ATTENTION! Wage indexation in 2021 in commercial organizations

Inflation is a process that does not need to be proven to anyone who has made expenditures at intervals over time. Part 1. Article 61 of the Civil Code of the Russian Federation states that this fact is generally known and does not need proof.

Is the employer obligated to index wages ?

It follows from this provision that the nominal wages established for workers are constantly reducing their purchasing power . It turns out that by spending the same amount of time and effort, working people will be able to acquire in return less and less material goods.

In order to at least partially compensate for this injustice, the Labor Code stipulates the obligation to index wages .

How this obligation is implemented in practice, what are the features of the indexing mechanism, and how this process is regulated by documents, we will consider below. We will also analyze how to act for an employee whose salary diverges significantly from the level of consumer prices, and the entrepreneur does nothing to improve the situation even a little.

Question: Is it necessary to index the wages of all employees of an organization, regardless of its level, or can we limit ourselves to indexing the wages of employees who have a minimum wage? View answer

What is wage indexation

When working, any person should be sure that he provides himself and his family with at least the minimum necessary opportunities for life. This standard is intended to be guaranteed by the established minimum wage - the amount of wages below which no employer can set the bar.

How to determine the indexation coefficient of wages for employees in an organization?

Since the cost of living is constantly growing due to the process of inflation, this requires a constant increase in the material component of labor remuneration. Art. 130 of the Labor Code of the Russian Federation affirms the worker’s right to increase the real content of financial stimulation of labor, and Art. 134 specifies a specific mechanism for this – indexing.

Indexation is a means to ensure that labor income matches the purchasing power of the funds received, or at least to minimize the discrepancy. It consists of adjusting nominal wages (tariffs, salaries, rates) for a given time period depending on the level of inflation.

Types of indexing

Depending on the time when the employer plans to carry out indexation, it can be divided into 2 types:

- retrospective (prices increased first, and wage increases were made “to catch up” to compensate for their growth);

- proactive (salaries are increased in advance, anticipating a price jump).

Question: Does the employer have the right to set a wage indexation coefficient of 0.1% of the increase in consumer prices? View answer

The law obliges the employer to index wages

IMPORTANT! A sample of the Regulations on the procedure for indexing wages from ConsultantPlus is available at the link

The law affirms the absolute obligation of the employer to promote the welfare of its employees and the adequacy of the real content of wages. Art. 134 of the Labor Code of the Russian Federation calls indexation a direct duty of any employer, no matter in what area it operates - budgetary or commercial.

Thus, there can be no discrepancies here - the employer is imperatively required to carry out indexing. However, the provisions of this article do not allow for its unambiguous interpretation. So, from them it is impossible to draw an exact conclusion about:

- timing of indexation;

- its frequency;

- salary indexation procedure.

Since the indexation procedure is not prescribed in basic laws, it must be regulated by employers in internal regulations:

- when concluding employment contracts (individual and collective);

- when drawing up any agreements, including amendments to contracts;

- in a separate local regulatory act;

- in the industry agreement.

ATTENTION! If the enterprise does not have a document with indexation regulations or its mechanism is not mentioned in the text of the employment contract or collective agreement, this does not relieve the employer of obligations before the law. The document must be developed or changes and additions must be made to existing acts. The absence of such provisions is a direct violation of the requirements of the Labor Code.

Since modern labor legislation in terms of regulating indexation is imperfect, bills are being introduced calling for changes to a number of ambiguous formulations aimed at creating a more precise concept of the wage indexation procedure and its imperativeness.

Salary indexation in commercial organizations 2021

If the issue of indexation of salaries for public sector employees is decided at the state level, then in commercial companies the indexation of salaries for employees is established in a collective agreement, agreement, salary regulations, or other local regulation, as well as in the employment contract with the employee.

The law does not allow a commercial employer to deprive employees of guarantees and refuse to index wages on the basis that this obligation applies to public sector employers. Mandatory wage indexation is the obligation of any employer towards those working under an employment contract, even if it does not have a corresponding internal regulation. The Constitutional Court of the Russian Federation has repeatedly recalled this in its rulings (for example, rulings of the Constitutional Court of the Russian Federation dated June 17, 2010 No. 913-О-О; dated November 19, 2015 No. 2618-О), and Rostrud in a letter dated April 19, 2010 No. 1073-6- 1 indicated that in the absence of internal acts on indexation, the employer must develop such or make changes to existing provisions.

The employer must decide in what order the salary indexation will be calculated at his enterprise. It is necessary to determine the indicator to focus on when increasing salaries - the inflation rate, the cost of living, the consumer price index, etc., and the period for which it will be taken into account. The selected indicators and methodology for calculating the indexation coefficient are reflected in the relevant internal act and in employment contracts.

Example

The company decided to index salaries using the consumer price index (I) - 102.5%. The calculation is made using the formula: Salary x (I: 100).

