» Managing individual entrepreneurs » Salary

If an individual entrepreneur uses hired employees, then he must pay for their work. It is only at first glance that everything is simple. In fact, there are many nuances that you should know about the payroll process. All of them are established by the laws of the Russian Federation, the Labor Code.

- 2 Payment dates

- 3 How to calculate the advance amount?

- 4 Payment methods

4.1 Payment of wages in cash through the cash register

- 4.2 Paying salaries to bank cards

Basic rules for paying salaries

An employee has the right to timely receipt of wages in full (Part 1, Article 21 of the Labor Code of the Russian Federation). Wages are paid to the employee at the place of work or by transfer using the details of an individual’s current account with a credit institution (Article 136 of the Labor Code of the Russian Federation). The conditions for receiving wages are specified in the employment or collective agreement.

An employee can also change the bank at any time to the one in which he wishes to receive wages. To do this, you need to contact your employer with an application (at least 5 working days before the payday).

Is it possible to receive salary in cash and not on a card?

According to the regulations of the Ministry of Labor of the Russian Federation, the employer is not authorized to issue wages to subordinates exclusively to a bank account or card. Purely theoretically, it is possible to receive wages in cash. But in practice the situation is fraught with a number of difficulties.

We recommend reading: Procedure for paying wages to a card.

Payroll is issued from the cash register according to the same rules as for non-cash payments:

- The interval between the advance and the main payment should not exceed 15 calendar days.

- The salary and incentive payments remain the same - the employer does not have the right to pay a smaller amount for non-cash payments.

- If the payday falls on a weekend or public holiday, the money must be transferred to the employee the day before.

- In any case, the employer is obliged to regularly pay the work of his subordinates; the form of payment of funds does not matter at all.

To issue wages in cash, an enterprise or individual entrepreneur must have a cash register.

The employer is obliged to pay the employee in cash if the latter does not have the opportunity to receive money by bank transfer.

An additional condition is that workers must be officially employed. Otherwise, issuing money “in an envelope” is a direct violation of the Labor Code of the Russian Federation on the part of the employer.

In some cases, non-monetary payment in kind is also possible - read more here.

Can an employer refuse to pay from the cash register?

Since 2021, a document has come into force prohibiting the issuance of cash to employees of budgetary and government organizations and production facilities. Transfer of funds is carried out using federal payment systems and banking organizations.

In other cases, an employer is prohibited from refusing to pay wages in cash to citizens of the Russian Federation, but judicial practice states that asking for wages to be paid at the cash desk is much more difficult.

If an employee entered into an employment contract that specified the transfer of wages to a bank card, then it is very difficult to make changes to the employment contract. If an organization allows you to receive “cash” from the cash register, this should be stipulated in a separate clause in the employment or collective agreement.

If the employee did not sign the application to transfer the salary to the bank, and this is not reflected in the collective/employment agreement, then the employer does not have the right to prohibit the employee from issuing cash. If an organization closes a cash register, it is automatically required to connect non-cash payments.

In practice, it is more profitable for an employer to make payments by bank transfer, because it is faster and easier to organize, and there is no need to pay a commission for withdrawing funds. And since cashing out costs should not affect employees, the organization will have to spend more money, which is definitely disadvantageous for the employer.

On the basis of what documents is payment paid?

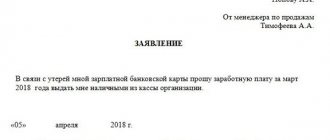

To start receiving a salary in cash, an employee must write an application and make adjustments to the employment contract.

Applications for payment of wages in cash can be found here.

If the enterprise has a cash register and an employee performing the functions of an accountant, you can receive wages according to statements.

Documentary base that allows you to receive wages from the cash register:

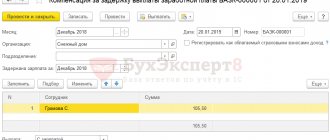

- pay slips (form No. T-53);

- payroll statements (form No. T-49);

- expense cash orders (form No. KO-2).

The documentation should indicate the name of the company, division, terms and amounts of payments, paid period, number and date of preparation of the statement. Documents must be certified by the personal signatures of the head of the enterprise and the chief accountant.

