Terms of payment in the organization

The terms within which wages are paid in an institution are established by the regulations on wages in accordance with the Labor Code of the Russian Federation. Local regulations determine how to calculate and how to pay wages for December 2021 to employees. According to the law (Part 6 of Article 136 of the Labor Code of the Russian Federation), the institution must pay remuneration for the work performed twice a month:

- advance payment - until the end of the reporting month (no later than the 30th day);

- the second part of the salary - no later than the 15th day of the month following the reporting month.

The main thing that the employer must remember is that the difference between the transfer of the advance and the final salary should not exceed 15 days, otherwise there is a high probability of penalties (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Tax Code about personal income tax: general case

From Chapter 23 of the Tax Code of the Russian Federation we know that:

- the date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- Personal income tax is calculated on the date of receipt of income, withheld upon its actual payment and transferred to the budget no later than the day following the day of payment (clauses 3, 4 and 6 of Article 226 of the Tax Code of the Russian Federation);

- payment of tax at the expense of a tax agent is not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation).

Payment of wages for December

We will pay the advance payment until December 30, 2020, and employees will receive the rest of the remuneration until January 15, 2021. The date for payment of the December advance is set by management. The main requirement is to transfer it no later than the end of the working year.

The exact dates of issue should be established in the collective agreement and local regulations on wages; they also state when it is better to pay wages and transfer personal income tax for December 2021 (don’t forget about insurance premiums). As a general rule, if an advance is issued on December 25, then the rest of the earnings are transferred after the holiday holidays, but no later than January 11 in 2021.

ConsultantPlus experts gave an example of how to correctly reflect the payment of December salaries in accounting. Use these instructions for free.

to read.

December and January payments

Payment for December in advance is mandatory - advance payment for the first part of the month. Delivery should not take place on a weekend. If the deadline set for advance transfers falls on a Saturday or Sunday, the accounting department pays the money in advance, that is, on the last working day before the weekend.

The January payment is the remaining part of the earnings. New Year holidays 2020–2021 last from 01/01/2021 to 01/10/2021. The remuneration will have to be transferred immediately after returning to work, observing the legal interval. In our example, this is 01/11/2021.

If an advance is made in an organization before December 23, 2020, then in this case payment is required according to the “December - in December” scheme. Local standards indicate how many payments state employees will have in December in this case - two: an advance and the main part of the salary. The employer is obliged to pay employees in full by the end of the working year - by Thursday, 12/31/2020. If you count according to the calendar, then the payment of the remaining income falls during the New Year holidays, which is obviously impossible.

To avoid violations of labor laws and subsequent fines, schedule all settlements with employees at the end of the current year. The correct day for payments in 2021 is 12/28/2020. The last December working days fall on the 30th and 31st, and most institutions direct all resources to mutual settlements with counterparties, including employees. This means that programs and payment systems will be overloaded, which will lead to delays in payments. Don’t take risks, pay everyone off in advance and calmly close the year. Provide salary funding in advance. The budget standards indicate when money must be ordered to pay salaries in order to pay for December at the end of December - at least for a month, that is, in November. The accountant preliminarily calculates the remaining allocations and selects the entire allocated funding for the December salary.

IMPORTANT!

Rostrud recommends paying December salaries on December 28!

Results

When paying your salary before December 31st, you actually have two options:

- Issue it without withholding personal income tax, and withhold tax from the January advance. Unusual. You may have to explain things to employees. But taking into account the position of officials, it is safe.

- Issue the salary minus tax, transfer it on December 31 and prepare for claims, which, however, may not occur.

The Ministry of Finance, by the way, promised to resolve the issue of early payment of personal income tax and prepare appropriate amendments.

But we haven’t seen their project yet. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Early payment of wages

The most numerous questions employees have to accountants are: when will the final remuneration be transferred, until what date are payrolls closed in December, will employers make a one-time payment for the entire month or will they split it into two payments? The Labor Code does not prohibit the advance payment of December income. The employer is responsible for late payment, which will happen if the payment of money is delayed in January 2021.

