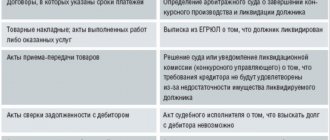

No organization is insured against violations of contractual obligations by counterparties. Penalties provided for in contracts do not frighten unscrupulous partners and clients if they cannot or do not want to fulfill the terms of the agreement. And even the court does not always help restore justice and return the company’s debts, the amounts of which “hang” on the company’s balance sheet, unreasonably increasing its taxable profit. Postings to write off receivables can only be made if they are recognized as “bad”.

How to return accounts receivable

Accounts receivable is the amount of debts that are due to an enterprise from individuals or legal entities as a result of economic relations with them. Such debts are usually incurred from making sales on credit. Sometimes situations may arise in which the buyer/customer does not pay the debt, and then it is necessary to return the receivables, resorting to various methods, which will be discussed below. If you look at it from the accounting perspective, accounts receivable are property rights that are an object of civil law.

Based on the article of the Civil Code of the Russian Federation, “the objects of civil rights include things, including money and securities, other property, including property rights; works and services, information; results of intellectual activity, including exclusive rights to them (intellectual property); intangible benefits."

Provided that a legal entity or individual does not want to repay the loan taken within the period established by the contractual relationship and receivables arise.

If there is a receivable (receivable), whatever its amount, there is a main condition: the faster the receivable is closed by the debtor to its debtor and the faster the services provided are paid for, the better for both parties!

The main goal of the creditor is to carry out a number of activities that make it possible to repay the debt, that is, to repay the debts in the shortest possible time.

In other words, a receivable appears provided that the goods are sold, services are provided in full, and funds are not provided by buyers. That is, receivables are what buyers owe.

This type of debt is called the property of the enterprise, and therefore the enterprise has all the property rights to return the funds belonging to it.

Accounts receivable groups:

- normal receivables are services and goods that are sold, while the seller has received an advance or the payment terms have not yet arrived;

- overdue receivables - the payment deadline for obligations has arrived, but in fact advances have not been made, funds have not been paid. If an assessment is made of the financial condition of an enterprise, its solvency, liquidity, then first of all specialists analyze receivables and payables.

Rebus Company

Contents Accounts receivable is one of the shares of an enterprise's working capital. These amounts represent the number of liabilities owed to the company.

Repayment of accounts receivable is the payment of amounts of obligations that an organization owes from individuals and legal entities as a result of economic interactions.

You should understand the difference between writing off and paying off accounts receivable. Write-off of accounts receivable is an assignment to the financial result, or to another indicator, of debt that cannot be repaid.

The posting of repayment of receivables will look like this: Dt 51 (52) Kt 62 - repayment of receivables by buyers for purchased products.

Accounts receivable can be managed by stimulating buyers to repay debts early. Accounts payable is an enterprise’s obligation to other organizations - creditors. Most often, receivables are debts to suppliers, employees of the organization (wages), budget, extra-budgetary funds, loans, etc. .

This debt is repaid if:

- fulfillment of a debt obligation;

- written off as unclaimed.

Short circuit write-off can be performed in the following cases:

- if the statute of limitations has passed;

- it is impossible to fulfill the obligation (reorganization of the enterprise or inability to collect the debt).

Repayment of accounts payable entails its reduction.

There are the following ways to repay a loan:

- Compensation is one of the last measures; in this case, property is accepted as repayment.

- mutually beneficial change in the debt structure;

- attraction of a mutual settlement mechanism;

Repayment of accounts payable occurs at the time of full settlement with creditors. In the posting of the accounts payable, cash accounts are debited and credited accordingly:

- Kt 50, 51, 52 and others.

- Dt 60, 62, 70, 68, etc.;

Even when the statute of limitations for the creditor has expired, this does not mean that the company will no longer be able to fulfill the agreement with the client.

Algorithm for the return of receivables

In order to check the reliability of borrowers and obtain reliable guarantees of debt repayment, accounts receivable are monitored. If facts of loan non-repayment arise, the lender needs to begin work on repaying the receivable as quickly as possible. The final result will largely depend on how quickly and methodically the work with the debtor is carried out.

The following are the steps to return receivables:

- Information is collected about the debtor, information about his financial condition is checked, and specialists find out the real reasons for non-repayment of debts. Attempts are being made to identify possibilities for their repayment. In other words, the debtor’s financial condition is re-analyzed to understand the real situation;

- methods of working with receivables are determined: negotiations - independent work - collection of receivables in court - transfer of receivables materials to a collection agency to carry out the collection process;

- planned activities to return receivables are carried out, or cases are transferred to a collection agency.

