Who is eligible for the child tax credit?

By law, if you have children under the age of eighteen, children with disabilities, or children receiving full-time education at any educational institution (under the age of 24), you are entitled to a standard tax deduction. In addition, the monthly tax deduction applies not only to parents, but also to the child’s guardians, trustees, adoptive parents, as well as their spouses who support the children.

Both parents at work and one parent, who in this case can claim a double deduction, can receive a monthly tax deduction. But in order to receive the double standard child tax credit in 2013 at the place of work of one of the parents, the other parent must refuse the deduction by writing a corresponding application.

The procedure for filling out a certificate in form 2-NDFL

Certificate 2-NDFL is filled out based on accounting data:

- income paid to individuals by a tax agent,

- tax deductions provided to individuals,

- calculated and withheld taxes in tax registers.

When filling out the Certificate form, the Directories “Income Codes”, “Deduction Codes”, “Document Codes” and “Region Codes” are used, which are contained in the Appendices to Order No. ММВ-7-3 / [email protected]

Certificates are submitted by tax agents for each individual person who received income from this tax agent.

For example, if a tax agent paid an individual during the tax period income taxed at rates of 9% and 13%, then at the end of the tax period he prepares one Certificate for this individual and submits to the Federal Tax Service Inspectorate in form 2-NDFL.

All total indicators in the Certificate form are reflected in rubles and kopecks separated by a decimal point, with the exception of tax amounts. Tax amounts are calculated and reflected in full rubles. A tax amount of less than 50 kopecks is discarded, and 50 kopecks or more are rounded up to the full ruble.

In the Certificate form, all details and amounts are filled in, unless otherwise specified in Section II of Order No. ММВ-7-3/ [email protected]

Information on the income of an individual for whom a tax agent recalculated personal income tax for previous tax periods in connection with the clarification of his tax obligations is drawn up in the form of a new Certificate.

When drawing up a new Certificate to replace the previously submitted one, in the fields “No. ____” and “from ____” you should indicate the number of the previously submitted Certificate and the new date of preparation of the Certificate.

The title of the Help indicates:

The year for which the Certificate is being prepared is entered in the “for 20__ year” field. In our case, the year is 2013.

in the “N ____” field - the serial number of the Certificate in the reporting tax period, assigned by the tax agent.

in the “from ____” field - indicate the date (date, month number, year) of the Certificate in the following format: 03/15/2014.

in the “sign” field - enter:

a) Number 1 - if the Certificate is submitted in accordance with clause 2 of Article 230 of the Tax Code of the Russian Federation (in the case when personal income tax is accrued, withheld and transferred to the budget).

b) Number 2 - if the Certificate is submitted in accordance with clause 5 of Article 226 of the Tax Code of the Russian Federation (if it is impossible to withhold personal income tax from the taxpayer).

in the field “in the Federal Tax Service (code)” - the four-digit code of the tax authority in which the tax agent is registered, for example: 7707, where 77 is the region code (Moscow), 07 is the tax authority code.

Section 1 “Data about the tax agent” of the Certificate contains information about the tax agent.

In paragraph 1.1, for tax agents - organizations, the taxpayer identification number (hereinafter - TIN) and the reason for registration code (hereinafter - KPP) are reflected (indicated through the separator "/"), and for tax agents - individuals, the TIN is indicated.

If information on income is filled out by an organization for individuals receiving income from its separate division, in this paragraph after the TIN, through the separator “/”, the checkpoint at the place of registration of the organization at the location of its separate division .

Clause 1.2 “Name of the organization/Last name, first name, patronymic of an individual” indicates the abbreviated name (in case of absence - full name) of the organization according to its constituent documents.

The content part of the name (its abbreviation or name, for example: “school No. 241” or “OKB “Vympel”) is located at the beginning of the line.

In relation to an individual recognized as a tax agent, the full last, first and patronymic names, without abbreviations, are indicated in accordance with his identity document.

In the case of a double surname, the words are written with a hyphen. For example: Ivanov-Yuryev Alexey Mikhailovich.

Clause 1.3 “OKTMO Code” indicates the code of the municipality on the territory of which funds are mobilized, the organization or a separate division of the organization is located where the stationary workplace of the employee for whom the Certificate form is being filled out is equipped, or they are paying income to another individual.

If during a calendar year an individual, about whose income the Certificate is being filled out, received income in several separate divisions located on the territory of different municipalities, then several Certificates (according to the number of municipalities on whose territory the separate divisions are located, in which the individual received income).

Codes OK OK 033-2013 (OKTMO).

