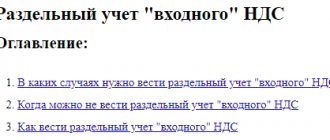

Let's look at how to properly maintain separate VAT accounting and what settings to use for this in the 1C: Enterprise Accounting 8 program, ed. 3.0.

No time to read? Cheat sheet on the summary of the article

- Who needs to keep separate VAT records and who doesn’t.

- How to set up separate accounting in 1C in the accounting policy.

- Which method of accounting for PMZ is suitable for separating VAT in different batches of goods?

- How to distribute VAT on fixed assets for separate accounting.

Who maintains separate VAT accounting

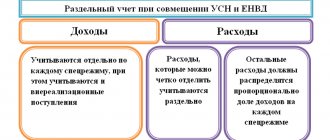

Separate VAT accounting must be carried out by those organizations that combine types of activities subject to VAT, as well as types of activities not subject to VAT.

The most common reasons for the need to distribute VAT is the need to distribute incoming VAT between types of activities for organizations that combine SST with UTII, or for organizations engaged in export trade. This is a non-exhaustive list of cases.

There are exceptions to the requirement to maintain separate VAT accounting. Thus, if in an organization the share of revenue from activities not subject to VAT or taxed at a rate of 0% does not exceed 5% of all revenue, the organization has the right not to share input VAT. Or an organization that is engaged only in exports and does not conduct operations in the domestic market also has the right not to maintain separate accounting.

When maintaining separate VAT accounting, it is important that the software product allows for the distribution of VAT by type of activity: part of the amount is accepted for deduction, and part is included in the cost. Such opportunities are provided by the software product “1C: Enterprise Accounting 8”, ed. 3.0.

VAT accounting in 1C

Let's set up separate VAT accounting in 1C. Once the “Incoming VAT is kept separately accounted for” setting is set, when posting documents, the program will remember what subsequently happens to VAT in the context of each document. If VAT was accepted for deduction upon receipt, and in the future the organization makes a sale without VAT, then the VAT previously accepted for deduction will be automatically restored. When using this setting, batches of goods are automatically tracked for subsequent VAT accounting purposes.

This setting is set in the accounting policy using the “Taxes” hyperlink.

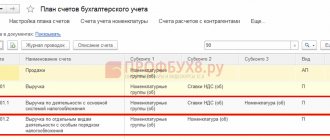

In edition 3.0, it became possible to maintain additional analytical accounting on account 19 - according to VAT accounting methods. Thanks to this analytics, it is possible to determine the need to distribute VAT at the time of purchase. With this setting, you can distribute VAT not only for indirect costs, but also for direct ones. To do this, in the “VAT Accounting Method” analytics, set the value to “Distribute”.

With further movement of inventory in the organization, it is possible to change this setting for a batch of items. For example, in the document for the receipt of goods and services, the method “Accept for deduction” was indicated, and at the time of inclusion in expenses it became clear that the inventories would be used for UTII activities, which means that VAT must be included in the cost. This operation will be performed by the document “Request-invoice”, where the VAT accounting method will be set to “Include in price”. After the invoice request is completed, the VAT amount will be automatically restored to the budget and included in expenses.

Consignments of goods for VAT accounting

It must be remembered that when selling goods, VAT is written off for a specific batch of a document - since for the correct calculation and distribution of the amount of incoming VAT, the program uses the “Batch” of each document. In order for accounting for VAT purposes regarding batches to coincide with regulatory accounting and cost calculation, it is necessary to use the FIFO method of accounting for PMZ.

In order to maintain batch accounting for inventory accounts, you need to set this option in the settings. This can be done in the menu “Administration” – “Accounting parameters” – “Setting up a chart of accounts” – “By item, batches, warehouses”. In the settings menu that opens, you must set the “By batches (receipt documents)” flag.

Example.

Organization A purchased chairs. November 1 – 10 pcs. at a price of 1180 rub. per piece, VAT on top, as well as on November 15 - 10 pcs. at a price of 1550 rub. per piece, VAT on top. Let's assume that the organization sold 15 units. 20 November.

If we maintain FIFO accounting, then for both VAT and costing purposes the chairs will be written off as follows:

- 10 pieces. from the batch at a price of 1180 rubles.

- 5 pieces. from the batch at a price of 1550 rubles.

And if an organization maintains accounting at average cost and separate VAT accounting, then for VAT purposes the program will write off data from batch documents, as described in the FIFO case, and for the purpose of calculating cost the following will be written off:

- 15 pcs. without batch, but based on the cost of 1365 rubles. (1180 + 1550= 2730 / 2 = 1365)

Thus, for the purposes of VAT accounting, the program will calculate based on batches, and for the cost price - based on other amounts. For sales transactions on the domestic market, this situation is not incorrect, but in the case of exports and the use of a 0% rate, difficulties arise, since confirmation of the zero rate will occur immediately for batches of all receipts stored on balances.

For this reason, those organizations that apply a 0% rate or without VAT are recommended to use the FIFO method instead of average cost accounting. If you change the method of accounting for inventories, do not forget to document this change in the form of an order for the accounting policy of the organization.

Section 5

This section is intended to reflect deductions related to activities for which a zero VAT rate can be applied, and in the past periods one of the events occurred:

- a complete package of supporting documents has been submitted;

- The 180-day period for submitting documents has expired, and the taxpayer did not have time to collect supporting documents (i.e., he lost the right to apply the zero rate).

