justice pro...

If in one year you bought an apartment and spent money on treatment, is it possible to receive a social and property deduction at the same time? In the article we will tell you under what conditions a tax deduction is possible for both an apartment and for treatment, what are the differences in the procedure for providing a deduction for medical services and the purchase of an apartment, and whether a tax refund for treatment is possible if you have already reimbursed 13% for the purchase of real estate.

Is it possible to get a tax deduction for an apartment and treatment at the same time?

The law does not establish any obstacles to simultaneously receiving a tax deduction for the purchase of an apartment and treatment. But you should remember that for income of a particular year you will not be able to return more tax than was withheld from your income.

Example 1

In 2021, the taxpayer paid for dental treatment in the amount of 100 thousand rubles. and purchased an apartment worth 3 million rubles. For 2021, the amount of personal income tax withheld was 97,500 rubles

In this case, you can return 13% of the costs for treatment - 13,000 rubles.

For the purchase of an apartment 13 percent of the limit of 2 million rubles. – 260,000 rubles.

The taxpayer will be able to return the income tax withheld for 2021 on expenses for treatment and the purchase of an apartment (he will be able to continue receiving a property deduction in any next year).

How to get social and property deductions at the same time

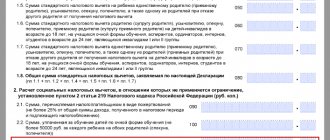

To return the tax for treatment and purchase of an apartment in the corresponding year, you must submit a tax return 3-NDFL (if you are going to receive a deduction through the tax office), which will indicate the costs of treatment and purchase of an apartment. For social and property deductions, the tax return has separate sheets that need to be filled out.

However, if you want to simultaneously receive a tax deduction when purchasing an apartment and when receiving treatment, then you should take into account their differences in the procedure for provision. Let's look at their differences in the following parameters.

Year for which income you can receive a deduction for apartments and treatment:

- a deduction for treatment is provided based on the income of the tax period in which the taxpayer actually incurred expenses to pay for treatment (Letter of the Ministry of Finance of the Russian Federation dated March 20, 2018 N 03-04-05/17128),

- the deduction for the purchase of an apartment is provided for the tax period in which the right to receive it arose, or in subsequent tax periods, regardless of the period when the taxpayer incurred expenses for the purchase of the apartment (Letter of the Federal Tax Service of the Russian Federation dated July 6, 2021 NBS-19-11 / [email protected] ).

Possibility of transferring deductions for treatment when purchasing an apartment to another year:

- the transfer of unused tax deductions for treatment to subsequent tax periods is not provided for in Article 219 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated March 20, 2018 N 03-04-05/17128, Letter of the Federal Tax Service dated August 16, 2012 N ED-4-3/ [ email protected] ). Pensioners will also not be able to transfer the deduction for treatment to previous tax periods (Letter of the Federal Tax Service of the Russian Federation dated January 17, 2012 N ED-3-3 / [email protected] ).

- if during a tax period property tax deductions for expenses on the purchase of real estate and for expenses on repaying mortgage interest cannot be used in full, their balance can be transferred to subsequent tax periods until they are fully used (Clause 9 of Article 220 of the Tax Code of the Russian Federation). Pensioners can transfer the balance of the property deduction to previous tax periods (clause 10 of Article 220 of the Tax Code of the Russian Federation).

Thus, if you paid for treatment, then in the 3-NDFL declaration for the corresponding year, be sure to indicate the costs of paying for medical services, otherwise you may lose the right to this deduction. If, based on the income of the year in which you paid for treatment, you plan to return 13% for the purchase of an apartment, then you should take into account that a property deduction can be obtained on the income of another year, and a deduction for treatment - only on the income of the year in which you paid for medical services.

Example 2

In 2021, the taxpayer paid for expensive treatment in the amount of 300 thousand rubles. (service code 2 in the certificate of payment for medical services) and acquired a share in the apartment (cost 2 million rubles). In the 3-NDFL declaration, he indicated the costs of treatment, as well as the costs of purchasing a share in the apartment. For 2020 income, the taxpayer will receive a deduction for treatment and part of the deduction for the purchase of a share in an apartment (he will be able to continue receiving a property deduction next year).

Is it possible to receive social and property deductions simultaneously in one year?

Tax deduction for apartment and treatment simultaneously through the employer

Is it possible to receive property and social deductions at the same time at work? Yes, such a possibility exists. But we pay attention to the following provisions. The law does not establish a procedure for determining the sequence in which a tax agent provides tax deductions when an individual applies to him for various reasons. And, according to the Federal Tax Service of Russia, if during the tax period the tax agent has several applications from the taxpayer for the provision of various types of tax deductions, the tax agent has the right to provide such tax deductions in any sequence, taking into account the preferences of the taxpayer, while observing the features and restrictions in the amount established by Articles 218, 219 and 220 of the Tax Code (Letter of the Federal Tax Service of the Russian Federation dated June 28, 2017 N BS-4-11/ [email protected] , Letter of the Ministry of Finance of the Russian Federation dated October 11, 2018 N 03-04-05/73034).

