96 account in accounting is maintained in subaccounts depending on the types of reserves for upcoming expenses:

- the reserve for vacation pay is calculated on account 96.01;

- other reserves are reflected in account 96.09;

- Account 96 falls into the liability side of the balance sheet.

Account 96 “Reserves for future expenses” is intended for the movement of reserved expenses that the company faces in production activities.

What are contingent debts in accounting?

To understand what expenses can be taken into account in this account, you need to study PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”.

Note from the author! As the name of the document suggests, debts that exist conditionally will be assessed. That is, no one will provide a certificate of completion of work or a delivery note for them. The accountant must himself or with the help of experts evaluate liabilities and assets from the point of view of future consequences.

In accounting, account 96 is classified as active-passive. This means that it can reflect both property (assets) and sources of income (liabilities) at the same time.

Reserves for future expenses include:

- costs of paying vacation pay to employees;

- estimated liabilities for loans issued;

- contingent debts in court cases;

- warranty service and repair.

Account 96 in the balance sheet

The amount of reserves is reflected in the balance sheet as an estimated liability. To be recognized, several conditions must be met:

- the amount of liabilities can be estimated;

- the emergence of a specific obligation was a consequence of the enterprise’s past activities;

- there is likely to be a decrease in economic benefits when fulfilling the obligation.

96 account in the balance sheet is reflected as part of the credit balance. The balance must be justified; overstatement of the reserve amount is not allowed. The period for fulfillment of obligations must be less than 12 months. Account 96 in the balance sheet transfers its balance to line 1540.

According to financiers, from this year, enterprises are required to create reserves for vacation pay for accounting purposes. Let's consider the rules for using such reserves.

Everything remains unchanged in tax accounting

As before, in tax accounting for the payment of vacation pay, a reserve can be created at the discretion of the enterprise.

If a reserve is not created, vacation pay amounts are taken into account for profit tax purposes as labor costs.

Moreover (using the accrual method) it is proportional to the vacation days falling in the corresponding months.

Therefore, for example, if in August an employee was paid vacation pay for the period from August 15 to September 11, it is impossible to take into account the entire amount of payment in August. This month, only that part of the vacation pay that falls on the days of rest provided for August should be included in expenses.

And the rest of the vacation pay must be recognized in September. This is stated, in particular, in the letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107.

But in accounting, vacation pay now needs to be calculated taking into account PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n). Thus, the organization’s obligations in connection with the emergence of employees’ right to paid leave are estimated (letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107).

In other words, if previously enterprises could decide for themselves whether to form them or not, now only small enterprises can not do this (then they will take vacation pay into account in the labor costs of the month in which they are accrued).

However, a specific methodology for the formation of valuation reserves, unfortunately, has not been established, so the enterprise needs to develop it independently and consolidate it in its accounting policies.

The ideal option would be to form a reserve at the end of each month for each employee based on the number of rest days he earned during that month and his average earnings, determined in the prescribed manner.

But this is very labor-intensive, and the only benefit is to correctly generate reporting indicators. Therefore, the organization has the right to provide for other methods of forming an estimated liability. The main thing is to justify and consolidate a specific procedure in the accounting policy.

Example 1.

The accounting policy of Krasnoderevshchik LLC stipulates the following methodology for the formation of estimated liabilities in relation to payment of vacations.

Since all employees are entitled to vacation pay for 28 calendar days, the estimated liability is formed evenly throughout the year based on the annual wage fund as follows:

– the expected annual amount of vacation pay is calculated (by dividing the annual wage fund by 12 months and by 29.4 and multiplying the result by 28);

– the monthly amount of increase in the valuation reserve is determined (the calculated expected annual amount of vacation pay is divided by 12).

Let us assume that the annual wage fund for workers of Krasnoderevshchik LLC for 2011 is 2,600,000 rubles.

Then the expected annual amount of vacation pay for this category of employees is equal to:

RUB 2,600,000 : 12 months : 29.4 × 28 days = 206,349.21 rub.

