Accounting policy for LLC with UTII

Accounting policy

The “imputed” organizations are required to keep accounting records, and therefore must have a properly drawn up accounting policy of an accounting nature. The basic rules and principles are reflected in the PBU, however, this document may include several alternative accounting methods, and for some transactions may not have them at all. The task of the LLC is to determine for itself a suitable and convenient way to organize accounting, and to develop the missing methods.

Accounting policy is not just a required formality, but a solution to controversial and ambiguous situations that arise in the process of doing business. That is, this type of policy is necessary, first of all, for the LLC itself.

Accounting policies for accounting should include:

| Policy item | Explanations |

| Working chart of accounts | A list of accounts selected from the existing Chart of Accounts and necessary to fully reflect all required indicators. It is convenient to carry out this plan with a list that includes the necessary accounts and specific sub-accounts for them, which will actually be used and will allow you to separately take into account the necessary indicators for calculating taxes for different types of business (it is on sub-accounts that it is most convenient to keep separate records). |

| The procedure for assigning various indicators between subaccounts | Rules for organizing separate accounting for different types of business. |

| Forms of primary documentation | Forms that will be used by the company (unified or personally prepared). Samples of self-prepared forms should be included in the policy. |

| Register forms | We independently develop consolidated registers designed to transfer data from primary documentation. Must take into account transactions for each type of business. |

| Accounting for intangible assets and fixed assets | Installed:

|

| Accounting for inventory and products | Defined by:

|

| Income, expenses | Features of accounting for commercial and administrative expenses, nuances of revenue recognition. |

If the company is a small entity, then accounting can be significantly reduced by writing in the accounting policy principles that simplify accounting and reporting - reduce the work plan by combining some accounts, abandon some PBUs, submit reports in a simplified form. All these points need to be written in the LLC policy.

Tax policy of LLC under UTII

The policy under consideration for UTII is mandatory for an LLC; it must be formed in such a way as to ensure the correct calculation of tax. For this reason, the policy must define the methods and rules by which the company's tax liability will be calculated.

First of all, tax accounting should reflect separate accounting of indicators. How to do this is determined by the company independently, since tax laws do not clearly define this. The main thing is that the principles enshrined in the policy make it possible to correctly calculate the single special tax and other tax obligations.

An accounting tax policy will be needed for UTII even if separate accounting is not needed due to running only one type of business. At the same time, it includes the type of activity, the physical indicator for it, the procedure for calculating the special tax, and accounting for insurance payments when reducing the tax payable.

Accounting policies for tax purposes include:

- Activities;

- A set of physical indicators that will be used when calculating the tax burden;

- The procedure for distributing these indicators when calculating a single special tax (for example, a company sells retail and repairs clothes in the same premises, these are different types of business for which it is necessary to determine how the premises area will be distributed between them);

- Method of separate accounting with simultaneous operation in different modes;

- Tax register forms required to reflect the required indicators are subject to independent development, taking into account the specifics of conducting business;

- Accounting for insurance premiums in order to reduce tax payable.

This policy comes into force from the beginning of the year, that is, it must be formed and approved before the end of the year in order to begin its application from January next. If the period for its application is not defined, then the policy is valid until the end of the business. It is convenient to make adjustments using separate administrative documents without changing the original document.

UTII calculation register

First of all, the accounting policy of individual entrepreneurs on UTII must reflect which document will confirm the calculation of the quarterly tax. This indicator is not influenced by actual income received in the course of business activities, as well as expenses. Therefore, there is no need to maintain tax registers that take these indicators into account.

However, when developing a sample register for calculation, you should take into account the algorithm for its implementation:

- The product of the basic yield and the physical indicator is found.

- The result obtained in the first paragraph is adjusted by coefficients K 1 and K 2.

- The final tax amount is reduced by benefits paid to employees and insurance premiums.

It is most convenient to make such calculations in the tax register. However, the laws do not provide a special form for this. Therefore, an individual entrepreneur will have to develop it independently. After this, an accounting policy is drawn up, the sample calculation of which will serve as an appendix. In this case, reference should be made to it in the text of the document. One phrase is enough: the calculation of the amount of imputed tax for the reporting period is carried out in the tax register, which is given in the appendix.

