If the value of the company's net assets remains less than its authorized capital at the end of the financial year following the second financial year or each subsequent financial year, at the end of which the value of the company's net assets was less than its authorized capital, the company no later than six months after the end of the corresponding financial year year is obliged to make one of the following decisions (clause 6 of article 35 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as the Law on JSC), clause 4 of article 30 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law)):

- on reducing the authorized capital of the company to an amount not exceeding the value of its net assets;

- on the liquidation of the company.

When is the Criminal Code reduced?

Authorized capital, fund (MC) is a concept inherent in commercial organizations: business entities (PJSC, JSC, LLC), business partnerships (HT), state unitary enterprises and municipal unitary enterprises (UP). The smallest amount of the Criminal Code is fixed by law (except for HT, which does not have such restrictions):

- for PJSC – 100,000 rubles;

- for JSC and LLC – 10,000 rubles;

- for state unitary enterprises – 5,000 minimum wages;

- for municipal unitary enterprises – 1,000 minimum wages.

In this case, the minimum wage is equal to the value established on the date of registration of the UE.

The owners of the listed legal entities have the right to reduce the capital on their own initiative, and in some situations this procedure is required by law. However, in any case, the charter capital cannot fall below its minimum value (as of the date of registration of changes in the constituent documents of the charter capital in the case of a voluntary reduction and on the date of registration of a legal entity in the case of a reduction due to obligation). If this happens, the legal entity will be liquidated. State unitary enterprises and municipal unitary enterprises that find themselves in a situation of mandatory reduction (when the capital capital is greater than the value of net assets (NA), but if reduced to NA, the capital capital will become less than required by law), they have 3 months from the end of the year to correct the situation, based on the results which this situation was created.

For information on how net assets are calculated, read the material “The procedure for calculating net assets on the balance sheet - formula” .

According to the decision made by the owners, a reduction is possible when:

- The organizational and legal form of a legal entity is changing, and the new form allows for a lower value of the Criminal Code.

- The owners made this decision. Since with a voluntary reduction it is possible to pay them income, this procedure can be regarded as an analogue of the calculation of dividends.

The obligation to reduce the capital capital arises in the following situations:

- A PJSC, JSC or LLC has unpaid or undistributed shares (or unsold shares of the primary issue) or shares (shares) purchased by the business entity that could not be sold during the year.

- In a PJSC, JSC or LLC for 2 years, and in a unitary enterprise - at the end of the year, the value of the authorized capital turns out to be greater than the calculated value of the NA.

- A participant leaves the LLC, and he needs to pay his share at its real value, and the difference between the private equity and the charter capital is not enough for this.

Read about available ways to increase net assets in the article “Procedure for increasing net assets by founders (nuances)” .

Regardless of the reason for reducing the capital, you need to do the following before doing so:

- Notify the Federal Tax Service.

- Twice a month publish a message about these intentions, intended for creditors who have the right to demand payment of their debts.

- Register the conversion of shares or redemption of their quantity in the SBRFR (for PJSC and JSC).

- Make sure that as a result of the reduction procedure at the initiative of the owners of the management capital there is no more than the NAV.

The Guide from ConsultantPlus will help you reflect the decrease in the authorized capital in the financial statements. If you do not already have access to this legal system, a full access trial is available for free.

Ways to reduce

The authorized capital of an organization can be reduced by:

- reducing the nominal value of the shares of all participants in the company;

- repayment of shares owned by the company.

In the first case, when the authorized capital is reduced, the nominal value of the shares of all participants becomes less, but the size of their shares remains the same.

In the second case, shares are redeemed that were not distributed or sold within one year from the moment they became the property of the company. In this case, the nominal value of the participants' shares does not change, and the size of their shares increases proportionally.

This follows from paragraphs 2 and 4 of paragraph 1 of Article 20, paragraphs 2 and 5 of Article 24 of the Law of February 8, 1998 No. 14-FZ.

Situation: if the authorized capital is reduced, is it possible to pay the company's participants the amount by which the nominal value of their shares has decreased?

