Photo from the site rest-kavkaz.rf Providing loans to employees can play into your hands twice - it will increase your competitiveness as an employer and become an effective tool for retaining valuable personnel. What you need to pay attention to when applying for such loans - said Alesya Tretyakevich, head of the payroll department of the accounting service Do Your Business.

— During interviews, specialists who know their worth are often interested in what other “goodies” the company can offer, in addition to the standard social package.

Alesya Tretyakevich Head of the payroll department of the accounting service “Do Your Business”, co-author of “Manager’s Cheat Sheets”

The social package refers to all bonuses not provided for by law that employers offer to employees in order to increase the attractiveness of the company as an employer. This could be: payment for meals, sports activities, training at the expense of the company, bonuses for holidays, etc.

But sometimes, in addition to the standard set of bonuses, you can increasingly hear one - providing loans to employees.

In most cases, loans are perceived as an additional benefit to the employer, while employers use them to retain employees in the workplace.

Therefore, if a company has free cash and a desire to retain valuable personnel, a loan agreement can be an excellent (mutually beneficial) tool. In this article I will talk about how to competently issue a loan to an employee.

Procedure

The algorithm for providing an interest-free loan is as follows:

- An employee of a company applies for a loan.

- The management of the organization arranges a meeting of the founders and makes a decision on issuing a loan.

- An agreement is drawn up under which the transaction will be carried out.

A written application requesting a loan is free-form; it must indicate:

- loan amount;

- maturity;

- indication of the absence of interest;

- return procedure;

- goals (if the loan is targeted);

- details of the parties.

It is important to know: if the application does not indicate that the loan is interest-free, then interest will be accrued at the refinancing rate at the time of repayment of the debt or part of the debt.

The refinance rate is the percentage that central banks and other government agencies charge for the loans they make.

What are the tax implications of loan and interest forgiveness for an employee?

The tax consequences in this case should be considered separately for forgiveness:

- The principal amount of the debt.

It will be necessary to charge personal income tax on it in the usual amount - 13% for residents, 30% for non-residents (clause 1 of Article 210 of the Tax Code of the Russian Federation). From the amount of debt, as we noted above, up to 4 thousand rubles can be deducted. in year.

- Percent.

If interest is provided for in the loan agreement, then they can be divided into 2 types:

- interest in an amount greater than or equal to 2/3 of the Bank of Russia key rate;

- interest in an amount less than 2/3 of the key rate of the Bank of Russia.

In the first case, personal income tax is paid on the forgiven (donated) interest at the usual rate - 13%.

In the second case, the employee’s material benefit is formed, which is calculated according to the formula (clauses 1, 2 of Article 212 of the Tax Code of the Russian Federation):

MV = (LOAN × (2/3 × KS - ST) / YEAR) × DAYS,

Where:

- MB - material benefit;

- LOAN - forgiven loan amount;

- KS is the key rate of the Central Bank as of the end of the month;

- ST - rate under the loan agreement;

- YEAR - number of days in a year;

- DAYS - the number of days between the beginning of the month and the day the debt is forgiven.

If interest on the loan was not provided for in the contract, then failure to accrue it and, accordingly, non-payment is recognized as a material benefit to the employee, calculated according to the formula:

MV (INTEREST) = (LOAN × 2/3 × KS / YEAR) × DAYS.

Personal income tax is charged on the amount of material benefit in the amount of 35% for residents, 30% for non-residents at the end of each month (subclause 7, clause 1, article 223, clauses 2, 3, article 224 of the Tax Code of the Russian Federation).

You can enter an agreement for forgiveness of debt to an employee in the form of a gift agreement on our website.

Features of the agreement

The agreement does not come into force at the moment of its signing, but at the moment of receiving the loan. To confirm receipt of money, you need to provide a payment order and a cash receipt order; in addition, the borrower can provide a receipt for the loan.

Any interest-free loan can be repaid ahead of schedule (unlike a loan with interest). It is necessary to indicate the period for repayment of the debt and the procedure for repayment; if the loan period is not specified or the loan is indefinite, then the money must be returned 30 days after the lender’s first request.

You may be interested in an article about microloans and improving your credit history. How to apply for a consumer loan, read this article.

If the agreement does not provide for a form of loan repayment, then the employee can return the money at his choice - deposit it into the lender’s cash desk or into his current account.

How can an employer (founder) forgive a debt under a loan agreement with an employee?

Lenders and borrowers of funds (or inventory items) can be any persons (clause 1 of Article 807 of the Civil Code of the Russian Federation), including:

- employers and their employees;

- founders of employing companies and employees of these companies.

The borrower's debts (and interest on them, if any) can also in all cases be forgiven by the lender through:

- concluding a debt write-off agreement;

- concluding a donation agreement for an amount corresponding to the amount of debt.

