- developers, forwarders, intermediaries submit logs of received/issued invoices no later than the 20th day of the month following the reporting period;

- if there are taxable transactions and if VAT invoices have been issued, the declaration is submitted no later than the 25th day of the month following the reporting period

Violation of deadlines for submitting certain reports does not go unnoticed. Government authorities apply various types of sanctions to unpunctual entrepreneurs. The table below shows all the information on the fines you may receive for violating reporting deadlines. Table 2 - fines for violating reporting deadlines

Report

| Amount of fine | |

| Tax return, calculations of insurance premiums (VAT, 3-NDFL, simplified tax system) | 5% of the tax amount according to the declaration or the amount of contributions calculated for each month of delay, but not more than 30% and not less than 1,000 rubles + blocking of the current account for being late for more than 10 days. |

| Calculation of 6-NDFL | 1,000 rubles for each month of delay + account blocking for being late by more than 10 days. |

| Certificates 2-NDFL | 200 rubles for each certificate. |

| SZV-M and SZV-STAZH | 500 rubles for each employee. |

| Statistical reporting | From 10,000 to 20,000 thousand rubles, for repeated violation from 30,000 to 50,000 rubles. |

Who can apply the patent tax system?

Only individual entrepreneurs who bought a patent or several patents in the prescribed manner. The patent system is available for different types of activities.

Who is the patent tax system suitable for:

- software developers;

- to retailers in areas not exceeding 150 m2;

- catering representatives;

- owners of beauty salons and hairdressers;

- landlords;

- workshops for repairing/sewing clothes, shoes or household appliances;

- parking lot owners;

- private tutors who receive official payment;

- language schools and translators, etc.

All types of activities are described in Art. 346.43 Tax Code of the Russian Federation. But constituent entities of the Russian Federation have the right to expand this list, so also read the regional legislation on PSN.

There are also restrictions on the use of a patent. Entrepreneurs who conduct business under a partnership agreement or under a property trust agreement, are engaged in wholesale trade, provide credit and financial services, or make transactions with securities will not be able to switch to the PSN. There are also a number of restrictions on physical indicators:

- for retail trade - the sales floor area should not exceed 150 m² for each facility;

- for catering - the area of the service hall should not be more than 150 m²;

- for cargo and passenger transportation - the individual entrepreneur should not own more than 20 cars.

Regions may introduce additional restrictions on physical indicators. For example, individual entrepreneurs who have 15 vehicles for transporting goods should not be allowed to buy a patent.

Excise goods listed in paragraphs cannot be sold on a patent. 6-10 p. 1 tbsp. 181 of the Tax Code of the Russian Federation, and some types of goods subject to mandatory labeling: medicines, shoes and fur products. Beer and cigarettes can be sold.

How to switch to a patent tax system?

The procedure for switching to a patent is as follows:

- Submit an application to the Federal Tax Service at the place of registration of the individual entrepreneur 10 or more working days before you start using the PSN. You can submit your application by mail or electronically. The application form was approved by order dated December 9, 2020 No. KCh-7-3/ [email protected]

2. Five working days after receiving the application, the Federal Tax Service must issue you a patent or notify you of the refusal against receipt.

Why they may refuse:

- A type of activity is indicated that is not included in the list of eligible patents.

- Incorrect patent expiration date.

- You already lost the right to enforce the patent this year, and this is your re-application.

- You have patent tax debts.

How long does a patent last?

You can be on this tax system from a month to a year, but within one calendar year. That is, you cannot obtain a patent from March 10, 2021 to March 10, 2022, until a maximum of December 31, 2021. Then you need to get a new patent. As you probably guessed, you can get a patent for less than a month.

Domain name as an object of intellectual property

A domain name can also refer to intangible assets. However, such property is accounted for only if it meets these criteria:

- Use for profit.

- Having full rights to the asset.

- The useful life is more than a year.

- The right is not planned to be transferred to other companies.

- The actual cost of the object is known.

If all these characteristics are absent, the domain name cannot be considered an intangible asset.

How to calculate the value of a patent?

There is a certain formula for calculation. 346.51 Tax Code of the Russian Federation:

Patent cost = potential income (PI) per year / 365 (366) × number of days for which the patent was obtained × 6%.