Thus, if you plan to receive a tax deduction for treatment and the purchase of an apartment in one year through your employer, then you should inform your accountant that first of all you would like to receive a deduction for medical expenses (since the transfer of the deduction for treatment to subsequent years not provided).

What to do if you have already received a deduction when purchasing an apartment for the year in which you paid for treatment?

If for some reason you did not indicate treatment expenses in the 3-NDFL tax return and received a deduction for an apartment based on the income of the corresponding year, is it possible to submit an updated declaration to return 13% for medical services? Previously, the Ministry of Finance gave an explanation on this issue: “If, according to the tax return submitted by the taxpayer, a property tax deduction was provided and the corresponding amount of personal income tax was returned, the submission of an updated tax return in order to reduce the amount of the property tax deduction and the declaration of the amount of the social tax deduction is not allowed, since the Code does not provide for the possibility of a taxpayer refusing an already received property tax deduction” (Letter of the Ministry of Finance of the Russian Federation dated December 9, 2013 N 03-04-07/53635).

But if you manage to submit an updated 3-NDFL declaration before the tax refund, then you have the right to receive a tax deduction for both the apartment and for treatment. In the updated declaration, it is necessary to declare a social tax deduction for medical services and recalculate the balance of the property tax deduction carried over to the next year.

Please note that letters from the Ministry of Finance are not normative legal acts, therefore, if you have already received a property deduction (you were refunded the income tax of the year when you paid for treatment), regarding clarification of the tax return in order to issue a deduction for medical services, you can contact Your Federal Tax Service.

Tax deduction for apartments and treatment for spouses

If a marriage was registered at the time of payment for medical services, then the other spouse has the right to receive a deduction for medical services provided to one of the spouses. Also, if the apartment was purchased during marriage and no marriage contract was concluded between the spouses, each spouse can apply for a deduction for the purchase of the apartment (subject to the restrictions established by law). You can also take these provisions into account when returning tax when purchasing an apartment and receiving treatment.

Example 3

In 2021, the taxpayer spent 100,000 rubles on treatment. But he did not know about the possibility of returning 13 percent for medical services, so in the declaration for 2021 the taxpayer did not indicate these expenses and, based on income in 2021, continued to receive the balance of the deduction for the apartment that was not used in 2021. In this case, it was decided that the wife would receive a deduction for the treatment provided to the husband - she would file a 3-NDFL declaration for 2021 and return 13% of the funds spent.

You have the right to simultaneously claim a tax deduction for both the apartment and the treatment. In this case, first you will receive a social deduction, and then a property one. To get a tax refund for an apartment and treatment at the same time, you can submit a 3rd personal income tax return, which will indicate the costs of paying for medical services and purchasing an apartment.

Posted by:

Ralenko Anton Andreevich

Moscow 2020

Who is eligible for the deduction?

Only a tax resident of the Russian Federation can receive a property deduction: a person who lives in the country for at least 183 days a year. The apartment for which the deduction is received must also be located in Russia.

Being a resident is not enough. It is important to officially work and pay income tax (NDFL) at a rate of 13%.

It will not be possible to receive more than you gave to the state: the amount is calculated based on taxable income and the cost of the apartment.

Expenses that are taken into account when calculating the deduction:

- purchasing an apartment or a share in it, including a house under construction;

- finishing the apartment and preparing an estimate for finishing work, if it was purchased under a contract without finishing;

- purchase of finishing materials.

If the apartment was purchased with a mortgage , you can additionally reimburse 13% of the amount of interest on the loan that the person paid to the bank. If you purchased an apartment after 2014, the limit for such a deduction is 3 million rubles (Article 220, clause 3.11 of the Tax Code of the Russian Federation).

You will only be able to receive a deduction for mortgage interest expenses for one property. If a person buys an apartment with a mortgage, and after a while - another one, he will receive an interest deduction only for the first or the second.

You can receive a deduction on interest even if the mortgage has not yet been completely closed. You will be able to return 13% of the interest paid.

If spouses bought an apartment together, both have the right to receive a deduction. The husband and wife decide for themselves how much they will claim, and the size of the share of the co-owners is not important. It doesn’t matter who the purchase is registered to, because according to the law, it is their common property.

