Standard tax deductions are dealt with in Article 218 of the Tax Code of the Russian Federation. In accordance with clause 1 of this norm, taxpayers - individuals whose income is subject to personal income tax at the rate established by clause 1 of Article 224 of the Tax Code of the Russian Federation (13%) have the right to receive a deduction for this tax. If there is no taxable income, then you should not count on a deduction (for example, pensioners who receive only a pension (clause 2 of Article 217 of the Tax Code of the Russian Federation)).

Taxpayers are usually employees . They can also be executors under a civil contract.

Note! Non-residents of the Russian Federation cannot take advantage of personal income tax deductions, since the tax rate on their income is not established by clause 1 of Article 224 of the Tax Code of the Russian Federation. Therefore, even if the income of a non-resident of the Russian Federation is taxed at a rate of 13%, he cannot reduce it by standard deductions (letter of the Federal Tax Service of Russia dated October 22, 2012 No. AS-3-3/). In particular, this applies (clause 3 of Article 224 of the Tax Code of the Russian Federation): - highly qualified specialists; — crew members of ships flying the state flag of the Russian Federation; — others

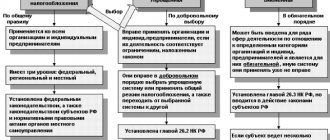

There are two types of standard tax deductions :

- deduction for the taxpayer, i.e. for oneself;

- deduction for the child(ren) of the taxpayer.

In this consultation we will consider in detail the first type of deduction.

Expenses that can be included in the social tax deduction

A complete list of expenses that can be included in the social deduction for personal income tax is presented in Article 219 of the Tax Code of the Russian Federation. Costs incurred by individuals for health insurance (voluntary), purchase of medicines, and treatment are exempt from taxation. People who study themselves or teach their children in educational institutions can also include expenses incurred as part of deductions. Benefits also apply to citizens participating in voluntary life insurance and pension insurance programs, including those who make additional contributions to the labor pension (to its funded part). People involved in charity can also take advantage of social deductions for personal income tax.

Tip : Individuals can apply for some social deductions from their employers. The basis for their registration will be a notification issued by the tax authority.

Standard deductions

According to Art. 218 of the Tax Code of the Russian Federation, the following are entitled to receive compensation of this kind:

- liquidators of Chernobyl;

- nuclear weapons testers;

- disabled people of the Second World War;

- war participants;

- guardians, parents and children.

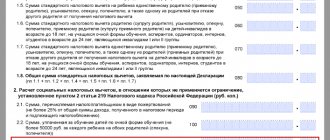

The following significant changes have occurred:

- The maximum allowable annual income has been significantly increased from 280 thousand to 350 thousand.

- The amounts of payments have been increased for persons who are caring for a disabled minor child or a full-time education student under 24 years of age. For parents the amount was 12 thousand, and for trustees – 6 thousand.

How much deduction can you expect in 2021?

The Tax Code of the Russian Federation regulates the procedure for calculating the amounts of social deductions that can be used by certain categories of citizens:

| Charity | Individuals can receive a maximum deduction of 25% of the total income received for the calendar year |

| Own training | The amount of deduction for yourself is a maximum of 120,000 rubles |

| Education of children, sisters, brothers (age no more than 24 years). Only full-time uniform is allowed in institutions that have the official status of educational institutions (license or other supporting document) | The maximum deduction amount for one child is a maximum of 50,000 rubles (distributed to both parents, custodian or guardian). The invoice for payment must be issued to the personal income tax payer |

| Treatment (taxpayer, spouse, children and wards under 18 years of age, parents) | The maximum deduction for treatment is fixed at a maximum of 120,000 rubles. The deduction amount may include expenses incurred for the purchase of medications that are on the government-approved list and prescribed by the attending physician. All costs incurred for expensive treatment are included in the social deduction in full (the list is approved by the Government of the Russian Federation). Federal legislation specifies how sick leave is paid after dismissal |

| Insurance (medical, pension) | The tax deduction amount includes all expenses incurred |

Advice : if parents paid for their children’s education using maternity capital, they are deprived of the opportunity to take advantage of the social tax deduction.

Example . The secretary receives a salary of 55,000 rubles. At the same time as working, she is pursuing higher education. The cost of training is 140,000 rubles per year. In accordance with the regulations of the Tax Code of the Russian Federation, the maximum amount of personal income tax deduction applicable for training expenses is 120,000 rubles.