6% is the tax rate for a patent, according to Art. 346.50 Tax Code of the Russian Federation. In Crimea and Sevastopol, the patent rate cannot be higher than 4% until 2021. And the constituent entities of the Russian Federation can establish a tax rate of 0% for newly registered individual entrepreneurs working in the fields of production, science, social and consumer services.

Potential income is determined by the subject of the Russian Federation. There are currently no restrictions on its amounts, so in different regions the potential income may differ significantly. The period for which potential income is established is 1 year. If there have been no changes, then the previous year's limit applies by default. Previously, the Tax Code of the Russian Federation limited potential income to 1 million rubles, and regions could increase it, but now this rule has been removed - there are no restrictions.

The cost of a patent can be calculated on the tax service website.

Example . Pyshka LLC is a cafe in Yekaterinburg. Its area is 50 m². Regional authorities have established the potential income per 1 m² of the visitor service hall in the amount of 29,137 rubles per year. To calculate the cost of a patent for March-December 2021, we use the formula given above:

Potential income for the year = 29,137 rubles × 50 m² = 1,456,850 rubles.

The cost of a patent per year = 1,456,850 / 365 × 306 × 6% = 73,282 rubles.

From 2021, the cost of a patent can be reduced by a deduction similar to that existing on the simplified tax system “income” and UTII. Entrepreneurs will be able to reduce the cost of a patent by:

- the amount of insurance premiums for yourself and your employees,

- the amount of sick leave for the first three days of employee illness;

- the amount of contributions for voluntary personal insurance of employees.

At the same time, there is a limitation for individual entrepreneurs with employees - they reduce the patent by a maximum of 50%, even if the amount of the deduction exceeds the cost of the patent. Entrepreneurs without employees can reduce the cost of a patent down to zero if the deduction amount is sufficient for this.

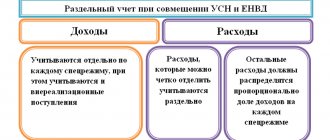

Separate accounting of income when combining the simplified tax system and a patent in 1C: Accounting ed. 3.0.

Created 02/11/2021 06:55 Published 02/11/2021 06:55 Author: Administrator In 2021, many individual entrepreneurs switched to a patent tax system, and some had to combine the simplified tax system and a patent. On the website of the Federal Tax Service of Russia, in the “Patent System” section, there are explanations and samples of documents necessary for registration of a patent. And if from the legislative side it is more or less clear, then from the point of view of the 1C program, users have questions: how to keep records of revenue, wages, income and expenses when combining these modes? We already had an article “Record keeping in 1C under the patent taxation system” (PSN). In it we looked at the theoretical aspects of PSN and the starting settings in the program. What to do next? Anyone can check the box! When combining tax regimes, how can you set up the 1C: Enterprise Accounting program and correctly reflect transactions? We'll figure it out together. In this publication we will touch upon the topic of separate income accounting.

Setting up a combination of taxation modes: simplified tax system + patent

Let's consider a conditional example: IP Grishchenko I.S. Previously, I applied the simplified tax system of 15% (income minus expenses), while trading household appliances and spare parts for them. In 2021, he opened a repair shop to troubleshoot these household appliances, and he took out a patent to perform these services. In addition, he installs and connects sold equipment: split systems, washing machines, etc.

Individual entrepreneur Grishchenko has three employees: a salesperson in a store, a repairman for equipment and household appliances, and a specialist in the installation of equipment and household appliances.

Let's look at examples of reflecting operations in the 1C program: Accounting ed. 3.0 when combining two taxation regimes: simplified taxation system and patent.

The taxation system is set up in the organization’s card by clicking on the hyperlink of the same name.

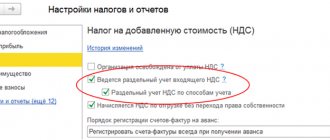

Step 1. In the “Main” section, launch the “Taxes and Reports” hyperlink.

In the “Taxation systems” section, in addition to the existing simplified tax system, check the “Patent” box. Above, in the “Apply from January 2021” value area, click the “OK” button.