Earnings transferred in advance do not in any way violate the employee’s labor rights, and therefore do not entail additional liability for the employer. The manager has the right to organize a one-time payment of December income, that is, to issue both an advance and the remaining part of the labor remuneration on a set day. If there is no financial possibility of a single payment, then the transfer of December wages is scheduled for the last working days of the year - in the period from December 28, 2020 to December 31, 2020.

How to calculate salary for holidays

Let's consider how to calculate wages on holidays if the employee performed his official duties on these days. For the performance of labor duties on a holiday, the employer is obliged (Article 153 of the Labor Code of the Russian Federation):

- or pay for the time worked at least double the amount;

- or provide an additional day off.

Whether holidays are counted towards the salary at double the rate depends on the employee’s decision to take or not to take an additional day off for performing work duties on a holiday.

If a day of rest is not registered, then payment for holidays must be at least double:

- piece rates - for piece workers;

- daily or hourly tariff rate - employees who receive wages based on the tariff rate;

- daily or hourly rate in addition to salary, if the work was performed in excess of normal working hours - salaried employees.

If an employee decides to take an additional day off, then the day off on a holiday is paid at a single rate. No compensation is paid for a day of rest.

The specific amount of compensation is established by the organization in an employment or collective agreement or other local act of the company. But it cannot be lower than that established in the Labor Code. 2020 is a leap year. Therefore, it has more working days and hours. An example of calculating holidays according to the new production calendar will help you understand the calculation procedure.

Preparation of an order for early payment of wages

Any deviations in the timing of accrual and payment of labor remuneration are accompanied by an order from management. If the manager or manager has decided to make advance payments to employees according to the “December - in December” scheme, they must prepare an order for early payment of wages.

In commercial organizations, everything is not so strict; January payments for such enterprises are quite common. But the budget has different rules: in December, state employees will receive their salaries for the last month in full. In budgetary institutions of all types, the obligation to make early payments is defined at the regulatory level. The table lists the timing of payments to public sector employees.

| Payment | Deadline |

| Salary | From 28.12 to 31.12.2020 |

| Personal income tax | We withhold it on the day the salary is issued and transfer it to the budget on the next working day after the salary (clause 6 of Article 226 of the Tax Code of the Russian Federation). This is another reason why we advise shifting settlements with employees to 12/28 or 12/29. Then the correct date for personal income tax transfer is December 29 or December 30, respectively |

| Insurance premiums | 01/15/2020. If a budget organization needs to fulfill the budget in the current reporting period, then mutual settlements for insurance premiums are carried out on the same day as personal income tax. In Art. 226 of the Tax Code of the Russian Federation indicates when to pay personal income tax if the salary was paid in December (insurance contributions by analogy) - 29.12 (if payment of income is 28.12) or 30.12 (if payment is 29.12) |

If the company transfers the final remuneration on December 31, 2020, then personal income tax and insurance premiums will have to be paid on the first working day of 2021 - January 11.

Early payment of earnings is approved by order. Such an order is prepared in advance - issue it a week before the planned settlement. Here's how to create an order:

- Prepare the institution's letterhead.

- Mark the basis for the formation of the order.

- Please indicate the reason for early payment.

- Enter the exact date of transfer and appoint a responsible employee.

- Have the document certified by your supervisor.

There is no need to familiarize employees with the order. This order does not violate the rights of employees, so their signatures on the document are not required.

What are the dangers?

The biggest fears are directly related to early payment. Rostrud believes that this is not a problem, because the Labor Code of the Russian Federation specifies the minimum number of payments per month - 2 times. The maximum is set by the employer himself, and it is important that this does not worsen the employee’s situation.

Another difficult question: if you transfer money earlier, it turns out that the period between payments will exceed 15 days, and this is a violation of the law, for which, on the basis of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, the company and its officials have the right to be fined (up to 50,000 and up to 20,000 rubles, respectively). In explanatory letters and consultations they acknowledge: there is indeed a violation of the frequency of payments to subordinates, but if the employer fulfilled the obligation to pay wages to employees taking into account the last period established in the Labor Code of the Russian Federation, and the next payment was made within the time limits approved by the organization’s LNA, then there will be no punishment.

