Account 68 “Calculations for taxes and duties” is used by legal entities to display all information about mutual settlements with regulatory authorities for taxes and duties, both from the organization and from the employees of the enterprise.

Account 68 in accounting is intended to collect information about mutual settlements on accrued tax payments required for payment to budgets, the organization's debts to regulatory authorities and identified amounts of overpayments.

Count 68 is active-passive. The loan displays the amounts accrued for payment to regulatory authorities in accordance with the declarations provided in correspondence with the corresponding accounting accounts (for example, employee compensation, profits and losses, etc.). On debit, data on actual transfers of the organization is collected. In addition, VAT amounts presented by suppliers and accepted for deduction (from Kt19) and credited advances from buyers (from Kt76AV) are transferred to Debit account 68.

Attention! Balances on account 68 must coincide with the settlement certificate for mutual settlements ordered from the Federal Tax Service.

Calculations for each tax are analyzed separately, therefore, separate sub-accounts 68 accounts are opened in accounting:

68.01 – mutual settlements with the budget as a tax agent are taken into account when transferring personal income tax from employee salaries;

68.02 – VAT

68.03 – excise taxes;

68.04 – data on advance payments and annual tax calculation on the profit received by the company is displayed here. The payment is distributed between the federal and regional budgets.

Something to keep in mind! Organizations operating in accordance with PBU 18/02 must open an additional sub-account to reflect information on the calculation of advance payments.

68.07 – display of information about transport tax;

68.08 – property taxes;

68.09 – tax payments on advertising

68.10 – other types of taxes and fees

68.11 – UTII (for business entities who have chosen this form of taxation);

68.12 – simplified tax system (for business entities who have chosen this form of taxation);

68.13 – information on trading fees

68.22 – this sub-account records information on possible VAT refunds on exports if it is necessary to obtain additional permission from regulatory authorities (the sub-account is active)

68.32 – data on VAT transfers if the company acts as a tax agent (passive subaccount)

Why is account 91 needed?

The result of a business is profit or loss. Companies spend and receive money not only in their core activities: there are other sources of income and directions of payments. For example, a manufacturer can make money by selling leftover raw materials, or a trading company can rent out warehouses. And among the expenses of almost every business is the maintenance of a current account. All this is other income and expenses.

More examples in the table:

| Other income | other expenses |

|

|

It is important that the list does not include revenues and expenses that have become extraordinary.

Account accounting is regulated by PBU 9/99 and PBU 10/99. According to them, the account reflects two types of income and expenses:

- operational - related to economic activity, but not its purpose;

- non-realization - follow from economic activity.

Account 68 in accounting

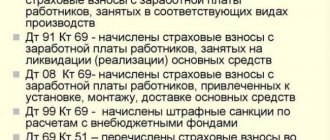

Account 68 is credited for amounts according to tax returns or calculations in correspondence:

- Account 99 - for the amount of accrued income tax;

- Invoice 70 - for the amount of personal income tax;

- Accounts 20, 25, 26, 44 - for the amount of local taxes, transport tax, property tax, etc.;

- Accounts 90.3, 91.2, 76.AV - when calculating VAT for the reporting quarter;

- Invoice 51 - upon receipt of overpaid tax from the budget.

The debit of the account records the amounts of taxes actually transferred to the budget, including the amounts of VAT written off from account 19.

Postings to account “68.02”

By debit

| Debit | Credit | Content | Document |

| 68.02 | 19.01 | Manually reflecting VAT deduction on a commissioned fixed asset | Reflection of VAT for deduction |

| 68.02 | 19.01 | VAT deduction on a fixed asset put into operation | Generating purchase ledger entries |

| 68.02 | 19.02 | Manually reflecting VAT deduction on intangible assets | Reflection of VAT for deduction |

| 68.02 | 19.02 | VAT deduction on intangible assets | Generating purchase ledger entries |

| 68.02 | 19.03 | Acceptance of VAT deduction for downward adjustment of sales | Generating purchase ledger entries |