That is, an employee’s salary, for example, equal to 20,000 rubles, after indexation will be:

20,000 rub. x (102.5%: 100) = 20,500 rub.

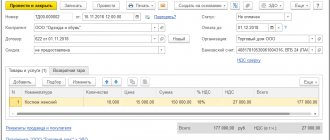

The next indexation of employee salaries is formalized by order of the organization, indicating:

- reasons for indexation (price increases, inflation, etc.),

- indicator that will be used for calculation,

- the date from which the salary increase is made.

Sample order for salary indexation in 2021 in a commercial organization:

| Limited Liability Company "Albatross" ORDER No. 5-K Moscow 01/09/2018 In accordance with Art. 134 of the Labor Code of the Russian Federation, clause 8 “Regulations on wages in Albatros LLC”, and in connection with the increase in the consumer price index I ORDER:

General Director Losev Losev L.V. I have read the order: Chief accountant Ivanova Ivanova A.A. |

Inflation-indexation spiral

As a result of inflation, prices rise and the entrepreneur raises wages. In turn, as prices increase, production costs also increase, that is, costs increase. To avoid loss, the manufacturer must raise the cost of its goods and services. Raising prices again means inflation.

In order to at least slightly reduce the rate of increase in this “spiral” , some restrictions are provided for the indexing mechanism.

Indexation is aimed at compensating not for any price jumps, but only for those associated with inflation. The rate and size of inflation is monitored at the state level; other factors of a market economy are less amenable to accounting and control.

Not any income is subject to indexation, but only those that are controlled and regulated by government bodies (wages, pensions, social benefits).

Additional protection is not needed for the income that the owners bring to their private property and business activities:

- Rental Property;

- trade in personal property;

- income from private farms and subsidiary plots;

- profit from other types of legal activities.

Owners and businessmen themselves regulate the level of costs and income by freely setting prices for their goods and services.

Where to get funds for indexation

How can regular salary increases be carried out in conditions of inflation? For this, there are official sources, different for certain areas of activity:

- budgets of different levels - for public sector workers;

- Pension Fund of the Russian Federation - for calculating pensions;

- Federal budget, social insurance funds - for social payments;

- own funds - for commercial entrepreneurship and the private sector of the economy (current income or retained earnings of past years).

Indexation of salaries for public sector employees

By Order of the Government of the Russian Federation dated December 6, 2017 No. 2716-r, from January 1, 2018. From the federal budget, the salaries of all employees of budgetary, state and autonomous institutions, government agencies and other federal institutions, as well as civilian personnel of military units are indexed by 4%.

In 2021, the “moratorium” on indexation of salaries for civil servants listed in Art. 4.3 of Law No. 68-FZ dated 04/06/2015 (military, judges, civil servants, etc.). This year, indexing the earnings of all state employees mentioned in the so-called. “May decrees” of the President of 2012, prescribing a significant increase in their income by 2021 (for example, decree No. 597 dated 05/07/2012), should be 4.1%.

The earnings of those public sector workers who were not mentioned in the “May decrees” will also be indexed, President Putin himself stated this. For example, in this regard, the mayor of Moscow adopted a resolution dated November 28, 2017 No. 917-PP - according to it, wages will be indexed from January 1, 2021 for employees of Moscow government agencies who were not included in the presidential decrees on the growth of budget salaries.

Indexation coefficient

How exactly to index and how much to raise wages depends on the indicator chosen by the employer and fixed in the documents specified by law. It is permissible to use it as:

- consumer price index, which is established in a specific region or throughout the country (according to official data from Rosstat);

- inflation rate included in the federal or regional budget;

- the cost of living for the population;

- any objective indicator of rising prices for goods and services.

Salary – not less than the minimum wage

The Labor Code of the Russian Federation establishes a guaranteed minimum wage, which any employee has the right to claim. In accordance with Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the required working hours during this period cannot be lower than the minimum wage (minimum wage).

The minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and is mandatory for all organizations and individual entrepreneurs using hired labor. The amount of the minimum wage is regulated by Art. 1 of Federal Law No. 82-FZ of June 19, 2000 “On the minimum wage.” According to this norm, the minimum wage in the Russian Federation is currently 7,800 rubles per month.

The next increase in this value is planned for January 1, 2018 as part of a gradual increase in the minimum wage to the subsistence level (a government bill has already been prepared and recommended for adoption).

From January 1, 2021, the minimum wage will be increased to 85% of the subsistence level and will be 9,489 rubles per month.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. The state encourages employers to constantly increase wages for employees.

2. The Labor Code of the Russian Federation establishes a guaranteed minimum wage - the minimum wage (minimum wage).

3. The minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and is mandatory for all organizations and individual entrepreneurs using hired labor.

4. The minimum wage in the Russian Federation is currently 7,800 rubles per month.

5. When the minimum wage increases, employers paying their employees the minimum wage are required to increase it to new values.