Methods for collecting receivables

Pre-trial methods

- conduct of negotiations. When conducting

negotiations, specialists remind the debtor that he has debts - unfulfilled obligations. This method can be effective in a simple situation; it helps to obtain payment from the debtor in a short time and at minimal cost;

- writing notification letters. Notification letters and demand letters with messages about the need to return receivables are effective in the initial stages. This method allows you to additionally remind the debtor about the debt, and also shows the seriousness of the creditors’ intentions.

- filling out a statement of claim or petition form;

- preparation of a package of documents with the collection of evidence;

- sitting and hearing the case in court;

- the court's decision;

- work of the bailiff service on the writ of execution.

These letters show the work of creditors to recover debts. These letters, if the case goes to court, will be taken into account in the trial. The letters contain the following information: the amount of debt, the terms and procedure for its return, clauses of the contract that the debtor violates.

The notice letter reminds the debtor of the obligations. The letter of demand contains not only information about the need to make payment, but also information about the actions that may be taken by the creditor in relation to the debtor in the event of failure to comply with the requirements of the contract.

The above methods together are the most effective pre-trial measures for the return of receivables.

Forensic methods

Provided that it was not possible to agree with the debtor on the return of receivables for various reasons, the creditor may go to court.

Steps to collect receivables by going to court:

Judicial methods have their disadvantages:

Provided that the debtor does not have liquid, quickly realizable assets, going to court may not yield positive results. And if the debtor has debts from several creditors, then there is a high probability that the receivables will not be liquidated in full, since the debtor does not have enough funds for everyone, even if the case is won in court.

For overdue receivables, the statute of limitations is established by Article 196 of the Civil Code of the Russian Federation; it is 3 years. Upon expiration of the limitation period, the debt is written off. The statute of limitations may increase, since it can be suspended by law.

The time frame for returning receivables through judicial methods can drag on for several years, usually due to the imperfection of the enforcement system.

The presence of competent specialists will help in the recovery of receivables, even if several years have passed.

Postings V1S court decision on debt collection

× — — Contents: — an expense is recognized in the form of overdue rent. As the debt is repaid, the following entry will need to be made in the accounting: Debit 76, subaccount “Calculations for claims” Credit 51-100,000 rubles.

— the amount was transferred (partially) to pay off the debt. The court will accept this document even if at the time of its filing, the last day of the statute of limitations had expired.

But the court, at the same time, does not have the right to close the case until one of the parties involved in the process has to point out that the statute of limitations has expired, having in hand the relevant documents to confirm this fact.

More details about this mandatory condition can be found at the link: https://www.consultant.ru/document/cons_doc_LAW_71450/fc444ed8814124947a9fe7345f36f791070ce352/. The positive aspect of the case for the defendant is the fact that the law to which the reference is made is aimed at protecting his interests. and reimburse the cost of state duty in the amount of 26,932.04 rubles.

Before the court decision, the specified debt was not taken into account as expenses due to the lack of primary documents. Debt collection through the court - postings According to a court decision, it is necessary to return part of the money paid for the work done to the legal successor of the bankrupt company. What are the entries for the return of funds to the writ of execution? According to the court decision, the defendant must pay the plaintiff the cost of the contract and compensate for legal expenses.

The following entries are made in the enterprise's accounting: Operation Debit entry Credit entry Amount (in rubles) State duty paid to the budget 68 51 2 300 State duty for filing an application with the court is included in expenses 91/2 68 2 300 Legal costs are reflected when making a court decision 91/ 2 60 12 000 Recognized by the court as costs incurred when considering the issue in court 76/2 91/1 12 000 Recognized 10/17/2021 Unfortunately, from time to time there are situations when an organization performs work, but the customer does not pay it. As a result, you have to go to court and forcefully collect debts.

Involvement of collection agencies

They resort to the help of collection agencies in cases where they cannot repay the debt on their own.

In this case, professionals who have certain abilities and have professional skills in these matters work with debtors. This method of debt recovery is an alternative to going to court. Using the services of collection agencies, creditors can receive professional support in solving the above problems in a fairly short time. Specialists from such agencies help carry out all necessary activities and develop the required documentation to improve the level of work with debtors.