| 68.02 | 19.03 | Manually reflecting VAT deduction on material resources | Reflection of VAT for deduction |

| 68.02 | 19.03 | VAT deduction on inventories | Generating purchase ledger entries |

| 68.02 | 19.03 | Acceptance for deduction of VAT upon adjustment of receipts upward | Generating purchase ledger entries |

| 68.02 | 19.04 | Reflection of VAT deduction for work performed and services provided manually | Reflection of VAT for deduction |

| 68.02 | 19.04 | VAT deduction on work performed, services provided | Generating purchase ledger entries |

| 68.02 | 19.05 | Reflection of VAT deduction paid to customs authorities on imported imported goods manually | Reflection of VAT for deduction |

| 68.02 | 19.05 | Deduction of VAT paid to customs authorities on imported imported goods | Generating purchase ledger entries |

| 68.02 | 19.07 | VAT deduction on purchased goods for sale for export at a rate of 0% | Generating purchase ledger entries |

| 68.02 | 19.07 | Reflection of VAT deduction on purchased goods for sale for export at a rate of 0% manually | Reflection of VAT for deduction |

| 68.02 | 19.08 | Reflection of VAT deduction when constructing fixed assets manually | Reflection of VAT for deduction |

| 68.02 | 19.08 | VAT deduction for the construction of fixed assets | Generating purchase ledger entries |

| 68.02 | 19.10 | Deduction of VAT accrued when importing goods from the Customs Union | Generating purchase ledger entries |

| 68.02 | 51 | Transfer of funds from the organization’s current account to pay off debt to the budget for value added tax (VAT) | Debiting from current account |

| 68.02 | 76.AB | Deduction of VAT on advance payment previously received from the buyer (advance payment) | Generating purchase ledger entries |

| 68.02 | 76.VA | Deduction of VAT on advance payment (advance payment) transferred to the supplier | Invoice received |

By loan

| Debit | Credit | Content | Document |

| 000 | 68.02 | Entering opening balances: value added tax (VAT) | Entering balances |

| 19.03 | 68.02 | Reinstatement of VAT when adjusting the cost of receipt downward | Adjustment of receipts |

| 19.03 | 68.02 | Reinstatement of VAT on purchased inventories sold for export at a 0% rate | VAT recovery |

| 19.04 | 68.02 | Reinstatement of VAT on work performed, services provided for export at a rate of 0% | VAT recovery |

| 19.08 | 68.02 | VAT accrual for the construction of fixed assets using economic methods | Accrual of VAT on construction and installation work using the economic method |

| 68.22 | 68.02 | VAT accrual on goods sold for export is 0%, if the right to apply the 0% rate is not confirmed within the prescribed period | Confirmation of zero VAT rate |

| 76.02 | 68.02 | VAT accrual upon return to the supplier under a contract in rubles. | Returning goods to the supplier |

| 76.22 | 68.02 | VAT accrual when returning to the supplier under a contract in foreign currency | Returning goods to the supplier |

| 76.32 | 68.02 | VAT accrual upon return to the supplier under a contract in cu. | Returning goods to the supplier |

| 76.AB | 68.02 | VAT accrual on advance payment received from the buyer (advance payment) | Invoice issued |

| 76.VA | 68.02 | Recovering VAT on advance payment (advance payment) previously transferred to the supplier | Generating sales ledger entries |

| 76.OT | 68.02 | Accrual of VAT on the amount of shipment of goods to a third party without transfer of ownership (if the setting is specified in the organization’s accounting policy) | Sales (acts, invoices) |

| 90.03 | 68.02 | Reinstatement of VAT when adjusting the cost of sales upward | Adjustment of receipts |

| 90.03 | 68.02 | VAT accrual on goods sold at an automated point of sale (retail, accounting at sales value) | Retail sales report |

| 90.03 | 68.02 | VAT accrual on services provided by an agent (accounting with the agent) | Report to the committent |

| 90.03 | 68.02 | VAT accrual on works and non-production services provided | Sales (acts, invoices) |

