Who has the right to receive money

Accountable amounts are money that is given to employees to carry out company instructions.

New reporting rules have been established relatively recently - from August 19, 2021, with the adoption of a new edition of Bank of Russia Directive No. 3210-U. Employer, according to Part 1 of Art. 19 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, is obliged to organize and maintain internal control of the facts of economic activity. The procedure for monitoring the issuance of money to accountable persons is determined by the head of the company. He issues an order with a list of persons entitled to receive funds from the organization’s cash desk.

Accountable persons are persons to whom an organization or individual entrepreneur gives money to carry out instructions and who are obliged to provide a report on their use. They are any employees of the enterprise.

How to receive the money

Before the introduction of the amendments, in order to receive money, the employee sent an application to the accounting department or human resources department, which indicated the required amount and an explanation of what it would be spent on.

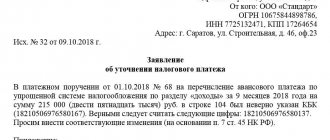

But in 2021, from August 19, it has become easier to issue reports to employees. The changes are provided for by the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U. From August 19, 2007, it is not necessary to submit an application. To issue money, an order or other administrative document of the company on behalf of the director is sufficient. The form of such a document is arbitrary. But it must contain the following details:

- FULL NAME. faces;

- document registration number;

- amount of cash;

- the period for which cash is issued; appointment (optional);

- director's signature and date.

It is allowed to carry out settlements with accountable persons using a new sample of statements:

An employee did not report on time: what to do

There are times when an accountable person does not report on time. In this case, the accountant must know what to do. There are several options:

- Withhold the debt from the employee's salary if he agrees.

- Forgive him the debt by decision of management.

- If the accountable person objects to the deduction of the debt from the salary, then the issue can only be resolved through the court.

If the accountable person does not submit an advance report to the accounting department and does not return the funds received into the account, the manager, within a month after the last day for submitting the advance report (Article 137 of the Labor Code of the Russian Federation), is obliged to make a decision to withhold money from the employee’s salary. To do this, it is necessary to prepare a deduction order, sign it with the director and notify the debtor employee (obtain his signature on the order and record the date of review).

If the director decides to forgive the employee’s debt, then after making such a decision, formalized by order, insurance contributions and personal income tax must be calculated on the amount of the accountable debt and transferred to the budget. In this case, the date of the employee’s income will be considered the date of his signature on the document in which he is notified that his debt has been forgiven (Clause 2 of Article 415 of the Civil Code of the Russian Federation). Personal income tax can be withheld upon the first payment to the employee following the decision and notification of the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

In cases where it is impossible to withhold personal income tax (for example, an employee quits), it is necessary to issue a 2-NDFL certificate with attribute “2”. It must be submitted to the tax office no later than March 1 of the year following the one in which the employee received the income (clause 5 of Article 226 of the Tax Code of the Russian Federation).

What amount should I report?

In Russia, payments in rubles that are carried out within the framework of one agreement should not exceed 100,000 rubles.

This is indicated in paragraphs 5 and 6 of the instructions of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U. It is believed that this limit cannot be exceeded. But there are also nuances. This limit on expenses is established only for settlements with other organizations and individual entrepreneurs (see clause 6 of the instructions of the Central Bank of the Russian Federation No. 3073-U). But it does not apply to settlements with individuals who are employees of the enterprise. This includes wages, social benefits, personal needs of the head of the organization and the issuance of funds. Taking this into account, issuing a larger amount is not a violation of cash discipline.

Is a report required for the amount received?

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated 03/11/2014 No. 3210-U, until 08/19/2017 it was prohibited to issue money if the employee did not provide a report on previously received amounts.

Here the Central Bank made changes to the report. Now money can be issued even if the employee has not repaid the debt on previously issued funds. But this does not mean that employees no longer need to prepare advance reports on the amounts spent. The employee must submit reporting documents on the money spent to the accounting department.

Report deadlines

As stated in clause 6.3 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the employee is obliged to provide a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued.

But the new requirements for the preparation of accountable amounts do not establish a specific period during which an employee must submit a report on the money spent. It is indicated in the employer's order. If the return period is not established, the employee submits the report on the same day on which he received them. This is indicated in the letter of the Federal Tax Service dated January 24, 2005 No. 04-1-02/704.

