Any organization owns tangible assets - fixed assets, which over time are subject to depreciation, wear out, lose their usefulness, and therefore lose value. This must be reflected in financial accounting, since it is directly related to the calculation of income tax payments.

Let's consider the questions:

- On what basis are fixed assets divided into classes and types?

- Which authorities approve this classification?

- How to determine the useful life of fixed assets in complex cases?

Logic of the Classifier operation

Fixed assets of organizations can be varied. The costs of their acquisition and renewal form part of the tax base when accounting for income tax (Clause 1 of Article 258 of the Tax Code of the Russian Federation). When calculating the amount intended for payment, the costs of depreciation of fixed assets (among other deductions and tax “minuses”) are deducted.

Each type of fixed assets can be used for operation for a certain time - useful life . This period cannot be chosen arbitrarily. The enterprise establishes it on the basis of the Classifier adopted by the Government of the Russian Federation.

Depreciation and its categories

When purchasing these funds, they must be accepted into the accounting records of the enterprise at the initial price. Which includes delivery of equipment, its installation, and commissioning work. When exploiting basic resources, they occur. Therefore, to compensate for damage from wear and tear, both individual parts and the entire equipment, depreciation funds are charged.

The transfer of a certain share of the cost of fixed assets to the initial price of finished products is called depreciation. When an organization purchases the necessary resources, it spends a certain amount of money. Therefore, in order for the company not to incur losses in connection with this, it must return the funds spent, that is, recoup the purchased equipment. This is what depreciation is for. Most enterprises recoup the funds spent over a fairly long period of time, which sometimes leaves more than thirty years.

To calculate depreciation, fixed assets are divided into specific categories that take into account their useful life. When using production tools, their price is transferred to the cost of the goods produced.

If part of the amount, for some reason, remains not written off, it is referred to as the residual price. It is at this cost that equipment that has failed is completely written off.

Today, the legislation of the Russian Federation provides for ten depreciation categories. Thanks to which, the useful life of the enterprise’s production facilities is determined, and financial deductions for their wear and tear are calculated.

OKOF as a government document

OKOF (All-Russian Classifier of Fixed Assets) is a directory where all types of fixed assets are coded based on their belonging to one of the depreciation groups.

Each type of property fund is assigned its own code value, by which the useful life of such a material asset should be calculated, and vice versa, the established service life determines membership in each specific group and the assigned code.

For the first time, the government classification was introduced into business use at the beginning of 2002 by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (clause 3). Until this time (since 1991), a slightly different system was used; the term “depreciation group” was not used; instead, “depreciation rates” . They were regulated by previous legislation: Unified standards of depreciation charges were intended for the reconstruction of fixed assets of the Soviet economy, on the basis of Resolution of the USSR Council of Ministers of October 22, 1990 No. 1072.

FOR YOUR INFORMATION! The modern classification of fixed assets reduces the useful life of tangible assets by almost a third. This means that they can be written off more quickly as an expense, which is more beneficial for taxpayers.

Categories with a useful life of up to thirty years

These categories distribute fixed assets with the longest service life. And they are divided, just like the previous ones, into five groups. According to the codifier, the report of categories continues and starts from the sixth.

Sixth group

This includes buildings, vehicles and other equipment with a write-off period of ten to fifteen years:

- railway equipment;

- stationary boilers and furnaces;

- wells for water intake;

- property used in the production of paper and paper products;

- railway sites;

- sea or river freight transport.

Seventh group

Here are funds with a service period of fifteen to twenty years:

Eighth group of fixed assets

This is the property of an enterprise that can be used for up to twenty-five years:

- furnaces for melting cast iron;

- metal structures, including fences;

- cables designed for high voltage;

- reinforced concrete premises;

- property operated in metropolitan areas;

- cargo and passenger sea transport;

- trains.

The ninth group and what it includes

- high pressure vessels;

- airport runways;

- capital warehouses and storage facilities;

- water treatment facilities;

- automobile overpasses;

- specialized fire-fighting equipment, which is used in open bodies of water (rivers, seas, lakes);

- reactors operating on nuclear fuel.

Tenth group

The last group provides for operating systems that cannot be written off for more than thirty years:

- buildings intended for housing;

- water platforms that are used for specialized work;

- railway tracks and civilian trains located in the metro.

Classifier Structure

All fixed assets are combined into 10 depreciation groups (clause 3 of Article 258 of the Tax Code of the Russian Federation). The main basis for classification is the period after which a tangible asset is subject to write-off, since its useful use is impossible. Deadline figures are given “inclusive”.

- 1-2 years: short-lived assets that quickly lose their usefulness, e.g. communications equipment, medical equipment.

- 2-3 years: property that can last a little longer without losing its properties, such as presses, cranes, perennial plantings, etc.

- 3-5 years: assets that are designed to last longer, such as pipelines, various analyzers, optics, transportation.

- 5-7 years: material assets designed to provide benefits for quite a long time, these include real estate, except residential buildings, various structures, serious equipment, and some types of vehicles.

