Accounting entries for account 69

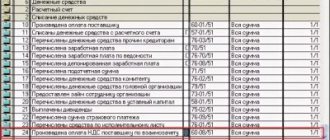

List of main entries for debit 69:

- Dt69 Kt50 - payment of contributions in cash from the enterprise;

- Dt69 Kt51 - deductions to state funds or repayment of debt from a current account;

- Dt69 Kt52 - repayment of debt under the unified social tax in foreign currency;

- Dt69 Kt55 - repayment of debt under the Unified Social Tax from special accounts of the enterprise;

- Dt69 Kt70 - calculation of compensation to employees of an enterprise for social insurance funds (for example, sickness benefits).

List of main entries for loan 69:

- Dt08-1 Kt69 - calculation of contributions for personnel engaged in external landscaping of the territory;

- Dt08-3 Kt69 - costs for payment of unified social tax and insurance payments associated with construction work performed in an economic way;

- Dt20 Kt69 - contributions for workers of primary production;

- Dt23 Kt69 - contributions for employees of an auxiliary production enterprise;

- Dt25 Kt69 - contributions for workers in workshops;

- Dt26 Kt69 - contributions to the management staff of the enterprise;

- Dt28 Kt69 - contributions for workers involved in correcting defective manufactured products;

- Dt29 Kt69 - insurance premiums for service production workers;

- Dt44 Kt69 - calculation of contributions for the personnel of trading enterprises;

- Dt51 Kt69 - refund of overpaid amounts of social contributions;

- Dt52 Kt69 - crediting overpaid amounts in foreign currency to foreign currency accounts;

- Dt55 Kt69 - crediting overpaid amounts to special accounts of the enterprise;

- Dt79 Kt69 - deduction from salary of the amount for a trip paid for by the Social Insurance Fund;

- Dt91-2 Kt69 - social contributions for employees receiving other income;

- Dt99 Kt69 - accrued fines and penalties in the Pension Fund and the Social Insurance Fund.

Basic entries for accounting for settlements with extra-budgetary funds

Examples of entries for account 69 for dummies:

On May 25, 2019, the enterprise paid wages to employees of the main production, which amounted to 650,000 rubles. At the same time, insurance contributions are: to the Social Insurance Fund - 2.9%, to the pension fund - 22%, for compulsory health insurance - 5.1%, insurance against occupational diseases and accidents - 1.2%.

Accounting will make the following entries:

- Dt20 Kt70 - payroll - 650,000 rubles.

- Dt20 Kt69-01 - accrual of payments to the Social Insurance Fund - 1,885 rubles.

- Dt20 Kt69-02 - payments to the Pension Fund - 14,300 rubles.

- Dt20 Kt69-03 - contributions for compulsory medical insurance - 3,315 rubles.

- Dt20 Kt69-11 - insurance against occupational diseases and accidents at work - 7,800 rubles.

Thus, count. 69 reflects transactions carried out with mandatory contributions to various government funds. Reconciliation of mutual settlements between the organization and government agencies occurs under the strict control of the latter. After all, these payments are the guarantor of social protection for all employees of the enterprise.

https://youtube.com/watch?v=fP8Ay1UPA9c

Common business transactions and postings for them.

- Calculation of insurance premiums

Dt20.23 Kt69 – for workers of main or auxiliary productionDt26 Kt69 – management personnel

Dt44 Kt69 – employees engaged in sales (entry can be used to display all accrued contributions in accounting, eligible to apply the simplified regime).

- Penalties charged for late transfer of payments

- Return of overpaid amounts to the budget to the current account

- Transfer of payments to the Russian budget

- Employee benefits paid through social insurance (for example, sick leave)

Lyudmila Poberezhnykh, 2017-03-28

Parameters MSK-69

MSK-69 is divided into three 3-degree zones for which two solutions can be proposed: calculated and taking into account GOST 51794-2008. The following is the format for use in a MapInfo GIS projection file.