When filling out the “OKTMO Code” indicator, for which eleven familiar spaces are allocated, the free familiar spaces to the right of the code value if the OKTMO code has eight characters are not subject to filling with additional symbols (filled with dashes).

For example, for the eight-digit OKTMO code 12445698, the eleven-digit value “12445698—” is indicated in the “OKTMO Code” field.

When filling out the form of a Certificate of income received by an individual in the parent organization, in paragraph 1.1 the TIN of the organization is indicated, the checkpoint at the location of the organization, in paragraph 1.3 the OKTMO code is indicated at the location of the organization.

When filling out a Certificate of income received by an employee from working in a separate division of the same organization, in paragraph 1.1 the INN of the organization is indicated, the checkpoint at the place of its registration at the location of the separate division of the organization, in paragraph 1.3 the OKTMO code is indicated at the location of the separate division of the organization.

For an individual recognized as a tax agent, the OKTMO code at his place of residence is indicated.

Clause 1.4 “Telephone” indicates the contact telephone number of the tax agent, through which, if necessary, reference information regarding the taxation of income of a given taxpayer, as well as the credentials of this tax agent and the taxpayer, can be obtained.

If the tax agent does not have a contact phone number, this detail is not filled in.

Section 2 “Data about the individual - recipient of income” of the Certificate reflects data about the individual - recipient of income.

Clause 2.1 “TIN” indicates the identification number of the taxpayer - an individual, which is indicated in the document confirming the registration of this individual with the tax authority of the Russian Federation. If the taxpayer does not have a TIN, this detail is not filled in .

Clause 2.2 “Last name, first name, patronymic” indicates the last name, first name and patronymic of the individual taxpayer, without abbreviations, in accordance with the identity document.

For foreign individuals, it is allowed to use letters of the Latin alphabet when writing. The patronymic may be absent if it is not indicated in the taxpayer’s identity document.

In paragraph 2.3 “Taxpayer status” the taxpayer status code is indicated. If the taxpayer is a tax resident of the Russian Federation, the number 1 is indicated; if the taxpayer is not a tax resident of the Russian Federation, the number 2 is indicated if the taxpayer is not a tax resident of the Russian Federation, but is recognized as a highly qualified specialist in accordance with the law of July 25, 2002. No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”, then the number 3 .

In clause 2.4 “Date of birth” the date of birth (day, month, year) is indicated in the following format: 01/01/1985.

In paragraph 2.5 “Citizenship” the numeric code of the country of which the taxpayer is a citizen is indicated.

The country code is indicated according to the All-Russian Classifier of Countries of the World (OKSM). For example, code 643 is the code of Russia, code 804 is the code of Ukraine.

If the taxpayer does not have citizenship, the code of the country that issued the document proving his identity is indicated in the “Country Code” field.

Clause 2.6 “Identity document code” indicates the code that is selected from the “Document Codes” Directory.

In paragraph 2.7 “Series and number of the document” the details of the taxpayer’s identity document are indicated; accordingly, the series and number of the document; the “N” sign is not affixed.

Clause 2.8 “Residence address in the Russian Federation” indicates the full address of the taxpayer’s permanent place of residence on the basis of an identification document or other document confirming the address of residence.

Address elements are: “Postal code”, “Region code”, “District”, “City”, “Settlement”, “Street”, “House”, “Building”, “Apartment”.

“Region code” is the code of the region in which the individual has his place of residence. The region code is selected from the Region Codes Directory.

“Postal code” is the index of a communications company located at the taxpayer’s place of residence. When reflecting the House address element, both numeric and alphabetic values can be used, as well as a "/" sign to indicate a corner house. For example: 4A or 4/2. Modifications of the “Building” type are filled in the “Body” field.

Order No. ММВ-7-3/ [email protected] provides the following examples of filling out addresses:

Example 1 . The address Moscow, Leninsky Prospekt, building 4a, building 1, apartment 10 is reflected as follows:

- in the “Postal code” field 110515 is indicated;

- in the “Region code” field 77 is indicated;

- in the “Street” field, Leninsky Prospekt is indicated;

- in the “House” field 4A is indicated;

- in the “Body” field, 1 is indicated;

- in the “Apartment” field 10 is indicated.

Example 2 . Address Moscow region, Naro-Fominsk district, Aprelevka, microdistrict. Augustinsky, house 14, building 1, apartment 50 is reflected as follows:

- in the “Postal code” field 143360 is indicated;

- in the “Region code” field 50 is indicated;

- in the “District” field the Naro-Fominsk district is indicated;

- in the “City” field Aprelevka city is indicated;

- in the “Street” field the microdistrict is indicated. Augustinian;

- in the “Home” field 14 is indicated;

- in the “Case” field, page 1 is indicated;

- in the “Apartment” field - 50.