Calculation . For the year, personal income tax was withheld from the secretary's salary in the amount of 85,800 rubles (The Tax Code specifies how to calculate personal income tax from a salary): 55,000 rubles * 12 months = 660,000 * 13% = 85,800 rubles personal income tax. The secretary can receive a social deduction for himself in full.

It is important to know! A catalog of franchises has opened on our website! Go to catalog...

Standard employee tax deduction in 2021

Provided to an individual if he belongs to a certain category of taxpayers. The employee has the right to a deduction in the amount of:

3,000 rub. , if it is (clause 1, clause 1, article 218 of the Tax Code of the Russian Federation):

- disabled WWII;

- participant in the liquidation of the Chernobyl accident;

- etc.;

500 rub. , if it is (clause 2, clause 1, article 218 of the Tax Code of the Russian Federation):

- Hero of the Soviet Union or the Russian Federation, holder of the Order of Glory of three degrees;

- participant of the Second World War;

- disabled since childhood, or disabled group I or II;

- etc.

For those who don't know! The standard personal income tax deduction in the amount of 400 rubles, which was used by the vast majority of working Russians, was canceled from January 1, 2012 on the basis of paragraphs. “a” clause 8, article 1 and clause 1, article 5 of the Federal Law of November 21, 2011 No. 330-FZ (clause 3, clause 1, article 218 of the Tax Code of the Russian Federation).

The right to a standard tax deduction for an employee is not limited to any of its maximum amounts or the maximum amount of income received (unlike the same “children’s” deductions).

Let's look at the rules for providing a standard tax deduction “for yourself”.

1. The deduction is provided by the tax agent (clause 3 of Article 218 of the Tax Code of the Russian Federation).

As a rule, this is the employer.

Moreover, if a citizen receives income from several tax agents at once (for example, an employee works simultaneously for two or more employers), then he can claim a deduction only for one of them (any one of his choice).

By the way, the Tax Code does not oblige the employer to check whether his employee receives the same deductions at another place of work. At the same time, he holds him responsible for the correct calculation and withholding of tax (letter of the Ministry of Finance of Russia dated July 15, 2016 No. 03-04-06/41390, letter of the Federal Tax Service of Russia dated November 17, 2008 No. 3-5-04/) . Therefore, in order to protect yourself from mistakes and claims from inspectors, it is better to request from the employee a certificate from other places of work stating that he does not receive personal income tax deductions there. Although, let us note once again, the employer is not obliged to do this.

If a subordinate did not receive his deduction at work (did not declare it or did not submit supporting documents) or received it in a smaller amount, then at the end of the year he can apply to the Federal Tax Service at his place of residence with a 3-NDFL declaration for recalculation (clause 4 of Art. 218 of the Tax Code of the Russian Federation).

2. The deduction is provided for each month of the tax period (clause 1 and clause 2 of clause 1 of Article 218 of the Tax Code of the Russian Federation).

Even if in certain months within the calendar year the employee did not have taxable income.

The courts agree with this approach (see Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 14, 2009 No. 4431/09, FAS Moscow District dated January 24, 2011 No. KA-A40/16982-10, etc.) and financiers (see. letters of the Ministry of Finance of Russia: dated October 22, 2014 No. 03-04-06/53186 (clause 2), dated July 23, 2012 No. 03-04-06/8-207, dated July 21, 2011 No. 03- 04-06/8-175, etc.).

That is, during “no-income” periods, tax deductions accumulate. And as soon as income appears, the personal income tax base is reduced by these deductions.

Note! Unused standard tax deductions can only be totaled within a calendar year. They are not carried over to the future.

If at the end of the year, due to the transfer of deductions, an employee has an overpayment of personal income tax, then he can return it by independently contacting the Federal Tax Service.

If, by the end of the year, the payment of taxable income to the employee has not been resumed, then he loses the right to deductions for personal income tax for “non-income” months. This is the opinion of the Russian Ministry of Finance (letters: dated October 22, 2014 No. 03-04-06/53186 (clause 2), dated May 6, 2013 No. 03-04-06/15669, etc.).

3. The deduction is granted to the one that is larger in size (i.e. 3,000 rubles), if the employee claims both personal deductions and 500 rubles. and by 3,000 rubles. (paragraph 1, clause 2, article 218 of the Tax Code of the Russian Federation).