Step 2 . In the “STS” section, settings for the simplified taxation system are specified:

• tax rate;

• the procedure for reflecting advances from the buyer;

• procedure for recognizing expenses.

Step 3. Go to the "Patent" section and click on the "List of Patents" hyperlink.

Step 4. In the window that opens, click the “Create” button and enter a list of patents received for certain types of activities.

In our example, this is “Repair of electronic household appliances, household appliances according to individual orders of the population.”

Step 5. Fill in the data from the patent:

• Number and date of issue of the patent – indicated in the header of the document;

• The tax base is indicated in line 010 on the back of the patent;

• The amount of tax on the patent is indicated in line 040 of the reverse side of the document.

After specifying the patent amount, the breakdown of payment amounts and their dates will be filled in automatically.

Potential income is established in the regions of the Russian Federation depending on the specific type of activity. When calculating the cost of a patent for a year, the tax base is taken into account, multiplied by a rate of 6%.

If you are planning to switch to a patent and first want to estimate its cost, you can do this using the online service on the website of the Federal Tax Service of Russia.

Having specified the requested parameters, click “Calculate” and the cost of a patent for a given type of activity and a breakdown by payment terms will be displayed at the bottom of the window.

After filling out all the information about the patent in 1C, click “Record and close”. Patent information saved.

According to the conditions of our example, individual entrepreneur Grishchenko is engaged in the installation of air conditioners and washing machines. And this is another type of activity that does not fall under the patent “Repair of electronic household appliances, household appliances according to individual orders of the population.”

According to the clarifications of the Ministry of Finance (Letter of the Ministry of Finance of the Russian Federation dated April 22, 2011 No. 03-11-11/102), the installation of air conditioners is classified as sanitary work, which falls under another patent “Services for the production of installation, electrical, sanitary and welding works."

Let's add the second patent to the directory - “Installation and Installation”, similarly as discussed above.

So, in the “Patents” directory of IP Grishchenko I.S. 2 patents submitted.

When reflecting operations in the 1C program, these patents will detail the operations and thus separate them.

For example, when reflecting income from the repair of household appliances, the patent “Repair of household appliances” is indicated; when reflecting installation and installation services, the corresponding patent “Installation and installation” is indicated. The situation is similar with expenses.

Let's move on to separate accounting of income in the 1C program: Enterprise Accounting ed. 3.0.

Reflection of income from the sale of goods under the simplified tax system

We will reflect operations on the sale of household appliances.

The buyer was sold goods for a total amount of 30,900 rubles:

1. Split system Centek CT-65V12 – cost 30,000 rubles;

2. Electric kettle Aceline G-3000 white – cost 900 rubles.

Payment for goods was received in cash at the store cash register.

Step 1. Go to the “Sales” section - “Sales (acts, invoices, UPD)” and create the document “Sales of goods: Invoice”. Complete the document.

Please note that when using two modes, an additional “Patent” field appears in the document.

Since the implementation relates to the simplified tax system, we do not put any marks on the patent.

Step 2. Carry out the implementation using the “Perform” button and generate a report on the movement of documents by clicking.

Accounting records and register records according to the simplified tax system have been generated.

Expenses for the sale of goods are reflected in the Book of Income and Expenses (KUDiR). The condition for recording purchases and sales in the ledger is met: goods purchased from the supplier are paid for and sold.

Step 3. Create a payment receipt document based on the implementation using the “Create based on” button.

For example, let’s create a “Cash Receipt”.

Similarly, you can create a “Receipt to a current account” or a “Payment card transaction”.

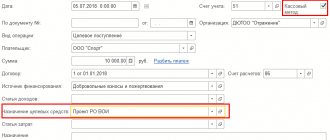

Step 4. The document is filled in automatically. Please note that an additional field for clarifying the tax regime has also appeared for the advances account.

Step 5. Look at the postings and document entries after posting - click the “Post” button, then .

KUDiR reflects income from sales: the goods are sold and paid for by the buyer.

Let's look at the example below.

We will reflect income from services related to the patent.

Reflection of income from services on a patent

Let's continue our example: a buyer who bought a split system ordered a service for its installation. The cost of the service was 3500 rubles. Payment for installation was made in cash at the cash desk.