Example 3. Address Voronezh, Borovoe village, st. Gagarina, house 1 is reflected as follows:

- in the “Postal code” field 394050 is indicated;

- in the “Region Code” field 36 is indicated;

- in the “City” field indicate Voronezh;

- in the “Settlement” field, Borovoe village is indicated;

- in the “Street” field, Gagarina Street is indicated;

- in the “Home” field, 1 is indicated.

Example 4. The address Ivanovo region, Ivanovo district, Andreevo village, 12 is reflected as follows:

- in the “Postal code” field 155110 is indicated;

- in the “Region code” field 37 is indicated;

- in the “District” field the Ivanovo district is indicated;

- in the field “Settlement” Andreevo d is indicated;

- in the “Home” field 12 is indicated.

If one of the address elements is missing, the field allocated for this element is not filled in and may not appear in the Help.

In clause 2.9 “Address in the country of residence” for individuals who are not tax residents of the Russian Federation, as well as foreign citizens, the address of residence in the country of permanent residence is indicated.

In this case, the code of this country is indicated in the “Country Code” field, then the address is written in any form (letters of the Latin alphabet are allowed).

For individuals who are not tax residents of the Russian Federation and foreign citizens, the absence of the indicator “Residence address in the Russian Federation” is allowed, provided that clause 2.9 of the Certificate is completed.

Section 3 of the Certificate “Income taxed at the rate of __%” reflects information on income received by individuals in cash and in kind, by month of the tax period.

The heading of section 3 of the Certificate indicates the tax rate in respect of which the section of the Certificate is being filled out (13%, 30%, 9%, 15%, 35% or the rate based on the relevant double taxation agreement).

If the tax agent paid an individual during the tax period income taxed at different rates, sections 3 - 5 of the Certificate are completed for each tax rate.

So, for example, if a tax agent paid an individual during the tax period income taxed at rates of 13% (salaries) and 9% (dividends), sections 3 - 5 of the Certificate for a rate of 13% are sequentially completed, and then sections 3 are sequentially completed and 5 Certificates for a rate of 9%.

Next, the amounts of income received by an individual in the tax period are reflected sequentially, separately for each income received.

In the “Month” column, the serial number of the month of the tax period corresponding to the date of actual receipt of income, determined in accordance with the provisions of Article 223 of the Tax Code of the Russian Federation, is indicated in chronological order.

In the “Income Code” column, income codes are indicated, which are selected from the “Income Codes” Directory.

The “Amount of Income” column reflects the entire amount of income (without tax deductions) according to the specified income code.

Opposite those types of income for which professional tax deductions are provided or which are subject to taxation not in full in accordance with Article 217 of the Tax Code of the Russian Federation, in the column “Deduction Code” the code of the corresponding deduction is indicated, selected from the Directory “Deduction Codes”.

The column “Deduction Amount” reflects the corresponding amount of tax deduction, which should not exceed the amount of income indicated in the corresponding column “Amount of Income”.

The income code is indicated if there is a positive amount of income. The deduction code is indicated if there is a deduction amount.

For income, the taxation features of which are determined by Articles 214.1, 214.3 and 214.4 of the Tax Code of the Russian Federation, several deduction codes may be indicated in relation to one income code.

In this case, the first deduction code and deduction amount are indicated opposite the corresponding income code, and the remaining deduction codes and deduction amounts are indicated in the corresponding columns in the lines below.

The columns (fields) “month”, “income code” and “income amount” opposite such deduction codes and deduction amounts are not filled in . The total amount of deductions attributable to this income must not exceed the amount of the income.

When filling out a Certificate with attribute 2, section 3 of the Certificate indicates the amount of income from which is not withheld by the tax agent.

Example. The organization paid the employee a salary in the amount of 5,000 rubles, calculated and withheld tax in the amount of 650 rubles. In connection with the dismissal, the employee received income in kind in the amount of 500 rubles. The organization calculated tax in the amount of 65 rubles, but did not withhold it.

When filling out a Certificate with attribute 2, section 3 of the Certificate indicates the amount of income of 500 rubles, and in paragraph 5.3 of section 5 of the Certificate the amount of tax calculated is indicated - 65 rubles, in paragraph 5.7 of section 5 of the Certificate the amount of tax not withheld by the tax agent is indicated - 65 rubles .