At the same time, the entrepreneur can independently decide whether it is more convenient for him to open the register every quarter or maintain it throughout the year. It is important, when drawing up a document for calculation, to include columns for all indicators used. The basic profitability and physical indicator are taken into account for each month; this should also be taken into account when drawing up the form.

It is most convenient if the register for calculation includes two tables:

- to calculate imputed income;

- to calculate the total amount of imputed tax.

Above is an example of a register for calculating tax for an individual entrepreneur whose main type of activity is retail trade, and the tax regime is UTII. The first table shows that all the necessary indicators by month are taken into account. This provides for a situation where the application of imputation began in the reporting quarter. In this case, column No. 5 is useful, which takes into account a coefficient equal to the ratio of the number of days that the entrepreneur worked in the month in question on imputed income to the total number of calendar days in that month.

The second table is intended to calculate the following values:

- total amount of UTII;

- tax-reducing indicators;

- the amount of tax to be paid to the budget (total line in the table).

Accounting policy for individual entrepreneurs with UTII

Individuals with the education of an individual entrepreneur can work for UTII, but are not required to keep accounting, which means they do not have to have an accounting policy.

At the same time, an individual entrepreneur is required to have a tax policy. The tax must be calculated by any “imputed” person, which means that the indicators required to calculate the tax burden must be taken into account.

In general, the tax policies of individual entrepreneurs and organizations are no different. Its content depends on the characteristics of the entrepreneur’s business, the number of types of activities on UTII, the location of the activity, and the presence of a combination of taxation regimes.

The minimum that needs to be specified in the policy is the type of business, the corresponding indicator, as well as the procedure for reducing the tax on the amount of payments for your insurance and your employees.

When conducting business in several directions, when carrying out one type in different territorial locations, when combining regimes, the principles of separate accounting are indicated in the tax policy.

The drawn up policy is approved by order of the individual entrepreneur.

Accounting for physical indicators

An important component of the imputation tax calculation formula is the physical indicator. An entrepreneur should carefully monitor its changes. If in any month the value of a physical indicator decreased or increased, from this period UTII should be calculated based on new data.

It is important to understand that when using area or number of retail outlets as physical indicators, it is enough to indicate a new value in the register. If it is planned to use the number of employees in the calculations for the activity being carried out, another register will have to be additionally developed. In this case, the accounting policy of individual entrepreneurs on UTII must contain a form for calculating the average number of employees, since it is this that is used in the calculation.

The average number should be calculated every month. The result obtained is transferred to the main calculation register.

On video: What is UTII? Features of imputation

Accounting policy for UTII and simplified tax system

The combination of two special modes requires separate accounting of income and expenditure indicators. It is necessary to separate part of the company’s expenses and income attributable to activities for each type of taxation regime, which will allow the special tax UTII and simplified tax system to be correctly calculated.

Specific principles for organizing separate accounting have not been established, so the company itself prescribes the rules for itself in its accounting policies. The only thing the Ministry of Finance pays attention to is the need to ensure unambiguous assignment of indicators between types of activities under different tax regimes.

For these purposes, the accounting policy provides explanations on the components of the working chart of accounts - the names of the accounts and subaccounts opened for them. It is convenient to open two sub-accounts for each account, each of which will keep records of indicators for different special modes. This point needs to be clarified in the accounting policy.

As for tax policy, it is necessary to clearly distinguish between the accounting of company income and expenses. It is these indicators that will allow you to correctly calculate the single special tax for the simplified regime. In this regard, the tax policy states:

- Separate accounting of income and expense indicators (the latter are distributed in proportion to the share of income on a monthly or quarterly basis);

- The distribution of insurance-type contributions between modes is in accordance with the income received, while you need to remember about different tax periods - a year for the simplified tax system and a quarter for UTII.

Otherwise, the formation of accounting policies is based on the structure described above.