Yes, you can.

The organization has the right to reduce the authorized capital by reducing the nominal value of the shares of all participants (paragraph 1, 2, paragraph 1, article 20 of the Law of February 8, 1998 No. 14-FZ).

The legislation does not contain a direct prohibition on the return to company participants of the amount by which the nominal value of their shares has decreased as a result of a decrease in the authorized capital (Law No. 14-FZ of February 8, 1998). Therefore, the organization has the right to decide on such a return. At the same time, it is necessary to control that such a return does not lead to a decrease in the value of net assets to an amount less than the authorized capital of the organization. Otherwise, the organization will have to decide to reduce the authorized capital to the amount of net assets.

On the need to withhold personal income tax from the amount of payments to a participant - an individual when reducing his share in the authorized capital, see: On what income must personal income tax be withheld.

The decision of the meeting of participants to repay the company’s share by reducing the capital

Regulatory regulation

The share of the withdrawing participant, by decision of the general meeting of participants, must be distributed among all participants of the company in proportion to their shares in the authorized capital (AC) or offered for purchase to participants or third parties, unless this is prohibited by the charter of the company (clause 1, article 20, clause 2 Article 24 of the Federal Law of 02/08/1998 N 14-FZ).

If this is not done within a year, then the share of the withdrawing participant is repaid by reducing the authorized capital (paragraph 2, paragraph 8, article 23, paragraph 2, 5, article 24 of the Federal Law of 02/08/1998 N 14-FZ).

In accounting, transactions related to changes in the amount of the authorized capital, registration of changes in the charter, are reflected on the date of making an entry in the Unified State Register of Legal Entities (clause 4 of article 12 of the Federal Law of 02/08/1998 N 14-FZ, clause 2 of article 11 of the Federal Law dated 08.08.2001 N 129-FZ).

BOO

When reducing the capital by redeeming the company's share, an expense is generated in the amount of the difference between the actual and nominal value of the share, which is related to other expenses.

The following entries are generated in accounting (Instructions for using the chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation October 31, 2000 N 94n):

- Dt 80.09 Kt 81.09 - by the amount of reduction in the capital: in the amount of the nominal value of the share.

- Dt 91.02 Kt 81.09 - in the amount of the difference between the actual and nominal value of the share.

WELL

Costs associated with reducing the capital capital cannot be recognized as NU expenses: they do not correspond to the concept of economically justified expenses, because are not aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Let's calculate how the size of the participants' shares will change after the repayment of the share of the withdrawing participant transferred to the company due to a decrease in the capital.

The size of the participants' shares has changed, but their nominal value remains the same.

Accounting in 1C

Because the share is not sold or distributed, then it is repaid by reducing the authorized capital. This means that income and expenses are not generated for tax accounting purposes (Letter of the Ministry of Finance of the Russian Federation dated October 29, 2018 N 03-03-06/1/77371).

Redemption of a share by reducing the authorized capital is formalized using the Transaction document entered manually in the Transactions – Transactions section.

Please indicate:

- Date – the date of amendments to the Unified State Register of Legal Entities.

In the postings:

- repayment of the company's share: Debit – 80.09;

- Subconto is the name of the LLC, i.e. our organization;

- Credit – 81.09;

- Subconto – the name of the participant whose share has transferred to the company;

- Amount – the nominal value of the redeemed share.

- Debit– 91.02;

Control

Let's check the reduction of the capital and the repayment of the company's share with the report Turnover balance sheet for account 80.09 in the Reports .

Let's make sure that account 81.09 is closed.

See also:

- Withdrawal of a participant from the society

- Sale of a company share to other participants

- Distribution of the share of a withdrawn LLC participant among other participants

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Sale of 100% share of the authorized capital The sole participant of the LLC is an individual. This sole participant decided to sell...

- Do LLC participants have income when increasing the authorized capital at the expense of profits? ...

- Personal income tax when increasing the authorized capital at the expense of retained earnings Good afternoon! 1C ZUP 3.1 (3.1.9.187) - BASIC. Please tell me how...