Both options are completely legal and equally easy to implement. However, the second has advantages because:

- When calculating personal income tax on a gift, you can always apply a deduction in the amount of 4 thousand rubles. per year (clause 28 of article 217 of the Tax Code of the Russian Federation);

- Gifts that are transferred from one person to another within the framework of civil legal relations are not subject to insurance premiums for disability and maternity (clause 4 of Article 420 of the Tax Code of the Russian Federation), and contributions for injuries from gifts are not provided for by law.

It is worth noting that even with the first option of debt forgiveness, the company can count on legal non-payment of social contributions (determination of the Supreme Arbitration Court of the Russian Federation dated September 26, 2014 No. 309-KG14-1674).

However, these are not all the nuances that characterize the taxation of forgiven debt.

Targeted loan

When specifying the purposes for obtaining a loan, the borrower may be exempt from personal income tax, but restrictions are imposed.

Such an agreement provides only for the intended use of funds, and it will be necessary to provide documents confirming compliance with the terms of the agreement.

Good to know: the borrower is exempt from personal income tax on material benefits only if he spends all borrowed funds on the construction of a new facility or the purchase of housing or its share in Russia.

Documents that need to be provided to be exempt from personal income tax:

- loan agreement;

- certificate 2-NDFL;

- documents certifying the expenditure of funds;

- when constructing buildings, purchasing land plots or apartments, provide property rights and a purchase and sale agreement;

- a letter confirming the right to a property tax deduction.

Results

Forgiveness of a loan by the founder of a company or its manager to an employee is carried out within the framework of the legal norms established by the Civil Code of the Russian Federation, namely through the conclusion of forgiveness or donation agreements. In both cases, personal income tax is charged on the forgiven debt (at a rate of 13%), as well as interest (at a rate of 13% or 35% if material benefits are calculated).

You can learn more about tax accounting for employee debt forgiven by the employer in the following articles:

- “Losses from debt forgiveness do not reduce profits”;

- “When the “physician” returns the forgiven debt, 6-NDFL will have to be clarified”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment of the money

An organization can issue an interest-free loan to an employee in two ways:

- transfer to the current account (or previously issued bank card) of the employee;

- in cash directly from the company's cash desk.

In both cases, specialized employees are required to record the transfer of funds in their accounting.

In the first case, the company writes off the issued borrowed funds from the Debit 71 account and transfers the specified amount to the Credit 51 account. In the second case, the accounting entry will look like this: Debit 73 – Credit 50.

Repayment of debt by an employee can be carried out in one of the following ways:

- transferring the amount of debt or part thereof to the organization’s current account, the details of which are given to the employee in advance;

- depositing cash into the company's cash desk;

- deduction of a previously determined amount from the employee’s salary.

If the loan agreement clearly defines any method of debt repayment, the lender does not have the right to arbitrarily collect funds in another way.

For example, the contract stipulates that the employee repays the debt in installments, depositing certain amounts into the company’s cash desk.

If an employee has missed or systematically misses loan payments, the organization’s management does not have the right to unilaterally withhold the specified amount from the employee’s salary.

All changes to the loan agreement are made solely with the consent of both parties and are approved by signing additional agreements to the main loan agreement.

What an employer needs to know

To apply for a loan correctly, the employer needs to know the following:

1. Loans to employees can be of two types:

- Interest-free: the employee will return only the amount he took from the employer and does not pay anything on top of it (no interest)

- Interest: the employee will return the amount borrowed from the employer, and will also pay interest on the use of the funds.

2. Most often, employers issue loans for:

- Construction (purchase) of housing

- Buying a car

- Tuition fees

- Purchasing household appliances

- Treatment/rehabilitation

- Other (the list shows the most common examples, that is, this does not mean that the loan cannot be issued for any other human need).

Photo from the site popmech.ru

3. It is beneficial for employees to receive a loan from the company. Such loans always have more flexible conditions compared to banks (loan term, repayment procedure, assessment of employee income, etc.). Moreover, interest rates are lower than in banks, or even non-existent.

4. The employer himself benefits. And here's what:

- As I already said, the employer has a tool with which to keep an employee in the company. In a way, this is additional insurance for personnel stability. For example. The employee asked the employer to provide him with an interest-free loan to purchase a car for a period of 2 years. The employer agreed to an interest-free loan with the condition that in the event of dismissal of the employee, the remaining debt on the loan must be repaid no later than the day of dismissal. Penalties for violation of the terms of the contract were also agreed upon. All parties accepted the terms and the loan agreement was concluded. As a result, the employee purchased a car cheaper than he would have done with a bank loan, and the employer reduced the risk of the employee’s unplanned dismissal.

- As for monetary benefits: if the employer provides a loan with interest, he receives benefits in the amount of interest paid by the employee for the use of the funds.

It is worth keeping in mind that providing loans to employees does not help save on taxes in any way :)

5. What taxes arise when issuing a loan in cash. VAT is not charged on the issuance of a cash loan to an employee. Profit on the loan (the interest that the employee pays to the company under the agreement) is included in non-operating income and is subject to income tax. The money that was transferred to the employee as a loan is not an income tax expense.