GLAVBUKH-INFO

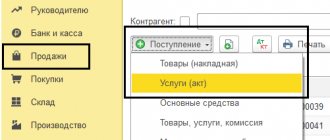

1. Tax accounting is the responsibility of the accounting department, headed by the chief accountant. 2. Apply the object of taxation in the form of the difference between the income and expenses of the organization. Base: Article 346.14 of the Tax Code of the Russian Federation. 3. In relation to retail trade carried out through shops and pavilions with a sales area of less than 150 square meters, apply a special UTII regime. Base: paragraph 1 of article 346.28 of the Tax Code of the Russian Federation. 4. Keep records of transactions under various special tax regimes on the basis of accounting data for the organization as a whole. Income and expenses from activities taxed under the simplified taxation system are reflected in the book of income and expenses. Business transactions in activities taxed by UTII are accounted for in the general manner. Base: paragraph 8 of article 346.18, article 346.24, paragraph 7 of article 346.26 of the Tax Code of the Russian Federation, part 1 of article 6 of the Law of December 6, 2011 No. 402-FZ. 5. Property, liabilities and business transactions for activities subject to UTII are reflected in accounting using subaccounts and additional analytical features separately. Base: Part 1 of Article 6 of the Law of December 6, 2011 No. 402-FZ, paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation. 6. Maintain an automated book of income and expenses using the standard version of “1C: Simplified Taxation System”. Base: Article 346.24 of the Tax Code of the Russian Federation, paragraph 1.4 of the Procedure approved by Order of the Ministry of Finance of Russia dated December 31, 2008 No. 154n. 7. Entries in the book of income and expenses should be made on the basis of primary documents for each business transaction. Base: clause 1.1 of the Procedure approved by order of the Ministry of Finance of Russia dated December 31, 2008 No. 154n, part 2 of Article 9 of the Law dated December 6, 2011 No. 402-FZ. Accounting for depreciable property 8. For the purpose of applying the simplified taxation system, fixed assets are property used as means of labor to carry out commercial activities (perform work, provide services) or to manage an organization, with an initial cost of more than 40,000 rubles. and a useful life of more than 12 months. Base: paragraph 4 of article 346.16, paragraph 1 of article 257, paragraph 1 of article 256 of the Tax Code of the Russian Federation. 9. To determine the initial cost of a fixed asset, accounting data for account 01 “Fixed assets” is used, with the exception of data for the subaccount “Fixed assets of retail trade” to account 01. Base: subparagraph 3 of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation, part 1 of Article 2 and part 1 of Article 6 of the Law of December 6, 2011 No. 402-FZ. 10. Subject to payment, the initial cost of the fixed asset, as well as the costs of its additional equipment (reconstruction, modernization and technical re-equipment) are reflected in the book of income and expenses in equal shares, starting from the quarter in which the paid fixed asset was put into operation until the end of the year. When calculating the share, the cost of partially paid fixed assets is taken into account in the amount of partial payment. Base: subparagraph 3 of paragraph 3 of Article 346.16, subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. 11. The share of the cost of a fixed asset (intangible asset) acquired during the period of application of the simplified tax system, subject to recognition in the reporting period, is determined by dividing the original cost by the number of quarters remaining until the end of the year, including the quarter in which all conditions for writing off the cost of the object as expenses are met .If a partially paid fixed asset is put into operation, the share of its cost recognized in the current and remaining quarters until the end of the year is determined by dividing the amount of partial payment for the quarter by the number of quarters remaining until the end of the year, including the quarter in which partial payment was made payment for the commissioned facility. Base: subparagraph 3 of paragraph 3 of Article 346.16, subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. 12. For the purpose of separate accounting of expenses by type of activity, the direction of use of fixed assets in the reporting period is reflected in primary documents, organizational and administrative documents (orders) and in tax accounting registers. Expenses for the acquisition of fixed assets are taken into account when calculating tax according to the simplified tax system only for the period of use object in this activity in accordance with the schedule approved by the head of the organization. The amount of expenses for such fixed assets, recorded in the book of income and expenses, is determined in proportion to the number of days of use of the object in activities taxable under the simplified tax system, in the total number of working days in the reporting period. If part of the retail premises in the building is used in activities taxed by UTII , then expenses on such a fixed asset recognized in the reporting period are determined by calculation. In the book of income and expenses for the reporting period, costs are recorded in proportion to the share of the area used in activities taxed under the simplified tax system in the total area of the building indicated in the technical passports of the BTI. Base: paragraph 8 of article 346.18, paragraph 7 of article 346.26 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 30, 2011 No. 03-11-11/296, dated October 4, 2006 No. 03-11-04/3/431. Accounting for inventory 13. Material costs include the purchase price of materials, costs of commissions to intermediaries, import customs duties and fees, transportation costs, as well as costs of information and consulting services related to the purchase of materials. Amounts of value added tax paid to suppliers when purchasing material inventories are reflected in the income and expense book as a separate line at the time materials are recognized as costs. Base: subparagraph 5 of paragraph 1, paragraph 2 of paragraph 2 of Article 346.16, paragraph 2 of Article 254, subparagraph 8 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. 14. Material costs are included in costs as they are paid. In this case, material costs are adjusted to the cost of materials used in activities subject to UTII. The adjustment is reflected in a negative entry in the book of income and expenses at the time of transfer of materials for use in activities subject to UTII. To determine the amount of adjustment, the average cost method of valuing materials is used. Base: subparagraph 1 of paragraph 2 of Article 346.17, paragraph 8 of Article 346.18, paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 29, 2010 No. 03-11-06/2/11. 15. Expenses for fuel and lubricants are taken into account as part of material expenses as they are accepted for accounting and paid for. Base: subparagraph 5 of paragraph 1 of Article 346.16, subparagraph 1 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. 