Nevertheless, many are afraid of fines for violating specific deadlines for paying salaries and final settlements with employees. We hasten to reassure readers: there is already some judicial practice in favor of employers who paid wages ahead of schedule (see the decision of the Saratov Regional Court dated September 22, 2016 in case No. 21-667/2016, the decision of the Novosibirsk Regional Court dated September 27, 2016 in case No. 7- 909/2016).

Methods for issuing funds

Methods for issuing wages to employees are prescribed in the collective agreement, labor agreement and in the regulations on remuneration of the organization. And don't forget to prepare an order. If the organization does not have an order for early payment, then it is not recommended to issue salaries for December before the New Year. And the basic rule: do not violate the deadlines established for settlements with employees.

Here's how to pay December wages:

- issue “by hand” - in cash;

- transfer to employees' salary bank cards.

In both cases, management ensures that funds are received in advance - at the end of the year, due to the huge volume of transactions, banks work more slowly, payment systems hang, and payments take much longer to process.

If you plan to transfer the December remuneration no later than December 28, 2020, then send salary payment orders in advance to the bank that services your organization. Under the normal rhythm of operation of a banking institution, payments are processed during the business day, and the money is credited to employee accounts the next day.

Update 1C:ZUP to the latest version!

Healthy payroll: all changes to preferential insurance premium rates and terms and effects will be applied automatically!

- We will configure 1C:ZUP to accommodate changes in legislation and new introductions due to restrictions due to self-isolation;

- We will set up electronic personnel document flow with employees;

- We will set up the integration of 1C:ZUP with the Corporate Portal or create one;

- We will connect 1C:Employee’s Office and train them to work in it.

More details Order

Issuing pay slips

Upon the issuance of monthly remuneration for December, the accountant provides the employee with a payslip, the form of which is approved by the appropriate order in each institution (Part 2 of Article 136 of the Labor Code of the Russian Federation). If employers pay wages for December before the new year, then payslips should be distributed immediately after payments, that is, no later than December 31, 2020. If the balance of income is paid in January 2021, then the calculation will be issued in the same month.

In the payslip for the last month, the accountant reflects the total amount of income. It includes the basic salary, incentives, compensation, bonus payments, and other additional payments and allowances. The calculation indicates all deductions for December 2020: personal income tax, union dues and other payments confirmed by management orders. The final line of the payslip indicates the amount of income to be issued.

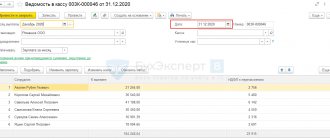

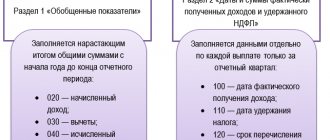

Taxation

The possibility of transferring salaries was sorted out in advance, but the issue of taxation of paid income remained. Accountants will not have any difficulties with how to calculate salaries for December, but the timing of personal income tax transfers should be clarified. Money paid on December 31, 2020, and personal income tax from them, must be reflected only in section 1 of form 6-NDFL for 2021. These amounts are then duplicated in 6-NDFL for the 1st quarter of 2021, because according to the Tax Code of the Russian Federation, the deadline for paying personal income tax is this In this case, 01/11/2021 is the first working day after payment of income. And even if the company transferred the tax on December 31, 2020, the calculation shows the date January 11, 2021, since it is provided for by law (see question 3 in the letter of the Federal Tax Service No. BS-4-11/ dated July 21, 2017).

IMPORTANT!

Employers report on the results of 2021 using Form 6-NDFL, approved by Order of the Federal Tax Service No. ММВ-7-11/ dated 10/14/2015. Starting with reporting for the 1st quarter of 2021, organizations and individual entrepreneurs should submit information to tax authorities in the form introduced by Federal Tax Service Order No. ED-7-11/ dated 10/15/2020.