And the monthly amount of the created valuation reserve will be:

RUB 206,349.21 : 12 months = 17,195.77 rub.

Please note: regarding whether it is also necessary to reserve the amount of insurance premiums from vacation pay, experts have differing opinions.

Some suggest forming an estimated liability for the entire amount, including both the vacation pay itself and the insurance premiums from it. But there is another point of view.

The fact is that the obligation to pay vacation pay actually arises for the enterprise as a result of past events - for each month worked, employees earn the right to a certain number of days of vacation (in case of dismissal, compensation or vacation followed by dismissal).

But the obligation to pay insurance premiums arises only when payments are actually accrued in favor of employees. That is, until vacation pay is accrued, the company does not need to pay insurance premiums on it.

Therefore, it is necessary to form an estimated liability only for the amount of the vacation pay itself, and insurance premiums are not reserved in accounting, they are recognized as expenses at a time as they are actually accrued.

Estimated liabilities should be taken into account in the “Reserves for future expenses” account.

When creating estimated liabilities for the payment of vacation pay, their value is included in expenses for ordinary activities (in the debit of accounts , , ...).

Example 2.

Let's continue to look at example 1.

Every month during 2011, the accountant creates (increases) an assessment reserve in relation to upcoming expenses for paying vacation pay to staff by writing:

DEBIT 20 CREDIT 96

– 17,195.77 rub. – the estimated reserve for the payment of vacation pay to workers has been increased.

Let’s assume that in August vacation was granted to two employees and they were accrued vacation pay in the amount of 43,000 rubles.

Let's also assume that:

– standard deductions for these employees are no longer provided;

– insurance premiums (including contributions for injuries) are paid at a rate totaling 34.2 percent.

The accountant reflected the accrual and payment of vacation pay as follows:

DEBIT 96 CREDIT 70

– 43,000 rub. – vacation pay is accrued (part of the estimated liability is written off to account for the recognition of accounts payable for the payment of vacation pay);

DEBIT 20 CREDIT 69

– 14,706 rub. (RUB 43,000 × 34.2%) – insurance premiums were accrued for the amount of employees’ vacation pay;

DEBIT 70 CREDIT 68

– 5590 rub. (RUB 43,000 × 13%) – personal income tax is withheld from the amount of vacation pay;

DEBIT 70 CREDIT 50

– 37,410 rub. (43,000 – 5590) – vacation pay was paid.

But the main difference between the new estimated liabilities and the old reserves for the payment of vacation pay is that if the funds of the estimated liability are insufficient, the enterprise’s expenses for vacation pay are reflected in accounting in the general manner. In other words, there cannot be a debit balance on the account.

That is, if the amount of vacation pay accrued in the current month exceeds the amount of the estimated liability created by that moment, an entry is made to the debit of the account only for the amount that is in this account, and the difference (excess) is charged directly to the debit of the enterprise’s cost accounting accounts.

Accordingly, in the future, the amount of the estimated liability created in the following months should be adjusted.

After all, if vacation pay has already been paid to someone, the obligation for it will no longer be formed in the current year.

Example 3.

Let's continue to look at the previous examples.

Let's assume that in September vacation pay was accrued to employees in the amount of 115,000 rubles.

Prior to this, for the period from January to August inclusive, the estimated liability (account credit turnover) was formed in the amount of:

RUB 17,195.77 × 8 months = 137,566.16 rub.

Thus, in August the estimated liability in the amount of RUB 43,000 was already used.

This means that the balance of unused estimated liabilities (account balance as of September 1, before accrual of vacation pay in September) is:

RUB 137,566.16 – 43,000 rub. = 94,566.16 rub.