When filling out a Certificate with attribute 1, section 3 of the Certificate indicates the amount of income of 5,500 rubles, in paragraphs 5.3 - 5.5 of section 5 of the Certificate the amount of tax calculated is 715 rubles, the amount of tax withheld and transferred is 650 rubles, and in paragraph 5.7 of section 5 The certificate indicates the amount of tax not withheld by the tax agent - 65 rubles.

Please note: Standard tax deductions, property tax deductions, and social tax deductions are not reflected .

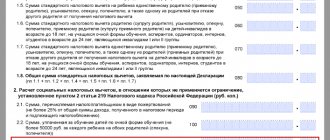

Section 4 of the Certificate “Standard, social and property tax deductions” is completed if the taxpayer was provided with standard, social or property tax deductions.

In this case, paragraphs 4.2, 4.3, 4.4 are completed if the taxpayer was provided with a property tax deduction.

Section 4 of the Certificate “Standard, social and property tax deductions” reflects the following information:

- on standard tax deductions established by Article 218 of the Tax Code of the Russian Federation,

- property tax deduction established by clause 2, clause 1, article 220 of the Tax Code of the Russian Federation *,

- as well as the social tax deduction established by clause 4, clause 1, article 219 of the Tax Code of the Russian Federation.

*In accordance with Federal Law dated July 23, 2013. No. 212-FZ, Article 220 of the Tax Code of the Russian Federation is set out in a new edition, which is valid from January 1, 2014.

Clause 4.1 “Amounts of tax deductions provided to the taxpayer” reflects the amounts actually provided to the taxpayer:

- standard tax deductions,

- property tax deduction,

- as well as social tax deduction.

In the “Deduction Code” column of clause 4.1, the deduction code selected from the “Deduction Codes” Directory is indicated.

The column “Deduction Amount” reflects the amount of deductions corresponding to the specified code. The number of completed lines in this paragraph depends on the number of types of deductions to which the taxpayer was entitled.

Paragraphs 4.2 and 4.3 indicate the number and date of the notification confirming the taxpayer’s right to a property tax deduction, issued by the tax authority in accordance with clause 3 of Article 220 of the Tax Code of the Russian Federation.

Clause 4.4 “Code of the tax authority that issued the notification” indicates the code of the Federal Tax Service that issued the notification.

Section 5 of the Certificate “Total amounts of income and tax based on the results of the tax period at the rate of __%” reflects the total amounts of income and tax on personal income based on the results of the tax period at the rate specified in the title of Section 5 of the Certificate.

Section 5 is formed separately for each tax rate reflected in the Certificate.

Clause 5.1 “Total amount of income” indicates the total amount of income based on the results of the tax period, excluding tax deductions. This paragraph reflects the total amount of income specified in section 3 of the Certificate.

When filling out a Certificate with feature 2, clause 5.1 indicates the total amount of income from which was not withheld by the tax agent, reflected in section 3 of the Certificate.

Clause 5.2 “Tax base” indicates the tax base from which the tax is calculated. The indicator indicated in this paragraph corresponds to the total amount of income reflected in paragraph 5.1. Certificate reduced by the total amount of tax deductions reflected in Sections 3 and 4 of the Certificate.

Clause 5.3 “Amount of tax calculated” indicates the total amount of tax calculated at the rate specified in section 3 of the Certificate based on the results of the tax period. When filling out a Certificate with feature 2, clause 5.3 indicates the total amount of tax calculated but not withheld.

In clause 5.4 “Amount of tax withheld”, the total amount of tax withheld is indicated accordingly at the rate specified in section 3 for the tax period. When filling out a Certificate with feature 2, clause 5.4 is not completed.

Clause 5.5 “Tax amount transferred” indicates the amount of tax transferred for the tax period. This paragraph is completed in relation to income received starting from 01/01/2011. When filling out a Certificate with feature 2, clause 5.5 is not completed.

Clause 5.6 “Amount of tax excessively withheld by the tax agent” indicates the amount of tax excessively withheld from the taxpayer by the tax agent. When filling out a Certificate with feature 2, clause 5.6 is not completed.

Clause 5.7 “Amount of tax not withheld by the tax agent” indicates the calculated amount of tax that the tax agent did not withhold in the reporting tax period.

The completed Certificate is signed in the “Tax Agent (signature)” field. The signature must not be sealed . The stamp is affixed in the space provided (“M.P.” in the lower left corner of the Certificate). In the field “Tax Agent (position)” the position of the person who signed the Certificate is indicated. In the field “Tax agent (full name)” the surname and initials of the specified person are indicated. Tax agent - an individual signs the Certificate and indicates his surname and initials of his name and patronymic.

