Accounting and reporting

Home articles Accounting and reporting

01/06/2021 print

The procedure for conducting cash transactions, initially approved by Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, has changed since November 30, 2020. By the beginning of 2021, all organizations and individual entrepreneurs are required to conduct cash transactions, taking into account the changes introduced by the Directive of the Bank of Russia dated October 5, 2020 No. 5587-U. The rules for issuing old banknotes, issuing cash on account, maintaining the cash book of the OP and depositing salaries have changed.

New rules for conducting cash transactions are mandatory for all organizations and individual entrepreneurs, including those who maintain simplified accounting.

Document:

Directive No. 5587-U dated 10/05/2020

Who is covered by the procedure for conducting cash transactions?

By order of the Central Bank of the Russian Federation, new rules for conducting cash transactions were introduced. At the same time, the forms for maintaining cash documents have not undergone any changes.

The changes will most affect individual entrepreneurs. And, despite the fact that individual entrepreneurs will have to change their usual mode of operation, for them this will more than pay off by simplifying cash transactions.

In addition to individual entrepreneurs, the changes will affect enterprises and organizations. In particular, innovations will affect accounting.

It is very important that individual entrepreneurs promptly familiarize themselves with the updated rules for conducting cash transactions in order to avoid penalties.

What to do if the cash register malfunctions

Many users of online cash registers encountered a massive outage on December 20, 2017. As a result of uncertainty about how to work in such a situation and fear of penalties, many retail outlets throughout the country were forced to close. As a result, the Federal Tax Service urgently issued a clarification in which it explained the procedure for action in the event of a massive technical failure in the operation of the cash register (letter dated December 20, 2017 No. ED-4-20/25867). It concluded that institutions can continue to operate in this case without the use of cash registers; in this case, there will be no penalties. After the system is restored to working order, the user is required to generate a correction cash receipt, which must reflect the total amount of revenue unaccounted for by cash register.

How not to violate cash discipline if the only cash register that the company uses in its activities breaks down? If the CCP breaks down, the organization has the right to conduct business without using it. In this case, the buyer is given a paper document confirming the fact of payment (for example, a sales receipt). Immediately after eliminating the breakdown, in order to avoid a fine, it is necessary (clause 14.5 of the Code of Administrative Offenses of the Russian Federation):

- generate a correction check for each operation;

- report the situation in writing, indicating information about each correction check created.

It is very important to follow the procedure before the Federal Tax Service finds out about a breakdown as a result of an inspection. Only in this case penalties will not be applied. In order not to find yourself in a situation where it is impossible to work if the cash register is broken, the tax authorities suggest purchasing a spare cash register (letter No. ED-4-20/24899).

Organization and management of cash transactions in 2018

As noted above, from June 2014 a new procedure for conducting cash transactions was introduced. This order can be divided into two parts:

- Regular (for legal entities, except banks).

- Simplified (for individual entrepreneurs and small businesses).

Cash transactions can only be carried out at the cash register. The person responsible for carrying out such operations is the cashier. If the company has several cashiers, then a senior cashier is appointed.

The head of the organization or an individual entrepreneur has the right to conduct cash transactions personally.

The accountant (chief accountant) signs cash documents. If there is no accountant at the enterprise, documents are signed by the cashier and the manager.

Cash transactions carried out personally by the head of the enterprise do not require additional signatures.

Since 2015, it is allowed to conduct cash transactions using software and hardware.

Changes have occurred in the management of cash transactions in separate divisions. A separate division should be understood as any division of the company (at the location of which there is at least one equipped workplace).

For such divisions, a cash balance limit and maintaining their own cash book have been introduced. The cash book sheets are now in one copy. They do not need to be returned the next day to the main office.

Cash documents in 2021

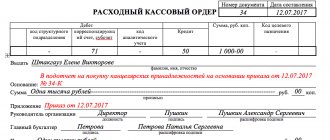

There were no significant changes in the field of cash documents. The cash book, receipt and expenditure orders, as well as statements have not changed. All previously unified forms continue to be used. These documents should be filled out taking into account innovations.

