Shortage of money is a serious situation that can arise in any organization. The budget was not calculated, force majeure or some other problems. In this case, the company can obtain an interest-free loan from its founder.

Many people arrange this money through a loan agreement and simply deposit it into a current account or into the cash register. In this instruction, we will tell you how to reflect the receipt from the founder and the return of money in the future in the program.

We will consider two options:

- the money goes to the organization’s cash desk under a six-month contract;

- The funds are sent to the current account, and the loan term is for two years.

In both cases, an interest-free loan agreement is used.

The money is received at the cash desk for a period of six months

Let's start with the first option. To reflect such an arrival, you need:

- open the “Bank and cash desk” tab;

- find the “Cashier” section;

- select the “Cash Documents” tab.

Now we create a document in the “Cash receipt” format. Select the type of operation “Receiving a loan from a counterparty”. We indicate the founder, organization as the counterparty and also enter the amount of money received.

Below is a tabular section in which you enter information regarding the contract. If the contract is new, then click the “Add” button and enter the data, indicating the document details.

Next, select the cash flow item; to do this, add a new item “Loan from the founder”. Due to the fact that the loan is short-term, choose account 66.03

For the amount of the loan you received, the posting Debit 50.01 and Credit 66.03 will be generated.

To return the money, you need to use the “Cash Withdrawal” document, which contains the operation to return the loan to the counterparty. To add it, we do everything described above, but in the tabular part you add the column “Type of payment” and indicate “Loan repayment”.

A reverse entry will be generated, where the debit will be 66.03 and the credit will be 50.01. Thus, mutual settlements will be closed if you return the entire amount received from the counterparty.

1C Accounting 8 edition 3.0 - Issuing an interest-free loan to an employee

An interest-free loan is issued to an employee on the basis of a loan agreement concluded between the employee and the organization in writing, with a direct indication in the agreement that the loan is interest-free.

Let's look at an example. On January 12, 2015, the Rassvet organization issued an interest-free loan to employee S.S. Sidorov. in the amount of 720,000 rubles. The funds are transferred to the employee's bank account. Borrowed funds are not intended for the purchase of housing. The loan is repaid in installments by deducting 20,000 rubles from the employee’s salary each month until the loan amount is fully repaid. The issuance of a loan to an employee in the program is formalized using the document Write-off from the current account with the operation Issuance of a loan to an employee. The document indicates the employee who received the loan and the loan amount.

When posting, the document will write off funds from the credit of account 51 “Current accounts” to the debit of account 73.01 “Settlements for loans provided.” The document Write-off from the current account and its result are presented in Fig. 1.

Picture 1.

In accordance with paragraphs. 1 clause 1 art. 212 of the Tax Code of the Russian Federation (TC RF), an employee who has received an interest-free loan has income in the form of material benefits from savings on interest on the loan, which is subject to personal income tax.

The lending organization is recognized as a tax agent in relation to the above-mentioned employee income. The organization is obliged to calculate personal income tax on the income received, withhold the calculated personal income tax from any funds paid to the employee, and transfer the withheld amount of personal income tax to the budget.

Personal income tax on income in the form of material benefits is calculated at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation). The tax base when calculating personal income tax is determined as the excess of the amount of interest for the use of borrowed funds, expressed in rubles, calculated on the basis of two-thirds of the current refinancing rate established by the Central Bank of the Russian Federation on the date of actual receipt of income by the taxpayer, over the amount of interest calculated on the basis of the terms of the agreement (Clause 1, Clause 2, Article 212 of the Tax Code of the Russian Federation).

Regarding the date of actual receipt of income when issuing an interest-free loan, the Russian Ministry of Finance has explained in numerous letters that such dates should be considered the corresponding dates of repayment of borrowed funds. In our case, repayment of the loan amount issued to the employee is made monthly. Consequently, the organization’s tax agent obligation also arises monthly. First, let's calculate the tax base for personal income tax in terms of the employee's material benefits in the month of January: Income = 720,000 rubles * 8.25% / 365 days. * 20 days * 2/3 = 2,169.86 rubles, where 8.25% is the refinancing rate. valid on the loan repayment date, 365 days. – number of days in a year, 20 days. – the validity period of the loan agreement in the past month. Let's calculate the amount of personal income tax: personal income tax = 2,169.86 rubles. * 35% = 759 rub. (taxes are calculated and paid in whole rubles).

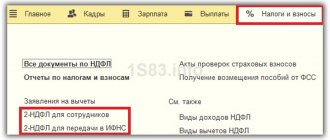

To reflect in the program the occurrence of income for an individual and the facts of calculation and withholding of personal income tax, we will use the document Personal Income Tax Accounting Operation. This document is used in cases where there is no accrual, but income is recognized and/or the amount of personal income tax is calculated and withheld at tax rates different from the basic rate (13% (30%)).

The head of the document indicates the employee and the date of the operation. On the Income Information tab, the date of receipt of income is indicated, income code – 2610 Material benefit received from savings on interest for the use of borrowed (credit) funds, the amount of income and calculated personal income tax.