But for travel expenses there are special conditions for the advance report. According to clause 26 of the regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, the employee is obliged to report on them within 3 working days from the date of return.

Travel allowances issued: standard posting

In order to be able to send employees on business trips, the company needs to develop a Regulation on Business Travel. This or a similar internal document indicates all the main nuances regulating this procedure: to whom, when, in what amounts money is given for travel expenses and what these expenses may include.

Let us remind you that travel expenses have a daily allowance limit established in 2021 in the amount of:

- For business trips throughout Russia – 700 rubles/day.

- When traveling abroad - 2,500 rubles/day.

If the amount of daily allowance exceeds the established limits, this excess is subject to personal income tax and insurance contributions (clause 3 of Article 217, clause 2 of Article 422 of the Tax Code of the Russian Federation).

You can read more about the daily spending limit here.

Example

Employee Ivanov P.P. was sent on a business trip around the Russian Federation for 6 days (including travel there and back). 02/14/2017 Ivanov P.P. received money for a business trip in the amount of 10,000 rubles. The employee’s departure is 02/14/2017, return is 01/19/2017 (this is a day off). On Monday, 02/21/2017, the employee came to the accounting department and provided a business trip report and an advance report. Ivanov P.P. attached a hotel bill and a check for payment for clothes cleaning services to the advance report.

The daily allowance at the enterprise for business trips around Russia is 700 rubles/day. Ivanov P.P. is an employee of the commercial department, the business trip is related to his official duties and the conclusion of an agreement for the sale of the company’s products.

IMPORTANT! Despite the fact that 02/19/2016 is a day off according to the calendar, this day is a working day for P.P. Ivanov, since he was on the road, returning from a business trip. Daily allowances for this day are also accrued (clause 4 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749, Article 113 of the Labor Code of the Russian Federation).

| Date of operation | Dt | CT | Sum | Operation description |

| 14.02.2017 | 71 | 50 | 10 000 | Money was given to an accountable person for travel expenses |

| 21. 02.2017 | 44 | 71 | 9 500 | An advance report on the use of funds was received: — 5,000 rub. — purchasing train tickets; — 4,200 rub. — daily allowance for 6 days of business trip; — 300 rub. - expenses for cleaning clothes - additional hotel services (allowed by the regulations of the enterprise) |

| 21. 02.2017 | 50 | 71 | 500 | The balance of unspent accountable amounts was returned to the enterprise's cash desk |

| 28. 02.2017 | 70 | 68NDFL | 39 | Personal income tax was accrued on the amount of costs for cleaning clothes, since the total amount of daily allowance, taking into account these expenses, exceeds the established limit for business trips within the Russian Federation |

| 01. 03.2017 | 68NDFL | 51 | 39 | Personal income tax transferred to the budget |

| 28.02.2017 | 44 | 69 | 90 | Contributions for compulsory medical insurance, compulsory health insurance, VNiM have been accrued for the amount of costs for cleaning clothes, since the total amount of daily allowance, taking into account these expenses, exceeds the established limit for business trips |

| 01.03.2017 | 69 | 51 | 90 | Insurance contributions to the budget have been transferred |

What to consider in 2021

When accepting the report, take into account changes in the design of cash receipts and BSO.

From 07/01/2019, the cash register receipt or BSO issued instead includes information about the name of the buyer (organization or individual entrepreneur) and his tax identification number. When preparing documents using the new reporting templates from August 19, 2017, remember:

1. If the accountable person has been given a power of attorney to purchase goods and services in the interests of the organization and he has presented it to the seller, then the seller is obliged to reflect this data in the issued cash receipt.

2. If the seller is not able to reliably establish that an individual is acting in the interests of a certain organization, then he is not obliged to comply with this requirement for issuing a check. In this case, the buyer for the seller is the individual himself. And the cashier's check is issued in the usual manner.

We are changing the regulations on conducting cash transactions

Since adjustments have been made to the procedure for issuing money, changes in accountable amounts in 2021 also affected documentation.

Enterprises should update their regulations on working with imprest amounts. Employees have the right to receive accountable funds in cash at the enterprise's cash desk. It is also allowed for the company to issue money to a bank card, including to the employee’s salary card (see instruction No. 3073-U, letter of the Ministry of Finance of Russia dated July 25, 2014 No. 03-11-11/42288). To make this possible, the procedure for settlements with reporting employees should be recorded in the company's accounting policies.