| 90.03 | 68.02 | Accrual of VAT on works and services of a production nature provided | Provision of production services |

| 90.03 | 68.02 | Accrual of VAT on goods sold by a commission agent (accounting with the principal) | Commission agent's report on sales |

| 90.03 | 68.02 | Accrual of VAT on goods sold by a commission agent (accounting with a commission agent, sub-commission agent) | Report to the committent |

| 90.03 | 68.02 | VAT accrual on goods sold at an automated point of sale (retail, accounting at cost of acquisition) | Retail sales report |

| 90.03 | 68.02 | VAT charged on agency fees | Report to the committent |

| 90.03 | 68.02 | Accrual of VAT on non-production services provided to several contractors | Provision of services |

| 90.03 | 68.02 | VAT accrual on services provided by the agent (accounting with the principal) | Commission agent's report on sales |

| 90.03 | 68.02 | VAT accrual on goods sold, materials, finished products | Sales (acts, invoices) |

| 90.03 | 68.02 | VAT accrual on goods sold at a non-automated point of sale (retail, accounting at sales cost) | Cash receipt |

| 90.03 | 68.02 | VAT accrual on goods sold at a manual point of sale (retail, accounting at cost of acquisition) | Cash receipt |

| 90.03 | 68.02 | Write-off of VAT when returning goods, materials, finished products from the buyer (reversal) | Return of goods from the buyer |

| 91.02 | 68.02 | Accrual of VAT on the sale of returnable reusable packaging, which was previously transferred to the buyer and is registered with him | Reflection of VAT accrual |

| 91.02 | 68.02 | VAT accrual on sold fixed assets | OS transfer |

| 91.02 | 68.02 | Restoration of VAT on real estate | Restoration of VAT on real estate |

| 91.02 | 68.02 | VAT write-off when returning equipment from the buyer (reversal) | Return of goods from the buyer |

| 91.02 | 68.02 | VAT accrual on equipment sold under a contract in rubles. | Sales (acts, invoices) |

| 91.02 | 68.02 | VAT accrual on sold intangible assets | Transfer of intangible assets |

Postings to display profits and losses on account 99

In general, the accounting entry for making a profit or incurring losses in account 99 is as follows:

- Dt99 – Kt84 – retained earnings are taken into account;

- Dt84 – Kt99 – transfer of the amount of net loss;

- Dt99 – Dt90 – write-off of losses for the leading type of activity;

- Dt90 – Kt99 – reflection of profit for the leading type of activity;

- Dt99 – Kt91 – display of losses from other types of activities;

- Dt91 – Kt99 – receipt of income from other types of activities;

- Dt96 – Kt99 – increase in profit due to the balance of unused reserves;

- Dt99 – Kt10 – write-off of the cost of materials damaged as a result of emergency situations;

- Dt73 – Kt99 – recovery of expenses incurred from those responsible in emergency circumstances;

- Dt99 – Kt68 – calculation of income tax.

Profits and losses from emergency circumstances and situations include cash flows due to fire, flood, nationalization of an enterprise, natural disasters, receipt of insurance compensation, etc.

Account 91 - active or passive

Account 91 belongs to the category of mixed, or active-passive. It simultaneously takes into account both assets and liabilities. And its balance is changeable - it can only be debit or only credit.

On credit 91 accounts during the month reflect income from other sources, and on debit - other expenses. At the end of the month, the debit and credit turnovers are compared, the smaller is subtracted from the larger and the result is obtained. If the balance turns out to be a credit balance, income exceeds expenses, and the company generates profit from other activities. If it's the other way around, it's a loss.

There should be no balance left in the account at the end of each month. It is written off to the Profit and Loss account.

DEBIT 91-2 CREDIT 68 SUB-ACCOUNT “PROPERTY TAX CALCULATIONS”

On the credit side of account 68, the accounting records reflect accrued or withheld amounts of taxes and fees, and on the debit side - amounts actually transferred to the budget or otherwise reducing the debt to it.

We transfer the ending balance for each subaccount from November, it will be the beginning balance for December.