16. Standards for recognizing expenses for fuel and lubricants as expenses are calculated as trips are made based on waybills. An entry is made in the book of income and expenses in the amount of amounts not exceeding the standard. Base: paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated January 30, 2009 No. 19-12/007413. 17. The cost of goods purchased for further sale is determined based on the price of their acquisition under the contract (reduced by the amount of VAT presented by the supplier of the goods). Transportation and procurement costs are included in costs as expenses associated with the acquisition of goods, on an independent basis, separately from the cost of goods. Base: subparagraphs 8, 23 paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. 18. The cost of goods sold within the framework of activities taxed under the simplified tax system is taken into account as part of costs as the goods are sold. All goods sold are valued using the average cost method. Base: subclause 23 of clause 1 of article 346.16, subclause 2 of clause 2 of article 346.17 of the Tax Code of the Russian Federation. 19. Amounts of value added tax presented on goods sold within the framework of activities taxed under the simplified tax system are included in costs as such goods are sold. In this case, VAT amounts are reflected in the book of income and expenses as a separate line. Base: subparagraphs 8 and 23 of paragraph 1 of Article 346.16, subparagraph 2 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 2, 2009 No. 03-11-06/2/256. 20. Costs associated with the acquisition of goods, including costs of servicing and transporting goods, are included in costs as actual payment is made. Base: subparagraph 23 of paragraph 1 of Article 346.16, paragraph 6 of subparagraph 2 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 8, 2011 No. 03-11-06/2/124. 21. An entry in the book of income and expenses regarding the recognition of materials as expenses is made on the basis of a payment order (or other document confirming payment for materials or expenses associated with their acquisition). An entry in the book of income and expenses regarding the recognition of goods as expenses is made on the basis of an invoice for the release of goods to the buyer. Base: paragraph 2 of article 346.17, article 346.24 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 18, 2010 No. 03-11-11/03, paragraph 1.1 of the Procedure approved by order of the Ministry of Finance of Russia dated December 31, 2008 No. 154n. Cost accounting 22. The costs of selling goods purchased for resale include costs of storing and transporting goods to the buyer, as well as costs of servicing goods, including costs of renting and maintaining retail buildings and premises, advertising costs and intermediary fees selling goods. Expenses for the sale of goods related to activities taxed under the simplified tax system are taken into account as expenses after their actual payment. Base: subparagraph 23 of paragraph 1 of Article 346.16, paragraph 6 of subparagraph 2 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 15, 2010 No. 03-11-06/2/59. 23. The amount of expenses (except for expenses for fuel and lubricants) taken into account when calculating tax according to the simplified tax system within the limits of the standards is calculated quarterly on an accrual basis based on the paid expenses of the reporting (tax) period. An entry on the adjustment of standardized costs is made in the book of income and expenses after the corresponding calculation at the end of the reporting period. Base: paragraph 2 of article 346.16, paragraph 5 of article 346.18, article 346.19 of the Tax Code of the Russian Federation. 24. Interest on borrowed funds is included in expenses within the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times, for ruble obligations and 15 percent per annum for foreign currency obligations. Base: paragraph 2 of article 346.16, paragraph 1 of article 269 of the Tax Code of the Russian Federation. 25. Income and expenses from the revaluation of property in the form of currency values and claims (liabilities), the value of which is expressed in foreign currency, are not taken into account. Base: paragraph 5 of article 346.17 of the Tax Code of the Russian Federation. 26. Income and expenses received from activities for which the simplified taxation system is applied are accounted for separately from income received from activities transferred to UTII. Base: paragraph 8 of article 346.18, paragraph 7 of article 346.26 of the Tax Code of the Russian Federation. 27. The participation of each employee in various types of activities is taken into account on the basis of a working time sheet. The amount of monthly labor costs related to each type of activity is determined in proportion to the time the employee participates in the corresponding type of activity for the current month. Base: paragraph 8 of article 346.18, paragraph 7 of article 346.26 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 14, 2007 No. 03-11-04/3/494. 28. The organization’s expenses, for which it is impossible to organize separate accounting by type of activity in accordance with this accounting policy, are distributed in proportion to the shares of income from the type of activity in the total income of the organization. Base: paragraph 8 of article 346.18 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 30, 2011 No. 03-11-11/296. 29. Distribution of expenses that cannot be divided by type of activity is carried out monthly based on revenue (income) and expenses for the month. Base: paragraphs 5 and 8 of Article 346.18 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 23, 2012 No. 03-11-06/3/35. Accounting for compulsory insurance contributions 30. Contributions for compulsory pension (medical, social) insurance, as well as compulsory insurance against industrial accidents, are distributed by type of activity taxed under different tax regimes, based on data on the distribution of labor costs. Contributions accrued for employee benefits, classified in accordance with the working time sheet to activities subject to UTII, also apply to this activity. Base: paragraph 8 of article 346.18, paragraph 7 of article 346.26, paragraph 2 of article 346.32 of the Tax Code of the Russian Federation. Accounting for losses 31. An organization reduces the tax base under the simplified tax system for the current year by the amount of losses received over the previous 10 tax periods when carrying out this type of activity. In this case, the loss is not transferred to that part of the current year’s profit for which the amount of the single tax does not exceed the amount of the minimum tax. Base: paragraph 7 of article 346.18 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated July 14, 2010 No. ШС-37-3/6701. 32. The organization includes in expenses the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner. This includes increasing the amount of losses carried forward to the future. Base: paragraph 4 of paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation. Chief accountant Full name| Next > |

