What are the types of settlements with counterparties?

The section VI of the Ministry of Finance Order No. 94n dated October 31, 2000 is intended for accounting of settlements. The accounts of this section account for settlements with the following persons:

- Company suppliers and contractors (60).

- Buyers and customers (62).

- Lenders and borrowers (66, 67).

- Budget (68).

- FSS (69).

- Personnel in terms of remuneration (70).

- Reportable employees of the company (71).

- Personnel for other types of operations (73).

- Founders of the company (75).

- Other creditors and debtors (76).

- Company divisions (79).

Most of these accounts are classified as active-passive, some are classified as passive. If an account is active-passive, it can have both a debit and a credit balance. For example, count. 60 reflects settlements with the company’s suppliers. When goods are received, accounts payable increases; when payments under contracts are transferred, accounts receivable increases. Depending on where the turnover is greater, a balance is formed.

When keeping records with counterparties, it is important to have an accurate idea not only of the total indicators of obligations, but also in the context of analytical data. The company decides on its own how to organize the detailing. Typically, analytics is carried out by types of counterparties, contracts, advances, settlement documents, bills of exchange (account 60 and 62), claims (account 76.2), insurance contracts (account 76.1), etc. The following are the entries for accounting for settlements with counterparties on the account. 60, 62, 76.

Note! According to the account 76, entries are made about settlements with other counterparties, that is, those that are not included in the account. 60 and 62. For example, these are settlements under insurance contracts (personal and property), recognized and presented claims, amounts of dividends due to the company, deposited salaries, VAT on advances, etc.

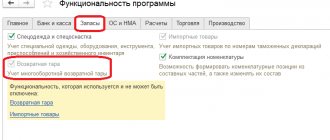

Item accounting accounts in 1C 8.3

If in the Chart of Accounts of the 1C 8.3 program you specify a search for accounts on which the item is taken into account:

then we will see a fairly large number of accounting accounts for services, goods, materials, products, fuel:

Setting up item accounting accounts

For most of these accounts, the formation of transactions in 1C 8.3 is configured automatically when you first start the program. Let's look at these accounts by selecting the Item Accounts command in the Items directory:

Let's figure out how to set the required accounting account in the 1C 8.3 program. Let's go to the Directories:

Let's create a new element Fittings (material) in the Nomenclature directory:

Let's see which accounting accounts this element will be reflected in the documents. To do this, select the Rules for determining accounting accounts command:

Let's check by generating the Goods Receipt document:

Let's look at the postings according to this document - the DtKt button:

Now let’s change the item type in the Fittings element and select the Products type:

Let's look at the Rules for determining accounting accounts in 1C 8.3. Now the main accounting account has become account 41 “Goods”. Thus, when creating a new element in the Nomenclature directory, the defining attribute is Item Type:

Setting up the mechanism for generating transactions for operations with items

To add new settings for the mechanism for generating transactions for operations with items in 1C 8.3, you need to go to the corresponding directory by clicking on the Item Accounting Accounts link and select the Create command. In the dialog box that appears, fill in the required information:

What to pay attention to. If, when entering a new element, the item type is not defined:

then transactions for transactions with this element will be generated in accordance with the settings of the Goods element:

since the 1C 8.3 program automatically substitutes this particular type of nomenclature:

How to establish a relationship between the Nomenclature directory and item accounting accounts so that the primary documents are filled out correctly, that is, the item accounting account is automatically entered correctly in 1C 8.2 - see our video:

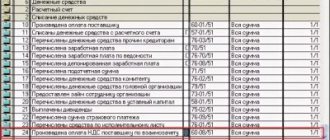

Accounting for settlements with counterparties – postings:

- D 08 (07, 41, 10) K 60.1 – the organization received fixed assets (equipment, goods, materials) from the supplier.

- D 20 (26, 25, 23, 44, 91) K 60.1 – various services were provided by suppliers, work was performed.

- D 19 K 60.1 – allocated according to the VAT invoice.

- D 60.1 K 51 – funds were transferred to the supplier under the contract.

- D 60.2 K 51 – advance payment is transferred (for settlements on prepayment terms).

- D 60.1 K 60.2 – advance payment is credited after receipt of goods from the supplier, provision of services or performance of work.