If the Help cannot be placed on one page, then the required number of pages is filled in. On the next page at the top of the Certificate the following is indicated: the page number of the Certificate, “Certificate of income of an individual for the year 20__ N ___ from ________.” In this case, the “tax agent” field is filled in on each page of the Help.

Standard child tax credit in 2013: how much was it raised to?

In 2012, there was an increase in the child tax deduction and today the amount of the deduction depends on the code and on whether it is the first, second, third or disabled child.

So, for example, the deduction for the first child under code 114 will be 1,400 rubles, for the second – under code 115 – 1,400 rubles, for the third under code 116 – 3,000 rubles, for a disabled child under code 117 – 3,000 rubles.

Currently, the amount within which a child tax deduction is made is 280,000 rubles. This means that the deduction is made until the income of the child’s parent in a particular calendar year reaches this amount.

How to get the standard child deduction?

To receive a standard tax deduction for a child in 2013, documents confirming the right to deduction, age and status of the child must be provided to the employer. What documents exactly are we talking about? This:

- application of the established form for the provision of a tax deduction;

- certificate 2-NDFL for the current year;

- a copy of the child's birth certificate;

- a certificate from the child’s place of study (if the children are between 18 and 24 years old and are studying in various educational institutions);

- certificate of disability for disabled children of the first and second groups.

Sometimes there are situations when the employer, for some reason, does not provide tax deductions to employees. In this case, the employee can receive the deduction due to him next year. To do this, he must contact the tax authority with the same documents, and also provide his tax return for the previous year in form 3-NDFL.

Standard tax deductions are provided to a number of citizens. This article will discuss tax deductions for children. Namely, what is the amount of tax deductions for a child in 2013 and the codes of these deductions.

So, parents have the right to tax deductions for children, and this can be either spouse or both, there are no restrictions. However, there are restrictions on the age of the child for whom the above tax deduction is provided.

The standard tax deduction is provided until the child reaches 18 years of age, or up to 24 years of age if he is a full-time student at an educational institution; this also applies to graduate students, cadets, etc.

Tax deductions for children in 2013!

If there is only one parent in the family, then he is given a double deduction. A double deduction will also be provided if it is issued for only one parent.

In this case, you must provide the employer with the following documents:

- an application for a double deduction and an application from the other parent to waive the child deduction;

- and what is also new is that it is necessary to provide a certificate of income in Form 2-NDFL of the refusing parent every month since 2013.

In standard situations, to receive a deduction, the employer must provide:

- child's birth certificate,

- a certificate in form 2-NDFL from the previous place of work for the current year;

- application for the standard child tax credit;

- for children aged 18 to 24 years - a certificate from the educational institution.

The deduction for children is valid until the month in which the taxpayer’s income, calculated on an accrual basis from the beginning of the tax period (new year), exceeded 280,000 rubles.

So, in 2013, for the first child the standard tax deduction is 1,400 rubles, and the code is 114. For the second child, the deduction is also 1,400 rubles, but the code is already 115. For the third child and a disabled child, a deduction of 3,000 rubles is due. In the first option, code 116, if the child is disabled - code 117.

And for those who are just learning about what a tax deduction for a child is, I would like to note that these figures are the amount from which 13% is not withheld, that is, for one child (1400 rubles) the tax deduction will be 182 rubles every month.

Thus, we see that the size of the standard child tax deduction has not changed and in 2013 is the same as in 2012!

However, the Ministry of Finance put forward a proposal that the amount of deductions would be increased for the second child to 2,000 rubles, for the third and each subsequent child to 4,000 rubles. And if the child is disabled, increase the tax deduction 4 times, that is, up to 12,000 rubles. So we just have to wait to see whether these amendments will be made to the Tax Code or not.

If you have a legal question, ask by filling out the form, and our lawyers will answer you!

Similar articles:

- Features of initiating deprivation of parental rights...

- Are there any good sides to mortgage lending?

- 5 investment security factors

- Features of obtaining a loan for a small business in…

Double tax deduction: documents and rules for provision

If one parent refuses a tax deduction in favor of the other parent, then the second has the right to a double tax deduction. The refusal of the deduction is formalized by a corresponding application, which, together with the application for a double tax deduction, the employee who wishes to receive it must submit to his employer.

In addition, you will have to provide the employer providing the tax deduction with a monthly 2-NDFL certificate from the place of work of the parent who refused the deduction (since otherwise it is impossible to determine when the salary of the other parent will reach the limit of 280,000 rubles established for the child tax deduction), and also documents confirming the child’s status - birth certificate, certificate from the place of study, certificate of disability (for disabled children).