Let's reflect this fact in the 1C program.

Step 1. Create the document “Services (act, UPD)” in the “Sales” - “Sales (acts, invoices, UPD)” section.

Step 2. Fill out the document with data and set the o, indicating which patent this service belongs to.

In our example, this is the patent “Services for installation, electrical installation, plumbing and welding work,” which for brevity we called “Installation and installation.” Step 3. Post the document and look at the postings and register entries using the button.

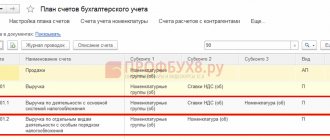

In addition to the accounting entry reflecting the revenue from the sale of the service, this document reflects the entry to the account USN.03 with o.

The program provides auxiliary accounts for a simplified taxation system with the allocation of accounts for different tax regimes, incl. for a patent - USN.03 - “Settlements with buyers for activities on a patent.”

Step 4. Reflect the receipt of payment for the service provided by creating a payment document based on “Implementation.

Step 5. The document will be filled in automatically. Although we do not have an advance payment, indicate in the field “Accounting for advances” - “Income from a patent”, specifying the patent “Installation and installation”. Although when conducting a document in our situation, this does not play a role, because account 62.02 is not involved in postings.

Step 6. Post the document and generate a transaction report using the button.

In addition to the accounting entry reflecting the receipt of payment, an entry is generated for the credit of account USN.03 - “Calculations for activities on a patent.”

Thus, when selling services on a patent, 1C reflects the posting to the debit of account USN.03, and when payment is received, to the credit of account USN.03.

In addition, the document made an entry in the register “Income Book (patent)”.

Let's see how the operations are reflected in the reports.

Reports on the simplified tax system and patent in 1C: Enterprise Accounting ed. 3.0

Step 1. Go to the “Reports” section.

Since IP Grishchenko has been applying two taxation systems, the simplified tax system and a patent, since 2021, an additional section has appeared in the reports section.

In addition to the “STS Book of Income and Expenses”, in the “Reports for Individual Entrepreneurs” subsection, you can generate the “Patent Income Book” report.

Step 2. Open KUDiR – subsection “STS”. Set the period and click “Generate”.

In Section I. “Income and expenses for 1 quarter.” reflects the amount of revenue (column 4) and the amount of expenses (column 5) for goods sold, in particular the cost of goods.

Step 3: Open the Patent Income Ledger report.

The report is generated for each patent separately.

The “Patent Income Book” consists of a title page and the income statement itself.

Select the "Installation and Installation" patent. Click "Generate".

To view report data, set the “Income” book sheet. The report reflects the amount of revenue received from the buyer from the split system installation service.

In addition to expenses related directly to the purchase of goods, there may be other expenses of an individual entrepreneur: wages, insurance premiums, utility bills, etc. We will discuss how to reflect such expenses when combining modes in the next article.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Natalya 05.26.2021 17:58 I read your article, thank you, now I’m waiting for how to correctly reflect expenses, I want to be sure of the correctness of actions. Thank you!

Quote

0 Andrey 05.25.2021 19:32 I quote Irina Plotnikova:

I quote Olga: Good afternoon. Please tell me what if part of the payment is in cash, and part is non-cash using the buyer’s card. How to correctly reflect it in accounting?

Olga, good afternoon.

This cannot be described in a nutshell, so stay tuned to our website, we will prepare a publication on this topic! It should be possible to indicate a patent in the document of receipt of DS to the current account to reflect non-cash payments as income, but it is not... Quote +9 Irina 04/07/2021 17:24 Please consider an example when money arrives at the bank. On the simplified tax system and on the patent through the terminal. Where to set up a patent? Everything is posted to the simplified tax system.

Quote

0 Natalya 04/02/2021 22:56 I liked the article, I’m looking forward to the continuation!

Quote

+1 Irina Plotnikova 02.20.2021 17:34 I quote Olga:

Good afternoon. Please tell me what if part of the payment is in cash, and part is non-cash using the buyer’s card. How to correctly reflect it in accounting?

Olga, good afternoon.

