Every year, every working citizen uses his right to vacation. Before issuing a rest period, the employer must comply with a number of rules established by labor legislation. In particular, the vacationer is entitled to compensation for days of rest.

The calculation of wages and vacation pay upon dismissal also has some features that the employer should know.

In both cases, the main thing is to comply with the deadlines for payment of funds. Violation of strictly established temporary rules may threaten the organization as a whole and responsible persons in particular with very serious sanctions from the Labor Inspectorate and other inspection bodies.

General information

To find out how wages and vacation pay are paid before a vacation, it is necessary to define the basic concepts. They are described in the articles of the Labor Code. In addition, information regarding rest for employees is stipulated by numerous federal laws.

It is important to know! Vacation means a temporary cessation of work. A designated period is provided for employee rest. Article 122 of the Labor Code states that it must be allocated every year or at least once every 2 years, if the citizen himself agrees to this.

According to this article:

- An employee may request leave after 6 months of continuous work in one place.

- An employee has the right to request compensation instead of days off.

- Upon written request, with the consent of management, vacation dates can be postponed.

Annual leave must be paid by the employer. This means that the employee must be paid the average salary, even though he is absent. The minimum allowed period of such rest is 28 days. Articles 117, 118 and 119 describe the categories of workers entitled to additional leave, which is also paid by the employer.

Money instead of vacation - only upon dismissal

In some cases, the employer compensates the employee for unspent rest days. You can not go on vacation, but take money in two cases.

Upon dismissal, when there are unspent vacation days left

If an employee decides to quit, the company will reimburse him for unspent vacation. For example, a person worked for six months and “accumulated” his 14 days. I wrote a letter of resignation, but was not on vacation. In this case, the company will pay compensation for these 14 days.

And vice versa: those who worked for the first six months, managed to take 28 days off and then decided to quit, may be deducted part of the payments. Because the employee took half of this time off as if in advance. By law, you can withhold no more than 20% of the salary paid upon dismissal. If they do not cover the debt, the balance can only be collected if the employee agrees to pay it back voluntarily.

For days beyond the usual 28 (for some professions)

If you are a teacher or doctor, are not going on vacation, but want to receive payments, you can write an application addressed to your manager. Whether to pay or not is at the discretion of the management. It must be taken into account that not the entire vacation is compensated with money, but only days over the mandatory 28.

Payments before leaving

Article 114 of the Labor Code guarantees the possibility of going on vacation every year. Moreover, such vacations are paid for by management. Before leaving, the employee must be provided with the full amount, which is determined based on the average salary and the number of days worked.

Determining the amount of vacation pay

Calculating the amount of payments due is a simple process. It is enough to multiply the duration of the days of rest provided and the amount of average earnings for the billing period.

For example, an employee has worked for a full year. The average daily salary is 900 rubles, and the duration of vacation is 28 days. To determine the amount of accruals due, it is enough to multiply these numbers. The result will be 25,200 rubles. This is the total amount that is required to be provided to the employee before he goes on vacation.

Attention! The calculation of charges itself is not difficult. However, many have difficulty determining average earnings. Therefore, you should familiarize yourself with this procedure in more detail and find out what affects this indicator.

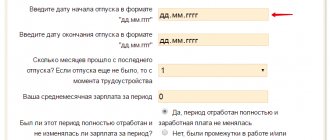

First of all, the billing period is determined. This is the period of time that an employee worked and received regular wages. As a rule, it is 1 year, but there are often exceptions.

On average, each month has 29.3 days. To determine the billing period, the number of months worked is multiplied by this number.

Example:

- The employee worked from January 1, 2021 to December 31, 2021.

- The deadline was fully fulfilled.

- Based on this, the billing period will be 29.3 * 12 = 351.

This indicator is subsequently used to determine the average salary for 1 day. First of all, the entire salary volume for the billing year is calculated. The resulting amount is then divided by the number of days in the period.

Example:

- For the full 12 months, the employee earned 240 thousand rubles. with a monthly salary of 20 thousand rubles.

- To calculate the average salary, this amount must be divided by the number of days in the billing period.

- 240,000 / 351 = 683 rubles.

This is the average daily salary. To find out how much the employee is entitled to before leaving, this amount is multiplied by the duration of the vacation provided.

May holidays

Let's take a closer look at the upcoming May holidays.

According to the Decree of the Government of the Russian Federation dated October 15, 2012. No. 1048 “On the transfer of days off in 2013”, due to the coincidence of non-working holidays on January 5 and 6 with Saturday and Sunday, and February 23 with Saturday, the transfer of days off is provided from Saturday, January 5 to Thursday, May 2, from Sunday 6 January to Friday May 3 and from Monday February 25 to Friday May 10.

Thus, in the coming May we are closed from May 1 to May 5 inclusive and from May 9 to May 12 inclusive.