Also, the only parent of the child (single mother, widows, widowers, adoptive parents, etc.) has the right to double deduction. But when entering into a remarriage or when a child is adopted by another person, the parent ceases to be considered the only one.

But we should not forget that only those taxpayers who support a child and those who have official income taxed at a rate of 13% (for personal taxes) have the right to a tax deduction.

Therefore, if one of the child’s parents does not work and, accordingly, does not have income that is taxed at a rate of 13%, he cannot legally transfer his right to a tax deduction to a working parent.

Conditions for receiving a deduction

In order for an employee to receive such a deduction, the following conditions must be met (clauses 3, 4 of Article 210, subclause 4 of clause 1 of Article 218, Article 224 of the Tax Code of the Russian Federation):

- Only the employee’s income, taxed at a rate of 13%, can be reduced by the amount of the deduction.

- An employee of the organization must be a resident of the Russian Federation. Let us remind you that a resident is an individual (a citizen of the Russian Federation, a citizen of a foreign state, a stateless person) who actually stays on the territory of the Russian Federation for at least 183 calendar days within 12 consecutive months. Moreover, the 12-month period of stay in Russia is not interrupted by periods of travel abroad for short-term (less than 6 months) treatment or training. Also, this period is not interrupted if an employee leaves to perform work or provide services in offshore hydrocarbon fields (clauses 2, 3 of Article 207 of the Tax Code of the Russian Federation). If an agreement on the elimination of double taxation has been signed between the Russian Federation and a foreign state, which recognizes individuals as residents under other conditions, then these norms have priority over the norms of the Tax Code of the Russian Federation (Article 7 of the Tax Code of the Russian Federation).

- The deduction can be provided until the month in which the employee’s income from the beginning of the year on an accrual basis exceeds 280 thousand rubles. The amount of income must include only income that is taxed at a rate of 13%. Income not subject to personal income tax does not need to be included in the calculation (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

As a general rule, deductions are provided until the child reaches 18 years of age. However, if the child is a full-time student, the deduction is provided until the child reaches 24 years of age (letter of the Ministry of Finance of Russia dated October 25, 2013 No. 03-04-05/45277).

Keep your accounting records, automatically calculate payroll and send reports online

Try for free

Future changes to the child deduction amount

The issue of increasing the tax deduction for children in 2013 is currently being discussed. So in the near future, the amount of deduction for the first child may be 1,400 rubles, for the second – 2,000 rubles, for the third, fourth, and so on – 4,000 rubles. For disabled children under 18 years of age, as well as for full-time students, interns, graduate students, and residents under 24 years of age who are disabled in the first or second group - 12,000 rubles. And the amount within which tax deductions for children are made will be raised from 280,000 to 350,000 rubles

Procedure

To receive a deduction for a child, the employee must provide the employer with documents for the child (in particular, a birth certificate). If there are several children, then documents must be provided for each of them.

The deduction can be applied until the end of the year in which the child’s age exceeds 18 years. If the child is a full-time student, the deduction is provided until the end of the year in which the child turns 24 years old (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). Moreover, a child can study both in Russia and abroad (letter of the Ministry of Finance of Russia dated April 15, 2011 No. 03-04-05/5-263).

If a child stopped studying before he turned 24 years old, then the right to deduction is lost from the month following the month of termination of studies (letter of the Ministry of Finance of Russia dated October 12, 2010 No. 03-04-05/7-617).

How to calculate the child tax deduction in 2013?

Calculating the child tax deduction is quite simple, since the amount of the deduction depends on the number of children and is fixed. To make a deduction, the deduction rate of a specific employee is taken and subtracted from the amount of accrued wages, and income tax is already taken from the remainder. Thus, the tax base is reduced by the amount of the deduction.

For example, the accrued salary is 30,000 rubles. If the employee has a third child, the deduction is 3,000 rubles. This means that out of 30,000 - 3,000 = 27,000, then we take an income tax of 13% from this amount - 3,510 rubles, and the employee receives 30,000 - 3,510 = 26,490 rubles.

Child tax deduction in 2013: single mothers

Today, single mothers in our country have the right to a double tax deduction for the costs of maintaining each of their children until they reach the age of 18, as well as for children under 24 years of age who are students, cadets, graduate students, and residents.