Let's add a condition to our example:

TransExpert LLC, providing international transport services, used the services of renting a warehouse for short-term storage of transported goods in the amount of 12,480 rubles. + VAT RUB 2,496. Documents confirming the expenses incurred and an invoice for them were received only in the next quarter, i.e., after the company, following the results of the reporting quarter, had already submitted to the Federal Tax Service a package of documents confirming the right to a zero rate.

What Section 5 of the VAT return for the next quarter, completed in this case, will look like can be seen in the figure below.

Distribution of VAT on fixed assets

In version 3.0, it became possible to distribute VAT on fixed assets. To do this, in the document “Acquisition of fixed assets” in the VAT accounting method, select the value “Distribute”. After an item of fixed assets has been accepted for accounting and the “VAT Allocation” document has been posted, this VAT will be distributed in proportion to revenue. In terms of the percentage of VAT for non-VAT taxable activities, this amount of VAT will be included in the initial cost of the fixed asset item. After this, depreciation of the object, as well as all analytical reports on fixed assets, will display the cost of the object, taking into account the amount of VAT included in the price.

Example.

In organization A, in the fourth quarter of 2021, revenue from activities subject to VAT amounted to 1 million rubles, revenue from activities subject to the payment of UTII amounted to 250,000 rubles. During the fourth quarter, services related to both types of activities were purchased in the amount of 50,000 rubles, VAT on top. An object of fixed assets worth 150,000 rubles was also purchased, VAT on top (Fig. 1).

To calculate the amount of VAT distribution, we calculate the percentage. Transactions excluding VAT accounted for 20% of total revenue. Accordingly, the VAT amounts are distributed as follows: 80% – “Accept for deduction”, 20% – “Include in price”. We calculate: 9000 * 20% = 1800 rubles, 27,000 * 20% = 5400 rubles. (Fig. 2).

The “VAT Allocation” document includes the amounts we indicated. And after completing the document, the amount for services is 1800 rubles. will be reflected in the cost accounts (in our case this is account 44). Amount 5400 rub. will be reflected in account 08, and then in correspondence Dt. 01 Kt. 08 will increase the initial cost of the fixed asset item (Fig. 3).

At the end of the quarter, the amount on account 19 in the “Accept for deduction” analytics is accepted for deduction by the document “Creating purchase ledger entries.” To analyze and evaluate the correctness of closing account 19, it is convenient to use a balance sheet with analytics on VAT accounting methods (Fig. 4).

For a more detailed analysis of the SALT for account 19, you can get it with analytics up to the counterparty and the movement document.

If your organization did not maintain separate VAT accounting in the program, but is required to do so, then to switch to separate accounting you need to set the settings indicated in the article and enter balances for batch accounting. You can enter batch accounting balances manually or with the help of a programmer.

Another situation when the “Maintaining separate VAT accounting” setting will help an organization is the need to write off inventory. Write-offs can be carried out for various reasons, for example, in the event of a identified shortage. In this case, since the goods are written off as a result of shortages (for activities not subject to VAT), the VAT previously accepted for deduction must be restored to payment to the budget. When using the specified setting, the program will automatically restore VAT for payment after posting the “Write-off of goods” document. If the separate accounting setting is not used, for correct accounting it is necessary to reflect this operation using the “VAT Restoration” document.

Rules for drawing up proportions

The proportional distribution of input VAT must be carried out in the tax period in which the purchased goods were accepted for accounting (letter of the Ministry of Finance of Russia dated October 18, 2007 No. 03-07-15/159).

Another requirement of the tax authorities: the amounts taken into account when determining the proportion must be determined in comparable terms. To do this, VAT should be deducted from the cost of shipped goods (letters of the Ministry of Finance of Russia dated August 18, 2009 No. 03-07-11/208, June 26, 2009 No. 03-07-14/61 and June 17, 2009 No. 03-07-11/162) . Similar conclusions are contained in court decisions (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 No. 7185/08, FAS West Siberian District dated November 21, 2012 No. A03-18530/2011, FAS Ural District dated June 23, 2011 No. F09-3021/11- C2, FAS East Siberian District dated 10/08/2010 No. A78-1427/2009).

The opposite point of view was expressed by the judges in the resolution of the Federal Antimonopoly Service of the West Siberian District dated March 4, 2008 No. F04-1298/2008 (1320-A03-29), indicating that in Art. 170 of the Tax Code of the Russian Federation there is no direct indication of the exclusion of the amount of tax from the cost of shipped goods.

For information on how to distribute input VAT if there was no shipment in a given period, see the material “Separate accounting of VAT in non-income periods is carried out according to taxpayer rules”

Special rules for calculating the proportion are provided for by the Tax Code of the Russian Federation in the following cases (paragraph 4, clause 4, article 170 of the Tax Code of the Russian Federation):

- during operations with financial instruments of futures transactions (clause 2, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- for organizations carrying out clearing activities (clause 3, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- when carrying out transactions exempt from VAT:

- providing a loan in cash or securities (clause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation);

See also “Loan Interest Affects Separate Accounting.”

- REPO operations (clause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- sale of securities (clause 5, clause 4.1, article 170 of the Tax Code of the Russian Federation).

See the material “Explained how to calculate the proportion for separate accounting if there was a sale of securities”