Reasons for dismissal and amount of benefits

A benefit in the amount of two average monthly earnings is provided in case of staff reduction or closure of a company. It is paid on the basis of Part 1 of Article 178 of the Labor Code. If an employee contacted the Employment Service within two weeks after dismissal, but was not employed, the territorial body may decide that benefits should be paid to him for the third month.

If an employment contract is terminated because the employer violated the rules when concluding it, the employee is entitled to pay severance pay in the amount of average monthly earnings. This is stated in the last paragraph of Article 84 of the Labor Code of the Russian Federation.

In accordance with Part 3 of Article 178 of the Code, an employee is paid severance pay in the amount of two weeks’ average earnings in cases where:

- due to his health condition, he should be transferred to another job, but refused this or the employer was unable to offer him such a job;

- in accordance with a medical report, the employee is declared incapable of work;

- he was called up for military or alternative civilian service;

- the employee who previously occupied this position is reinstated;

- the employer moves to another area, but the employee refuses to transfer there;

- the employee refuses to work because working conditions have changed.

The grounds and amounts of benefits listed above are mandatory. But besides them, the employer can provide other measures to support dismissed employees. This may be an increase in the amount of benefits or the assignment of it in cases where it is not required by law. In order for the payment to be justified in terms of costs, it is necessary to stipulate the relevant provisions in local regulations or an employment contract.

Severance pay is not due in the following cases:

- upon dismissal of one's own free will;

- if the employee has not completed the probationary period;

- if the contract is terminated due to the fact that it was drawn up with violations due to the fault of the employee himself;

- if the dismissal occurs due to the fault of the employee.

In the latter case, this means, for example, dismissal under paragraph 6 of Article 81 of the Labor Code of the Russian Federation. This is a gross violation by an employee of labor duties - absenteeism, showing up at work while drunk, disclosing secret information, theft or embezzlement in the workplace, destruction of property, as well as violation of labor protection requirements, which resulted in a dangerous situation or led to serious consequences.

Dismissal due to reduction

Before considering what payments are provided for during layoffs, let us recall the procedure for carrying out this procedure:

- an order is issued to carry out measures to reduce personnel,

- employees who are subject to layoffs are given personal notices 2 months before, indicating the date and reason for the layoff, as well as offers of other work options, if any (Article 180 of the Labor Code of the Russian Federation); The trade union and the employment service are notified 2 months in advance. Temporary workers are notified of layoffs 3 days in advance, and seasonal workers 7 days in advance (Articles 292, 296 of the Labor Code of the Russian Federation);

- if an employee refuses the offered job, he will be dismissed under clause 2, part 1, art. 81 of the Labor Code of the Russian Federation and will receive payments due in case of staff reduction.

Benefit amount

To calculate benefits, the following formula is used: Average salary X Number of working days in the month following dismissal.

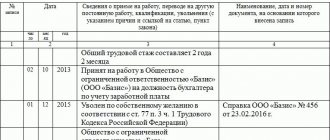

To calculate average earnings you need to determine:

- The calculation period is the 12 months preceding the month of dismissal. If the dismissal occurs on the last day of the month, then it is included in the billing period.

- The total amount of payments to the employee for the pay period . This means wages, as well as other payments, if any.

Average earnings are calculated using the formula: Amount of payments for the billing period / number of days of the billing period.

For example, the number of working days over the last 12 months is 252 days, wages are 30,000 rubles , no other payments were made. The amount of payments will be: 30,000 X 12 = 360,000 rubles.

This will be true if the employee has worked all the working days of the estimated period. If he went on vacation, sick leave, went on a business trip, or was released from work for some other reason, then to calculate average earnings these periods and payments for them are excluded.

In the example above, the average earnings will be: 360,000 / 252 = 1,428.57 rubles per day.

To calculate the benefit, it must be multiplied by the number of working days of the next month. For example, if there are 22 , then the benefit amount will be: 1428.57 X 22 = 31428.54 rubles.

How are redundancy payments calculated?

To calculate payments when an employee is laid off in 2021, you first need to determine his average daily earnings (AD):

- SZ = wages for 12 months before dismissal / days worked for 12 months,

In this case, vacation and sick leave, as well as vacation and sick days, are excluded from payments.

Calculation of reductions for severance pay is carried out as follows:

- VP = SZ * number of working days in the first month after dismissal

The amount of payments for the second and subsequent months of employment is calculated in the same way.

The number of working days is determined taking into account the work schedule of the laid-off employee - office “five-day” shift, shift work, etc.

Example

Employee Ivanov was dismissed as of October 1, 2017 due to staff reduction. What payments, in addition to the September salary and compensation for unused vacation, will he receive if in the 12 months before the layoff he worked 220 days, and his earnings for the time worked are 440,000 rubles.

First, let’s determine Ivanov’s average daily salary:

SZ = 440,000 rub. / 220 days = 2000 rub.

Severance pay = 2000 rub. x 22 days (working days in October 2017) = 44,000 rubles.

What other payments can Ivanov receive if he is laid off:

- If Ivanov does not get a job within 2 months, the employer, upon his application, will accrue a payment in December after the employee is laid off, equal to the average earnings for November: Payment for the 2nd month = 2000 rubles. x 21 days (working days in November 2021) = 42,000 rubles.