- 7-10 years: assets intended for ten years of service, such as demountable buildings, many types of structures and equipment, agricultural machinery, etc.

- 10-15 years: such funds cannot be written off before they have served out their significant useful life - metal structures, telecommunication lines, railways, housing.

- Some types of buildings, utilities, and ships may be useful for 15-20 years.

- 20-25 years: during this time, access roads, railway tracks, subway lines, carriages, and safes will not become obsolete.

- 25-30 years of expected usefulness are allocated to agricultural storage facilities, piers, nuclear reactors, and some types of carriages.

- More than 30 years of useful life are allocated to such types of assets as escalators, cruise ships, floating docks and timber strips, as well as those tangible assets with a corresponding service life that are not included in other subgroups.

Within each of the depreciation groups, several subgroups are distinguished that unite tangible tangible assets on the following grounds:

- building;

- structures;

- cars and equipment;

- vehicles;

- communication and transmission devices;

- perennial plantings;

- livestock

NOTE! The classification of fixed assets by depreciation groups is less detailed than the OKOF directory: in the first, the object is classified to the class level, and in the directory it is detailed to the type.

Categories up to ten years of use

Equipment with a service life of up to ten years is divided into five groups.

First group

- mechanisms for automatic and manual machines;

- compressor;

- belt conveyors;

- electric generators;

- a press used to roll steel;

- fendering and drilling equipment, manual;

- instruments used in medicine;

- mechanisms by which oil or other minerals are extracted. Since they are operated in an environment that negatively affects them;

- cable production;

- tools that are used for deep exploration or development drilling

- wells

Second group

This includes mechanisms whose useful life is no more than three years:

Third group

This group includes the following funds that can be written off from the report within five years:

- mechanisms that are used to extract gas or oil;

- special buildings for timber harvesting;

- transport used in logging;

- video and photographic equipment;

- household lifts;

- thermal generators;

- air and water pipes;

- devices for unloading and loading cargo;

- sawmills;

- devices that use meta color in manufacturing;

- low-power transformers;

- tools for pertussis production;

- distribution mechanisms;

- various types of instrumentation;

- equipment whose body is made of glass.

Fourth group

This includes production assets whose operating period is at least five and no more than seven years:

- cooling towers made from wood raw materials;

- any types of fences, with the exception of metal ones;

- industrial structures built from any material other than steel;

- suspended live wires;

- auxiliary industrial equipment (mixers, ovens);

- tools for making wooden or rubber products;

- devices necessary for television and radio broadcasting.

Fifth group

This group, according to the classifier, includes production devices, the write-off period of which can occur from seven to ten years. First of all, these include:

- quick assembly and disassembly facilities;

- military transport and equipment;

- equipment producing ebonite;

- numerically controlled mechanisms;

- industrial platforms;

- equipment designed for heating liquid or solid materials, as well as space heating;

- metal processing machines;

- weapons used in sports or leisure;

- forging equipment;

- agricultural machinery (combines, tractors, trucks, etc.).

Objects missing from the Classifier

Not often, but there are assets that cannot be found in any category of the Classifier.

If you need to determine which depreciation group to include this or that fixed asset not mentioned in the OKOF, you need to refer to the technical conditions and information provided by the manufacturers for it (clause 6 of Article 258 of the Tax Code of the Russian Federation).

The taxpayer will indicate the useful life in accordance with these data, comparing the resulting period figure with the required group from the Classifier.

To correctly indicate the depreciation group of an unidentified object, you should use information from OKOF by finding the code value of a specific property asset. The established code will help to correlate this object with one or another depreciation group according to the Classifier.

Controller depreciation group of fixed assets

According to the law, the fourth category usually includes property whose useful life is from 5 to 7 years (inclusive): metal stalls, agricultural equipment (with the exception of tractors), equipment for making furniture, welding, soldering, structures made of film, instruments for sharpening woodworking tools, products that provide uninterrupted power supply to base stations, television and radio receivers.

Depreciation groups of fixed assets and what applies to them

Regardless of the form of ownership of the company, its size and types of activities, the issue of efficient use of fixed assets is one of the paramount ones. The competitiveness of the company's products, its position in industrial production, and the financial condition of the organization depend on it. Therefore, the use of OKOF is especially important.

Requirements for depreciation groups

Depreciation amounts are calculated in the manner prescribed by the current Tax Code. Depreciation funds include not only property, but also intellectual property that the taxpayer owns and uses for his own benefit.

Fixed asset depreciation groups

telephone apparatus and special devices, payphone apparatus and radiotelephones; subscriber unit of compaction equipment; equipment for multiplexing subscriber lines; Smart Service Control Node (SCP); service border router (BRAS/BNG/BSR); optoelectronic interface converter; batteries at communication facilities; uninterruptible power supplies - third group

(property with a useful life of more than 3 years up to 5 years inclusive)

Code OKOF-2

Fixed assets are the tools, machines and other labor tools necessary for the production of products. Without them, production is impossible. The main characteristic by which means of labor can be classified as fixed assets is their useful life. It must be at least a year old.