Notice! “Children’s” deductions are provided regardless of the provision of other tax deductions (paragraph 2, paragraph 2, article 218 of the Tax Code of the Russian Federation).

In other words, if an employee claims a deduction for both himself and the child, then the employer must provide both.

How to receive a notification from the Federal Tax Service for social deductions?

Individuals who are officially employed in organizations or individual entrepreneurs (the application form for individual entrepreneur registration can be downloaded on the Internet) must provide the following documents when contacting the tax authority:

- application form approved by law (form ZN-4-11/21381);

- documents confirming all expenses incurred, which can be included in the social deduction for personal income tax.

Russian citizens must apply to the tax service located at their place of residence. The Federal Tax Service can issue one notification, which simultaneously confirms the right to deductions for several types of expenses incurred. This document is valid until December 31 of the year in which it was issued. The notification must bear the official seal of the Federal Tax Service, as well as the details.

General concept of tax deduction

All citizens of our, and not only our, country are taxpayers. The obligation to pay taxes is spelled out in the main document of the country - the Constitution of the Russian Federation. Citizens are required to pay taxes in a variety of situations: someone rents out an apartment, someone sells cars, and someone simply goes to work and receives a salary minus taxes paid to the state budget.

In certain cases established by law, citizens can return the paid tax or part of it. To do this, you need to use a tax deduction. A tax deduction is an amount established by law by which a taxpayer’s tax base can be reduced. In other words, this is the amount of taxes paid, which a citizen has the right to return, and if the tax is not paid, not to pay legally.

A citizen has the right to claim a tax deduction provided that he is a taxpayer of personal income tax at a rate of 13%.

One type of tax deduction is social tax deduction , which we will consider in detail in our article.

Where should individuals apply to receive social deductions?

Russian citizens can receive a social tax deduction in 2021 in two ways:

- To the Federal Tax Service at your place of residence. At the end of the calendar year, individuals have the right to apply to the tax authority to receive a social deduction. To do this, you must provide a declaration of form 3-NDFL, to which all documents confirming the expenses incurred are attached. If Russian citizens engaged in charity work during a calendar year (the same reporting period for financial statements is provided for) then they can only receive a tax deduction for such expenses from the Federal Tax Service (Article 219 of the Tax Code of the Russian Federation).

- At the employer's. In this case, the individual must first contact the tax service and receive a notification there. An appeal to the employer (it does not matter whether he is on the general system or submits a single simplified tax return) is made in writing. At the place of official employment, Russian citizens can receive deductions for expenses incurred on voluntary life insurance, regardless of whether wage contributions were withheld or transferred to the insurance company's account.

Refund of property fees

Significant transformations have affected compensation for the sale of real estate. The minimum ownership period during which the owner has the right not to pay taxes has been increased from 3 years to 5.

There are exceptions to the rule, that is, those for whom time has not changed:

- who became owners of real estate as a result of a donation procedure from a close relative. The grandfather gave his grandson a country plot of land with a dacha. For 3 years, the recipient may not transfer funds for taxes;

- received property by inheritance. Skvortsova’s father died and left her a one-room apartment in the city. Having fulfilled all the requirements of the current legislation, she became an heiress;

- who formalized privatization and became owners. Having moved to the Aktubinsky collective farm in 1984, the welder and his family received a house with a plot. In 2000, the property was privatized by the persons living in it;

- payers of rent with lifelong maintenance and, in this regard, who became owners of real estate. A childless old woman of advanced years met a young girl who was a nurse in the hospital (she was caring for her grandmother), the woman liked the treatment and care. She offered to give the girl ownership of her apartment in exchange for care and maintenance. The latter agreed, they entered into an agreement. So the nurse became the owner of her own square meters.

Also, the ownership period of three years is limited for owners of cars, paintings, places for cars and other belongings.

Holders of securities are provided with benefits based on the calculation of losses incurred. Information must be indicated when filling out form 3-NDFL.

An important change is the introduction of a cadastral value coefficient for objects. Previously, in order to avoid paying tax or make payments at a lower level, a reduced price was indicated in the purchase and sale agreement. Now, when selling, for example, an apartment, its cadastral assessment will be taken into account with a minus coefficient of 0.7.