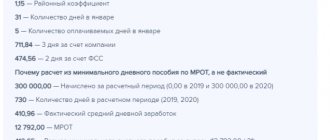

FSZN and Belgosstrakh are not accrued to the employee when issuing loans. An organization is required to pay income tax when issuing a loan to an employee. It is calculated like this:

Income tax on loan = loan amount x 13%. Income tax is paid by the organization at its own expense no later than the day following the day the loan was issued. In the future, as the employee repays the loan, the tax amount is returned in proportion to the repaid debt. The refund comes from the total amount of tax accrued by the organization for payment to the budget in the current month.

Let's look at this with an example:

On 01/03/2019, the organization issued a loan to the employee of 10,000 Belarusian rubles ($5000) and paid income tax no later than 01/04/2019: 10,000×13% = 1300 Belarusian rubles ($650). In February, the employee returned 1,000 Belarusian rubles ($500). The organization received an income tax of 5,000 Belarusian rubles ($2,500) in February. This means she can count 1000 rubles. x 13% = 130 Belarusian rubles ($65) income due to repay the loan and pay income with salary in the amount of 5000 − 130 = 4870 Belarusian rubles ($2435).

If the employee does not repay (or does not fully repay) the loan within the period established by the contract, the return of income tax on the loan to the organization is due to its withholding from the employee. That is, if an employee is late in paying a loan (for example, 700 Belarusian rubles ($350), then the company will return the income tax on the payment (700 * 13%) of 91 Belarusian rubles ($45) without paying less income from the salary, and by deducting this amount of income from the employee's income (for example, from his salary).In order for the company not to withhold income from the salary, the employee can deposit it into the organization's cash desk.

If this is not possible (for example, the employee quit), the tax refund is made by the tax authority within a month after the audit at the organization’s request.

Please note that income tax does not have to be paid on a loan issued for:

- Construction or purchase of housing for employees registered as needing improved housing conditions

- Payment for training in Belarusian educational institutions upon receipt of the first higher, secondary specialized, vocational education.

6. HTP resident companies can also issue loans to their own employees (clause 19, Chapter 4 of the Decree “On the High Technology Park”). When issuing a loan, a HTP resident is also required to pay income tax at a rate of 13% (a preferential income tax rate cannot be applied). VAT is not charged on the issuance of a cash loan to an employee. Interest under the loan agreement that is due to the employer is included in non-operating income and is subject to income tax.

Documentation of loans in HTP resident companies will be the same as in any other company - I will talk about this later.

Photo from the site dev.by

How to properly apply for an interest-free loan to an employee

Absolutely any employee can get an interest-free loan at their place of work. The main thing is to achieve full agreement with the management of the enterprise. Organizations also have no legislative restrictions affecting the ability to issue a loan.

An interest-free loan to an employee is issued using a standard cash loan agreement, which contains:

- time and place of conclusion of the contract;

- full details of the parties to the agreement (name of the enterprise, legal address of the company, bank details, passport details of the borrower, address of his actual residence and place of registration);

- the amount to be disbursed to the borrower, as well as the timing of debt repayment;

- responsibility of the parties, their rights and obligations;

- other points reached during the negotiations;

- signatures of the parties, as well as the seal of the company issuing the loan.

An addition to the interest-free loan agreement issued by an organization to its employee is a debt repayment schedule. This document is drawn up if the amount of debt is large enough and it cannot be repaid at once.

The drawing up of a debt repayment schedule is also influenced by the period for which the loan is issued and the agreement previously reached between the borrower and the lender on the terms of loan repayment.

The procedure for applying for an Easy card loan is described in the article: Easy loan. A sample assignment agreement for a loan agreement can be found here.

Tax for individuals

The company, the lender, as well as the borrower, are obliged to pay certain taxes to the state.

The main document regulating taxation is the Tax Code of the Russian Federation. An interest-free loan to an employee is subject to personal income tax.

When issuing an interest-free loan, personal income tax arises at the time of repayment of the debt in whole or in part. The enterprise is obliged to pay tax for the employee, that is, an individual does not need to file a tax return on his own (Article 212 of the Tax Code of the Russian Federation).

Tax can be withheld directly from an employee’s salary, but the amount of tax should not exceed 50% of the amount accrued for payment.

If for some reason an organization cannot withhold the amount of personal income tax from its employee, then it is obliged to report this to the relevant tax authorities, which will make individual decisions in each individual case.

Personal income tax is charged on the amount that the borrower employee saves on interest payments, the so-called material benefit. How to correctly calculate the benefit amount will be discussed below.

From January 1, 2008, the tax rate levied on material benefits is 35%. There are situations when an employee of an organization is exempt from paying personal income tax due to receiving a tax deduction.

Such situations include loans that are issued for the purchase or construction of housing or repayment of debt on a previously obtained mortgage loan.

It should be noted that any person can take advantage of the tax deduction, but only once in his life (Article 212 of the Tax Code of the Russian Federation).