- Increasing the authorized capital due to contributions from third parties in 1C Please help me correctly form the authorized capital when entering balances and...

basic information

There are two procedures for reducing capital:

- Voluntary.

- Required.

What is the procedure for reducing the authorized capital of an LLC by reducing the nominal value of the shares of all participants ?

Regardless of the order in which changes are made, they must not contradict the law. In particular, the minimum size of the authorized capital is at least 10 thousand rubles. The amount of capital should not be below this level.

Reducing the amount of capital on a voluntary basis is carried out by reducing the nominal value of the founders' shares. However, the ratio of shares does not change, since redistribution occurs.

IMPORTANT! Reducing the capital on a voluntary basis cannot be a method of avoiding the company's liability to creditors. In particular, an organization cannot avoid paying its debts in this way. Creditors to whom there are early obligations must be notified of the changes being considered. The presence of the notification must be confirmed.

The amount of capital can be reduced both through money and property. For example, the organization’s capital is 10 thousand rubles. The new founder contributed to the company's assets in the form of a production building. However, the entrepreneurial project began to bring only losses. In this regard, the founder decided to withdraw his contribution. The accountant must deal with the registration of disposal of fixed assets. Then the cost of the building is written off from accounting. In this case, you need to draw up an act of acceptance and transfer of the OS object.

What is the procedure for reducing the authorized capital of a joint stock company by redeeming shares ?

ATTENTION! Personal income tax is deducted from the amount of disposal of objects that are transferred to the founders. The founder, in turn, receives taxable income. This rule is specified in the letter of the Ministry of Finance dated August 26, 2016. However, the founder has the opportunity to provide a tax deduction for the amount of expenses associated with the acquisition of rights to property. The rule in question is stipulated by Article 220 of the Tax Code of the Russian Federation.

Step-by-step instruction

On January 17, I.I. Ivanov, who is a participant in TEKHNOMIR LLC (50% share in the management company), left the Company. As a result, he was paid the actual value of the share.

The share of the withdrawing participant passed to the Company. The authorized capital of TEKHNOMIR LLC is 1,000,000 rubles, incl. in the shares of the owners:

- 30% (300,000 rubles) - Druzhnikov Georgy Petrovich;

- 20% (RUB 200,000) - Zarya LLC;

- 50% (RUB 500,000) share belongs to the company itself - TEKHNOMIR LLC.

On June 1, at the general meeting of the company’s participants, a decision was made to redeem the share of the withdrawing participant by reducing the authorized capital. The company's participants refused to purchase the share of the withdrawing participant, and the sale of the share to third parties is prohibited in accordance with the company's Charter.

On June 22, the Company submitted documents for state registration to amend the authorized capital.

On June 25, changes in the authorized capital were registered in the Unified State Register of Legal Entities.

Let's look at step-by-step instructions for creating an example. PDF

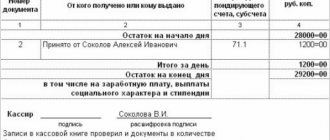

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Withdrawal of a participant from the Company | |||||||

| January 17 | 80.09 | 80.09 | 500 000 | Transfer of a share from a participant to the Company at nominal value | Manual entry - Operation | ||

| 81.09 | 75.02 | 2 000 000 | Reflection of the Company's debt to the withdrawing participant in the amount of the actual value of the share | ||||

| The decision of the meeting of participants to repay the company’s share at the expense of the management company | |||||||

| June 25 | 80.09 | 81.09 | 500 000 | Redemption of the company's share by reducing the capital in the amount of the nominal value of the share | Manual entry - Operation | ||

| 91.02 | 81.09 | 1 500 000 | Reflection of expenses for the repurchase of a share by the company in the amount of the excess of the actual value of the share over the nominal value | ||||

Valuation of net assets of LLC

The procedure for assessing net assets was approved by order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

Attention: if at the time of making a decision to reduce the authorized capital, the value of the company’s net assets is less than the minimum amount of authorized capital established by law, the company is obliged to make a decision on liquidation (clause 4 of article 90 of the Civil Code of the Russian Federation, clause 1 of article 14, clause 1 Article 20, subparagraph 2, paragraph 4, article 30 of the Law of February 8, 1998 No. 14-FZ).