Calculated

Postings for accrual and payment to extra-budgetary funds

GOST 51794-2008

The distribution of cadastral districts by zone is as follows:

- Andreapolsky (69:01), Belsky (69:03), Zharkovsky (69:07), Zapadnodvinsky (69:08), Nelidovsky (69:22), Oleninsky (69:23), Ostashkovsky (69:24), Penovsky (69:25), Selizharovsky (69:29), Toropetsky (69:34), Nelidovo (69:44), Ostashkov (69:45), ZATO “Solnechny” (69:50) - zone 1;

- Bezhetsky (69:02), Bologovsky (69:04), Vyshnevolotsky (69:06), Zubtsovsky (69:09), Kalininsky (69:10), Kalyazinsky (69:11), Konakovsky (69:15), Kuvshinovsky (69:17), Lesnoy (69:18), Likhoslavlsky (69:19), Maksatikhinsky (69:20), Molokovsky (69:21), Rameshkovsky (69:26), Rzhevsky (69:27), Sandovsky ( 69:28), Spirovsky (69:31), Staritsky (69:32), Torzhoksky (69:33), Udomelsky (69:35), Firovsky (69:36), Bezhetsk (69:37), Bologoe (69 :38), Vyshny Volochyok (69:39), Tver (69:40), Kashin (69:41), Kimry (69:42), Konakovo (69:43), Rzhev (69:46), Torzhok (69 :47), Udomlya (69:48), ZATO “Ozerny” (69:49) - zone 2;

- Vesyegonsky (69:05), Kashinsky (69:12), Kesovogorsky (69:13), Kimrsky (69:14), Krasnokholmsky (69:16), Sonkovsky (69:30) - zone 3.

GIS Panorama

In GIS Panorama versions 12 and higher, parameters according to GOST 51794-2008 are used, and in version 11 and lower, calculated parameters are used. You can connect the parameters of MSK-69 through the file “MSK of Subjects of the Russian Federation.xml”. How to set MCS parameters in GIS Panorama, see the video, and how to convert to other coordinate systems, read the article “Converting MCS data to another coordinate system.”

https://youtube.com/watch?v=_aCVO34yXGs%3F

GIS Mapinfo

GIS Mapinfo uses parameters in accordance with GOST 51794-2008. You can enable MSK-69 parameters by enabling them in the “MAPINFO.PRJ” file and then setting them when creating a map. You can see how to do this in the following video.

https://youtube.com/watch?v=znb1IZc2VCc%3F

GIS QGIS

To insert parameters into QGIS, you need to convert them slightly into the “PROJ.4” format. Parameters are registered in user coordinate systems. Below are the parameters taking into account GOST 51794-2008.

MSK-69 zone 1

Accrued wages: posting

MSK-69 zone 2

MSK-69 zone 3

The following video shows how to set local coordinate system parameters in QGIS.

https://youtube.com/watch?v=jW-aAfINj34%3F

General provisions

The following are put on special military registration:

- citizens working in internal organs;

- citizens from drug trafficking control agencies;

- citizens who work in the fire service;

- citizens working in penitentiary agencies.

The main tasks of special military registration:

- ensuring the protection of the state in wartime;

- high-quality mobilization.

Control over special accounting is carried out by internal affairs bodies, local executive authorities, and village councils.

Citizens who wish to be removed from general military registration and switch to special military registration must contact the military commissariat with a request or petition justifying this desire.

Existing subaccounts 69

Account 69, the sub-accounts of which reflect data in the context of state funds receiving payments, shows the accrued and paid amounts of contributions:

- Accounting and tax accounting of insurance premiums

- 69-01 - an account for reflecting social insurance payments that are paid to the Social Insurance Fund.

- 69-02 - accounting for pension accruals in favor of the Russian Pension Fund. Depending on the activity of the enterprise, additional sections may be opened on this sub-account to reflect information on contributions for additional payments to certain categories of employees, for example, aviation workers, coal industry organizations, and those employed in work with harmful or difficult working conditions.

- 69-03 - accounting for payments for compulsory health insurance for employees. The subaccount is divided into payments to the Federal Compulsory Medical Insurance Fund and the territorial one.

- 69-07 - contributions to the funded part of the pension, made on the basis of the employee’s application.

- 69-08 - employer contributions for employees to private medical centers.

- 69-11 - an account for accrual (expense) of amounts for insurance against occupational diseases or industrial accidents in favor of the Social Insurance Fund.