Individual entrepreneurs, in accordance with the new procedure for conducting cash transactions, are exempt from maintaining the following list of documents:

- cash book;

- cash receipt orders;

- expense cash orders.

Individual entrepreneurs keep tax records of income and physical indicators that characterize their type of activity.

To maintain cash documentation, you can now choose electronic or paper media.

An incoming accountant (an individual who works under a service agreement) has the right to draw up cash documents.

Separate divisions of the enterprise now transfer cash book sheets in a new way. A copy of the book sheet (which is certified by the head of the unit) is transferred in the manner established by the legal entity itself. That is, cash book sheets can be submitted once a year - when preparing financial or accounting statements.

Errors in cash documents (on paper) can now be corrected, with the exception of incoming and outgoing cash orders.

The main innovations are as follows:

- It is allowed to maintain cash documentation in electronic form using an electronic signature;

- paper copies of the cash book and orders (receipt and expense) are not required if electronic documents are available;

- It is impossible to correct errors in electronic documents (a signed document with an error is deleted and a new one is filled out in its place);

- the second sheet of the cash book is no longer relevant;

- a single receipt order can now be issued on a strict reporting form;

- The manager’s own record of terms and amounts is not required;

- there is no register of deposited amounts (but this column is retained in salary slips);

- the recipient can enter the amount in words on the expense order;

- the cash book is not filled out if no cash payments were made on any day.

The cashier puts a stamp and his signature on the receipt for the cash receipt order. Cashiers can now transfer money without a debit order based on the cash ledger.

The cashier's obligation to require a passport from the recipient of funds has been eliminated

Previously, the cashier had to request a passport from the recipient of funds, and, if necessary, a power of attorney. If a proxy received the salary instead of the employee, the entry “By proxy” had to be made in the payroll or payroll sheet before his signature. The cashier attached the power of attorney to the cash receipt or payroll slip.

After the changes are made, the cashier must ensure that he is issuing money to the person indicated on the cash receipt order or payroll. The requirement to request a passport and power of attorney has been removed. But it is safer to still require these documents. Otherwise there is a risk of disputes. For example, if the recipient states that he was not given funds.

Cash balance limit in 2021

In 2015, the cash balance limit was changed. The new formula for calculating the cash limit is not tied to cash receipts. The organization has the right to make calculations based on the amount of expenses or revenue.

The cash limit is mandatory, except for small and micro enterprises. It establishes the amount of funds that can be freely stored in the cash register. Enterprises and organizations have the right to personally introduce a certain limit. If the limit has not been entered, it is considered zero. The entire remaining amount is deposited into the bank account at the end of the day.

The formula for calculating the cash limit is regulated by the new regulation. An enterprise can choose one of two proposed calculation formulas:

- The calculation is made based on cash proceeds (receipts from goods, services, etc.).

- The calculation is made based on the amount of funds issued.

If there are separate divisions, the total cash limit is determined taking into account the limit established for the division.

That is, the amount of the limit can be distributed among separate divisions.

The cash limit of a separate division is established by a responsible administrative document.

The first formula for calculating the cash limit looks like this:

L = V / P x Nc , where: L - limit in rubles; V is the volume of revenue in cash; P - billing period, the number of working days for which the volume of cash receipts is recorded (but not more than 92 working days for legal entities). Nc - the period of time between depositing proceeds to the bank: 1–7 working days (if there is no bank nearby, up to 14 days).

The second formula for calculating the cash limit is L = R / P x Nc , where:

R is the volume of cash disbursement (excluding the amounts of salaries, stipends or other payments to employees).

What you should not spend cash on

Quite often, store owners or accountants have a question about what expense items can be spent on cash proceeds from the cash register.