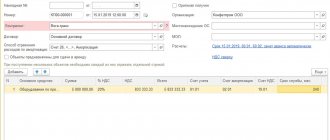

Classification of fixed assets into depreciation groups

How much money can a company save just by correctly calculating depreciation on a car/computer equipment/furniture, etc. Correctly calculated depreciation can save a significant amount of taxes! But many accountants of small firms do not even think about this important point.

Classifier of fixed assets included in depreciation groups

Having analyzed the information given in the table, it is worth noting that among most groups of fixed assets allocated in both the new and old OKOF, a correspondence can be made, for example, group 100 corresponds to group 13, group 220 to group 12, group 310 to group 15 and etc.

New classifiers of fixed assets: OKOF and depreciation groups

Find out whether a certain property belongs to the PF category. Its cost must be more than 100 thousand rubles. Next, you need to select a depreciation group, taking into account various criteria. At the next stage, you need to calculate the useful life period and record the result in the relevant documents

Which depreciation group does a computer in the Russian Federation belong to in 2020?

- As an OS - if the server is more expensive than 100,000 rubles. In this case, you need to determine the depreciation group and depreciation method. Thus, accounting for property more expensive than 100,000 rubles. coincides both in accounting (BU) and in tax accounting (TA).

- Property less than 100,000 rubles.

in tax accounting, the company does not have the right to depreciate - this is a gross violation of accounting rules (Article 120 of the Tax Code of the Russian Federation). But such property can be classified as material expenses and written off evenly, taking into account its useful life. In this case, when taking into account the operating system, it is more expensive than 40,000 rubles., but cheaper than 100,000 rubles. NU and BU of the company will coincide.

- The company can write off property worth less than RUB 100,000.

to material expenses immediately - this method is convenient to choose if the server costs less than 40,000 rubles. Then the NU and BU will also coincide. Otherwise, temporary differences will arise in accordance with clause 4 of PBU 18/02.

Which depreciation group should the server be assigned to?

In 2021, the useful life of certain fixed assets for depreciation purposes will change. The fact is that the new OKOF classifier comes into effect in 2021 . Our consultation on what an accountant needs to do in this regard.

New OKOF classifier from 2021

Methodological recommendations for accounting of production costs and calculating the cost of production (work, services) in agricultural organizations - Terminology Methodological recommendations for accounting of production costs and calculating the cost of production (work, services) in agricultural organizations: 50. Budgeting technology of financial planning, accounting and... ...

Shock absorption groups

In the current classifier, the coding of fixed assets had a 9-digit value of the form XX XXXXXXX. In the new OKOF, from 2021 it will be a digital designation in the format XXX.XX.XX.XX.XXX. This innovation quite significantly changed the very structure of the classifier.

Depreciation groups of fixed assets 2020

As can be seen from the table above, in class 14 3222 there may indeed be a fixed asset from the first depreciation group.

But the “note” column of the Classification explains that of the entire specified class, only tool sets, fixtures and equipment should be included in the first group.

Since the franking machine does not fall into any of the categories of class 14 3222 listed in the other depreciation groups, code 14 3222301 should be assigned to the fifth depreciation group.

Encyclopedia of solutions

If it is necessary to apply certain coefficients to objects, then in this case the useful life is subject to reduction or increase, according to the coefficients. Moreover, you need to remember that the main property must be registered in the depreciation group, without calculating coefficients.

Which OKOF standard to use

Innovations in modern tax legislation have made adjustments to the establishment of the OKOF code: this document was adopted in a new edition, the old one has become invalid, and some codes have been updated.

If your fixed assets were put into operation before 2017, you can account for them using the old classifier without changing the already established depreciation group, even if it does not coincide with the new edition of this document.

Tangible assets have the right to serve the established period without changes in accounting. But if fixed assets are acquired in 2021 and beyond, it is necessary to use the new OKOF standard.

IMPORTANT INFORMATION! For the convenience of entrepreneurs, Rosstandart has published a comparative table of previous and updated fixed asset codes for OKOF.

Changes in the legislative framework

Since the beginning of 2021, amendments to existing regulatory legal acts have come into force. Thus, a new amended classification of fixed assets was adopted by the Ministry's Decree.

To facilitate the transition from the old classifier to the new modified one, special tables were created. Which are intended to determine the depreciation category.

Thus, these innovations should not have a negative impact on the calculation and processing of depreciation payments.

Clarification codes

The entry in the classifier with code 330.28.13.1 contains 4 clarifying (child) codes.

| 330.28.13.11 | Fuel pumps, lubrication pumps (lubricators), coolant pumps and concrete pumps |

| 330.28.13.12 | Other reciprocating positive displacement pumps for pumping liquids |

| 330.28.13.13 | Other rotary displacement pumps for pumping liquids |

| 330.28.13.14 | Other centrifugal pumps for supplying liquids; other pumps |