Attention! If an enterprise has relationships with other extra-budgetary funds, then accounting provides for the possibility of opening other sub-accounts to simplify the accounting of transactions

a brief description of

According to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), in accounting account 69 is officially called “Calculations for social insurance and security.”

To put it quite simply, accounting account 69 for dummies is intended to summarize information about calculations for:

- social insurance of the organization’s employees (in case of temporary disability and/or maternity);

- pension provision;

- compulsory health insurance.

Regarding what the score is 69, it is active-passive. That is, it is possible to have both a debit and a credit balance on account 69.

Characteristics of account 68

Based on the results of their economic activities, organizations and entrepreneurs must transfer part of their funds to the budget. The same responsibilities apply to individuals.

Tax accrual for legal entities reflects account 68 in the accounting department. Transactions for the payment of budget obligations are also formed by accounting account 68.

The records contain data on accrued and paid tax liabilities of the organization itself, reflect the status of taxes withheld from employees, and provide data on indirect taxes, including those declared for deduction.

Subaccounts

The chart of accounts recommends opening three subaccounts for this account:

- 69/1 “Calculations for social insurance”

- 69/2 “Calculations for pension provision”

- 69/3 “Calculations for compulsory health insurance.”

You might be interested in:

Authorized capital of LLC: why is it needed, size, timing and procedure for its payment

At each of them, amounts are recorded in a separate type of insurance fund. In addition, organizations are also required to make transfers to the injury fund.

To account for these amounts, you can open another subaccount 69/4 “Calculations for contributions for injuries”, or split subaccount 69/1 into two separate accounts:

- 69/1/1 - Calculations for social insurance contributions;

- 69/1/2 - Calculations for contributions for injuries.

Also, for late or incomplete payment of contributions, the regulatory authority may impose fines or penalties. It is recommended to account for these amounts in separate sub-accounts opened for each type of transfer to social funds.

Attention! If there are other types of deductions, subaccounts can be opened for them. For example, if voluntary contributions of employees to pension are transferred

Subaccounts of account 69

For convenience and clarity of accounting, the account is divided into several auxiliary subaccounts.

The main subaccounts are presented in the table:

| Subaccount | Purpose |

| 69.1 | Used to reflect payments to the Social Insurance Fund for compulsory social insurance |

| 69.2 | Designed to account for pension accruals paid to the Pension Fund of the Russian Federation |

| 69.3 | Used to reflect payments to the Compulsory Medical Insurance Fund |

If the company carries out settlements with other funds, in addition to the listed sub-accounts, additional ones may be opened. For example, contributions to the funded part of a pension, transferred voluntarily, may be reflected in subaccount 69.4, contributions to insurance funds for accidents and occupational diseases - in subaccount 69.11, etc.

In addition, the debit displays the amounts of compensation for medical, social and pension insurance, which are compensated to the policyholder by the relevant funds and are payable upon the occurrence of insured events. It also reflects the amounts of insurance payments that were overpaid by the policyholder and returned by the funds.

The credit of the 69th account takes into account the accrual of funds that are subject to payment to extra-budgetary funds. The credit of the account corresponds with the debit of accounts that take into account various costs (20, 23, 25, 26, 44), and with account 70.

In addition to accruals and payment of mandatory insurance payments, the 69th account reflects penalties that were accrued for late payments.

What does the 69th accounting account contain and how is it maintained - Business Legal Directory

In accounting, account 69 is intended to collect information on accruals and payment of payments for compulsory insurance (pension, social, medical, accidents and occupational diseases).

Thus, the account is used to interact with extra-budgetary funds: pension, medical, social insurance and others.

These funds were created for the social protection of citizens and providing guarantees in the form of old-age pensions, payment of compensation for loss of ability to work, etc.

This account is passive. On the credit side of account 69, accruals of contributions are taken into account, and on the debit side, transfers of contributions or write-off of debts to various funds are taken into account. Unlike many other accounts, account 69 has an expanded balance, that is, at the end of the reporting period, both credit and debit balances are calculated.

Contributions to the funds are calculated every month, and payment is made until the middle of the month following the reporting period.

The procedure for settlements on account 69 directly depends on the tax regime used by the payer. Medical, social and pension contributions are calculated taking into account the amount of employee salaries. To do this, the employee’s income, approved by the employment contract, is multiplied by the interest rate established for each type of compulsory social insurance.