This cannot be described in a nutshell, so stay tuned to our website, we will prepare a publication on this topic! Quote 0 Olga 02/18/2021 14:33 Good afternoon. Tell me, please, what if part of the payment is in cash, and part is non-cash using the buyer’s card. How to correctly reflect it in accounting?

Quote

0 Irina Plotnikova 02/11/2021 20:53 I quote Anna:

Tell me, there is no Patent in tax regimes. This may be due to the fact that I have a basic version of 1C Accounting or what other reason may be (the configuration version has been updated to the latest 3.0.89.34)

Anna, good afternoon.

No, it's not about version 1C. Tell me, what tax system do you combine with the Patent? Quote 0 Anna 02/11/2021 18:27 Tell me, there is no Patent in tax regimes. This may be due to the fact that I have a basic version of 1C Accounting or what other reason may be (the configuration version has been updated to the latest 3.0.89.34)

Quote

Update list of comments

JComments

How to reduce the patent on contributions

To reduce the tax on contributions under the simplified tax system, we submit a tax return, but the patent does not provide for declarations. To enable patent holders to reduce their tax, the Federal Tax Service has developed a special notification form - Federal Tax Service letter dated January 26, 2021 No. SD-4-3/ [email protected] The notification consists of a title page and two sections. Submit one notification at once for all patents from one inspection whose value you want to reduce.

The submission deadline has not been confirmed. If you have already paid for the patent and did not take into account the deduction, the overpayment of tax will be returned or counted against future payments. Send the notification to the tax office where you are registered as a patent payer and to which you pay this tax.

How can I pay for a patent?

To pay, you need to know the details of the tax office that issued your patent. The payment method depends on the patent term:

- Less than six months. If you have received a patent and it will be valid from 1 to 6 months, then you need to pay for it in full before its expiration date.

- From six months to a year. If you are allowed to remain on a patent for 6–12 months, then you can pay for it in two tranches: you pay a third within up to 90 days, and the rest until the end of the patent.

When does the right to use PSN lose in 2021?

An individual entrepreneur will lose the right to be in the patent tax system when he:

- will increase the average number of employees engaged in patent activities to 16 people;

- will receive an income of more than 60 million rubles - this is the maximum permissible income for applying PSN. If for other types of activity you are on the simplified tax system or, for example, on OSNO, then the total income for all types should not be more than 60 million rubles;

- will sell excisable goods, furs, shoes or medicines;

- will violate the patent payment deadlines established by Art. 346.51 Tax Code of the Russian Federation.

If you lose the right to be on the PSN within one calendar year, you can switch to the PSN again only in the next year. After you have lost the right to PSN, you need to write a corresponding application to the Federal Tax Service in the patent department. Deadline: no later than 10 calendar days. Rights to a patent cease from the moment the tax period begins, that is, from the beginning of the patent.

If you lose your right to PSN, you do not automatically switch to the general system. That is, if you had an Unified Agricultural Tax or simplified tax system before the PSN, then you will apply it in the future, and you need to calculate the tax for the period of the patent according to the rules of the Unified Agricultural Tax or simplified tax system.

Primary documents

The basis of accounting and tax accounting is the availability of primary documentation. It confirms the existence of ownership rights to an intellectual object. It is on the basis of information from primary documentation that accounting entries are formed. Let's consider the papers that are needed when accounting for intellectual property:

- Agreement on the alienation of IP for the object.

- Patent.

- Registration certificate.

- Contract agreement.

- Internal regulations.

How to take into account exclusive rights to intellectual property ?

There is also a minimum list of primary documentation for intellectual property:

- The acceptance certificate, which contains information about the initial cost of the object.

- Provision on trade secrets, necessary to establish ownership of know-how.

- Order to classify information as secret.

- The act of beginning to use intellectual property in the company's activities.

- Protocols with useful life.

- Protocols on depreciation (features of calculating depreciation charges, etc.).

- An act of temporary completion of operation of facilities.

- The act of disposing of intellectual property after its depreciation has been completed.

- An act of disposal due to the transfer of rights to an object to another company.

Only those objects that meet a number of criteria can be taken into account: the use of property for the purpose of generating income, the presence of primary documents. These requirements are specified in PBU 14/2007.