And the amount of vacation pay accrued in September is 115,000 rubles. As we can see, it exceeds the amount of the generated estimated liability. This means that the accountant needs to accrue vacation pay in September like this:

DEBIT 96 CREDIT 70

– 94,556.16 rub. – vacation pay was accrued within the amount of the previously formed estimated liability (the estimated liability was written off to account for the recognition of accounts payable for the payment of vacation pay);

DEBIT 20 CREDIT 70

– 20,433.84 rub. (115,000 – 94,556.16) – vacation pay was accrued in excess of the amount of the previously formed estimated liability;

DEBIT 20 CREDIT 69

– 39,330 rub. (RUB 115,000 × 34.2%) – insurance premiums are accrued for the amount of vacation pay;

DEBIT 70 CREDIT 68

– 14,950 rub. (RUB 115,000 × 13%) – tax is withheld from the amount of vacation pay;

DEBIT 70 CREDIT 50

– 100,050 rub. (115,000 – 14,950) – vacation pay was paid.

In addition, in the future it is necessary to take into account the fact that some employees have already received vacation pay in excess of the amount of the previously formed estimated liability. That is, deductions should become smaller.

The validity of recognition and the amount of the estimated liability is checked at the end of the year, as well as upon the occurrence of new events related to this liability. In the end it could be:

– increased in the manner established for the recognition of an estimated liability;

– reduced in the manner established for writing off an estimated liability;

– remain unchanged;

- completely written off.

Excess amounts of the reserve are included in other income of the enterprise.

Important to remember

When creating a reserve for paying vacations to employees, it is more profitable for an enterprise to choose for accounting purposes the same procedure for its formation as in tax accounting. True, if the reserve funds turn out to be insufficient, then the amount of excess vacation pay in accounting can be written off as expenses immediately, and for profit tax purposes - only at the end of the year based on the results of the inventory.

Accounting for distribution costs

Distribution costs are usually understood as the costs of material, labor and financial resources in the process of promoting a product. In organizations engaged in production activities, distribution costs include:

— packaging of products in GP warehouses;

— delivery of the GP to the departure station;

— loading the GP into the vehicle;

— commission fees paid to sales and other intermediary organizations;

— costs of maintaining premises for storing GP in the places of its sale;

— expenses for hospitality (4% of payroll), advertising (1% of turnover without indirect ones) and other similar expenses.

Sales expenses are accounted for in active costing account 44 “Sales expenses”. The debit balance shows sales expenses related to the balance of goods at the beginning (end) of the reporting period.

To distribute distribution costs between goods sold and warehouse balances at the end of the month, the following calculations are made:

1. The average % of distribution costs is determined:

K = (In + Ip) / (Tp + Tkop)

I – distribution costs at the beginning and for the reporting period;

T – goods sold during the reporting period and balances at the end of the period.

2. Distribution costs for the remaining goods are calculated:

Iot = K (average distribution costs) * Tkop/100

3. The amount of distribution costs written off to the financial result is determined:

Irop = It + Iop – Iot

Accounting entries for account 44:

1. The write-off of inventories for distribution costs is reflected: D44 K10

2. Accrued depreciation on fixed assets and intangible assets: D44 K02(05)

4. VAT allocated: D19-3 K76

5. Accrued taxes related to distribution costs: D44 K68

6. Accrued salary for employees involved in product sales: D44 K70

7. Insurance premiums accrued: D44 K69

8. Write-off of accountable amounts is reflected: D44 K71

9. Deductions are made to reserves for future expenses: D44 K96

10. Distribution costs are written off for sales: D90-2 K44

RBP are costs that relate to future periods and which cannot be fully attributed to current costs (from/from manufactured products). Οʜᴎ are included in the s/s in certain (equal) shares for several months or years (maximum period up to 2 years).

To account for the RPB, active account 97 is used, which takes into account the following types of costs:

— rent payments (leasing payments) for subsequent periods;

— to develop new products;

— for OS repair;

— to pay for subscriptions and purchase technical literature;

— for research and development work, for a period of no more than 2 years;

— insurance costs;

RBP are implemented at the expense of the enterprise's free working capital.

At the moment costs arise, account 97 is debited in correspondence with the credit of the corresponding current accounts. These costs are reimbursed to the enterprise through their equal inclusion in the accounting system over the period determined by the accounting policy of the enterprise.