The highest interest rate is set for the Pension Fund – it is 22%.

Analytical accounting for account 69 is carried out according to the types of payments made.

The main subaccounts are presented in the table:

| Subaccount | Purpose |

| 69.1 | Used to reflect payments to the Social Insurance Fund for compulsory social insurance |

| 69.2 | Designed to account for pension accruals paid to the Pension Fund of the Russian Federation |

| 69.3 | Used to reflect payments to the Compulsory Medical Insurance Fund |

If the company carries out settlements with other funds, in addition to the listed sub-accounts, additional ones may be opened. For example, contributions to the funded part of the pension, transferred voluntarily, may be reflected in subaccount 69.

4, contributions to insurance funds against accidents and occupational diseases - in subaccount 69.11, etc.

The debit of account 69 corresponds with the credit of accounts 50, 51 (cash accounts).

The credit of the 69th account takes into account the accrual of funds that are subject to payment to extra-budgetary funds. The credit of the account corresponds with the debit of accounts that take into account various costs (20, 23, 25, 26, 44), and with account 70.

In addition to accruals and payment of mandatory insurance payments, the 69th account reflects penalties that were accrued for late payments.

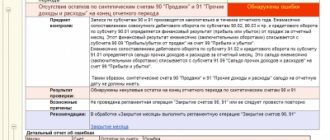

Main entries for account 69

Account 69 is subject to thorough checks by the tax authorities, therefore, when calculating social payments, you should correctly distinguish between debited accounts. Errors can lead to inconsistencies in the financial balance sheet. The main operations carried out on account 69 are presented in the table.

Basic operations:

| Postings by debit | |

| Dt 69 / Kt 50 | Issuance of vouchers from the cash desk to employees paid for by the Social Insurance Fund |

| Dt 69 / Kt 50 | Payment of mandatory contributions from the company's cash register |

| Dt 69 / Kt 51 | Transfer of insurance premiums from a current account to funds |

| Dt 69 / Kt 70 | Calculation of payments to employees using social insurance funds |

| Loan transactions | |

| D 20 / Kt 69 | Calculation of contributions payable to the funds for employees of the main production for OSS, OMS, OPS |

| Dt 23 / Kt 69 | Calculation of contributions for employees of auxiliary production |

| Dt 25 / Kt 69 | Calculation of contributions payable for workshop employees |

| Dt 26 / Kt 69 | Calculation of contributions for management employees |

| Dt 44 / Kt 69 | Calculation of contributions for employees of trading companies |

| Dt 99 / Kt 69 | Accrual of penalties to the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund |

| Dt 51 / Kt 69 | Return of excess insurance payments paid by funds |

| Dt 70 / Kt 69 | Withholding of voucher amounts from employee salaries received using Social Insurance Fund funds |

An organization can write off accrued insurance premiums in full to reduce taxable profit. This rule also applies to contributions accrued on payments that are not taken into account when taxing profits.

Contributions, as a rule, are included in direct, indirect or other costs, depending on the reflection of the remuneration from which they were calculated. The list of direct and indirect expenses must be economically justified and approved in the accounting policies of the organization.

Thus, insurance contributions to the wage fund of employees directly involved in production activities are included in direct costs, while the accrual of contributions to the wage fund of management personnel belongs to indirect costs.

What does debit 69 credit 69 show?

Correspondence Dt 69 Kt 69 is reflected in the instructions.

In this case, the debit of account 69 shows:

- Accrued amounts of benefits, which is accompanied by the posting of debit 69 credit 70.

Example 1

The employee was on sick leave. After his illness, he submitted a certificate of incapacity for work. As a result, the following entries were reflected in the accounting for amounts compensated by the Social Insurance Fund:

- Dt 69 Kt 70 - temporary disability benefits accrued;

- Dt 70 Kt 51 - payment of benefits;

- Dt 51 Kt 69 - FSS reimbursed the benefits.

- Payment of insurance premiums, penalties, fines.

- Adjustments related to excessive assessment of insurance premiums or reimbursement of benefits by funds.

Credit account 69 is mainly found when calculating insurance premiums, penalties and fines on them. At the same time, we note that the moments of calculation of contributions and payments to employees coincide, and the correspondence of account 69 is similar to the cost account used to reflect the specified payment.