From all that has been said, we can conclude: any of the methods requires professionalism in the collection of receivables and specific knowledge in this area. It is necessary to pay special attention to compliance with the legislative side of the issue, so as not to harm the creditor himself.

Return of accounts receivable from previous years

Its accounts receivable were recognized as uncollectible and written off from the balance sheet at the expense of the created reserve.

Reflection of transactions in the accounting records of Alpha LLC:

Debit 63 Credit 62

— the debt of Omega LLC was written off at the expense of the created reserve. For tax purposes, the same amount will be written off from the created reserve in September.

Previously written off unclaimed receivables have been credited, what entries should be made?

Postings of receivables-positive bonds

Accounts receivable represent the property claims of an organization for long-term repayment of which is expected no earlier than a year or more after shipment. To take into account the amounts of written off accounts receivable in tax expenses, the amounts and ...

What primary documents need to be drawn up “previously written off unclaimed receivables have been credited to the account”?

Operating activities involve the creation of accounts receivable. However, if collection is unrealistic, it must be written off. Carrying out tax accounting to write off debts of debtors that will definitely not be repaid is used...

Tell me the posting: Funds received from customers that were previously written off as bad receivables

Write-off of receivables is carried out in accordance with the provisions and requirements of the Instructions on Budget Accounting, approved by Order of the Ministry of Finance of Russia dated December 30, 2008 N 148n, hereinafter referred to as Instruction N 148n.

Correspondence of accounts for the recovery of accounts receivable from previous years

Did you write her off? Write the postings.

Accounting for accounts receivable. Since 01/01/2000, the procedure for implementing the domestic Restoration of the reserve for doubtful debts. 38.944. 3. Upon payment, the amount of previously written off bad debts is debited from the off-balance sheet account.

D-t 62(76) K-t 91.1. If you previously wrote off on D-t 91.2

Help me decide

Account 62. Account 62 has had a debit balance since 2008. how to close it correctly, where to take it

Are book profit and profit before tax the same thing?

There is no balance sheet now.

Debt accounting. Write-off of bad receivables. Write-off of bad accounts payable. Accounting for debt forgiveness. Restoring VAT deduction.

How to make postings in 1C if an organization pays an invoice for another organization free of charge?

Dt 91 Kt 51 - payment

Restoration of tax amounts when writing off receivables generated by When writing off receivables, an organization should take into account that, according to clause 1B of accounting, in order to reflect the written off debt on an off-balance sheet account...

This is called “tax evasion” Art. 199 of the Criminal Code of the Russian Federation. if there is an invoice and money (numbers, indicators), then your payment for such an invoice is no longer free. You will have accounts receivable for 3 years, unless you previously create a reserve and write them off under Art. 266 Tax Code of the Russian Federation. But you have a transaction between affiliates - one director in 2 offices. I don’t even recommend thinking in the direction of a reserve. I didn’t understand why there were such hemorrhoids at all.

No way... donation between legal entities is prohibited... and money too... B will have a debt from A and an advance payment from B... after 3 years, B will have an advance payment as income, the debt will be written off from net profit... where did company C come from on VAT?

Help me install the wiring.

1) debit 90.9 - credit 99, 2) debit 91.9 - credit 99, 3) most likely d. 91.9 - cr. 99, 4) What does received mean? Accrued? Then like this: no. 99 - cr. 68 (on taxes), d. 91.2 - cr. 76. And if it was received at the cash desk or to a current account, then d. 50 (51) - cr. 76. 5) Most likely reversal: d. 91.2 - cr. 62 (76, 70, 71) 6) d. 51 (50) - cr. 62 (76), d. 62 (76) - d. 91.1, 7) d. 76 - cr. 50 (51), d. 91.2 - cr. 76, building 91.2 - cr. 66, 9) - 10) - 11) d. 91.2 - cr. 10, building 91.2 - cr. 43, d. 91.2 - 70 12) d. 60 - cr. 91.1, d. 50 (51) - cr. 60 13) d. 91.2 - cr. 94, 14) - , 15) d. 52 - cr. 76

99, 4) What does received mean? Accrued? Then like this: no. 99 - cr. 68 (on taxes), d. 91.2 - cr. 76. And if it was received at the cash desk or to a current account, then d. 50 (51) - cr. 76. 5) Most likely reversal: d. 91.2 - cr. 62 (76, 70, 71) 6) d. 51 (50) - cr. 62 (76), d. 62 (76) - d. 91.1, 7) d. 76 - cr. 50 (51), d. 91.2 - cr. 76, building 91.2 - cr. 66, 9) - 10) - 11) d. 91.2 - cr. 10, building 91.2 - cr. 43, d. 91.2 - 70 12) d. 60 - cr. 91.1, d. 50 (51) - cr. 60 13) d. 91.2 - cr. 94, 14) - , 15) d. 52 - cr. 76

How to recover previously written off receivables? Sveta X 4 points, Petrozavodsk. Quote ... since you have corrected the tax accounting in this part based on the results of the audit, then nothing else needs to be done, since registration of the posting for restoration ...