Accounting entries for account 97:

1. Costs allocated to RBP: D97 K10 (02, 05, 60, 70, 69, 76...)

2. RBP are evenly included in current costs: D20 (26) K97

3. The services of the intermediary organization for the work performed are reflected: D97 K76

4. VAT reflected: D19-3 K76

Accounting for the formation and use of the reserve fund is kept in passive account 96 “Reserve for future expenses”. The credit balance on account 96 reflects the amount of unused reserves at the beginning (end) of the reporting period. Debit turnover shows the use of funds for their intended purpose, while credit is the source of reserve formation due to monthly deductions for the agricultural output of manufactured products.

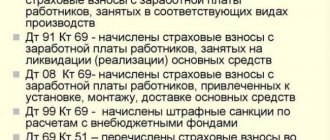

Accounting entries for account 96:

1. The creation of a reserve for future expenses is reflected:

A) for vacation pay: D20 (23, 25, 26, 44) K96-1

B) payment of remuneration at the end of the year: D20 (23, 25, 26, 44) K96-2

B) for major repairs of OS: D20 (23, 25, 26, 44) K96-3

2. The closure of account 96 at the end of the reporting period is reflected:

A) if there is a credit balance (reserve balance): D96 K91-1

B) if there is a debit balance (overspending): D97 K96

How to calculate and take into account the vacation reserve?

Reserves for vacation pay include:

- vacation pay and compensation;

- payroll insurance premiums and other employee benefits.

Accounting for such amounts should be kept in subaccount 96.01.

Important point! The accountant evaluates the company's possible costs of paying vacation pay during the year, since a sudden significant outflow of money can become an unpleasant surprise for the company.

Analysis of costs and determination of their participation in the formation of product costs must be enshrined in the company’s accounting policy (Letter of the Ministry of Finance of Russia dated February 19, 2016 N 07-01-09/9317), provided that they are carried out:

- monthly;

- quarterly;

- once a year.

There are no instructions for calculation, but the most rational way would be to use the number of days of unused vacation multiplied by the average daily earnings.

Note from the author! Calculations are performed for each employee separately. This function is provided in the 1C ZUP program. If the available software product does not meet the requirements, then it is necessary to make a calculation using office tools.

We reflect vacation pay according to new accounting rules

November 14, 2011 November 14, 2011 Leading expert, chief accountant with 10 years of experience Starting this year, new rules for recording vacation pay in accounting are in effect.

We recommend reading: Fill out an application to the traffic police to replace your license in Moscow 2021

And the balance of the organization’s vacation reserve can be transferred to the next year.

We analyzed the innovations and prepared practical recommendations for accountants. However, before using our advice, you need to consolidate the appropriate methodology in the company’s accounting policies. Last year and earlier, most companies included vacation pay in the operating expenses of the month in which they were accrued.

If part of the vacation fell on the next month, the corresponding amount of vacation pay was shown in the debit of account 97 “Future expenses.”

When the next month arrived, the “carryover” value was written off from account 97 for current expenses. Many experts previously believed that this option for accounting for vacation pay was not entirely correct. Indeed, it does not follow from the instructions for using the chart of accounts* that vacation pay falling in another month are deferred expenses (abbreviated as FBP).

However, popular accounting programs used account 97, and organizations from year to year showed “rolling” vacations as RBP. Since 2011, the situation has changed radically, and there are two reasons for this. The first is amendments to paragraph 65 of the Accounting Regulations**. According to them, costs related to future periods must be written off in the manner established for writing off the value of assets of this type.