An example of calculating the value of the net assets of an LLC to determine the need to reduce the authorized capital in accordance with legal requirements

LLC “Trading Company “Hermes”” was registered in January 2015.

When preparing financial statements for 2021, the Hermes accountant calculated the amount of the organization’s net assets. The calculation was made based on balance sheet indicators for 2021.

At the end of the reporting year, the balance sheet asset reflected:

- on line 1130 “Fixed assets” – 100,000 rubles;

- on line 1160 “Deferred tax assets” – 5,000 rubles;

- on line 1210 “Inventories” - 400,000 rubles;

- on line 1230 “Accounts receivable” – 150,000 rubles. There are no debts of participants regarding contributions to the authorized capital;

- on line 1250 “Cash” – 200,000 rubles.

At the end of the reporting year, the liabilities side of the balance sheet reflected:

- on line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)” - 50,000 rubles;

- on line 1370 “Retained earnings (uncovered loss)” - 200,000 rubles;

- on line 1520 “Accounts payable” – 605,000 rubles.

All balance sheet asset indicators are taken into account when calculating net assets. Balance sheet liability indicators are taken into account only in terms of accounts payable.

The net assets of Hermes as of December 31, 2021 are: RUB 100,000. + 5000 rub. + 400,000 rub. + 150,000 rub. + 200,000 rub. – 605,000 rub. = 250,000 rub.

The size of the organization's net assets is greater than its authorized capital. Therefore, the organization is not obliged to reduce the authorized capital or increase the value of net assets.

Reduction of authorized capital

A decrease in the authorized capital of an LLC can be made voluntarily or compulsorily.

There may be several reasons for this, the main ones being:

- the company declared the amount of the capital upon its registration, but subsequently did not pay it;

- the value of assets in comparison with the authorized capital has decreased;

If there is a voluntary desire to reduce the capital capital, the reason, as a rule, is debt on loans, or a decrease in the volume of products produced, up to the complete cessation of the enterprise’s activities.

There are several ways to reduce the authorized capital of an LLC.

Replenishment through the organization's cash desk

Based on current legislation, participants are entitled to replenish the capital through the cash register. At the same time, the company has every right to direct monetary resources, bypassing current accounts, for any purpose. The main condition is that at the end of the period the amount of the capital must be no less than that specified in the statutory documents. If this condition is violated, a fine is set for the enterprise - 40,000 - 50,000 rubles.

When a participant replenishes the capital through the cash register, the posting will take the following form:

D-t 50 K-t 75.1

The company sets its own cash limit. At the end of the day it should not exceed the insurance limit. Excess funds are transferred to current accounts. The only exceptions may be paydays, holidays or weekends.

Reduction methods and corresponding postings

When there is an obligation to reduce, situations are divided into two groups:

- Part of the Criminal Code is not actually paid and must be cancelled. These are shares (shares) at the disposal of the business entity. They are taken into account in account 81. When conditions arise for reducing the capital, a posting is made for them Dt 80 Kt 81.

- The activities of the legal entity are unprofitable or ineffective, as shown by the ratio of the net asset value to the capital asset. By reducing the capital in this case, the loss is covered or the retained earnings are increased by the amount missing to pay off the share in the LLC: Dt 80 Kt 84. In relation to each participant (shareholder), there will be a commensurate decrease in his share or the nominal value of the shares.

When reducing at the initiative of the owners, the following options are possible:

- The participant leaves HT, fully withdrawing his share of participation: Dt 80 Kt 75.

- The economic society buys out part of the management company. These may be full shares of retiring participants or a specific number of shares. The redemption is recorded by posting Dt 81 Kt 75 (50, 51, 52). Then this part of the Criminal Code is canceled: Dt 80 Kt 81.