6. In a number of cases specified in the Labor Code of the Russian Federation, the employer is not obliged to adhere to the minimum wage.

7. The fine for paying wages below the minimum wage for legal entities ranges from 30,000 to 50,000 rubles. Repeated violation will increase the fine to 70,000 rubles.

8. Employers must index wages in connection with rising consumer prices for goods and services.

9. The legislation does not establish a clear indexation amount. An employer can “evade” indexation by drawing up local acts in a certain way.

10. Along with the federal minimum wage, each Russian region has its own minimum wage indicator. As a rule, the regional minimum wage is significantly higher than the federal one.

11. Employers are considered to have automatically joined the agreement on the regional minimum wage after 30 days from the date of official publication of the proposal to join such an agreement. Written consent from employers is not required. But it is possible to refuse in writing.

Accordingly, from January 1, 2021, an employer paying its employees the minimum wage is obliged to increase it to new values. To do this, you need to issue an order to make changes to the staffing table. This can be done either by approving a new schedule appendix or by adopting a new staffing table.

When talking about a salary “not lower than the minimum wage,” they always mean payments specifically under an employment contract, and not under a civil law contract. By engaging employees on the basis of a contract or paid services, the employer may not comply with the minimum wage conditions. Accordingly, an increase in this indicator does not lead to the employer’s obligation to increase the amount of remuneration under GPC agreements.

In addition, in a number of cases directly specified in the Labor Code of the Russian Federation, the employer is also not obliged to adhere to the minimum wage. This is, for example, part-time work (Article 93 of the Labor Code of the Russian Federation) and part-time work (Article 284 of the Labor Code of the Russian Federation). In relation to such employees, the employer is not obliged to draw up any additional agreements in connection with an increase in the minimum wage.

In all other cases that are not directly specified in the Labor Code of the Russian Federation, employers cannot pay their employees wages below the minimum wage. Otherwise, they may be held accountable under Art. 5.27 Code of Administrative Offenses of the Russian Federation. The fine for paying wages below the minimum wage for legal entities ranges from 30,000 to 50,000 rubles. Repeated violation will increase the fine to 70,000 rubles.

Does the employer neglect indexation?

This is a violation of the law, fraught with administrative liability. The labor inspectorate, having recorded such a violation, can provide infringed employees with protection of their violated rights, forcing the negligent entrepreneur to correct the mistake and answer according to the law. To do this, employees will need to go there with a complaint that the company does not have or does not comply with the wage indexation procedure.

IMPORTANT INFORMATION! Many are afraid to contact the labor inspectorate, not knowing about their right to demand that the employer not provide information about the author of the complaint in accordance with Part 2 of Article 358 of the Labor Code of the Russian Federation. At the same time, it will also not be possible to apply anonymously: complaints without authorship will not be considered.

You can also go straight to court; it happens that the claim is made on the proposal of the control authorities. The period for this is 3 months from the day the worker realized that his rights were infringed (this may be the day the non-indexed salary or advance payment was calculated).

ATTENTION! In most cases, the court will simply oblige the entrepreneur to develop and accept an indexation provision if the claim does not contain additional requirements.

Indexation of wages in the non-budgetary sphere - what in practice

In the absence of local acts on the indexation procedure, the court can, at best, oblige the employer to establish such a procedure in its organization, and at worst, apply a fine in accordance with the provisions of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (for example, the ruling of the Investigative Committee of the Moscow Regional Court dated September 21, 2015 in case No. 33-22551/2015, the decision of the Moscow City Court dated September 18, 2015 No. 7-9856/15).

As for the claims of employees to pay them under-accrued wages, here the courts are not always on the side of the plaintiffs - if the provisions on indexation indicate the conditions under which it is impossible (for example, the company has financial problems), the court will most likely take the employer’s side. It is also necessary to take into account the opinion of the Supreme Court of the Russian Federation, which believes that when ensuring wage growth in ways other than indexation (increasing salaries, bonuses, etc.), the employer may not carry it out (clause Review of Judicial Practice No. 4 (2017) RF Armed Forces, approved November 15, 2017).

So will wages for employees of commercial firms increase in 2018? The latest indexation news is not encouraging yet: deputies have repeatedly tried to make changes to Art. 134 of the Labor Code of the Russian Federation, more clearly spelling out the obligation of businessmen to annually index the salaries of their employees, excluding those whose income exceeded 10 times the subsistence level. It was also proposed to legislatively establish the minimum amount of wage indexation by region - not lower than the approved minimum consumer price index (for example, ]]>draft law No. 1119655-6]]>). So far, all the bills introduced by the State Duma have been rejected, but given the active position and explanatory activities of Rostrud, it seems that this topic will not be closed and the Labor Code of the Russian Federation will finally be supplemented with new provisions on wage indexation in the commercial sphere.