Each spouse is entitled to a deduction of up to 2 million rubles. The decision of the spouses is recorded on paper in the form of an agreement. It will not be possible to revise this agreement, so it is better to weigh everything in advance (Letter from the Federal Tax Service dated November 14, 2017).

Distribution of deductions between spouses

The Grachev family bought an apartment for 2.5 million.

They decided among themselves that the spouse would exhaust the 2 million limit, and the spouse would receive a deduction of half a million. Thus, 260 thousand rubles will be returned to the husband, and 65 thousand rubles to the wife. The spouse will transfer the remaining deduction of 1.5 million to another apartment that they will buy in the future. The right to transfer the deduction to other objects appeared after 2004. It applies to real estate acquired since January 1, 2004.

Before 2004, the property deduction was available for only one piece of real estate. Now this limit does not apply: the money will be returned every year until the limit is used up. The main thing is that the grounds for this are preserved: the person remains a resident of the country, pays tax at a rate of 13% and annually submits the necessary documents to the tax office.

The right to a property deduction is granted once in a lifetime. Illustration by Alina Yorokhova

Procedure and required documents

Property deductions are issued in two ways: independently or through the employer. Let's consider both options.

We get the deduction ourselves

Documents are submitted no earlier than the next year after purchasing the apartment. This can be done in person at the tax office at the place of registration, through the taxpayer’s personal account, or sent by mail.

Required documents:

- copy of the passport;

- certificate in form 2-NDFL;

- apartment purchase agreement;

- acceptance certificate, if the apartment is in a new building;

- certificate of state registration of the right to an apartment or an extract from the Unified State Register of Real Estate;

- confirmation of payment: receipts, bank statements, receipt from the seller, checks;

- a copy of the marriage certificate and a written agreement on the distribution of the deduction, if the apartment was purchased by spouses;

- if the apartment was purchased with a mortgage: loan agreement, interest payment schedule, certificate from the bank confirming interest payment;

- birth certificate of a minor child, if the parents purchased a share for him;

- completed declaration in form 3-NDFL.

There is no need to submit original documents, but it is better to keep them at hand. Some tax authorities require notarized copies, but more often it is enough to attach ordinary ones.

An income certificate can be obtained from the employer or in the taxpayer’s personal account. The tax office will check the documents and make a decision, after which the money will be credited to the account specified in the application. The verification takes up to three months.

We receive a deduction through the employer

It is important to obtain written confirmation of this entitlement before requesting a deduction from your employer. An application to receive a notification is submitted to the tax office at your place of residence. It is written in free form and supported by documents confirming the right to deduct. The list of documents is the same as in the first case, only without the 3-NDFL declaration.

You can submit an application at the tax office or through the taxpayer’s personal account. On average, the review process takes a month. When the tax office makes a positive decision, the person will receive a notification, which, together with the application for a deduction, is sent to the employer.

The notice will confirm to the employer the right to the deduction. The money will be credited along with your salary.

- Sample application for confirmation of the right to deduction

When no deduction is allowed

If the apartment was paid for by the state or work. Budget funds, military mortgages or maternity capital are not suitable for deduction. The person will only get back a portion of their own taxable funds that they invested in the purchase.

If a person pays taxes under a simplified system as an individual entrepreneur and does not pay personal income tax.

If a person bought an apartment from a spouse, parents or stepbrother. Close relatives are considered interdependent; no deduction is allowed for this transaction. The state also considers an adoptive parent, guardian or adopted child to be interdependent, but you can buy an apartment from your father-in-law.

If a person remodeled or changed plumbing, these expenses will not be taken into account when calculating the deduction, as well as completing the purchase transaction.

If a person has already returned tax when buying an apartment and has exhausted the limit. The right to a property deduction is given once in a lifetime.

The right to a property deduction has no statute of limitations. If a person bought an apartment in 2000, he can still get his income tax back. But you can take into account personal income tax only for the last three years: in 2021, the deduction for 2021, 2021 and 2017 will return. However, the year the apartment was purchased will affect the amount that will be returned.

The maximum amount of expenses from which the deduction is calculated in 2019 is 2 million rubles. Until 2008, it was 1 million rubles. Previously, it was possible to return up to 130 thousand rubles, now - twice as much.

If a person bought an apartment in 2021, 260 thousand rubles are due for return. Let me remind you that mortgage interest is calculated separately.

Special conditions for property deduction apply to pensioners, because when a person does not work, he does not pay income tax.

If a person retired in 2021 and wants to receive a deduction for the purchase of an apartment, he will return the tax for the three previous years: 2021, 2017 and 2021. This also applies to working pensioners: they will also receive a deduction for the three years preceding retirement, if you paid income tax during this period.

It is not possible to transfer the right to deduction to children.