If there are any other sub-accounts on account 91, then they are closed in the same way to the 9th sub-account. Depreciation is the gradual transfer of the cost of a fixed asset to the cost of products (works, services).

Additional sub-accounts can also be opened under account 68:

- 68.11 - UTII;

- 68.12 – simplified tax system;

- 68.13 – Trade fee.

Income related to the sale of own assets (with the exception of cash), interest payments to counterparties for the use of provided funds, participation in the authorized capital of third-party companies: income is accepted in the same way as revenue recognition.

Note! For business entities that, according to the criteria, are classified as small businesses, the application of PBU 18/02 is a right, not an obligation.

In the previous article, we examined the accounting of income and expenses received from the normal activities of the organization. Other income and expenses are recorded on 91 accounting accounts. The data from this account also forms the final financial result of the enterprise.

Analytical accounting

Analytical accounting for 91 accounts has two tasks:

- Provide the opportunity to determine the financial result for each operation;

- Divide income and expenses into operating and non-operating to simplify the preparation of a report on financial results.

The chart of accounts provides three subaccounts to accounting account 91:

- 91-1 - other income;

- 91-2 - other expenses;

- 91-9 - balance.

Example . Bely Oak LLC paused production during the coronavirus crisis and decided to rent out the machine to earn extra money. Monthly rent payment is 21,000 rubles, including VAT 3,500 rubles. Depreciation - 3,000 rubles per month. The White Oak accountant will record the following transactions on a monthly basis:

- Dt 62 Kt 91.01 - 21,000 rubles - payment received from the tenant.

- Dt 91.02 Kt 68 - 3,500 rubles - tax charged on rental payment.

- Dt 91.02 Kt 02 - 3,000 rubles - depreciation of the machine has been accrued.

- Dt 51 Kt 62 - 21,000 rubles - the money was credited to the account.

But three subaccounts are not enough to effectively manage an organization and conveniently prepare accounting records. More detailed information is needed about groups and types of income and expenses.

The second option is to open sub-accounts within the following groups:

- 91-1 - operating income;

- 91-2 - operating expenses;

- 91-3 - non-operating income;

- 91-4 - non-operating expenses;

- 91-9 - balance.

You can open additional subaccounts for each of the groups in order to link the indicators of the financial results report with the subaccounts. For example, among operating income, highlight interest, income from participation in other companies and other income.

Debit 44 credit 68 debit 51 credit 68 and what is the next entry?

The amount of contributions to it is calculated separately for each name (nomenclature number) of valuables or for groups of homogeneous materials.

When carrying out transactions with counterparties (shipment of goods, purchase of services, etc.), organizations are faced with the need to carry out VAT calculations. The main VAT transactions include:

- calculation of VAT amount;

- accounting for “input” VAT;

- acceptance of tax for deduction;

- adjustment of the VAT amount (including its restoration);

- reimbursement of VAT from the budget;

- transfer of VAT amount to the budget.

In its structure, account 91 “Other income and expenses” is in many ways similar to account 90 “Sales”. It also consists of several subaccounts; income, expenses and financial results are reflected in different subaccounts.

Accounting for tax amounts is necessary to monitor the fulfillment of the enterprise’s obligations to pay taxes to the budget. Account 68 is used to reflect tax transactions.

What does the entry Debit 91 Credit 94 mean?

In cases where losses of valuables that have occurred in an organization or shortages identified as a result of an inventory cannot be compensated at the expense of the guilty parties, the resulting expenses are charged to account 91: Dt 91 Kt 94 - writing off shortages and losses as other expenses.

Important to consider! Recommendation from “ConsultantPlus”: When writing off shortages of valuables or their damage in excess of the norms of natural loss, confirmation of the validity of such a write-off is necessary. They must be confirmed by the following documents... For more details, see K+. Trial access is free.

And when transferring property and materials free of charge to third parties, the following entries are made: Debit 91 Credit 10 or Dt 91 Kt 41.

For additional information on establishing the facts of shortages, see the article “Accounting for losses from theft if the culprit is not identified.”