- If Ivanov gets a job, for example, from November 20, his compensation for being laid off from work will be proportional to the “unemployed” time in November:

Payment for the 2nd month = 2000 rubles. x 12 days (working days in the period from November 1 to November 20, 2021) = RUB 24,000.

Payment procedure

In all cases, except for dismissal due to staff reduction or liquidation, the benefit is paid in a lump sum no later than the last working day . It happens that on the last day an employee is on vacation, on sick leave, or absent for some other reason. In this case, you need to pay him no later than the next day after he applies for such a settlement.

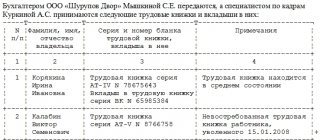

If we are talking about a reduction or liquidation benefit, then it is paid separately for each of the two months. The first month's benefit is paid according to the general rules given above. Benefits for the second month are due only if the employee does not find a new job in the first month after dismissal. To confirm this, he must provide the employer with:

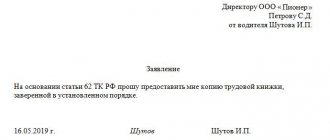

- application in free form;

- work book without a record of new employment;

- a certificate from the Employment Center stating that you are registered as unemployed.

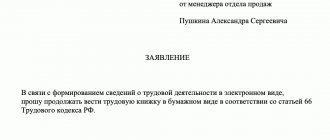

The text of the statement could be something like this:

“I ask you to pay the average monthly salary for the second month after dismissal due to staff reduction. I am attaching copies of the certificate from the Employment Center and the Work Book.”

Before making a payment, the employer must issue an order . If we are talking about benefits by agreement of the parties, in addition to the order, you need to draw up an additional agreement to the employment contract.

Payments upon dismissal of an employee 2021 – Labor Code

For employees, such dismissal is one of the most financially “protected”, since it is accompanied by a number of appropriate payments and compensations established by law.

Art. 178 of the Labor Code of the Russian Federation contains information about what payments are due when an employee is laid off:

- severance pay,

- the average monthly salary for the period of searching for a new job, but for a maximum of 2 months after dismissal, severance pay is taken into account.

In addition to the payment in case of staff reduction, the employee is paid the amounts due to him, as in the case of dismissal in the usual manner:

- salary for hours worked,

- compensation for unused vacation.

By an employment contract or local act, the employer can establish other compensation for employees in the event of layoffs.

Taxation

If the amount of the benefit does not exceed three times the average monthly earnings , then in accordance with paragraph 3 of Article 217 of the Tax Code, personal income tax does not need to be withheld from this payment. If the employer assigns benefits in an increased amount, then the amount exceeding three times earnings is subject to personal income tax . It must be withheld at the time of payment (the deadline is the last day of work), and transferred no later than the next day.

The same rule applies to insurance premiums . That is, if the amount of the benefit does not exceed three times the average earnings, then there is no need to accrue contributions from it.

Attention! Child support for minor children should be withheld from the amount of severance pay (letter of the Ministry of Labor dated September 12, 2017 No. 11-1/OSCHG-1816).

Expert commentary on the taxation of benefits with contributions and personal income tax:

Additional payment for early termination

An employee can be fired before the two-month notice period for layoff expires. This is possible with the agreement of the parties and the written consent of the dismissed employee.

In this case, upon layoff, the employer pays another compensation: the employee’s average salary, calculated in proportion to the time remaining until the date of dismissal (Article 180 of the Labor Code of the Russian Federation).

For example, the notice period expires on October 31, 2017, but by mutual agreement the employee leaves earlier - from October 9, 2017. The calculation of payments when an employee is laid off will include additional compensation, which will be calculated on the basis of 17 working days falling during the period from 10/09/2017 to 10/31/2017.

What affects payments?

All main points regarding payments in the event of layoffs are regulated by the provisions of Articles 178 and 180 of the Labor Code.

These items are used to generate payments in 2017.

The amount of payments is influenced by two factors - length of service and the amount of wages (its average monthly indicators are important). Such payments are of the social type and are divided into two main categories:

- Severance pay is one-time and one-time payments, the amount of which cannot be lower than the average official salary. The employment contract may specify a fixed amount. It must be paid even if it is higher than the average salary for a particular position.

- Social benefits are assistance in the amount of the average salary that the employer is obliged to pay while a former employee is looking for a new job. The period of employment should not exceed sixty days. It is during these two months that social payments are made.

Usually the entire amount is paid at once, including severance pay and the average salary for two months. In some cases, payments may be extended for a third month. The basis for such an exception is the lack of a suitable vacancy at the employment center (a redundant employee must register with this organization within two weeks!).

Also, “compensation” may be added to the payments - funds due to the employee for unused vacation or for shifts (hours) worked in the current month. In addition, the company will be required to pay for sick leave received by an employee immediately after layoffs (its maximum duration is 30 days).

Compensation payments are not subject to personal income tax!

If, according to the employment contract, they exceed the maximum permissible values (the comparison is based on the average salary), the compensation is not exempt from taxation. However, it can be taken into account as a tax expense of the enterprise.

Employees are notified of layoffs two months before dismissal. At the same time, they have the right to resign before the end of the allotted period (by agreement of the parties).