Money is issued through the cash desk in accordance with the following requirements:

1. When preparing cash documents, the accountant must be guided by the provisions of instructions No. 3210-U.

2. Money is issued to an accountable person on the basis of an order (or other administrative document) or upon his written application. As stated in the letter of the Central Bank of the Russian Federation dated September 6, 2017 No. 29-1-1-OE/2064, the order is signed by the director, indicating the date and registration number.

3. The period for which accountable funds are issued is established in the administrative document for their issuance. The report period (paragraph 2, clause 6.3 of instructions No. 3210-U) is 3 days. During this time, the accountable is obliged to report or return the money to the organization.

4. The issuance of money for reporting from the cash register is formalized by an expense order. Return of balances of accountable amounts - receipt orders. Money can also be issued for reporting by transferring it to the applicant’s bank card (letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288). It is allowed to return the money to the accountable by transferring funds to the company's current account. The possibility of non-cash accountable payments is fixed in the accounting policy.

5. There is no limit on the amounts that can be reported. The enterprise has the right to issue money to the accountable person in any amount. The settlement limit (RUB 100,000 per agreement) must be taken into account only when making payments between enterprises. In this regard, there have been no changes for accountable persons.

6. Issuing money on account to a person who has a debt on accountable amounts is not a violation of the law from 08/19/2017.

7. Organizations and individual entrepreneurs have the right to issue money on account not only to those employees who work on the basis of a permanent employment contract, but also to those who are in civil legal relations with the enterprise (letter of the Central Bank of the Russian Federation dated October 2, 2014 No. 29-1-1 -6/7859).

8. Issue from the cash register to the account is documented by posting Dt 71 Kt 50. When transferring funds to a card - posting Dt 71 Kt 51.

For what business expenses are funds issued for reporting?

In the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n), in the section describing account 71 “Settlements with accountable persons”, it is said that this account reflects transactions for settlements with employees of the enterprise for amounts issued for administrative, business and other expenses to the report.

What exactly administrative and economic expenses include is set out in the letter of the State Construction Committee of the Russian Federation “On the Procedure for determining the cost of construction and free (negotiable) prices for construction products in market conditions” dated December 29, 1993 No. 12-349. Despite the fact that the letter is related to pricing in construction, it quite fully reveals the meaning of the concept of “administrative expenses”.

In practice, accountable money is most often issued for the following needs:

- postage and communication costs;

- Inventory and materials for management personnel, including stationery;

- representation needs;

- travel expenses, etc.

Above we cited the following rule: in the application for the release of money to the account or the corresponding order of the manager, it is necessary to indicate the needs for which the money is issued. And although this is not formally directly established by law, in paragraph 6.3. Directive No. 3210-U states that money is issued “for expenses related to the activities of a legal entity or individual entrepreneur.” Therefore, in an application or order for the release of money for reporting, it is better to indicate the specific purpose for receiving the funds.

If money is issued from the cash register to an accountable person for household needs, the transactions may look like this:

| Date of operation | Dt | CT | Sum | Operation description |

| 15.08.2017 | 71 | 50 | 10 000 | Money was issued to an accountable person for the purchase of stationery until 08/25/2017 inclusive (this is Friday) |

| 28.08.2017 | 26 | 71 | 7 500 | An advance report was received from the accountable person |

| 28.08.2017 | 50 | 71 | 2 500 | The accountant returned the balance of unspent funds to the cash register |

Main rules

Let's summarize what has been said:

1. Any amount is issued for the report.

2. From August 19, 2017, in order for an employee to receive an accountable payment, an order from the head of the company is sufficient. It is not necessary to write an application.

3. Previously, before submitting a report for the previous amount, an employee could not receive an accountable amount; now the answer to the question: is it possible to issue money for an accountable amount if the employee has not accounted for the previous one? Yes, it is possible.

4. Accountable amounts may be transferred to bank cards.

5. As of August 19, 2017, local acts on settlements with accountable persons have been updated.

Results

We looked at the procedure for issuing accountable amounts, as well as how the business transaction “issued from the cash register accountable” is recorded.

We draw your attention once again to the fact that from 2021 an application for the issuance of funds against a report is not required, and new amounts can be issued even if the employee did not report on the previous report. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.