Smart people, help! Subject: taxes and taxation!

Why did I become an accountant this year, it’s terrible

When the debtor repays debt previously written off as expenses, this debt is subject to restoration as part of the organization’s income. For tax accounting purposes, expenses from writing off accounts receivable can be either taken into account or not taken into account when...

PLEASE. help me solve the problem. accounting

3. b 4. c 7. d 8. c a in general we need to learn ourselves

After five years, previously written-off receivables for debtor organizations were excluded from off-balance sheet accounting in the amount of Accounting instructions do not contain specific entries for the recovery of receivables, therefore...

Help solve a problem in business economics.

Pay your taxes and go to bed) Who cares... you still have to wrap up my order at McDuck)

Previously written off receivables in the debit of the accounts receivable account; contents of the transaction. Restoration of receivables from Creative Lens Photography, written off. The accounts receivable register reflects monetary amounts...

If you are not going to think with your own head, but will always beg for your uncles and aunts to solve your problems, then you certainly will not make an economist, and the “rosy” picture drawn by your previous answer will become reality

Please check the wiring

Accountants, please respond.

All postings are correct, off-balance sheet account. 007.A K-t 007 is set when a previously written off debt is received, then it is reduced from the balance sheet.

The organization is obliged to write off bad receivables and payables. Write-off of receivables. Tax accounting. Written-off debt is not taken into account in expenses, since previously the sales amount was not included in income, since...

VAT when writing off receivables and payables, what to do with it?

When writing off accounts receivable, VAT is not restored, since VAT is taken into account on shipment. But the accounts payable will have to be restored, since you accepted it if it was offset from the budget. Postings written off as accounts payable D-t 60 K-t 91.1 and VAT D-t 91.2 K-t 68

How to reflect in accounting the write-off of receivables with an expired statute of limitations? The debt of the debtor organization has been written off. 12,500. Is previously written off receivables subject to restoration if they are repaid...

Help me solve this problem:...

Recovering written off accounts receivable. Sometimes a customer whose account has been written off as doubtful may, after some time, be able to pay all or part of the amount owed.

Please check the correctness of the solution to the problem

Write-off of accounts receivable: D91.2 K 62; D76...K68 are these postings correct? D76? which subconto?: 76AB K68

My mother is a woman, father of three children….

Return of accounts receivable: features of accounting (Zernova I.)

And what does dt 76 have to do with it?

5.1. writing off accounts receivable in accounting. When the buyer receives an amount of previously written off debt, the amount of debt is written off off-balance sheet and reflected in the organization’s other income on...

If the following postings were made before: Services were provided to a third party organization Dt62 -KT90-1 on the basis of the Acceptance Certificate for services rendered VAT was accrued - (accounting policy - VAT on payment) Dt90-2 -Kt76N (VAT) - Deferred VAT was accrued Now you need make the following entries: The amount of receivables with an expired statute of limitations is written off Dt91-2 -Kt62 on the basis of the settlement inventory report, Order of the head of the organization VAT is charged on the amount of receivables written off Dt76N (VAT) -Kt68-2 based on - Entry in the sales book for based on a previously issued invoice. The amount of debt written off is taken into account in an off-balance sheet account - Accounting certificate

Why do you charge VAT? Where do you want to send it? Do you have VAT on your accounts receivable? You are writing off accounts receivable!! ! So write off “other expenses” in debit 91 in the entire amount. Has it been three years? Were any attempts to get money back for this documented? If yes, then write it off. If not, then by showing this expense in your income statement, you prepare an explanatory note for the tax office. Somehow, pay more attention, otherwise people have already begun to lament from your writing!

Please help me figure out this problem in economics.

Please help me check the wiring... please

15)D-t 58.1 K-t 76 18)accrued %-D-t 76 K-t 91.1 and credited to the account D-t 51 K-t 76 19)D_t 51 K-t 58 The rest of the postings are correct.