First, let's look at what an entrepreneur has the right to spend cash proceeds on:

- Payment of wages to employees;

- Expenses for scholarships;

- Issuance of travel expenses to accountable persons;

- Any other payments to persons who are accountable;

- Expenses on goods or services (except for payment for securities);

- Insurance payments;

- Payment for returned goods;

- Issuance of funds for services/work not provided;

- Issuance of funds for the consumer needs of the owner of the organization, if these needs are classified as personal;

- Payments to the paying agent when carrying out banking transactions.

The list of expense items on which an entrepreneur cannot spend cash from the enterprise’s cash desk includes much fewer items, but their compliance is strictly mandatory:

- Rent;

- Interest on loans, as well as the issuance or repayment of the loans themselves;

- Any manipulation with securities;

- Costs of organizing games from the gambling category.

If an entrepreneur needs to make one of the above payments, the funds will need to be withdrawn from the organization’s current account.

Cash limit for small and micro enterprises

The instruction of the Bank of the Russian Federation No. 320-U dated March 11, 2014 states that all small and micro enterprises are exempt from the mandatory establishment of a cash limit. This means that these types of enterprises have the right to keep any amounts in the cash register.

The criteria for classification as micro and small enterprises are as follows:

For micro-enterprises:

- income limits on the tax return for the previous year - 120 million;

- The average number of employees for the previous year was 15 people.

For small businesses:

- income limits on the tax return for the previous year - 800 million;

- the average number of employees for the previous year was 100 people.

According to these criteria, individual entrepreneurs are classified as micro or small enterprises, therefore, it is not necessary for individual entrepreneurs to introduce a cash limit.

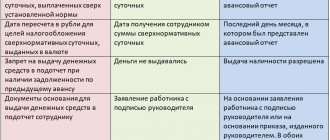

Issuing money from the cash register for reporting

Accountable persons are employees who are given money from the company's cash register to pay for any production services or purchase goods for internal needs. Since August 19, 2017, money against the report is issued to the employee on the basis of an internal document. Moreover, the form and name of this document are not regulated in any way by the Central Bank. Those. it must be drawn up in any form, indicating in it, in accordance with clause 6.3 of the Bank of Russia Directives dated March 11, 2014, as amended, the following data:

- Full name of the person to whom the cash is issued;

- amount of cash;

- the period for which cash is issued;

- manager's signature and date.

Until August 19, 2017, money should have been issued only on the basis of an employee’s application.

The article was edited in accordance with current legislation 06/04/2018

How is cash discipline checked?

Cash discipline is checked as part of on-site activities of the tax service.

The main aspects that the Federal Tax Service pays attention to:

- Algorithm for posting revenue, availability of uncapitalized funds;

- Compliance with the cash limit;

- Condition, serviceability and availability in the state. online cash register register;

- Compliance of cash documents with actual amounts;

- The fact of issuance/non-issuance of cash receipts to customers;

- The presence of large amounts issued on account for unreasonably long periods, etc.

This might also be useful:

- Online cash registers in 2021

- Taxpayer personal account Nalog.ru

- Chart of Accounts 2019

- What an individual entrepreneur needs to know about auditing cash transactions

- Cash discipline for individual entrepreneurs in 2021

- How can an individual entrepreneur keep accounting records?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

New rules for using CCP

In 2021, the procedure for using cash register equipment, approved by Federal Law No. 54-FZ of May 22, 2003 (as amended on July 3, 2016), is in effect. Recent changes have affected not only the rules for registering cash register devices with the tax office, but also the procedure for using online cash registers.

Organizations using CCPs should not provide the device to the inspection for registration or changes. All actions can be carried out through your personal account on the website of the Federal Tax Service of Russia. In addition, all information about calculations will be automatically transmitted to tax authorities through fiscal data operators.

Innovations will improve the financial efficiency of using cash register systems, reduce the cost of maintenance and re-registration of equipment, and reduce the risk of financial fraud. The changes are aimed at increasing the transparency of payments made in cash, as well as reducing the number of tax audits.