Deduction for payment of expenses for conducting an independent assessment of one’s qualifications

This type of deduction was introduced by Law No. 251-FZ of July 3, 2016, which came into force on January 1, 2017. You can take advantage of this deduction if you pay for an independent assessment of your qualifications. A deduction can be received in the amount of actual expenses, but the total amount of this deduction and other above-mentioned deductions (with the exception of deductions for the costs of educating children, expensive treatment and charity) cannot exceed 120,000 rubles. (Subclause 6, Clause 1, Article 219 of the Tax Code of the Russian Federation).

Deduction for payment of additional insurance contributions for funded pension

Another type of expenses for which you can count on receiving a social tax deduction are expenses in the amount of additional insurance contributions paid for a funded pension in accordance with the Law “On Additional Insurance Contributions...” dated April 30, 2008 No. 56-FZ. This deduction can be obtained upon presentation of documents confirming payment or a certificate confirming the transfer of such contributions by a tax agent.

The maximum deduction amount when paying pension contributions in both cases (voluntary pensions to non-state funds and additional insurance for the funded part of the pension) will be 120,000 rubles.

In what cases are social deductions for personal income tax provided in 2021?

The procedure for providing social deductions for personal income tax in 2017 is regulated by Art. 219 of the Tax Code of the Russian Federation. It provides a complete list of situations when a taxpayer has the right to receive a so-called social tax deduction .

Today, there are several types of expenses for which taxpayers have the right to receive social deductions for personal income tax in 2021 . These include expenses:

- for donations and charity;

- education;

- medical services and drugs;

- payment of voluntary pension contributions to non-state pension funds;

- payment of additional insurance contributions for funded pension;

- payment for an independent assessment of your qualifications.

Find out whether a deduction is possible for the purchase of tour packages here .

Now let's take a closer look at each of them.

Official text of Art. 219 of the Tax Code of the Russian Federation, as well as answers to some questions related to this article, see the material “Art. 219 of the Tax Code of the Russian Federation (2017): questions and answers" .

Deduction for payment of voluntary pension contributions to non-state pension funds

Another type of expenses for which you can receive a social tax deduction are expenses in the form of amounts paid:

- pension contributions under an agreement with a non-state pension fund;

- insurance premiums under a voluntary pension insurance agreement;

- insurance premiums under a voluntary life insurance agreement (agreements), if such agreements are concluded for a period of at least 5 years.

Such expenses are recognized in relation not only to the taxpayer, but also to his close relatives (spouse, parents, children, grandparents, brothers, sisters, etc. in accordance with the Family Code of the Russian Federation).

Medical services and drugs

Now let's look at the social tax deduction provided for expenses on medical services and drugs. Taxpayers who paid with their own funds during the reporting period are entitled to receive such a deduction:

- your treatment;

- treatment of your relatives (spouse, parents, children under 18 years of age);

- purchasing medicines for yourself and your relatives (spouse, parents, children under 18 years of age);

- contributions under voluntary personal insurance contracts for yourself and your relatives (spouse, parents, children under the age of 18).

For information about whose treatment does not give the right to a deduction, read the material “Social deductions for the costs of treatment of the spouse’s parents are not given .

IMPORTANT! The list of medical services for which it is possible to receive a social deduction is established by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201.

The maximum amount of social tax deduction for medical services, as well as for educational services, is 120,000 rubles. The exception in this case is expensive treatment. In this case, the limits of the deduction are not limited, and it is provided in the amount of the full cost of such treatment.

IMPORTANT! In order to determine whether the medical services provided to you are considered expensive, you need to look at what code is indicated in the certificate of payment for medical services for submission to the tax authorities. The number 1 in the code field means that the treatment is not expensive, the number 2 means that it is an expensive treatment.

A social tax deduction can only be obtained if medical services are provided by organizations and individual entrepreneurs that have a state license to carry out medical activities.

Let's look at a few examples.

Example 1

In 2021, A.Yu. Krivov spent 20,000 rubles on the treatment of his child (aged 3 years). He also purchased medicines for his wife in the amount of 50,000 rubles. Both treatment and medications are included in the list approved by the Government of the Russian Federation. Krivov can reimburse the tax he paid in the amount of 9,100 rubles. ((20,000 + 50,000) × 13% = 9,100 rub.).

Example 2

Chernov I.B. in 2021 underwent complex eye treatment, which belongs to the expensive group, and spent 500,000 rubles on it. Consequently, he has the right to submit documents for a tax refund in the amount of 65,000 rubles. (500,000 × 13% = 65,000 rubles).

For an exception to the rule about having a license, read the article “You can get a deduction for treatment in Crimea even if the medical institution does not have a license .