Example 2

The production organization paid wages to employees:

- production personnel RUB 570,000;

- management staff RUB 800,000;

- commercial department 650,000 rub.

Contribution rates for VNIM - 2.9%, for compulsory health insurance - 22%, compulsory medical insurance - 5.1%, for NS and PZ - 0.2%.

For insurance premium rates, see this article.

An example of accounting for insurance premiums for the purpose of calculating income tax from ConsultantPlus A trading organization accrued and paid a bonus to employees in June for the 20th anniversary of the company. The total amount of insurance premiums accrued for bonuses for all employees is RUB 755,000. You can view the entire example in K+ by getting free trial access.

The accounting records reflect the following entries:

- Dt 20 Kt 70 - payroll for employees in production 570,000 rubles;

- Dt 20 Kt 69.01 - accrual of contributions from VNiM 16,530 rubles. (570,000 × 2.9%);

- Dt 20 Kt 69.02 - contributions to the mandatory insurance policy 125,400 rubles. (570,000 × 22%);

- Dt 20 Kt 69.03 - compulsory medical insurance contributions 29,070 rubles. (570,000 × 5.1%);

- Dt 20 Kt 69.11 - contributions from NS and PZ 1140 rubles. (570,000 × 0.2%);

- Dt 26 Kt 70 - salary calculation for management staff 800,000 rubles;

- Dt 26 Kt 69.01 - from VNiM 23,200 rub. (800,000 × 2.9%);

- Dt 26 Kt 69.02 - for OPS 176,000 rubles. (800,000 × 22%);

- Dt 26 Kt 69.03 - for compulsory medical insurance 40,800 rubles. (800,000 × 5.1%);

- Dt 26 Kt 69.11 - contributions from NS and PZ 1600 rubles. (800,000 × 0.2%);

- Dt 44 Kt 70 - salary of the commercial department 650,000 rubles;

- Dt 44 Kt 69.01 - from VNIM 18,850 rub. (650,000 × 2.9%);

- Dt 44 Kt 69.02 - for OPS 143,000 rubles. (650,000 × 22%);

- Dt 44 Kt 69.03 - for compulsory medical insurance 33,150 rubles. (650,000 × 5.1%);

- Dt 44 Kt 69.11 - contributions from NS and PZ 1300 rubles. (650,000 × 0.2%);

- Dt 69.01 Kt 51 - payment of contributions from VNiM 58,580 rubles;

- Dt 69.02 Kt 51 - payment of contributions to the OPS 444,400 rubles;

- Dt 69.03 Kt 51 - payment of contributions for compulsory medical insurance 103,020 rubles;

- Dt 69.11 Kt 51 - payment of contributions from NS and PZ 4040 rubles.

If an organization underestimates the amount of insurance premiums or pays them later than due, it will have to accrue and pay penalties and fines.

Important! Hint from ConsultantPlus Depending on the situation, entries for accrual of penalties can be made on the following dates (clause 16 of PBU 10/99): on the date of the decision...; on the date of demand...; Read more about the date of reflection of penalties on contributions in K+. Trial access is available for free.

Example 3

The organization paid insurance premiums from VNiM on September 25 instead of September 15, 2020, and therefore it was charged penalties for violating the payment deadlines. The amount of contributions from example 2.

Amount of penalty = 10 × 1/300 × 4.25% × 58,580 = 83 rubles,

Where:

10 — number of days of delay;

4.25% - refinancing rate;

Dt 91 Kt 69.01 - accrual of penalties 83 rubles.

Dt 69.01 Kt 51 - payment of penalties 83 rubles.

Our article will help you fill out payment forms.

At what age can you sign an employment contract?

To find the answer to this question, you need to turn to the Labor Code.

This is the basic law governing the relationship between employee and employer. It spells out the rights and responsibilities of everyone, so studying the Labor Code will be useful for everyone. The answer to the question about the age at which you can get a job is contained in Art. 63 Labor Code of the Russian Federation. According to this article, a teenager can enter into an employment contract at the age of 16. However, there are conditions that allow you to start working at an earlier age.