On the personal income tax withheld at all rates tab, the month of the tax period, the personal income tax rate, the tax amount withheld and the income code are indicated. When carried out, the document will generate entries in three accumulation registers: Income accounting for calculating personal income tax - the amount and code of income received is recorded; Calculations of taxpayers with the budget for personal income tax - two entries will be generated in the register for the amount of tax. With the sign “+” - personal income tax has been calculated and with the sign “-” - personal income tax has been withheld; Calculations of tax agents with the budget for personal income tax - the organization, as a tax agent, must pay the amount of personal income tax withheld from the employee to the budget. The document does not make any accounting entries. Filling out the document Personal Income Tax Accounting Operation is shown in Fig. 2.

Figure 2.

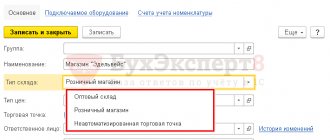

Since the amount of the loan issued to the employee and personal income tax on material benefits are withheld from the employee’s salary, it is necessary to create new types of deductions in the program. You can create separate deductions for loan repayment and personal income tax. An example of creating a hold is shown in Fig. 3.

Figure 3.

To calculate employee salaries, personal income tax and insurance contributions, the program uses the Payroll document. When filling out this document, you must select the required employee, type of deduction and amount to be withheld on the Deductions tab. Filling out the Payroll document for the example we are considering is shown in Fig. 4.

Figure 4.

From the contents of the tabular part on the Employees tab, it is clear that employee Sidorov received a salary in the amount of 60,000 rubles, personal income tax was withheld - 7,800 rubles (60,000 rubles * 13%) and other deductions were withheld - 20,759 rubles (loan repayment - 20,000 rubles and personal income tax on material benefits – 759 rubles).

The types of deductions we created will reduce the amount of wages to be paid, but they will not be reflected in accounting, since the Payroll document can generate accounting entries only when deducting according to a writ of execution. Therefore, to reflect transactions of deduction from wages and accrual of personal income tax on material benefits in accounting, you will have to use the Accounting Certificate (Operation entered manually).

It is necessary to generate two entries: - withhold the amount of the repaid loan from wages (Dt 70 Settlements with personnel for wages - Kt 73.01 Settlements on loans provided); - withhold from wages the amount of personal income tax for material benefits and accrue it for payment to the budget (Dt 70 Settlements with personnel for wages - Kt 68.01 Personal income tax when performing the duties of a tax agent). The corresponding Accounting statement (Operation) is presented in Fig. 5.

Figure 5.

In the Rassvet organization, wages are paid through the cash register, so we will create a document called Statement to the Cashier. We will select January 2015 as the payment month, and we will pay monthly salaries. The tabular part of the document is filled in automatically with the amounts of wages to be issued in person (accrual register Mutual settlements with employees). Let's check the amount to be paid: Accrued (60,000) – personal income tax (7,800) – loan repayment (20,000) – personal income tax (759) = 31,441 rubles. The document Cashier Statement is shown in Fig. 6.

Figure 6.

Based on the posted document Statement to the cash desk, the Cash Issue document (Cash Issue) is created. When carried out, this document will cover the arrears of wages using cash by posting Dt 70 Settlements with personnel for wages - Kt 50.01 Cash desk of the organization. The Cash Issuance document and the result of its implementation are shown in Fig. 7.

Figure 7.

In addition to the accounting entry, the document regarding personal income tax on wages (RUB 7,800) will generate entries in the accumulation registers Taxpayers’ settlements with the personal income tax budget (tax withheld) and Tax agents’ settlements with the personal income tax budget (tax agent must pay the amount of personal income tax withheld in budget).

But before we pay personal income tax, we will check the correctness of our previous actions. Let's create a balance sheet for account 70 with selection for employee Sidorov (shown in Fig. 8). Judging by this statement, we have settled with Sidorov.

Figure 8.

Carrying out the duties of a tax agent, the organization must pay for the employee - individual S.S. Sidorov. for the month of January, personal income tax in the amount of 8,559 rubles, including personal income tax at a rate of 13% - 7,800 rubles, personal income tax at a rate of 35% (material benefit) - 759 rubles. To reflect this operation in the program, after receiving a bank statement about tax payment, we will use the document Write-off from a current account with the Tax payment operation. In the document, we will select the required tax - personal income tax when performing the duties of a tax agent, indicate the amount of tax paid and the payment period. When posted, the document will generate posting Dt 68.01 Personal Income Tax when performing the duties of a tax agent - Kt 51 Current accounts. Also, entries will be made in the registers Calculations of tax agents with the budget for personal income tax and Payment of personal income tax by tax agents (for distribution) - the tax agent paid the amount of personal income tax to the budget. The document Write-off from the current account and the result of its execution are presented in Fig. 9.

Figure 9.

Directly from the document Write-off from a current account with the Tax Payment operation, you can create a Personal Income Tax Payment Register. The corresponding register is shown in Fig. 10.

Figure 10.

The last thing that interests us is the Personal Income Tax Register. A fragment of this register for the individual Sidorov S.S. shown in Fig. 11. Personal income tax at rates of 13% and 35% (income code - 2610 Material benefit received from savings on interest for the use of borrowed (credit) funds) was correctly calculated, withheld and transferred.

Figure 11.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

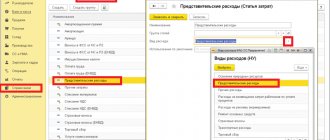

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization