Unified agricultural tax: basic concepts

In 2002, the Unified Agricultural Tax payment regime was first introduced in Russia. This tax system is applied by farmers on a voluntary basis. Thus, if for some reason it is more profitable for a company to apply a different tax regime, it has the right to do so.

In accordance with the Tax Code, taxpayers of the Unified Agricultural Tax are recognized as:

- Organizations that carry out both production and processing of agricultural products;

- Companies offering secondary services to agricultural companies;

- Agricultural associations (cooperatives) of citizens.

Like any other special tax regime, payment of the Unified Agricultural Tax implies exemption of the payer from calculating and transferring to the budget labor-intensive and difficult to understand taxes, such as income tax, VAT and property tax.

The tax rate under the Unified Agricultural Tax is 6%. The reporting period for a single tax is six months, and the tax period is a calendar year. The object of taxation is calculated as the difference between the income received and the expenses incurred by the company.

Who pays the Unified Agricultural Tax

Russian organizations and individual entrepreneurs who are agricultural producers and have voluntarily switched to paying the Unified Agricultural Tax.

Companies and entrepreneurs granted the status of agricultural producers, but who have not expressed a desire to switch to paying a single agricultural tax, by default use other taxation systems. In other words, the transition to the unified agricultural tax cannot be forced.

Submit a notification about the transition to the unified agricultural tax and submit tax reports via the Internet Submit for free

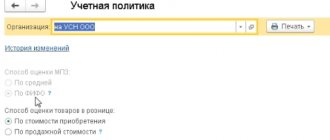

Accounting of Unified Agricultural Tax

Accounting for Unified Agricultural Tax is in many ways similar to accounting when using any other special tax regime.

When working for the Unified Agricultural Tax, entrepreneurs need to keep a book of income and expenses. In accounting, income and expenses are reflected on the accrual basis, and in tax accounting, the law requires the use of the cash method of recognizing income and expenses.

In the accounting of the Unified Agricultural Tax, the company must carry out calculations for the unified agricultural tax on account 68 “Calculations for taxes and fees”. It is necessary to open a sub-account for this account “Settlements under Unified Agricultural Tax” and approve these changes in the organization’s working chart of accounts.

Here we also see several subsections (Fig. 6):

- Balance of accounts payable for suppliers of goods and materials and services at the beginning of the period;

Balance of accounts payable for suppliers of goods and materials and services at the end of the period;

There are some nuances within the sections for your control. As you can see, the program gives us a unique decoding for each creditor - from which account of goods and materials or Costs the debt arose (this is what we all used to look for for a long time in the accounting registers under account 60 “Settlements with suppliers and contractors”). Now the program displays this automatically on its own; our task is simply to control it.

For example, in the subsections “Initial balance register No. 3” and “Final balance register No. 3” you need to look to see if there are any amounts with “000” in the first column “account account” (this happens when an organization has been working with 1C for a very short time). Scroll with your mouse the entire list of creditors decrypted by the program, find if there is an account “000” (which is used for entering initial balances), and instead of it simply put the account that you had before switching to the 1Cv8.3 program (this account for a specific counterparty can be find out either from journal order 6 in manual accounting, or from previous software products in the balance sheet for account 60).

Next, go down to the subsection “Non-production expenses”, these are, as you remember, those expenses that we must exclude when calculating the Unified Agricultural Tax, since they do not relate to the activities of the enterprise as a whole. Let us recall that, as a rule, these are expenses associated with construction, with service industries and farms (except for canteens and catering units), with other expenses and expenses from retained earnings (for example, gifts and prizes, material assistance in the form of inventory items, etc.) . Here the program indicates the amounts calculated for non-productive accounts, and you only need to look and, if necessary, add or remove something.

For example, as a rule, all farms, as non-production enterprises, should not include in the Unified Agricultural Tax expenses the costs of housing and communal services, landscaping and social and cultural life, except for city-forming enterprises. So, the program will automatically select all these amounts for you in the appropriate column, line by line, for each inventory and cost account. And if you just happen to be a city-forming economy, then you just need to use the “Delete” button on the keyboard to remove the corresponding amount. Or it happens that you definitely remember some non-production costs of the period, but you see that the program did not take them into account, then you simply place the cursor in the line, select the inventory and cost account from which you need to remove non-production, and in the appropriate column ( “other expenses” or “retained earnings”) simply enter the amount manually.

By the way, register No. 3 will differ from the similar register that was in the “Assistant” in that it will collect expenses not only for inventory items, but also for all production costs, which was previously in the fourth register. And behind register No. 4 we left the opportunity to collect and analyze precisely “Other expenses”, mainly from the account of the same name 91.02 - such as bank services, state duties, interest on loans, etc. We hope you remember them well.

Next, let's talk about Register No. 4 “Accounting for other expenses,” which has undergone some changes in order to increase the comfort of filling. The register tab No. 4 also has its own subsections. One of them will select for you in a completely unique way the expenses that are standard for this register (leasing payments, bank services, state duties, rent, interest on loans and others) (see Fig. 7).

An example of calculation and recording of settlements under the Unified Agricultural Tax

Spectr LLC produces sunflower oil and pays the unified agricultural tax. At the end of the first half of the year, the company received income in the amount of 700,000 rubles and incurred expenses of 300,000 rubles.

We will calculate the amount of the advance payment for the first half of the year to be transferred.

Unified agricultural tax = (700,000 rubles – 300,000 rubles) x 6% = 24,000 rubles.

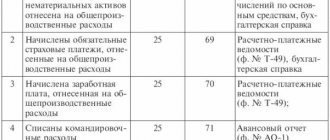

Let's reflect the transactions under the Unified Agricultural Tax in accounting:

- Unified agricultural tax accrued, posting:

Dt 99 Kr 68 – 24,000 rubles

- Unified agricultural tax is transferred to the budget, posting:

Dt 68 Kr 51 – 24,000 rubles

The tax must be transferred to the budget no later than the 25th day of the month following the reporting period, that is, before July 25.

What taxes are Unified Agricultural Tax payers exempt from?

In general, organizations that charge a single agricultural tax are exempt from income tax, and entrepreneurs are exempt from personal income tax. In addition, companies do not pay property tax, and individual entrepreneurs do not pay property tax for individuals (from 2021, the exemption applies only to objects used in the production of agricultural products, primary and subsequent industrial processing and sale of these products, as well as in the provision of services by agricultural producers) .

In addition, until 2021, companies and entrepreneurs on the Unified Agricultural Tax did not pay value added tax (except for VAT on imports). Starting from January 2021, Unified Agricultural Tax payers have lost their exemption from VAT and pay this tax on a general basis.

Other taxes and fees must be paid in accordance with the general procedure. In particular, contributions to compulsory insurance must be made from employee salaries, and personal income tax must be withheld and transferred.

Please note: companies classified as agricultural producers, but not switched to the unified agricultural tax, pay income tax at a general rate of 20%.

Innovations for 2021

2017 was the year of large-scale changes to Russian tax legislation. Norms that regulate the activities of agricultural companies have not been left aside.

Federal Law No. 401-FZ dated November 30, 2016 allowed agricultural producers to take into account the following expenses:

- Amounts of budget payments transferred to the state independently;

- Amounts, both in cash and in kind, that are transferred to repay the debt to the person who paid taxes and insurance payments for the organization.

Who are agricultural producers?

- enterprises and individual entrepreneurs that produce, process and sell agricultural products. There is one important condition here: the share of income from the sale of such products must be at least 70% of the income from the sale of all goods and services;

- agricultural consumer cooperatives whose share of income from the sale of agricultural products of their own production is at least 70% of income from the sale of all goods and services;

- fishing organizations and entrepreneurs that meet a number of conditions (the share of income from the sale of catch is at least 70% of the total income, fishing vessels belong to them by right of ownership or under charter agreements, etc.)

- organizations and individual entrepreneurs that provide agricultural producers with services related to auxiliary activities in the field of crop production and post-harvest processing of agricultural products: field preparation, sowing, driving and grazing livestock, etc. The share of income from the sale of the listed services must be at least 70% of the income from the sale of all goods and services

Leaving the Unified Agricultural Tax: voluntary and forced options

A taxpayer who has switched to a single agricultural tax must accrue it until the end of the tax period, that is, until December 31 of the current year inclusive. Until this time, it is impossible to abandon the Unified Agricultural Tax. You can change the system at your own request only from January 1 of the next year, which must be notified in writing to the tax office by January 15.

A forced return from the Unified Agricultural Tax to other taxation systems is also provided. It occurs when, at the end of the year, the share of income from the sale of agricultural products of its own production turned out to be less than 70% of the income from all sales, or the fish farm did not fulfill the conditions established for it. Another reason for the mandatory transition from the Unified Agricultural Tax is the start of production of excisable goods, or engaging in the gambling business. In all of the above cases, the right to a single agricultural tax is considered lost from the beginning of the year in which the discrepancy occurred.

In case of a forced refund from the Unified Agricultural Tax, the taxpayer must retroactively recalculate taxes for the previous year and pay them in January of the coming year. You may also have to list penalties. If it turns out that the taxpayer initially began to apply agricultural tax without having the right to do so (for example, he hid his affiliation with the gambling business), then penalties will be charged for the entire previous year. If the refund occurred because restrictions on the share of income from the sale of agricultural products (or criteria approved for fish farms) were violated during the past year, and the taxpayer did not recalculate taxes in January, then penalties will be accrued from February of the coming year.

If the taxpayer ceases to engage in agricultural activities, then within 15 days he must notify his inspectorate about this.

Submit a notice of refusal from the simplified tax system, UTII or unified agricultural tax via the Internet Submit for free

How to switch to paying a single agricultural tax

Companies and individual entrepreneurs that are agricultural producers, as well as agricultural consumer cooperatives, can switch to paying the Unified Agricultural Tax if the following condition is met. For the calendar year preceding the year of filing the application for transition, the share of income from the sale of agricultural products of own production must be at least 70% of the income from the sale of all goods and services. For those registered in the current year, this condition must be met in relation to the last reporting period, that is, half a year.

Fish farms have the right to switch to a single agricultural tax if, for the calendar year preceding the year of filing the application for the transition, the share of income from the sale of catch is at least 70% of the total income. For fish farms registered in the current year, this condition must be met in relation to the last reporting period, that is, half a year. In addition, for fishing enterprises and individual entrepreneurs, additional conditions are provided for the number of employees and the ownership of fishing fleet vessels.

If all the necessary conditions are met, you need to submit an application to the tax office no later than December 31, and from January of the next year you can apply the Unified Agricultural Tax.

Newly created enterprises and newly registered individual entrepreneurs have the right to become payers of the unified agricultural tax from the date of registration with the tax office. To do this, you must submit an application no later than 30 calendar days from the date of tax registration. In addition, for “newcomers” there is a rule: if in the year of application the income from agricultural activities is zero, then for the next year the 70 percent limit does not apply.

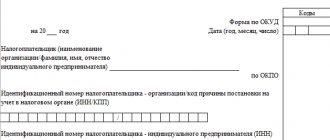

Declaration of Unified Agricultural Tax: general concepts

Declaration under Unified Agricultural Tax is a special declaration for a special taxation regime. It is formed and submitted to the inspection by entrepreneurs, legal entities and peasant farms, in short, by all those who are involved in agriculture .

Initially, the declaration form was approved by order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] dated July 28, 2014, and the letter of the Federal Tax Service of Russia No. ММВ [email protected] dated February 1, 2016 confirmed its current version.

Despite the fact that tax advances are provided, the declaration itself is annual and is submitted once a year, until March 31. If for one reason or another the taxpayer can no longer apply this special regime (for example, he no longer operates in the agricultural sector), then the declaration must be submitted by the 25th day of the month following the month of loss of the right to pay the Unified Agricultural Tax.

The report can be submitted to the tax office in 3 ways:

- You can submit a declaration when visiting the tax authority in person. In this case, you must have 2 copies on hand. One will remain with the inspector, the second with a mark will be kept by the taxpayer. Both the head of the company and an authorized representative can submit the declaration. If the report is provided by a representative, then a power of attorney is required.

- If you don’t want to go to the tax office and meet with inspectors in person, you can send the report by letter with the declared value and inventory. The taxpayer keeps the second copy of the report with the inventory and receipt of payment for the shipment.

- The fastest and most convenient way is to generate a report electronically. If the report is submitted via telecommunication channels, a large amount of time and effort is saved for the accountant, since the program checks the declaration and points out errors. In addition, there is no need to run to the post office or the tax office and waste time in queues; sending occurs instantly.

Report preparation programs

The Unified Agricultural Tax declaration can be prepared using the following programs:

| Software name | Website |

| “Taxpayer Legal Entity” (free) | https://www.nalog.ru/rn77/program/5961229/ |

| "Bukhsoft" | https://online.buhsoft.ru/2017/reps/external.php?rep=23 |

| "Sky" | nebopro.ru |

| "My business" | www.moedelo.org |

| "Taxpayer PRO" | nalogypro.ru |

| "1C" | 1c.ru |

Unified Agricultural Sciences. Tax information

Payment of unified agricultural tax is allowed to companies that:

- Carries out the production and sale of agricultural products, as well as their processing;

- Offer side services to agricultural organizations;

- They unite individuals carrying out joint activities related to cultivating land and raising livestock.

For the Unified Agricultural Tax, the rate is set at 6 percent. The tax to be transferred must be calculated as the difference between income and expenses, multiplied by the interest rate on the single tax.

Accounting for individual entrepreneurs on UTII in 2021

Zero reporting under Unified Agricultural Tax

If a newly created organization or individual entrepreneur registered as payers of the unified agricultural tax did not conduct business activities in the first tax period and did not violate the requirements established for the use of this special regime, they have the right to continue using the Unified Agricultural Tax in the next calendar year (subparagraph 1 p. 4.1, Article 346.3 of the Tax Code of the Russian Federation).

In this case, based on the results of the first tax period, you should submit zero reports under the Unified Agricultural Tax.

The zero declaration includes:

- title page;

- section 1;

- section 2.

Reflection of accrued tax in accounting

It is legally established that the reporting period for the Unified Agricultural Tax is six months, and the tax period is a year. It follows from this that the organization must charge tax twice - on the last day of the relevant period:

- until 25.07 – for advance payment;

- until 31.03 – for final payment.

In both cases, the accrual is reflected by the posting: D 99 – K 68 (sub-account “Unified Agricultural Tax”).

When funds are actually transferred to the state budget, the accountant makes the following entry: D 68 (sub-account “Unified Agricultural Tax”) - K 51.

Important! The legislation allows only non-cash payment of tax.

Subsequently, during a desk audit, tax authorities may find errors in accounting and charge an additional single tax. In this case, the accountant will make the following entries:

- D 99 – K 68 (sub-account “Unified Agricultural Tax”) – accrual of arrears;

- D 99 – K 68 (sub-account fines (penalties) under the Unified Agricultural Tax) – accrual of penalties.

Important! Fines and penalties imposed by fiscal authorities and payable cannot be included in expenses for calculating the single tax. For convenience, they can be combined into one accounting category “tax sanctions”.

Consequences for violations

The Unified Agricultural Tax declaration is a mandatory form, and payment of taxes based on the completed document is also mandatory. If problems are discovered when filling it out or submitting it, this will lead to negative consequences. If you do not pay taxes on time and do not file reports, penalties begin to accrue, the amount of which is calculated using the following formula:

Amount of unpaid tax payments * number of days overdue * 1/300 of the refinancing rates established by the Central Bank of Russia

Thus, the longer you do not pay taxes and do not submit a reporting document, the greater the amount of the penalty will be.

Also, employees of the Federal Tax Service have the right to apply penalties. Issue fines to entrepreneurs and legal organizations. The fine ranges from 20% to 40% of the total amount of unpaid taxes and is calculated individually for each debtor based on a number of factors.

If the deadline for submitting a document is violated, a separate fine is imposed in the amount of 5% to 30% of the accrued tax amount. Please note that the minimum fine in this case is 1000 rubles.