Accounting for input VAT

Organizations on the OSN pay VAT, while the single tax is exempt from its payment. Input VAT on UTII is included in the cost of goods, works and services, and input VAT on the general system can be deducted. When combining regimes, it is necessary to regulate the procedure for calculating VAT in the accounting policy and separate the accounting of input tax. If you do not keep separate records, you will not be able to deduct VAT and will have to cover the tax from your own funds.

Combining the two modes, distribute VAT according to the rules of clause 4 of Art. 170 Tax Code of the Russian Federation. Divide goods, works and services into three types and open sub-accounts for them on account 19:

- used on special tax purposes in taxable transactions - 19.1;

- used on UTII - 19.2;

- used in two types of activities - 19.3.

For general resources, distribute the tax using the proportional method based on quarterly indicators. Fix the procedure for determining the proportion in the accounting policy.

If you do not know in what activity the resource will be used, then you can take into account input VAT when implementing one of the options, which must be indicated in the accounting policy:

- accept VAT as a deduction, and then restore and pay to the budget that part that relates to goods used for imputation;

- take into account input VAT in the cost of goods, and then restore the part that falls on the main tax base and take it for deduction;

- divide the VAT in parts - take part for deduction, and leave part in the cost of goods. Then restore it and take part for deduction.

Insurance premiums

Separate accounting of insurance premiums is needed to calculate profits and to reduce UTII. To do this, you need to divide the staff into three groups:

- engaged in imputed activities;

- employed in general regime activities;

- engaged in both types of activities.

Companies issue orders to distribute employees by type of activity and establish their affiliation in job descriptions. Difficulties arise with insurance premiums for employees engaged in two types of activities. The number of such personnel is distributed, as a rule, based on the share of revenue of one mode in the total revenue of the company or based on the percentage of personnel involved in each type of activity. It is important to note that management personnel are prohibited from being distributed and must be counted among employees for assigned activities.

Combine modes easily in the web service for small businesses Kontur.Accounting. In the service you can select an accounting policy for combination (except for OSNO+UTII). You enter data into accounting, the system itself generates reports, calculates taxes and creates payments for online banking. For the first 14 days, use the service for free.