To receive a double tax deduction, a single mother must provide documents confirming that the child has only one parent. This may be a birth certificate, where only one parent is indicated - the mother, a certificate of form 25 from the registry office, which will confirm that the child’s father is entered on the birth certificate according to the mother’s words (if both parents are recorded on the certificate), a death certificate of the father a child entered on the birth certificate, a court decision declaring the child’s father dead or missing.

Many people are interested in the question: is it possible to receive a double deduction for the child of the mother with whom the child lives if the parents of this child have divorced their marriage or are not married at all? If the father who recognized the child and is now alive is included in the birth certificate, then the mother is not considered a single parent or the only parent of the child. So she can receive a double deduction only if the child’s father refuses the deduction in her favor.

Standard deductions for personal income tax in 2013

Standard deductions for personal income tax in 2013 did not change compared to the size and composition of deductions in force in 2012.

We remind you that since 2012 the standard deduction in the amount of 400 rubles per employee has not been applied.

The changes also affected children's deductions; for example, since 2012, deductions for children have been significantly increased.

Changes in the composition and size of standard deductions for personal income tax occurred in connection with the entry into force of Federal Law No. 330-FZ of November 21, 2011. All changes can be seen in the table; for clarity, the table shows the standard deductions in force in 2011, and the standard deductions in force in 2012 and 2013.

| Deduction | 2011 | 2012 2013 | Limit for deduction | |||

| Per employee | 400 rub. | — | 40,000 rub. | |||

| Per employee for the categories of citizens specified in paragraph 2, paragraph 1 of Art. 218 Tax Code of the Russian Federation | 500 rub. | 500 rub. | No limit | |||

| Per employee for the categories of citizens specified in paragraph 1, paragraph 1 of Art. 218 Tax Code of the Russian Federation | 3000 rub. | 3000 rub. | No limit | |||

| For the first and second child | 1000 rub. | 1400 rub. | 280,000 rub. | |||

| For the third and each subsequent child | 3000 rub. | 3000 rub. | 280,000 rub. | |||

| For each disabled child under 18 years old (disabled student of groups I and II up to 24 years old) | 3000 rub. | 3000 rub. | 280,000 rub. | |||

The standard employee deduction has been cancelled.

Until the end of 2011, the deduction provided for in paragraph 3 of clause 1 of Article 218 of the Tax Code of the Russian Federation was provided to each employee for income up to 40,000 rubles.

Since 2012, the standard deduction per employee for personal income tax in the amount of 400 rubles has been abolished, and in 2013 standard deductions are also not provided to employees.

As for other standard deductions provided for by the Tax Code, certain categories of employees can still count on them in 2012 and 2013.

Thus, a standard deduction in the amount of 3,000 rubles is provided to employees specified in paragraph 1 of paragraph 1 of Article 218 of the Code, these include:

- Persons who have received various types of diseases, disabilities as a result of the disaster at the Chernobyl nuclear power plant;

- Participated in testing nuclear weapons and radioactive substances;

- Disabled people of the Great Patriotic War;

- Military personnel who received disabilities due to wounds and other injuries received while defending the USSR and the Russian Federation.

The second subparagraph of the first paragraph of the same article lists persons who are provided with a monthly standard personal income tax deduction in the amount of 500 rubles, these include:

- Heroes of the Soviet Union, Heroes of the Russian Federation, persons awarded the Order of Glory of three degrees;

- Civilian employees of the SA, Navy of the USSR, Department of Internal Affairs and State Security of the USSR;

- Participants of the Second World War, participants in military operations to defend the USSR;

- Those who were in besieged Leningrad;

- Former prisoners of concentration camps, ghettos and other similar places of forced detention during the Second World War;

- Disabled people of groups I and II, and people with disabilities since childhood;

- Persons who have received various diseases as a result of radiation accidents;

- Persons who donated bone marrow to save people's lives;

- To the parents and spouses of military personnel who died defending the USSR and the Russian Federation;

- Persons who served in Afghanistan, in other countries where military operations took place and who participated in hostilities on the territory of the Russian Federation.

In 2012 and 2013, these categories of employees are provided with deductions in the amount of 3,000 rubles or 500 rubles monthly during the year.

There is no salary limit beyond which deductions are not provided. Employees are not required to submit annual applications for standard deductions; it is enough to receive such an application once.

Children's personal income tax deductions increased

With the entry into force of Law 330-FZ, the amount of children's deductions has increased since 2012. The following categories of employees receive deductions for children:

- Parents, siblings and adoptive parents;

- Spouses of parents, spouses of adoptive parents;

- Adoptive parents, guardians, trustees (spouses of this category are not given a deduction).

In connection with the adopted amendments, which also apply to 2011, the amount of the deduction provided is directly related to the number of children.