After restoring previously written off receivables in the accounting system, reflect their return in accordance with the material provided by postings Debit 1.205.31.560 Credit KRB.1.206.26.660...

VAT recovery

If the contract is not terminated and the money is not returned to you, then there is no need. Your supplier paid this VAT to the budget in due time.

VAT restoration. Pay for peace of mind. Should you underestimate employees? Write-off of accounts receivable. Current accounting issues exist despite the fact that the receivables should have been written off earlier, the organization has the right to file...

When writing off receivables for advances (prepayments) issued to suppliers, VAT accepted for deduction from this advance payment (clause 12 of Article 171 of the Tax Code of the Russian Federation) cannot be restored by the buyer (clause 3 of clause 3 of Article 170 Tax Code of the Russian Federation). In this case, the amount of VAT written off on advances issued is recognized in accounting as other income (clauses 7 and 16 of PBU 9/99). In accounting we reflect this: D 63 K 60.02 - an advance with an expired statute of limitations is written off (if reserves for doubtful debts were created, if not, then Debit 91.2) D 76.VA, K 91.1 - VAT previously claimed for deduction from the amount advance payment is included in other income of the organization. I am looking for a Russifier and a crack for the TAX CODE of the RUSSIAN FEDERATION

Yes, VAT will have to be restored (Article 170, paragraph 3 of the Tax Code). At the same time, figure out the real write-off period - 3 years are counted from the last reconciliation act. I read Gena’s answer - the person seems to be delusional, but professionally)

Please help me arrange Dt and Kt, it is very necessary

The procedure for an organization's accounting of receivables in account 007 is regulated. Based on the specified documents in the organization's accounting, receivables previously written off in connection with the liquidation of the debtor are subject to restoration.

Accounting entries for receivables based on a court decision

Our customers have a receivable that we would like to write off: according to A - due to the expiration of the statute of limitations, according to B - due to the impossibility of withholding in a lawsuit, by a court decision, according to C - due to the impossibility of withholding, by decision founder. Please tell me whether we have the right to do this, what entries need to be made, should we reflect the amount of debt written off in the book of income and expenses, should we pay taxes on this debt write-off? Yes, you have the right to write off accounts receivable in your accounting due to the expiration of the statute of limitations and a court decision, paragraph.

Read more in the Simplified magazine. To write off bad debts, draw up two documents, a letter from the Ministry of Finance of Russia from the Amount of the written off debt, take into account in an off-balance sheet account for five years from the date of write-off p.

For 1 rub. Received from the counterparty 71 rubles. At the same time, reflect all legal expenses in the same way as the state fee for consideration of a case by the court, and a detailed procedure for recording transactions on debts and expenses is contained in the materials of the Glavbukh System. Debit 63 Credit 62, 71, 73, If by the end of the year following the year the reserve for doubtful debts was created, the reserve is not used, then include the unspent amounts in other income.

Debit 63 Credit - the unspent reserve for doubtful debts was restored. For 1 rub. Received from the counterparty 71 rubles. At the same time, reflect all legal expenses in the same way as the state fee for consideration of a case by the court, and a detailed procedure for recording transactions on debts and expenses is contained in the materials of the Glavbukh System.

Debit 63 Credit - 45 rub.

Restoration of accounts receivable from a previously written off entry in the budget

To restore debt on other accounts, there are no entries in Instruction No. 174n, so coordinate them with:

- financial authority;

- body exercising the functions and powers of the founder.

This is stated in paragraph 4 of Instruction No. 174n.

An example of how written off receivables are reflected in accounting

- reflect on the off-balance sheet account the fact of recovery of receivables (Kt 007 “Debt of insolvent debtors written off at a loss”).

The schemes for “recovery” entries for examples 1 and 2 are identical, despite the different reasons for restoring written-off debt on balance sheet accounts - justified write-off (example 1) and erroneous (example 2).

“How to take into account non-operating income when calculating income tax?” will introduce you to the procedure for recognizing non-operating income for tax accounting purposes. .

Reanimation of the creditor

In tax accounting, the need to write off debt is due to the need for correct adjustment of the tax base. The reliability of the data has a direct impact on the tax payable. At first glance, there should not be any particular difficulties when writing off debt. What’s easier is to determine which debts need to be written off and reduce the amount of real capital by their amount. But the simplicity is only apparent. In fact, any write-off must be properly executed, properly reflected in accounting, and documented. Definitions Accounts receivable is a part of an organization's current assets. This amount represents the amount of obligations of third parties in favor of the enterprise.