From here you can

An example of making entries for account 96

Table 1. Calculation of the reserve for payment of upcoming vacations

| Job title | Number of unused vacation days | Average daily earnings | Amount of vacation pay as of the date of the period (column 2 * gr.3) | Insurance premium rate in % | Amount of insurance contributions for vacation pay (gr.4 * gr.5%) | Total reserve amount (column 4 + column 6) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Lawyer | 6,66 | 500,10 | 3 330,67 | 30 | 999,20 | 4 329,87 |

| Accountant | 16,65 | 434,20 | 7 229,43 | 30 | 2 168,83 | 9 398,26 |

| Engineer | 23,31 | 651,32 | 15 182,27 | 30 | 4 554,68 | 19 736,95 |

| HR specialist | 13,32 | 367,45 | 4 894,43 | 30 | 1 468,33 | 6 362,76 |

The total amount of wages and insurance contributions that must be included in the reserve will be 39,827.84 rubles:

- Dt 26 “General business expenses” Kt 96.01.01 “Estimated liabilities for employee benefits” - 30,636.80 rubles for the amount of salary;

- Dt 26 Kt 96.01.02 - 9,191.04 rubles for the amount of charges to the funds.

- Dt 96.01.01 Kt 70 “Settlements with personnel for wages” - a reserve for employees on leave in the amount of 30,636.80 rubles was used;

- Dt 96.01.02 Kt 69 “Calculations for social insurance and security” - a reserve in the amount of 9,191.04 rubles was used for the amount of accrued insurance contributions.

Write-off of reserves

Write-off of vacation reserve (example)

In our example, a vacation reserve was created in the amount of 124,900 rubles (100,000+22,000+2900).

During the first month, the amount of expenses for vacations of employees of the production division amounted to 60,000. The amount of contributions to pension insurance for these vacations was 13,200, insurance contributions to the Social Insurance Fund - 1,740.

Postings for writing off the vacation reserve

Postings for writing off the reserve for repairs of fixed assets

The fixed asset was repaired in the amount of 56,000 rubles.

Other accounting options

- There is an approach in which the estimated liability for vacations is included in other expenses, that is, it corresponds with account 91.02. If during the month the pledged amount was used and the employees went on vacation, then the reserve is transferred to other income: Debit 96.01 Credit 91.01 “Other income”.

- The excess balance of the estimated liability is reversed by accrual posting: Debit 91.02 “Other expenses” Credit 96.01.

Both approaches are legal. The company itself chooses its accounting methodology. Analytical accounting on account 96 for each employee is not maintained; amounts are entered into the program by department or in one line.

At the end of the reporting year, an inventory of reserves for upcoming expenses for vacation pay is carried out for the purpose of reconciliation and the legality of assigning amounts to the account. There is no unified form for these purposes, so it can repeat the tabular form of calculation after modification. The results of the reconciliation must be announced in the order for the enterprise and reflected in the program.

Note from the author! Until 2011, the calculation of reserves for future company expenses was carried out at will. After amendments were made to the Accounting Regulations, the reflection of contingent debts became mandatory for everyone except enterprises using the simplified system.

Closing 96 accounts

You need to understand that reserve amounts cannot be calculated with absolute accuracy. The salary reserve, for example, may change for reasons such as:

- dismissal of employees;

- salary changes;

- changes in the actual vacation schedule, etc.

If the reserve is exceeded, the amount “on top” is written off against current costs.

If the reserve is not fully spent, it is carried over to the next year or reversed.

For the reserve for OS repairs, the unspent balance can be closed to account 99.1 at the close of the year, if the repairs are not completed in the current year.

Account 96 of accounting is a passive account, Reserves for future expenses, used to summarize information about the reserved amounts of future expenses of the organization. Let's study how to calculate and reflect in the postings the creation of a reserve for paying vacation pay to employees and a reserve for warranty repairs.

The organization's reserves for future expenses consist of:

- Upcoming costs of paying vacation pay to employees;

- Costs for current repairs of equipment and fixed assets;

- Costs for warranty service and repairs;

- Other expenses of the organization.

An enterprise has the right to independently establish the procedure for calculating the reserve for paying vacation pay to employees, indicating in its accounting policy, taking into account paragraphs 15 and 16 of PBU 8/2010:

When determining the calculation base of the reserve for the repair of fixed assets or equipment, you need to take into account data on the sale of products in the reporting period, the estimated percentage of defects, statistics in the field of warranty repairs, and so on.