- Existing shares or par value of shares are reduced in the required proportion. With this method, the difference in the amount of the contribution to the management company can remain at the disposal of the legal entity and become its income: Dt 80 Kt 91. Or it can be paid to participants (shareholders), and then this will be their income: Dt 80 Kt 75. If the participant refuses to receive such amounts, then they will also become the income of the legal entity: Dt 75 Kt 91.

Find out how a decrease in capital assets affects the taxation of an LLC in the Guide from ConsultantPlus. Trial access to the system can be obtained for free.

It will be impossible to pay income to participants if:

- The Criminal Code has not been paid or has not been paid in full.

- The legal entity has signs of bankruptcy.

- Dividends already declared for payment have not been paid or have not been paid in full.

- Shares or shares for which there is a redemption requirement have not been repurchased.

Legal basis

The legal basis for reflecting business facts is Law 402-FZ “On Accounting” dated December 6, 2011. The normative act establishes the general principles of reporting. All participants in business transactions are required to follow its provisions. The nuances of registration related to the organizational structure are regulated by the provisions of Federal Law-14 “On LLC” dated 02/08/98.

Orders of the Ministry of Finance, letters from the tax service, instructions from Rosstat, the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation are of great importance. The same departments approve unified forms of documents. Basic accounting principles are listed in the fifth paragraph of PBU 1/2008:

- Property separation. The assets of the enterprise are not the property of the founders. The owners are liable for the obligations of the company to the extent of their contributions. Exceptions are cases of deliberately bringing a company to a state of financial insolvency (Article 3 of Law 14-FZ).

- Continuity of recording economic facts. Accounting is maintained from the moment of establishment of the company until its exclusion from the state register (official liquidation).

- Clear sequence. Transactions and business events are reflected by accrual (clause 5 of PBU 1/2008). What is key is the date the obligation arose, not the actual settlement. The cash method is used in tax accounting, but not in accounting.

We should not forget about precedents. The positions of the Supreme and Constitutional Courts of Russia are regularly published in open sources. The clarifications provide guidance in bridging legal gaps.

Documents and entries for reducing the authorized capital of LLC

Bank statement on current account 07, 08–4, 08-5 75-1 Received equipment, fixed assets, intangible assets with an increase in the authorized capital. Constituent documents, No. OS-14 “Act of acceptance (receipt) of equipment.” 10, 41 75-1 Inventories were received with an increase in the authorized capital. No. M-4 “Receipt order”, No. MX-1 “Act of acceptance and transfer of inventory items for storage.” Documents and entries for reducing the authorized capital of LLC Management Company.

- The owners made this decision.

Increase the authorized capital

First of all, why might it be necessary to increase the authorized capital of an LLC? There may be several reasons for this:

- Lack of working capital

. In this case, when increasing the MC (authorized capital), the funds contributed to the MC can be spent on financial and economic needs, in addition, these contributions will not be subject to taxation (VAT, income tax, etc.). - Availability of a regulated minimum size of the charter capital.

In a number of cases, the minimum size of the capital company is legally established, and the right to obtain certain permits and licenses depends on compliance with this condition. It is worth noting that the maximum size of the capital is not regulated by law. - The emergence of a new participant in the LLC.

Of course, there are a number of conditions to carry out this procedure:

- All participants must fully repay the debt on their shares in the management company.

- The amount of funds by which the capital stock is increased should not exceed the difference between the amount of the capital stock, the Reserve Fund and the value of the LLC’s net assets.

- Net assets at the end of the second and all subsequent years of the enterprise’s activity should not be less than the authorized capital.

- Net assets at the end of the second and all subsequent years of activity should not be less than the minimum size of the capital company, regulated by law at the time of registration of the LLC.

If these conditions are met, you should proceed to the next step - choosing a way to achieve the goal.

Ways to increase authorized capital

There are a number of ways to increase the authorized capital of an LLC:

- using LLC property;

- using the investment of additional funds by participants;

- using third party investments.