May 6, 7 and 8 are working days.

In total, May has 31 calendar days, 18 working days, 2 holidays and 11 weekends.

Two holidays are May 1 and May 9 (Article 112 of the Labor Code of the Russian Federation). All other days are a transfer of weekends and are not considered as holidays from the point of view of labor legislation. This circumstance is important, since in accordance with Article 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of annual paid leave are not included .

Weekends are a completely different matter. They are included in the number of calendar days of vacation. Accordingly, if an employee writes an application for vacation from May 1 to May 10, then he uses 8 calendar days of vacation (May 1 and 9 will not be included in the number of vacation days). Of these, 3 days will be on weekdays and 5 on weekends.

From the point of view of vacation payments, this is a more pleasant option. However, it is completely unsuitable for the majority of workers who value the vacation days themselves. Thus, to save vacation days, a vacation application can be written for May 6, 7 and 8 - 3 days.

In Table No. 4 we present the calculation of “losses” for this choice, using the data from Example No. 1 (salary 50,000 rubles “net”, price of a vacation day 1,700.68 rubles).

Table No. 4

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*3) | Total “on hand” | Difference (salary – total “in hand”) |

| May | 18 | 50 000,00 | 2 777,78 | 15 | 41 666,67 | 5 102,04 | 46 768,71 | 3 231,29 |

As can be seen from the table above, the “cost” of a May vacation for 3 working days will be 3,231.29 rubles.

Now let’s consider another option for combining a short vacation and the May holidays - 2 days of vacation are taken at the end of April (29 and 30). Thus, the last 2 weekends in April are added to 2 vacation days and to the 5 days of the first May holidays. The result is a 9-day vacation, as well as saving money and 1 vacation day.

The calculation of the “cost” of such a vacation is presented in Table No. 5.

Table No. 5

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*2) | Total “on hand” | Difference (salary – total “in hand”) |

| April | 22 | 50 000,00 | 2 272,73 | 20 | 45 454,55 | 3 401,36 | 48 855,91 | 1 144,09 |

As can be seen from Table No. 5, the “cost” of an April vacation for 2 working days will be 1,144.09 rubles. (plus one vacation day is saved at a cost of 1,700.68 rubles), which is much more profitable than the May vacation:

- savings on payments RUB 2,087.20. + vacation day savings RUB 1,700.68. = 3,787.88 rub. saving everything.

Choose your vacation dates to your advantage!

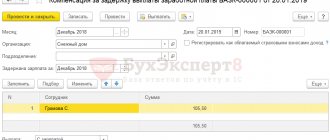

Payroll preparation

In most enterprises, salaries are paid twice a month. This is a norm established by law, violation of which may result in administrative penalties. Therefore, all employers must pay citizens at least twice a month.

Advice! The most convenient way to calculate salary is based on salary. It is written down in the employment contract and the employee must know it when hired.

The calculation is carried out using the formula: (salary/KRD)*CODE

- KRD – number of working days

- CODE – number of days worked

Calculation example:

- An employee works at a salary of 20 thousand rubles. per month

- In July, out of 23 workloads, 20 days were worked

- (20,000 / 23) * 20 = 17,391 rub.

It should be noted that from this amount it is still necessary to subtract 13% of income tax:

- (17,391/100) * 13 = 2,260 rub.

- 17,391 – 2,260 = 15,131 rubles. – the amount that will be given to the employee, taking into account personal income tax

Allowances, compensations, incentives, bonuses and similar payments may be added to the final salary amount. They are not taken into account in the calculation and in some cases are not taxed.

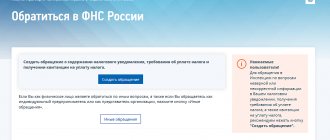

Actions of the employee in case of non-payment

Many employers violate existing legal norms. Employees must know how to assert their rights and where to go for help and support.

Late transfer of funds is a direct violation of the rights of a party to an employment contract, therefore no independent agreements should be reached with the employer.

The injured party may appeal to any of three authorities if desired:

- Labor inspection.

- The prosecutor's office.

- Court.

The order of appeals does not matter, so you can even start right away with the court, but it is more logical to complain to the Labor Inspectorate first. This organization guards compliance with labor legislation. Upon receipt of a statement of violations, it initiates an unscheduled inspection and seeks confirmation of the information received. If such evidence is identified, then she tries to resolve the conflict by forcing payment or takes the case to court herself.

Why vacation pay is less than salary

Many workers face a similar situation. In most cases, this is not a violation, but is a natural consequence of calculations made on the basis of the norms prescribed by law. Therefore, if there is a difference in amounts when paying salaries along with vacation pay, several aspects should be taken into account.

These include the following:

- When calculating vacation pay, some payments provided to an employee are not taken into account.