Please note that the annual amount of the reserve for guaranteed repairs should not exceed the arithmetic average of the amount of guaranteed repairs actually performed over the previous three years.

Having determined the annual amount of the reserve, you can calculate the amount of monthly deductions: the annual amount is divided by 12. If the amount of the reserve is deducted once a quarter, then the total annual amount is divided by 4.

The amount exceeding the organization's vacation reserve can be written off against current costs. And the balance of the organization’s vacation reserve can be transferred to the next year.

If the reserve for repairs of fixed assets and equipment is not spent in the current year, then the balance can be closed on account 99.01 “Profits and losses from activities with OSNO:

We also note that in the balance sheet the amount of the reserve is reflected in line 1540 “Reserves for future expenses.”

Get 267 video lessons on 1C for free:

How are other reserves reflected?

For other contingent debts, subaccount 96.09 “Other reserves for future expenses” is used. Using this sub-account, you can maintain analytical accounting in the context of counterparties and contracts in the event of the formation of reserves:

- for legal obligations;

- on loans;

- warranty service and repair.

Important point! Unlike vacation payments, an enterprise cannot say for sure that other reserves are inevitable in financial activities. For this reason, they are usually classified as contingent liabilities. However, a spending plan is still necessary because the program entry contains the exact amount.

During legal proceedings, lawyers usually analyze claims against an organization that are in arbitration proceedings at the end of the year. The lawyer writes a memo according to a sample developed within the company, which should contain a number of details:

- name of the plaintiff;

- contract number and date;

- court case number;

- amount of claim;

- percentage of probability of losing a lawsuit (up to 50% - low, over 50% - high).

On account 96.09, the accounting department accrues an estimated liability for legal cases in the context of counterparties and contracts in the amount of the percentage of the probability of loss of the amount of the claim: Debit 91.02 Credit 96.09.

When forming a reserve for future expenses on loans issued, the likelihood of the borrower not repaying the loan received is assessed.

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

We recommend reading: Change Ukrainian license to Russian one November 2015

I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business!

Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use. Submitting documents We take care of everything.

Compilation. Collection of the necessary package of documents.

How to prepare reports?

Reserves for future expenses may not be reflected in tax accounting, but this circumstance must be specified in the accounting policy of the enterprise. If it is decided that reserves or part of them are taken into account for tax purposes, then one must be guided by the procedure prescribed in Article 324.1 of the Tax Code of the Russian Federation. When preparing your income tax return, they will be included in non-operating income and expenses.

As for the balance sheet, for contingent debts in liabilities, in section IV “Long-term liabilities” a separate line 1430 “Estimated liabilities” is allocated, which collects the credit balance of account 96 in terms of long-term reserves, that is, more than one year. In section V “Short-term liabilities” on line 1540, you can reflect debts for a period of less than a year.

Closing the account at the end of the period

Evdokimova Natalya Author PPT.RU January 14, 2021 Determination of the financial result of a company’s activities is carried out not only before the reformation of the balance sheet, but also at the end of the reporting period - the calendar month. In this article we will tell you which accounts are closed at the end of the reporting month and calendar year.

ConsultantPlus TRY IT FOR FREE First of all, let’s define the concept. Thus, in accounting, account closure (ACC) is recognized as an accounting operation of attributing the final balance of the accounting account to special CACs, which determine the financial results of the company. Before starting to prepare the annual financial statements, that is, before reforming the balance sheet, the accountant is required to generate the final entries for the reporting period. In accounting, the reporting period is a calendar month (paragraph 48).

Consequently, before closing the financial year, the accountant will need to draw up the final monthly turnover. Which accounts are closed at the end of the month or year? Such BSCH can be tentatively divided into three groups: BSCh, which cannot have balances at the end of the reporting (financial) period.

These include counting. 25 “General production expenses” and 26 “General operating expenses”.

BSCs that may have a remainder, but which can be completely closed. These include counting. 20 “Main production”, 23 “Auxiliary production”, 29 “Service facilities and production”. BSCs that cannot have a general balance, but have a balance in open subaccounts.