When deciding to increase the capital using the property of the LLC, it is necessary to reflect this in the Minutes of the General Meeting or the Decision of the sole participant. If there is more than one member in the LLC, the majority of members must decide on this action by voting at the General Meeting. This decision should be based on the financial statements for the previous year.

When increasing the capital due to additional contributions from the participants themselves, this decision must be made by a majority vote at the General Meeting and reflected in the Minutes. If there is only one member in the LLC, the decision is formalized by the Decision of the sole participant.

In both documents it is necessary to indicate data regarding the total amount of additional contributions and the ratio of the size of the additional contribution and the amount of increase in the nominal value of its share, common for all participants.

Increasing the authorized capital with the attraction of third-party investments is most often relevant when a new member is accepted into the LLC or the composition is completely changed. Thus, the person wishing to join the LLC becomes an investor. First of all, those who wish to join the participants submit a corresponding application, indicating the size of their share and contribution. If the consideration of the application is positive, the LLC participants formalize their decision in the Protocol, after which the agreed additional contribution must be made to the management company within six months.

Postings of authorized capital

Articles on the topic

If the owners invest funds in the activities of the organization, it is important to correctly reflect all transactions in accounting. Read about accounting entries for authorized capital in this article.

Authorized capital is the funds and property of the founders aimed at ensuring the start-up activities of the organization. These assets ensure the interests of creditors in the event of bankruptcy of the company, as well as in the distribution of profits. The volume of initial investments is determined by the owners and is enshrined in the constituent documents. In the future, additional investments in a legal entity are possible, which are registered with the Federal Tax Service.

Basic accounting entries for authorized capital

Accounting for the authorized capital is carried out using account 80. The loan balance must be equal to the volume of investments specified in the organization's charter. Any movements are possible only with additions or changes to the company’s charter.

The following analytics are used in accounting: founders, stages of formation and types of shares. The last two analysts are necessary for accounting in joint stock companies.

They plan to change the chart of accounts. The Ministry of Finance reported this to the UNP newspaper.

Contribution to the authorized capital: postings

The first entry in a new organization is the accrual of debt for payment of the authorized capital:

The basis for making this entry is the charter, as well as an extract from the Unified State Register of Legal Entities. The entry on balance sheet accounts is reflected on the date of registration of the company with the Federal Tax Service.

- When forming an LLC, the posting amount is equal to the full value of capital specified in the articles of association.

- In joint-stock companies, the debt for payment of issued shares is initially shown.

On account 75 it is necessary to show transactions with investors for the transfer of funds and property to the initial capital, as well as for calculations related to the payment of net profit from the activities of a legal entity.

The debit balance must be equal to the amount of unpaid shares. Founders of legal entities can be both individuals and legal entities. The transfer of cash and other property is shown on the credit of account 75 in correspondence with the asset accounts. A very common form is cash to a current account or to a cash desk:

| Debit | Credit | Business transaction |

| 50 | 75 | depositing cash through a cash register |

| 51, 52, 55 | 75 | payment by bank transfer or special account |

Procedure for reducing the authorized capital

The following procedure for reducing the amount of capital is relevant:

- Convening a meeting of participants.

- Sending notification of changes to the tax office . It must be sent within three days after the meeting at which the relevant decision was made. The notification is drawn up in form P14002. The director signs the application.

- Sending notices to creditors . The announcement of changes is published in the State Registration Bulletin.

- Submitting papers to the Federal Tax Service to register the reduction . The Inspectorate of the Federal Tax Service is provided with the minutes of the meeting, the new Charter of the organization, a receipt for payment of the fee, a statement of changes, and the journal “Bulletin” in which the corresponding announcement was published. In the event that the procedure is carried out due to the ratio of the capital and net assets, you must also submit a calculation of the value of the assets.

- Receiving documents on changes in capital . The new charter and extract from the Unified State Register of Legal Entities are provided by the tax office within 5 days.

The procedure is quite simple, but it is important to follow all the nuances. You cannot skip items, otherwise the changes will be considered illegal.