How to confirm expenses for restoring damaged documents

Due to emergency circumstances, not only property, but also documents are damaged. The latter cannot be sold, but they are also of great value. If accounting or tax documentation was lost (for example, it burned down), you need to restore it. Restoring papers is important if they were not verified as part of a tax audit. This procedure is divided into these stages:

- Inventory of documents, the need for which is specified in paragraph 2 of Article 12 of Federal Law No. 129.

- The company organizes a commission that should establish the reasons for the loss of documents. The corresponding instruction is given in paragraph 6.8 of the Regulation “On document flow in accounting” No. 105, approved by the Ministry of Finance on July 29, 1983. Sometimes the commission’s activities involve interaction with the Ministry of Emergency Situations.

- The results of the commission’s activities are recorded in the act. It states the fact of damage to documents. The act must be approved by the manager.

- Attached to the document is a certificate of emergency issued by authorized bodies, and a list of papers that were lost.

- A person responsible for the restoration of papers is appointed. Usually this is the chief accountant.

- You can contact an intermediary company to restore documents. After the restoration is completed, a work acceptance certificate is created.

- It is on the basis of the act that related expenses are recorded in accounting.

Expenses for the restoration of documents (as part of accounting) are recognized as part of other expenses. Within the framework of tax accounting, they will be reflected in the structure of non-operating expenses on the basis of subparagraph 6 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation. Expenses are taken into account in the standard manner.

Account 69 Social insurance payments

Account 69 “Calculations for social insurance” is a necessary element of accounting in the process of activities of individual entrepreneurs and legal entities.

Through this account, calculations related to the transfer of funds to extra-budgetary funds of the compulsory social, pension and health insurance systems (FSS, PFR and FFOMS) are carried out. Count 69 is passive-active.

According to current legislation, the employer is obliged to make transfers for its employees to extra-budgetary funds, which include the Pension Fund of Russia (PFR), the Social Insurance Fund (FSS) and the Compulsory Medical Insurance Fund (MHIF). These institutions are, to some extent, social protection bodies, since the function of the Pension Fund is pension provision, the Social Insurance Fund provides a guarantee of payments in case of disability, and medical care for citizens is provided at the expense of the Compulsory Medical Insurance Fund.

In addition, the law provides for the mandatory payment of insurance premiums by individual entrepreneurs for themselves, although it does not play a significant role whether the individual entrepreneur conducts any activity or not.

The monthly obligation to pay insurance premiums by account 69 is established by the 15th day of the month following the reporting month.

Subaccounts 69 accounts

Given the presence of various recipients of payments, this account 99 in accounting is divided into three sub-accounts.

- 69.1 for transfers to the Social Insurance Fund

- 69.2 for accounting for contributions to the Pension Fund

- 69.3 transfer of funds to the compulsory medical insurance system

The procedure for making payments on account 69 directly depends on which tax regime the payer uses. Thus, those enterprises that are located on UTII, Unified Agricultural Tax and the simplified tax system have the obligation to reflect the following information when making payments to the Social Insurance Fund:

- The amount of all payments made and accrued, including penalties, fines, overpayments and excess charges for the reporting period

- The amount of funds spent on transfers to the social insurance system

Separately, it is necessary to register the amount of funds that were paid by the Social Insurance Fund itself in case of temporary disability of employees, including in cases related to maternity

At the moment, the amount of insurance contributions to extra-budgetary funds is 30% of the employee’s salary. It is worth noting that these transfers are made at the expense of the employer himself, and not his employees. Of this 30%, the Pension Fund accounts for 22%, 5.1% is transferred to the compulsory medical insurance system, and 2.9% is transferred to the Social Insurance Fund.

However, for a number of employers, an increased, additional percentage of transfers is provided. So for each employee engaged in work related to hazardous production, the tariff rises by 2 to 8%.

Thus, based on the above, the credit of account 69 displays the amounts that the organization must transfer to extra-budgetary funds, and in addition the amount of penalties and fines for late payments, or, in other words, the accrual of insurance contributions for compulsory pension, social and health insurance is indicated .

The debit of account 69 shows the paid amounts of contributions, fines and penalties for a particular billing period, and the write-off of debts.