- D 62.1 K 90 – products were shipped to customers.

- D 90 K 68.2 – VAT is charged on the sales amount.

- D 51 K 62.1 – payment for goods was received from the buyer to the personal account.

- D 51 K 62.2 – an advance was received from the buyer (for settlements on prepayment terms).

- D 62.2 K 62.1 – advance payment after shipment is credited.

- D 76.AV K 68.2 – reflects the accrual of VAT on the advance received.

- D 68.2 K 76.AB - the previously accrued amount of VAT was accepted by the company for deduction.

- D 68.2 K 76.VA – tax is deducted from the amount of the advance payment.

- D 76.VA K 68.2 – VAT has been restored from the previously issued advance amount.

- D 76.2 K 60 – the amount of the claim arising due to the fault of the supplier is reflected.

- D 51 K 76.2 – funds were received to pay off the claim.

- D 44 (20, 26) K 76.1 – funds under the employee insurance contract are written off for sales (production, general business) expenses.

- D 76.1 K 51 – insurance payment paid from the cash account.

- D 70 K 76.4 – the employer’s records reflect the deposit of staff salaries.

- D 76 K 51 – erroneous debiting of funds from a bank account is reflected.

Accounting entries for VAT: examples

Setting up accounting accounts in 1C ERP

- You must enable the “Financial accounting settings groups” option. This option allows you to reflect liabilities, assets, income and expenses on different accounting accounts. (Master data and Administration – Setting up Master data and sections – Financial results and controlling):

- Previously, users can add the necessary financial accounting groups (Regulated accounting – Settings and reference books – Financial accounting groups – Financial accounting groups for settlements / Financial accounting groups for items):

- When creating a financial accounting group, we set the settings on the basis of which transactions will be generated in the future (example):

- Next, for each element of the Nomenclature directory, its own GFU is set (Master data and administration – Master data – Nomenclature – Open the directory element – Regulated accounting and financial accounting – Financial accounting group). According to this data, postings for materials will be generated in the documents.

- GFCs for settlements with counterparties are specified in the following documents/directories:

- in the settings of agreements with suppliers:

- in contracts (accounting information):

- in the documents Order to supplier/Order to customer:

- in receipt/sales documents (Additional tab):

- After completing the program settings, we can generate transactions in the document. To do this, perform the following steps: Open the document – DT/CT – Reflect in regulatory accounting:

- Group posting of documents and setting up a schedule for automatic posting of documents.

Figure 2 - Financial results and controlling

Figure 3 - Financial accounting groups

Figure 4 — Groups of financial accounting settings

The second option for setting up accounting accounts through the workplace (Regulated accounting – Reflection of regulated accounting documents – Reflection of documents – Accounting accounts – Setting up reflection of documents in regulated accounting):

Figure 5 — Setting up the reflection of documents in regulated accounting

Accordingly, for each financial accounting group (FAG), we can establish our own accounting accounts.

Figure 6 — Directory Nomenclature

Setting up accounting accounts for settlements with counterparties is set in the same way as for materials.

For some business transactions, the settings for reflecting documents in regulated accounting are initially determined by the program.

The program has the ability to set settlement settings for individual counterparties and for each HFC. A “switch” is provided (Setup Mode – Exception):

Figure 7 — Settlement settings for individual counterparties

Figure 8 - Product delivery

Figure 9 — Contract with supplier

Figure 10 — Order to supplier

Figure 11 — Sales of goods and services

Figure 12 — Postings of regulated accounting

This execution of actions makes it possible to manually reflect the document in regulated accounting.

To reflect recorded documents in regulated accounting, we start processing in the section Regulated accounting – Reflection of documents in regulated accounting – Perform reflection:

Figure 13 — Reflection of documents in regulated accounting

Also in the database it is possible to set a schedule for automatically posting documents (in the section Regulated accounting - Reflection of documents in regulated accounting - check the box "Automatic reflection according to schedule" - set the settings):

Figure 14 - Automatic reflection according to schedule

The program contains functionality that performs the operation of reflecting documents in regulated accounting when performing the Month Closing operation.

Figure 15 — Regular operations for closing the month