Question: Are remuneration paid to an employee (author) for an object of intellectual property (work of service, invention) created by him as part of the performance of his job duties included in labor costs for profit tax purposes (Article 255 of the Tax Code of the Russian Federation)? View answer

This or that document must be stored for a certain period of time. For example, an agreement on the alienation of exclusive rights must be kept until the death of the author, as well as 70 years after death. This period is essentially the useful life of the object. The length of useful use indicated in accounting cannot exceed the storage period of documents.

IMPORTANT! PBU 14/2007 is not the only document that regulates asset accounting. Accounting for individual forms of objects is established by other documents. For example, for spending on scientific work, PBU 17/02 is relevant.

How to keep tax records and submit reports to PSN?

Entrepreneurs on PSN keep records using the income book of individual entrepreneurs on PSN. For each individual patent, you will have to keep your own separate book. Income accounting method: cash. All accounting rules are described in Art. 346.53 Tax Code of the Russian Federation.

Important! If you conduct business only on a patent, then you do not need to submit a declaration. But if you have other taxation systems for other types of business activities, you will have to submit even zero returns for them.

There is no need to keep accounting records for a patent, since all entrepreneurs are exempt from it. Preparation of a balance sheet, financial results report, development of accounting policies, etc. is not required. But without accounting it will be difficult if you combine a patent with the simplified tax system or another regime.

For hired employees, reporting will need to be submitted in the standard manner: DAM, 6-NDFL, 4-FSS, SZV-M and other papers.

Do you need convenient and simple accounting?

The cloud web service Kontur.Accounting allows you to conduct all necessary operations via the Internet. Get acquainted with the capabilities of the service for free for 14 days, keep records, calculate salaries, report online and work in the service together with colleagues. Try for free

Individual entrepreneur reporting on PSN with and without employees

So, let's find out what tax reporting exists for individual entrepreneurs on a patent in 2021.

Reporting of individual entrepreneurs on a patent without employees:

1. The declaration is not submitted to the Federal Tax Service. 2. To the Pension Fund - reports are not submitted 3. To the Social Insurance Fund - reports are not submitted.

Reporting of individual entrepreneurs on a patent with employees:

1. The declaration is not submitted to the Federal Tax Service. But it is necessary to provide reports:

2-NDFL - for employees from whom tax has been withheld, is provided once at the end of the year until April 1 of the year following the reporting year. For 2021 - until April 1, 2021.

2-NDFL for employees from whose income it was not possible to withhold personal income tax must be submitted before March 1, 2021.

6-NDFL - quarterly report. It is due until the last day of the first month of the next quarter.

Starting from 2021, it is planned to merge 2-NDFL certificates with 6-NDFL calculations in one report, the deadline for submission of which has not yet been set.

2. The following reports are submitted to the Pension Fund:

SZV-M - monthly until the 15th day of the month following the reporting month;

RSV-1 - quarterly until the 15th day of the second month following the reporting month, on paper, and until the 20th day in electronic format.

SZV-STAZH - annually until March 31 of the year following the reporting year.

SZV-TD - monthly until the 15th day of the month following the reporting month. This is a new form of reporting, introduced in 2021 in connection with the transition to electronic work books.

3. In the Social Insurance Fund - a quarterly report 4-FSS is submitted by the 20th day of the month following the reporting month on paper, and by the 25th day in electronic format.

The law establishes that if the number of employees exceeds 25 people, then all reports, except 6-NDFL and 2-NDFL, must be provided only in electronic form. For 6-NDFL and 2-NDFL reports in 2021, the threshold for the number of employees for submitting reports on paper is 10 people.

This does not apply to entrepreneurs using PSN by default, since individual entrepreneurs using a patent cannot have more than 15 employees. But for convenience, an individual entrepreneur can connect to electronic reporting, this will save his time and allow him to check the correctness of filling out the report before sending, especially for two reports 6-NDFL and 2-NDFL, as mentioned above, from 2021 an electronic report must be submitted, when number of more than 10 people.

You can download all the necessary report forms for individual entrepreneurs on PSN, as well as the procedure for filling them out, from the pages of our website.