Thus, the base for calculating personal income tax is reduced by 1,400 rubles - this is the amount that is deducted for the first and second child. Parents with many children receive a deduction of three thousand rubles for the third and all subsequent children.

If you have employees raising disabled minors, provide them with a deduction of three thousand rubles; a deduction in the same amount is due to parents raising children with disabilities of groups I and II who are studying full-time until they reach 24 years of age.

Employees who are single parents are entitled to a double deduction for each child. To receive child deductions, there is a limit on the income received by the employee, which is 280,000 rubles.

From the month in which the employee’s income reaches the established limit, he loses the right to standard child deductions.

Due to the fact that the size of children's deductions has increased, in order to avoid possible claims from regulatory authorities, new applications should be received from employees. Applications must indicate the new deduction amount.

If the eldest child has reached the age of majority, what amount of deduction should be provided for the third child?

If a parent with many children has an eldest child over eighteen years old, how much is the deduction for the third child?

The norms contained in Article 218 of the Tax Code do not specify this issue; it only says that the deduction is provided for the third child until he reaches eighteen years of age, or until he reaches 24 years of age, if he is a full-time student.

The Ministry of Finance in letter No. 03-04-05/8-1014 dated December 8, 2011 on this issue expressed the opinion that when determining the amount of children's deductions for personal income tax, all children are taken into account, regardless of the age of the older child. That is, the eldest of the children is considered first, regardless of the fact that age-related deductions are no longer based on him.

Let's look at an example

Personal income tax deductions for an employee with three children

The employee has three children, the eldest of whom is 25 years old, and the youngest of whom are 12 and 6 years old.

The employee has the right to a deduction for the two youngest children. Due to his age, there are no deductions for the older child. The employee's salary is set at 40,000 rubles.

The employee must be provided with child deductions in the following amounts:

- For a child 12 years old – 1400 rubles;

- For a child 6 years old – 3000 rubles.

40000 – (1400+3000) = 35600 x 13% = 4628 rubles – the amount of personal income tax taking into account the deductions provided. The employee will receive 35,372 rubles per month.

Thus, personal income tax should be calculated on the employee’s income, taking into account children’s deductions, until the month in which the total income received by the employee for one year does not reach the limit established for the deductions provided, namely 280,000 rubles. That is, until the month of July inclusive: 40,000 x 7 months = 280,000 rubles. Since August, the employee loses the right to a child deduction.

How to return overpayment of personal income tax for last year

If last year, there was an overpayment of tax due to incorrect provision of deductions to parents with many children. Indeed, in practice, a situation often occurs when, when determining the amount of the child deduction, older children are not taken into account. And deductions for the second and third child are provided in the amount of 1,400 rubles per month, and not 1,400 and 3,000 rubles per month.

If you have overpaid for this or another reason, and by the end of the year you have not offset the overpayment, next year you can no longer reduce the amount of personal income tax by the amount of the overpayment for the previous year. From the beginning of the year, continue to calculate the amount of tax in the usual manner, carefully determining the amount of personal income tax deductions for parents with many children, and the tax office can return the amount of overpayment.

To do this, the employee submits a personal income tax declaration to the inspectorate at the place of residence, attaching a 2-NDFL certificate and documents confirming the right to deductions. This procedure is established by paragraph 4 of Article 218 of the Tax Code.

If the amount of personal income tax deductions is greater than the salary

This also happens quite often. For example, a mother with many children who works part-time. Or a single parent with three or more children.

And so, if the amount of deductions exceeds the amount of income, the tax base is reset to zero and income tax is not calculated. The employee will receive the accrued salary in full, without withholding personal income tax. This procedure is provided for in paragraph 3 of Article 210 of the Tax Code.

At the same time, the resulting difference between income and the amount of deductions can be transferred from month to month, but only within one year. A similar opinion is in the letter of the Ministry of Finance No. 03-04-06-01/269 dated October 22, 2009.

Let's look at an example

The amount of standard deductions for personal income tax is greater than the amount of wages

An employee with three children works part-time. For each child, she is entitled to a double personal income tax deduction, since she is the only parent. The salary, taking into account working conditions, is calculated in the amount of 10,000 rubles.

The employee is provided with deductions in the following amount:

- For the first and second child – 5600 rubles (1400 x 2) x 2;

- For the third child – 6000 (3000 x 2);

- The amount of deductions per month is 11,600 rubles (5,600 + 6,000).

10000 < 11600 The amount of wages is less than the amount of deductions, therefore no tax is withheld, and the employee receives the entire amount of wages.

up