not everyone knows about the functionality that is included in modern online cash register models.

Integration of cash register systems with commodity accounting systems

Many cash register models have the ability to connect to a commodity accounting system. Filling the nomenclature database and maintaining various types of records can be fully automated. For example, you can integrate an online cash register into the work of the popular 1C commodity accounting system.

Discounts and promotions

The cash register can be used to run discount programs, promotions, pay with bonuses, etc. The complexity of implementation depends on the specific cash register model.

Changes when crediting or returning an advance

If a company or entrepreneur accepts an advance for certain types of services, then when it is offset or returned, a check (BSO) can be issued in a special manner. It is allowed to generate one fiscal document for settlements for a period from one day to a calendar month , and also not to hand it over to the buyer.

This procedure can be used for services:

- communications;

- in the field of cultural events;

- for the transportation of passengers, luggage and cargo;

- provided in electronic form by foreign organizations under Article 174.2 of the Tax Code of the Russian Federation;

- others determined by the Government.

Changes from July 1, 2021

From this date, new details will be introduced for cash receipts that accompany operations related to lotteries and gambling . The check will need to indicate the name or full name, as well as the TIN of the client or policyholder. If an individual does not know his TIN, it is permissible to indicate his passport data - series and number.

A number of new details will appear on July 1, 2021 in checks used for cash payments (including with the presentation of electronic means of payment, in particular, corporate cards) between organizations and/or individual entrepreneurs . The check will need to indicate:

- name of the organization or full name of the entrepreneur who purchases the product or service;

- Buyer's TIN;

- if a product is purchased, then information about its country of origin;

- the amount of excise tax when purchasing excisable goods;

- registration number of the customs declaration when purchasing imported goods.