The statement (second page) must include personnel numbers and names of employees, compiled into a single table. Funds are issued exclusively in domestic currency. When receiving money at the cash desk, employees will attest to the process with signatures.

Entry in accounting for payment of wages from the cash register - Dt 70 Kt 50.

Deadlines for issuing money to employees

When issuing money, employees are identified by their passport. If an employee receives someone else’s salary by proxy, the statement must indicate both the employee and the proxy receiving the salary for the former.

It is important that when issuing, the employee must count the money in the presence of the cashier before signing the statement or “calculation”.

When issuing wages according to statements, the cashier is required to indicate the amount transferred and the fact of full or partial payment of funds to employees. If the established period for issuance has come to an end, the cashier indicates the payment amount against his signature and gives the statement to the accountant for verification.

The validity period of the statement is determined by the management of the organization, but no more than 5 working days, including the day of cashing out at the bank, according to the instructions of the Central Bank. Consequently, the first day is considered the date of the local act of issuing wages, and the end of this period falls on the fifth day after the start of cash payments to employees.

It is extremely important to summarize the results of the payment of wages. So, if after issuing money (taking into account the deposited salary) the amount of funds exceeds the cash limits, the organization is obliged to hand over the excess to the bank on the same day.

Who should not be paid in cash?

Labor legislation of the Russian Federation prohibits the payment of wages in cash to foreign citizens and stateless persons, even if they are employed under an official employment contract. The employer is obliged to pay foreigners only by non-cash form.

As mentioned above, issuing “cash” to public sector employees is prohibited. This is regulated by the amendment of July 1, 2021 to Federal Law No. 161-FZ “On National Currency”, according to which employees of budgetary and government services should receive salaries only by bank transfer and through bank cards of the Mir system. This completed the next stage of transferring the organization to the main national payment system.

Penalties for payments to foreign workers

By paying cash to a foreign citizen, the employer violates Russian legislation in the field of foreign exchange turnover.

of 75% to 100% of the amount issued as punishment .

Punishment for violation of currency legislation also threatens for inaction of a person. Therefore, enterprise employees and accounting departments must act preventively and inform the relevant authorities about management’s intention to pay a salary in cash to a foreign citizen.

Can an employee claim payment of wages in cash?

The Constitutional Court of the Russian Federation, in its Determination No. 769-o dated April 26, 2016, explained that in Part 3 of Art. 136 of the Labor Code of the Russian Federation spells out guarantees for each employee, according to which the implementation of other articles of the Code is possible (Articles 2, 21, 22, 56). The employee can count with full confidence that all his work will be paid, regardless of the employer’s financial problems or other circumstances.

This article of the Labor Code of the Russian Federation is aimed at providing the opportunity for the employee and the employer to come to some agreement that will take into account the interests of both parties, based on the current labor legislation. That is, the employee must agree with the manager to change the form of payment for his work.

Legal platform

The regulation of the question of how to receive money in cash or on a bank card is found in the field of regulations and provisions on the payment of wages in the Russian Federation:

- Article 131 of the Labor Code of the Russian Federation determines the forms of payments;

- Article 136 of the same code establishes the procedure for issuing money by the employer;

- Federal Law 161 of December 10, 2003 regulates the accounting, conduct and procedure of currency transactions.

These are the main documents valid throughout Russia. This issue can be regulated with the help of additionally adopted legal acts that consider the characteristics of the activity, region or industry.

The Russian employer is obliged first of all to study these documents, since the punishment for violations in the field of remuneration is becoming more stringent from year to year.

The employees themselves should do the same in order to better study their own rights and monitor their compliance.

How to change non-cash salary payments to cash

Transferring wages to employees under a salary project undoubtedly provides certain bonuses to the employer from the credit institution. However, the employee also has the right to assert his own rights.

It is worth drawing up an application in the form of a free-form petition addressed to the director of the enterprise, indicating the form of cash payment in which the employee wishes to receive the money earned. The application must refer to Art. 136.

There is no need to demand in the application: after all, the law in this case obliges the employee to negotiate with the employer.