Typical wiring

Postings to the debit of account 69 “Social insurance payments”:

- D69 K70 – transfer of amounts from funds intended for employees in connection with the occurrence of an insured event

- D69 K50 – the amount of insurance premiums was paid from the organization’s cash desk

- D69 K51 – the amount of insurance premiums was paid from the organization’s current account

Postings on account credit 69:

- D99 K69.1 – payment of penalties and fines to the Social Insurance Fund

- D99 K69.2 – payment of penalties and fines to the Compulsory Medical Insurance Fund

- D99 K69.3 – payment of penalties and fines to the Pension Fund

- D23 K69 – calculation of insurance premiums for employees of main industries

- D51 K69 – an operation was carried out to return funds that were paid to extra-budgetary funds in excess.

From the site: https://buhland.ru/schet-69-raschety-po-socialnomu-straxovaniyu/

What is account 69 used for in accounting?

The law obliges every employer to pay contributions to social funds on almost all remunerations (salaries) of its employees. Let's look at what it is.

Contributions to the funds are mandatory payments that guarantee each employee medical care, pensions, and insurance compensation in case of disability.

There are currently four types of such contributions:

- To the Pension Fund;

- To the social insurance fund - divided into two, payment of disability and compensation for injuries;

- To the health insurance fund.

Attention! Since 2021, the Federal Tax Service has been managing these contributions (except for injuries). They are transferred by the 15th of each month in separate payment orders.

To carry out accounting of accrued and paid amounts for each type of contribution in the chart of accounts, account 69 “Calculations for social insurance and security” is used. Since this information is widely used to fill out various reports, it is necessary to organize accounting in the context of each fund, as well as the type of transfer to it (contribution, fine, penalty, etc.).

What is perishable

Perishability is the official term that refers to perishable products that have a short shelf life. Perishable goods, like dangerous goods, have their own characteristics, which include certain transportation conditions.

A perishable product is any product whose quality deteriorates over time due to environmental conditions, such as meat and meat by-products, fish and seafood, dairy products, fruits and vegetables, flowers, pharmaceutical products and chemicals.

Due to their chemical and/or physiological characteristics, these products have a short service life; they are more susceptible to serious and permanent damage during transportation, especially if the temperature is not maintained constant.

These products must be handled with the utmost care and efficiency to keep them in excellent condition during shipping. To achieve this, key factors such as time, insulation and storage temperature must be kept in mind

In general, perishable goods include:

- Plant products: fruits, mushrooms, vegetables and berries;

- Products of animal origin: meat, fish, eggs, caviar, dairy products;

- Processed foods: cheeses, sausages, frozen vegetable and fruit mixtures;

- Plants: seedlings, saplings, flowers.

The shelf life of these food products can be up to one month, or less than this. Therefore, there is a need for prompt and high-quality delivery of goods to the client. If a perishable item is quite expensive, it can be insured.

As mentioned earlier, the main issue when transporting perishable goods is to take the utmost care of the cold chain, as it ensures that the properties of your products remain unchanged during and after transportation.

Accounting for emergency expenses

After an emergency (flood, etc.), it is necessary to conduct an inventory. It is needed in order to determine the exact amount of damage. An inventory commission is appointed. Its function in this situation is to detect spoiled and damaged objects. During the event, lists are compiled. It makes sense to make separate lists of property that cannot be restored or is subject to restoration.

Objects that cannot be used in the future are written off. To write off funds, a special act is drawn up in form OS-4. If these are material and production assets, an MB-8 act is issued to write them off. Write-off of valuables is carried out at their actual cost, fixed assets - at the residual price. Residual value is determined by taking the difference between initial cost and depreciation. Objects are written off in the month the inventory is taken. The remaining parts are received, for which a demand invoice is drawn up.

Expenses to eliminate the consequences of an emergency are recorded in account 99 “Losses”. The correspondence of this account are accounts 01, 04, 10, 43, 50, 70 and others. Expenses must be taken into account in the period in which the emergency occurred.

Accounting entries

When accounting for emergency expenses, these entries are used:

- DT91/2 KT01. Write-off of the residual value of fixed assets.

- DT91/2 KT04. Write-off of the residual value of an intangible object.

- DT91/2 KT10. Write-off of the value of tangible assets.

- DT91/2 KT43. Accounting for expenses on write-off of finished goods.