- The amount of benefits is affected by the number of days missed due to illness or other reasons.

- During the pay period, the salary may change.

- Vacation pay is also subject to taxes.

In addition, you need to understand that the accrual principle is somewhat different. Salary is determined based on the number of days worked and working days. When calculating vacation pay, average indicators are taken as a basis.

Payment terms

You can find out when vacation pay is paid before going on vacation in the Labor Code of the Russian Federation. The last paragraph of Article 136 states that payment must be made no later than three days before going on vacation. The amount can be given to the employee or transferred to his bank account.

A common question is whether salary and vacation pay can be issued simultaneously in the same month. This possibility exists, but only with the consent of the manager. The employer has no direct obligation to make such payments together. Therefore, most often funds are provided separately at different periods of time and this is not a violation.

Information about 6-NDFL

Form 6-NDFL was introduced into the circulation of tax reporting documents not so long ago. Since the beginning of 2021, all companies and entrepreneurs who have hired employees are required to report in the form of this form.

6-NDFL must be filled out so that the organization can provide the income of employees and send it to the Federal Tax Service.

Important ! This declaration is submitted to the tax authorities quarterly by all companies that have entered into agreements with individuals.

Form 6-NDFL

6-NDFL must be completed if you need to pay your salary in installments. Moreover, if income tax was deducted from an employee twice in parts, then the information must also be provided twice. Similar actions must be taken for issuing vacation pay. How to properly fill out this declaration? When is it not necessary to issue it? And what should you pay special attention to when sending a report to the tax office?

Basic moments

Citizens who live on the territory of the Russian Federation and receive wages must pay taxes. The amount of taxes depends on the salary and status of the citizen.

The 2-NDFL certificate is already known to everyone and has become a reporting standard. This certificate is issued by both individuals and legal entities.

Important ! If it is not, then a fine will be charged.

2-NDFL

Last year, the Federal Tax Service introduced another form, which is submitted by companies and organizations every quarter. Declaration 6-NDFL shows special nuances that are associated with income and taxes.

This declaration is filled out by employers for the total payroll tax of employees who are individuals and working in the state, and the 2-NDFL certificate refers to reporting for a specific employee.

The declaration can be submitted:

- electronic;

- on paper.

If the declaration is submitted on paper, then this method is more suitable for organizations with no more than 25 employees.

Important ! If there are many employees, then the 6-NDFL certificate must be sent electronically.

Form 6-NDFL is completed by employers

Income that is subject to personal income tax is indicated in the above certificate. This includes, in addition to salary, bonuses, incentives and vacation pay.

How to indicate wages along with vacation pay in 6-NDFL?

When filling out this declaration, it is important to remember that it is not necessary to indicate non-taxable income. The document must contain all information about the tax agent and his obligations to the tax authorities.

In the 6-NDFL declaration, vacation pay and wages are required to be indicated, as are bonuses along with sick leave. These types of returns are taxed at a rate of 13 percent and must be reported on tax documents.

In addition to income received by individuals, the following data must also be displayed:

- date of sending money to the employee’s account (actual);

- date of withholding of personal income tax;

- the day the tax is sent to the tax authorities of the Federal Tax Service.

Form 6-NDFL indicates taxable income

One of the main requirements when submitting a certificate is the mandatory compliance with all deadlines set by the Federal Tax Service. The first certificate is sent to the authorities no later than May, and the last one – before April of the following year.

Important ! Moreover, the latest report must be submitted together with the first certificate for the next year that has begun, but no later than May.

In order not to delay the submission of 6-NDFL certificates, you should personally go to the tax authorities to submit the certificates. If the documentation is sent by mail, you must require official confirmation of receipt of the letter.

If the declaration is submitted electronically, then all dates will be indicated automatically and there is no need to worry about them.

You can submit the 6-NDFL declaration electronically

All information on employee income must be indicated in the document for a specific date. For example, if an employee took a vacation, but not a full one, but wanted to divide it into parts, then, accordingly, payments are indicated separately. Similar actions are performed with salaries: the date of the advance and the date of the main payment are indicated, which are written separately from each other.

Important ! In the case where wages and vacation pay were paid together, the company indicates this in the certificate, otherwise an error will occur, which will lead to various sanctions, including a fine.

Consequences of delay

Late payment is possible only with the consent of the worker. If the employer did not arbitrarily provide vacation pay on time, this is regarded as a violation of Article 136 of the Labor Code. The following penalties apply for such an action:

- For individual entrepreneurs – a fine of up to 5 thousand rubles.

- For legal entities - a penalty of 30-50 thousand rubles.

- Officials – 10-20 thousand rubles.

It is important to know! An increase in the amount is possible in case of repeated violations or a long delay in payments. In addition to fines, the employee may demand compensation for material damage.