Permission from Rostrud

By 2021, employers received permission from Rostrud to receive wages in cash. The official statement states that employees independently choose the method of receiving salary.

Using a card has many serious advantages, but it does not always suit a particular person:

- older people are afraid of not being able to cope with modern technology;

- residents of certain areas often do not have the opportunity to make payments by card or receive cash from an ATM;

- in cases of damage or loss of a card or PIN code, the employee may be left without a livelihood.

In order to receive money in hand, the employee is required to draw up an application addressed to the chief accountant, which must be endorsed by the manager. An employer has no right to force a person to receive money through a card.

If an employee decides to change the form of receiving salary, you need to contact the accounting department to change the terms of the contract. This is also done by drawing up an application.

Arbitrage practice

In judicial practice, on claims of dissatisfied employees, judges quite often refuse to receive wages in cash (Decision of the Moscow City Court dated November 12, 2018 in case No. 33-48833/2018, appeal Determination of the Judicial Collegium for Civil Cases of the Kirov Regional Court dated April 25, 2017 to case No. 33-1671/2017, appeal Ruling of the Judicial Collegium for Civil Cases of the Krasnodar Regional Court dated 02/11/2014 in case No. 33-2765/14).

When making such decisions, the judicial authorities accept the position of the employer and are based on the fact that Part 2 of Art. 136 of the Labor Code of the Russian Federation only allows you to change the bank from which you can receive money, if the employment contract does not provide for another form of remuneration.

Payment methods

Each individual entrepreneur has the right to pay employees’ wages using the following methods:

- in cash by issuing it from the cash register;

- non-cash transfer to specified bank accounts;

- payment of wages in kind, but not more than 20%.

The methods chosen must be specified in the employment contract.

Payment of wages in cash through the cash register

In order to give an employee money in cash, you can use the following forms of documents:

- T-53 - payroll form, which indicates the details of employees and the amounts to be paid;

- T-49 - payroll form, which contains data, as in the T-53 form, but in addition it also contains information on payroll calculations by staff units;

- KO-2 is a form of cash receipt order that carries out the actual payment of funds.

The last document is drawn up in any case for cash withdrawal:

- with a small number of employees, it is better to issue an issue with filling out the cash register for each;

- if the staff is quite large, then individual data is indicated in the salary payment slips, and after receipt, one general cash settlement is drawn up.

This greatly simplifies the issuance to those cashiers and accountants whose enterprise employs more than a dozen, or even hundreds, of employees. Also, the ability to generalize cash settlements reduces the risk of errors in cash documents.

Paying salaries to bank cards

To pay wages in this way, it is necessary to clarify all the rules for such transfers in the collective and labor agreements. Today this is one of the most commonly used payment methods.

The scheme of such non-cash salary transfer includes several stages:

- conclusion of an agreement between an individual entrepreneur and a banking institution on the issuance and servicing of salary cards;

- The individual entrepreneur issues a payment order for the entire amount of wages;

- The individual entrepreneur generates a statement indicating the data of the employees and the amounts due to him;

- the bank distributes the amounts to employees according to statements prepared by the entrepreneur.

To make transfers to bank cards, you must follow the procedure for paying wages:

- transfers can only be made with the consent of the employee and to the details specified by him;

- the employee chooses the banking institution himself, the individual entrepreneur can only offer his own options;

- To change the bank to receive a salary, an employee simply needs to submit an application to change the details no later than 5 days before payment, in order to have time to open an account for the individual entrepreneur and the employee in a new financial organization.

If an employee requests payment of wages in cash upon employment

An employee has the right to receive wages in cash by default if he has not previously received any applications for the transfer of earned funds. The employer does not have the right to refuse payment in cash (Part 1, Article 21 of the Labor Code of the Russian Federation, Part 3, Article 136 of the Labor Code of the Russian Federation). Since the Labor Code of the Russian Federation guarantees the employee timely payment of labor in a way convenient for him, the right to choose this method remains with him.

That is, if an employee initially aims to receive a salary in cash, he should not fill out an application for the transfer of funds under the salary project provided for in the organization. If there is no application from the employee, there is no permission to open a salary account for him.

An exception is if the employer liquidated the cash register as such.