- DT99 KT68. Restoration of the VAT amount previously accepted for accounting.

- DT99 KT20 (70, 69, 60). Costs of work to eliminate the consequences of an emergency.

- DT10 KT99. Posting of materials.

IMPORTANT! Postings must be made in the reporting period in which extraordinary circumstances arose.

Example No. 1

The warehouse burned down. This premises is insured for the amount of 1,000,000 rubles. After the emergency, an inventory was taken. As a result, valuables suitable for further exploitation were discovered in the amount of 50,000 rubles. The insurance organization recognized damage in the amount of 1,000,000 rubles. Insurance was paid. In this case, these postings will be made:

- DT10 KT91/1. Capitalization of materials in the amount of 50,000 rubles.

- DT76/1 KT91/1. Fixation in the structure of other income of paid insurance in the amount of one million rubles.

- DT51 KT76/1. Obtaining insurance worth a million rubles.

The funds received (insurance) should be classified as non-operating income.

Example No. 2

Flooding occurred. An inventory was carried out, which resulted in the identification of irreparably damaged material worth 80,000 rubles. There was also equipment failure. The cost of repairing this equipment is 39,000 excluding VAT. The company must carry out these postings:

- KT91/2 DT43. Write-off of materials that have become unusable in the amount of 80,000 rubles.

- DT91/2 KT60. Accounting for the cost of repairs in the amount of 39,000 rubles.

- DT19 KT60. VAT accounting for repairs.

The posting of the write-off of materials must be confirmed by a special act.

Active or passive

This account can be used for transactions:

- on the calculation of contributions - penalties, penalties;

- when paying accrued penalties, fines, etc.;

- recording in the reporting documentation the amount of expenses for paying contributions to extra-budgetary funds.

From 01/01/2017, in accordance with the adopted changes in the legislation of the Russian Federation, all payments between the organization and the VNF will be carried out with the help of the branches of the Federal Tax Service. The exception is calculations in the event of an employee being injured at work.

Main type subaccounts:

- Sbsch. 69.1 - is responsible for recording information on transactions between the company, the Federal Tax Service and the Social Insurance Fund.

- Sbsch. 69.02 – displays settlements with the Pension Fund.

- Sbsch.69.03 – contributions to the Federal Tax Service on account of medical insurance companies.

Count 69 is active-passive. For debit, information on completed payments is displayed, and for credit, charges (their generalized amount) are displayed.

Accounting for fines that will not be challenged in court

If the inspection has made a decision to hold the organization liable for non-payment or incomplete payment of income tax, the fine should be reflected in the accounting records on the effective date of this decision and recorded in account 99 “Profits and losses”.

The following entries should be made in accounting:

- Debit 99 Credit 68

a fine was charged for non-payment or incomplete payment of income tax;

- the amount of the fine is transferred to the budget.

Penalties for UTII, Unified Agricultural Tax, and “simplified” tax are reflected in the same order.

If the inspectorate is held liable for non-payment or incomplete payment of other taxes, then the amounts of fines are reflected as expenses.

Since this expense is not related to production and sales, the amount of the fine is included in other expenses (clauses 4, 5, 11 of PBU 10/99).

The Ministry of Finance also indicates that paid fines and penalties, except for fines and penalties for income tax and other similar mandatory payments, form either profit or loss before taxation in the financial results statement (attachment to the Letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07- 04-09/78875).

Penalties are reflected in expenses on the date of entry into force of the decision of the Federal Tax Service.

The following entries should be made in accounting:

- Debit 91-2 Credit 68

reflects the fine for non-payment or incomplete payment of tax (except for income tax and other similar payments);

- the amount of the fine is transferred to the budget.

When calculating fines for underpayment of insurance premiums, the following entries should be made in accounting:

- Debit 91-2 Credit 69

reflects the fine on insurance premiums;

- the amount of the fine is transferred to the budget.

Working hours for teenagers under 16 years of age

The age at which an employment contract can be concluded directly affects the length of the working day. In the previous paragraphs it was mentioned that the work activity of teenagers should be easy and not interfere with their studies or mastering the educational program. Consequently, a teenager cannot spend a full day at work on an equal basis with adults. Before reaching the age of sixteen, a teenager can work no more than a day a week, i.e. only 24 hours.